BTC "Digital Gold" Narrative is Collapsing! 🚨 Bitcoin’s “Digital Gold” Narrative Is Collapsing — Gold Already Did What BTC Only Promised

Let’s stop pretending.

Bitcoin was supposed to:

Be a safe haven

Act as digital gold

Protect against currency debasement

Decouple during systemic stress

Instead, gold is doing all of that — right now — while Bitcoin is failing in real time.

🪙 Gold Is Doing the Job BTC Promised

Look at the facts, not the ideology.

Gold is making new highs

Gold is absorbing global capital

Gold is acting as a hedge during uncertainty

Gold volatility is controlled, not chaotic

Meanwhile Bitcoin:

Swings 30–50% in weeks

Sells off during risk-off events

Trades like leveraged tech, not money

Needs constant narrative reinforcement to justify holding it

📌 Gold doesn’t need a story. Price action does the talking.

🌍 Smart Money Is Choosing Gold — Not Crypto

Here’s the part crypto Twitter doesn’t want to talk about:

China has been buying gold relentlessly

India continues to accumulate physical gold

Central banks across the world are adding gold reserves

They are not buying Bitcoin.

They are not buying Ethereum.

They are not building reserves in crypto.

If Bitcoin were truly the future of money, governments would be front-running it.

They aren’t.

🧠 China’s Digital Currency Should Terrify Crypto Maxis

China is not banning money — it’s replacing it with control.

China is actively developing and rolling out a centralized digital currency, and that should make one thing painfully clear:

Governments want digital money they can track, control, censor, and manage.

They do not want:

Decentralization

Permissionless systems

Monetary sovereignty outside state control

This is the direction of the world — whether crypto believers like it or not.

📌 A state-controlled digital currency is the opposite of Bitcoin — and that’s exactly why governments prefer it.

❌ BTC Is Too Volatile to Be Money — Period

No serious currency:

Loses 40% in months

Gains 40% in weeks

Makes pricing, wages, or contracts impossible

How can BTC be used for payments when:

A salary paid today could be worth far less next month?

A merchant could lose profit before settlement clears?

Volatility is exciting for traders —

but it kills monetary utility.

This is why banks and governments will never hold BTC as a reserve currency.

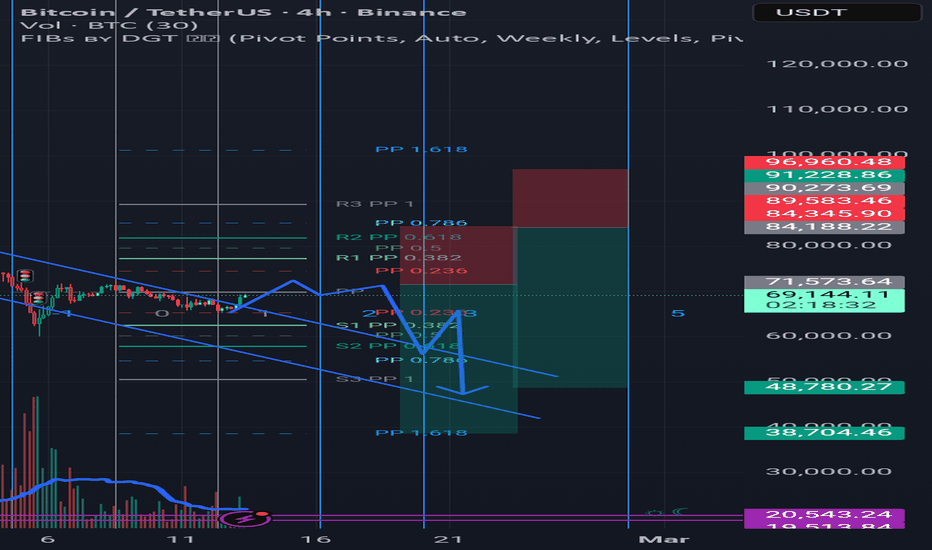

📉 BTC Trades Like a High-Leverage Risk Asset — Not a Hedge

Recent price action proves it:

BTC pumps = short squeezes

BTC dumps = liquidity events

BTC rallies = smart money selling into strength

BTC believers get trapped by “this time is different”

Do not confuse: 🟢 Green candles

with

🧠 Smart money accumulation

Algos are squeezing shorts, distributing into strength, and offloading risk to long-term believers.

