As highlighted in the previous update(pinned on my profile),

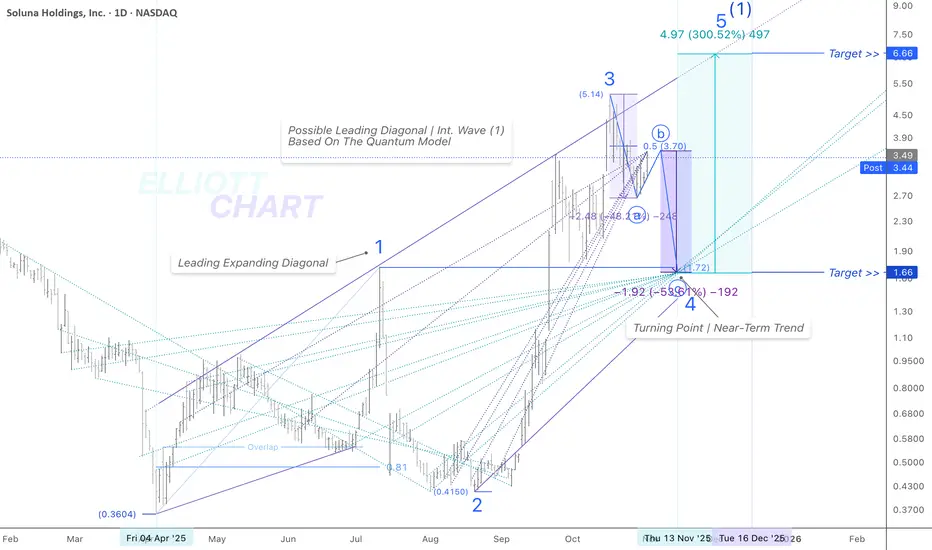

The Fibonacci retracement target at $3.70🎯 remains intact. Once the retracement in Wave ⓑ completes, a sharp decline of roughly 54% is expected to follow in Minute Wave ⓒ, continuing the broader corrective sequence of Minor Wave 4 📉.

Support is anticipated to emerge near the apex of the equivalence lines — would set the stage for a powerful +300%📈 surge into mid-December.

Bearish Alternate Scenario [Near-Term]

Under this alternate scenario, Minor Wave 4 is currently unfolding — a pullback that would retrace up to –66%, consistent with the behavior typically observed within a Leading Diagonal structure. This retracement is expected to be sharp and volatile, characteristic of fourth waves in such formations in Diagonal.

The near-term downside target is projected around $1.66🎯, with potential support near the apex of the convergent equivalence lines.

🔖 This outlook is derived from insights within my Quantum Models framework.

Bullish Alternate Scenario [Mid-Term | Long-Term]

The rising price action since early April continues to develop as a potentially bullish structure in Leading Diagonal, forming Intermediate Wave (1).

Int. Wave (1) is expected to complete near $6.66🎯 — a key target zone to watch.

#QuantumModels #EquivalenceLines #Targeting #MarketAnalysis #TechnicalAnalysis #ElliottWave #WaveAnalysis #TrendAnalysis #FibLevels #FinTwit #TradingView #Investing #SLNH #GreenDataCenters #BitcoinMining #CryptoMining #AIStocks #HPC #AI #BTC #Bitcoin #BTCUSD

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.