Gold just tapped $4,213 — the highest level in three weeks, powered by growing expectations of a dovish Fed and optimism around the potential reopening of the US government.

But the real story isn’t the headline spike — it’s the structure forming right beneath it.

📌 Why this zone matters right now

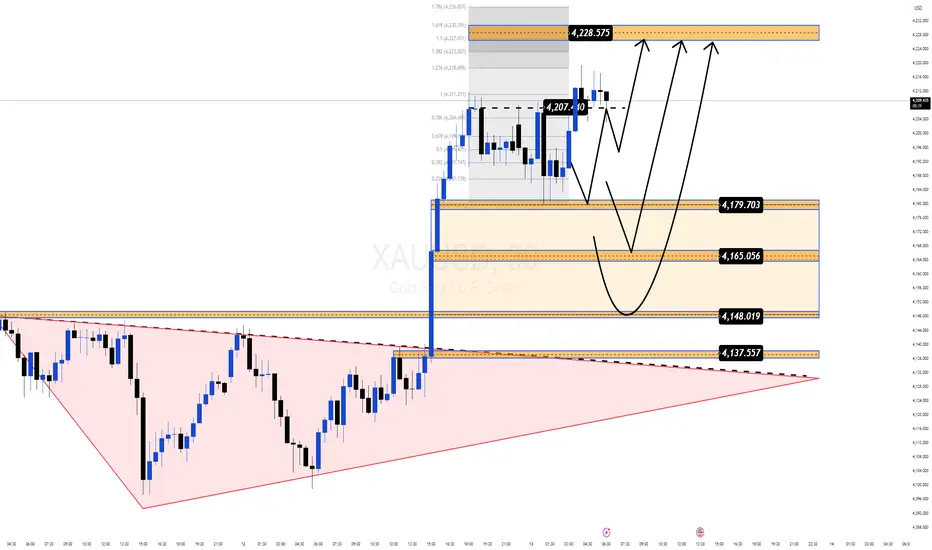

Price is pulling back into $4,179–$4,165, a clean Demand zone aligning with Fibo + breakout structure.

Buyers remain firmly in control despite a mild USD recovery.

The market swept liquidity around $4,207, hinting at accumulation before the next expansion.

The broader pattern resembles a falling-wedge breakout, often appearing before strong upside continuation phases.

🎯 Most Probable Scenario (Mind Insight)

Gold is in a “compression before expansion” phase.

Once this squeeze resolves, momentum is likely to continue in the direction that’s already dominant — and right now, that’s the bulls.

🔶 MMF BUY Zone

$4,179 → $4,165

Looking for a shallow pullback before the next leg.

🔼 Bullish Targets

• $4,207 (liquidity tap)

• $4,228 (Fibo 1.618)

• $4,236 (Fibo 1.786 — major reaction zone)

🧠 Key Takeaway

As long as Gold holds above $4,165, the bullish structure remains intact and the upside expansion toward the upper Fibo cluster stays in play.

But the real story isn’t the headline spike — it’s the structure forming right beneath it.

📌 Why this zone matters right now

Price is pulling back into $4,179–$4,165, a clean Demand zone aligning with Fibo + breakout structure.

Buyers remain firmly in control despite a mild USD recovery.

The market swept liquidity around $4,207, hinting at accumulation before the next expansion.

The broader pattern resembles a falling-wedge breakout, often appearing before strong upside continuation phases.

🎯 Most Probable Scenario (Mind Insight)

Gold is in a “compression before expansion” phase.

Once this squeeze resolves, momentum is likely to continue in the direction that’s already dominant — and right now, that’s the bulls.

🔶 MMF BUY Zone

$4,179 → $4,165

Looking for a shallow pullback before the next leg.

🔼 Bullish Targets

• $4,207 (liquidity tap)

• $4,228 (Fibo 1.618)

• $4,236 (Fibo 1.786 — major reaction zone)

🧠 Key Takeaway

As long as Gold holds above $4,165, the bullish structure remains intact and the upside expansion toward the upper Fibo cluster stays in play.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.