PAYPAL’S FINANCIAL LANDSCAPE: VALUATION & OPPORTUNITIES

1/8

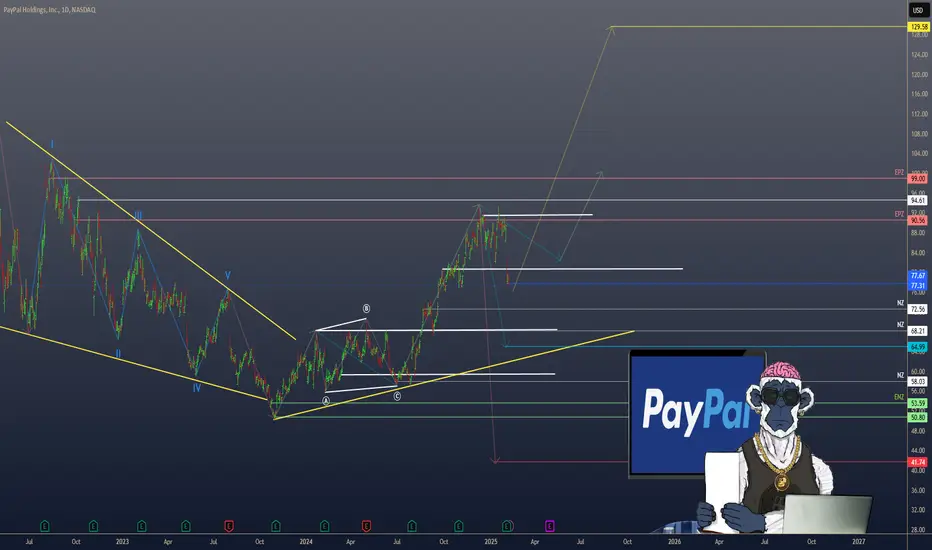

PayPal ( PYPL) has been on the move lately—announcing a

PYPL) has been on the move lately—announcing a  15B buyback and posting mixed but intriguing earnings results. Let’s dive into what’s making this fintech giant tick! 💳💡

15B buyback and posting mixed but intriguing earnings results. Let’s dive into what’s making this fintech giant tick! 💳💡

2/8 – Recent Revenue Growth

PayPal’s revenue soared during the digital payment boom but has moderated recently.

Although the exact figures aren’t in the latest posts, growth since 2017 is substantial.

Stabilization might indicate a new normal in digital payments.

3/8 – Earnings & Guidance

Some quarters saw EPS pop by 61%—pretty impressive! 🚀

Mixed guidance ahead: margin expansion concerns and flat-to-down cash flow.

The 15B buyback suggests management sees long-term potential.

15B buyback suggests management sees long-term potential.

4/8 – Valuation vs. Peers

Forward P/E near 10, PEG ratio of 0.52—that’s cheap compared to Visa/Mastercard.

PayPal straddles fintech + payments, competing with everyone from Square ( SQ) to Apple Pay.

SQ) to Apple Pay.

Lower growth vs. some peers, but strong operating margins help PayPal stay ahead.

5/8 – Risk Factors

1️⃣ Regulatory: New rules could cramp expansion.

2️⃣ Market Saturation: Need emerging markets to fuel next leg of growth.

3️⃣ Competition: Stripe, Apple Pay, & countless fintech upstarts.

4️⃣ Tech Disruption: Blockchain, AI, or next-gen payments could reshape the landscape.

6/8 What’s PayPal’s biggest near-term challenge?

1️⃣ Regulatory Hurdles

2️⃣ Competition

3️⃣ Market Saturation

4️⃣ Tech Disruption

Vote below! 🗳️👇

7/8 – SWOT/SCOT

Strengths: Massive user base, recognizable brand, buyback confidence.

Weaknesses: Slowing user growth, uncertain future margins.

Opportunities: Emerging markets, strategic partnerships, AI integration.

Threats: Fierce competition, cyber risks, evolving payment tech.

8/8 – Your Next Move?

PayPal’s at a pivot—undervalued or a value trap? 💰

Let’s see if PYPL can keep up the momentum!

PYPL can keep up the momentum!

#PayPal #Fintech #DigitalPayments #PYPL #Investing #Earnings #Valuation #Finance

1/8

PayPal (

2/8 – Recent Revenue Growth

PayPal’s revenue soared during the digital payment boom but has moderated recently.

Although the exact figures aren’t in the latest posts, growth since 2017 is substantial.

Stabilization might indicate a new normal in digital payments.

3/8 – Earnings & Guidance

Some quarters saw EPS pop by 61%—pretty impressive! 🚀

Mixed guidance ahead: margin expansion concerns and flat-to-down cash flow.

The

4/8 – Valuation vs. Peers

Forward P/E near 10, PEG ratio of 0.52—that’s cheap compared to Visa/Mastercard.

PayPal straddles fintech + payments, competing with everyone from Square (

Lower growth vs. some peers, but strong operating margins help PayPal stay ahead.

5/8 – Risk Factors

1️⃣ Regulatory: New rules could cramp expansion.

2️⃣ Market Saturation: Need emerging markets to fuel next leg of growth.

3️⃣ Competition: Stripe, Apple Pay, & countless fintech upstarts.

4️⃣ Tech Disruption: Blockchain, AI, or next-gen payments could reshape the landscape.

6/8 What’s PayPal’s biggest near-term challenge?

1️⃣ Regulatory Hurdles

2️⃣ Competition

3️⃣ Market Saturation

4️⃣ Tech Disruption

Vote below! 🗳️👇

7/8 – SWOT/SCOT

Strengths: Massive user base, recognizable brand, buyback confidence.

Weaknesses: Slowing user growth, uncertain future margins.

Opportunities: Emerging markets, strategic partnerships, AI integration.

Threats: Fierce competition, cyber risks, evolving payment tech.

8/8 – Your Next Move?

PayPal’s at a pivot—undervalued or a value trap? 💰

Let’s see if

#PayPal #Fintech #DigitalPayments #PYPL #Investing #Earnings #Valuation #Finance

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.