Hello Traders,

Here you can find my weekly trade ideas (unconventional fundamental trading Style, not that what most People know as "Normal"). They mainly serve to achieve a possible learning effect or to show other perspectives how other traders set their positions and act, should be very interesting. The focus is on the "point of view" (learning through seeing).

All trades amount to Fundamental, Economical, Mathematical, - Technical information.

In the 4 1/2 years that I have been trading now, I have simply learned that the trades are only as good as the information that is based on them, the higher the density of information, the better and more likely that the trade will work.

Every week on Sunday there is an update, because new information is published over the period. Depending on how these end, the trade is either closed "early" or it continues on its way towards TP (Take Profit).

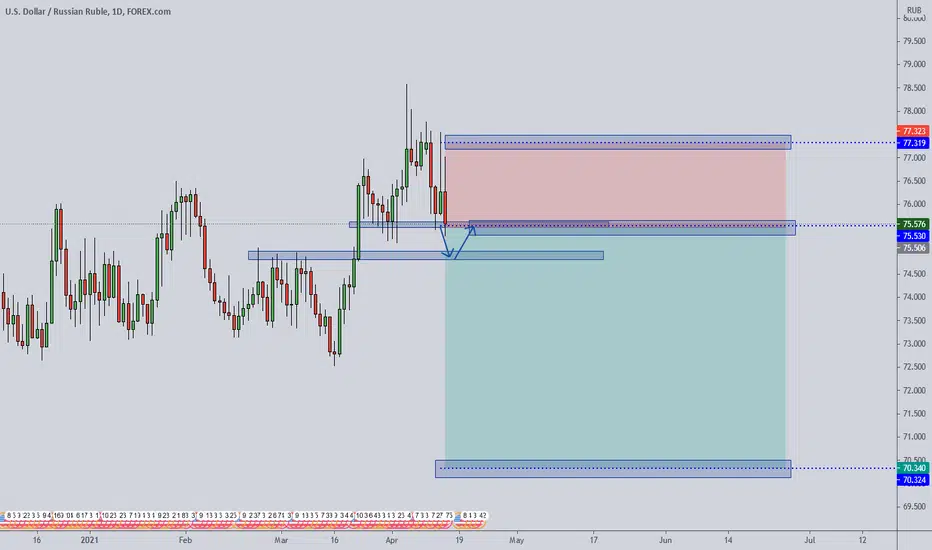

CRV (opportunity-risk ratio) is ALWAYS 1 to 3 (Can sometimes deviate a little, as I define target zones and stop loss by volume in order not to unexpectedly miss the TP or trap a stop hunt for a victim).

Trading style includes hedge and trend based swing trading and position trading approaches.

I also recommend that you use your own criteria for entry, exit and stop loss. Personally, the drawdown doesn't bother me because I've been using the system profitably for a long time. But I know myself, (especially when you start) that you are very impatient and expect too much, too quickly, then many quickly become emotional.

Be careful and don't fall for quick rich systems, they'll ruin your trading psychology.

Have a nice Week :)

Here you can find my weekly trade ideas (unconventional fundamental trading Style, not that what most People know as "Normal"). They mainly serve to achieve a possible learning effect or to show other perspectives how other traders set their positions and act, should be very interesting. The focus is on the "point of view" (learning through seeing).

All trades amount to Fundamental, Economical, Mathematical, - Technical information.

In the 4 1/2 years that I have been trading now, I have simply learned that the trades are only as good as the information that is based on them, the higher the density of information, the better and more likely that the trade will work.

Every week on Sunday there is an update, because new information is published over the period. Depending on how these end, the trade is either closed "early" or it continues on its way towards TP (Take Profit).

CRV (opportunity-risk ratio) is ALWAYS 1 to 3 (Can sometimes deviate a little, as I define target zones and stop loss by volume in order not to unexpectedly miss the TP or trap a stop hunt for a victim).

Trading style includes hedge and trend based swing trading and position trading approaches.

I also recommend that you use your own criteria for entry, exit and stop loss. Personally, the drawdown doesn't bother me because I've been using the system profitably for a long time. But I know myself, (especially when you start) that you are very impatient and expect too much, too quickly, then many quickly become emotional.

Be careful and don't fall for quick rich systems, they'll ruin your trading psychology.

Have a nice Week :)

Note

Wait for the short breakdown before entering the tradeNote

Go inside the Trade with the Retest, Breakdown ist thereNote

i Expect this MovementNote

Trade Triggerd and still active, i expect not much movement for this Pair for the next week.Note

All Moves like Expected, Let the Trade run.Note

Next Week i Expect only a correction.Note

Move like Expected, let the Trade run to our next Zone, No Change.Note

Move Like expected, here the Possible Movement for next WeekNote

Trade is going without correction in our ZoneNote

I Expect this Move for Next WeekNote

On Our WayNote

Next Expecting MoveNote

Move like expectedNote

Next Potential MoveNote

Move like expectedNote

Hold the Trade for the Next possible Short Move like in the Picture. Normally you have also Positive SwapDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.