The macro policy and interest rate environment provide strong support. The dovish signals from within the Federal Reserve have been released intensively, and the probability of a rate cut in December has soared from 40% last week to 81%. The market's re-pricing of the easing policy has become the core driving force behind the sharp rise in gold prices. At the same time, US Treasury yields have fallen across the board, with the 10-year US Treasury yield dropping to 4.038%. The decline in real interest rates directly reduces the opportunity cost of holding gold. Meanwhile, the US dollar index has also retreated to 100.15. The negative correlation between gold and the US dollar has further expanded the upside potential of gold prices, providing a perfect fundamental environment for going long at the macro level.

The geopolitical and capital aspects have solidified the foundation for the upward trend. The situation between Russia and Ukraine has seen new developments, with Kiev sounding air-raid sirens, and the resurgence of geopolitical risks has driven safe-haven buying. Meanwhile, the conflict in the Middle East continues to escalate, and the shipping risks in the Strait of Hormuz have further enhanced the safe-haven attribute of gold. On the capital front, the holdings of the world's largest gold ETF (SPDR Gold Trust) have continued to increase, with institutions actively building positions. Coupled with a 47% year-on-year growth in global gold investment demand in the third quarter, the influx of capital has further strengthened the stability of the bullish trend. Additionally, global central banks have been continuously increasing their gold holdings, with the People's Bank of China having done so for 12 consecutive months, providing long-term strategic support for gold prices.

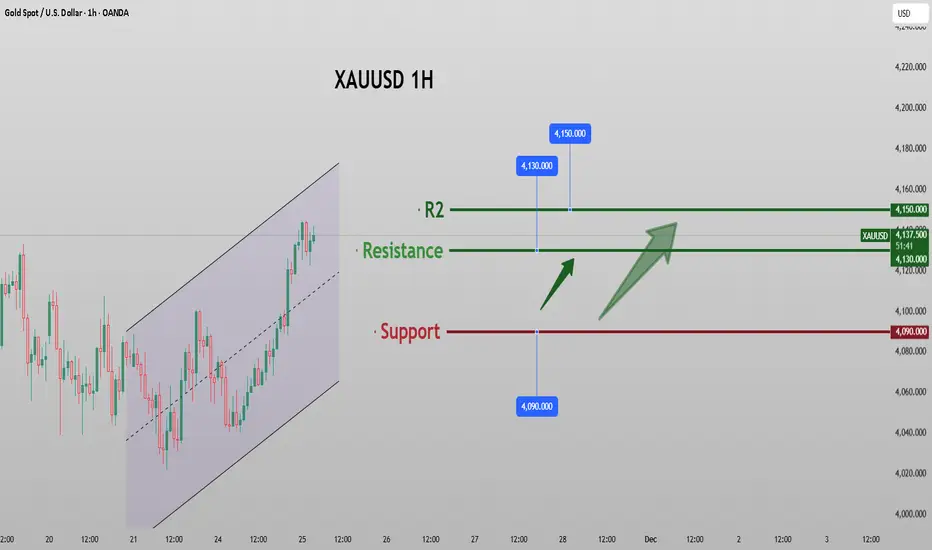

Gold trading strategy

buy:4090-4000

tp:4110-4130-4150

sl:4080

The geopolitical and capital aspects have solidified the foundation for the upward trend. The situation between Russia and Ukraine has seen new developments, with Kiev sounding air-raid sirens, and the resurgence of geopolitical risks has driven safe-haven buying. Meanwhile, the conflict in the Middle East continues to escalate, and the shipping risks in the Strait of Hormuz have further enhanced the safe-haven attribute of gold. On the capital front, the holdings of the world's largest gold ETF (SPDR Gold Trust) have continued to increase, with institutions actively building positions. Coupled with a 47% year-on-year growth in global gold investment demand in the third quarter, the influx of capital has further strengthened the stability of the bullish trend. Additionally, global central banks have been continuously increasing their gold holdings, with the People's Bank of China having done so for 12 consecutive months, providing long-term strategic support for gold prices.

Gold trading strategy

buy:4090-4000

tp:4110-4130-4150

sl:4080

💹💹💹Trading strategies and analysis: Gold, BTC, crude oil, foreign exchange, etc.

📶📶📶Free trading signals:t.me/+EbXVM-CStnFmNjBk

📶📶📶Free trading signals:t.me/+EbXVM-CStnFmNjBk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💹💹💹Trading strategies and analysis: Gold, BTC, crude oil, foreign exchange, etc.

📶📶📶Free trading signals:t.me/+EbXVM-CStnFmNjBk

📶📶📶Free trading signals:t.me/+EbXVM-CStnFmNjBk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.