September 28, Forex Outlook: What Can Traders Expect This Week?Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

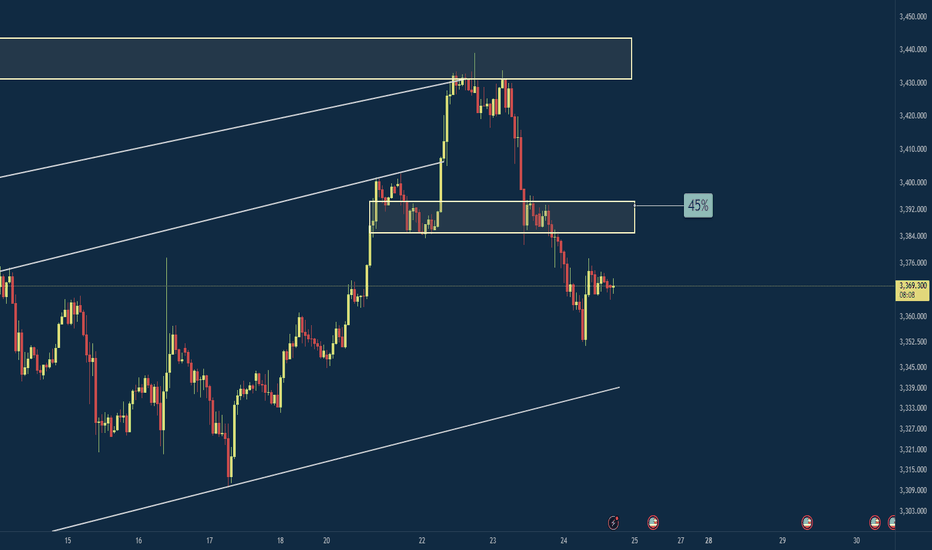

Support and Resistance

Master Horizontal Lines on Trading Charts | Signal & Structure 2In this second episode of the Signal and Structure series, we dive deep into one of the most fundamental yet powerful tools in technical analysis - horizontal support and resistance lines. This practical tutorial demonstrates a systematic approach to identifying and marking key price levels across multiple timeframes.

What You'll Learn:

Color-Coded Line System for Multiple Timeframes:

Monthly (Black, thickness 4) - The strongest levels from monthly candle closes

Weekly (Maroon/Brown, thickness 3) - Key weekly support/resistance zones

2-Day (Red, thickness 2) - Intermediate term levels

12-Hour (Orange, thickness 1-2) - Short-term trading levels

3-Hour (Yellow, thickness 1) - Day trading reference points

Key Concepts Covered:

Why monthly candle closes often matter more than wicks (with live examples)

How previous resistance becomes new support - demonstrated on Bitcoin's chart

Identifying distribution and accumulation ranges using horizontal levels

The importance of avoiding chart clutter - when NOT to add more lines

Using transparent candles to see through to your levels and indicators

Practical Techniques:

Live demonstration on TradingView using Bitcoin/USD charts

How to identify the most significant levels from each timeframe

Creating "boxes" to visualize trading ranges and distribution zones

Brief introduction to Wyckoff theory concepts (spring patterns)

Tips for maintaining clarity when working with multiple overlapping levels

Chart Setup Tips:

Why exchange charts (KuCoin, Gate.io) provide better volume data than index charts

Continuing emphasis on logarithmic scale for crypto analysis

How to organize your workspace for multi-timeframe analysis

This 20-minute tutorial walks you through the exact process of building a professional-grade support and resistance framework on your charts. The presenter demonstrates each concept in real-time on TradingView, making it easy to follow along and implement these techniques immediately.

Perfect for traders who want to move beyond random line drawing and develop a systematic, color-coded approach to identifying key market levels. Whether you're scalping on the 3-hour or position trading on the monthly, this hierarchical system helps you see exactly where the important levels are at a glance.

Next episode preview: Diagonal trend lines, channels, and Fibonacci levels - including a unique approach to stacking channels that provides an edge in the markets.

How to Use Moving Averages in TradingViewMaster moving averages using TradingView's charting tools in this comprehensive tutorial from Optimus Futures.

