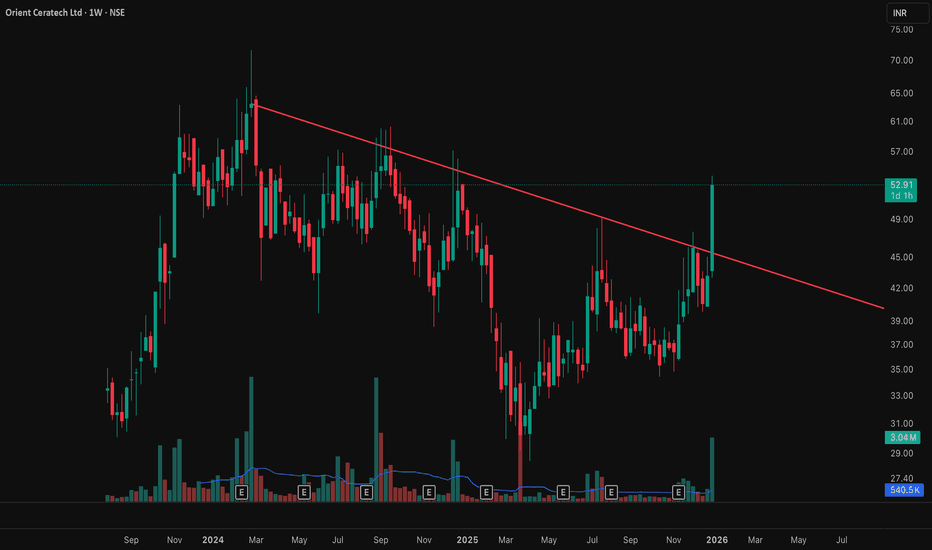

ORIENT CERATECH LTD - WEEKLY TRENDLINE BREAKOUT📊 ORIENT CERATECH LTD – Weekly Trendline Breakout Attempt 🔥

📅 Date: Jan 01, 2026

⏱️ Timeframe: 1W

💰 CMP: ₹52.51 (+21.64%)

📌 Exchange: NSE

🔍 Technical Structure Overview

Orient Ceratech has been trading under a long-term descending trendline, forming a broad consolidation / corrective phase after its previous rally.

Recent price action shows strong bullish momentum, with a high-volume bullish candle attempting to break above the falling trendline — a classic early sign of trend reversal.

This move becomes technically significant as it occurs after:

Higher lows formation

Demand stepping in near ₹32–35 zone

Strong weekly close near highs

🎯 Possible Scenarios

✅ Bullish Case:

Weekly close above ₹56

Retest and hold of breakout level

Targets: ₹65 → ₹72 → ₹80

⚠️ Caution Case:

Rejection near trendline

Sideways consolidation between ₹46–56

📌 Chart Summary

Orient Ceratech is at a critical inflection point on the weekly timeframe.

The stock is showing early trend reversal signals, supported by strong volume and price expansion. A confirmed breakout could open doors for a fresh medium-term uptrend.

⚠️ Disclaimer

This analysis is for educational purposes only. Not financial advice.

#weeklyanalysis

Market Year Wrap 2025 with Gary ThomsonMarket Year Wrap 2025 with Gary Thomson: Key Highlights and Outlook for 2026