💣 The Carry Trade Unwind Will Hit BTC Hard

The global carry trade is unwinding — slowly now, violently later.

Bitcoin is:

Extremely leveraged

Liquidity-dependent

Correlated with risk assets when stress rises

As leverage continues to unwind:

Stocks suffer

Crypto suffers more

BTC suffers the most

Any bounce in this environment is not bullish — it’s a short squeeze.

⚠️ Reality Check for Long-Term Holders

Scarcity does not equal safety

Ideology does not stop liquidation

Narratives do not override macro mechanics

Bitcoin is not digital gold.

Bitcoin is digital volatility.

Gold has already proven itself — again.

🛑 Final Warning

Don’t let price spikes fool you. Don’t let squeezes convince you the bottom is in. Don’t confuse belief with risk management.

📌 Smart money is reducing exposure, not increasing it

📌 Capital preservation matters more than conviction

📌 Being early feels the same as being wrong — until it doesn’t

Better to be safe than sorry.

(Not financial advice. Do your own research.)

Safehaven

XAU/USD ~ Gold Building Momentum from Key Support📝 Description 🔍 Setup OANDA:XAUUSD

✅Gold has been respecting a descending trendline with multiple rejections, showing clear bearish structure. Now price is attempting a breakout + retest while holding above a strong demand zone.

✅Buyers stepped in aggressively from support, forming higher lows and pushing price back toward the cloud resistance area.

✅Geopolitical tensions (Middle East concerns) continue to support safe-haven demand for gold — adding a fundamental tailwind.

📍 Support & Resistance

🟥 Support Zone: 4,760 – 4,650

🟥 Major Support: 4,570 – 4,400

🟩 1st Resistance: 5,310

🟩 2nd Resistance: 5,550

Volume profile shows strong acceptance near support — buyers defending the zone.

⚠️ Disclaimer

This analysis is for educational purposes only.

Trading involves risk. Always use proper risk management and your own strategy.

💬 Support the Idea👍 Like if you’re bullish on Gold

💬 Comment: Breakout rally or fakeout? 🔁 Share with fellow gold traders

#XAUUSD #Gold #Forex #PriceAction #TrendlineBreakout #SafeHaven #TradingView #SupportResistance #IntradayTrading #Kabhi_TATrading

UNH: adding into fear after a completed ABC correctionThesis

NYSE:UNH has completed its corrective ABC structure and is stabilizing within Wave 2, offering long-term accumulation opportunities in a proven cash-flow compounder.

Context

- Daily and weekly timeframes

- Deep corrective phase already completed

- Long-term uptrend remains intact on the weekly chart

- Dividend-paying, high free-cash-flow defensive name

What I see

- Yesterday’s selloff was headline-driven, not structural

- Price is holding inside the Wave 2 retracement zone

- Volatility is shaking out weak hands, not breaking structure

- This behavior is typical at the end of corrective phases

- I added to my long-term position yesterday, bringing my average into the $270s

What matters now

- The priority is stabilization and base-building

- A reclaim of the 50-day MA improves short-term structure

- Reclaiming the 200-day MA confirms the next impulsive leg

- Gap-filling narratives are noise, not a strategy

Buy / Accumulation zone

- Accumulation remains valid inside the current Wave 2 range

- I have no issue adding again once price stabilizes

- Risk is defined against the recent correction lows

Targets

- First major structural reference: 200-week MA near $460

- Wave 3 target remains the 1.618 Fib extension around $540

- Dividend yield (~2.6%) pays while waiting

Execution note

- This game isn’t for everyone — pressure exposes conviction

- I added at $250 and $240 when sentiment was darkest

- Buffett added at higher prices, yet fear returned instantly

- NYSE:UNH is my current safe-haven: strong FCF, cash-rich, defensive

This is a 3–5 year hold for me, not a short-term trade

Gold vs Bitcoin: Safety or Asymmetry?Every few years, the same question comes back.

