3 Actionable FX Strategies — With Real Trade Examples👋 Below are three practical strategies you can plug into your playbook today:

1. swing reversals (80+ pips), 2) short-term scalps (20–40 pips), and 3) the London range breakout (≈40 pips). Each section includes rules of engagement, risk management, and three real-market case studies on EURUSD and GBPUSD with conservative stops.

________________________________________

🔁 Strategy 1 — 4H Swing Reversals (Target: 80–120 pips)

Setup 🧩

• Identify exhaustion into a higher-timeframe S/R zone (4H/Day).

• Look for a reversal signal (engulfing/pin bar, momentum shift, or divergence) and a confirmation close.

• Conservative stop: beyond the swing extreme or ~1× ATR(14) on the entry timeframe.

• Take-profit: next HTF level or ≥ 1.8R, aiming for 80+ pips.

Case study A — EURUSD long (Jackson Hole boost) 📈

• When: Aug 22, 2025, NY session after Powell; EURUSD pushed above 1.1700 on broad USD weakness.

• Plan: After a 4H close back above 1.1700, buy a retest ~1.1705.

• Stop: 1.1650 (≈55 pips).

• Target: 1.1790 (≈85 pips).

Case study B — GBPUSD short (post-CPI fade) 📉

• When: May 21, 2025, UK CPI spike ran to 1.34695 then faded.

• Plan: After a 15–30m lower high below 1.3460, sell break of 1.3435.

• Stop: 1.3490 (≈55 pips).

• Target: 1.3345 (≈90 pips).

Case study C — EURUSD short (overextended pullback) 🔻

• When: Jul 1, 2025, EURUSD briefly poked above 1.1800 then eased.

• Plan: Sell 1.1775 after a 1H bearish engulfing.

• Stop: 1.1825 (≈50 pips).

• Target: 1.1690 (≈85 pips).

________________________________________

⚡ Strategy 2 — Short-Term Scalping (Target: 20–40 pips)

Setup 🧩

• Trade during high liquidity (London open or London/NY overlap).

• Use 1–5m charts: micro S/R + round numbers, quick momentum bursts.

• Conservative stop: 8–15 pips (just beyond the micro structure).

• Take-profit: 20–40 pips or to next intraday level.

Case study D — EURUSD scalp long (pre-Jackson Hole range) ⏱️

• When: Aug 21, 2025, Europe a.m.; EURUSD near 1.1650.

• Plan: Buy break-and-retest 1.1665.

• Stop: 1.1652 (≈13 pips).

• Target: 1.1687 (≈22 pips).

Case study E — GBPUSD scalp long (soft US CPI pop) 💥

• When: May 13, 2025, post-US CPI tone lifted risk; GBPUSD ~1.3226.

• Plan: Buy 1.3218 → 1.3242 after higher-low.

• Stop: 1.3208 (≈10 pips).

• Target: +24 pips.

Case study F — EURUSD scalp long (grind to 1.09) 🚀

• When: Mar 11, 2025, London morning; EURUSD nudged to 1.0890 / kissed 1.0900.

• Plan: Buy 1.0885 on retest.

• Stop: 1.0875 (≈10 pips).

• Target: 1.0905 (≈20 pips).

________________________________________

🕘 Strategy 3 — London Range Breakout (Target: ~40 pips)

Setup 🧩

• Mark the Asian/Late-Asia range before 08:00 London.

• Trade the first clean break/close outside the box.

• Entry: stop order beyond the box high/low.

• Conservative stop: opposite side of the box or box size + buffer (≤40–50 pips).

• Take-profit: ~40 pips (scale at 20 pips).

Case study G — GBPUSD upside break (calm pre-CPI session) 📦➡️📈

• When: Mar 25, 2025, London a.m.; GBPUSD drifted toward 1.2950.

• Box: 05:00–08:00 London ~22 pips.

• Plan: Buy box high +3 pips (≈1.2953).

• Stop: 1.2930 (≈23 pips).

• Target: 1.2993 (≈40 pips).

Case study H — EURUSD downside break (trend day toward 1.09) 📦➡️📉

• When: May 12, 2025, EURUSD bias turned lower and eyed the 1.09 handle.

• Box: 05:00–08:00 London ~28 pips.

• Plan: Sell box low −3 pips (≈1.0978).

• Stop: 1.1008 (≈30 pips).

• Target: 1.0938 (≈40 pips).

Case study I — GBPUSD downside break (inflation-week nerves) 📦➡️🔻

• When: Aug 12, 2025, London a.m.; GBPUSD softened from a two-week high.

• Box: 05:00–08:00 London ~24 pips.

• Plan: Sell box low −2 pips (≈1.3446).

• Stop: 1.3472 (≈26 pips).

• Target: 1.3406 (≈40 pips).

________________________________________

🛡️ Risk Management (applies to all three)

• Risk small per trade (e.g., 0.5–1%).

• Stops beyond structure: previous swing/box edge or ATR-based to avoid noise.

• News filter: avoid fresh entries seconds before major economic data.

________________________________________

🧰 Quick Checklists

Swing reversal (4H) ✅

🎯 Level picked • 📉 Reversal signal • 🛑 Stop beyond swing/ATR • 📐 ≥1.8R • 📰 No imminent shock

Scalp (1–5m) ✅

⏱️ Active session • 🔍 Micro S/R & round numbers • 🛑 8–15 pip stop • 🎯 20–40 pips • ✂️ Partial at +10–15

London breakout ✅

🕗 Box 05:00–08:00 • 📦 Reasonable width • 🚀 First break/close • 🛑 Stop other side • 🎯 ≈40 pips

________________________________________

⚠️ Final word

These examples show how setups map onto real market context. Adapt entries/levels to your feed and spreads. Nothing here is financial advice—test and size appropriately.

________________________________________

Tesla Motors (TSLA)

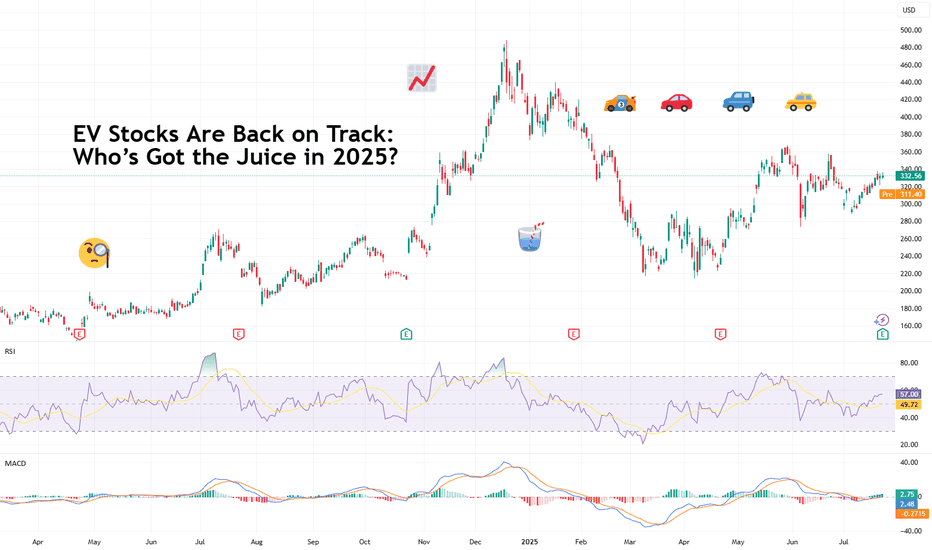

EV Stocks Are Back on Track: Who’s Got the Juice in 2025?This year is big for the EV sector so we figured let’s do a piece on it and bring you up to speed on who’s making moves and getting traction — both in the charts and on the road.

What we’ve got here is a lean, mean lineup of real contenders. Let’s go for a ride.

🚗 Tesla: Still King of the Road (for Now)

Tesla NASDAQ:TSLA isn’t just an EV company. It’s a tech firm, an AI shop, a robotaxi rollout machine, and an Elon-flavored media event every quarter. Even so, when it comes to margins, global volume, and name recognition, Tesla is still the benchmark everyone else is chasing.

In 2025, Tesla’s bounceback is fueled not just by EV hype but by its push into autonomous driving and different plays into the AI space.

The stock is down about 13% year-to-date. But investors love a narrative turnaround. Apparently, the earnings update didn't help the situation as shares slipped roughly 5%. Well, there's always another quarter — make sure to keep an eye on the Earnings Calendar .

🐉 BYD: The Dragon in the Fast Lane

BYD 1211 is calmly racking up sales, expanding across continents, and stealing global market share without breaking a sweat. The Chinese behemoth is outselling Tesla globally and doing it with less drama and more charge… literally .

