🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

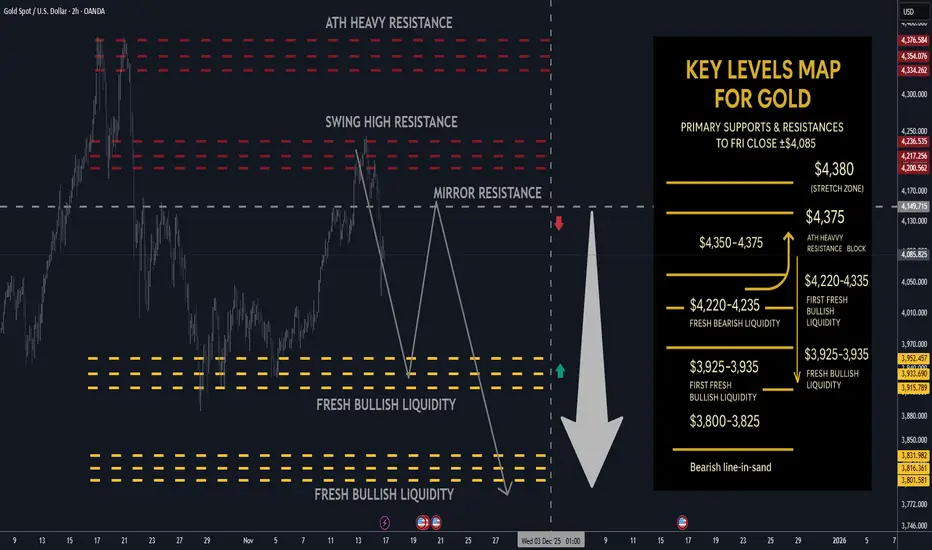

🏆 High/Close: ~$4,244 → ~$4,085 — buyers punched through $4.20k but sellers defended the $4,220–4,250 band; weekly close is soft but still comfortably above $4k and mid-range.

📈 Trend: Bullish but in corrective / two-way mode; treating current tape as range-trade while below the $4,350–4,375 ATH supply block.

🛡 Supports: $3,925–3,935 fresh bullish liquidity → $3,800–3,825 deeper demand pocket— key shelves where dip-buying is expected.

🚧 Resistances: $4,220–4,230 short-term fade zone → $4,350–4,375 (ATH heavy resistance block).

🧭 Bias next week: Preference to fade strength into $4,220–4,230, targeting a rotation back into $3,925–3,935. Alternative is to buy dips into $3,925–3,935 and ride the range back toward $4,220–4,230. Invalidation on sustained acceptance above $4,350–4,375; loss of $3,800–3,825 risks deeper mean reversion.

________________________________________

________________________________________

🔝 Key Resistance Zones

• $4,220–4,230 — immediate weekly ceiling; aligns with your noted resistance block, attractive area to initiate shorts on first tests.

• $4,350–4,375 — prior ATH / “heavy resistance block”; any spike here is a fade candidate unless price accepts above it on strong volume.

🛡 Support Zones

• $3,925–3,935 — fresh bullish liquidity; preferred first take-profit for shorts and primary dip-buy zone.

• $3,800–3,825 — deeper fresh liquidity; failure here would signal a more meaningful correction, not just a pullback in an uptrend.

________________________________________

⚖️ Base Case Scenario

Range/consolidation between roughly $3,800–$4,230:

• First pushes into $4,220–4,230 are sellable for rotations toward $3,925–3,935.

• As long as weekly closes keep rejecting the ATH block $4,350–4,375, bias stays “sell strength, buy clean liquidity dips.”

🚀 Breakout / Breakdown Triggers

• Bull trigger: Sustained acceptance above $4,350–4,375 multiple sessions holding above and using that band as support would shift tone back to full-on trend and reopen the path toward and beyond prior extremes (~$4,400+).

• Bear trigger: A decisive daily close below $3,800 turns the current “healthy pullback” into a deeper correction, opening room toward prior lower shelves sub-$3,750 and likely volatility expansion.

________________________________________

💡 Market Drivers to Watch

• Fed & real yields: Odds of a December cut have ramped up again; any hawkish pushback or hotter data could cap rallies near resistance.

• U.S. fiscal/political risk: Shutdown and fiscal brinkmanship are still in the background; resolution headlines could briefly pressure gold, while renewed instability supports the bid.

• Flows & positioning: ETF and central-bank demand remain supportive, but after a 60% YTD run, fast money is quick to take profits into strength.

• Cross-asset behavior: Watch that equity–gold correlation; if risk-off hits and gold still sells with stocks, dips could run further before strategic buyers step in.

________________________________________

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,350–$4,375 (sustained acceptance; ATH block reclaimed as support).

• Bearish below: $3,800 (opens risk of deeper liquidation below the current liquidity shelves).

________________________________________

🧭 Strategy for this week

Primary plan – short from resistance (your core idea):

• Entry zone: Scale into shorts around $4,220–4,230 front edge of the resistance block.

• TP #1: $3,925–3,935 fresh bullish liquidity; consider closing most size here.

• Runner / extension: If momentum extends lower, watch $3,800–3,825 for final profit-taking; below here the profile shifts into deeper correction mode.

• Risk: Hard invalidation if price accepts above $4,350–4,375 daily closes holding above and successful retests.

