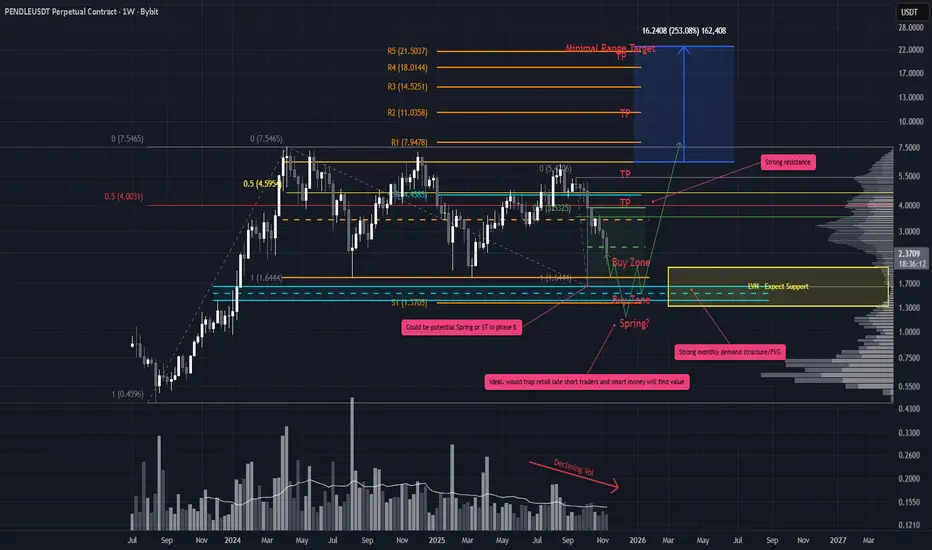

PENDLE’s chart is loaded with nuance right now. There’s a lot in play, and multiple paths could unfold from here so staying nimble and managing risk is key.

The October 10 flash crash left a deep wick at the bottom of the range. Price initially bounced back to ~$3.87 but has since retraced heavily into that wick. Candle spreads are widening, which suggests selling pressure is still present, but volume hasn’t picked up. That leans me toward accumulation rather than distribution.

We’re currently hovering around the EQ of that wick. If price pushes out strongly from here, the pullback may be complete and we can treat the October 10 low as a low-volume spring. If price continues to pull back, we may sweep those October lows and form the actual spring. The ideal confirmation would be a weekly move below the range on volume, followed by a close back inside the range preferably with a doji or hammer. Psychologically, that would be the cleanest setup, injecting liquidity and setting the stage for reversal.

Just below the range sits the yearly S1 pivot and a major monthly FVG both worth watching.

Trade Scenario 1 – Early Entry with Spring Add-on

Entry

• Start layering in now (as outlined above)

• Add again if we get the spring confirmation

Stop Loss

• No hard SL yet. This setup leans advanced.

• If we see large bearish candles on rising volume, the thesis is invalidated and we exit.

Trade Scenario 2 – Wait for Spring Confirmation

Entry

• Wait for price to sweep the lows and print the spring candle

• Enter on confirmation (weekly close back in range with volume)

Targets for Both Scenarios

Keep it simple:

• EQ of the range

• Range highs

• Minimal range extension if price breaks out above

This is a contrarian view. Many expect crypto to roll over into a broader bear phase. But if this spring plays out, PENDLE could offer a clean bounce setup with strong psychological structure with most retail traders left behind.

The October 10 flash crash left a deep wick at the bottom of the range. Price initially bounced back to ~$3.87 but has since retraced heavily into that wick. Candle spreads are widening, which suggests selling pressure is still present, but volume hasn’t picked up. That leans me toward accumulation rather than distribution.

We’re currently hovering around the EQ of that wick. If price pushes out strongly from here, the pullback may be complete and we can treat the October 10 low as a low-volume spring. If price continues to pull back, we may sweep those October lows and form the actual spring. The ideal confirmation would be a weekly move below the range on volume, followed by a close back inside the range preferably with a doji or hammer. Psychologically, that would be the cleanest setup, injecting liquidity and setting the stage for reversal.

Just below the range sits the yearly S1 pivot and a major monthly FVG both worth watching.

Trade Scenario 1 – Early Entry with Spring Add-on

Entry

• Start layering in now (as outlined above)

• Add again if we get the spring confirmation

Stop Loss

• No hard SL yet. This setup leans advanced.

• If we see large bearish candles on rising volume, the thesis is invalidated and we exit.

Trade Scenario 2 – Wait for Spring Confirmation

Entry

• Wait for price to sweep the lows and print the spring candle

• Enter on confirmation (weekly close back in range with volume)

Targets for Both Scenarios

Keep it simple:

• EQ of the range

• Range highs

• Minimal range extension if price breaks out above

This is a contrarian view. Many expect crypto to roll over into a broader bear phase. But if this spring plays out, PENDLE could offer a clean bounce setup with strong psychological structure with most retail traders left behind.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.