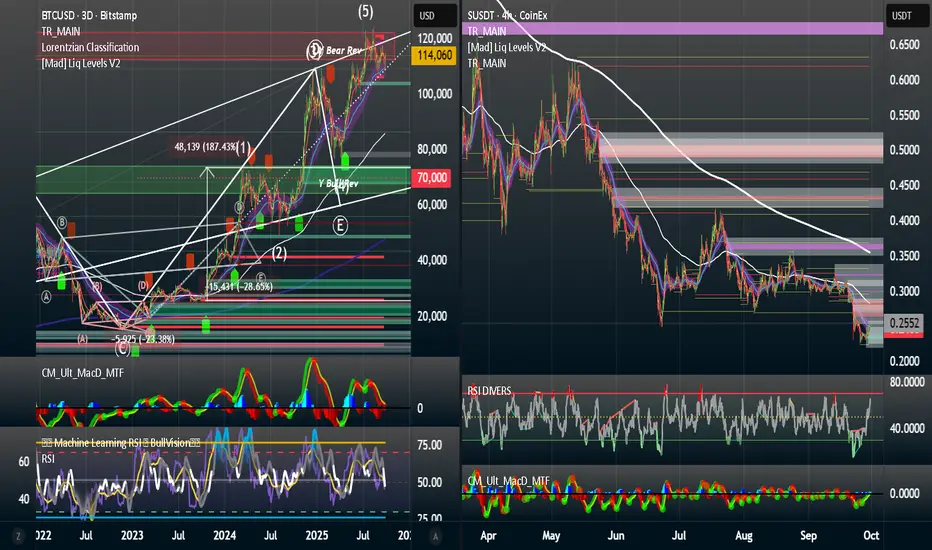

Sonic (SUSDT:COINEX) - Macro + TA

Context:

Macro drivers: USD showing softness, yields stable, equities firm.

Crypto majors holding higher ranges; sentiment neutral.

Key Levels:

Support zones: 0.300–0.305, 0.285, 0.270

Resistance zones: 0.335–0.350, 0.375–0.385, 0.400–0.410, 0.460

2H View:

A 2H close above 0.335 with RSI > 50 would suggest room toward 0.350 / 0.375 / 0.400.

A 2H close below 0.300 could open space toward 0.285 / 0.270 / 0.255.

4H View:

The 200EMA around 0.34–0.35 remains an important zone.

Sustained closes above 0.335–0.340 could leave upside potential to 0.350 / 0.375 / 0.400.

Rejections near 0.350 with momentum slowing may see a move back toward 0.335 / 0.322 / 0.305.

1D View:

Since July, price has ranged 0.30–0.35; supply sits at 0.40–0.46.

Closes around 0.300–0.305 with constructive candles may lead toward 0.335 / 0.350 / 0.375.

A daily close above 0.375 would highlight 0.400 / 0.430 / 0.460.

A daily close under 0.300 would refocus attention on 0.285 / 0.270 / 0.250.

1W Lens:

Market remains under weekly supply 0.40–0.46.

A weekly close above 0.46 would bring 0.50–0.55 into view.

0.30–0.32 may act as an accumulation range while USD stays soft and majors stable; stronger USD or yields could shift focus toward 0.285–0.270.

---

Risk Notes:

Macro events (CPI releases, DXY moves, yield spikes) can shift these dynamics quickly.

TL;DR:

Constructive bias if 0.335 is reclaimed and held.

Losing 0.300 would shift focus to 0.285 / 0.270.

---

*Educational purposes only. Not financial advice. I also warrant that the information created and published here is not prohibited, doesn't constitute investment advice, and isn't created solely for qualified investors.*

Context:

Macro drivers: USD showing softness, yields stable, equities firm.

Crypto majors holding higher ranges; sentiment neutral.

Key Levels:

Support zones: 0.300–0.305, 0.285, 0.270

Resistance zones: 0.335–0.350, 0.375–0.385, 0.400–0.410, 0.460

2H View:

A 2H close above 0.335 with RSI > 50 would suggest room toward 0.350 / 0.375 / 0.400.

A 2H close below 0.300 could open space toward 0.285 / 0.270 / 0.255.

4H View:

The 200EMA around 0.34–0.35 remains an important zone.

Sustained closes above 0.335–0.340 could leave upside potential to 0.350 / 0.375 / 0.400.

Rejections near 0.350 with momentum slowing may see a move back toward 0.335 / 0.322 / 0.305.

1D View:

Since July, price has ranged 0.30–0.35; supply sits at 0.40–0.46.

Closes around 0.300–0.305 with constructive candles may lead toward 0.335 / 0.350 / 0.375.

A daily close above 0.375 would highlight 0.400 / 0.430 / 0.460.

A daily close under 0.300 would refocus attention on 0.285 / 0.270 / 0.250.

1W Lens:

Market remains under weekly supply 0.40–0.46.

A weekly close above 0.46 would bring 0.50–0.55 into view.

0.30–0.32 may act as an accumulation range while USD stays soft and majors stable; stronger USD or yields could shift focus toward 0.285–0.270.

---

Risk Notes:

Macro events (CPI releases, DXY moves, yield spikes) can shift these dynamics quickly.

TL;DR:

Constructive bias if 0.335 is reclaimed and held.

Losing 0.300 would shift focus to 0.285 / 0.270.

---

*Educational purposes only. Not financial advice. I also warrant that the information created and published here is not prohibited, doesn't constitute investment advice, and isn't created solely for qualified investors.*

imaCŁ◎NΞ.x | TA & Market Analysis | x.com/DJC4ndyM4n | imacl.one | https://imaclone.x

PGP Public Key: pastebin.com/aYgSg6m6

PGP Public Key: pastebin.com/aYgSg6m6

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

imaCŁ◎NΞ.x | TA & Market Analysis | x.com/DJC4ndyM4n | imacl.one | https://imaclone.x

PGP Public Key: pastebin.com/aYgSg6m6

PGP Public Key: pastebin.com/aYgSg6m6

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.