Moving averages are among the most versatile technical analysis tools available, helping traders analyze trends, identify overbought/oversold conditions, and create tradeable support and resistance levels.

What You'll Learn:

Understanding moving averages: lagging indicators with multiple applications

Simple moving average basics: calculating price averages over set periods

Key configuration choices: lookback periods, price inputs, and timeframes

How to select optimal lookback periods (like 200-day) for different trading styles

Using different price inputs: close, open, high, or low prices

Applying moving averages across all timeframes from daily to 5-minute charts

Analyzing price relative to moving averages for trend identification

Using 50-day and 200-day moving averages for trend analysis on E-Mini S&P 500

Mean reversion trading: how price tends to return to moving averages

Trend direction analysis using moving average slopes

Famous crossover signals: "Death Cross" and "Golden Cross" explained

Trading moving averages as dynamic support and resistance levels

Advanced moving average types: weighted and exponential moving averages

Applying moving averages to other indicators like MACD and Stochastics

Balancing sensitivity vs. noise when choosing periods

This tutorial may benefit futures traders, swing traders, and technical analysts who want to incorporate moving averages into their trading strategies.

The concepts covered could help you identify trend direction, potential reversal points, and dynamic trading levels across multiple timeframes.

Learn more about futures trading with TradingView:

optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting

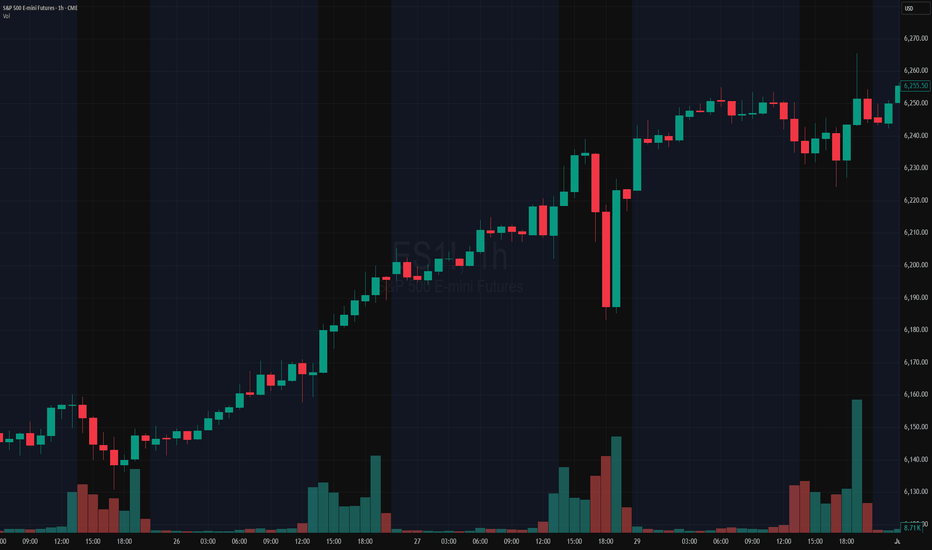

Its Non-Farm: How much will ES Move?Hi all - Happy Non-Farm Friday!

I haven't done this in a while and thought it might be helpful to share my process for estimating the size of the move that we may get on ES after the Non-Farm Payrolls data is released.

I'm not trying to make a prediction on direction here - but more understand where the boundaries could be so I can determine how to trade this (what trading tool I can pull out of my box) once the announcement comes out.

Hope it helps and please let me know if you find it useful and I'll create more posts .

Cheers,

Jeff

How to Trade Morning Star and Evening Star Candlestick Patterns Learn to identify and trade Morning Star and Evening Star candlestick formations using TradingView’s charting tools in this detailed tutorial from Optimus Futures.

Morning and Evening Stars are powerful reversal patterns that often mark turning points in the market. Recognizing them can help you anticipate when momentum is about to shift—and take advantage of new trading opportunities.

