Paypal Pretty nicely setupPaypal has be bucking the trend it seems, but in my view that looks like an ABC Flat correction, Not financial advice, but it provides excellent trade potential as the stop at the all time high is close by. Looking for 5 waves down, we will be able to squeeze out the structure and timing better as it forms, but April options make sense based on the pitchfork and algo target at the .236

Algorithm

Bitcoin at a cross roads area of $3888 Hi Guys,

I thought i would share a set up, I'm initially looking for a 4hr sell signal on Bitcoin from our Algorithm and then looking to get long for higher prices. I've created a crypto algorithm which will pick the trade live.

The next targets to the upside are $3,888.22 to $3,915 were I expect to see resistance.

The selloff could be back down to the $3,600 area again before another run higher towards $4,372 and then $4,655 and $4,829

I'll keep you posted as we go.

Cheers

Moss

Find and Trade the Winners....Not the Losers!!!Here is how I trade:

1. I find WINNING investments (aka: Above the 200 hour EMA)

2. I look for clear winning scenarios (aka: Low crossing stochastics)

3. I play the odds in my favor (aka: Using stop losses and take profit levels)

Way too many people have a pride for the economy. They think that it can never go down. They are almost insulted by the drops in the market. I look at things unbiased. I don't care what is going up. I don't care what is going down. I simply find what is going up and I trade that. I don't make things complicated. I don't buy into falling assets. I play this game with the odds in my favor.

You might LOVE NASDAQ:AAPL . But....right now they are getting smacked along with all of the other companies that people love. If you are a trader, why would you join the bloodbath?

Here is something good to think about:

Stocks move in trends and it is much more likely for a stock too continue in its current trend than too switch directions (this is a FACT. Think about it, the reversal happens every once and awhile while the trends occur all of the time).

So why are so many people out here trying to pick the reversals? Why do so many people buy into stocks that are clearly in bearish trends?

I think what I said above explains why so many people lose.

This is a game of probabilities. Play WITH the odds. Not against them.

It all comes down to whether you are in this for the long or the short term.

Long-Term Thinkers:

- Play with the odds

- Take their emotions out of it

- Have high win-rates

- Track their trades

- Make money

Short-Term Thinkers:

- Play against the odds in hopes of massive returns

- Get emotional and make rash choices

- Lose more than they win

- Think they are good traders since they don't track anything

- Lose money

It's your choice who you want to be.

Bitcoin Dives once again!!SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Bitcoin Dives once again !!

BITFINEX:BTCUSD continues on a further south direction. If it breaks the @4500 level and will see a further push towards the @3000 level. From my experience stay on the sidelines or short sell.

Follow your Trading plan, remained disciplined and keep learning !!

Please Follow, Like,Comment & Follow

Thank you for your support :)

This information is not a recommendation to buy or sell. It is to be used for educational purposes only!

Update idea

Beating Bitcoin buy and hold: 2600%* Active strategy vs. passive buy-and-hold (light blue line in backtest plot below).

* Includes Bitfinex fees (0.1%).

* Backtest plot is from 2017-01-03 until today.

* It is possible to reduce the drawdown by adjusting position size strategy and/or other parameters -- to get a smoother equity curve.

* No indicator or entry "repainting" is being done here; this is a common problem with some strategies here on TV.

* Send me a message if you're interested in development of automated trading of this and/or other strategies!

Works on other assets too!

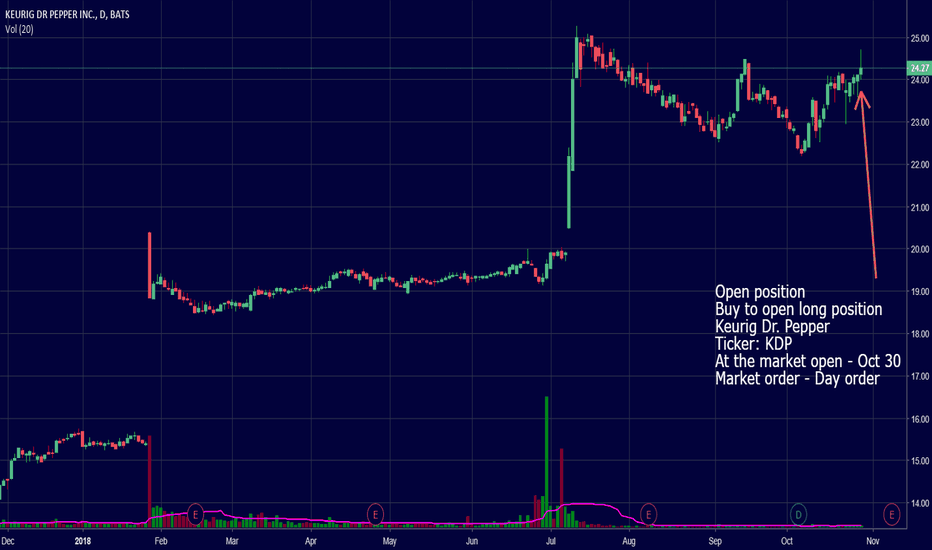

Signal from the equity algorithm for the market open Oct 30The equity trading algorithm opens a long position in KDP - Keurig Dr. Pepper stock.