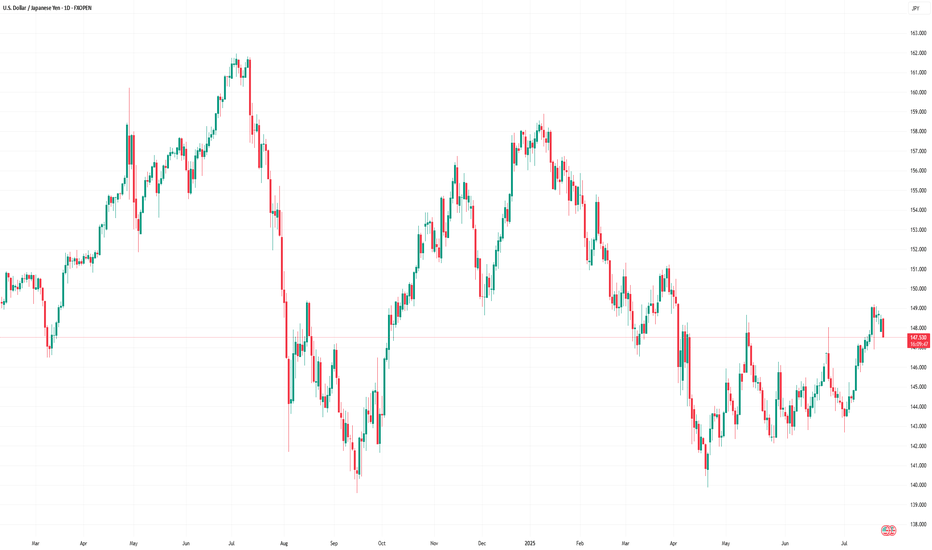

2025 was a year defined by policy shocks, geopolitical risk, and strong divergence across asset classes. From renewed trade wars to record-breaking equity and commodity moves, markets were repeatedly forced to reprice macro assumptions. Let’s recall the most critical events that had an impact across FX, equities, and commodities.

Key Highlights:

- FX Markets: Currency pairs were highly volatile throughout the year as persistent recession fears, weak and uneven macro data, contradictory monetary policy signals, and rising geopolitical tension triggered significant price swings.

- Equities: US equities experienced sharp volatility during the year. In April 2025, the implementation of broad tariffs triggered a large sell-off, marking the largest decline since the COVID crash of 2020. Despite this, equities recovered strongly. Expectations of easier monetary policy and resilient corporate earnings pushed major indices to record levels by year-end.

- Commodities: Precious metals were among the strongest performers of the year. Energy markets told a different story. Policy decisions and geopolitical dynamics played a central role across the markets.

Stay informed and ahead of the market with us!

Disclaimer: This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

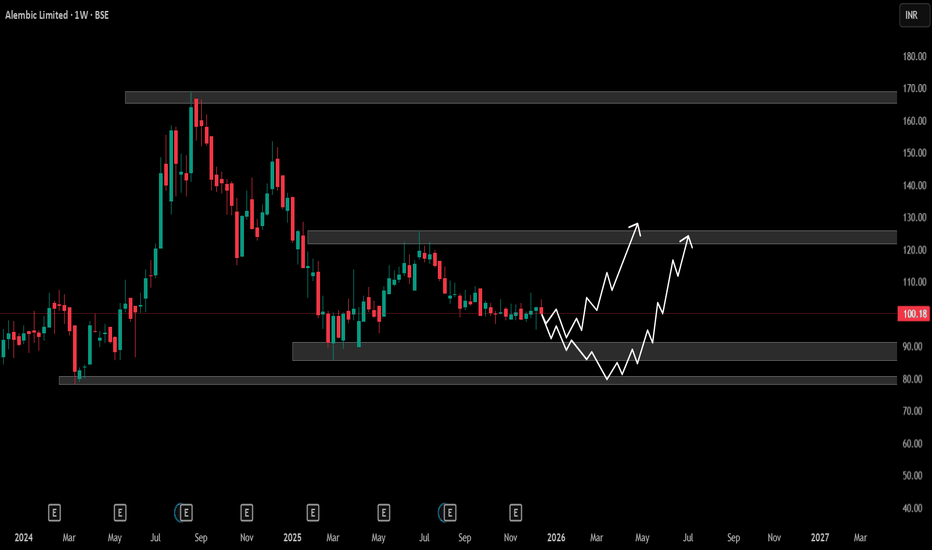

Alembic Limited – Weekly Chart Technical AnalysisMarket Structure

On the weekly timeframe, the stock has been in a broad consolidation phase after a sharp decline from the ₹160–165 supply zone.

Price is currently trading near ₹100, which lies in the middle of a long-term range, indicating indecision and low momentum.

Multiple rejections from higher levels suggest that sellers remain active near resistance zones.

Key Demand & Supply Zones

Major Support Zone: ₹80–85

This is a long-term demand area where strong buying previously emerged.

Intermediate Support: ₹90–92

Short-term support; loss of this level may accelerate downside.

Immediate Resistance: ₹120–125

Strong supply zone; price needs acceptance above this level for trend reversal.

Major Resistance: ₹165–170

Previous distribution zone and long-term supply area.

Price Action Outlook

As long as price holds above ₹80–85, the structure remains range-bound with accumulation potential.

