The Case for Nubank  NU

NU

Nubank is a combination of growth and value in the fintech space. I personally like it when, as an investor, I find a stock that is a growth and value stock simultaneously.

Nu is trading at a P/E of 31.5x, and the company is a compelling story with upside potential as Latin America's leading digital bank continues its rapid expansion.

The LATAM market still has lots of underbanked people, but Nubank offers the neobank and digital services necessary for those people.

The fact that it amassed 110 million clients in just a few years tells us something. The clients are mostly in Brazil, Mexico, and Colombia, but the company is planning expansion to other countries, including the US

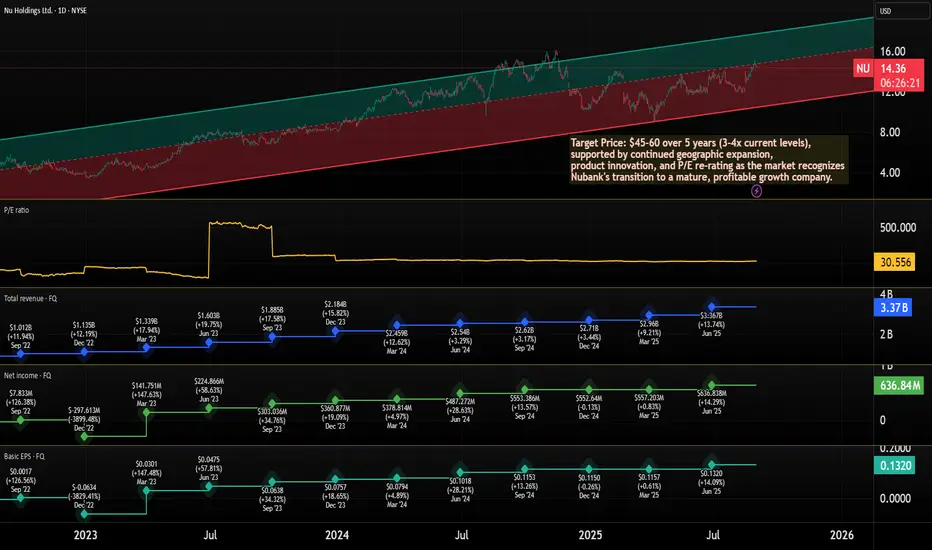

Remarkable Financial Trajectory (2023-2025)

Revenue Growth Acceleration:

2023: $3.37B total revenue

Q2 2025 alone: $3.36B revenue. Q2 2025 alone had the same revenue as 2023. Truly impressive

Very strong quarter-over-quarter growth and operational leverage.

Key Financial Metrics Progression

Investment thesis: Why Nubank is undervalued

1. Valuation arbitrage

2. Proven Business Model Scalability

The 2023-2025 data eliminates key execution risks:

3. Structural advantages in underserved arkets

4. Multiple Expansion Catalysts

Medium-term (3-5 years):

Geographic Expansion: The untapped opportunity

Brazil (Mature Market)

Mexico/Colombia (Growth Markets)

US Expansion (Game Changer)

Risk-Reward Analysis

Conservative 5-Year Scenario:

Base Case Assumptions:

Why Now??

Target Price: $45-60 over 5 years (3-4x current levels), supported by continued geographic expansion, product innovation, and P/E re-rating as the market recognizes Nubank's transition to a mature, profitable growth company.

Conclusion

Nubank in 2025 is no longer a speculative fintech play - it's a proven, profitable, growing financial services powerhouse trading at a discount to inferior peers. The combination of 63% revenue growth, sustainable profitability, massive TAM, and 31.5x P/E creates an asymmetric risk-reward opportunity rarely seen in public markets.

Nubank is a combination of growth and value in the fintech space. I personally like it when, as an investor, I find a stock that is a growth and value stock simultaneously.

Nu is trading at a P/E of 31.5x, and the company is a compelling story with upside potential as Latin America's leading digital bank continues its rapid expansion.

The LATAM market still has lots of underbanked people, but Nubank offers the neobank and digital services necessary for those people.

