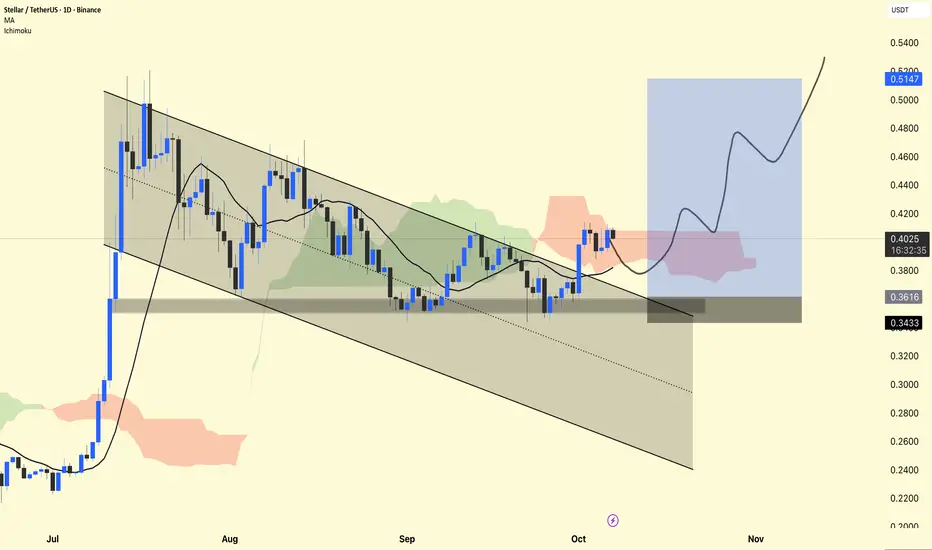

XLM/USDT — Daily Chart Analysis

The price is currently trading around $0.40, holding firmly above the demand zone ($0.36–$0.34).

The chart shows a falling channel breakout, which is a bullish reversal pattern.

The Ichimoku Cloud is showing early signs of a bullish trend as the price is attempting to hold above the cloud base.

The moving average (MA) at $0.38 is acting as dynamic support – a positive sign for further upside.

📈 Long Setup:

Entry Zone: $0.38–$0.40

Stop-Loss: Below $0.34 (clear invalidation level)

Targets:

🎯 $0.46 → First Target

🎯 $0.51 → Main Swing Target

DYOR | NFA

The price is currently trading around $0.40, holding firmly above the demand zone ($0.36–$0.34).

The chart shows a falling channel breakout, which is a bullish reversal pattern.

The Ichimoku Cloud is showing early signs of a bullish trend as the price is attempting to hold above the cloud base.

The moving average (MA) at $0.38 is acting as dynamic support – a positive sign for further upside.

📈 Long Setup:

Entry Zone: $0.38–$0.40

Stop-Loss: Below $0.34 (clear invalidation level)

Targets:

🎯 $0.46 → First Target

🎯 $0.51 → Main Swing Target

DYOR | NFA

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.