The Art of the Exit: Mastering the "Wise Cut"Hello Friends, Welcom to RK_Chaarts,

Today we are going to understand that what is The Art of the Exit: Why "Cutting Losses" is Your Most Important Skill.

Let’s be real: nobody likes losing money. It stings. But if you’re going to survive in these markets, you have to get comfortable with being wrong.

In trading, a loss is just a business expense. The goal isn’t to avoid them entirely (that’s impossible); the goal is to keep them small enough that they don't take you out of the game.

Here is how to manage your exits without losing your mind—or your account:

1. Your Stop-Loss is Non-Negotiable

Think of a stop-loss as your "insurance policy." You should know exactly where you’re getting out before you ever hit the buy button. By setting a hard exit point, you take the decision-making out of your hands when emotions are running high.

2. Stick to the Script

We’ve all been there: price hits your stop, and you think, "Maybe if I just give it a few more pips, it’ll bounce." Don't do it. That’s how a small, manageable loss turns into a portfolio-killer. Trust your plan, not your gut.

3. Lock in Gains with Trailing Stops

If a trade is moving in your favor, don’t be greedy. Use a trailing stop to follow the price up (or down). This lets you stay in the trend while ensuring that even if the market reverses, you still walk away with a profit.

4. Don't Bet the House

The "Golden Rule" is simple: never risk more than you can afford to lose on a single trade. Most pros only risk 1-2% of their account per setup. This way, even a string of five losses is just a minor setback, not a disaster.

5. Keep an Eye on the Bigger Picture

Markets don't move in a vacuum. High-impact news or economic shifts can wreck a perfectly good technical setup. Stay informed, check the calendar, and be ready to step aside if the environment gets too chaotic.

6. "Hope" is Not a Strategy

Holding onto a losing position and praying for a miracle is the fastest way to blow an account. Cut the dead weight early. There will always be another setup tomorrow. Protect your capital so you can live to trade it.

7. Pay for Your Education

Every time you take a loss, you’ve essentially paid a "tuition fee" to the market. Don't waste it. Review the trade: Did you follow your rules? Was the entry off? Use those mistakes to sharpen your edge for the next one.

The Bottom Line

Trading isn't about being right; it's about math and discipline. If you can keep your losses small and your winners big, the math will eventually work in your favor.

Stop trying to be "right" and start being "profitable."

How do you handle a losing streak? Drop a comment below 👇

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Beyond Technical Analysis

Earnings Demystified If you are a trader, the chances are you have run into observing an earnings release. And more chances are, you have been like “WTF?!” when the ticker tanked on solid earnings released, or rallied on terrible earnings releases.

And so you’re sitting there being like “what the heck is going on?”, “earnings is a gamble”, “ earnings make no sense ”, etc. etc.

And you wouldn’t be wrong, at least for the most part. Centuries ago, I wrote about the relationship between earnings for META (and because it was literally centuries ago at the time it was called FB) and how the earnings release impact PA.

Since centuries have passed and I now have a whole server (that keeps growing in computational power) dedicated just to market analysis and statistics, I think its time for this idea to be updated slightly. And also, in the process, hopefully demystify earnings and provide traders with a more fundamental understanding of earnings and its nuances.

So, let’s get into it!

The task:

Task AI (or more specifically machine learning algorithms) to look at many different features surrounding earnings and return which features actually improve prediction accuracy (i.e. enhance the algorithms ability to predict successfully) and which do not.

Method:

For this approach I usually like Random Forest, but for simplicity and speed in execution, we will use XG Boost to feature select.

The Sample:

I think we do 10 comparisons to highlight nuances but we will deep dive into maybe 2.

Understanding the lingo:

Because we are using AI and MLA (Machine Learning Algorithms) applying pure statistical concepts, I will clarify the 3 key terms we need to understand in order to make sense of this analysis. The 3 main results we will get are

Gain: is the most critical metric because it measures the direct contribution a feature makes to the model's performance. It calculates how much the "error" or "uncertainty" in the model drops every time this feature is used to make a decision. The higher the gain, you can visualize it as the more important and higher the prediction confidence.

Cover: measures the breadth of a feature, specifically how many observations (samples) are affected by a specific rule. If a feature has high cover, it means the model is using it to make decisions for a large portion of the dataset, rather than just a few niche cases.

Frequency: (also called Weight) simply counts how many times a feature appears in all the trees the model built. While it sounds important, a feature can have high frequency just because it’s a "busybody" (like RSI, which has many levels to check) without actually providing much "Gain" or "Cover."

The Features:

For this analysis, I chose to include:

Previous day returns leading into earnings,

RSI

MFI

Previous Day Volume,

14-Day Trend Information,

EPS Estimate,

Actual EPS,

Surprise EPS,

Previous Actual EPS from the last quarter Release,

Seasonality

The Analysis

Let’s start with the ticker in which this idea is being posted, $NFLX.

NFLX

Significance:

As you can see, the model knowing that its Q1 improves its ability to predict exponentially. The 100% you see means Q1 is a substantial quarter for NFLX. However, you will notice there is no mention of other quarters. That means, the seasonality effect dissipates after Q1 and seasonality no longer becomes predictive of NFLX earnings in the other quarters.

The most interesting thing for NFLX is looking at the General features. Here, you will see that the actual EPS release is the LEAST important feature, all the way at the bottom of the list, offering only 0.3% gain to the model. This is incredible! It means that the actual EPS is, essentially, useless in predicting the investors response to the earnings release.

This alone is the EURKA! Moment that we should all have. Remember those tickers tanking on solid earnings? Well, now you know.

The next observations one would need to look closely at is that NFLX is a highly momentum driven stock. If you look at the top features, you will see a lot of momentum based metrics added the most value for the models predictions, including the 14 day trend (Trend_cor), the RSI, MFI, previous day volume, previous day returns, etc. These are the metrics providing the model with the most predictive power. These are also mostly momentum based metrics, devoid of really anything fundamental about earnings.

An example of Q1 earnings for NFLX:

This was January 2024. The surprise was a whopping -4.81%. Yes, NFLX under-delivered by over 4% and it still rallied > 10%.

Next Up, NYSE:MMM

MMM returned all NULLs on Seasonal metrics. Meaning, there is no significant seasonality impact on MMM’s earnings.

Jumping to the general table, we can see that MMM is mostly fundamentally driven. For MMM, their earnings and performance matter, unlike NFLX which is all about trend, momentum and most likely characteristic of meme traders. MMM, on the other hand, is about solid performance and growth.

Why do I say this? Well look at the General table. The top 3 metrics are all fundamental, based on the actual earnings release and all add >= 10% gain to the model, meaning that the models accuracy is improving by >= 10% based on these metrics alone.

We can see a little bit of trend following, with the 14 day trend accounting for feature 4. This can still be fundamentally driven in the sense that investors may be anticipating good releases and buying into the release. However, the model is not capable of making that determination, so its mostly conjecture from me.

Let’s take a look at an example:

Here, MMM delivered a surprise of 5.59% and ended up rallying 7.66%, indicating the direct link between actual earnings and response.

Next NASDAQ:META

I think its fair to go back to META, since this was the ticker that was my first ever ticker of interest for analysis of earnings and price action! So let’s check the results.

Interestingly, seasonality means nothing to NASDAQ:META which is interesting.

And even more interestingly, META, which I assumed would be full of memers, is actually very fundamentally driven. If you look at the top features, one can see that actual fundamental aspects of META ‘s earnings are driving its response, most notably its estimate, its surprise and interestingly the previous investors response to the last earnings release.

However, for META, this is very visible in the historical responses. Take a look at this example:

Here, META delivered a whopping surprise of -84%. Yes, NEGATIVE 84%. This caused it to tumble >11%, highlighting the importance of META’s earning’s estimates and actual EPS releases.

