EURUSD H1 – Rejection at Resistance, Pullback Toward On the H1 timeframe, EURUSD has completed a clean impulsive leg up from demand, breaking the prior descending structure and confirming a short-term bullish shift. However, price is now stalling directly inside a well-defined resistance zone, where upside momentum has clearly weakened. The recent candles show hesitation and rejection rather than continuation a typical sign of profit-taking and short-term exhaustion, not a full trend reversal.

Structurally, this move looks like an impulse → corrective pullback sequence. The market has already delivered the expansion; what’s missing now is rebalancing. With price extended away from the EMA and failing to hold above the mid-level, a controlled pullback toward the 1.1700–1.1695 demand zone becomes the higher-probability scenario. This area also aligns with previous structure and dynamic support, making it the logical zone for buyers to step back in.

If price reacts positively at demand and forms a higher low, the bullish structure remains intact and another attempt toward the 1.1760–1.1780 resistance can follow. On the flip side, a clean break and acceptance below the demand zone would invalidate the immediate bullish thesis and open the door for a deeper correction toward the lower range.

EURUSD is not breaking down it’s cooling off after an impulse. Until resistance is decisively reclaimed, the market favors a pullback to demand first, with continuation only confirmed by reaction and structure, not prediction.

Analysis

ATH Under Pressure: Continuation or Distribution?Gold is currently trading at a critical inflection point near the All-Time High (ATH) after completing a strong impulsive rally from the lower accumulation zone. The bullish leg was clean and well structured, driven by sustained higher highs and higher lows, confirming strong buyer control throughout the advance. However, upon reaching the ATH region, price has begun to stall and reject, signaling that supply is actively responding at this premium area.

Structurally, the market is now compressed between two key forces. On the downside, the upper demand zone around 4,880–4,900 has already proven its importance, acting as a reaction level where buyers previously stepped in aggressively. On the upside, the ATH resistance band is capping price and preventing immediate continuation. This creates a classic decision zone, where Gold must either absorb supply and break higher, or fail and rotate lower.

From a bullish continuation perspective, a clean breakout and acceptance above the ATH zone would confirm that buyers remain in full control. In that scenario, the projected expansion toward the 5,100 target becomes technically valid, following range-expansion and momentum continuation logic. This would imply that the recent pause is merely consolidation before another markup phase.

Conversely, if price breaks decisively below the upper demand zone, the structure starts to resemble a potential Head & Shoulders distribution, as highlighted on the chart. A confirmed breakdown would likely trigger a deeper corrective move toward the lower demand zone around 4,730–4,760, where the broader bullish structure would be tested. As long as this lower demand holds, the higher-timeframe uptrend remains intact, but momentum would clearly shift from expansion to correction.

Key takeaway: Gold is not weak, but it is no longer in free-flow markup. This is a high-stakes area where confirmation matters more than prediction. Either the ATH breaks and opens the door to 5,100, or failure here leads to a controlled but meaningful pullback. Traders should stay patient and let price confirm direction before committing risk.

Pullback Into Demand After ATH, Trend Still ConstructiveOn the H1 timeframe, Gold remains in a strong bullish context despite the recent pullback. The market previously delivered a clean impulsive expansion, breaking structure and printing a new ATH, which confirms higher-timeframe bullish control. The current retracement should be read as profit-taking and liquidity rebalancing, not a trend reversal. Price is now reacting inside the key demand zone around 4,760–4,780, which aligns with the prior breakout base and sits well above the EMA 98 a classic bullish pullback into value. The sharp rejection wick into this zone shows buyers are still active, absorbing sell pressure. As long as price continues to hold above this demand, the structure remains intact and the move is best classified as continuation consolidation. From a price action perspective, the ideal scenario is sideways-to-higher rotation above demand, followed by a renewed push toward the ATH at ~4,888, and if momentum expands again, continuation toward 4,900–4,920 becomes technically reasonable. The projected green path on the chart reflects this expectation: higher low formation → reclaim momentum → breakout attempt. Invalidation is clear and clean: a decisive H1 close below the demand zone would signal acceptance back into the previous range and open a deeper pullback toward the gap / demand premium below. Until that happens, bias remains bullish with patience, not chase.

trend is still up, pullback is constructive, and this zone is where continuation setups are built not where fear should dominate.

“EURUSD Pulls Back — Structure Still Favors the UpsideEURUSD H1 — Bullish Structure Holds, Pullback Is Still Corrective

On the H1 timeframe, EURUSD remains in a bullish market structure, with price continuing to respect the EMA 98 and holding above a clearly defined support zone around the 1.1680–1.1700 region. The previous impulsive rally shifted structure to the upside, and the current price action is best interpreted as a corrective pullback, not a trend reversal.

