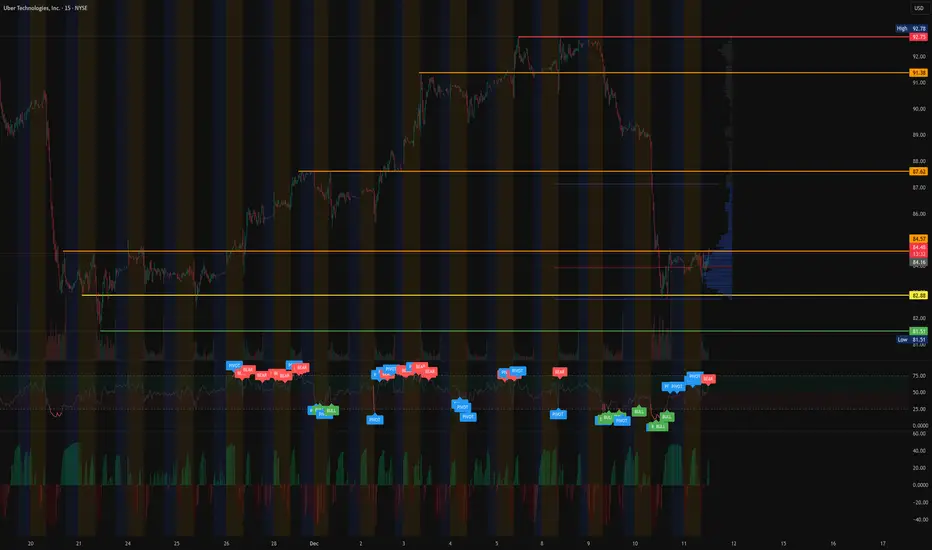

UBER has pulled back into a major support zone at 82.88 after a strong run toward the recent highs near 92.75. Price is now consolidating at the lower end of this micro-range, holding above value-area support and attempting to stabilize after heavy selling pressure.

The chart shows a clear liquidity sweep below support followed by buyers stepping back in, which can be a constructive sign if momentum continues to shift upward.

We prefer the long setup closer to 82.88, where both structure and volume support align.

Technical Overview

Support Levels:

82.88 (primary support, ideal buy zone)

82.40 (local low)

81.51 (momentum failure level)

Resistance Levels:

84.57 (current ceiling and VWAP zone)

87.62 (value-area boundary)

91.38 (major supply zone)

92.75 (recent high)

Structure:

Strong prior uptrend followed by retracement

Consolidation forming above 82.88

Sideways corrective range with declining volume

Price trading inside high-volume node on VPVR

Momentum:

MACD histogram shifting toward neutral

RSI stabilizing after the flush

Buyers defending support consistently

Trend Bias:

Bullish as long as price holds above 82.88

Strongly bullish above 84.57

As long as UBER holds above 82.88, bulls maintain control over this retracement setup.

A reclaim and hold above 84.57 opens the door to 87.62, 91.38, and a potential retest of 92.75.

A breakdown below 81.51 signals failed momentum for this setup.

My Plan

Entry Zone: 82.88 to 83.25

Targets: 84.57, 87.62, 91.38

Stretch Target: 92.75

Invalidation: Close below 81.51

UBER remains in a bullish macro structure, and this pullback may offer one of the cleaner continuation entries if support holds.

Share your thoughts, and I will post an update if we confirm a breakout over 84.57.

#UBER #Stocks #MyMIWallet #TradeAlerts LYFT

LYFT  AMZN

AMZN  GOOG

GOOG

The chart shows a clear liquidity sweep below support followed by buyers stepping back in, which can be a constructive sign if momentum continues to shift upward.

We prefer the long setup closer to 82.88, where both structure and volume support align.

Technical Overview

Support Levels:

82.88 (primary support, ideal buy zone)

82.40 (local low)

81.51 (momentum failure level)

Resistance Levels:

84.57 (current ceiling and VWAP zone)

87.62 (value-area boundary)

91.38 (major supply zone)

92.75 (recent high)

Structure:

Strong prior uptrend followed by retracement

Consolidation forming above 82.88

Sideways corrective range with declining volume

Price trading inside high-volume node on VPVR

Momentum:

MACD histogram shifting toward neutral

RSI stabilizing after the flush

Buyers defending support consistently

Trend Bias:

Bullish as long as price holds above 82.88

Strongly bullish above 84.57

As long as UBER holds above 82.88, bulls maintain control over this retracement setup.

A reclaim and hold above 84.57 opens the door to 87.62, 91.38, and a potential retest of 92.75.

A breakdown below 81.51 signals failed momentum for this setup.

My Plan

Entry Zone: 82.88 to 83.25

Targets: 84.57, 87.62, 91.38

Stretch Target: 92.75

Invalidation: Close below 81.51

UBER remains in a bullish macro structure, and this pullback may offer one of the cleaner continuation entries if support holds.

Share your thoughts, and I will post an update if we confirm a breakout over 84.57.

#UBER #Stocks #MyMIWallet #TradeAlerts

AMZN

AMZN Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.