Gold or Bitcoin?

But the chart above tells a more interesting story.

Not about competition... but about role.

Gold: The Anchor

Gold doesn’t chase excitement.

It absorbs fear.

Through uncertainty, inflation scares, and macro stress, Gold keeps doing what it has done for centuries:

protect purchasing power.

Its moves are steadier.

Its drawdowns are shallower.

Its purpose is stability.

Gold isn’t here to impress you.

It’s here to hold the line.

Bitcoin: The Asymmetry

Bitcoin is different.

It doesn’t move quietly... it moves decisively.

Long consolidations.

Deep corrections.

Then explosive expansions.

Bitcoin rewards patience, not comfort.

It offers upside, not calm.

It’s volatile by design; and that volatility is the cost of exponential potential.

Two Assets. Two Jobs.

Look at the cycles.

Gold rises when confidence fades.

Bitcoin accelerates when confidence returns.

One absorbs shock.

The other compounds growth.

This is why the real conversation isn’t which one is better.

It’s why they belong together.

The Real Strategy

This isn’t about timing tops.

Or picking winners.

It’s about:

DCA

Long-term holding

Letting time do the heavy lifting

"Gold for safety.

Bitcoin for upside."

"In times of fear, Gold is what you go to.

Bitcoin is what you go through."

And over time, that combination doesn’t just protect capital, it grows it.

Question for you:

If you zoom out 10 years from now, which matters more: picking one, or holding both?

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~ Richard Nasr

Silver & the $100 MagnetFrom a long-term perspective, Silver remains clearly bullish, holding well above the blue rising trendline.

Zooming in, the short-term structure is just as clean. XAGUSD is trading inside a rising red channel, respecting both its upper and lower bounds with precision.

As long as this red channel continues to hold, my focus stays on trend-following long setups. The natural target remains the upper bound of the channel, which aligns perfectly with the $100 level, a round number that has been acting like a magnet for price.

What do you think? Does Silver tap $100 again before any deeper correction? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Gold at $5k? RSI divergence vs. breakout – which comes first?Gold is just $30 away from the historic $5,000 level, and silver is approaching $100 for the first time ever. But before you chase the breakout, we need to talk about the RSI divergence flashing on multiple timeframes and what it means for the next move.

In this video, we analyse the technical setup as gold approaches the most critical resistance level of this bull run. We explain why the "no safe haven" thesis—with the dollar collapsing on Greenland tensions and the yen crashing past 158 after the BOJ decision—is flooding capital into precious metals. But we also map out the warning signs that suggest $5K could trigger heavy profit-taking.

Key topics :

Measured move complete : The corrective leg projects to 4,930, which we just hit. Similarly, the Elliott Wave net distance (Waves 1-4) also targets the same level—two confluences at resistance.

Accelerated channel : Gold is trading in a parabolic, accelerated channel. As long as we hold 4,680 (61.8% Fib on daily) and 4,770 (61.8% Fib on 4H), the bias remains bullish.

RSI divergence : Weekly, daily, and 4-hour charts all show bearish divergence. Price is making new highs, but momentum is not confirming—classic topping behaviour.

The $5K test : Next upside targets are 5,012, 5,100, and 5,200. But $5K might be where sell orders are stacked. A failure here could trigger a sharp correction to 4,770-4,800.

Risky counter-trend Play : For the brave, a short at $5K with a stop at $5,050 and a target at $4,770 (61.8% support). But remember: "The trend is your friend."

Are you buying the dip or fading the $5K level? Let us know in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Gold Prep for $5,000 -- Q1 2026Based on Gold's macro Elliott Wave structure, the pending new all-time high near $5,000 is likely to unleash the most magnificently tremendous episode of bear power ever witnessed in Gold's history.

