A note:

It is not my norm to make posts like this, especially as long as it is. It's partially for my personal record, and also because I welcome discussion and other ideas for those who want to participate. This is highly speculative and as always do your own research.

Why Now?

ZEC (Z Cash) has existed since 2016, why is it just now gaining traction?

The privacy narrative is building strong within this market cycle, namely because it's becoming clearer and clearer that government entities have easy ways of tracking transactions on public ledger blockchains. Z-Cash is uniquely positioned in a way that appeals to long-time Bitcoin holders, and as privacy fears arise some have made a switch.

Usability, Zcash has made significant improvements to the utilization of it's privacy feature. Additionally, the fact that privacy is an optional form of transacting and not mandatory makes it more appealing, 85% of ZCash transactions done on the blockchain are via transparent transactions. New apps/wallet applications such as Zashi have also made it more appealing as they offer methods of off-ramping your zcash for direct spending.

A supply model that directly copies Bitcoin. (Well Almost)

Bitcoin Supply Limit: 21 Million

ZCash Supply Limit: 21 Million

Bitcoin Halving: Every 4 Years

Zcash Halving: Every 4 Years

Now here's some indepth differences in their supply model, and this is KEY to understanding why Zcash is going to go turbulent.

Something to understand first:

Bitcoin Block Time: 10 Minutes

ZCash Block Time: 75 Seconds

1 BTC Block = 8 ZEC Blocks for equivalent Supply Release

When Zcash First Launched in 2016 they released 12.5 ZEC per block mined, this was double the amount of new supply released that BTC First started with. Zcash corrected this with something called the 'Blossom' network upgrade in 2019, then it had another halvening in 2020, and most recently a third in 2024.

3 Halvings in 8 years.

Currently, ZEC emissions match that of Bitcoin's in 2016 (12.5 BTC per 10 min/12.5 ZEC per 10 min)

There's still one catch, 20% of the block rewards do NOT go to miners. Currently:

8% goes to the 'Electric Coin Company' - basically, focused on growth and partnerships involving Zcash.

7% goes to the 'Zcash Community Grants' used to fund development tools/infrastructure as well as marketing and community growth. There's been proof of this as new wallet/apps and options for zcash have become apparent in the last few years.

5% to the Zcash Foundation - nonprofit aimed at privacy research and maintaining zcash's node software.

The Technicals?

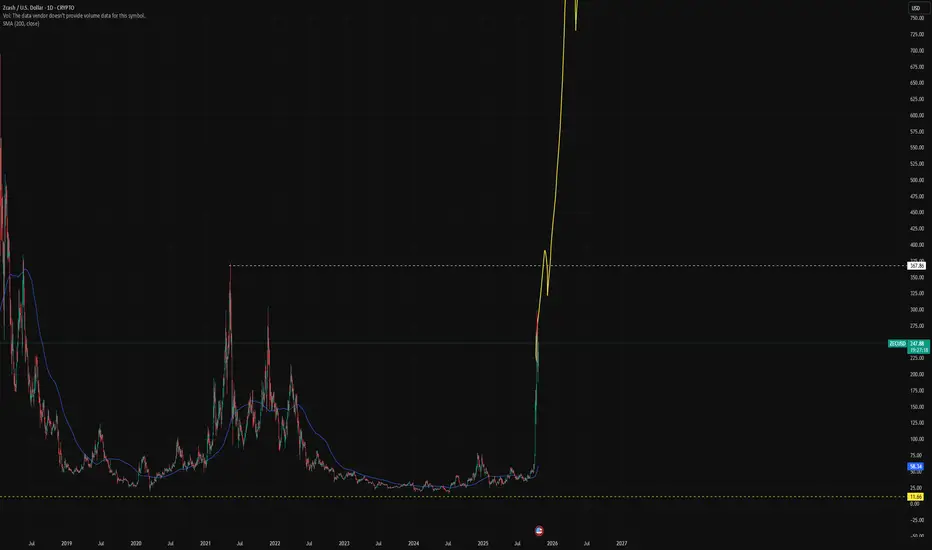

There is no solid reliable ZEC/BTC chart available, by reliable I mean with consistent volume. So I've created my own by pairing the ZEC/USD Kraken pairing to BTC/USD coinbase pairing, and I created a VWAP point from the beginning. In terms of BTC price alone, ZEC will hit just over 0.01 BTC, chart for reference (Logarithmic):

In terms of elliot wave theory, I'm already seeing extensions building into other wave extensions. Still in the midst of wave 3, and nowhere near it's end most likely.

