#XAUUSD  XAUUSD

XAUUSD

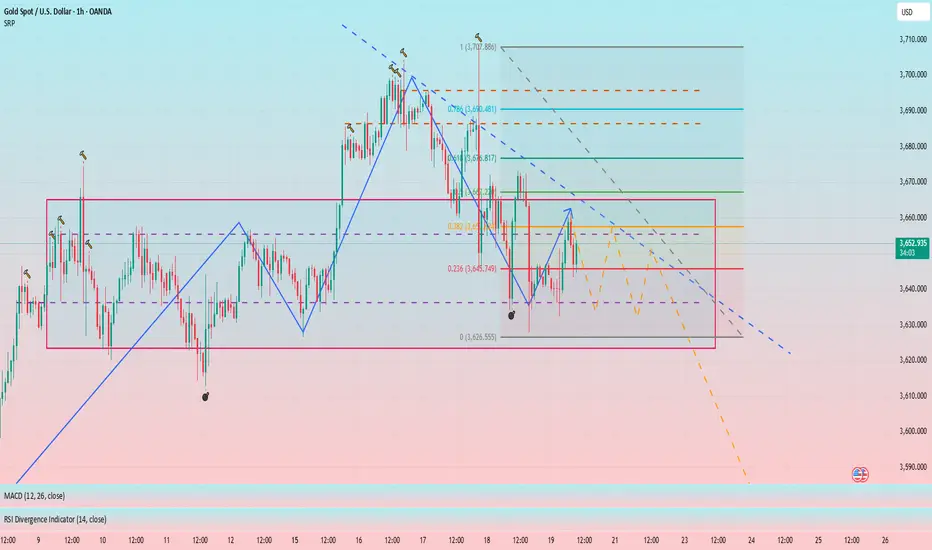

I don’t know if you guys still remember that before the interest rate cut was announced, gold overall maintained a box-shaped fluctuation. Yesterday, gold continued the bearish trend of Wednesday, fluctuating downward, and rebounded after hitting a low of around 3627 in the evening. The overall trend was in line with our expectations. If you observe carefully, you will find that the current market has returned to the box range of 3665-3625.

As the center of gravity moves downward, the resistance moves down to 3650-3660, while 3630-3620 below constitutes short-term support. If gold cannot effectively break through the box boundary in the short term, then the market may remain volatile today.

From the perspective of the big cycle trend, if the intraday shock rebound fails to effectively break through 3665, it may form a head and shoulders top pattern in the future. Therefore, today's trading is mainly short selling. If the price falls back and touches the support but does not break, you can go long on gold with a light position.

I don’t know if you guys still remember that before the interest rate cut was announced, gold overall maintained a box-shaped fluctuation. Yesterday, gold continued the bearish trend of Wednesday, fluctuating downward, and rebounded after hitting a low of around 3627 in the evening. The overall trend was in line with our expectations. If you observe carefully, you will find that the current market has returned to the box range of 3665-3625.

As the center of gravity moves downward, the resistance moves down to 3650-3660, while 3630-3620 below constitutes short-term support. If gold cannot effectively break through the box boundary in the short term, then the market may remain volatile today.

From the perspective of the big cycle trend, if the intraday shock rebound fails to effectively break through 3665, it may form a head and shoulders top pattern in the future. Therefore, today's trading is mainly short selling. If the price falls back and touches the support but does not break, you can go long on gold with a light position.

Trade active

There are only two scenarios for the U.S. market: continue to short sell during the rebound, or the market goes down or consolidates sideways. It is expected that there will be no new high in the evening. If you follow my strategy to short, you can choose to take profits around 45 or hold until the target price.Trade closed: target reached

I'm sorry, but the gold price rebounded beyond my expectations, forcing me to take a loss. I have already indicated in my post earlier that it is appropriate to reduce positions or take profits when the price reaches around 3645. Considering that my account funds are relatively sufficient and I have good risk tolerance, I reduced some of my positions. But then gold just touched around 3643 and rebounded quickly, exceeding 3655, so the remaining positions unfortunately hit the SL loss and exited the market.✅ CFA® Charterholder | 90% Win Rate | 300%-500% Profit ✅

👉🏻 Free Trading Strategy:t.me/Elite_Exchange_G

👉🏻 Professional Instructor:t.me/AccurateAnalysis_Garrick

🌈 Control risks, control emotions, and make perfect profits 🌈

👉🏻 Free Trading Strategy:t.me/Elite_Exchange_G

👉🏻 Professional Instructor:t.me/AccurateAnalysis_Garrick

🌈 Control risks, control emotions, and make perfect profits 🌈

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ CFA® Charterholder | 90% Win Rate | 300%-500% Profit ✅

👉🏻 Free Trading Strategy:t.me/Elite_Exchange_G

👉🏻 Professional Instructor:t.me/AccurateAnalysis_Garrick

🌈 Control risks, control emotions, and make perfect profits 🌈

👉🏻 Free Trading Strategy:t.me/Elite_Exchange_G

👉🏻 Professional Instructor:t.me/AccurateAnalysis_Garrick

🌈 Control risks, control emotions, and make perfect profits 🌈

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.