Gold Is Inside a Bearish Structure — Breakout or BrekdownPrice is respecting a descending trendline and trading below the EMA50, confirming a short-term bearish structure as momentum continues to weaken. The market is currently reacting near the 4,420–4,430 demand zone, where buyers are attempting to slow the sell-off.

A bullish reaction from this zone could trigger a corrective bounce toward 4,445–4,460, aligning with the trendline resistance and prior supply. However, this move is expected to remain corrective unless price can reclaim the EMA and break structure.

A clean break and close below 4,420 would confirm bearish continuation, exposing downside liquidity toward 4,400–4,395. Failure of the demand zone would likely accelerate selling pressure into the lower range before any meaningful reversal attempt.

A-trend

xauusd 2026-2027As of January 2026, the XAU/USD (Gold/USD) pair is coming off an extraordinary performance in 2025, where it saw gains of over 60%, the highest since 1979.The consensus among major financial institutions like J.P. Morgan, UBS, and Goldman Sachs is that the bullish momentum will carry through 2026, though the pace may become more volatile as it reaches new psychological milestones.

📊 Market Price Forecasts

Most analysts have significantly revised their targets upward following the record-breaking surge in late 2025.

Institution2026 Target (Year-End)Primary Outlook

J.P. Morgan $5,055 /ozBullish; driven by investor diversification.

Goldman Sachs $4,900 /ozBullish; structural demand from central banks.

UBS $5,000 /ozBullish; lower real yields and policy uncertainty.

Bank of America $5,000 /ozBullish; safe-haven demand remains high.

🔍 Fundamental Analysis

The 2026 outlook is anchored by several structural shifts in the global economy:1. De-dollarization & Central Bank DemandCentral banks—particularly in Poland, Kazakhstan, Brazil, and China—are no longer just "opportunistic" buyers; they are strategic diversifiers. While 2026 demand might not hit the 1,000-tonne-per-year peak of the previous three years, it is expected to remain high (averaging 750+ tonnes), providing a solid price floor.2. Monetary Policy & Real YieldsAs the Federal Reserve's easing cycle matures in 2026, real yields are expected to drift lower. Historically, gold thrives in the 4–6 months following initial rate cuts. Investors are increasingly viewing gold not just as a hedge against inflation, but as a hedge against rising global debt levels.3. Geopolitical Risk PremiumOngoing tensions in the Middle East and Eastern Europe, combined with new trade uncertainties (tariffs and domestic policy shifts in the U.S.), continue to drive "flight-to-safety" flows into XAU/USD.

📈 Technical Analysis

(XAU/USD)As of early January 2026, gold is trading near $4,400.The Bullish Channel: The weekly chart shows Gold moving within a well-defined ascending channel. A sustained break above $4,655 would confirm a move toward the $5,000 psychological barrier.Key Support Levels: If a correction occurs, the first major support sits near $4,255. A deeper correction could see a test of the $4,150 – $4,175 zone, which represents a strong "buy the dip" area for long-term investors.Momentum Indicators: The RSI is currently in overbought territory on higher timeframes. While this suggests strength, it also signals the potential for a "blow-out" phase or a sharp, healthy distribution (correction) before the next leg up.⚠️ Key Risks to the Bullish CaseWhile the trend is upward, traders should watch for:Strong Economic Rebound: If the U.S. achieves 6–7% growth with low inflation, the need for a safe haven diminishes.Policy Reversal: A "higher for longer" stance on interest rates by major central banks would increase the opportunity cost of holding non-yielding gold.Liquidity Squeeze: Sharp corrections in the equity markets can sometimes lead to temporary gold sell-offs as investors cover margin calls

Bitcoin - Compression Before Expansion?⚔️Bitcoin has been absorbing pressure above a rising base , with price holding firmly above the ascending blue trendline. Despite the prior selloff, bears are no longer able to push price lower, signaling structural strength building beneath the surface.

Price is now pressing against a key resistance band. This zone is acting as the final barrier between consolidation and continuation. A clean break and hold above this area would shift control decisively back to the bulls and open the door for a move toward the 100K psychological level and beyond.📈

🏹Until then, the bias remains cautiously bullish , with buyers clearly defending dips and preparing for a potential expansion phase.

Is this the calm before Bitcoin’s next leg higher?🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

AUDCAD - From Shorts to Potential Longs!!Earlier in this range, we sold 📉AUDCAD near the upper boundary, fading resistance as price showed clear exhaustion. That idea played out well, with price rotating back into the middle and now pressing toward the lower bound of the range.