Vertical integration is BYD’s secret weapon — they make their own batteries, chips, and even semiconductors. The West might not be in love with BYD’s designs, but fleet operators and emerging-market governments are. And that’s where the real growth is.

⛰️ Rivian: Built for Trails, Not Earnings (Yet)

Rivian NASDAQ:RIVN still feels like the Patagonia of EV makers — rugged, outdoorsy, aspirational. Its R1T pickup truck has cult status, but the company had to tone down its ambitions and revised its guidance for 2025 deliveries to between 40,000 and 46,000. Early 2025 projections floated around 50,000 .

The good news? Rivian is improving on cost control, production pace, and market fit. The bad news? It’s still burning cash faster than it builds trucks. But for investors betting on a post-rate-cut growth stock rally, Rivian may be the comeback kid to watch. It just needs a few solid quarters.

🛋️ Lucid: Luxury Dreams, Reality Checks

Lucid NASDAQ:LCID , the one that’ll either go under or make it big. The luxury carmaker, worth about $8 billion, came into the EV game promising to out-Tesla Tesla — with longer range, more appeal, and a price tag to match.

But here’s the rub: rich people aren’t lining up for boutique sedans, especially when Mercedes and BMW now offer their own electric gliders with badge power and a dealer network.

Lucid’s challenge in 2025 is existential. The cars are sleek, the tech is strong, but the cash runway is shrinking and demand isn’t scaling like the pitch deck promised.

Unless it nails a strategic partnership (Saudi backing only goes so far), Lucid could end up as a cautionary tale — a beautifully engineered one, but a cautionary tale nonetheless. Thankfully, Uber NYSE:UBER showed up to the rescue ?

💪 NIO : Battling to Stay in the Race

Remember when NIO NYSE:NIO was dubbed the “Tesla of China”? Fast forward, and it’s still swinging — but now the narrative is more about survival than supremacy. NIO's battery-swap stations remain a unique selling point, but delivery volumes and profitability are still trailing.

The company’s leaning into smart-tech partnerships and next-gen vehicle platforms. The stock, meanwhile, needs more than just optimism to get moving again — it’s virtually flat on the year.

✈️ XPeng: Flying Cars, Literally

XPeng’s NYSE:XPEV claim to fame used to be its semi-autonomous driving suite. Now? It's working on literal flying vehicles with its Land Aircraft Carrier. Innovation isn’t the problem — it's execution and scale.

XPeng is beloved by futurists and punished by spreadsheets. It’s still getting government love, but without a clear margin path, the stock might stay grounded.

🏁 Li Auto: The Surprise Front-Runner

Li Auto NASDAQ:LI doesn’t get the headlines, but it’s quietly killing it with its range-extended EVs — hybrids that let you plug in or gas up. A smart move in a country still building out its charging infrastructure.

Li is delivering big numbers, posting improving margins, and seems laser-focused on practicality over hype. Of all the Chinese EV stocks, this one might be the most mature.

🧠 Nvidia: The Brains of the Operation

Okay, not an EV stock per se, but Nvidia NASDAQ:NVDA deserves a spot on any EV watchlist. Its AI chips are running the show inside Tesla’s Full Self-Driving computers, powering sensor fusion in dozens of autonomous pilot programs, and quietly taking over the brains of modern mobility.

As self-driving becomes less sci-fi and more of a supply-chain item, Nvidia's value-add grows with every mile driven by data-hungry EVs.

🔋 ChargePoint & EVgo: Picks and Shovels

If you can’t sell the cars, sell the cables.

EV charging companies were once seen as the “safe bet” on electrification. Now they’re just seen as massively underperforming.

ChargePoint BOATS:CHPT : Still the leader in US charging stations but struggling with profitability and adoption pacing. Stock’s down bad from its peak in 2021 (like, 98% bad).

EVgo NASDAQ:EVGO : Focused on fast-charging and partnerships (hello, GM), but scale and margin pressures remain.

Both stocks are beaten down hard. But with billions in infrastructure funding still flowing, who knows, maybe there’s potential for a second act.

👉 Off to you : are you plugged into any of these EV plays? Share your EV investment picks in the comments!

Vanguard Mega Cap Growth ETF (MGK): FAQ guide before investing🚀 Vanguard Mega Cap Growth ETF (MGK): A Deep Dive into Holdings and Hypothetical Returns

🌟 The Vanguard Mega Cap Growth ETF (MGK) is a popular exchange-traded fund offering investors access to some of the largest and most dynamic growth-oriented companies in the U.S. market. MGK closely tracks the CRSP US Mega Cap Growth Index, emphasizing mega-cap stocks.

🎯 Key Features of MGK

💰 Expense Ratio: 0.07%, a cost-effective choice for investors.

📊 Assets Under Management: Around $25.42 billion.

💵 Dividend Yield: 0.44%, distributed quarterly.

🏆 Top Holdings:

🍎 Apple Inc. (AAPL): 14.34%

🖥️ Microsoft Corp. (MSFT): 11.93%

🎮 NVIDIA Corp. (NVDA): 10.70%

📦 Amazon.com Inc. (AMZN): 7.63%

📱 Meta Platforms Inc. (META): 4.33%

🔌 Broadcom Inc. (AVGO): 3.54%

🚗 Tesla Inc. (TSLA): 3.22%

💊 Eli Lilly and Co. (LLY): 3.20%

💳 Visa Inc. (V): 2.76%

🔍 Alphabet Inc. (GOOGL): 2.31%

📌 Sector Allocation:

💻 Technology: ~52.8%

🛒 Consumer Discretionary: 15.9%

📡 Communication Services: 11.0%

📈 Performance Overview

MGK has consistently demonstrated strong returns:

🗓️ Year-to-Date (YTD): 0.96%

📅 1-Year Return: ~21.09%

📆 3-Year Return: ~23.26%

📊 5-Year Return: ~19.26%

💸 Hypothetical Investment Scenarios

Assuming an average annual return of 19.26%, here's how various investments might grow over five years:

💲 $10,000 Investment:

Year 1: $11,926

Year 2: $14,219

Year 3: $16,951

Year 4: $20,207

Year 5: $24,070

💲 $100,000 Investment:

Year 1: $119,260

Year 2: $142,190

Year 3: $169,510

Year 4: $202,070

Year 5: $240,700

💲 $1,000,000 Investment:

Year 1: $1,192,600

Year 2: $1,421,900

Year 3: $1,695,100

Year 4: $2,020,700

Year 5: $2,407,000

⚠️ Note: These returns are hypothetical and assume consistent annual performance, which may not reflect actual market volatility.

🔑 Considerations for Investors

🎯 Concentration Risk: MGK heavily invests in technology and a few major stocks, tying its success closely to these specific companies.

📉 Market Volatility: Although historically strong, MGK can be highly volatile, particularly during tech-sector downturns.

📈 Long-Term Growth: Ideal for investors seeking significant long-term capital appreciation through prominent U.S. growth firms.

📌 In Summary: MGK provides focused exposure to U.S. mega-cap growth stocks with a strong track record. Investors should consider portfolio diversification carefully due to its sector concentration.

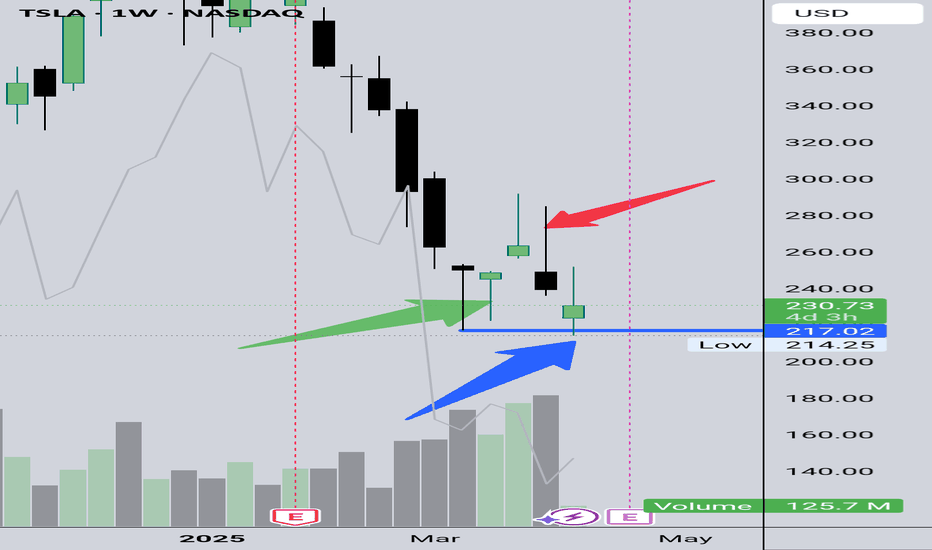

TESLA Always Pay YOURSELF! Tsla Stock were you PAID? GOLD Lesson

⭐️I want to go into depth regarding the this topic but it is a long one with PROS & CONS for doing and not doing it.