Let’s take a look at 2 actual MEME stocks, legendary ones:

Seasonality has no effect here as well, but what is incredibly interesting is that these memers are mostly driven by momentum and speculation. And what makes me say that? Its because if you look at the feature importance, you will see the top drivers are PREVIOUS response to earnings and momentum metrics.

To put it into context of trading psychology, this is what this feature profile could translate to in an investors/trader’s mind:

“ The stock is trending up, the last earnings release was bullish, so I am going to long it” .

This statement embodies the feature selection of this ticker perfectly!

Math meets Psychology, don’t you love it?!

Before we tie this analysis/idea off, let’s look at 1 more modern/new meme stock, AKA NASDAQ:RKLB and one historic behemoth, $MSFT.

First up, RKLB:

No seasonality here. Just pure momentum with a dash of speculation we saw with GME and AMC. However, the major driver is momentum here.

I want to highlight this because this is another “retail fingerprint” you can see when you breakdown ticker anatomy. Here you can see “We are trending X (up/down), last earnings release was Y, so I am going to Z (long/short)”.

This is a very interesting nuance I have discovered in meme / retail stocks and I find it absolutely fascinating as the math really embodies human psychology!

And last but definitely not least we have that behemoth of a money maker, NASDAQ:MSFT

Again, seasonality is a no go. But we can also see something interesting.

What is it, you ask?

Well, despite MSFT’s long standing, old status of being an ancient but modern and adaptive tech giant, it still succumbs to some momentum based plays. In fact, looking at MSFT, the model prefers momentum based metrics over more fundamental based metrics.

This is another thing I find just absolutely fascinating. How can we understand trader psychology here? Actually, it is pretty easy!

“ MSFT is trending. It’s a long standing company that can’t fail. I am bullish ”.

BOOM.

Done.

Conclusion

I have went over and attempted to demystify earnings and explain the nuances of a few specific tickers. But I think it’s important to understand, what are the key take aways here? I mentioned in some of these analysis “trader psychology”. At the end of the day, if you look at these metrics that the model has found that indicate importance, it tells you a lot about the psychology that goes into earnings releases and that, for the most part, earnings are less about math and eps and more about investor psychology.

Each ticker is unique. While some important metrics tend to overlap, at the end of the day, each ticker has its own unique composition that drives its response to earnings. And these drivers likely play into the psychology of the particular group of investors/traders trading that particular equity into the release.

I hope you found this helpful and informative!

As always, leave your questions/comments below and safe trades!

If you are interesting in the centuries old post about META (former FB) earnings and Price Action, check it out here.

If you want my indicator that assesses earnings seasonality and creates EPS profile of earnings response, check it out here.

Behavioral Biases: Why Most Traders Make the Same MistakesHello, traders! 😎

Crypto markets may look chaotic, but they are driven by a single force: human psychology — the core of trading psychology. Every pump and dump is fueled by cognitive biases, fear and greed, and distorted decision-making under uncertainty, which is exactly why most traders end up repeating the same costly mistakes.

Fear-Driven Herding in a Sideways Market

Since late 2025, Bitcoin has spent months grinding sideways between roughly $80K and $97K, frustrating trend followers and wearing down traders who were betting on a clean breakout to new highs. Retail traders who bought panic dips often ended up selling into relief rallies — a textbook fear-and-greed cycle — while more seasoned players quietly rotated into BTC as a relative safe haven amid rising macro stress.

This wasn’t random price action; it was market psychology on full display . Those caught on the wrong side struggled to stay disciplined, letting emotion override their plans, chasing tops and dumping into support instead of executing a strategy.

Overconfidence and Risk Neglect Bias

Throughout 2025, futures markets were pushed to historic leverage extremes, only to be repeatedly wiped out by relentless volatility. Retail traders running 50× or even 100× got steamrolled when minor pullbacks triggered cascading liquidations. It was a brutal display of cognitive bias — especially overconfidence and optimism — as traders underestimated risk while wildly overestimating their edge, often blowing up their accounts in the process.

Hype-Driven Narrative Bias

The 2025–26 cycle has been littered with fiascos like the sudden collapse of “NYC Token” after its high-profile launch, wiping out speculative holders almost overnight. It wasn’t just a fundamental failure — it was a textbook case of behavioral finance bias: herd chasing and narrative addiction , where traders bought the story and ignored the absence of real underlying value.

Smart Money Anchoring Bias

From mid-2025 into 2026, institutional demand — driven largely by Bitcoin and altcoin ETFs — became one of the dominant forces shaping market structure. Record XRP ETF inflows pulled sidelined capital back into risk assets, pushing momentum traders to chase relief rallies without any real risk framework.

The irony is that professional money doesn’t chase highs the way retail does — but retail trader psychology tends to shadow institutional headlines, magnifying every move. Once ETF flows hit the mainstream narrative, FOMO breeds crowded positioning , turning yet another behavioral bias into a market-moving force.

News-Driven Anchoring Bias

Every macro headline — inflation prints, regulatory noise, or the latest Senate drama — becomes fuel for biased interpretation, amplified by emotions in trading and flawed decision making under uncertainty. Anchoring bias makes traders cling to whatever narrative they heard last: “Bitcoin is a safe haven” one week, “crypto is collapsing” the next.

When markets stop trending cleanly, traders swing between these extremes instead of relying on probability, structure, and risk management .

This macro-crypto feedback loop exposes how psychology drives risk appetite in often contradictory ways. Patterns keep repeating because people repeat the same mental errors — chasing price, overleveraging, anchoring to headlines, and letting emotion overrule strategy. Understanding that behavior is a far more powerful edge than any indicator.

This material is for informational purposes only and does not constitute trading or investment advice.

Finding Edge Where Others Aren't Looking

The Best Traders Aren't Just Looking at Charts Anymore

While most traders stare at the same charts, indicators, and news feeds...

A new breed of traders is counting cars in parking lots from space, tracking shipping containers across oceans, and analyzing millions of social media posts.

This is alternative data - and it's changing who has the edge.

What Is Alternative Data?

Definition:

Alternative data is any data used for investment decisions that isn't traditional financial data (price, volume, earnings, etc.).

Traditional Data:

Price and volume

Financial statements

Earnings reports

Economic indicators

Analyst ratings

Alternative Data:

Satellite imagery

Social media sentiment

Web traffic and app usage

Credit card transactions

Geolocation data

Weather patterns

Job postings

Patent filings

And much more...

Types of Alternative Data

1. Satellite and Geospatial Data

What It Tracks:

Retail parking lot traffic

Oil storage tank levels

Crop health and yields

Shipping and logistics

Construction activity

Example:

Count cars in Walmart parking lots before earnings.

More cars = more sales = potential earnings beat.

Edge: Information before it appears in financial reports.

2. Social Media and Sentiment Data

What It Tracks:

Brand mentions and sentiment

Product buzz

Consumer complaints

Viral trends

Influencer activity

Example:

Track sentiment around a new product launch.

Negative sentiment spike = potential sales disappointment.

Edge: Real-time consumer reaction before sales data.

3. Web Traffic and App Data

What It Tracks:

Website visits

App downloads and usage

Search trends

E-commerce activity

User engagement

Example:

Track app downloads for a gaming company.

Declining downloads = potential revenue miss.

Edge: Usage data before quarterly reports.

4. Transaction Data

What It Tracks:

Credit card spending

Point-of-sale data

E-commerce transactions

Consumer behavior patterns

Example:

Aggregate credit card data shows spending at restaurants declining.

Restaurant stocks may underperform.

Edge: Spending patterns before earnings.

5. Employment and Job Data

What It Tracks:

Job postings

Hiring trends

Layoff announcements

Glassdoor reviews

LinkedIn activity

Example:

Company suddenly posts many engineering jobs.

