Fundamentals

I don't think it is good idea to be selling the dollar any longer but it's still good to be long on equities indexes.

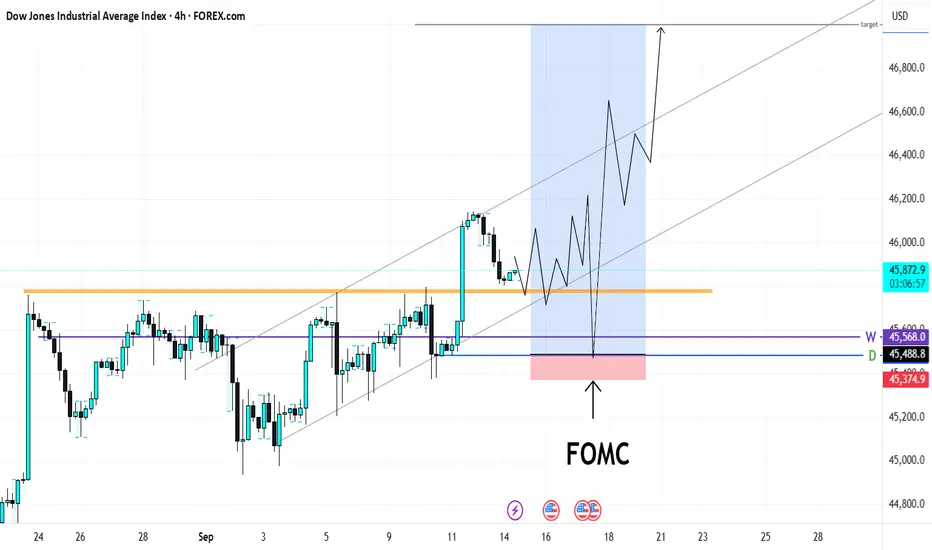

There's a guaranteed rate cut of -0.25% from the Federal Reserve on Wednesday. Lowering interest rates means more people are going to borrow. More people spending, more businesses thriving, stocks go up, index go up. There are two more cuts to be expected for 2025 and that is what smart money is pricing in. That is the expectation. The Fed has chosen the labor market over inflation issue. The surprise here would be if the Fed changes its focus to inflation. Which could stun or drop the indexes. That is unlikely that is why it is high probability long.

Technical

It's too early to tell right now, how the price action is going to be. If price action changes on tuesday, I'm going to be doing the same thing. That is to find liquidity of bandwagon buyers, at an obvious break and retest support. Below that where stops and sell stops is I estimate where the discounted smart money longs would be. That is 45,500

I will not be putting a buy limit until Wednesday London session that is if price action remains the same

I don't think it is good idea to be selling the dollar any longer but it's still good to be long on equities indexes.

There's a guaranteed rate cut of -0.25% from the Federal Reserve on Wednesday. Lowering interest rates means more people are going to borrow. More people spending, more businesses thriving, stocks go up, index go up. There are two more cuts to be expected for 2025 and that is what smart money is pricing in. That is the expectation. The Fed has chosen the labor market over inflation issue. The surprise here would be if the Fed changes its focus to inflation. Which could stun or drop the indexes. That is unlikely that is why it is high probability long.

Technical

It's too early to tell right now, how the price action is going to be. If price action changes on tuesday, I'm going to be doing the same thing. That is to find liquidity of bandwagon buyers, at an obvious break and retest support. Below that where stops and sell stops is I estimate where the discounted smart money longs would be. That is 45,500

I will not be putting a buy limit until Wednesday London session that is if price action remains the same

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.