What You’ll Learn:

• How Morning Stars signal bullish reversals at the end of a downtrend

• How Evening Stars indicate bearish reversals after extended uptrends

• The three-candle structure of each pattern and what it means for trader psychology

• Why indecision candles (like dojis) play a critical role in confirming momentum shifts

• Using volume confirmation to validate Morning and Evening Star setups

• The importance of context: spotting these patterns at major support and resistance levels

• Setting effective stop losses at the high/low of the pattern for risk control

• Advanced entry tactic: waiting for retracement after confirmation to optimize risk/reward

This tutorial may help futures traders and technical analysts who want to harness candlestick reversal signals to identify potential market turning points.

The strategies covered could assist you in creating structured setups when strong buying or selling pressure appears at key chart levels.

Learn more about futures trading with TradingView:

optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objective

From Fakeout to Takeoff: How the V-Pattern REALLY WorksEver seen a support level break, only for the price to rocket back up in a V-shape? That’s the V-Pattern in action! In this post, Skeptic from Skeptic Lab breaks down the step-by-step mechanics of this powerful setup. From the fakeout that traps short sellers to the surge of buy orders from liquidations, you’ll learn exactly how buyers flip the script and create explosive reversals. Perfect for traders looking to spot high-probability setups. Join me to decode the markets—check out the steps and level up your trading game!

Welcome Back! Gold Trading Strategy & Key Zones to WatchIn this week’s welcome back video, I’m breaking down my updated approach to XAU/USD and how I plan to tackle the Gold markets in the coming days. After taking a short break, I’m back with fresh eyes and refined focus.

We’ll review current market structure, identify key liquidity zones, and outline the scenarios I’m watching for potential entries. Whether you’re day trading or swing trading gold, this breakdown will help you frame your week with clarity and confidence.

📌 Covered in this video:

My refreshed trading mindset after a break

Key support/resistance and liquidity zones

Market structure insights and setup conditions

What I’ll personally avoid this week

The “trap zones” that might catch retail traders off guard

🧠 Let’s focus on process over profits — welcome back, and let’s get to work.

How to Trade Doji Candles on TradingViewLearn to identify and trade doji candlestick patterns using TradingView's charting tools in this comprehensive tutorial from Optimus Futures. Doji candles are among the most significant candlestick formations because they signal market indecision and can help you spot potential trend reversal opportunities.

What You'll Learn:

• Understanding doji candlestick patterns and their significance in market analysis

• How to identify valid doji formations

• The psychology behind doji candles: when buyers and sellers fight to a draw

• Using volume analysis to confirm doji pattern validity

• Finding meaningful doji patterns at trend highs and lows for reversal setups

• Timeframe considerations for doji analysis on any chart period

• Step-by-step trading strategy for doji reversal setups

• How to set stop losses and profit targets

• Real example using E-Mini S&P 500 futures on 60-minute charts

This tutorial may help futures traders and technical analysts who want to use candlestick patterns to identify potential trend reversals. The strategies covered could assist you in creating straightforward reversal setups when market indecision appears at key price levels.

Learn more about futures trading with Tradingview: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