Could indicate new product development.

Edge: Corporate strategy signals before announcements.

6. Supply Chain Data

What It Tracks:

Shipping container movements

Port activity

Supplier relationships

Inventory levels

Logistics patterns

Example:

Track shipping from key suppliers to Apple.

Increased shipments before product launch = strong demand.

Edge: Supply chain signals before sales data.

How AI Processes Alternative Data

Challenge:

Alternative data is:

Massive in volume

Unstructured (images, text, etc.)

Noisy

Requires specialized processing

AI Solutions:

1. Computer Vision

Analyzes satellite imagery

Counts objects (cars, ships, tanks)

Detects changes over time

2. Natural Language Processing

Processes social media text

Extracts sentiment

Identifies trends and topics

3. Machine Learning

Finds patterns in transaction data

Predicts outcomes from alternative signals

Combines multiple data sources

4. Time Series Analysis

Tracks changes over time

Identifies anomalies

Forecasts future values

Alternative Data in Practice

Case Study 1: Retail Earnings

Satellite data shows parking lot traffic up 15% vs last year

Social sentiment for brand is positive

Web traffic to e-commerce site increasing

Prediction: Earnings beat

Result: Stock rises on earnings

Case Study 2: Oil Prices

Satellite shows oil storage tanks filling up

Shipping data shows tankers waiting to unload

Prediction: Supply glut, prices may fall

Result: Oil prices decline

Case Study 3: Tech Company

App download data shows declining engagement

Job postings show layoffs in key division

Social sentiment turning negative

Prediction: Guidance cut coming

Result: Stock falls on earnings

Alternative Data Challenges

Cost - Quality alternative data is expensive. Satellite data: $10,000-$100,000+/year. Transaction data: $50,000-$500,000+/year. Not accessible to most retail traders.

Signal vs Noise - Most alternative data is noise. Requires sophisticated processing. Easy to find false patterns. Overfitting risk is high.

Alpha Decay - As more traders use the same data, edge disappears. Popular datasets become crowded. Unique data sources are key.

Legal and Ethical Issues - Some data collection is questionable. Privacy concerns. Data sourcing legality. Regulatory scrutiny increasing.

Integration Complexity - Combining alternative data with trading is hard. Different formats and frequencies. Requires specialized infrastructure.

Alternative Data for Retail Traders

Accessible Options:

1. Social Sentiment Tools

Free or low-cost sentiment indicators

Twitter/X trending analysis

Reddit sentiment trackers

2. Google Trends

Free search trend data

Track interest in products/companies

Identify emerging trends

3. Web Traffic Estimators

SimilarWeb, Alexa (limited free tiers)

Estimate website traffic

Compare competitors

4. App Store Data

App Annie, Sensor Tower (limited free)

Track app rankings and downloads

Monitor mobile trends

5. Job Posting Aggregators

Indeed, LinkedIn trends

Track hiring patterns

Identify company direction

Building an Alternative Data Framework

Step 1: Identify Your Edge

What information would give you an advantage?

What do you trade?

What drives those assets?

What data could predict those drivers?

Step 2: Find Data Sources

Free sources first (Google Trends, social media)

Low-cost aggregators

Premium sources if justified

Step 3: Process and Analyze

Clean and structure the data

Look for correlations with price

Backtest any signals

Step 4: Integrate with Trading

How will you use the signal?

What's the trading rule?

How do you size positions?

Step 5: Monitor and Adapt

Track signal performance

Watch for alpha decay

Continuously improve

Key Takeaways

Alternative data provides information before it appears in traditional sources

Types include satellite imagery, social sentiment, web traffic, transactions, and more

AI is essential for processing unstructured alternative data at scale

Challenges include cost, noise, alpha decay, and integration complexity

Retail traders can access some alternative data through free or low-cost tools

Your Turn

Have you used any alternative data sources in your trading?

What unconventional information do you think could provide edge?

Share your thoughts below 👇

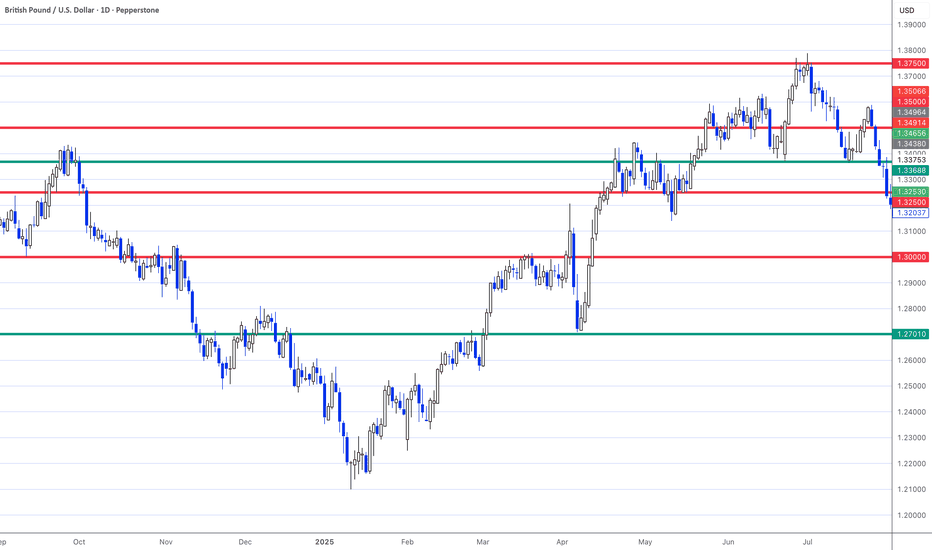

How to Sit through Drawdown on GBPUSD (Part 1)Most traders don’t fail because they lack strategy.

They fail because they never slow down long enough to master one market.

In this video, I’m starting the only series I’m running in 2026: Mastering GBPUSD.

This is not about indicators or hype. It’s about rebuilding consistency by focusing on one pair, learning its rhythm, managing drawdown, and developing the discipline most traders avoid.

We cover

• Why mastering GBPUSD starts with a decision, not a strategy

• How to build trust in a market before increasing position size

• How to sit through normal drawdown without sabotaging your plan

• Practical ways to observe price, mark levels, and reduce overtrading

• Why alerts and walking away matter more than staring at charts

If you’ve traded before, had success, lost momentum, and you’re looking to get back into rhythm, this video is for you.

This series is about focus, patience, and self-mastery through one market.

Watch. Apply. Repeat.

Comment “GBPUSD only” if you’re committing to this journey, and subscribe so you don’t miss the next deep dive in the series.

How to Build Trust With GBPUSD Before You Ever Place SizeMost traders don’t fail because they lack strategy.

They fail because they never slow down long enough to master one market.

In this video, I’m starting the only series I’m running in 2026: Mastering GBPUSD.

This is not about indicators or hype. It’s about rebuilding consistency by focusing on one pair, learning its rhythm, managing drawdown, and developing the discipline most traders avoid.

We cover

• Why mastering GBPUSD starts with a decision, not a strategy

• How to build trust in a market before increasing position size

• How to sit through normal drawdown without sabotaging your plan

• Practical ways to observe price, mark levels, and reduce overtrading

• Why alerts and walking away matter more than staring at charts

If you’ve traded before, had success, lost momentum, and you’re looking to get back into rhythm, this video is for you.

This series is about focus, patience, and self-mastery through one market.

Watch. Apply. Repeat.

Comment “GBPUSD only” if you’re committing to this journey, and subscribe so you don’t miss the next deep dive in the series.

GBPUSD PSYCHOLOGY: Profitability is a Decision, Not a StrategyMost traders don’t fail because they lack strategy.

They fail because they never slow down long enough to master one market.

In this video, I’m starting the only series I’m running in 2026: Mastering GBPUSD.