A pullback towards ₹90–85, followed by strong bullish price action, can act as a base for medium-term recovery.

A decisive weekly close above ₹125 would signal a trend change and open upside towards higher resistance zones.

Until then, rallies are likely to face selling pressure near ₹120–125.

Bias

Neutral to mildly bearish below ₹120

Range-bound between ₹85 and ₹125

Bullish confirmation only on sustained breakout above ₹125

Disclaimer

This analysis is based purely on technical analysis and historical price behavior. It is provided for educational purposes only and should not be considered as investment or trading advice.

MOIL LTD – Weekly AnalysisTrend: Medium-term downtrend but approaching a major reversal zone.

Structure: Price still below falling trendline; momentum weak.

🟢 Strong Demand Zone: 260–285

Major support area.

Multiple historical reversals from this zone.

High probability of a bounce if price retests this region.

🔴 Resistance Levels

380–405: First major resistance. Expect selling here.

520–560: Long-term strong supply zone.

📈 Expected Move

Price likely to retest 260–285 zone.

If demand holds, a bullish reversal towards 380–405 is expected.

Sustained weekly close above 405 can open targets toward 480+.

⚠️ Invalid Scenario

Weekly close below 260 = bearish breakdown and deeper correction risk.

📌 Summary

Stock nearing a high-probability reversal area.

Watch 260–285 for accumulation + bounce setup.

First upside target: 380–405.

⚠️ Disclaimer

This is only for educational purposes, not financial advice. Use stop-loss and manage risk.

Week 48 Market Update — $SPXStrong week for the SP:SPX index. After two weeks of hesitation candles, price finally shifted back into strength and pushed decisively higher. This week’s candle not only reclaimed momentum but fully erased last week’s cooling-off behavior.

Price also moved well above the key mid-range levels that traders usually watch to define trend health. It’s now sitting firmly above the major risk zone and continues building distance away from it — a clear sign of strength. From the moment this week’s upside break triggered, the index has gained roughly 1.9%, and that kind of move typically translates into solid returns for options traders playing directional setups.

Major support zones sit lower around 5900, 5100, and the deeper structural support near 4000. As long as price holds above the upper layers of support, momentum remains intact.

On the higher-timeframe monthly chart, the trend has been active for eight straight months with no signs of exhaustion. Price is still far above the level where the monthly trend began, and even further above the long-term midline — showing how dominant the larger trend still is.

The 2-day chart continues to support the overall bullish structure, breaking above short-term levels and maintaining strength after multiple confirmations earlier in the week.

This week was a clean continuation of the broader uptrend — strong candle, strong momentum, and strong positioning above every major structural region.

Elite clarity. Elite precision. More coming soon.

QuantSignals V3: High-Confidence VIX DowntrendVIX QuantSignals Katy 1M Prediction (2025-11-19)

Current Price: $22.40

Trend: Bearish

Confidence: 75%

Volatility: 94.1%

Final Prediction: $20.98 (-6.34%)

30-Min Target: $21.10 (-5.81%)

Trade Signal:

Direction: PUT

Entry: $22.40

Target: $21.26

Stop Loss: $22.74

Expected Move: -6.34%

Summary: 1 trade signal generated from 1 successful analysis.

Weekly Outlook: XAUUSD, #SP500, #BRENT for 17-21 November 2025XAUUSD: BUY 4085.00, SL 4055.00, TP 4175.00

Gold enters the new week around $4,080 per ounce on Monday, November 17, 2025. The market focus is the release of the Federal Reserve minutes this week and the resumption of delayed U.S. macro data after the government pause ended: this shapes expectations for the future rate path and the dollar’s dynamics. Meanwhile, overall demand for gold is supported by sustained official purchases: according to the World Gold Council, central banks kept net buying elevated in Q3, and October marked a fifth consecutive month of inflows into gold funds. On the supply and alternative-yield side there are no notable new factors; 10-year Treasury yields remain near recent levels, which limits the cost of holding gold but does not negate safe-haven demand.

Fundamentally, the week looks moderately favorable for XAUUSD: the minutes may confirm a course toward gradual easing of conditions in 2026, while uncertainty in data and the geopolitical backdrop preserve interest in defensive assets. Risks for buyers include a tougher reading of the minutes and a stronger dollar; supportive factors include steady official purchases, continuing ETF inflows, and stable retail investment demand. In this environment, buying dips with a nearby loss limit is preferred.

Trade recommendation: BUY 4085.00, SL 4055.00, TP 4175.00

#SP500: BUY 6735, SL 6685, TP 6885

The S&P 500 starts the week near 6,734 at Friday’s close (November 14), while Monday futures trade modestly higher on expectations for key corporate earnings. The main catalyst is results from the leading producer of AI-focused semiconductors, viewed as a gauge of whether the investment cycle in AI and corporate capex continues. On the macro side, the Fed minutes and the return of several delayed indicators will help refine the monetary-policy path after recent rate cuts. Yields on 10-year U.S. Treasuries are holding around 4% with choppy swings, which does not add fresh pressure to equity multiples.

The weekly backdrop supports the benchmark: anticipated corporate drivers (AI investment, retailer reports as a read on consumer demand) and reduced data uncertainty as releases resume. Risks include softer guidance on AI capex, a jump in yields, or more cautious signals from the Fed minutes. The base case is a measured continuation of the uptrend if earnings resilience is confirmed and no negative surprises appear in the data.

Trade recommendation: BUY 6735, SL 6685, TP 6885

#BRENT: BUY 64.00, SL 61.80, TP 70.60

Brent crude on Monday, November 17, 2025, holds near $64 a barrel as the market digests the resumption of loadings at Russia’s Novorossiysk port after a brief halt while reassessing the global supply-demand balance. Recent assessments point to a growing surplus in 2025–2026: agencies note faster output growth alongside moderate demand, while OPEC+ signals readiness to manage supply flexibly against the backdrop of lowered official selling prices for Asia in December. At the same time, geopolitical risks and occasional disruptions periodically restore a risk premium, cushioning the pressure from oversupply.

This week, prices will be driven by news on OPEC+ discipline, stock/export data, regulator commentary, and the dollar’s path after the Fed minutes. The base balance is “moderately neutral” with elevated sensitivity to headlines: absent fresh signals of a larger surplus, the market tends to consolidate with potential for a recovery toward the upper end of the range as short positions are covered and risk appetite improves. Key risks to long positions are faster non-OPEC+ supply growth, softer Asian demand, and a lack of geopolitical premium in the news flow.

Trade recommendation: BUY 64.00, SL 61.80, TP 70.60

TSLA 1M AI Prediction📊 TSLA 1M AI Prediction – 2025-11-12

Current Price: $442.35

Trend: Neutral

Confidence: 55%

Volatility: 14.7%

Trade Signal:

Direction: Short

Entry Price: $442.35

Target: $440.50 (-0.52%)

Stop Loss: $448.99

Expected Move: -0.52%

30min Target: $440.31 (-0.46%)

Insight:

Katy AI predicts a small downward move in the short term

Low-moderate confidence; trade with proper risk management

Market trend is neutral, so position sizing should remain cautious

SKYGOLDLooks good on Chart.

Breakout Visible.

Above all key EMA.

Good for Short Term.

Target 410,500.

Do Like ,Comment , Follow for regular Updates...

Keep Learning ,Keep Earning...

Disclaimer : This is not a Buy or Sell recommendation. I am not SEBI Registered. Please consult your financial advisor before making any investments . This is for Educational purpose only.

Market Insights with Gary Thomson: 20 - 24 OctoberMarket Insights with Gary Thomson: Canada, UK & US Inflation, UK Retail Sales, Earnings Reports

In this video, we’ll explore the key economic events and market trends, shaping the financial landscape. Get ready for expert insights into financial markets to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

— Canada’s Inflation Rate

— UK Inflation Rate

— UK Retail Sales

— US Inflation Rate

— Corporate Earnings Reports

Gain insights to strengthen your trading knowledge.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

#Bitcoin Weekly Update !!#BTC UPDATE

#Bitcoin has printed a new weekly high, confirming the ongoing strength of the broader uptrend. Both the 21 EMA (yellow) and the 55 EMA (green) are trending upward, indicating that medium-term momentum remains bullish.

The key structural level to focus on is the former weekly resistance around $120,000, which Bitcoin has successfully broken above. As long as the price holds above this level on a closing basis, the bullish bias will remain intact.

If the breakout holds, the next potential target lies in the mid-$130K range.

