XAUUSD – ACCUMULATION & WAIT FOR NEW TREND CONFIRMATION WHEN BREAKING 3956

Hello trader 👋

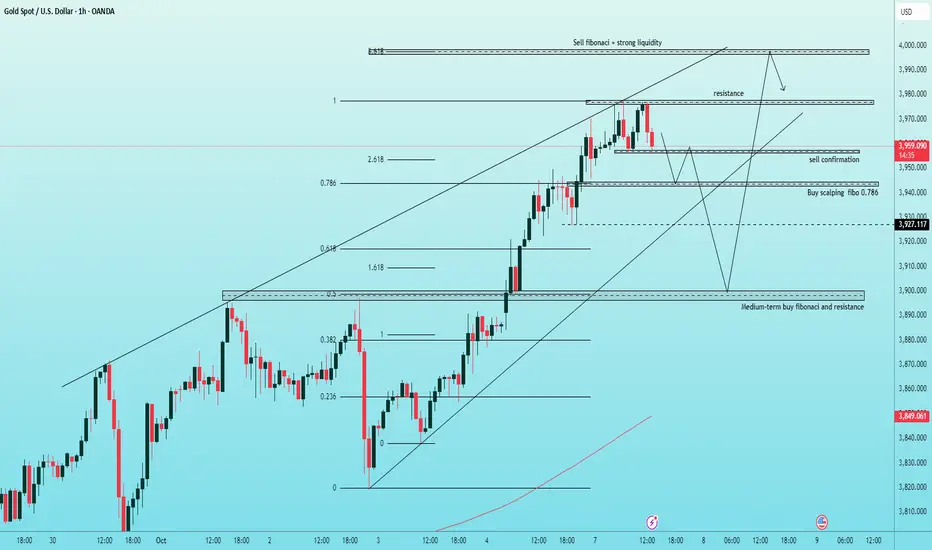

Gold is fluctuating in a short-term accumulation phase, following a strong rally last week. The technical structure on the H1 frame shows the price is retesting the central support area around 3956, which will determine the next direction.

In the current context, price action is mainly restrained within the rising channel, but buying momentum has slowed. The market is waiting for new trend confirmation – either breaking up to the 4000 area or adjusting to lower support.

🔎 Technical Perspective

Fibonacci 0.618 – 1.618 indicates significant resistance at the 3997–4000 area, coinciding with a strong liquidity zone.

The medium-term uptrend line remains intact, however, the RSI momentum shows slight divergence – warning of a potential adjustment.

Key price areas to watch: 3956 – 3946 – 3927 – 3917.

⚖️ Detailed Trading Scenarios

🔴 Main SELL Scenario:

Entry: 3997 – 4000

Stop Loss: 4005

Take Profit: 3976 → 3945 → 3928 → 3910

👉 Sell at the Fibonacci extension area + psychological resistance 4000 (high liquidity zone).

🔴 SELL upon confirmation of breaking 3956:

Entry: 3959 – 3961

SL: 3965

TP: 3945 → 3928 → 3910

👉 Short-term breakout order when the price closes below 3956, confirming a daily downtrend.

🟢 BUY when price retraces to support:

Entry: 3942 – 3944

SL: 3938

TP: 3955 → 3970 → 3990

👉 Suitable for Buy strategy following the short rising channel, prioritised when there is a strong candlestick reaction.

🟢 BUY at deep support area (POC & Trendline):

Entry: 3900 – 3898

SL: 3892

TP: 3910 → 3928 → 3940 → 3955 → 3970

💡 Macro Perspective

Many major financial institutions have raised their December 2026 gold price forecast from $4,300 to $4,900/oz, citing that central banks in emerging markets continue to diversify foreign exchange reserves into gold.

This reinforces the belief that the long-term uptrend remains robust.

📌 Summary:

Gold is in an accumulation phase waiting for a new direction around the 3956 area.

Strict capital management – the market may experience strong volatility when political news and US data return.

share your thoughts in the comments section, follow me for the earliest scenarios

Hello trader 👋

Gold is fluctuating in a short-term accumulation phase, following a strong rally last week. The technical structure on the H1 frame shows the price is retesting the central support area around 3956, which will determine the next direction.

In the current context, price action is mainly restrained within the rising channel, but buying momentum has slowed. The market is waiting for new trend confirmation – either breaking up to the 4000 area or adjusting to lower support.

🔎 Technical Perspective

Fibonacci 0.618 – 1.618 indicates significant resistance at the 3997–4000 area, coinciding with a strong liquidity zone.

The medium-term uptrend line remains intact, however, the RSI momentum shows slight divergence – warning of a potential adjustment.

Key price areas to watch: 3956 – 3946 – 3927 – 3917.

⚖️ Detailed Trading Scenarios

🔴 Main SELL Scenario:

Entry: 3997 – 4000

Stop Loss: 4005

Take Profit: 3976 → 3945 → 3928 → 3910

👉 Sell at the Fibonacci extension area + psychological resistance 4000 (high liquidity zone).

🔴 SELL upon confirmation of breaking 3956:

Entry: 3959 – 3961

SL: 3965

TP: 3945 → 3928 → 3910

👉 Short-term breakout order when the price closes below 3956, confirming a daily downtrend.

🟢 BUY when price retraces to support:

Entry: 3942 – 3944

SL: 3938

TP: 3955 → 3970 → 3990

👉 Suitable for Buy strategy following the short rising channel, prioritised when there is a strong candlestick reaction.

🟢 BUY at deep support area (POC & Trendline):

Entry: 3900 – 3898

SL: 3892

TP: 3910 → 3928 → 3940 → 3955 → 3970

💡 Macro Perspective

Many major financial institutions have raised their December 2026 gold price forecast from $4,300 to $4,900/oz, citing that central banks in emerging markets continue to diversify foreign exchange reserves into gold.

This reinforces the belief that the long-term uptrend remains robust.

📌 Summary:

Gold is in an accumulation phase waiting for a new direction around the 3956 area.

Strict capital management – the market may experience strong volatility when political news and US data return.

share your thoughts in the comments section, follow me for the earliest scenarios

Free 🚀 XAUUSD Signals: 10/Day

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+ORp2eY7p9oZjYWJl

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+ORp2eY7p9oZjYWJl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free 🚀 XAUUSD Signals: 10/Day

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+ORp2eY7p9oZjYWJl

Live Updates | 📈 85%+ Win Rate | Powered by the 💎 Diamond System.

🚀 Trading is More Than Money: It's About Transcending Your Limits

t.me/+ORp2eY7p9oZjYWJl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.