Every trader must choose what's best for them but you will SEE when I finally get to the write up that MANY OF THE PROS are NOT FINANCIAL but PSYCHOLOGICAL❗️

Another of 🟢SeekingPips🟢 KEY RULES!

⚠️ Always Pay YOURSELF.⚠️

I know some of you chose to HOLD ONTO EVERYTHING and place your STOP at the base of the WEEKLY CANDLE we entered on or the week priors base.

If you did that and it was in your plan GREAT but... if it was NOT that is a TRADING MISTAKE and You need to UPDATE YOUR JOURNAL NOW.

You need to note EVERYTHING. What you wanted to see before your exit, explain why not taking anything was justified to you, were there EARLY exit signals that you did not act on. EVERYTHING.

🟢SeekingPips🟢 ALWAYS SAYS THE BEST TRADING BOOK YOU WILL EVER READ WILL BE YOUR COMPLETE & HONEST TRADING JOURNAL ⚠️

📉When you read it in black amd white you will have YOUR OWN RECORD of your BEST trades and TRADING TRIUMPHS and your WORST TRADES and TRADING ERRORS.📈

✅️ KEEPING an UPTO DATE JOURNAL is STEP ONE.

STUDYING IT IS JUST AS IMPORTANT👍

⭐️🌟⭐️🌟⭐️A sneak peek of the LESSON after will be HOW & WHEN TO ENTER WHEN THE OPEN BAR IS GOING THE OPPOSITE WAY OF YOUR IDEA.👌

🚥Looking at the TESLA CHART ABOVE you will see that we were interested in being a BUYER when the weekly bar was BEARISH (GREEN ARROW) and we started to consider TAKE PROFITS and EXITS when the (RED ARROW) Weekly bar was still BULLISH.🚥

6 Things to Do before you start Investing and Trading1. Build an Emergency Fund

▪️Why it's important: Having an emergency fund ensures you have a financial cushion for unexpected expenses (e.g., medical bills, car repairs, job loss). Without this safety net, you may be forced to sell investments or go into debt if something unforeseen happens.

▪️How to do it: Aim for 3-6 months' worth of living expenses in a liquid, easily accessible account like a savings account. Focus on saving first before putting money into investments.

2. Pay Down High-Interest Debt

▪️Why it's important: High-interest debt, especially from credit cards, can severely hinder your financial progress. The interest on these debts is often higher than the returns you could earn from investments in the short term.

▪️How to do it: Prioritize paying off high-interest debts first (e.g., credit cards), then move on to other debts like student loans or car loans. Consider strategies like the debt snowball or debt avalanche method.

3. Define Your Financial Goals and Priorities

▪️Why it's important: Knowing what you're investing for (e.g., retirement, a down payment on a house, education, or travel) will help you choose the right investment vehicles and timeframes. It also provides motivation and direction.

▪️How to do it: Set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals. Break them down into short-term, medium-term, and long-term goals. This helps you align your investments with your needs.

4. Know Your Cash Flow

▪️Why it's important: Understanding your income and expenses is essential for managing your finances and determining how much money you can consistently allocate to investing. If you don't have a clear picture of your cash flow, you might overextend yourself or miss opportunities.

▪️How to do it: Create a monthly budget to track your income, fixed expenses, and discretionary spending. Consider using a budgeting tool or app to make this process easier. Be honest about where you can cut back to free up funds for investing.

5. Track Your Net Worth

▪️Why it's important: Tracking your net worth gives you a clear picture of your overall financial health. It's a snapshot of what you own (assets) minus what you owe (liabilities). This helps you measure your progress over time and adjust as needed.

▪️How to do it: List all your assets (e.g., savings, investments, real estate) and liabilities (e.g., mortgages, student loans, credit card debt). Update this regularly to see how your financial situation is evolving. You can use free online tools or apps to make this process easier.

6. Understand the Basics of Investing and Trading

▪️Why it's important: If you're going to invest or trade, you need to understand the fundamental principles behind both activities. This includes knowledge of risk, returns, diversification, asset classes (stocks, bonds, real estate), and how markets operate.

▪️How to do it: Read books, take online courses, or follow credible financial blogs and YouTube channels. It’s important to grasp concepts like risk tolerance, time horizon, and the different types of investments (stocks, mutual funds, ETFs, etc.). Understanding these principles will help you avoid common mistakes and make informed decisions.

BIG POST! | How To Beat SP500?

S&P 500 Performance: +35% since 2022.

My Selected Portfolio Performance: +62%, with an 82% hit rate.

Top Performing Stocks: NVDA (+735%), ANET (+343%), META (+209%), and more.

Technical Analysis Tools Used: Price action, trendlines, Fibonacci levels, round numbers, and more.

It’s been nearly three years since I posted my analysis of S&P 500 stocks on February 23, 2022. Back then, I reviewed all 500 stocks, applied some quick technical analysis, and identified 75 stocks that stood out for me. Importantly, I relied solely on technical analysis to make my picks. Fast forward to today, and the results speak for themselves. Most of these selections have significantly outperformed the broader market, proving the power and importance of technical analysis.

While many investors rely solely on fundamentals, technical analysis brings a dynamic edge that’s often underestimated. By focusing on price action and market behavior, technical analysis allows us to spot opportunities that others might miss, especially it gives a massive psychological edge while the markets are making corrections. The market doesn't care what you know, the market cares what you do!

Here’s what I used for my analysis:

It's kind of pure price action - previous yearly highs, trendlines, a 50% retracement from the top, round numbers, Fibonacci levels, equal waves, and channel projections. For breakout trades, determined strong and waited for confirmation before pulling the trigger.

The Results

While the S&P 500 has gained around 35% over this period , my selected stocks from the same list have made +62%! Out of the 75 stocks I picked, 67 have hit my target zones and 54 are currently in the green. That’s an 82% hit rate, and for me, that’s a good number!

Now, for those who favor fundamental analysis, don’t get me wrong, it has its place. But remember, fundamentals tell you what to buy, while technicals tell you when to buy - to be a perfect investor, you need them both. You could hold a fundamentally strong stock for years, waiting for it to catch up to its "true value," while a technical analyst might ride multiple trends and capture far superior returns during that same time. Also, the opposite can happen – you may see a great technical setup, but if the fundamental factors are against it, you could end up with your money stuck in a bad trade.

To put these ideas in perspective, starting with a simulated portfolio of $76,000, where each stock had an equal investment of around $1,000–$1,100, the portfolio is now worth around $124,000. The results are based on buying at marked zones and holding until today. I calculated entries from the middle of the target zone, as it’s a more realistic and optimal approach compared to aiming for perfect lows (which, frankly, feels a bit scammy) to get much(!) higher returns. This method reflects real-world trading.

Before we dive in, here are the current Top 5 stocks from My Picks:

NVDA: +735%

ANET: +343%

TT: +227%

META: +209%

LEN: +164%

These numbers demonstrate the effectiveness of a solid technical strategy. Many say it's tough to beat the market with individual stock picks, but these results show it’s not just possible, it’s absolutely achievable with the right tools and approach.

Now, let's dive into the charts!

1. Apple (AAPL) - a load-it-up type of setup has worked out nicely. Used previously worked resistance levels. If the stocks performing well and the market cap is big enough then these levels can help you to get on board.

Current profit 65%

Before:

After:

---------------------------

2. Adobe (ADBE) - came down sharply, but the price reached the optimal area and reversed.

Current profi 38%.

Before:

After:

---------------------------

3. Advanced Micro Devices (AMD) - round number, strong resistance level becomes support and the climb can continue.

Current profit 101%

Before:

After:

---------------------------

4. Amazon (AMZN) - came down from high prices to the marked levels and those who were patient enough got rewarded nicely.

Current profit 66%

Before:

After:

---------------------------

5. Arista Networks (ANET) - retest of the round nr. worked perfectly, as a momentum price level, after the strong breakout.

Current profit 343%

Before:

After:

---------------------------

6. Aptiv PLC (APTV): Came down quite sharply and it will take some time to start growing from here, if at all. The setup was quite solid but probably fundamentals got weaker after the all-time high.

Current loss -24%

Before:

After:

---------------------------

7. American Express (AXP) - firstly the round nr. 200 worked as a strong resistance level. Another example is to avoid buying if the stock price approaches bigger round numbers the first time. Came to a previous resistance level and rejection from there…

Current profit 104%

Before:

After:

---------------------------

8. Bio-Rad Laboratories (BIO) - in general I like the price action, kind of smoothly to the optimal zone. It might take some time to start growing from here but also fundamentals need to look over.

Current loss 6%

Before:

After:

---------------------------

9. BlackRock (BLK) - kind of flawless. All criteria are in place and worked perfectly.

Current profit 81%

Before:

After:

---------------------------

10. Ball Corporation (BALL) - a perfect example of why you should wait for a breakout to get a confirmed move. No trade.

Before:

After:

---------------------------

11) Berkshire Hathaway (BRK.B) - Buy the dip. Again, as Apple, a big and well-known company - all you need to do is to determine the round numbers, and small previous resistances that act as support levels, and you should be good.

Current avg. profit from two purchases 64%

Before:

After:

---------------------------

12) Cardinal Health (CAH) - the retest isn't as deep as wanted but still a confirmed breakout and rally afterward. Still, the bias was correct!

Before:

After:https://www.tradingview.com/x/83OmlWuv/

---------------------------

13) Ceridian HCM Holding (DAY) - found support from the shown area but not much momentum.

Current profit 20%

Before:

After:

---------------------------

14) Charter Communications (CHTR) - technically speaking it is a quite good price action but kind of slow momentum from the shown area. Probably came too sharply and did not have enough previous yearly highs to support the fall.

Current loss -10%

Before:

After:

---------------------------

15) Comcast Corp. (CMCSA) - got liquidity from new lows, pumped up quickly, and is currently fairly solid.

Current profit 10%

Before:

After:

---------------------------

16) Cummins (CMI) - got rejected from 2028 and 2019 clear highs, fairly hot stock, and off it goes.

Current profit 80%

Before:

After:

---------------------------

17) Salesforce.com (CRM) - perfect. 50% drop, strong horizontal area, and mid-round nr did the work.

Current profit 83%

Before:

After:

---------------------------

18) Cisco Systems (CSCO) - worked and slow grind upwards can continue.

Current profit 30%

Before:

After:

---------------------------

19) Caesars Entertainment (CZR) - not in good shape imo. It has taken too much time and the majority of that is sideways movement. Again, came too sharply to the optimal entry area.

Current loss -16%

Before:

After:

---------------------------

20) Devon Energy (DVN) - inside the area and actually active atm. Still, now I’m seeing a bit deeper correction than shown.

Before:

After:

---------------------------

21) Electric Arts (EA) - 6 years of failed attempts to get a monthly close above $150 have ended here. It got it and we are ready to ride with it to the higher levels.

Current profit: kind of BE

Before:

After:

---------------------------

22) eBay (EBAY) - it took some time but again, worked nicely.

Before:

After:

---------------------------

23) Enphase Energy (ENPH) - got a breakout, got a retest, and did a ~76% rally after that! If you still hold it, as I do statistics, then…

Current loss -59%

Before:

After:

---------------------------

24) Expeditors International of Washington (EXPD) - kind of worked but didn't reach. No trade.

Before:

After:

---------------------------

25) Meta Platforms (META) - the bottom rejection from the round number $100 is like a goddamn textbook :D At that time 160 and 200 were also a good area to enter. Here are several examples of the sharp falls/drops/declines - watch out for that, everything should come fairly smoothly. Still, it ended up nicely and we have a massive winner here...

Current profit 209%

Before:

After:

---------------------------

26) FedEx (FDX) - I love the outcome of this. Very solid price action and multiple criteria worked as they should. Perfect.

Current profit 60%

Before:

After:

---------------------------

27) First Republic Bank (FRC) - firstly got a solid 30 to 35% gain from the shown area but...we cannot fight with the fundamentals.

Current loss 99%

Before:

After:

---------------------------

28) General Motors (GM) - finally found some liquidity between strong areas and we are moving up.

Current profit 47%

Before:

After:

---------------------------

29) Alphabet (GOOG) - load it up 3.0, a good and strong company, and use every previous historical resistance level to jump in.

Current avg. profit after three different price level purchases 63%

Before:

After:

---------------------------

30) Genuine Parts (GPC) - coming and it looks solid.

Before:

After:

---------------------------

31) Goldman Sachs (GS) - really close one.

Current profit 86%

Before:

After:

---------------------------

32) Hormel Foods (HRL) - quite bad performance here. Two trades, two losses.

The current loss combined these two together is 35%

Before:

After:

---------------------------

33) Intel (INTC) - at first perfect area from where it found liquidity, peaked at 65%. Still, I make statistics if you still holding it then…

Current loss -21%

Before:

After:

---------------------------

34) Ingersoll Rand (IR) - beautiful!

Current profit 144%

Before:

After:

---------------------------

35) Intuitive Surgical (ISRG) - the trendline, 50% drop, strong horizontal area. Ready, set, go!

Current profit 157%

Before:

After:

---------------------------

36) Johnson Controls International (JCI) - second rest of the area and then it started to move finally..

Current profit 55%

Before:

After:

---------------------------

37) Johnson & Johnson (JNJ) - Buy the dip and we had only one dip :)

Current profit 13%

Before:

After:

---------------------------

38) CarMax (KMX) - the area is strong but not enough momentum in it so I take it as a weakness.

Current profit kind of BE

Before:

After:

---------------------------

39) Kroger Company (KR) - without that peak it is like walking on my lines

Current profit 15%

Before:

After:

---------------------------

40) Lennar Corp. (LEN) - strong resistance level becomes strong support. Beautiful!

Current profit 164%

Before:

After:

---------------------------

41) LKQ Corp. (LKQ) - just reached and it should be solid. Probably takes some time, not the strongest setup but still valid I would say.

Before:

After:

---------------------------

42) Southwest Airlines (LUV) - no breakout = no trade! Don’t cheat! Your money can be stuck forever but in the meantime, other stocks are flying as you also see in this post. If there is a solid resistance, wait for the breakout and possibly retest afterward! Currently only lower lows and lower highs.

Before:

After:

---------------------------

43) Las Vegas Sands (LVS) - channel inside a channel projection ;) TA its own goodness!

Current profit 70%

Before:

After:

---------------------------

44) Microchip Technology Incorporated (MCHP) - worked!

Current profit 37%

Before:

After:

---------------------------

45) Altria Group (MO) - got a bit deeper retest, liquidity from lower areas, and probably a second try..

Currently kind of BE

Before:

After:

---------------------------

46) Moderna (MRNA) - "seasonal stocks", again too sharp and we are at a loss…

Current loss -37%

Before:

After:

---------------------------

47) Morgan Stanley (MS) - the first stop has worked, and got some nice movements.

Current profit 62%

Before:

After:

---------------------------

48) Microsoft (MSFT) - Load it up 4.0, buy the dip has worked again with well-known stock.

Three purchases and avg. return from these are amazing 70%

Before:

After:

---------------------------

49) Match Group (MTCH) - it happens..

Current loss -53%

Before:

After:

---------------------------

50) Netflix (NFLX) - almost the same as Meta. Came quite sharply but the recovery has been also quick. Another proof is that technical analysis should give you a psychological advantage to buy these big stocks on deep corrections.

Current profit 153%

Before:

After:

---------------------------

51) NRG Energy (NRG) - Perfect weekly close, perfect retest…

Current profit 90%

Before:

After:

---------------------------

52) NVIDIA (NVDA) lol - let this speak for itself!

Current profit 735%

Before:

After:

---------------------------

53) NXP Semiconductors (NXPI) - usually the sweet spot stays in the middle of the box, and also as I look over these ideas quite a few have started to climb from the first half of the box. Touched the previous highs.

Current profit 74%

Before:

After:

---------------------------

54) Pfizer (PFE) - actually quite ugly, TA is not the strongest. Probably results-oriented but yeah..

Current loss -25%

Before:

After:

---------------------------

55) PerkinElmer - “after” is EUR chart but you get the point.

Current profit 25%

Before:

After:

---------------------------

56) Pentair (PNR) - worked correctly, 50% drop combined with the horizontal area, easily recognizable, and the results speak for themselves.

Current profit 124%

Before:

After:

---------------------------

57) Public Storage (PSA) - again, previous yearly highs and the trendline did the job.

Current profit 36%

Before:

After:

---------------------------

58) PayPal (PYPL) - the area just lowers the speed of dropping, but slowly has started to recover.

Current loss -14%

Before:

After:

---------------------------

59) Qorvo (QRVO) - slow, no momentum.

Current profit 10%

Before:

After:

---------------------------

60) Rockwell Automation (ROK) - previous yearly high again, plus some confluence factors.

Current profit 32%

Before:

After:

---------------------------

61) Rollins (ROL) - after posting it didn’t come to retest the shown area. Being late for a couple of weeks. Worked but cannot count it in, the only thing I can count is that my bias was correct ;)

Before:

After:

---------------------------

62) Snap-On Incorporated (SNA) - same story!

Before:

After:

---------------------------

63) Seagate Technology (STX) - firstly it came there! Look how far it was, the technical levels are like magnets, the price needs to find some liquidity for further growth and these areas can offer it. I like this a lot, almost all the criteria are in place there.

Current profit 73%

Before:

After:

---------------------------

64) Skyworks Solutions (SWKS) - one of the textbook examples of how trendline, 50% drop, round nr. and strong horizontal price zone should match. Still a bit slow and it will decrease the changes a bit.

Kind of BE

Before:

After:

---------------------------

65) TE Connectivity (TEL) - came down, and got a rejection. “Simple” as that.

Current profit 37%

Before:

After:

---------------------------

66) Thermo Fisher Scientific (TMO) - mister Ranging Market.

Current profit 19%

Before:

After:

---------------------------

67) Trimble (TRMB) - finally has started to move a bit. Got liquidity from previous highs again and..

Current profit 45%

Before:

After:

---------------------------

68) Tesla (TSLA) - made a split. Have been successfully recommended many times after that here and there but two years ago we traded in these price levels and..

Current profit 19%

Before:

After:

---------------------------

69) Train Technologies (TT) - dipped the box and off it goes! Epic!

Current profit 227%

Before:

After:

---------------------------

70) Take-Two Interactive Software (TTWO) - I like this analysis a lot. Worked as a clockwork.

Current profit 60%

Before:

After:

---------------------------

71) United Rentals (URI) - WHYY you didn’t reach there :D Cannot count it.

Before:

After:

---------------------------

72) Waters Corp. (WAT) - came to the box as it should be slow and steady. As the plane came to the runway.

Current profit 41%

Before:

After:

---------------------------

73) Exxon Mobil Corp. (XOM) - another escaped winner. Didn’t come down to retest my retest area so, missed it.

Before:

After:

---------------------------

74) Xylem (XYL) - perfect trendline, good previous highs, 50% drop from the peak and..

Current profit 76%

Before:

After:

---------------------------

75) Autodesk (ADSK) - took a bit of time to start climbing but everything looks perfect. Nice trendline, 50% drop from ATH, previous yearly highs - quite clean!

Current profit 66%

Before:

After:

The strategies above show how useful price action, key levels, and psychology can be for investing. By spotting breakouts, and pullbacks, or focusing on round numbers and past highs, technical analysis helps give traders an edge in understanding the market.

Regards,

Vaido

Ultimate Winrate KDJ Strategy by reset parameter!(best tutorial)You've ever had this happen?

Bought a stock at rock bottom, and it starts to rise a bit, and then the J line turns down on the KDJ indicator, telling you to sell. So, you sell, but then it quickly shoots up, leaving you pretty blue. like you missed out on a fortune. Was the KDJ indicator down?

Nope

Hold tight, cause we're about to see a miracle. By just tweaking a bit the KDJ indicator's parameters, you can nail those short-term highs and be on your way to the success.

So, how do you find the right KDJ indicator parameters?

Stick around, and I'll spill the beans!

First off, why do we need to optimize this lil' parameter?

Well, every stock moves differently cause the folks trading it are different. So, a one-size-fits-all KDJ indicator won’t always work well on every stock at every stage. To up our chances, we gotta tweak those parameters to find the best fit for our stock.

Now, onto the second question: how do you find the right ones?

Let’s go back to the Tesla stock chart.

After changing the KDJ indicator parameters to 74, the sell point lines up perfectly with the peak.

Why 74?

Well, from point A to point B, there’s exactly 74 candles. Why use the number of candles between those two points as the KDJ parameter?

Here’s the crux of it.

The KDJ indicator is a momentum oscillator, calculating the close price at latest candle with the highest and lowest prices of the previous nine candles since the default KDJ parameter is 9.

so If the price breaks above the highest price of those nine candles, it will be constantly giving false sell signals.

So, we need to set the KDJ parameter to the number of candles from the previous high to the low. This way, the highest price and lowest price are not broken.

Then, the KDJ works accurately.

Still lost? Let’s look at another example. Here’s an Apple stock chart.

With the default parameter of 9, we bought after the golden cross, but few days later, it prompt to sell signal, and then the price soared. Feeling furious yet?

But if we set the KDJ parameter to 95, we’d have sold right near the top, securing a nice profit!

Why 95?

Same method: from the highest point A to the lowest point B, there’s 95 candles.

Got it? Ain’t it something?

Check your stocks with this method. Got questions? Leave a comment, and I’ll get back to ya ASAP! Today we focused on using KDJ to find sell points. It’s just as magical for buy points, which I’ll cover in future videos.

So, please follow me and hit that boost bell so you don’t miss out!

HERE ARE 10 COMMON TRADING INDICATORS MADE SIMPLE Chart has all 10.

Hope this helps.

Hope it's simple to understand if you still struggle with indicators.

Remember, no one indicator is good on its own.

Think of an indicator as a sign that you should pay attention to a possibility. For example, if I go to the ocean, maybe I have an indicator that says you're closer to sharks than in the great lakes, will I be eaten? Probably not, but also, there are more sharks and my indicator confirms that. I can't use this one indicator to say, I'm probably about to be eaten. BUT.. Let's say I have multiple indicators that I use to give me a better idea if I'll be eaten. Maybe an indicator tells me there is an oddly higher than avg number of a sharks number 1 food source within the area. Can I say I'll be eaten? No, but I could say, maybe due to the increased food supply, there may be more sharks. What if I have a few more indicators, one of which says there are 30 great whites within 10 miles, and another that says, usually at this time of the year, there are only ever between 2 to 7 great whites. Can I say, Yes, I'll be eaten? NOPE, not yet.

What if I have another indicator that says, across the globe, shark attacks are increasing by a certain percentage, and another that says, there is blood detected within the water you're swimming in, which is lower than the threshold for human's to detect, but higher than the threshold needed for sharks to smell. What if I combine that with an indicator that says, on avg there are 1000 swimmers here, but now, there are under 30. Can I say I'll be eaten? Nope, BUT, I can say, hmm. Something is up and if one of us were to get eaten, I'm more likely to be picked out of 30 people than 1000.

When can I say I'll be eaten? Probably if you build an indicator that can detect bite force and compare to known bit forces of sharks that could sense you're actively being eaten, but at that point, the stock moved already... err I mean, the shark ate already, and you're late to the show..

My point being, use them, but don't always assume when it comes to indicators. Take in all the data and then make a decision. Some indicators fit your style, some won't. Do I need 30 stacked indicators for sharks if I'm swimming in Lake Michigan? Probably not, it would make everything a mess.

So, here there are.

Relative Strength Index (RSI): Ah, the RSI, the “I’ve had too much” indicator of the stock market. When it hits above 70, it’s like your stock had too much to drink at the party and is likely to come crashing down. Below 30? It’s been left out in the cold and might be due for a warm-up (a.k.a. price increase). Remember, it’s not foolproof, but then again, neither is your weather app.

On-Balance Volume (OBV): This one’s all about following the crowd. If the volume is increasing, it’s like everyone’s rushing to get the latest iPhone. But remember, even if everyone jumps off a bridge, it doesn’t mean you should too. Always double-check before you follow the herd.

Simple Moving Average (SMA): The SMA is like that reliable friend who’s always a bit behind on the latest trends. It gives you the average closing price over a certain period. It’s simple, it’s moving, it’s average. It’s the SMA.

Exponential Moving Average (EMA): The EMA is the SMA’s hip younger sibling. It cares more about what happened recently than what happened way back when. It’s great for short-term trading, but remember, even the coolest kids can get things wrong.

Moving Average Convergence Divergence (MACD): This one sounds complicated, but it’s not. It’s like watching two rabbits on a race track. If the fast rabbit (the 12-day EMA) overtakes the slow rabbit (the 26-day EMA), it’s a bullish signal. If the slow rabbit overtakes the fast one, it’s a bearish signal. Just remember, rabbits are unpredictable!