BTC algo confluence, Elliot wave clarity to comeHere are the confluent algo zones, pattern targets and fib support. We can see 3 major clusters of likely support from the profits that algos take from their shorts, combined with the targets of the thrust from the potential elliot wave triangle(Needs to break the low to confirm) and the .786 fib retrace from the major wave structure and the next high volume node. If the triangle is confirmed here we would expect to complete this correction in one of two probable ways, 1) An impulse, looking for 5 waves, we would likely be working on the 1 wave of that sequence now, or 2) an ABC zig zag correction and we would be working on either the 1 of the A or the A itself. Elliot will have to be updated as we go, and will ultimately decide how we can get to some of those lower targets.

How could you have avoided the drop in the stock market?For many conspiracy theorists familiar with the cover of an edition of The Economist from 1988, the 10/10/2018 is significant for being the date when a new world currency will be ushered in. It seems instead the date that traditional stock markets come tumbling down, with DJI down 1,300 points over the past two days and many other stocks following suit.

China's 100-basis-point cut to their reserve requirement ratio is likely to inject about 109B$ into their economy and could devaluate their currency, thereby allowing China to make goods and services cheaper compared to the US. This could be a sign of China struggling against the US's aggressive trade policies. Any rattling of their economic growth is likely to effect markets globally, as it's the largest developing economy at the moment.

Not only this, but the Fed's decision to raise interest rates means that the rate of borrowing goes up which dips into the bottom line of companies that need to borrow to finance growth.

Higher rates restrict economic growth. This has made investors wary of markets at the moment and could be seen as reasons for the decline in the market. Saying that, it's too early to know whether or not we're officially in a downturn.

Anticipating, and acting, on this news is difficult and risky. It's hard to beat markets with this tactic. The big moves always happen after the fact, but the smaller movements in the markets beforehand create ripples and divergences that can be spotted quite easily with algorithms. -=Simplicity=- God Complex is one of those algorithms that anticipates big movements as opposed to reacting to them.

The chart above details the last 10 months of price-action against the DJI and if we assume an initial 10k trading position and compound the returns, then these are the results. These trades are without leverage too.

1st trade: +9.3% / 10930$

2nd trade: +5.73% / 11556$

3rd trade: -0.46% / 11503$

4th trade: +0.46% / 11555$

5th trade: breakeven / 11555$

6th trade: -1.22% / 11416$

7th trade: -1.01% / 11302$

8th trade: -0.88% / 11203$

9th trade: +1.23% / 11341$

10th trade: +0.65% / 11415$

11th trade: -0.24% / 11388$

12th trade: -0.9% / 11286$

13th trade: +1.54% / 11460$

14th trade: -0.94% / 11353$

15th trade: +1.18% / 11487$

16th trade: -0.44% / 11437$

17th trade: +1.83% / 11646$

18th trade: +4% / 12112$

That's a return of 21.12% with the biggest loss being recorded at -1.22%. If you had of bought and held, you would have made about 5%.

Don't react to news. Act before it.

---------------------------------------------------------------------------------

docs.google.com

Megalodon Trading - BTC - Long Term Bull - Short Term BearMegalodon Pro+ Short Term Isolators look like short term pull down.

--------------------------------------

Swing and day traders —> Look for 1D confirmation(green rectangle close) on Megalodon Pro+ Long Term Isolator. —> Look for 240 min & 60 min confirmation(green rectangle close) on Megalodon Pro+ Short Term Isolator.

1) Take the next red confirmation on the hourly if you believe the market state is bear.

2) Wait for daily confirmations(red rectangles) if you think market is more uppy.

Learn more about it on our website. Go to our TradingView profile for how to gain access.

--------------------------------------

MEGALODON PRO+ Long Term Isolator

Megalodon Pro+ is designed for longer term and shorter term investors.

Megalodon Pro+ is really simple to use.

Megalodon Pro+ combines 16 different back-tested indicators, that each have more than 66% win rate.

Megalodon Pro+ lets you turn on or off any setups that has been used for a better analysis.

Megalodon Pro+ works with any kind of market state, and any kind of asset.

Megalodon Pro+ can be used to set alarms as soon as a candle closes with a green or red bar.

Megalodon Pro+ has more features than any other indicator in the market, these features can also be turned off in the settings:

Looks for 12 different investing setups automatically and prints them out.

Shows 2 different viewing options: Setups View that shows how many bear or bull setups are currently formed, Isolator View that shows Megalodon Price, Volume and Momentum isolators.

Prints green or red bars for longer term signals.

--------------------------------------

MEGALODON PRO+ Long Term Isolator is designed for longer term and shorter term investors!

All you have to do is:

1- Apply it on any asset with 1Day time frame and combine it with 240minutes and 60 minutes Megalodon Pro+ Short Term Isolator.

2- Look for green bar confirmation on all isolators.

3- Define your stop losses.

4- Define your target before you enter.

5-Repeat

--------------------------------------

~Megalodon Trading~

Enlighten others