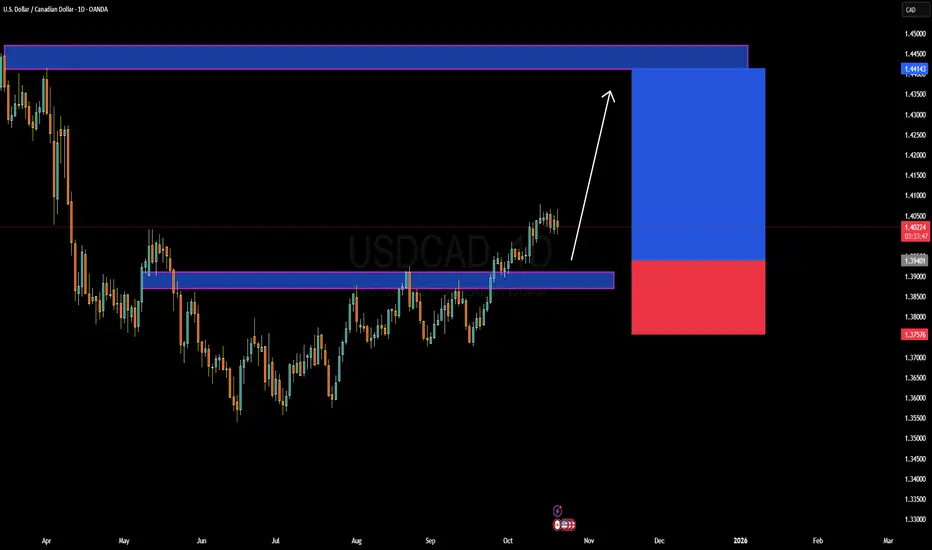

USDCAD on the daily chart is maintaining a strong bullish structure after breaking above the previous resistance zone around 1.3940. The market has been forming higher highs and higher lows, showing solid buying pressure as the pair heads toward the 1.4140–1.4200 resistance range. The current price action suggests a potential continuation setup where a minor pullback toward the breakout zone could invite more buyers before the next bullish impulse. The upward momentum is supported by clear technical strength, making this a favorable setup for long positions if price sustains above 1.3940.

From a fundamental standpoint, the US dollar remains dominant amid the ongoing strength in the US economy and persistent inflation pressures, which keep expectations of prolonged higher interest rates from the Federal Reserve alive. In contrast, the Canadian dollar faces pressure due to weaker growth prospects and declining oil prices, which reduce demand for the CAD as a commodity-linked currency. Additionally, global risk sentiment has leaned defensive, favoring the USD as a safe-haven asset.

If the bullish momentum continues and the market holds above the current support region, USDCAD could likely retest the 1.4140–1.4200 zone in the near term. Traders will closely monitor US inflation data and crude oil performance as key drivers for this pair’s next move. Overall, the setup aligns with both technical and fundamental bullish conditions, offering a clear profit potential on continuation of the trend.

From a fundamental standpoint, the US dollar remains dominant amid the ongoing strength in the US economy and persistent inflation pressures, which keep expectations of prolonged higher interest rates from the Federal Reserve alive. In contrast, the Canadian dollar faces pressure due to weaker growth prospects and declining oil prices, which reduce demand for the CAD as a commodity-linked currency. Additionally, global risk sentiment has leaned defensive, favoring the USD as a safe-haven asset.

If the bullish momentum continues and the market holds above the current support region, USDCAD could likely retest the 1.4140–1.4200 zone in the near term. Traders will closely monitor US inflation data and crude oil performance as key drivers for this pair’s next move. Overall, the setup aligns with both technical and fundamental bullish conditions, offering a clear profit potential on continuation of the trend.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.