The elders, boomers, OGs, etc. are likely preparing to migrate to crypto. I believe this is the quiet part that institutions and media is not saying out loud. Then again, this idea of a catalyst is totally speculation.

The chart is more of a science.

Gold M15 FVG Hold and Continuation Setup📝 Description

TVC:GOLD is consolidating above a short-term FVG after a strong impulsive leg. Price is holding structure and showing acceptance above intraday support, suggesting continuation rather than distribution.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the M15 FVG base

Preferred Setup:

• Entry: 4,586

• Stop Loss: Below 4,573

• TP1: 4,601

• TP2: 4,612

• TP3: 4,629 (ATH liquidity)

________________________________________

🎯 ICT & SMC Notes

• Clean impulsive leg with shallow pullback

• FVG acting as valid support

• Upside liquidity remains intact

________________________________________

🧩 Summary

As long as price holds above the intraday FVG, continuation toward higher liquidity and ATH extension remains the favored scenario.

________________________________________

🌍 Fundamental Notes / Sentiment

Despite near-term USD strength, safe-haven demand and macro uncertainty keep gold supported. Any pullbacks are likely corrective, with upside continuation favored as markets remain sensitive to growth risks and policy uncertainty.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

New ATH Incoming? Gold (XAUUSD) Holds Bullish Structure!Hey Traders,

In today’s trading session, we are monitoring XAUUSD for a buying opportunity around the 4,380 zone. Gold remains in a well-defined uptrend and is currently in a corrective phase approaching the key trendline confluence and the 4,380 support & resistance area, which may act as a strong demand zone for continuation to the upside.

From a fundamental perspective, markets are keenly watching US labor data due Friday. Should the report come in soft, it would likely reinforce expectations of further Fed rate cuts in January, similar to December’s dovish messaging, which tends to weaken the US Dollar and support bullish flows into Gold.

In addition, escalating geopolitical tensions between the US and Venezuela have boosted safe-haven demand, as investors seek protection amid heightened uncertainty, pressuring traditional assets and strengthening gold’s appeal.

With these technical and macro drivers aligned, Gold may continue its bullish trajectory and challenge fresh all-time highs this year.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Gold surges 2.75% on Venezuela, weak dollar! Eyes on new recordsGold has surged 2.75% on Monday and continues higher on Tuesday, now trading around $4,465 and eyeing a retest of record highs at $4,550. This rally is fuelled by Venezuelan tensions, a weaker US dollar, and soft manufacturing data—but is this a breakout or a trap before NFP?

We analyse why the weaker dollar—not pure safe-haven demand—is the dominant driver, as both gold and stocks are rallying together. We then map out the critical Fibonacci levels that will determine whether gold breaks to new highs or corrects back toward $4,400.

Key drivers

- Venezuela tensions & dovish Fed : Gold got a safe-haven bid following Trump's aggressive stance on Venezuela, but the real driver is dollar weakness after Fed Governor Kashkari's dovish comments about slow disinflation and rising unemployment risks.

- Weak Manufacturing PMI : US ISM PMI dropped to 47.9 from 48.4 expected, reinforcing the soft-landing narrative and pushing the dollar lower.

- Dead Cat Bounce invalidated : Price has broken above both the 50% and 61.8% Fibonacci retracements ($4,447), invalidating the bearish "dead cat bounce" scenario that suggested another leg down.

- Upside targets : The immediate hurdle is the 78.6% Fib at $4,490. A break here strongly suggests new record highs toward $4,550 before the NFP report on January 9. Above that, $4,600 and $4,750 are psychological targets.

- Downside risks : Key support is the weekly open at $4,430 (or gap fill at $4,455). A breakdown below the 50% Fib at $4,412 would shift sentiment bearish and open the door to deeper corrections.

- NFP wildcard : Markets are cautious heading into Thursday's jobs report. A weak NFP could fuel another leg higher, while a strong print may trigger profit-taking.

Are you buying the breakout toward $4,550 or waiting for a pullback? Share your gold strategy in the comments and follow for NFP coverage later this week.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Gold - Control vs Patience… Who Wins Next?Gold hasn’t done anything crazy lately, and that’s exactly the point.

