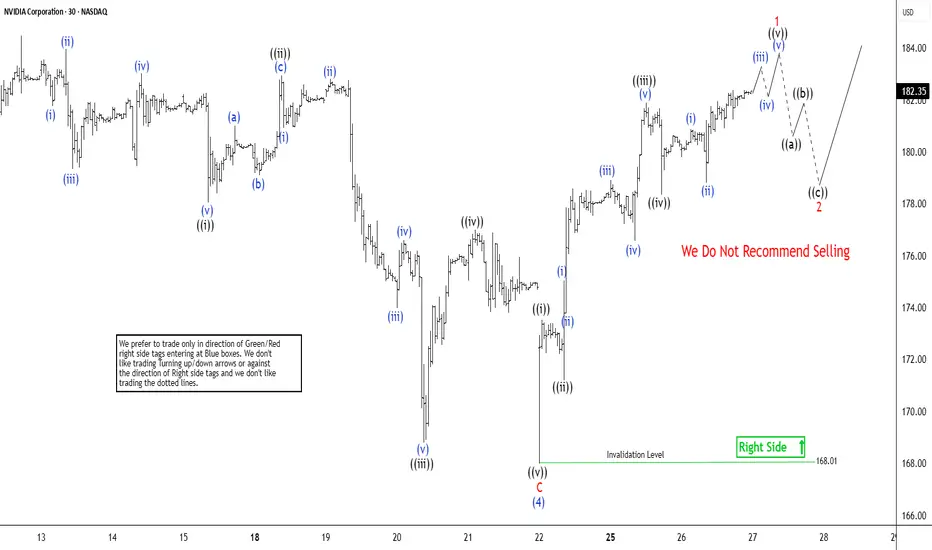

Nvidia (NVDA) aims to advance in wave (5), targeting $189 or higher. The rally to $185.22 completed wave (3). A pullback in wave (4) formed a zigzag Elliott Wave pattern. From wave (3), wave A dropped to $170.89. Wave B peaked at $184.48, and wave C fell to $168.01, showing an impulsive structure on the 30-minute chart below.

The stock has since turned upward. It must break above $185.22, the wave (3) high, to confirm no double correction. The rally from wave (4) unfolds as a five-wave impulse, supporting a bullish bias. From the wave (4) low, wave ((i)) reached $173.53. Wave ((ii)) dipped to $171.11. The stock then climbed in wave ((iii)) to $181.91. A brief wave ((iv)) pullback ended at $178.35. Nvidia nears completion of wave ((v)), finalizing wave 1 in a higher degree.

A wave 2 pullback should follow, correcting the cycle from the August 22 low. The stock will likely resume its climb afterward. As long as the $168.01 pivot holds, pullbacks should attract buyers in a 3, 7, or 11 swing, paving the way for further upside. This setup keeps Nvidia’s bullish momentum intact, provided the key support level remains unbroken.

The stock has since turned upward. It must break above $185.22, the wave (3) high, to confirm no double correction. The rally from wave (4) unfolds as a five-wave impulse, supporting a bullish bias. From the wave (4) low, wave ((i)) reached $173.53. Wave ((ii)) dipped to $171.11. The stock then climbed in wave ((iii)) to $181.91. A brief wave ((iv)) pullback ended at $178.35. Nvidia nears completion of wave ((v)), finalizing wave 1 in a higher degree.

A wave 2 pullback should follow, correcting the cycle from the August 22 low. The stock will likely resume its climb afterward. As long as the $168.01 pivot holds, pullbacks should attract buyers in a 3, 7, or 11 swing, paving the way for further upside. This setup keeps Nvidia’s bullish momentum intact, provided the key support level remains unbroken.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.