However, if Bitcoin closes below $120,000, the move would be neutralized, potentially opening the door for a retest of the EMAs in the $112K–$114K zone.

For now, both the trend structure and EMAs suggest that the continuation of this bullish trend is likely.

Market Insights with Gary Thomson: 6 - 10 OctoberMarket Insights with Gary Thomson: FOMC Minutes & Powell’s Speech, Canada Jobs, RBNZ Rate Decision

In this video, we’ll explore the key economic events and market trends, shaping the financial landscape. Get ready for expert insights into financial markets to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

— FOMC Minutes and Fed Powell’s Comments

— Canada’s Unemployment Rate

— RBNZ Interest Rate Decision

Gain insights to strengthen your trading knowledge.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Weekly Market Wrap: Nifty, BankNifty & S&P 500 OutlookNifty closed the week at 24894, gaining 240 points from the previous week. The index made a high of 24904 and a low of 24587, once again respecting the range I mentioned last week — 25050–24250.

From the week’s low of 24587, we’ve seen a sharp bounce back toward 24900, exactly as projected.

Nifty Outlook for Next Week

For the coming week, I expect Nifty to trade between 25300–24500.

A breakout or breakdown beyond this range could bring some real fireworks

Bullish Scenario:

If Nifty sustains above 24900/24950 on Monday, we could see a rally toward 25300, supported by strength in Banking, Financials, and Metal sectors.

Bearish Scenario:

Below 24750, bears might get an opening to drag Nifty toward 24500 — though, as of now, that looks less likely unless global sentiment weakens.

⚠️ Caution:

While short-term momentum looks positive, the monthly and weekly charts of Nifty still lack strong bullish confirmation. Those waiting to capture a big 800–1000-point breakout move should be patient until we see a clear bullish crossover on higher timeframes.

Sector Spotlight: Metals

As mentioned last week, Metals continued to shine, with the Metal Index up 4% this week!

It also gave an all-time high weekly close above 10220, a key breakout level.

If it sustains above 10220 next week, the index can rally another 4% toward the next major resistance at 10709.

👉 Keep your eyes on metal stocks hitting new all-time highs (ATHs) — momentum could stay strong here.

BankNifty Update

BankNifty is forming a W pattern on the weekly timeframe — a strong bullish reversal formation.

Stay alert for potential breakouts in leading banking stocks, as they might fuel the next leg of the rally.

Global Cues – S&P 500

The S&P 500 gave an all-time high close at 6715, up 72 points from last week.

If it sustains above 6700, expect a move toward 6780.

For investors already long — move your trailing SL to 6560 to protect profits.

For those waiting to enter — 6568/6570 offers a better risk–reward entry zone.

Key Takeaways

✅ Nifty range for next week: 25300–24500

✅ Bulls need 24950+ for continuation; bears only active below 24750

✅ Metals remain the sector leader

✅ BankNifty W pattern could fuel the next upmove

✅ S&P 500 remains in a strong uptrend — global sentiment supportive

Back to 4H Frame – Fed & Inflation Shape Gold PathGold on the 4H timeframe is consolidating near premium supply after multiple liquidity sweeps. Recent U.S. inflation data kept the dollar resilient, while traders anticipate upcoming Fed commentary for clearer policy direction. Price rejected from the 3,795 supply pocket and is now retracing toward discount demand zones. Market structure suggests engineered sweeps below support before bullish continuation into Q4.

________________________________________

📌 Key Structure & Liquidity Zones (4H):

• 🔼 Buy Zone 3,692 – 3,694 (SL 3,685): Discount demand aligned with liquidity grab, ideal for continuation longs.

• 🔽 Sell Zone 3,795 – 3,797 (SL 3,804): Premium supply pocket where liquidity sweeps may trigger short-term rejections.

________________________________________

📊 Trading Ideas (Scenario-Based):

🔺 Buy Setup – Discount Demand Reaction

• Entry: 3,692 – 3,694

• Stop Loss: 3,685

• Take Profits:

TP1: 3,715

TP2: 3,740

TP3: 3,760+

👉 Smart money may engineer a sweep below 3,694 before reversing higher. Watch for bullish rejection patterns at demand.

🔻 Sell Setup – Premium Supply Reaction

• Entry: 3,795 – 3,797

• Stop Loss: 3,804

• Take Profits:

TP1: 3,780

TP2: 3,765

TP3: 3,750

👉 Short-term liquidity scalp opportunity against trend. Valid if price fails to break above breakout point.