This is not about indicators or hype. It’s about rebuilding consistency by focusing on one pair, learning its rhythm, managing drawdown, and developing the discipline most traders avoid.

We cover

• Why mastering GBPUSD starts with a decision, not a strategy

• How to build trust in a market before increasing position size

• How to sit through normal drawdown without sabotaging your plan

• Practical ways to observe price, mark levels, and reduce overtrading

• Why alerts and walking away matter more than staring at charts

If you’ve traded before, had success, lost momentum, and you’re looking to get back into rhythm, this video is for you.

This series is about focus, patience, and self-mastery through one market.

Watch. Apply. Repeat.

Comment “GBPUSD only” if you’re committing to this journey, and subscribe so you don’t miss the next deep dive in the series.

Detachment Is a Skill, Not a FeelingDetachment Is a Skill, Not a Feeling

“Detachment isn’t about not caring.

It’s about not clinging.”

Many traders misunderstand detachment.

They think it means being cold.

Emotionless.

Disconnected.

That misunderstanding keeps them stuck.

True detachment is not the absence of emotion.

It is the presence of clarity.

Why Traders Struggle With Detachment

Attachment forms quietly.

To:

• A bias

• A winning streak

• A well-researched idea

• A trade that “should work”

The more effort you put into an analysis,

the harder it becomes to let go.

You don’t want to be wrong.

So you stop listening.

Engagement vs Attachment

Engagement is healthy.

Attachment is dangerous.

Engagement means you observe price closely.

Attachment means you defend your opinion.

Engagement adapts.

Attachment insists.

Professionals stay engaged.

Amateurs get attached.

What Attachment Does to Trading

• You ignore early warning signs

• You delay exits

• You justify holding longer

• You confuse hope with patience

• You feel personally affected by outcomes

The trade becomes about you,

not about price.

What Detachment Actually Looks Like

Detachment means:

• You accept invalidation quickly

• You respect structure changes

• You exit without emotional negotiation

• You treat each trade independently

• You care about execution, not outcome

You’re still focused.

You’re just not entangled.

How to Train Detachment

• Define invalidation before entry

• Journal emotional reactions, not just results

• Reduce position size to reduce attachment

• Pause after wins and losses

• Ask: “What is price telling me now?”

Detachment is not a personality trait.

It’s a practiced skill.

📘 Shared by @ChartIsMirror

Where do you feel the strongest attachment — entries, exits, or bias?

Comment honestly. Awareness begins there.

Trading Center: The Dashboard That Changes EverythingStop Drowning in Data. Start Seeing What Matters.

Most traders have 47 browser tabs open, three charting platforms running, and still miss important information.

The problem isn't lack of data. It's lack of organization.

A well-designed trading dashboard transforms chaos into clarity — showing you exactly what you need, when you need it.

Why You Need a Dashboard

The Problem:

Information scattered across platforms

Important data buried in noise

Constant tab-switching and distraction

Missing signals while looking elsewhere

Decision fatigue from information overload

The Solution:

A centralized dashboard that:

Shows key metrics at a glance

Alerts you to important changes

Reduces cognitive load

Keeps you focused on what matters

Dashboard Components

1. Market Overview Panel

What to Include:

Major indices (SPY, QQQ, IWM)

Key sectors

VIX/volatility

Market breadth

Futures if relevant

Purpose:

Understand overall market context before any trade.

2. Watchlist Panel

What to Include:

Your active watchlist

Current price and change

Key levels (support/resistance)

Volume vs average

Alerts status

Purpose:

Track potential opportunities without switching screens.

3. Open Positions Panel

What to Include:

All current positions

Entry price and current price

P&L ($ and %)

Stop loss and target levels

Time in trade

Purpose:

Monitor all positions at a glance.

4. Risk Dashboard

What to Include:

Total portfolio exposure

Open risk ($ at risk)

Daily P&L

Drawdown from peak

Correlation warnings

Purpose:

Never lose track of your risk.

5. Economic Calendar

What to Include:

Upcoming economic events

Earnings dates for watchlist

Fed meetings

Major news events

Purpose:

Avoid being surprised by scheduled events.

6. Performance Metrics

What to Include:

Win rate (recent and overall)

Average R-multiple

Profit factor

Current streak

Monthly P&L

Purpose:

Track performance without opening spreadsheets.

7. Alerts and Notifications

What to Include:

Price alerts

Indicator alerts

News alerts

Risk threshold warnings

Purpose:

Get notified of important events without constant monitoring.

Dashboard Design Principles

Principle 1: Hierarchy of Information

Most important information should be most visible.

Critical data: Large, prominent

Supporting data: Smaller, secondary

Reference data: Available but not distracting

Principle 2: Reduce Noise

Only include what you actually use.

If you haven't looked at it in a week, remove it

Every element should serve a purpose

White space is valuable

Principle 3: Consistent Layout

Same information in same place every time.

Build muscle memory

Reduce search time

Faster decision making

Principle 4: Color Coding

Use color meaningfully.

Green: Positive/bullish

Red: Negative/bearish

Yellow: Warning/attention

Neutral: Normal state

Principle 5: Real-Time Where Needed

Not everything needs to update every second.

Price data: Real-time

Performance metrics: Daily update fine

Economic calendar: Daily update fine

AI-Enhanced Dashboards

1. Smart Alerts

AI filters alerts to show only significant ones:

Unusual volume

Pattern completions

Correlation changes

Risk threshold approaches

2. Anomaly Detection

AI highlights unusual conditions:

Abnormal price movements

Unusual options activity

Sentiment shifts

Correlation breakdowns

3. Predictive Insights

AI provides forward-looking information:

Expected volatility

Probability of hitting targets

Risk scenario analysis

4. Personalized Recommendations

AI suggests based on your patterns:

Best times to trade

Setups matching your edge

Risk adjustments needed

Building Your Dashboard

Option 1: TradingView Layout

Multiple chart layout

Watchlists

Alerts

Limited customization but integrated

Option 2: Spreadsheet Dashboard

Google Sheets or Excel

Pull data via APIs or manual

Highly customizable

Requires maintenance

Option 3: Dedicated Dashboard Tools

Notion, Airtable

Trading-specific tools

More features, learning curve

Option 4: Custom Build

Python + visualization libraries

Maximum flexibility

Requires coding skills

Dashboard Checklist

Before Market Open:

Check market overview (futures, indices)

Review economic calendar

Check open positions

Review watchlist for setups

Verify alerts are set

During Trading:

Monitor open positions

Track risk exposure

Watch for alerts

Note market context changes

After Market Close:

Review daily P&L

Update performance metrics

Adjust watchlist

Set alerts for tomorrow

Dashboard Mistakes

Too Much Information — Cramming everything onto one screen. Only include what you actually use daily.

No Hierarchy — Everything same size and prominence. Make critical information stand out.

Inconsistent Layout — Moving things around constantly. Set a layout and stick with it.

Ignoring Mobile — No way to check when away from desk. Have a simplified mobile version.

Not Updating — Dashboard becomes stale and ignored. Regular review and refinement.

Sample Dashboard Layout

Top Row: MARKET OVERVIEW — SPY, QQQ, IWM, VIX at a glance

Left Column: WATCHLIST — Your opportunities with price, change, key levels

Center: OPEN POSITIONS — All positions with P&L, stops, targets

Right Column: RISK DASHBOARD — Exposure, open risk, drawdown

Bottom Left: ALERTS — Price alerts, indicator alerts, warnings

Bottom Right: CALENDAR — Today's events, upcoming earnings

Key Takeaways

A dashboard transforms scattered information into organized clarity

Include only what you actually use — less is more

Design with hierarchy — critical information most prominent

Consistency builds speed — same layout every day

Regular refinement keeps the dashboard useful

Your Turn

What does your current trading setup look like?