This is where things shift.

⚔️As long as range support holds, the bias flips from selling rallies to looking for longs from support. In a well-defined range, edges matter more than direction, and the lower boundary is where buyers historically step in.

The plan from here is simple and disciplined.

No chasing. No guessing....

🏹If price holds above support and shows bullish reaction on lower timeframes, longs become valid back toward the range highs. A clean breakdown below support would invalidate this idea and put sellers back in control.

Range trading is not about prediction, it’s about location and reaction.

Will buyers defend the floor once again, or is this range finally ready to break? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

EURGBP - When Structure Breaks, Bias FollowsFor a while, EURGBP was respecting a rising blue broadening wedge, keeping the overall momentum bullish. That changed.

📉 Momentum has now shifted from bullish to bearish after price broke below the blue rising structure, signaling a clear loss of upside control.

Since then, price has been trading inside a falling red channel, confirming that sellers are in control for now.

🔍 What matters next:

As long as EURGBP remains below the broken structure and continues to trade within the falling channel.

Any pullback toward the upper bound of the red channel, and the previous structure low marked in red, will be considered a sell zone!

I’ll then be zooming into lower timeframes and looking for trend-following short setups.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Are Lower Highs Setting Up a Deeper Sell-Off?Hello traders! Here’s a clear technical breakdown of ETHUSD (1H) based on the current chart structure.

Ethereum has transitioned from a previously bullish environment into a clear bearish market structure, defined by a sequence of lower highs (LH) and lower lows (LL). After failing to sustain price above the recent swing highs, sellers stepped in aggressively, forcing a breakdown through multiple structure levels.

The sharp impulsive move lower confirms bearish momentum, while subsequent pullbacks have remained corrective, consistently forming lower highs beneath prior support now acting as resistance. This price behavior reflects a market that has shifted control decisively to sellers.

Key Supply / Structure Resistance:

The 3,130–3,150 region now acts as a critical supply zone, where previous support was broken and sellers have defended retracement attempts. This area is also aligned with the EMA, reinforcing bearish pressure.

Intermediate Resistance:

The 3,090–3,100 level represents a minor structure cap. Any pullback into this zone that fails would likely form another lower high.

Major Downside Demand / Liquidity Target:

The 3,020 area is the next significant demand zone, aligning with projected structure continuation and liquidity resting below recent lows.

Currently, ETH is trading after printing a fresh lower low, placing the market in continuation mode rather than exhaustion. Price is attempting a minor bounce, but as long as retracements remain capped below supply, this move should be treated as bearish corrective price action.

Momentum remains with sellers unless structure is reclaimed.

As long as Ethereum remains below the 3,130–3,150 supply zone, the bearish structure stays valid. Any pullback that stalls below this area is likely to form a lower high, opening the door for continuation toward the 3,020 demand zone and potentially lower if sell-side momentum accelerates.

A structural invalidation would only occur if price reclaims and holds above the broken resistance with strong bullish acceptance. Until then, rallies should be viewed as sell-side corrective moves, not reversals.

For now, the trend is down and controlled by sellers.

The trend is your friendHello everyone. I’m a financier and this is educational post that might help you get closer to consistent profitability (if you actually get the point).

Today I want to talk about trend trading. Yes - that very “best friend of a trader” that every book and every course keeps repeating. And after years in the market I can say: it’s not just a cliché - it really works.

I’ve been through plenty of strategies: classic TA, Elliott Waves, Smart Money Concepts, Williams’ trading chaos - you name it. I’ve traded with the trend, against it, and inside ranges.

Honestly, the results were average. My monthly win rate was about 30–40%. Not terrible, but I wanted fewer mistakes and more stability.

Eventually I set one hard rule for myself:

👉 I only trade in the direction of the trend.

And statistically, that mostly means trading the uptrend.

Here’s the logic. Any asset can drop around 99.99% - the downside is capped. But to the upside there is no limit. An asset can grow 2x, 5x, 10x and more. So statistically, longs are more favorable. I still take shorts when the market structure is bearish, but lately most assets are trending up.

So what’s the real advantage of trading with the trend?

The market has its own momentum. It’s simply easier to move with that flow than to fight it. I stopped trying to outsmart the market or predict every reversal. I don’t obsess over overbought/oversold signals. I just wait for my setup - the same repeatable scenario - and I trade it in the direction of the trend.

I’m a boring trader - and that’s exactly why I’m a profitable trader.

