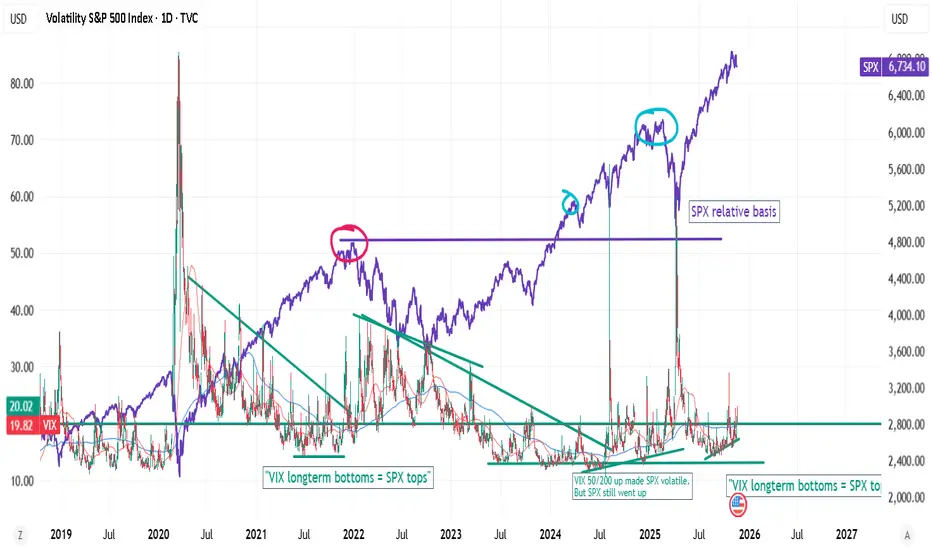

There's truth about VIX longterm bottoms and SPX tops, but believing that concept can come biting you back.

Stock performance will correlate with SPX in relative terms? ie how much potential and lack of resistance. Stocks go in cycles. So probably this is a important concept to study and master.

Stock performance will correlate with SPX in relative terms? ie how much potential and lack of resistance. Stocks go in cycles. So probably this is a important concept to study and master.

Note

statistically people will overestimate important of near events, ignoring the longterm statistics. Note

strong VIX high top + bullish VIX momentum, probably best idea to trade faang or soxx/nvda? and mistake to buy top momentum stocks.high VIX top + high VIX 50dma, or full exhaust, with a longterm VIX downtrend potential - usually best periods for small cap returns?

Note

sentiment at High VIX is usually a high risk, variance. Despite that most people are now out of positions? People discredit "SPX relative basis".Note

"VIX soon to be 50/200 deathcross" the best time to risk. because markets are risk-reward oriented. Note

NOV->DEC and JAN was the best time to trade or enter top1% stocks. I call these spots "pockets"? (pockets with potential to fill).When these deep corrections (with support at log fib 50%) - big mistake not to capitalize? that's where the big money is?

//ie buying 2-3 weeks before confirmation of a new bull. (Dan Zanger).

Markets are predictable.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.