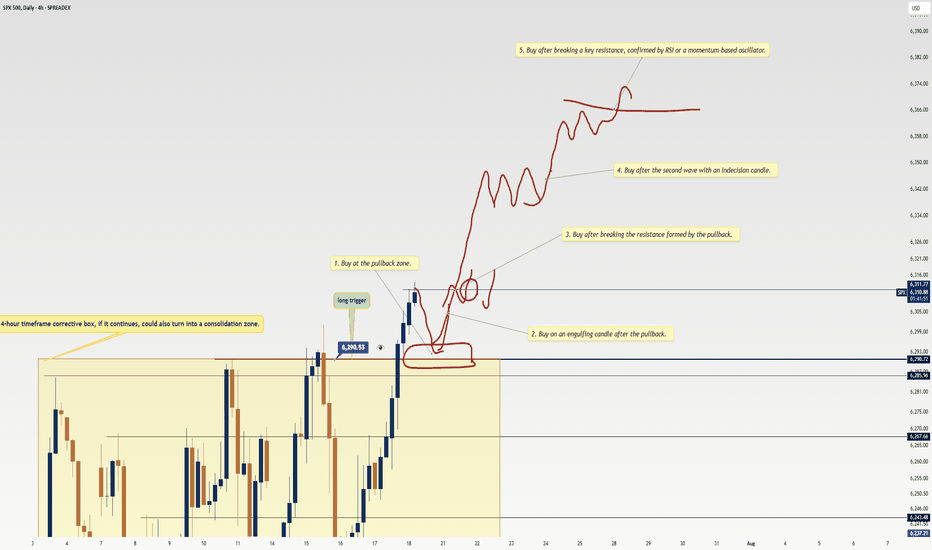

5 Proven Tricks to Trade Without FOMO After Missing Your TriggerYo traders! In this video, I’m breaking down what to do if you miss a trading trigger , so you can stay calm , avoid FOMO , and still catch the next move. We’re diving into five solid strategies to re-enter the market without losing your cool:

Buy on the pullback zone.

Buy with an engulfing candle after a pullback.

Buy after breaking the resistance formed by the pullback.

Buy after the second wave with an indecision candle.

Buy after breaking a major resistance post-second wave, confirmed by RSI or momentum oscillators.

These tips are all about keeping your trades smart and your head in the game. For more on indecision candles, check out this lesson . Wanna master breakout trading? Here’s the breakout trading guide . Drop your thoughts in the comments, boost if you vibe with it, and let’s grow together! 😎

How Bitcoin can impact alt coins like sol and sui This video is a very quick update on the potential for bitcoin to drop into the 96/97k region and the effect it will have on alt coins .

If you hold altcoins and you see them bleed in price then its important to know and understand whats ahead for Bitcoin .

Understanding this will help you with your entry's and your exits on all altcoins .

How to Draw Support & Resistance In TradingViewLearn how to effectively identify, draw, and utilize support and resistance levels in TradingView with this comprehensive step-by-step tutorial. Whether you're a beginner trader or looking to refine your technical analysis skills, this video covers everything you need to know about one of the most fundamental concepts in trading.

What You'll Learn:

Understanding support and resistance: the foundation of technical analysis and price action trading

Step-by-step instructions for drawing horizontal support and resistance lines in TradingView

Creating support and resistance zones for more flexible trading approaches

Practical tips for using TradingView's drawing tools effectively

This tutorial may be helpful for day traders, swing traders, and investors using TradingView who want to improve their chart analysis skills. The techniques covered could help you make more informed entry and exit decisions by understanding where price might find support or encounter resistance.

Visit Optimus Futures to learn more about trading futures with TradingView: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

What is a Bearish Breakaway and How To Spot One!This Educational Idea consists of:

- What a Bearish Breakaway Candlestick Pattern is

- How its Formed

- Added Confirmations

The example comes to us from EURGBP over the evening hours!

Since I was late to turn it into a Trade Idea, perfect opportunity for a Learning Curve!

Hope you enjoy and find value!

You want to be a trader but you have a 9-5 Educational purpose only. You want to be a day trader but can't trade market open because you have a job or you are too busy. The daily bar can give you just as much profits as the 5 min charts. In this video ill teach you how to find support and resistance zone on any market. Opening a line chart starting from the weekly and then looking for areas where price has repeatedly reverse gives you a clue of where price may go in the future on a daily chart. Watch till the end to see how this strategy is applied to all markets.

Trading A Divergence Trade (Breakdown) with Pivots and LiquidityTrading divergences was always a problem for me in the past. I did the same thing you did and got it wrong every time. I was trading divergences when i saw them instead of realizing a divergence is a flip of support and resistance levels. I just needed to know where they are.

In this video:

Internal vs External Pivot divergence confirmation:

You can have two types of pivots on your chart. One for long term and one for short term.

Using them to confirm short and long term price action is intuitive as youll be able to see the market squeezing on the short term while knowing where your long term price structure exists.

Price action to Divergence Confirmation:

A divergence on a short term pivot is an indication of short term loss of trend or reversal.

If the short term has no divergence but the long term does, you are about to end up with some pretty large price moves.

Youll be confirming the divergence by looking for highs, lows, and closes moving the wrong way from current price action.

This video will give you a method you can use to draw out your support zone / resistance zone / divergence zone and use them to your advantage.

