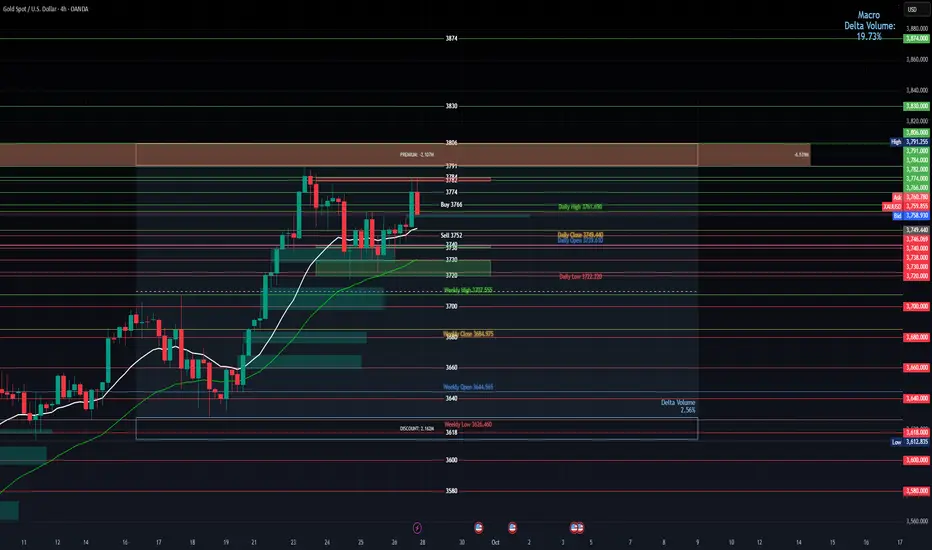

H4 structure and levels

Bias: Still bullish (higher highs/lows), price above EMAs.

Supply/resistance: 3774, 3781–3806 (primary supply), 3830, 3874.

Demand/support: 3750–3745 (pivot/EMA confluence), 3738–3735, 3730–3720, 3707, 3685.

Volatility context: Typical H4 range about $12–$20; your $5 stop is ~25–40% of that—usable, but it demands precise triggers.

Setup 1: Buy 3766

Context: Long below major supply (3781–3806); limited clearance overhead.

Probability:

Taken as marked (3766 with 50‑pip/$5 stop): 40–45% due to frequent pullbacks before any breakout.

Improves to ~58–65% if you only take it after H4 acceptance above 3781 (close above, then a held retest of 3778–3781).

Alternative long with same stop: buy a pullback at 3750 ±0.5 with SL 3745; ~55–60% since you’re buying demand, not into supply.

Targets and R:R (risk = 50 pips = $500/lot):

T1 3774: +80 pips ≈ 1.6R

T2 3791: +250 pips ≈ 5.0R

T3 3806–3830: +400–640 pips ≈ 8–12.8R

Setup 2: Sell 3752

Context: Counter‑trend into layered demand (3738 → 3720) with EMAs below.

Probability:

As marked (3752 with a 50‑pip stop): 35–40% while H4 holds above 3745.

Improves to ~55–60% only after a clean H4 breakdown/close below 3738–3735 and a failed retest (sell 3738–3742, SL 3743–3745).

Higher‑quality short that fits the stop: fade 3781–3806 on H4 rejection (enter 3800–3805, SL 3805–3810); ~56–62%.

Targets and R:R (risk = 50 pips):

T1 3738: +140 pips ≈ 2.8R

T2 3730: +220 pips ≈ 4.4R

T3 3707: +450 pips ≈ 9.0R

Which ideas best match a 50‑pip/$500 max stop

Longs: Prefer 3750–3745 pullbacks or post‑acceptance above 3781. Avoid chasing 3766 into supply without confirmation.

Shorts: Prefer H4 rejection inside 3781–3806, or breakdown/retest short after an H4 close below 3738.

Entry filters and management

Long filter: Either H4 close >3781 and hold retest, or wick‑down into 3750–3745 that quickly reclaims 3755+.

Short filter: H4 long‑wick rejection in 3781–3806 with lower close, or H4 close <3738 and failed retest into 3738–3742.

Move to breakeven after +80–120 pips or once the nearest opposing level is cleared (e.g., long above 3774; short below 3738).

Scale partials at first objective (3774 for longs, 3738 for shorts); let runners aim for 3791/3806 or 3730/3707.

Week‑ahead catalysts (verify exact dates on your calendar)

Likely in the coming week: ISM Manufacturing (early week), JOLTS (early week), ADP (mid‑week), ISM Services (later), and NFP/Unemployment/Average Hourly Earnings (Fri, Oct 3).

Implications:

Strong labor/earnings or firm ISM Prices Paid → higher yields/stronger USD → bearish gold. Favors shorts from 3781–3806 or breakdowns below 3738.