The recent rejection from the local high near 1.1750–1.1760 shows short-term profit taking, but importantly, the pullback is overlapping and controlled, lacking bearish momentum. This type of retracement typically serves to rebalance liquidity and attract fresh buyers, especially while price remains above both the EMA and the demand/support zone.

As long as the support zone holds, the bullish scenario remains valid. A reaction from this area would likely produce another leg higher, with price targeting a retest of 1.1768, and if that level is broken and accepted, continuation toward higher highs becomes increasingly probable.

However, if price loses acceptance below the support zone and the EMA 98, that would invalidate the bullish continuation thesis and shift focus back to deeper consolidation or a range.

EURUSD is still in a buy the dip environment, not a sell-the-rally market. Bias remains bullish, with continuation dependent on support holding and momentum returning on the next push up.

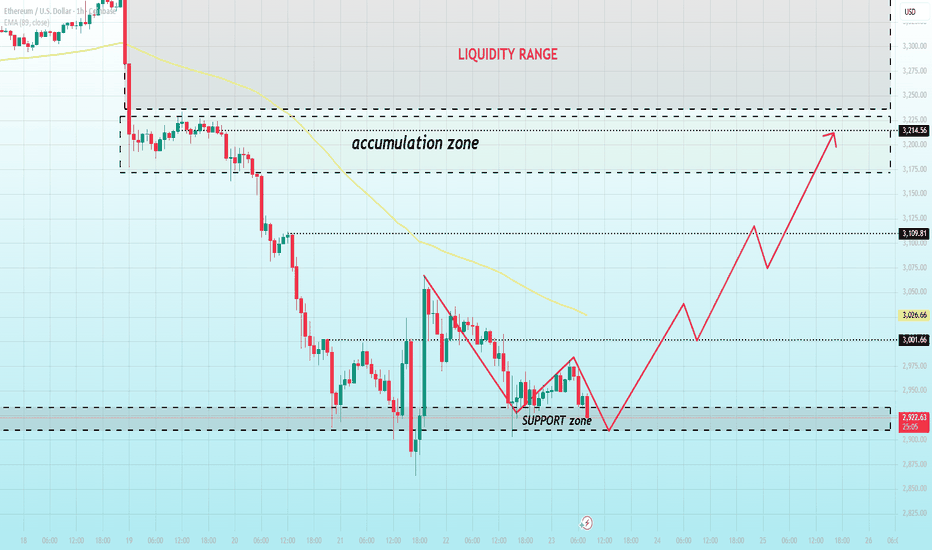

ETH After the Flush — Correction Phase or Just a PauseETHUSD H4 — Capitulation Complete, Is a New Impulse Wave Loading?

ETH on the H4 timeframe has completed a clear distribution → breakdown → impulsive sell-off, followed by a developing Elliott Wave corrective structure at lower prices. The prior accumulation range at the top failed decisively, triggering a strong bearish impulse that unfolded cleanly into a 5-wave decline (1–2–3–4–5), confirming a completed impulsive leg to the downside.

Price is now transitioning into a corrective phase, currently mapping out an ABC correction. Wave (A) has already formed with a sharp rebound from the lows, while the market is now probing for a Wave (B) retracement, likely into the lower liquidity pocket near the recent lows. This is typical post-impulse behavior, where the market retests demand to confirm whether sellers are exhausted.

The key technical detail here is that price remains below the EMA 98, which is still sloping downward a strong sign that macro control remains bearish. As long as ETH trades below this dynamic resistance, any upside move should be treated as corrective, not trend reversal.

If Wave (B) holds above the recent low and structure remains intact, the market opens the door for Wave (C) a corrective expansion targeting the 3,200–3,250 region, aligning with prior structure and the EMA zone. That area would be a high-probability reaction zone, not a blind breakout level.

Invalidation occurs if price loses acceptance below the Wave (B) low, which would signal continuation of the bearish trend rather than correction.

ETH has likely completed a bearish impulse and is now in a textbook Elliott Wave correction (ABC). Upside is possible, but it remains corrective until the EMA 98 and prior structure are reclaimed.

ES (SPX, SPY) Analysis Week of January 26-30, 2026ES FUTURES | Week of Jan 26-30, 2026 | FOMC + Mag 7 Collision

ES closed Friday at 6,914.50 — sitting at equilibrium ahead of the most catalyst-dense week of Q1.