On social platforms my job is to share analysis and possible scenarios. But trading itself is different: the goal is not to predict, the goal is to execute. If the setup plays out - great. If not -no problem, I wait for the next one. I’m no longer a hostage to my own forecasts, which only kill objectivity.

Trend filters out a huge number of bad trades. It instantly removes about half of all random entries. After I really internalized that, my win rate improved, my psychology inside trades got much cleaner, less FOMO, less second-guessing. I stopped guessing - and started systematically executing.

So my takeaway for today:

👉 Trend really is your friend.

Try focusing only on trend trading and then tell me in the comments how it changed your results and mindset.

First 2026 Shot on #NZDUSD ?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #NZDUSD

⚠️ Risk Environment: High

📈 Technical Overview:

I'm Not a fan of it but , lets see . with a valid momentum Structure we can take it as a QuickScalp

🚀 Trading Plan:

• Wait for Momentum around key levels

• No chasing moves, let price come to you

• Manage risk aggressively, protect capital first

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

Gold - Control vs Patience… Who Wins Next?Gold hasn’t done anything crazy lately, and that’s exactly the point.

Zooming out, the structure is still bullish. Every dip so far has been met with buyers, and the market keeps printing higher highs and higher lows.

Right now, price is sitting inside what I like to call a decision zone. This is where the market usually pauses, shakes out impatient traders, and shows its real intention.

As long as we’re holding above this green zone, bulls are still in control. This looks more like a pause or reload than a reversal.

That said, if price loses this area and starts accepting below it, then the story changes... and a deeper correction would be on the table.

What do you think? Will Gold reload and continue higher, or is this where control shifts? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

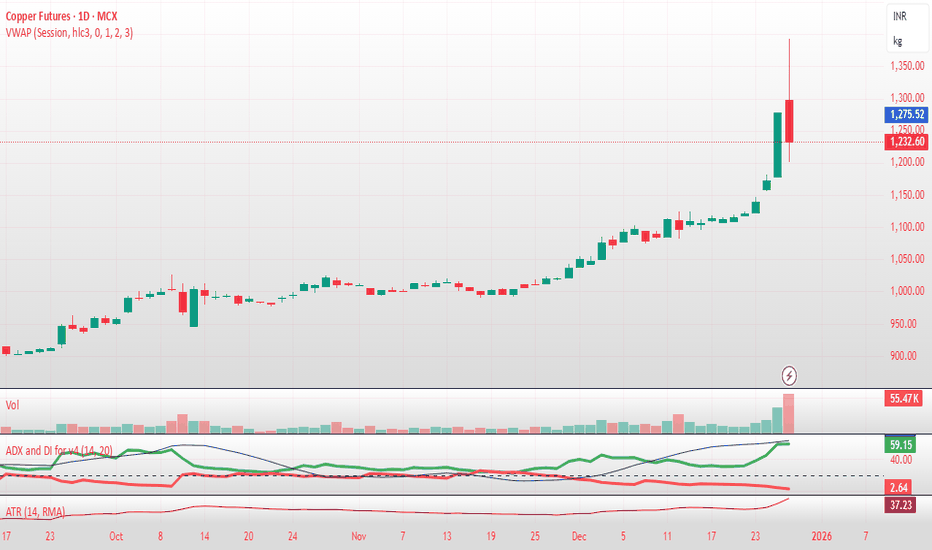

COPPER - The Metal No One Is Talking About… YetCopper just did something important, it broke above its previous all-time high. That alone puts it back on the radar from a macro perspective.

Structurally, the trend is clearly bullish. Price is respecting the rising trendline, and what we are seeing now is a normal post-breakout reaction, not weakness.

The plan from here is simple: 👇

i will be watching the intersection of the rising trendline and the prior structure zone. That confluence is where risk becomes defined and where trend-following longs make the most sense.

As long as price holds above structure and respects the trendline, the bullish thesis remains intact.

📊 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

AUDUSD (Short)The pair is still on a Uptrend its currently looking like its in the process of making a Higher Low, There is a good risk to reward trade presenting itself but it is Friday the last day of the trading week I don't like holding trades over the weekend but in this pair it is common for a weekly low or high to be set on Friday... Spreads suck especially on a sell order during market close or open the spread alone can hit your stop loss, so unless this trade is in profit by a big margin I don't recommend holding on Friday just my opinion from experience.

Update: IREN Limited (IREN) - structure beats emotionsIREN Limited operates in Bitcoin mining and AI cloud infrastructure, focused on renewable energy and scalable data centers. Mining is the core revenue driver, AI services are still small but growing fast.