Zooming out, the structure is still bullish. Every dip so far has been met with buyers, and the market keeps printing higher highs and higher lows.

Right now, price is sitting inside what I like to call a decision zone. This is where the market usually pauses, shakes out impatient traders, and shows its real intention.

As long as we’re holding above this green zone, bulls are still in control. This looks more like a pause or reload than a reversal.

That said, if price loses this area and starts accepting below it, then the story changes... and a deeper correction would be on the table.

What do you think? Will Gold reload and continue higher, or is this where control shifts? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Gold Safe-Haven Bid, Bullish OTE Hold with Upside Move📝 Description

Gold on H4 is holding a bullish HTF structure as rising geopolitical risk keeps it in a classic safe-haven bid. Price is currently consolidating around 4,331, trading inside the H4 OTE zone (0.618–0.786) after the recent pullback from highs. Demand has remained intact on dips, signaling accumulation rather than distribution.

________________________________________

📈 Analysis (Scenario-Based | Non-Signal)

Primary Bias: Bullish, while key lows hold

Liquidity & Pullback Context:

• Short-term chop and liquidity collection likely around 4,305

• Downside inefficiency sits at H4 FVG around 4,250, acting as the main downside magnet if liquidity is required

Continuation Path:

• Holding above OTE favors a rotation back toward H4 FVG 4,440–4,480

• With sustained risk-off flows, price can retest prior highs near 4,550 (BSL)

Risk-Relief Case:

• Any de-escalation may trigger a temporary correction, not a trend flip

• Structural damage only if acceptance occurs below 4,240

________________________________________

🎯 ICT & SMC Notes

• Pullbacks classified as buy-the-dip within HTF bullish context

• OTE (0.618–0.786) holding supports continuation

• H4 FVGs define magnets both above and below

________________________________________

🧩 Summary

Gold remains structurally bullish amid elevated geopolitical risk. Expect short-term volatility and liquidity runs, but as long as ~4,240 holds, dips are corrective. Continuation favors 4,440–4,480, with a potential retest of 4,550 if tensions persist.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Gold - Breakout, Retest, Reload?Gold continues to respect a clean bullish structure 📈 on the 4H timeframe. After breaking above the previous all-time high, price has shifted that level into demand, confirming strength rather than exhaustion.

⚔️The rising blue trendline remains intact , and every pullback so far has been met with aggressive dip-buying, reinforcing the trend-following environment.

As long as price holds above the highlighted demand zone, the bias remains firmly bullish.

From here, the plan is simple and disciplined:

🏹I’ll be looking for longs on pullbacks into demand, in alignment with the trend, rather than chasing price higher. A clean reaction from this zone keeps the path open for continuation toward new highs.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Gold - Pullback or Reload Before the Next Push?📈 Gold remains overall bullish , trading within a well-defined ascending structure.

Price is now approaching a high-confluence area, where the demand zone aligns perfectly with the lower red trendline. This intersection is critical, as it represents a classic trend-following buy zone within a healthy uptrend.

⚔️As long as this zone holds, we will be looking for bullish reactions and continuation setups, aiming for a move back toward the upper side of the channel and the previous highs.

A clean rejection from this level would confirm buyers are still in control.

A decisive breakdown below it would invalidate this bullish scenario.

Is Gold setting up for another trend continuation, or will it surprise the crowd? 🤔👇

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Gold - Bullish Structure Still Intact… Eyes on the Next Higher!!📈Gold remains overall bullish, consistently forming higher lows along its rising trendline. Every time price tapped the lower boundary of the structure, buyers stepped in aggressively, and we may be approaching that point again.

⚔️Price is currently hovering near a blue support zone, which aligns perfectly with the rising trendline. As long as this confluence holds, we will be looking for trend-following longs, targeting the upper resistance zone highlighted in beige.

🏹If buyers defend this area once again, Gold could be preparing its next impulsive leg upward.

Do you expect Gold to print another higher low here? Share your thoughts below 👇

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

XAUUSD - The Golden Retest Zone!📈Gold remains overall bullish , respecting its rising structure and printing higher lows along the way. Each corrective dip has been met with strong buying pressure, keeping the broader trend intact.

📉As price pulls back, it is now approaching a key blue structure zone that aligns perfectly with the lower blue trendline. This intersection forms a high-confluence area where we will be looking for trend-following longs.

⚔️As long as Gold holds this zone, the bullish scenario remains dominant, with the next potential push targeting the previous ATH highlighted on the chart.

🏹A clean reaction here could be the catalyst for the next leg of the uptrend.

Will the bulls defend the golden zone again? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Gold Reload Zone… Bulls Waiting Patiently!📈Gold remains overall bullish, respecting both its rising structure and the major support zones beneath current price. After breaking above the light-blue resistance area, XAUUSD is now pushing higher, but a pullback remains very likely before the next impulse.

⚔️On the upcoming retest of the blue structure zone and the rising trendline, we will be looking for trend-following longs. This area has acted as support multiple times and now aligns with the bullish context, making it a high-probability buy zone.

🏹As long as Gold remains above the red demand area and respects the rising structure, the next wave upward toward the 4,385 resistance remains the most likely scenario. Only a clean break below the red zone would weaken the bullish outlook.

For now, patience is key… wait for the retest, then look for longs from structure. 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

XAUUSD - Bulls Still Stepping In at Demand… Watching the Retest!Gold remains overall bullish, holding firmly above the major support zone around $4,000–$4,050. This entire red area has been acting as a strong demand zone for weeks, with price bouncing from it multiple times, a clear sign that buyers are defending this level aggressively.

📈XAUUSD is also respecting the rising trendline , forming a clean higher-low structure. As long as Gold remains above both the trendline and the support zone, the bullish outlook stays intact. I will be looking for long setups on the next retest of this confluence area.

🏹If buyers step in again, the next move could push toward the previous highs near $4,385. But if price breaks below the support zone and the trendline, the bullish structure would weaken and open the door for a deeper correction.

For now, this zone is the key. Will Gold bounce again… or finally break through support? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

USDJPY breakout: Can the rally extend toward 155?The dollar-yen pair smashed through 150 with one of the strongest breakouts recently, confirming a new technical phase as it trades above the 61.8% Fib retracement. Here’s what’s fuelling the move and what traders should watch next:

Dollar strength returned as safe haven flows dominate, even with a US government shutdown, while Japan’s new prime minister’s dovish signals are sending the yen into freefall.

Key drivers

Safe haven flows : Investors seek shelter in the dollar as global uncertainty rises; DXY index hit a 6-week high.

Yield differentials : The Fed/BOJ spread powers further carry trade buying as Japanese rates remain ultra-low.

Japanese political shift : PM Takaichi’s win spurs fiscal stimulus and pushes back market hopes for BOJ tightening, deepening yen weakness.

Technical breakout : Clean break above multi-year resistance and 61.8% Fibonacci retracement; watch for support validation and continuation toward the next 78.6% Fib at 154.80.

What to watch

Holding above 150 and 61.8% Fib support sets the stage for a bullish continuation.

Profit taking is possible near 153.25–154.80, as RSI shows signs of overbought.

Tonight’s FOMC minutes, Thursday’s BoJ/Ueda speech, and political headlines could trigger sharp moves.

Cross-pair momentum : EURJPY at record highs, GBPJPY surging, confirming broad-based yen weakness.

The bulls are in control as long as USDJPY stays above 151.15–150.50. Pullbacks to support offer opportunities to buy dips, with 154.80 as the next bullish target. Keep stop losses disciplined, and don’t ignore the chance for sharp reversals if intervention or a dramatic shift in sentiment emerges.