What information do you wish you could see at a glance?

Share your dashboard ideas below 👇

One small loser and a lot of patient waiting. This recording is a look at what it takes to be a professional trader. I took a fake out short and got stopped for a small loss. Spent the rest of the session waiting for a good setup, including NOT jumping on many fake break outs.

Successful trading is about patience and discipline. Have a plan and follow it. Wait for confirmation. Always use a stop loss. Have a plan for how you will manage your trade once you've entered.

GBPUSD: Mastering One Pair Teaches Swing Trading PerfectlyMost traders don’t fail because they lack strategy

They fail because they lack discipline

In this video, we break down the psychology of trading a single pair and why mastering GBPUSD is one of the fastest ways to build consistency, confidence, and emotional control in the markets.

This isn’t about indicators or chasing setups

It’s about learning one market deeply enough to trust your decisions

Hold trades through drawdown

Stick to a plan

And stop sabotaging yourself with overtrading and noise

We cover

Why focusing on one pair sharpens discipline

How mastering GBPUSD improves risk management and execution

The mental edge that comes from knowing a market inside and out

How to hold trades during drawdown without breaking your rules

If you’re getting back into trading or rebuilding consistency

This video is for you

CTA

Drop a comment with the pair you’re committing to mastering

Subscribe for practical trading psychology and execution-based lessons

And if this resonates share it with a trader who needs to hear it

How To Make Macroeconomics Work For YouIntroduction

Trading around news releases is a powerful tool in financial markets.

The ability to identify the direction of the economy and understand market behavior is a skill that requires patience and extensive practice. In this post, we break down the theory behind trading macroeconomic releases and systematically explain how to form a structured view of the market.

Actual vs. Consensus

In almost any economic calendar, you will see a consensus / forecast column. To properly understand released macroeconomic data, it is not enough to simply look at the headline number. The key to interpretation lies in comparing the actual result with the consensus forecast.

This deviation — often referred to as a “surprise” — is the primary driver of volatility in financial markets.

The reason is that the market is a forward-discounting machine. By the time a report is released, asset prices already reflect the prevailing consensus expectations. The market has priced in a specific scenario. When the actual data comes in above or below those expectations, an immediate repricing occurs — the market reassesses future growth, inflation, and central bank policy paths, adjusting prices to reflect the new information.

Therefore, at the moment of the release, the market is not reacting to the number itself, but rather correcting a previously held — and potentially incorrect — expectation. It is this collective and instantaneous adjustment that creates the surge in volatility we observe around economic data releases.

Trend

Trend is the alpha and omega of analysis — the foundation upon which most trading systems are built. This principle fully applies to macroeconomics as well: to correctly interpret a single data release, one must clearly understand the trend in which the economy, or a specific sector, currently operates.

Yes, a trend on its own rarely generates the same explosive volatility as an unexpected deviation from consensus. However, its role is far more fundamental: the trend is what shapes the consensus itself. The dynamics of previous months define the baseline for analysts’ forecasts and market expectations.

Without accounting for the trend, an individual macro indicator becomes just a number in a vacuum. It may point to completely opposite scenarios depending on interpretation. Data must be evaluated in context and over time. A sector may be performing below its long-term averages, but consistent improvement over recent quarters can be a clear signal that central bank policy is having a positive effect. Conversely, a peak reading within a broader downtrend is far more likely to be a statistical anomaly than a genuine turning point.

Historical data serves as a compass for central banks. By understanding what is “normal” for a given sector, policymakers can interpret readings that break away from the trend not as noise, but as structural shifts — a “slowdown in growth” or a “fundamental change in trend.” This is the power of trend analysis: it separates signal from noise, transforming raw data into a coherent picture of the economic cycle.

Context

Accurately understanding the macroeconomic landscape and anticipating market reactions is only possible when data is viewed collectively, not in isolation. Financial markets are complex, interconnected systems, where developments in one sector inevitably ripple through others.

Labor market data directly shape inflation expectations. Central bank decisions and forward guidance impose structural constraints, defining not only the current phase of the cycle but also future conditions across the entire spectrum of assets.

Equally important is the global political and geo-economic backdrop. These forces either introduce a risk premium, increasing volatility, or reduce uncertainty, making outcomes more predictable.

Together, all of this forms the context — the interpretive framework in which numbers exist. Without it, even the most significant deviation from forecast is nothing more than a statistical outlier. Context turns fragmented data into a coherent narrative, allowing us to understand what is truly happening in the economy and where capital is flowing.

The ability to identify this context is the core skill that translates the language of macroeconomic statistics into the language of real market movements.

Federal Reserve Policy

We have reached the key element that determines the development of both individual sectors and the financial market as a whole. Central bank policy is the primary force that sets the rhythm of market movements. Most forecasts and trading strategies ultimately boil down to an attempt to anticipate the regulator’s next steps.

When analyzing a new set of data, the first question we ask is:

what does this mean for the Federal Reserve? What actions will the regulator take to stabilize conditions or support positive momentum?

To do this, the central bank has a set of fine-tuning tools at its disposal. By understanding how each of them works, one can form well-reasoned assumptions about the future direction of financial markets. The central bank’s toolkit includes:

• the policy interest rate

• the interest rate on reserves

• forward guidance

• balance sheet operations

• open market operations

• direct lending facilities

All of these are important, but the central role belongs to the policy rate — the Federal Funds Rate (FFR).

The policy rate is the central bank’s main interest rate. It defines the base cost of money in the financial system and serves as the primary benchmark for all other interest rates in the economy. By adjusting it, the central bank directly influences inflation and economic activity.

Accommodative stance (rate cuts):

The central bank lowers borrowing costs for businesses and households. This expands the money supply and stimulates demand, supporting economic growth, but it also creates inflation risks and may put downward pressure on the national currency.

Restrictive stance (rate hikes):

The central bank makes borrowing more expensive. This cools demand, slows economic activity, and restrains inflationary pressure. In such an environment, the cost of money in the economy rises, often leading to a strengthening of the national currency.

Thus, by monitoring the Fed’s rate decisions, we gain insight not only into the current diagnosis of the economy, but also a clear signal of the environment — accommodative or restrictive — in which all markets will operate in the near future.

Which Data Actually Move the Market?

Having mastered the basic principles of macro analysis, we move on to practice. Now, when looking at an economic calendar, we no longer see just a list of events — we understand their meaning and can anticipate market reactions. To do this, indicators must be grouped by the type of information they provide about the state of the economy.

1. Inflation Indicators

CPI (Consumer Price Index) and especially Core CPI are the primary measures of consumer inflation and directly influence central bank decisions.

2. Labor Market Data

• NFP (Nonfarm Payrolls) and the Unemployment Rate (UR) are key indicators of labor market health.

• AHE (Average Hourly Earnings) reflects wage-driven inflationary pressure.

• JOLTS (Job Openings, Quits) are leading indicators of labor demand and worker confidence.

• Jobless Claims provide a weekly “pulse check” of the labor market.

3. Consumer Demand Indicator

Retail Sales are the main barometer of consumers’ willingness to spend and a key component of GDP.

4. Leading Indicators

PMI (Purchasing Managers’ Index) from ISM and S&P Global is the most important monthly leading indicator, capturing sentiment and the pace of change in the real economy (manufacturing and services).

Beyond these indicators, there are many other important metrics (industrial production, consumer confidence, housing data). However, we focus on the primary market movers — the releases that generate the most volatility and most often reshape the market narrative. Understanding these four categories provides the key to decoding the majority of price movements driven by macroeconomic news.

Inflation Indicators (CPI and Core CPI)

These indices track changes in the cost of living. Imagine a basket that contains everything a typical household buys: food, gasoline, housing costs, clothing, and medical services.