On the daily chart, a falling wedge has been broken to the upside, followed by a clean retest. The structure is holding. Price is now sitting in a strong daily support zone at 36–38, aligned with the 0.618 Fibonacci level.

MACD is turning bullish on higher timeframes, and short- to mid-term moving averages are stabilizing. This looks like accumulation after a deep correction, not a random bounce.

By the end of 2025, IREN scaled materially.

Revenue grew from $184M in 2024 to roughly $485M in 2025.

Bitcoin mining remains the main contributor, while AI Cloud Services added about $16M and continue expanding.

Consensus estimates point to ~$230M revenue in Q2 2026. EPS is still negative, which fits a capital-intensive expansion phase.

As long as price holds 36–38, the market is pricing a move toward 50 → 60 → 70.

This is not a one-day trade. It’s a structural recovery setup.

The chart already did the talking.

BTC - Where the 2026 Bottom Might Actually FormLet me be clear from the start.

This is not about calling a bottom today.

It’s about comparing this cycle to the previous ones.

📉 From a structural point of view:

Price is trading below the key moving average, and as long as that MA is not reclaimed to the upside, the trend remains bearish.

At the same time, momentum confirms this view.

The MACD has flipped bearish, which historically marks the transition from expansion into a corrective cycle.

In previous BTC cycles, the real bottom never formed until both conditions were met:

- MACD flips back bullish

- Price reclaims the moving average

Until that happens, we stay in a bearish or corrective regime, even if price bounces short term.

🧠 Now zooming out.

When you compare this structure to prior cycles, Bitcoin tends to:

• Correct deeply

• Find support at prior major resistance

• Reset momentum near long term demand

• Then flip trend again

On this chart, that area is very clear.

The green zone around 55k to 65k aligns with:

• Previous cycle highs

• Strong historical demand

• The lower boundary of the long-term rising structure

If history rhymes again, this is where we would expect:

• Momentum to stabilize

• MACD to start curling bullish

• Price to eventually reclaim the moving average

⏳ Timing wise , based on previous cycles, this process usually takes time.

That points toward late 2026, roughly October and beyond, not before.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

AFTER CYCLE BTC WILL BREAK UP 100k+ - NEW BULLRUN ON WAYBased on the trend analysis around the $92K–$93K level, this zone could mark the beginning of a new bull run. If this target is reached and held, there is a high probability that BTC will enter a new upward cycle, potentially moving beyond $100K. The coming days are crucial for confirming the overall trend direction.

Before this, there could be manipulation trends, with a fake downtrend wick, but the Data shows that we are since the 80k+ still in the uptrend and cycle can get confirmed any time.

Gold Is Executing the Next Wyckoff LegGOLD (XAUUSD) – 30M STRUCTURE UPDATE

Price is confirming Wyckoff Phase C → D, with a clean breakout from Phase B.

Structure shows impulsive markup followed by controlled pullbacks — classic continuation behavior.

Price holds above EMA 34 & EMA 89, confirming trend strength and acceptance at higher levels.

The move labeled (1) → (2) → (3) reflects a healthy bullish sequence, not exhaustion.

Near-Term Path

Base case: Short consolidation / shallow pullback → continuation toward (5).

Invalidation: Only if price loses the EMA cluster and falls back into the prior range.

Bottom line:

Gold is not topping it is advancing in phases.

Patience favors continuation, not counter-trend trades.

GBPCAD - Trend Intact, Buyers Watching This Zone!!📈GBPCAD remains overall bullish on the higher timeframe, with price respecting a well-defined rising channel.

📹The key focus right now is the confluence zone where horizontal support aligns with the lower blue trendline. This intersection has already proven its importance in the past, and as long as it continues to hold, the bullish structure remains valid.

🏹From a trend-following perspective, this is the type of location where I’ll be looking for longs, not chasing price higher. The plan is simple: patience at support, confirmation on lower timeframes, and alignment with the broader uptrend.

Only a clean breakdown below this support–trendline intersection would weaken the bullish bias and force a reassessment. Until then, dips into this zone favor buyers.

Will this support fuel the next leg higher, or do sellers finally break the structure? 🤔📊

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Review and plan for 22nd December 2025 Nifty future and banknifty future analysis and intraday plan.

Few stocks.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

ETH Holds Support - Bulls Still in Play!?📈ETH has been trading within a rising broadening wedge pattern.

⚔️This week, price rejected the lower boundary of the structure.

🏹As long as the wedge remains intact, and ETH holds above the last major low at $2,750, a bullish continuation toward the upper boundary of the wedge remains the favored scenario.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr