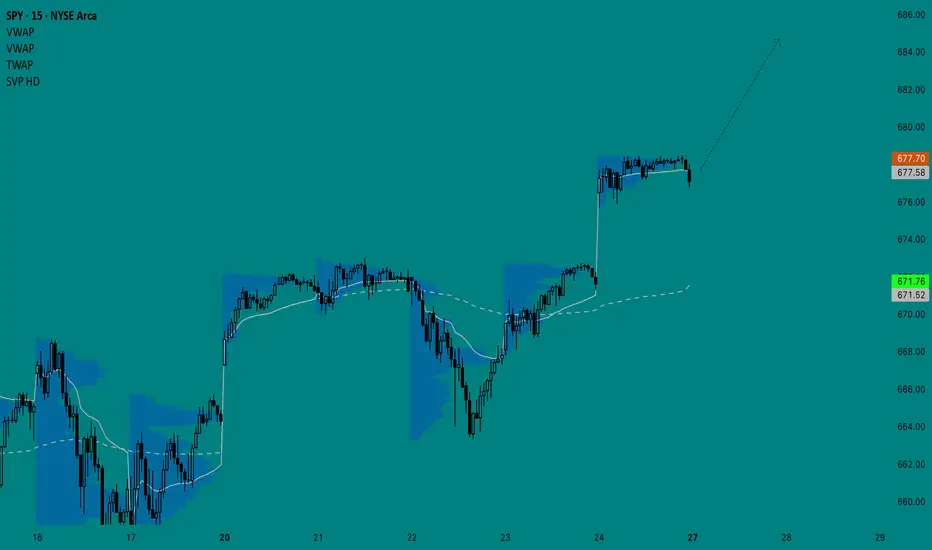

Last week of the month and the market is back at ATH - but is this a true breakout or a final shakeout of buyers? I think the market is showing some important clues and will run through my charts again but plan on keeping this brief so I can move on to other things on this beautiful Sunday.

1. Macro

As I mentioned in last week’s post, the GGOLD/GVZ spread was showing signs of trend exhaustion (gold puts were being hedged heavily compared to the underlying) which provided to be an early signal of the Gold pullback. Here we are seeing the Dollar’s continued flat movement, which may result in a move below the average this week.

Yields continue to slide and are now diverging, with the 3M yield possibly showing signs of outpacing the 10Y yield to the downside, which may suggest that the market is expecting speedier intervention from the Fed.

On the bottom left, I have overlaid USCCPI on my forward inflation gauge chart to illustrate that the market has been pricing in lower inflation expectations, and we are now seeing the initial tariff-bump to inflation flatten out, which is in line with the market’s expectation. Bottom line - the market should now be more sensitive to news that could indicate higher inflation since it is currently pricing for lower rather than before when the market was pricing higher inflation that ended up being slightly higher than the real data.

USCCPI on my forward inflation gauge chart to illustrate that the market has been pricing in lower inflation expectations, and we are now seeing the initial tariff-bump to inflation flatten out, which is in line with the market’s expectation. Bottom line - the market should now be more sensitive to news that could indicate higher inflation since it is currently pricing for lower rather than before when the market was pricing higher inflation that ended up being slightly higher than the real data.

On the commodities side, we’re seeing more of the same. I’ll touch more on gold on my Risk layout and it looks like Oil CL1! is still in a flat range and may be making a lower high after a lower low. This week I have expanded my commodity index (bottom right) to add Cotton

CL1! is still in a flat range and may be making a lower high after a lower low. This week I have expanded my commodity index (bottom right) to add Cotton  CT1! and Aluminum

CT1! and Aluminum  ALI1! to broaden the scope. My thinking is that corn

ALI1! to broaden the scope. My thinking is that corn  MZC1! is one of the most versatile crops in the world: a staple food, biofuel, and industrial crop, while Cotton is unique in that it is a non-food crop that is essential to the manufacturing of clothing and other consumer & industrial products. This pairing covers all the bases when it comes to demand for crops for various uses. Similarly, my thinking for metals is that Copper

MZC1! is one of the most versatile crops in the world: a staple food, biofuel, and industrial crop, while Cotton is unique in that it is a non-food crop that is essential to the manufacturing of clothing and other consumer & industrial products. This pairing covers all the bases when it comes to demand for crops for various uses. Similarly, my thinking for metals is that Copper  HG1! is widely used in electrical infrastructure and consumer/industrial electronics while Aluminum

HG1! is widely used in electrical infrastructure and consumer/industrial electronics while Aluminum  ALI1! is used in consumer products, construction, auto manufacturing, and so on.

ALI1! is used in consumer products, construction, auto manufacturing, and so on.

The takeaway is that the gauge here has been in an uptrend in April while real inflation and forward inflation expectations have cooled, so the market is likely absorbing these higher prices/not passing them to consumers. Conclusion: the macro environment is looking more stable, however with China tariffs in focus it will be highly important to watch the commodity gauge and US03MY . Commodity gauge rising sharply could force the market to reprice inflation expectations, which would benefit Gold, hurt the dollar

US03MY . Commodity gauge rising sharply could force the market to reprice inflation expectations, which would benefit Gold, hurt the dollar  DXY and possibly lead to higher bond yields. I’m cautiously optimistic here.

DXY and possibly lead to higher bond yields. I’m cautiously optimistic here.

2. FX

Using a date range of the last Fed rate decision to today, the dollar DXY has outperformed other currency baskets (while still being the worst performer for the year). When looking at global 3M and 10Y yields on indexed charts, outside of Japan there was 10Y buying during mid-October that is now showing signs of flattening out. On the 3M side, treasuries have slid while Eurozone (EU, France, Italy, Germany) are showing some divergence, likely due to a troubling combination of slow growth, high debt, and political instability. The takeaway here is that I expect the dollar’s flat range to continue, and may outperform other currency baskets as a result. This chart also indicates that the US bond market is currently providing a safe haven, especially when relatively attractive Real Yields are considered as well.

DXY has outperformed other currency baskets (while still being the worst performer for the year). When looking at global 3M and 10Y yields on indexed charts, outside of Japan there was 10Y buying during mid-October that is now showing signs of flattening out. On the 3M side, treasuries have slid while Eurozone (EU, France, Italy, Germany) are showing some divergence, likely due to a troubling combination of slow growth, high debt, and political instability. The takeaway here is that I expect the dollar’s flat range to continue, and may outperform other currency baskets as a result. This chart also indicates that the US bond market is currently providing a safe haven, especially when relatively attractive Real Yields are considered as well.

3. Risk

This chart shows indexes appeared to have recovered from the period of volatility and the line chart appears to show upward momentum, rather than a top forming. This is bolstered by the High Yield-Investment Grade bond Option Adjusted Spread (top left) showing signs of consolidation or moving back down. Investment Grade bonds currently have a very low premium vs treasuries, so downside resistance should be expected. Keeping it around this level would be ideal, as the OAS moving too low could make the market sensitive to a shock and moving higher could indicate an adverse sentiment towards risk.

Other signs are promising though. EES1!/GOLD looks like it is going to move higher, further supporting the bias that the gold rally will continue to stall or pull back further. On the top right, SSPY/RSP (SPY vs the equal-weight ETF) shows the weighted index will continue in its uptrend, benefiting the companies with the most weight such as Tech.

One last comment on gold: on the GGOLD/GVZ chart we can see that Gold found support near a familiar level and will either see further reversion or a new upward trend form. This could suggest that the gold downside risk is fading, so it will be important to watch if Gold catches a bid and if so, whether or not it is accompanied by strong hedging. Since I’m mostly leaning towards Gold being flat, I think the more likely scenario is that the gold rally stalling will be temporary and will probably not be accompanied by strong hedging of puts.

4. Sector Analysis

Now that we have seen what is likely a volatility peak, it’s a good time to assess where the market is positioned. Good news is that even though the market pulled back and chopped around in October, Tech (XLK) is still outperforming the market and is on track to continue rising while defensive sectors underperform. Since I have already outlined other reasons why Tech and mega caps are likely to continue outperforming the broader market ( NNQ1!/YM1! and SSPY/RSP ), this is just further confirmation of what I’m already seeing.