Softer data → weaker USD/real yields → bullish gold. Favors buy‑the‑dip at 3750 or break‑and‑hold above 3781.

Tactics: Avoid initiating fresh breakouts within 12–24h of NFP; if in profit pre‑data, consider partials and protective stops at BE or just beyond structure.

Position sizing

Lot size = Account risk $ / (50 pips × $10). Example: risking $500 → 1.00 lot; risking $250 → 0.50 lot.

Bottom line

Buy 3766: 40–45% as marked; 58–65% after acceptance above 3781 or from a 3750 pullback.

Sell 3752: 35–40% into demand; 55–60% after a 3738 breakdown/retest or on a rejection from 3781–3806.

With a strict 50‑pip/$500 stop, the cleanest plays are: buy 3750–3745 or post‑acceptance above 3781; sell rejections in 3781–3806 or breakdowns below 3738.

Bias: Still bullish (higher highs/lows), price above EMAs.

Supply/resistance: 3774, 3781–3806 (primary supply), 3830, 3874.

Demand/support: 3750–3745 (pivot/EMA confluence), 3738–3735, 3730–3720, 3707, 3685.

Volatility context: Typical H4 range about $12–$20; your $5 stop is ~25–40% of that—usable, but it demands precise triggers.

Setup 1: Buy 3766

Context: Long below major supply (3781–3806); limited clearance overhead.

Probability:

Taken as marked (3766 with 50‑pip/$5 stop): 40–45% due to frequent pullbacks before any breakout.

Improves to ~58–65% if you only take it after H4 acceptance above 3781 (close above, then a held retest of 3778–3781).

Alternative long with same stop: buy a pullback at 3750 ±0.5 with SL 3745; ~55–60% since you’re buying demand, not into supply.

Targets and R:R (risk = 50 pips = $500/lot):

T1 3774: +80 pips ≈ 1.6R

T2 3791: +250 pips ≈ 5.0R

T3 3806–3830: +400–640 pips ≈ 8–12.8R

Setup 2: Sell 3752

Context: Counter‑trend into layered demand (3738 → 3720) with EMAs below.

Probability:

As marked (3752 with a 50‑pip stop): 35–40% while H4 holds above 3745.

Improves to ~55–60% only after a clean H4 breakdown/close below 3738–3735 and a failed retest (sell 3738–3742, SL 3743–3745).

Higher‑quality short that fits the stop: fade 3781–3806 on H4 rejection (enter 3800–3805, SL 3805–3810); ~56–62%.

Targets and R:R (risk = 50 pips):

T1 3738: +140 pips ≈ 2.8R

T2 3730: +220 pips ≈ 4.4R

T3 3707: +450 pips ≈ 9.0R

Which ideas best match a 50‑pip/$500 max stop

Longs: Prefer 3750–3745 pullbacks or post‑acceptance above 3781. Avoid chasing 3766 into supply without confirmation.

Shorts: Prefer H4 rejection inside 3781–3806, or breakdown/retest short after an H4 close below 3738.

Entry filters and management

Long filter: Either H4 close >3781 and hold retest, or wick‑down into 3750–3745 that quickly reclaims 3755+.

Short filter: H4 long‑wick rejection in 3781–3806 with lower close, or H4 close <3738 and failed retest into 3738–3742.

Move to breakeven after +80–120 pips or once the nearest opposing level is cleared (e.g., long above 3774; short below 3738).

Scale partials at first objective (3774 for longs, 3738 for shorts); let runners aim for 3791/3806 or 3730/3707.

Week‑ahead catalysts (verify exact dates on your calendar)

Likely in the coming week: ISM Manufacturing (early week), JOLTS (early week), ADP (mid‑week), ISM Services (later), and NFP/Unemployment/Average Hourly Earnings (Fri, Oct 3).

Implications:

Strong labor/earnings or firm ISM Prices Paid → higher yields/stronger USD → bearish gold. Favors shorts from 3781–3806 or breakdowns below 3738.

Softer data → weaker USD/real yields → bullish gold. Favors buy‑the‑dip at 3750 or break‑and‑hold above 3781.

Tactics: Avoid initiating fresh breakouts within 12–24h of NFP; if in profit pre‑data, consider partials and protective stops at BE or just beyond structure.

Position sizing

Lot size = Account risk $ / (50 pips × $10). Example: risking $500 → 1.00 lot; risking $250 → 0.50 lot.

Bottom line

Buy 3766: 40–45% as marked; 58–65% after acceptance above 3781 or from a 3750 pullback.

Sell 3752: 35–40% into demand; 55–60% after a 3738 breakdown/retest or on a rejection from 3781–3806.

With a strict 50‑pip/$500 stop, the cleanest plays are: buy 3750–3745 or post‑acceptance above 3781; sell rejections in 3781–3806 or breakdowns below 3738.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.