The headline Consumer Price Index looks at this entire basket. However, prices for certain items — such as gasoline or vegetables — can swing sharply due to weather conditions or political decisions. These swings create a lot of noise and make it harder to see the underlying trend.

That is why analysts and central banks focus primarily on core inflation. It is the same index, but with the most volatile components — food and energy — removed. What remains are prices that move more slowly but persistently: rent, childcare, repair services, and healthcare.

If core inflation is rising, it means the foundation of everyday life is becoming more expensive. The cause is usually an overheated economy — when consumers have ample money and are willing to pay more, while businesses face rising costs, often driven by higher wages. This type of inflation is sticky and difficult to contain. That is precisely why central banks react to core inflation when deciding whether to raise interest rates.

If, on the other hand, only headline CPI rises due to a temporary spike in gasoline prices while core inflation remains stable, the central bank is unlikely to tighten policy — such moves are usually seen as transitory.

Labor Market Data (NFP, AHE, JOLTS, Jobless Claims)

The labor market is not a collection of isolated numbers, but a living system where some indicators lay the groundwork for others. To understand it, one must see the sequence and the cause-and-effect relationships.

The first warning signal usually comes from weekly jobless claims. When the number of people filing for unemployment benefits begins to rise consistently, it is a direct signal that companies are laying off workers more frequently. This is the earliest indication that, a few weeks later, the main monthly report may deliver unpleasant surprises: weak job growth or even outright job losses, followed by a rise in the unemployment rate.

However, the strength of the labor market is determined not only by the number of jobs, but also by their quality and the balance of power between employers and workers. This is where the JOLTS report on job openings and labor turnover becomes critical. When job openings are abundant and workers are quitting voluntarily in large numbers, it points to a unique situation: employees are confident enough to switch jobs in search of higher pay. This scenario almost inevitably leads to accelerated wage growth, which later shows up in the Average Hourly Earnings (AHE) data.

Wages are where the strongest link to central bank policy lies. Persistent wage growth acts as a powerful engine for inflation in the services sector. Therefore, when the Fed sees low unemployment combined with steadily rising wages, it has little choice but to keep interest rates high in order to cool the economy. Conversely, when job creation slows and wage growth begins to decelerate, it sends the regulator a long-awaited signal that labor-driven inflationary pressure is easing — opening the door to discussions about policy easing.

By closely monitoring weekly jobless claims and vacancy data, one can anticipate the likely outcome of the key monthly labor report and, with a high degree of confidence, predict how the central bank will react.

Consumer Demand Indicator (Retail Sales)

This is the most direct snapshot of household wallets. The index shows how much money consumers spent during the month on goods — in physical stores, online, at car dealerships, and at gas stations.

Its strength lies in its simplicity. It does not attempt to predict the future or measure sentiment — it simply records whether people are actually spending their money. And since household consumption is the main engine of the U.S. economy, this number is closely watched by everyone.

Retail Sales are highly sensitive to two factors: labor market conditions and Federal Reserve policy.

When jobs are plentiful and wages are rising (strong NFP and AHE), consumers spend with confidence — sales increase.

When the Fed raises rates, borrowing costs (including credit cards) rise, large purchases are postponed, and sales slow or decline.

As a result, Retail Sales often serve as the final confirmation — or refutation — of trends suggested by other data. Persistent growth in sales despite high interest rates tells the Fed that the economy remains too hot and that policy is not restrictive enough. A sudden drop, especially against the backdrop of an already weakening labor market, becomes a powerful argument for a pivot toward policy easing.

What to focus on in the data:

• The month-over-month change, with particular attention to the Control Group, which excludes the most volatile components (autos, gasoline, and building materials) and provides a cleaner view of core consumer activity.

Leading Indicator (PMI)

PMI is a leading indicator that captures turning points in the economic cycle.

It does not measure production volumes or revenues. Its purpose is to identify the moment when business activity is accelerating or beginning to contract. The index is based on surveys of executives who make daily decisions about purchasing, hiring, and investment. Their collective assessment of changes is one of the most sensitive barometers of demand dynamics.

The key is not the absolute level of the index, but its direction and internal components. A decline from 55 to 52 still signals expansion, but indicates a loss of momentum. A rise from 48 to 49 still reflects contraction, but points to a slowdown in the pace of decline.

For central banks, two PMI components are particularly critical:

• New Orders — the purest indicator of future demand. A decline here typically precedes reductions in production and investment.

• Prices Paid — a direct signal of inflationary pressure in supply chains and the services sector. Sustained increases in this component can prevent monetary policy easing, even if the headline index is slowing.

PMI functions as an early warning system. A sustained deterioration over several months often precedes slower GDP growth and weakening labor market data. Conversely, resilience at elevated levels — especially when price components are rising — serves as evidence for central banks that the economy is overheating and that a restrictive stance must be maintained.

Conclusion

You now have a solid theoretical foundation for interpreting news releases and the signals they send to the market. To truly understand this framework and apply it effectively in trading, consistent practice is essential. From my own experience, keeping a macro trading journal can be extremely helpful. Record how the market reacts under different conditions and gradually develop your own independent view of each situation.

Be especially cautious of market rumors — more often than not, such opinions are simply attempts to attract attention with sensational headlines rather than provide meaningful insight.

Enjoy!

Shock Waves in TradingUnderstanding Sudden Market Movements and Their Impact

Financial markets are often perceived as systems driven by logic, data, and rational decision-making. However, in reality, markets are highly sensitive ecosystems where unexpected events can send powerful “shock waves” across asset classes, geographies, and investor psychology. Shock waves in trading refer to sudden, sharp, and often unforeseen movements in prices, volumes, and volatility caused by disruptive information or events. These shocks can originate from economic data, geopolitical developments, policy decisions, corporate actions, or even rumors amplified by modern technology. Understanding how shock waves form, propagate, and influence trading behavior is essential for traders, investors, and policymakers alike.

The Nature of Market Shock Waves

A shock wave in trading is characterized by speed, intensity, and wide-ranging impact. Unlike gradual trends that develop over time, shocks occur abruptly, catching market participants off guard. Prices may gap up or down, liquidity can evaporate, bid-ask spreads widen, and correlations between assets change rapidly. These movements resemble physical shock waves: a single disturbance at the source spreads outward, affecting everything in its path.

For example, an unexpected interest rate decision by a central bank can instantly alter currency valuations, bond yields, equity prices, and commodity markets. Similarly, a sudden geopolitical conflict can trigger risk-off behavior globally, pushing investors toward safe-haven assets like gold or government bonds while equities and emerging-market currencies sell off sharply.

Key Sources of Shock Waves in Trading

Shock waves can originate from multiple sources, often overlapping and reinforcing one another:

Macroeconomic Surprises

Economic indicators such as inflation data, employment reports, or GDP figures can trigger shocks when they deviate significantly from market expectations. Since many trades are positioned around forecasts, surprises force rapid repricing as traders adjust positions.

Central Bank Actions and Policy Shifts

Interest rate hikes, cuts, or unexpected policy statements are among the most powerful shock generators. Central banks influence the cost of capital, currency values, and risk appetite, making their decisions highly market-sensitive.

Geopolitical and Global Events

Wars, trade disputes, sanctions, elections, and diplomatic breakdowns can instantly change the outlook for industries and entire economies. These events often carry uncertainty, which markets tend to price aggressively.

Corporate-Specific Events

Earnings surprises, mergers and acquisitions, fraud revelations, or regulatory actions against companies can send shock waves through individual stocks and sometimes entire sectors.

Technological and Structural Factors

Algorithmic trading, high-frequency trading, and passive investment flows can amplify shocks. Once a trigger is hit, automated systems may execute large volumes of trades simultaneously, accelerating price movements.