Alternative plan – buy the dip into liquidity:

• Entry zone: Stagger bids around $3,925–3,935 and, for more aggressive positioning, into $3,800–3,825.

• Exit zone: First target back into $4,220–4,230; consider de-risking heavily as you approach that resistance band.

• Risk: Cut or reduce if price fails to hold above $3,800 on a daily closing basis or if selling accelerates on high volume through that shelf.

🏆 High/Close: ~$4,244 → ~$4,085 — buyers punched through $4.20k but sellers defended the $4,220–4,250 band; weekly close is soft but still comfortably above $4k and mid-range.

📈 Trend: Bullish but in corrective / two-way mode; treating current tape as range-trade while below the $4,350–4,375 ATH supply block.

🛡 Supports: $3,925–3,935 fresh bullish liquidity → $3,800–3,825 deeper demand pocket— key shelves where dip-buying is expected.

🚧 Resistances: $4,220–4,230 short-term fade zone → $4,350–4,375 (ATH heavy resistance block).

🧭 Bias next week: Preference to fade strength into $4,220–4,230, targeting a rotation back into $3,925–3,935. Alternative is to buy dips into $3,925–3,935 and ride the range back toward $4,220–4,230. Invalidation on sustained acceptance above $4,350–4,375; loss of $3,800–3,825 risks deeper mean reversion.

________________________________________

________________________________________

🔝 Key Resistance Zones

• $4,220–4,230 — immediate weekly ceiling; aligns with your noted resistance block, attractive area to initiate shorts on first tests.

• $4,350–4,375 — prior ATH / “heavy resistance block”; any spike here is a fade candidate unless price accepts above it on strong volume.

🛡 Support Zones

• $3,925–3,935 — fresh bullish liquidity; preferred first take-profit for shorts and primary dip-buy zone.

• $3,800–3,825 — deeper fresh liquidity; failure here would signal a more meaningful correction, not just a pullback in an uptrend.

________________________________________

⚖️ Base Case Scenario

Range/consolidation between roughly $3,800–$4,230:

• First pushes into $4,220–4,230 are sellable for rotations toward $3,925–3,935.

• As long as weekly closes keep rejecting the ATH block $4,350–4,375, bias stays “sell strength, buy clean liquidity dips.”

🚀 Breakout / Breakdown Triggers

• Bull trigger: Sustained acceptance above $4,350–4,375 multiple sessions holding above and using that band as support would shift tone back to full-on trend and reopen the path toward and beyond prior extremes (~$4,400+).

• Bear trigger: A decisive daily close below $3,800 turns the current “healthy pullback” into a deeper correction, opening room toward prior lower shelves sub-$3,750 and likely volatility expansion.

________________________________________

💡 Market Drivers to Watch

• Fed & real yields: Odds of a December cut have ramped up again; any hawkish pushback or hotter data could cap rallies near resistance.

• U.S. fiscal/political risk: Shutdown and fiscal brinkmanship are still in the background; resolution headlines could briefly pressure gold, while renewed instability supports the bid.

• Flows & positioning: ETF and central-bank demand remain supportive, but after a 60% YTD run, fast money is quick to take profits into strength.

• Cross-asset behavior: Watch that equity–gold correlation; if risk-off hits and gold still sells with stocks, dips could run further before strategic buyers step in.

________________________________________

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,350–$4,375 (sustained acceptance; ATH block reclaimed as support).

• Bearish below: $3,800 (opens risk of deeper liquidation below the current liquidity shelves).

________________________________________

🧭 Strategy for this week

Primary plan – short from resistance (your core idea):

• Entry zone: Scale into shorts around $4,220–4,230 front edge of the resistance block.

• TP #1: $3,925–3,935 fresh bullish liquidity; consider closing most size here.

• Runner / extension: If momentum extends lower, watch $3,800–3,825 for final profit-taking; below here the profile shifts into deeper correction mode.

• Risk: Hard invalidation if price accepts above $4,350–4,375 daily closes holding above and successful retests.

Alternative plan – buy the dip into liquidity:

• Entry zone: Stagger bids around $3,925–3,935 and, for more aggressive positioning, into $3,800–3,825.

• Exit zone: First target back into $4,220–4,230; consider de-risking heavily as you approach that resistance band.

• Risk: Cut or reduce if price fails to hold above $3,800 on a daily closing basis or if selling accelerates on high volume through that shelf.

Note

🔱 GOLD WEEKLY SUMMARY💰 High/Close: 4,244 → 4,085 — sellers defended 4,220–4,250.

📊 Trend: Bullish but corrective; range-trade while < 4,350–4,375.

🏰 Resistance: 4,220–4,230 (fade zone) → 4,350–4,375 (ATH block).

🛡 Support: 3,925–3,935 (fresh liquidity) → 3,800–3,825 (deep demand).

🎯 Bias: Sell strength → 4,220/4,230 → target 3,925/3,935.

🏹 Alt Plan: Buy dips at 3,925/3,935 toward 4,220/4,230.

🚀 Bull Trigger: Break & hold above 4,350–4,375.

⚠️ Bear Trigger: Daily close < 3,800.

🌐 Drivers: Fed cuts, USD/yields, fiscal risk, ETF/CB flows.

⚒️ Risk: Invalidate shorts on acceptance above 4,350–4,375.

Note

🎁Please hit the like button and🎁Leave a comment to support our team!

Note

let me know your thoughts on the above in the comments section 🔥🏧🚀taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.