Copper: Event-driven Trade Idea on Recent TariffsCOMEX: Micro Copper Futures ( COMEX_MINI:MHG1! ), #microfutures

The Event

On July 9th, President Trump announced that he would impose a 50% tariff on imports of copper, effective August 1st.

The decision was based on national security assessment. Copper is the second most used material by the U

Copper Futures

Sorry, this is only available to registered users

MCX provides data to our registered users only, so to get it you'll need to sign up for a TradingView account.

No news here

Looks like there's nothing to report right now

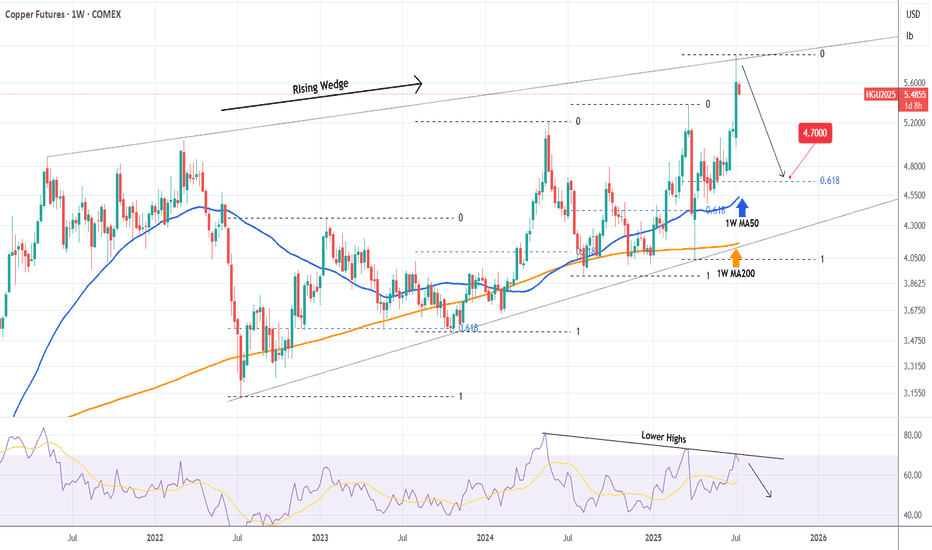

COPPER Top of 4-year Rising Wedge. Sell.Copper (HG1!) eventually followed the bearish break-out signal we gave on our last analysis (April 03, see chart below) and within 2 days it hit our 4.1250 Target:

Right now the price sits at the top of the 4-year Rising Wedge pattern and on the 1W time-frame it is a textbook technical sell sig

CShort

Tariffs Ignite a Copper FrenzyCOMEX copper has surged to a record premium over London Metal Exchange (LME) copper over the past few weeks, reflecting a lucrative arbitrage as traders rush metal into the U.S. ahead of looming import tariffs.

President Donald Trump’s announcement of a 50% tariff on U.S. copper imports (effective

CLong

Copper Cup & Handle Formation - Confirmed by Half-Yearly CloseIn a recent interview, Kevin Warsh, a former Member of Board of Governors Federal Reserve said: “External shocks like wars, pandemics, and supply chain disruptions may cause a spike in prices, that's not inflation. That's more like the weather. Inflation's more like the climate.

Weather refers to t

CLong

$COPPER triangle trade?CAPITALCOM:COPPER triangle has potentially printed and a triangle is an Elliot wave pattern that results in a terminal thrust up to complete a motif wave.

That would trap bulls as price terminates with a poke above the all time high keeping them believing they can capture the same gains already g

CLong

Copper - the hot topic this weekUS is planning to implement tariffs on copper imports at a scale of 50%. It's an interesting move, which might not make much sense. Let's dig in.

MARKETSCOM:COPPER

COMEX:HG1!

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when tra

Copper LongsBullish Bias for copper. Looking for daily BPR target, then possibly relative equal highs.

Ideally would like to pair a bullish weekly profile with longs. If the week opens lower first and delivers to a key level, thats favoring longs. So looking for Monday, Tuesday or Wednesday to create the low o

CLong

Bullish Reversal Builds in Copper: Eyes on $5.20 Resistance

The current price has closed above the Bollinger Band middle line (20-day SMA), indicating short-term upward momentum.

A sustained close above 4.90–4.95 could open the way to challenge the psychological level of 5.00 and possibly 5.20.

Immediate resistance: 4.95 → 5.00 → 5.20

Support zones: 4.7

CLong

MR. COPPER GOES FUN. WITH DONALD TRUMP — IT IS A BULL RUNCopper prices in 2025 are up about 27 percent year-to-date, driven by a complex interplay of technical and fundamental factors, with geopolitical events such as the Trump administration's tariff policies and the escalation of geopolitical tensions in the Middle East having a significant impact.

Fu

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Sorry, this is only available to registered users

MCX provides data to our registered users only, so to get it you'll need to sign up for a TradingView account.

Displays a symbol's price movements over previous years to identify recurring trends.

COPPERN2025

Jul 2025R

Can't show you this

COPPERQ2025

Aug 2025R

Can't show you this

COPPERU2025

Sep 2025R

Can't show you this

COPPERV2025

Oct 2025R

Can't show you this

COPPERX2025

Nov 2025R

Can't show you this

See all COPPER1! contracts

Frequently Asked Questions

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Copper Futures this number is 5.44 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Copper Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Copper Futures. Today its technical rating is strong buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Copper Futures technicals for a more comprehensive analysis.