The "Divergence Zone" that you draw out is the very reason why so many people fail at divergences.

Bare in mind that when you have a divergence, support and resistance are on the WRONG sides as their normally are so you'll learn here how to find those zones as well.

Then in the end of the video ill show you how to use lower timeframes to confirm the new move of the market.

Thanks, everyone. For coming through to the CoffeeShop.

What to do after you missed a big price move (Example: EUR/USD)There was a big fast move in EUR/USD last week.

The ‘European currencies’ did especially well versus the US dollar, including GBP/USD and USD/CHF as well as the ‘Skandies’ SEK/USD and NOK/USD.

If you rode the move, then job done. If you did ride the move up, you might have taken full profits already - or maybe you are leaving a little bit of the position open to ride any continuation of the move.

But, what to do if you missed it completely?

Explosive moves in the market usually mean traders who were on the ‘losing’ side step out for a while, having lost confidence in their view. For example if you were bearish and the market makes a significant move higher - you’re probably going to be a lot less confident in your bearish view - but perhaps also not ready to take an opposite bullish view. The loss of sellers in the market can see the up-move continue with minimal pullback.

This might suggest buying any small dips to ride the next leg higher, and emotionally it would offer some salvation to capture the second leg of the move even if you missed the first leg. However, what you are doing here is ‘chasing the market’.

One trouble is that after a big move in the market, there is no definitive place to put your stop loss, except at the beginning of the move - which is now far away. That's a bad risk: reward.

It is tempting to place a closer (more manageable) stop loss under lower timeframe levels of support - but then you find yourself trading an unknown strategy that requires different rules to follow because it is based on a lower timeframe.

And indeed, after a sharp move in the market - there is still a chance for a sharp pullback to match. Why? Because buyers quickly take profits on their unexpected quick gains, which will create selling pressure into minimal support - because the next support level is far away.

A sharp pullback would mean an opportunity to buy into the uptrend at a lower level, closer to the previous support. But then the flipside of the sharp pullback is that it raises questions over the sustainability of the initial move.

Probably the biggest takeaway here is not to think about this ‘explosive’ move in isolation.

Instead of forcing a trade, consider:

1. Waiting for the right setup in the same market. If your strategy is based on structured breakouts, wait for the next clean consolidation or pattern before re-engaging. A big move often leads to a new setup—but forcing a trade in the middle of a volatile move isn’t a strategy, it’s FOMO.

2. Looking at uncorrelated markets. Just because EUR/USD already made a big move doesn’t mean you have to trade it now. If you want to be in at the start of a move, shift focus to another market that hasn’t yet made its move.

3. Sticking to your edge. If your strategy works over hundreds of trades, don’t abandon it just because one market moved without you. The next opportunity will come—if not in this market, then in another.

Again, the best trades don’t come from reacting to what already happened, but from positioning for what’s about to happen. If you missed the move, accept it, reset, and wait for the next high-quality setup—whether in the same market or somewhere else.

How to Set Multiple TPs...for BeginnersHey Rich Friends,

I wanted to share how I find multiple TPs for my Forex trades using free tools and only 1 technical indicator. This strategy is perfect for beginners because it is easy to follow and has clear confirmations for entering and exiting a trade in profit, even if it hits your Stop Loss.

I keep my charts clean and let price action do the talking. Here's my setup:

✅ Session Breaks & Horizontal Lines – I mark the previous day’s highs, lows, and key levels to identify potential areas of interest.

✅ Stochastic for Entries & Exits – I use the Stochastic indicator to time my trades when the price reacts at my key levels (80 and 20 are very important here!)

✅ Horizontal Lines = Potential TPs – Instead of setting a take profit, I let the market tell me when to exit based on price action around these levels.

Less noise, more precision. Drop a "7" if you made it to the end of the video and let me know if it was helpful!

Peace and Profits,

Cha

what action I take when market open.This video will show you what I look at and my thought process when prepare for maket open.

Purpose of this video is to show how i make plan to take risk in first hour of market open.

example used is 5min&1min

1st. orb 5min

2nd. wait for breakout of 5min

3rd. use MA as (Support) of a trend to SCALP

ORB FIB levels i used is 0.5%(orb) 1.0% 1.5% 2.0%

Target is use orb breakout to target 2.0% fib levels as PriceTarget.

