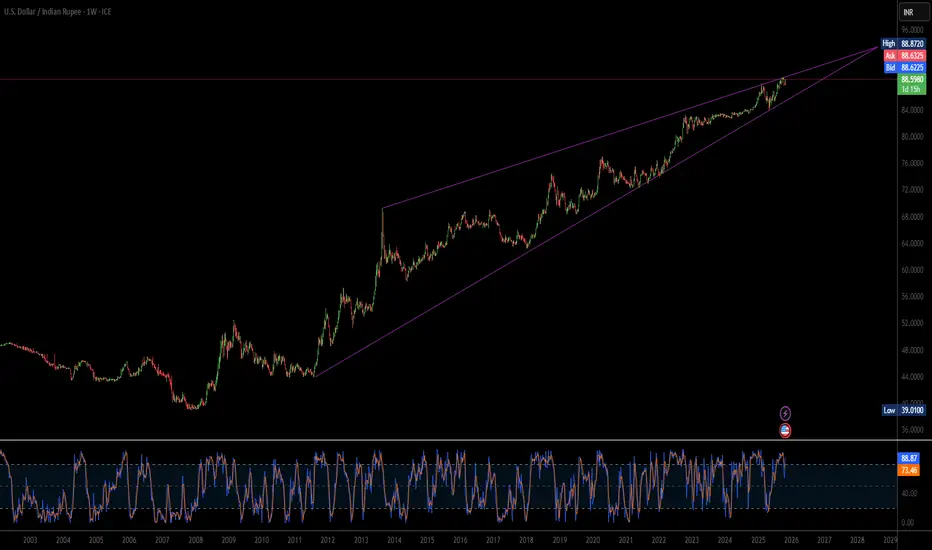

The Indian Rupee (INR) is exhibiting a pronounced, sustained weakness against the US Dollar (USD), pushing the USD/INR pair toward the 88.60 level, even as the global US Dollar Index (DXY) shows signs of softness. This resilience in the USD/INR confirms that domestic and structural headwinds—rather than external dollar strength—are primarily responsible for the Rupee's depreciation. A deep analysis across strategic, economic, and technological domains reveals that geopolitical delays and cautious monetary policy abroad are significantly outweighing any temporary relief from global dollar flows.

The central source of this structural weakness stems from two major factors: geopolitical uncertainty and macroeconomic policy divergence. The persistent delay in finalizing a comprehensive trade agreement between the US and India fuels Foreign Institutional Investor (FII) anxiety, leading to hesitant capital inflows. While FIIs showed a brief surge in buying, overall conviction remains low without a clear trade resolution. Concurrently, the US Federal Reserve's commitment to a "higher-for-longer" interest rate floor, despite a recent cut, strengthens the relative appeal of the USD. This policy stance attracts global capital to US assets, thereby limiting liquidity and increasing the cost of holding the INR.

Furthermore, India’s technological landscape adds to the structural demand for the USD. Low domestic Research & Development (R&D) investment and a heavy reliance on foreign patents mean the nation must spend more USD to import essential high-tech equipment and intellectual property. This technological deficit creates a persistent, structural requirement for foreign currency, putting continuous pressure on the Rupee. From a technical analysis perspective, the USD/INR pair's decisive hold above the 20-day Exponential Moving Average (EMA) confirms the market's bullish bias, suggesting the current trend is robust and targeting the all-time high of 89.12.

In essence, the Rupee's struggle is a complex interplay of internal and external structural factors. Until a major trade deal is confirmed, capital inflows become more decisive, or India's technological import needs stabilize, the market will continue to favor the USD. Traders must recognize that the technical path of least resistance for the USD/INR is upward, driven by these fundamental geopolitical and economic asymmetries rather than temporary movements in the global dollar index.

The central source of this structural weakness stems from two major factors: geopolitical uncertainty and macroeconomic policy divergence. The persistent delay in finalizing a comprehensive trade agreement between the US and India fuels Foreign Institutional Investor (FII) anxiety, leading to hesitant capital inflows. While FIIs showed a brief surge in buying, overall conviction remains low without a clear trade resolution. Concurrently, the US Federal Reserve's commitment to a "higher-for-longer" interest rate floor, despite a recent cut, strengthens the relative appeal of the USD. This policy stance attracts global capital to US assets, thereby limiting liquidity and increasing the cost of holding the INR.

Furthermore, India’s technological landscape adds to the structural demand for the USD. Low domestic Research & Development (R&D) investment and a heavy reliance on foreign patents mean the nation must spend more USD to import essential high-tech equipment and intellectual property. This technological deficit creates a persistent, structural requirement for foreign currency, putting continuous pressure on the Rupee. From a technical analysis perspective, the USD/INR pair's decisive hold above the 20-day Exponential Moving Average (EMA) confirms the market's bullish bias, suggesting the current trend is robust and targeting the all-time high of 89.12.

In essence, the Rupee's struggle is a complex interplay of internal and external structural factors. Until a major trade deal is confirmed, capital inflows become more decisive, or India's technological import needs stabilize, the market will continue to favor the USD. Traders must recognize that the technical path of least resistance for the USD/INR is upward, driven by these fundamental geopolitical and economic asymmetries rather than temporary movements in the global dollar index.

The5ers Funding Forex Traders & Growth Program. Get Funded with up to $2.56M

We Trade Forex - Come Join Us!

the5ers.com

We Trade Forex - Come Join Us!

the5ers.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

The5ers Funding Forex Traders & Growth Program. Get Funded with up to $2.56M

We Trade Forex - Come Join Us!

the5ers.com

We Trade Forex - Come Join Us!

the5ers.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.