How Shock Waves Spread Across Markets

One of the defining features of trading shock waves is contagion. A disturbance in one market rarely remains isolated. For instance, a sharp fall in U.S. equities can ripple through Asian and European markets due to global capital flows and interconnected investor sentiment. Currency markets may react to equity volatility, while commodity prices adjust based on revised growth expectations.

Correlation patterns often change during shocks. Assets that usually move independently may suddenly move together as investors rush to reduce risk. This phenomenon, sometimes called “correlation breakdown,” makes diversification less effective during extreme events and adds to portfolio volatility.

Psychological Impact on Traders

Beyond numbers and charts, shock waves have a profound psychological effect. Fear, panic, and uncertainty dominate decision-making during sudden market moves. Traders may abandon well-planned strategies, chase prices, or exit positions prematurely. Cognitive biases such as loss aversion and herd behavior become more pronounced, intensifying volatility.

At the same time, shock events can create overreactions. Prices may overshoot fair value as emotions take control, later correcting once clarity returns. Experienced traders often focus on managing emotions and sticking to risk rules during such periods, recognizing that survival is more important than short-term gains.

Risk Management During Market Shocks

Effective risk management is the primary defense against destructive shock waves. Traders who anticipate the possibility of sudden moves are better positioned to handle them. Common risk management practices include:

Position Sizing: Limiting exposure so that a single shock does not cause catastrophic losses.

Stop-Loss Orders: Predefined exit points help control downside risk, though slippage can occur during extreme volatility.

Diversification Across Assets and Time Frames: While correlations can rise during shocks, diversification still reduces reliance on a single outcome.

Liquidity Awareness: Trading highly liquid instruments reduces the risk of being trapped in unfavorable positions.

Professional traders also monitor volatility indicators, option pricing, and news flow to gauge the probability of upcoming shocks.

Opportunities Created by Shock Waves

While shocks are often associated with losses, they also create opportunities. Sudden dislocations can present attractive entry points for traders with a clear plan and strong discipline. Volatility increases option premiums, benefiting option sellers or volatility-focused strategies when managed carefully. Long-term investors may find quality assets trading at discounted prices due to temporary panic.

Event-driven traders, in particular, specialize in navigating shock environments by anticipating outcomes and positioning ahead of known risk events such as earnings releases or policy announcements.

Long-Term Implications for Markets

Repeated shock waves shape market structure over time. Regulatory reforms often follow major market disruptions, as seen after financial crises. Risk models evolve, trading strategies adapt, and participants become more sensitive to tail risks. Markets may also develop new instruments, such as volatility indices and derivatives, to hedge against sudden movements.

Importantly, shock waves remind participants that uncertainty is a permanent feature of financial markets. No model or strategy can eliminate risk entirely; the goal is to understand, prepare, and adapt.

Conclusion

Shock waves in trading are unavoidable expressions of uncertainty, information flow, and human behavior within financial markets. They can arise suddenly, spread rapidly, and challenge even the most experienced traders. By understanding their sources, recognizing how they propagate, and maintaining robust risk management, market participants can reduce damage and, in some cases, turn disruption into opportunity. Ultimately, success in trading is not about avoiding shocks altogether, but about building resilience and discipline to navigate them when they inevitably occur.

Indices Are Climbing: Understanding the Momentum Behind MarketsWhat Does It Mean When Indices Are Climbing?

Market indices like the Nifty 50, Sensex, Dow Jones, S&P 500, or Nasdaq track the performance of a selected group of stocks. When these indices climb consistently, it indicates that a majority of the constituent companies are gaining value. This upward movement usually reflects improving corporate earnings, favorable economic conditions, strong liquidity, or positive expectations about the future.

Climbing indices are often associated with a bullish market phase, where buying interest outweighs selling pressure. Investors feel confident about deploying capital, institutions increase exposure, and retail participation grows.

Key Reasons Behind Rising Indices

One of the primary drivers of climbing indices is economic growth. When GDP growth is strong, consumption rises, businesses expand, and corporate profits improve. This directly supports higher stock valuations. Alongside this, low interest rates encourage borrowing and investing. When returns from fixed-income instruments are relatively low, equities become more attractive, pushing indices upward.

Another important factor is corporate earnings growth. Markets are forward-looking, and indices often climb when companies report better-than-expected results or provide optimistic future guidance. Sectors like banking, IT, energy, and manufacturing can collectively lift indices when they perform well.

Liquidity and global capital flows also play a vital role. Foreign institutional investors (FIIs) and domestic institutional investors (DIIs) inject large sums into equity markets during stable or growth-oriented phases. Abundant liquidity reduces volatility and supports sustained upward trends.

The Role of Market Sentiment and Psychology

Market sentiment is a powerful force. When indices are climbing, it reinforces positive psychology among investors. This creates a feedback loop—rising prices attract more buyers, which in turn pushes prices even higher. Media coverage, social discussions, and analyst upgrades amplify this optimism.

Fear of missing out (FOMO) becomes common during strong rallies. Investors who stayed on the sidelines begin entering the market, further fueling the upward momentum. However, while sentiment-driven rallies can be strong, they may also become fragile if not supported by fundamentals.

Sectoral Contribution to Rising Indices

Indices do not climb uniformly; sectoral leadership matters. In many rallies, banking and financial stocks act as heavyweights, given their large index weightage. A rally in banks often reflects confidence in credit growth, asset quality, and economic stability.

Technology and export-oriented sectors benefit from global demand, currency movements, and digital transformation trends. Infrastructure, capital goods, and manufacturing stocks rise when governments increase spending and private investment picks up. When multiple sectors participate, the index climb becomes broader and healthier.

Impact on Retail and Long-Term Investors

For retail investors, climbing indices often boost confidence and portfolio values. Long-term investors benefit from wealth creation, as sustained index growth reflects compounding over time. Systematic Investment Plans (SIPs) perform particularly well during such phases, as regular investments capture both market highs and corrections.

However, rising indices can also tempt inexperienced investors to chase momentum without understanding valuations or risk. Disciplined investing, asset allocation, and diversification remain essential, even during bullish phases.

Valuations and Sustainability of the Rally

A critical question during any index rally is sustainability. Indices can climb even when valuations become stretched. Price-to-earnings (P/E) ratios, price-to-book values, and earnings yield are important metrics to assess whether markets are overheated.

If indices rise faster than earnings growth, it may signal speculative excess. On the other hand, if earnings growth supports price appreciation, the rally is considered fundamentally strong. Central bank policies, inflation trends, and global macroeconomic conditions also influence how long indices can continue climbing.

Risks Associated with Climbing Indices

While rising indices are positive, they are not without risks. Geopolitical tensions, unexpected policy changes, inflation spikes, or global economic slowdowns can quickly reverse sentiment. Overleveraging, excessive derivatives activity, and narrow market breadth can also increase vulnerability.

Corrections are a natural part of market cycles. Even in strong bull markets, temporary pullbacks help reset valuations and remove excess speculation. Investors should view corrections as opportunities rather than threats, provided fundamentals remain intact.

How Traders and Investors Can Approach a Rising Market

In a climbing index environment, trend-following strategies often work well. Traders look for higher highs and higher lows, using technical indicators like moving averages and relative strength. Investors, on the other hand, focus on quality businesses with strong balance sheets and long-term growth potential.

Risk management is crucial. Setting stop-losses, avoiding over-concentration, and not investing borrowed money helps protect capital. A rising market rewards patience and discipline more than impulsive decision-making.

Conclusion: What Climbing Indices Truly Signal

When indices are climbing, they signal confidence in economic prospects, corporate performance, and market stability. They reflect collective belief in future growth rather than just present conditions. For investors, this phase offers opportunities for wealth creation, but also demands caution and rational thinking.