Commitment of Traders Modelled as Stratified Poissant Processes Hey! This video theorizes about the relevance of the poissant process in predicting areas of support and resistance in a way that accounts for temporal and probabilistic grounding. Essentially, the commitment of traders is modelled as a poissant process. Lambda is remeasured at each time step and the stratas' opacity reflects the strength of the probability, modelling trader capitulation as a time decay function. The recency and recurrence of information is intuitive and visible at a glance. Enjoy!

Crude OIL SHORT Today Ran For +4R BreakdownNYMEX:CL1!

"Successful trading has always been about understand the convictions, the strength and the weakness of buyers and sellers. Once you understand what the other traders are doing in the market, you can successfully trade with them." -Michael Valtos

Confluence Profile 500K (Expectational Order-Flow + PA) 10pt Stop / +4R Run... Well Done!!

Remember; "Our Profession is to Manage the downside costs of printing HIGHSIDE returns of $$$ consistently. Done correctly, well Abundance awaits us." -500KTrey

20pt Stop / 5R Run... Well Done!COMEX:GC1!

"In order to be successful in life you have to learn how to do something so well that the dead, the living, or the unborn could not to do any better." -Dr. MLK Jr.

Self-explanatory... 'Confluence Profile 500K' (Expectational Order Flow + PA) 20pt Stop / 5R Run... 1OOpt Target w/ a 20pt STOP. Covering Todays NY HIGH... #APBTG On to the next 1. #BHM500K

Confluence Profile 500K (Order Flow Footprint + PA) 2.5RNYMEX:CL1!

"If you can't fly then run, if you can't run then walk. If you can't walk, then crawl. But whatever you do you have to keep moving forward." -Dr. Martin Luther King Jr.

Family I hope everyone is in good spirits as we kick off this new year of 2025!!!! Here in this video I have went into gr8 detail on this trade that I took SHORT todays during NY Session on Crude OIL and I broke down the Order Flow Footprint along with PA on why I decided to enter the trade and capitalize on 2.5R. My original target was 5R however volume died out and I decided to close and walk with profit. This year I'm going to consistently Over N over N over N over N over again study the 10pt Stop entry here on Crude Oil. On overage Crude Oil will run for +120pts during NY Session. All we need is half of that to eat. (60pts) this is my sweet spot. I'm determined to master it. Added along with better tape reading of the Order Flow Footprint. Let's stay active!

Remember; "Our Profession is to Manage the downside costs of printing HIGHSIDE returns of $$$ consistently. Done correctly, well Abundance awaits us." -500KTrey

'Confluence Profile 500K' (Order Flow Footprint + PA)"10pt STOP"NYMEX:CL1!

"Successful trading has always been about understand the convictions, the strength and the weakness of buyers and sellers. Once you understand what the other traders are doing in the market, you can successfully trade with them." -Michael Valtos

Family in this video I went into a gr8 in depth breakdown of a 5-6R trade that took place today during NY session SHORT on Crude OIL. Paying very close attention to the order flow footprint all the while observing very closely how PA is setting up will help us to develop the mastery of the 'Confluence Profile 500K' (Order Flow Footprint + PA) "10pt STOP". Just think about this......

December of 2024 price moved on average of 120pts during NY session. (5am-2pm) PST.

-We know we're not going to catch the whole 120pts so were going to focus our attention on cutting that point ratio in half and catch 50-60pts with a 10Pt STOP....

-Granting us 5-6R in our Favor!!

Now this is the RISK we face, WE HAVE ONLY 10PTS of pre-determined RISK. So, the 'Confluence Profile 500K' will consist of the (Order Flow Footprint + PA) to give us the highest probability ratio of entering a position with only 10pts to RISK & this is our journey to Master the 10pt STOP w/ a 50-60pt Target!!! Let's go 2 work.

Remember; "Our Profession is to Manage the downside costs of printing HIGHSIDE returns of $$$ consistently. Done correctly, well Abundance awaits us." -500KTrey