Fibonacci retracements: Ah, Fibonacci, the Da Vinci of math. These horizontal lines indicate where support and resistance levels might be. It’s like trying to predict where you’ll meet your ex at a party. It could be useful, but don’t rely on it too much.

Stochastic oscillator: This one’s a bit like a pendulum. When it swings one way, it’s likely to swing back the other way soon. It’s great for spotting potential reversals, but remember, even a broken clock is right twice a day.

Bollinger bands: These are like the elastic waistband of your favorite sweatpants. If the price hits the upper band, it might be time to sell (or stop eating pizza). If it hits the lower band, it might be time to buy (or hit the gym).

Average Directional Index (ADX): This one tells you whether the price is trending strongly or just wandering around like a lost puppy. Above 25 is a strong trend, below 20 is weak. But remember, even lost puppies find their way home eventually.

Accumulation/Distribution (A/D) line: This one’s all about supply and demand. If the line is going up, the stock is being accumulated. If it’s going down, it’s being distributed. It’s like tracking whether more people are buying or selling fidget spinners.

Remember, these indicators are like tools in a toolbox. Don’t try to build a house with just a hammer. Use them in combination, understand their limitations, and always do your own research. Happy trading! 📈

VOLUME INDICATORS, PART 2. SEVEN COMMON VOLUME INDICATORS.Understanding Volume Indicators:

Volume indicators are essential tools for traders and analysts, providing insights into market activity and sentiment. In this guide, we'll explore seven common volume indicators and how you can use them to enhance your trading strategies.

1. Volume

Volume is the simplest volume indicator, representing the total number of shares or contracts traded over a specific period. It's like the crowd size at a Super Bowl game—when the stadium is packed and roaring, it indicates a lot of interest and activity. Similarly, high trading volume suggests significant buying or selling activity in the market. Traders often use volume to confirm the strength of price movements and identify potential trends.

Volume, the bedrock of volume analysis, represents the total number of shares or contracts traded over a specific period. Common parameter values range from 20 to 50 periods for short-term analysis and 100 to 200 periods for long-term trends. Remember, volume precedes price movements, so significant changes can hint at impending shifts in direction.

2. On-Balance Volume (OBV)

On-Balance Volume (OBV) adds a cumulative total of volume when the price closes up and subtracts it when the price closes down. It's akin to keeping score of how loud each team's fans are cheering during the Super Bowl game. If one team's supporters get louder as the game progresses, it suggests growing momentum for that team. Likewise, OBV helps traders gauge buying and selling pressure, providing insights into potential price movements. A rising OBV indicates bullish momentum, while a falling OBV suggests bearish sentiment.

On-Balance Volume (OBV) tracks cumulative volume based on price movements. Set your period length typically between 14 to 20 periods for optimal results. A rising OBV confirms bullish trends, while a falling OBV suggests bearish sentiment. Divergences between OBV and price often foreshadow reversals.

3. Accumulation/Distribution Line (A/D Line)

The Accumulation/Distribution Line (A/D Line) combines price and volume to show how much of a security is being accumulated or distributed. It's like a tug-of-war between the two teams during halftime at the Super Bowl. The team with more supporters pulling harder gains ground. Similarly, the A/D Line measures the battle between buyers and sellers. If it's trending upwards, it suggests that accumulation (buying) is outweighing distribution (selling), indicating potential upward price movement.

The Accumulation/Distribution Line (A/D Line) gauges the flow of funds into or out of a security. Optimal period lengths range from 14 to 30 periods. Rising A/D Line values signal accumulation and potential price appreciation, while declining values indicate distribution and possible downturns.

4. Chaikin Money Flow (CMF)

Chaikin Money Flow (CMF) measures the flow of money into or out of a security based on both price and volume. It's akin to checking the enthusiasm of the fans after each touchdown at the Super Bowl. If the fans are still hyped and buying team merchandise, it suggests sustained enthusiasm and support. CMF helps traders assess the strength of buying or selling pressure. A positive CMF suggests buying pressure, while a negative CMF indicates selling pressure.

Chaikin Money Flow (CMF) measures buying and selling pressure relative to price movements. Common period lengths vary from 10 to 30 periods. Positive CMF values indicate buying pressure, while negative values suggest selling pressure. Look for divergences between CMF and price for early reversal signals.

5. Volume Weighted Average Price (VWAP)

Volume Weighted Average Price (VWAP) calculates the average price a security has traded at throughout the day, weighted by volume. It's like a buffet at a Super Bowl party where each dish is labeled with the average popularity rating from all the guests. The more popular dishes have a higher average rating. Similarly, VWAP gives traders a sense of the average price level where most trading activity has occurred. Traders use VWAP to assess whether their trades were executed at favorable prices relative to the day's average.

Volume Weighted Average Price (VWAP) calculates the average price weighted by volume. Period lengths typically range from 20 to 50 periods. VWAP acts as a dynamic support or resistance level, guiding traders on optimal entry and exit points. Monitor deviations from VWAP to identify potential trend shifts.

6. Money Flow Index (MFI)

The Money Flow Index (MFI) measures the rate at which money is flowing into or out of a security based on both price and volume. It's akin to fans at the Super Bowl game exchanging team merchandise and tickets. The more transactions happening, the more money is flowing between fans. MFI helps traders gauge market sentiment. A high MFI suggests strong buying pressure, while a low MFI indicates selling pressure. Traders often look for divergences between MFI and price movements to anticipate potential reversals.

The Money Flow Index (MFI) evaluates the rate of money flow into or out of a security. Optimal period lengths usually range from 10 to 20 periods. High MFI values indicate overbought conditions, while low values suggest oversold conditions. Watch for divergences between MFI and price for reversal signals.

7. Volume Rate of Change (VROC)

Volume Rate of Change (VROC) measures the rate of change in volume over a specific period, showing whether volume is increasing or decreasing rapidly. It's like measuring the acceleration or deceleration of the crowd's excitement level during different parts of the Super Bowl game. If the crowd gets louder and louder as the game progresses, it indicates increasing excitement and momentum. Similarly, a rising VROC suggests increasing buying or selling activity, while a falling VROC suggests waning activity.

Volume Rate of Change (VROC) measures the rate of change in volume over a specific period. Common period lengths vary from 10 to 20 periods. Rising VROC values signify increasing volume momentum, indicating potential price continuation. Falling values may precede price reversals.

GME and VOLUME? Let's go back and see GME on the Weekly

In conclusion, volume indicators provide valuable insights into market sentiment and potential price movements. By understanding and incorporating these indicators into your trading strategy, you can make more informed decisions and improve your overall trading performance.

REMEMBER, no one indicator on it's own tells you much, but a lot of different indicators all telling you the same thing at the same area... pay attention to that kind of confirmation.

Hope this helps!!

I've linked PART 1, 10 COMMON INDICATORS.

This post is all Volume related.

You can go in depth with all of these, I don't find it necessary for most traders, but the option is there, however, you'll need someone more advanced than myself to help you through that.

How to Trade with the Inside Bar PatternHow to Trade with the Inside Bar Pattern

The inside bar pattern is characterised by two consecutive candlesticks that often suggest a period of consolidation or indecision in the market. Traders and analysts can find value in identifying the setup as it can provide insights into potential future price movements. In this article, we will explore different examples of this formation on price charts and discuss how to interpret their signals for trading purposes.

What Is an Inside Bar Candle Pattern?

An inside bar is a two-candlestick formation that occurs when a candlestick's high and low range is contained within the high and low range of the preceding candle. In other words, the entire price action of one candle is confined within the previous candlestick's price range.

The setup signifies a period of consolidation or indecision in the market; however, it doesn’t identify a trend reversal. The price may continue moving in the prevailing trend or turn around. Also, the pattern may appear both in an uptrend and in a downtrend. It indicates that the trading range of the current candle is narrower than the range of the previous candlestick. This contraction in price volatility suggests a temporary equilibrium between buyers and sellers.

The inside bar can be observed across different financial instruments such as stocks, cryptocurrencies*, ETFs, indices, and forex currency pairs and can be traded using contracts for difference (CFDs) provided by FXOpen.

Identifying the Inside Bar on Trading Charts

To identify this formation on trading charts, traders follow these steps:

Look for two candlesticks: Start by identifying a candlestick with a defined high and low range and check a subsequent candlestick.

Compare the high and low range: Check if the high and low range of the subsequent candle is entirely contained within the high and low range of the preceding candlestick. The entire price action of the following candles should be within the boundaries of the last candlestick.

Confirmation: Once identifying that the subsequent candle meets the criteria, traders can confirm it as an inside bar.

Inside Bar vs Outside Bar

The inside candle pattern occurs when the high and low of a candle are contained within the range of the preceding candlestick, indicating consolidation or indecision in the market. It suggests a potential reversal or continuation of the current trend. On the other hand, an outside bar, or engulfing pattern, happens when the high and low of a candlestick completely engulf the previous candle, signalling a potential reversal. A bearish engulfing indicates a bearish reversal, while a bullish engulfing suggests a bullish reversal. Both are widely used by traders for technical analysis and identifying potential trading opportunities.

Traders can analyse outside and inside bars on forex, stocks, and other markets for free using the FXOpen TickTrader platform.

How to Trade Inside Bar Pattern

Trading with the inside bar candlestick pattern involves using it as a signal for potential breakouts or continuation of the prevailing trend. Here are the steps traders usually follow when trading with the pattern:

Determine the direction of the preceding trend: Traders assess the overall trend leading up to the formation. If it's an uptrend, the preceding candles should be mostly bullish. If it's a downtrend, the prior candles should be mostly bearish.

Wait for a breakout: The formation indicates consolidation and potential price compression. Traders often wait for a breakout from the setup's range to initiate a trade. A breakout above the high of the formation suggests a bullish signal, while a breakout below the low indicates a bearish signal.

Set your entry: Once the breakout occurs, traders may set the entry order slightly above the high of the bullish breakout or slightly below the low of the bearish breakout.

Consider additional confirmation: To increase the probability of a successful trade, traders may look for additional confirmation indicators such as volume analysis, trendlines, or other technical indicators to support your trade decision. An increasing volume at the breakout or the breakout from a trendline may provide additional confluence.

Manage your trade: As the trade progresses, traders monitor price movements and may want to adjust your stop-loss level to protect profits or limit losses.

Take profits: Traders may decide on your profit-taking strategy, whether it's a predetermined target, a trailing stop, or monitoring key levels of support and resistance.

Live Market Example

Below we present an inside bar stock pattern on Tesla. It contains a bullish inside bar. Following the inside bar trading strategy, the trader waits for the breakout above the setup marked by a horizontal line. The stop loss is set below the low of the formation, and the take profit is at the next resistance.

Final Thoughts

While the setup can be a useful tool for identifying potential breakout or continuation opportunities, it's important for traders not to rely solely on this pattern for their trading decisions. To enhance their analysis, traders combine the formation with other technical indicators and utilise effective risk management strategies to manage potential losses.

It's crucial to exercise caution and be mindful of false signals that can occur. Traders try to adapt their trading strategies accordingly to improve their chances of success. To develop your own trading strategy with this pattern, you can open an FXOpen account.

FAQ

Is an inside bar bullish or bearish?

It does not inherently indicate a bullish or bearish bias. It simply represents a period of consolidation or indecision in the market. So, the formation occurring within an uptrend can be bullish and signal a trend continuation or bearish and signal a trend reversal.

What does an inside bar bullish mean?

The meaning of an inside candle that is bullish refers to an inside bar, after which the price moves upwards. When this pattern forms during an uptrend, it suggests a temporary pause or consolidation in price before the uptrend potentially resumes. When it is formed in a downtrend, it signals a trend reversal.

How do you use the inside bar strategy?

To use the strategy, traders wait for the inside bar to form and then look for a breakout above the high of the formation to enter a long position or below the low to enter a short trade. A stop-loss order is typically placed below the low of the pattern in a long trade and above the high of the pattern in a short trade. Profit targets can be determined based on the trader's trading plan, technical indicators, or key support and resistance levels.

* At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Advanced Candlestick Pattern AnalysisAdvanced Candlestick Pattern Analysis

Welcome to the intricate world of advanced candlestick patterns, a realm where subtle shifts in market sentiment are captured in the form and structure of candles on a chart. This article delves into some of the more sophisticated patterns that, while less common, offer insightful signals to those who can identify them. For readers eager to try spotting these patterns themselves, FXOpen's free TickTrader platform provides an ideal canvas to practise and observe these formations in real-time markets.

Island Reversal Pattern

The Island Reversal pattern is a distinct formation in advanced candlestick patterns, marked by a gap on both sides of a cluster of candles. This pattern signifies a possible reversal of the current trend. It appears as a small 'island' of trading activity separated by gaps from the larger price movement, indicating a sudden shift in market sentiment.

Traders often view the Island Reversal as a strong signal. They typically wait for confirmation in the form of a price moving away from the 'island' before executing trades. For instance, traders might buy once the price moves above the pattern in a bullish island reversal. Conversely, in a bearish reversal, selling occurs when prices drop below the island. Stop-loss orders are generally placed on the opposite side of the gap, limiting potential losses if the expected trend reversal does not materialise.

Hook Reversal Pattern

The Hook Reversal pattern forms part of advanced candlestick analysis and is characterised by two candlesticks, where the first one aligns with the trend and the second is the opposite. Also, the second candlestick opens and closes within the first one. It can indicate a potential reversal in the current trend, particularly in a highly traded market.

In response, traders often seek additional confirmation before acting, such as a continued movement toward the reversal. For instance, in a Bullish Hook Reversal, they might enter a long position when subsequent candles continue to rise. Stop-losses are commonly set just below the low of the second candle in a bullish reversal or above the high in a bearish reversal to manage risk effectively.

Triple Gap (San-ku) Candlestick Pattern

The Triple Gap (San-ku) candlestick pattern is a notable formation in candlestick chart pattern analysis, often signalling an impending trend reversal. It emerges through three consecutive candlesticks, each marked by gaps between them, reflecting a buildup of momentum. Typically, at least two of these sessions feature notably large candles.

In recognising the San-ku, traders view it as a caution against the prevailing trend's sustainability, acknowledging that such accelerated momentum cannot persist indefinitely. This pattern does not pinpoint the exact reversal moment but indicates its likelihood shortly. Prudent traders often wait for further confirmation, such as a change in direction, before adjusting their positions. Stop-loss orders are strategically placed above a swing high/low to minimise potential losses if the anticipated trend reversal does not materialise promptly.

Kicker Candlestick Pattern

In stock analysis, candlestick patterns like the Kicker play a crucial role. This pattern is characterised by a drastic change in market sentiment, reflected by two candles moving in opposite directions. The first candle follows the current trend, while the second moves sharply in the opposite direction with a price gap, which strengthens the reversal signal.

The Kicker is considered one of the most powerful reversal indicators. For a bullish kicker, traders might initiate a buy when the second candle's upward trend is confirmed, while in a bearish kicker, a sell is considered when the market continues trading downwards after the second candle. Stop-losses are often placed just beyond the start of the second candle to manage risk.

Three Line Strike Pattern

The Three Line Strike pattern, in the realm of trading candlestick analysis, is a unique trend continuation signal. It consists of three consecutive candles following the current trend (either bullish or bearish), followed by a fourth candle that strikes through the range of the first three.

A bullish Three Line Strike starts with three rising green candles, followed by a long red candle that closes below the first candle's open price. This reflects a temporary pullback before the uptrend resumes. Conversely, in a bearish pattern, three falling red candles are followed by a green candle that closes above the first candle's open price, indicating a brief upward correction before the downtrend continues.

Traders typically use this pattern to reinforce their confidence in the prevailing trend. Stop-loss orders are placed just beyond the fourth candle's extreme to protect against unexpected reversals.

Belt Hold Pattern

In the candlestick chart technical analysis, the Belt Hold stands out as a key reversal indicator. It’s characterised by a single, long candlestick that signals a shift in market momentum. In a downtrend, a bullish Belt Hold is represented by a long green candle, opening at its low and closing near its high. This reflects a possible shift to an upward trend. Conversely, during an uptrend, a bearish Belt Hold is identified by a long red candle, opening at its high and closing near its low, indicating a potential reversal to a downward trend.

Traders typically look for additional market confirmation after a Belt Hold emerges before executing trades. For risk management, stop-loss orders are commonly placed just past the extreme end of the Belt Hold candle.

Concealing Baby Swallow

In candle technical analysis, the Concealing Baby Swallow is a rare but noteworthy bearish continuation formation. It consists of four candles in a downtrend, where the first two are black Marubozu candles (candles without shadows), indicating strong selling pressure. The third candle, also black, opens with a gap down. The fourth candle completely engulfs the third and closes within the first candle's body.

This pattern may reflect a strong continuation of the bearish trend, with the fourth candle's engulfing nature indicating the concealment of any bullish attempt to reverse the trend. Traders often interpret this as a signal to maintain or initiate short positions, with stop-loss orders set above the high of the fourth candle.

On-Neck

The On-Neck is a bearish continuation formation in candlestick charting. It typically emerges in a downtrend and is composed of two candles: the first is a red candle, followed by a green candle. The second candle opens lower than the first candle's close and closes near the low or close of the first candle but not below it, creating a pattern that resembles a neck.

This pattern indicates that selling pressure remains dominant despite a brief bullish interlude. Traders often view the On-Neck as a confirmation to continue or initiate short positions, expecting the downtrend to persist. For risk management, a stop-loss is usually placed just above the high of the second candle to protect against potential trend reversals.

The Bottom Line

In conclusion, mastering these advanced candlestick patterns may potentially enhance trading strategies. Each pattern provides unique insights into market dynamics, offering traders valuable tools for decision-making. To apply these concepts in real-world trading, consider opening an FXOpen account, a broker that provides robust platforms and resources to support your trading journey.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Box Trading MasteryBox Trading Mastery. Simply utilize the average movement over a specific period to establish a trading range. Focus on the most recent range. Every time this range is breached, anticipate an equivalent movement in the next range. This is the essence of the 'Box Breakout Strategy,' enabling seamless trading without reliance on external indicators.

How to Trade with the Hockey Stick Chart PatternTraders strive to identify structures and indicators that can assist their decisions. One such pattern that has garnered attention is the hockey stick. Whether you are an experienced trader or just starting your journey in the world of trading, understanding this hockey stick effect can be a valuable addition. In this FXOpen article, we will explore what this pattern is, how to spot it, and, most importantly, how to trade it effectively by identifying the hockey stick growth curve.

What Is the Hockey Stick Pattern?

The term hockey stick pattern is used to highlight a significant change or inflection point in a trend or data series. The name comes from the shape of a hockey stick, with its long handle and curved blade. This pattern can refer to a few different concepts depending on the context in which it is used. Here are two common interpretations:

In Finance and Economics: A hockey stick pattern can describe a financial or economic trend that resembles the shape of a hockey stick. In this context, it typically refers to a situation where there is a relatively flat or stable period followed by a sudden and significant upward (or sometimes downward) movement. This formation can be seen in various economic indicators, such as a sudden surge in stock prices.

In Data Visualisation and Business: The pattern is also used to describe a particular shape in data graphs or charts. It's often seen in business presentations, especially related to sales or revenue. In this context, the hockey stick represents a slow or steady start followed by a sharp increase in numbers.

In this article, we will consider the hockey stick trading pattern.

How to Spot the Hockey Stick in the Chart?

Here are some key characteristics:

Gradual Build-Up: The pattern begins with a period of stability or slow development, often represented by a nearly horizontal or slightly inclined line resembling the blade of a hockey stick. Given its shape, it is also known as the “blade phase” of the hockey stick pattern.

Inflection: The most defining feature of the formation is the sudden and steep upward curve that follows the initial flat phase.

Rapid Growth: The final phase of this formation is the hockey stick growth, meaning a continuous upward trajectory and signalling a rapid exponential increase. Usually, there is a surge in trading volume during the sharp uptrend phase, which validates the strength of the formation. This curve signifies an increase in the asset's value, akin to the shaft of a hockey stick.

Duration: This can occur over varying time frames, from days to months, so traders stay vigilant across different intervals.

How to Trade the Hockey Stick Pattern

Trading this formation involves a strategic approach that traders employ to potentially capitalise on the formation's characteristics.

Entry

Traders typically consider entering a position in the “inflection phase,” as it represents an opportunity to enter a trade while the asset's price is still relatively low, but the market signals growth potential.

Take Profit

In trading the hockey stick setup, establishing a take-profit level is vital, but the pattern doesn’t provide specific levels. Market players set this target above the inflection point, considering market conditions and their risk tolerance, as a strategy to secure gains.

Stop Loss

Risk management is pivotal in trading. For the hockey stick formation, the stop-loss placement depends on the entry point. Traders entering during the “inflection phase” often set it below the “blade phase”, typically beneath initial support. If entering during the third phase, they might position the stop loss near the inflection point.

Live Market Example

To better understand how to trade this formation, let's look at a live market example using FXOpen's TickTrader platform.

Suppose you open an FXOpen account and access the TickTrader platform to analyse the daily chart of TSLA stock.

During 2017-2020, the stock had shown flat movement resembling the blade phase of a hockey stick formation. The traders had a notable opportunity to open trades in this phase to receive potential gains. The stock price was $20 at this stage. Had market players believed in the company, they might have considered entering a long position at this stage.

After “blade” years, the growth began in the initial months of 2020. The sudden rise in this stock was witnessed, with stock prices hitting $60 in the early months of 2020. A huge increase of 200% in the stock price was very convincing for traders.

Over time, the stock experienced a slight downtrend followed by the expected sharp upward curve, resembling the shaft of a hockey stick. At this stage of surging growth, the stock price reached $420. Traders that decided to open a buy position at the ‘inflection point’ near $60 must have experienced a 700% gain if they closed the position at ATH of $420.

Limitations of the Hockey Stick Pattern

While the hockey stick formation offers market players valuable insights, it's crucial to understand its limitations. Like all chart formations, the hockey stick can occasionally produce false signals. It's recommended that traders use this pattern in combination with other analytical tools to confirm signals and enhance trading accuracy.

Conclusion

The hockey stick growth chart pattern is a valuable tool for traders seeking to identify opportunities in the global financial markets. By understanding the characteristics of this formation and following a disciplined trading strategy, they can potentially capitalise on significant price increases. However, it's important to remember that no pattern or strategy is foolproof, and risk management is essential to protect capital.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

How to Choose Stocks for TradingWhat stocks do day traders trade? What stock types are more appropriate for swing traders? Selecting suitable stocks for trading requires an amalgamation of keen market understanding and thorough research. This process, while complex, is fundamental for traders aiming to navigate the ever-evolving financial markets with precision. Platforms like FXOpen provide traders with the tools and resources necessary to facilitate this selection, with instruments like TickTrader aiding in a more refined analysis. This article offers a structured approach to stock selection, encompassing various analytical techniques and considerations.

Understanding Your Trading Goals

Every trader has unique objectives shaping their strategies. While a young trader might aim for aggressive growth, those nearing retirement might focus on capital safety.

Consequently:

Growth-oriented traders are drawn to emerging companies with promising revenue growth, even if earnings vary, as they provide a high level of volatility.

Those emphasising capital preservation opt for long-standing firms known for steady profits.

Defining Your Trading Approach

Your trading approach will determine the stocks you can trade:

Short-Term: This is where understanding how to research stocks for day trading becomes essential. This period, which can last anywhere from a few moments to a few days, is ideal for traders who are looking for rapid market movements. Emerging equities and penny stocks may be an ideal option.

Medium-Term: Traders who choose medium-term trading lasting anywhere from weeks to months pay attention to securities whose value highly depends on sector trends or company-specific developments that could affect their value in the near future.

Long-Term: This investment timeframe extends over years. Although it’s not common for traders to keep trades open for such long periods, they may choose stocks with promising growth potential supported by solid company fundamentals.

Are you scouting for the best day trading stocks today, or are you more intrigued by swing trading? With platforms like FXOpen, traders can optimally navigate the markets on chosen timeframes.

Risk Tolerance Assessment

If you are looking for the best stocks for trading, it's crucial to assess the level of risk you're comfortable with in relation to your entire trading capital. Risk tolerance can be categorised into different profiles, such as conservative, moderate, or aggressive:

Conservative approach: priority for capital preservation and lower-risk investments.

Moderate approach: a trader may take some risk but still prefer a balanced approach.

Aggressive approach: higher levels of risk for potentially higher returns.

Understand Stock Types

Stocks can be categorised into various types based on their risk profiles, such as:

Blue-chips: Generally considered less risky and associated with established financially stable companies.

Growth: Offers the potential for higher returns but comes with higher volatility and risk.

Value: Tend to be less volatile and may appeal to more conservative traders.

Fundamental Analysis

Fundamental analysis provides the map for a stock trading journey, using financial statements and key ratios to decode a company's performance and potential.

Evaluating Financial Statements

Income Statement: This vital document illuminates the revenue, expenses, and profits, acting as a window into a company's profitability over a specific period. By examining it, traders discern how the company generates profits and manages its operating expenses.

Balance Sheet: Acting as a financial snapshot, the balance sheet reveals a company's assets and liabilities at a particular point in time. It provides insights into the company's net worth and financial resilience.

Cash Flow Statement: A crucial tool for traders, it traces the journey of cash as it enters and exits the company. More than just profitability, this statement underscores the company's liquidity, showing how well it manages its cash resources.