Ultimately, climbing indices are a reminder that markets move in cycles. Those who understand the reasons behind the rise, respect risks, and stay aligned with long-term goals are best positioned to benefit. A rising index is not just a number going up—it is a story of growth, expectations, and the ever-evolving relationship between the economy and investor confidence.

Global Trade Assets: The Backbone of the International Economic Understanding Global Trade Assets

At their core, global trade assets refer to anything that adds value to or facilitates international trade. Traditionally, this concept was limited to tangible goods such as commodities, manufactured products, and raw materials. However, with globalization and digitalization, the definition has expanded to include intangible assets such as intellectual property, brand value, data, trade finance instruments, and digital platforms. Together, these assets form the foundation of global commerce.

Physical Assets in Global Trade

Physical assets remain the most visible component of global trade. These include natural resources like oil, gas, minerals, agricultural products, and water resources, which are traded extensively across borders. Manufactured goods such as machinery, electronics, automobiles, and pharmaceuticals also form a large share of global trade volumes.

Equally important are logistics and infrastructure assets. Ports, airports, highways, railways, warehouses, and shipping fleets are essential for transporting goods efficiently. Countries with advanced logistics infrastructure often enjoy a competitive advantage in global trade because they can move goods faster, cheaper, and more reliably. Strategic assets such as major ports, canals, and trade corridors significantly influence global supply chains.

Financial Assets and Trade Finance

Financial assets are critical enablers of global trade. International trade would be nearly impossible without mechanisms that manage risk, provide liquidity, and ensure trust between trading partners. Trade finance instruments such as letters of credit, bank guarantees, export credit insurance, and bills of exchange allow buyers and sellers from different countries to transact with confidence.

Currencies themselves are also global trade assets. Reserve currencies like the US dollar, euro, and increasingly the Chinese yuan play a central role in settling international trade transactions. Financial markets, including foreign exchange markets, commodity exchanges, and derivatives markets, allow businesses to hedge against currency, price, and interest rate risks associated with cross-border trade.

Human Capital as a Trade Asset

Human capital is one of the most valuable yet often underestimated global trade assets. Skilled labor, managerial expertise, technical knowledge, and entrepreneurial capabilities determine a country’s ability to produce competitive goods and services for the global market. Nations that invest in education, vocational training, and skill development tend to integrate more successfully into global value chains.

In services trade especially, human capital is the primary asset. Sectors such as information technology, finance, consulting, healthcare, education, and creative industries rely heavily on knowledge and expertise rather than physical goods. The global mobility of talent further enhances the importance of human capital in international trade.

Technology and Digital Trade Assets

Technology has transformed global trade assets dramatically. Digital platforms, e-commerce marketplaces, cloud computing, artificial intelligence, and blockchain systems have become essential tools for cross-border trade. These digital assets reduce transaction costs, increase transparency, and open global markets to small and medium-sized enterprises.

Intellectual property assets such as patents, trademarks, copyrights, and trade secrets are now central to global competitiveness. Companies and countries that control advanced technologies and strong brands often dominate global markets, even if they do not produce large volumes of physical goods. Data has also emerged as a strategic trade asset, influencing supply chain decisions, customer targeting, and market forecasting.

Institutional and Legal Assets

Institutional frameworks are crucial global trade assets that provide stability and predictability. Trade agreements, customs systems, regulatory standards, and dispute resolution mechanisms reduce uncertainty in international transactions. Organizations such as the World Trade Organization (WTO), regional trade blocs, and bilateral trade agreements establish rules that govern global trade.

Strong legal systems that protect property rights, enforce contracts, and ensure regulatory transparency attract foreign trade and investment. Trust in institutions enhances a country’s reputation as a reliable trading partner, which is itself an intangible but powerful trade asset.

Strategic and Geopolitical Trade Assets

In today’s world, trade assets are increasingly influenced by geopolitics. Strategic control over critical resources, shipping routes, technologies, and supply chains has become a major concern for nations. Assets such as rare earth minerals, semiconductor manufacturing capabilities, energy infrastructure, and food security resources are now viewed through both economic and strategic lenses.

Countries are actively seeking to diversify and secure their trade assets to reduce dependency on single markets or suppliers. This shift highlights the importance of resilience as a key attribute of global trade assets.

Role of Global Trade Assets in Economic Growth

Global trade assets drive economic growth by enabling specialization, efficiency, and scale. When countries leverage their comparative advantages—whether in natural resources, skilled labor, technology, or infrastructure—they can integrate more deeply into global markets. This integration leads to higher productivity, job creation, innovation, and improved living standards.

For developing economies, building and upgrading global trade assets is essential for moving up the value chain. Investments in infrastructure, education, digital technology, and institutional reforms can transform a country from a raw material exporter into a competitive participant in global manufacturing and services trade.

Challenges and Future Outlook

Despite their importance, global trade assets face numerous challenges. Supply chain disruptions, trade wars, protectionism, climate change, and technological divides threaten the stability of global trade systems. Maintaining and upgrading trade assets requires continuous investment, policy coordination, and international cooperation.

Looking ahead, sustainable trade assets will gain prominence. Green infrastructure, renewable energy systems, carbon-efficient logistics, and environmentally responsible production methods are becoming integral to global trade competitiveness. Digital and knowledge-based assets will continue to grow in importance, reshaping how global trade operates.

Conclusion

Global trade assets are the backbone of the international economic system. They encompass physical resources, financial instruments, human capital, technology, institutions, and strategic capabilities that collectively enable cross-border commerce. In a rapidly changing global environment, the effective development, management, and protection of these assets determine a nation’s ability to compete, grow, and prosper in global trade. Understanding and strengthening global trade assets is therefore not just an economic priority, but a strategic necessity for the future.

“Cut Your Losses, Let Your Profits Run.” Fine, But How Exactly?We’ve all heard it. It’s right up there with “buy low, sell high” in the Hall of Fame of obvious trading advice. Everyone agrees with it. Few people do it.

Why? Because cutting losses hurts. Letting profits run is scary (especially in the current macro ). And both go directly against how human brains are wired.

Still, that simple phrase sits at the core of nearly every profitable trading career ever built. So let’s talk about how traders actually do that in the real world.

🧠 Why Your Brain Hates This Rule

Your brain evolved to avoid the bad stuff and lock in the good stuff. Trading puts that wiring to the test.

When a trade is losing, your instinct is to wait — maybe it’ll bounce. So you avoid facing the bad consequences of your decision. It ain’t a loss unless you sell, right?

When a trade is winning, your instinct is to grab the money before it disappears. That’s called loss aversion, and it’s why so many traders end up with small wins and large losses. Revenge trading usually follows.

The goal here is simple: Make the average win bigger than the average loss. Or, even better, have one big winner that can take care of several small-size losses.

📉 Cutting Losses: Think in Probabilities

Cutting losses doesn’t mean being right less — it means being wrong cheaply. “It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong.”

Professional traders assume they will be wrong a lot. They build that expectation into their process and risk profile. When a trade moves against them beyond what they originally planned for, they step aside without drama.

“If you have a losing position that is making you uncomfortable, the solution is very simple: Get out, because you can always get back in.”

A small loss is just a data point. A big loss changes behavior.

The traders who make it treat exits like boring administrative work. Just a clean “this didn’t work, let’s see what’s next.”

📈 Letting Profits Run: The Harder Half

Cutting losses is uncomfortable — but letting profits run is even harder.

When a trade goes your way, your mind immediately starts calculating what you could buy with the gains or how much you’re up just for the day. The idea of losing those profits feels worse than the pain of an initial loss. So traders exit too early, again and again.

The result? They get paid for being right, but not enough to cover when they’re wrong.

Letting profits run means allowing the market to do the work. It means resisting the urge to micromanage every tick. It means giving strong trends time to show themselves.

🧮 The Math That Makes This Work

This rule isn’t philosophical — it’s mathematical (it’s fairly simple, though).