The fact that it amassed 110 million clients in just a few years tells us something. The clients are mostly in Brazil, Mexico, and Colombia, but the company is planning expansion to other countries, including the US

Remarkable Financial Trajectory (2023-2025)

Revenue Growth Acceleration:

2023: $3.37B total revenue

Q2 2025 alone: $3.36B revenue. Q2 2025 alone had the same revenue as 2023. Truly impressive

Very strong quarter-over-quarter growth and operational leverage.

Key Financial Metrics Progression

- P/E Evolution: From 90x+ (growth phase) → 31.5x (profitable growth phase)

- Revenue CAGR: 63.4% demonstrating consistent market penetration

- EPS Growth: 63.2% three-year average showing operational leverage

- User Growth: 30M → 110M+ (4x in 5 years) with improving unit economics

Investment thesis: Why Nubank is undervalued

1. Valuation arbitrage

- Current P/E: 31.5x vs. US fintech peer SoFi

SOFI at ~50x

- Growth-adjusted valuation: 63% revenue growth at 31x P/E = 0.49 PEG ratio (anything under 1.0 is attractive)

- International discount: Market applying "emerging market penalty" despite superior fundamentals

2. Proven Business Model Scalability

The 2023-2025 data eliminates key execution risks:

- Growing profitability across multiple quarters

- Growth maintained at scale (110M+ users, still growing)

- Margin expansion demonstrating operational leverage

- Multi-year consistency reducing one-time success concerns

3. Structural advantages in underserved arkets

- Digital-first cost structure: 80%+ lower cost base than traditional banks

- First-mover advantage: Dominant position in Brazil, early leadership in Mexico/Colombia

- Network effects: Growing ecosystem creates switching costs and viral acquisition

- Regulatory tailwinds: Government support for financial inclusion across Latin America

4. Multiple Expansion Catalysts

- Near-term (1-2 years):

- US market expansion announcement

- Continued profitability growth reducing "emerging market risk" perception

- Potential inclusion in major indices (MSCI, etc.)

Medium-term (3-5 years):

- Cross-border payments and remittance products

- Small business lending expansion

- Insurance and wealth management scaling

Geographic Expansion: The untapped opportunity

Brazil (Mature Market)

- Market-leading position providing stable cash flow foundation

- Still room for product penetration (insurance, wealth management)

Mexico/Colombia (Growth Markets)

- Early-stage penetration with massive TAM

- 2025 data suggests strong traction in these markets

US Expansion (Game Changer)

- Management indicated plans for US market entry

- Could unlock premium US fintech valuations (40-50x P/E multiples)

- Remittance corridor between US and Latin America represents $100B+ opportunity

Risk-Reward Analysis

Conservative 5-Year Scenario:

- Earnings growth: 25% CAGR (conservative given 63% current growth) = 3x earnings in 5 years

- Multiple expansion: P/E re-rating to 45x (still below SoFi's 50x) = 43% upside

- Combined effect: 3x earnings × 1.43x multiple = 4.3x total return

Base Case Assumptions:

- Revenue growth slows to 20-25% annually (from current 63%)

- P/E expands to 40-45x as profitability matures

- US expansion adds 20-30% valuation premium

- Target: 3-4x returns over 5 years

Why Now??

- Valuation Opportunity: 31.5x P/E for 63% growth company is historically cheap

- Proven Execution: 2023-2025 data eliminates major execution risks

- Market Inefficiency: US investors underweight due to "foreign" perception

- Catalyst Pipeline: US expansion, product launches, and regulatory tailwinds

Target Price: $45-60 over 5 years (3-4x current levels), supported by continued geographic expansion, product innovation, and P/E re-rating as the market recognizes Nubank's transition to a mature, profitable growth company.

Conclusion

Nubank in 2025 is no longer a speculative fintech play - it's a proven, profitable, growing financial services powerhouse trading at a discount to inferior peers. The combination of 63% revenue growth, sustainable profitability, massive TAM, and 31.5x P/E creates an asymmetric risk-reward opportunity rarely seen in public markets.

Trade active

I've opened a buy order allocating 1% of my portfolio. Quick note: I'm just sharing my journey - not financial advice! 😊

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.