For more actionable FX insight, follow ThinkMarkets.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Gold Eyes 4,000 — Key Buy Zone Ahead!!Hey Traders,

Today we’re keeping a close watch on XAUUSD, which continues to trade firmly within its medium-term uptrend. Price is currently pulling back in a healthy correction, and the 4,000 zone stands out as a major confluence level — a structural support, previous reaction area, and dynamic trend touchpoint.

A controlled dip into this zone could attract fresh buyers, especially with markets still leaning toward risk caution and demand for safe-haven flows remaining elevated. As long as the broader trend structure holds, Gold may attempt another leg higher from this area.

Trade safe,

Joe.

XAUUSD IDEA FOR 10TH OCT, 2025. (2H)Here we go again, I'm back at trading the XAU against the USD. It's been a hell of a ride this year, but it is what it is. The Pair is bullish due to sentiment and because Gold is known as a safe-haven asset, and currently, investors are long on the pair because of the weak USD

As we can see, the pair is resuming back on its overall trend from a previous retracement, so what's next?

Note: This is a very volatile pair and often filled with manipulations ensure to risk what you can afford to lose.

As usual, my calls or analysis are based on what I see, the current Bias, and from a probability standpoint, meaning that this projection may be or may not be validated, so tread carefully. This is not financial advice; trade responsibly.

Does US Tech Dominance Outweigh Dovish Fed Policy?The recent slight rise in the USD/CHF pair toward 0.7940 signals a crucial shift in favor of the US Dollar, despite immediate monetary headwinds. While the Federal Reserve is broadly expected to deliver a dovish 25 bps rate cut driven by cooling US inflation and a soft job market, the DXY remains resilient. This Dollar strength is not simply speculative; it highlights profound structural weakness in the Swiss Franc. The chronically negative Swiss ZEW Survey Expectations, which improved only marginally to -46.4 in September, point to persistent domestic economic pessimism, which significantly erodes the Franc's safe-haven appeal. This divergence of underlying economic health proves more influential than short-term rate expectations.

The influence of geopolitical and geostrategic risk further supports the US Dollar. Upcoming high-stakes discussions between the US and Chinese leaders on trade and technology issues, including tariffs and rare earth controls, inject uncertainty into global markets. When major power tensions escalate, the US Dollar automatically benefits from its unrivaled status as the world’s most dominant reserve currency. Capital rapidly flows from smaller, risk-exposed jurisdictions and into USD-denominated assets. This flight to the world's most liquid currency strengthens the Dollar against rivals like the Franc, which is typically a safe-haven but lacks the USD's depth and liquidity.

Crucially, the long-term upward trajectory of the USD/CHF is underpinned by US technological dominance. The United States leads decisively in high-tech sectors, particularly in AI and life sciences. This leadership, evidenced by robust patent analysis and significant private sector investment, guarantees a continuous inflow of global capital. Generative AI alone is projected to add trillions in annual economic value, primarily benefiting US-listed companies. This enduring, structural edge in high-tech and science creates a massive, consistent demand for US assets, systematically bolstering the Dollar's value and allowing it to outperform the Franc, regardless of short-term interest rate adjustments.

In summary, the USD/CHF gain is a complex interaction of factors. Although the Fed is expected to cut rates, a fundamentally weak Swiss economic outlook and immediate geopolitical risks drive capital to the superior stability of the Dollar. Ultimately, the US Dollar's strength derives from the unmatched geostrategic advantage of its reserve status and its sustained global leadership in technology and innovation. These long-term structural drivers decisively outweigh the immediate dovish signals from the Federal Reserve, positioning the USD for continued strength against the Franc.

GBPJPY Eyes 203.000 as Risk-On Mood Weakens YenHey Traders,

In tomorrow’s trading session, we’re monitoring GBPJPY for a buying opportunity around the 203.000 zone. The pair remains in a broader uptrend and is currently in a correction phase, approaching the 203.000 support and resistance area, which aligns with the prevailing trend structure.

On the fundamental side, easing tensions between the US and China are fueling a risk-on environment, typically leading to weaker demand for safe-haven assets like the JPY. This sentiment shift could support further upside in GBPJPY if buyers step in at this level.

Trade safe,

Joe