I have 2 things to leave you with.

Even if you're super skeptical, if you don't have a lotta money in general and have a distaste for crypto/bitcoin in genreal, just get 1 ZCash, just 1.

Secondly, I strongly urge you to go on X (Formerly twitter) and lookup latest posts by ZEC, filter through the spam and see community talk/interactions just in the last hour, you will likely be surprised.

ZEC, filter through the spam and see community talk/interactions just in the last hour, you will likely be surprised.

Just.

Get.

One.

It is not my norm to make posts like this, especially as long as it is. It's partially for my personal record, and also because I welcome discussion and other ideas for those who want to participate. This is highly speculative and as always do your own research.

Why Now?

ZEC (Z Cash) has existed since 2016, why is it just now gaining traction?

The privacy narrative is building strong within this market cycle, namely because it's becoming clearer and clearer that government entities have easy ways of tracking transactions on public ledger blockchains. Z-Cash is uniquely positioned in a way that appeals to long-time Bitcoin holders, and as privacy fears arise some have made a switch.

Usability, Zcash has made significant improvements to the utilization of it's privacy feature. Additionally, the fact that privacy is an optional form of transacting and not mandatory makes it more appealing, 85% of ZCash transactions done on the blockchain are via transparent transactions. New apps/wallet applications such as Zashi have also made it more appealing as they offer methods of off-ramping your zcash for direct spending.

A supply model that directly copies Bitcoin. (Well Almost)

Bitcoin Supply Limit: 21 Million

ZCash Supply Limit: 21 Million

Bitcoin Halving: Every 4 Years

Zcash Halving: Every 4 Years

Now here's some indepth differences in their supply model, and this is KEY to understanding why Zcash is going to go turbulent.

Something to understand first:

Bitcoin Block Time: 10 Minutes

ZCash Block Time: 75 Seconds

1 BTC Block = 8 ZEC Blocks for equivalent Supply Release

When Zcash First Launched in 2016 they released 12.5 ZEC per block mined, this was double the amount of new supply released that BTC First started with. Zcash corrected this with something called the 'Blossom' network upgrade in 2019, then it had another halvening in 2020, and most recently a third in 2024.

3 Halvings in 8 years.

Currently, ZEC emissions match that of Bitcoin's in 2016 (12.5 BTC per 10 min/12.5 ZEC per 10 min)

There's still one catch, 20% of the block rewards do NOT go to miners. Currently:

8% goes to the 'Electric Coin Company' - basically, focused on growth and partnerships involving Zcash.

7% goes to the 'Zcash Community Grants' used to fund development tools/infrastructure as well as marketing and community growth. There's been proof of this as new wallet/apps and options for zcash have become apparent in the last few years.

5% to the Zcash Foundation - nonprofit aimed at privacy research and maintaining zcash's node software.

The Technicals?

There is no solid reliable ZEC/BTC chart available, by reliable I mean with consistent volume. So I've created my own by pairing the ZEC/USD Kraken pairing to BTC/USD coinbase pairing, and I created a VWAP point from the beginning. In terms of BTC price alone, ZEC will hit just over 0.01 BTC, chart for reference (Logarithmic):

In terms of elliot wave theory, I'm already seeing extensions building into other wave extensions. Still in the midst of wave 3, and nowhere near it's end most likely.

I have 2 things to leave you with.

Even if you're super skeptical, if you don't have a lotta money in general and have a distaste for crypto/bitcoin in genreal, just get 1 ZCash, just 1.

Secondly, I strongly urge you to go on X (Formerly twitter) and lookup latest posts by

Just.

Get.

One.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.