________________________________________

🔑 Strategy Note

Bias remains bullish medium-term, but intraday sweeps into demand zones are expected as Fed officials continue to push cautious monetary guidance. Liquidity hunts around 3,795 supply and 3,694 demand will likely define the week’s volatility before a decisive breakout.

Market Insights with Gary Thomson: 22 - 26 SeptemberMarket Insights with Gary Thomson: US Durable Goods, GDP Final, PCE, Personal Income & Spending

In this video, we’ll explore the key economic events and market trends, shaping the financial landscape. Get ready for expert insights into financial markets to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

00:16 — US Durable Goods Orders

01:09 — US GDP Growth Rate QoQ Final

01:54 — US PCE Price Index, Personal Income & Personal Spending

03:00 — Trade Tensions

Gain insights to strengthen your trading knowledge.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Insights with Gary Thomson: 1 - 5 SeptemberMarket Insights with Gary Thomson: UK Retail Sales, Canada Jobs, US NFP, and OPEC+ Meeting

In this video, we’ll explore the key economic events and market trends, shaping the financial landscape. Get ready for expert insights into forex and commodities to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

— UK Retail Sales

— Unemployment Rate in Canada

— US NFP and Unemployment Rate

— OPEC+ Meeting

— Trade Tensions

Gain insights to strengthen your trading knowledge.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

UROY LongAnalysis

* Long accumulation phase formed a value area

* Maninpulation below the accumulation into weekly Fair Value Gap

* Subsequent initial distribution

* Pullback into equilibrium of the accumulation range and half way back measured move off the manipulation low

Trade Frame - Entry

* (Already partially at the pullback into the value area)

* Continuation of the bullish order flow on activation of the next weekly order block

Trade Frame - Profit targets

* At all time high

* 2 - 2.5 Standard deviations of the manipulation leg

Market Insights with Gary Thomson: 11 - 15 AugustMarket Insights with Gary Thomson: RBA Rate, US Inflation, UK Jobs & GDP, Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

— RBA Interest Rate Decision

— US Inflation Rate

— UK Unemployment Rate

— UK GDP Growth Rate

— Trade Tensions

— Earnings Reports

Gain insights to strengthen your trading knowledge.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Insights with Gary Thomson: 4 - 8 AugustMarket Insights with Gary Thomson: BoE Interest Rate, Canada Jobs Data & Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

— BoE Interest Rate Decision

— Unemployment Rate in Canada

— Corporate Earnings Statements

— Trade Tensions

Gain insights to strengthen your trading knowledge.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Insights with Gary Thomson: 21 - 25 JulyMarket Insights with Gary Thomson: RBA Minutes, BoJ Speech, ECB Decision, UK Sales, Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

— RBA Meeting Minutes

— BoJ Deputy Governor Uchida Speech

— ECB Interest Rate Decision & Press Conference

— UK Retail Sales

— Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Insights with Gary Thomson: 14 - 18 JulyMarket Insights with Gary Thomson: Inflation Rate in Canada, US, and UK, US PPI, Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

— Inflation Rate in Canada

— US Inflation Rate

— UK Inflation Rate

— US Producer Price Index

— Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Insights with Gary Thomson: 7 - 11 JulyMarket Insights: RBA Cut in Focus, UK GDP Weakens, Canada Jobs, FOMC Clues, Tariff Deadline

From rate decisions to rising unemployment and tariff deadlines, this week’s macro landscape is shaped by evolving dynamics and shifting momentum. If you’re trading FX, commodities, or indices — this is a moment to pay close attention.

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s biggest events:

— RBA Interest Rate Decision

— UK GDP Growth Rate

— Unemployment Rate in Canada

— FOMC Minutes

— Tariff Deadline

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Insights with Gary Thomson: 30 June - 4 JulyMarket Insights with Gary Thomson: Eurozone Inflation, US Jobs, ISM PMIs, ECB Forum Updates

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

— Euro Area Inflation Rate YoY Flash

— US Nonfarm Payrolls and Unemployment Rate

— US ISM Manufacturing and Services PMI

— ECB Forum on Central Banking

Note: U.S. markets may see thin trading ahead of the 4 July holiday, raising volatility risks.

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.