5. Bias

As I mentioned last week, I’m currently taking a shorter-term trading approach and as a result, this Bias chart is now focused more on assessing and capturing volatility than determining market bias.

With that being said, the important notes I have are that VIX and VVIX look to have peaked and CVD saw some action last week with strong effort from sellers that did not really move the price down. Futures just opened higher so the session may have lower volatility on Monday (mean reversion) but overall the bullish case here is solid.

Conclusion:

Most signs I’m seeing here point to continued upside for stocks, as fear is being priced out and greed is being priced back in. As I mentioned above, I will watch the macro indicators and sectors for signs that the trend is changing but since we are likely seeing a true breakout, more upside should be expected unless something major changes.

1. Macro

As I mentioned in last week’s post, the GGOLD/GVZ spread was showing signs of trend exhaustion (gold puts were being hedged heavily compared to the underlying) which provided to be an early signal of the Gold pullback. Here we are seeing the Dollar’s continued flat movement, which may result in a move below the average this week.

Yields continue to slide and are now diverging, with the 3M yield possibly showing signs of outpacing the 10Y yield to the downside, which may suggest that the market is expecting speedier intervention from the Fed.

On the bottom left, I have overlaid

On the commodities side, we’re seeing more of the same. I’ll touch more on gold on my Risk layout and it looks like Oil

The takeaway is that the gauge here has been in an uptrend in April while real inflation and forward inflation expectations have cooled, so the market is likely absorbing these higher prices/not passing them to consumers. Conclusion: the macro environment is looking more stable, however with China tariffs in focus it will be highly important to watch the commodity gauge and

2. FX

Using a date range of the last Fed rate decision to today, the dollar

3. Risk

This chart shows indexes appeared to have recovered from the period of volatility and the line chart appears to show upward momentum, rather than a top forming. This is bolstered by the High Yield-Investment Grade bond Option Adjusted Spread (top left) showing signs of consolidation or moving back down. Investment Grade bonds currently have a very low premium vs treasuries, so downside resistance should be expected. Keeping it around this level would be ideal, as the OAS moving too low could make the market sensitive to a shock and moving higher could indicate an adverse sentiment towards risk.

Other signs are promising though. EES1!/GOLD looks like it is going to move higher, further supporting the bias that the gold rally will continue to stall or pull back further. On the top right, SSPY/RSP (SPY vs the equal-weight ETF) shows the weighted index will continue in its uptrend, benefiting the companies with the most weight such as Tech.

One last comment on gold: on the GGOLD/GVZ chart we can see that Gold found support near a familiar level and will either see further reversion or a new upward trend form. This could suggest that the gold downside risk is fading, so it will be important to watch if Gold catches a bid and if so, whether or not it is accompanied by strong hedging. Since I’m mostly leaning towards Gold being flat, I think the more likely scenario is that the gold rally stalling will be temporary and will probably not be accompanied by strong hedging of puts.

4. Sector Analysis

Now that we have seen what is likely a volatility peak, it’s a good time to assess where the market is positioned. Good news is that even though the market pulled back and chopped around in October, Tech (XLK) is still outperforming the market and is on track to continue rising while defensive sectors underperform. Since I have already outlined other reasons why Tech and mega caps are likely to continue outperforming the broader market ( NNQ1!/YM1! and SSPY/RSP ), this is just further confirmation of what I’m already seeing.

5. Bias

As I mentioned last week, I’m currently taking a shorter-term trading approach and as a result, this Bias chart is now focused more on assessing and capturing volatility than determining market bias.

With that being said, the important notes I have are that VIX and VVIX look to have peaked and CVD saw some action last week with strong effort from sellers that did not really move the price down. Futures just opened higher so the session may have lower volatility on Monday (mean reversion) but overall the bullish case here is solid.

Conclusion:

Most signs I’m seeing here point to continued upside for stocks, as fear is being priced out and greed is being priced back in. As I mentioned above, I will watch the macro indicators and sectors for signs that the trend is changing but since we are likely seeing a true breakout, more upside should be expected unless something major changes.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.