KEY CATALYSTS

Tue-Wed: FOMC Meeting — 94% hold at 3.50-3.75%, Powell speaks Wed 2:30 PM

Wed AMC: MSFT, META, TSLA earnings

Thu 8:30 AM: Q4 GDP — Atlanta Fed nowcast 5.37% (HOT)

Thu AMC: AAPL earnings

Fri: PCE Inflation, Month-end flows

Wild cards: Fed Chair replacement speculation, Trump-Canada 100% tariff threat, Winter storm (150M affected)

SENTIMENT SNAPSHOT

VIX: 16.09 (complacent)

SKEW: 148 (hidden tail risk)

Put/Call: 0.76 (neutral)

AAII Bulls: 43% (elevated)

NAAIM: 88% invested

Credit Spreads: Tight (risk-on)

DIX: 45%+ (dark pool buying)

Margin Debt: $1.225T ATH

Read: Retail bullish, institutions hedging. Late-cycle but no crash signals.

KEY LEVELS

Resistance:

6,956-6,970 — PWH/PDH cluster

7,040 — 4H Strong High (90%)

7,100-7,150 — Fib extensions

Support:

6,892-6,907 — 1H Fibs

6,875-6,880 — Weekly EQ (key)

6,857-6,860 — PWL

6,820 — 1H Weak Low

TRADE IDEA — MONDAY

Bias: Long on dip

Setup: Buy pullback to 6,875-6,892 support cluster

Stop: Below 6,857

Targets: 6,911 then 6,948 then 6,970

Why: Pre-FOMC consolidation typical, strong breadth (65% beating SPX — 2nd best in 50 yrs), dips being bought, no bearish trigger until Wed.

Invalidation: Close below 6,857 or VIX above 20 sustained.

RISK FACTORS

Intel crashed 17% Fri — semi headwind

DXY collapsing (97.17) — policy uncertainty

Gold $5,044 / Silver $107 — safe haven bid

Hot GDP could trigger hawkish Fed repricing

SCENARIOS

Bullish (25%): Break above 6,970 targets 7,040-7,100

Range (50%): Chop 6,880-6,970 until Wed

Bearish (25%): Break below 6,857 targets 6,820-6,780

RESPECT THE RANGE UNTIL PROVEN OTHERWISE.

Good Luck !!!

Why Strategy Performance Depends More on Testing Than LogicTwo traders can trade the exact same strategy and walk away with completely different conclusions. One calls it profitable. The other calls it broken. Most of the time, neither is wrong.

The difference usually isn’t the strategy logic. It’s the testing.

Strategy logic explains why a trade might work. It tells a coherent story about market behavior, momentum, mean reversion, or trend. But logic alone doesn’t tell you how often that behavior holds up, how sensitive it is to small changes, or how it behaves when conditions shift. That’s where many disagreements begin.

Backtesting helps by expanding the sample beyond a single outcome. A strategy that looks reliable on one chart, timeframe, or parameter set may behave very differently when those assumptions are adjusted. Small changes in inputs, market regime, volatility, or timeframe can dramatically alter performance, drawdown, and consistency. Without testing across these variations, it’s easy to mistake coincidence for edge.

This is why strategy debates never really end. Each trader is often judging performance based on a limited slice of data. Within that slice, their conclusion feels justified. One trader may be looking at a period where conditions favored the strategy. Another may be looking at a period where those same rules struggled. Both are drawing conclusions from incomplete information.

Backtesting doesn’t exist to “prove” a strategy works. Its real value is in revealing distribution. It shows how often a strategy succeeds, how often it fails, and how fragile or stable it is when assumptions are changed. Robust strategies tend to exhibit similar behavior across a range of conditions. Fragile strategies depend heavily on specific settings or environments remaining intact.

This is also why optimization alone can be misleading. A strategy that produces exceptional results at a single configuration may collapse when slightly perturbed. Testing across broader parameter ranges helps separate genuine structural behavior from overfitting.

Logic still matters. Backtesting doesn’t replace it. But without testing, logic remains theoretical. With testing, it becomes contextualized. Performance stops being a story and starts becoming measurable.

Most disagreements in trading aren’t really about the market. They’re about how much of the picture has actually been tested.

NZDJPY – 4H | Bullish Structure Holds | Fundamentals SupportNZDJPY continues to trade within a well-defined ascending channel trendline support on the 4H timeframe, maintaining a clear sequence of higher highs and higher lows. Despite the recent rejection from the upper boundary, the broader trend structure remains bullish.

The move from recent highs has developed as a controlled pullback, with price rotating back into a key demand area aligned with the lower channel trendline support. This zone has repeatedly acted as structural support, and the current reaction suggests buyers are still defending the trend rather than exiting positions aggressively.

From a technical standpoint, price remains above rising structural support, keeping the bullish framework valid. There is no confirmed break in market structure at this stage, and momentum appears to be stabilizing following the corrective move and Next Potential terget's 'will be 94 and 94.500

Key Scenarios

As long as price holds above asending channel support, the bias favors trend continuation, with scope for a move back toward the previous high (HH) and potentially further upside within the channel.

A clean 4H close below the channel support would invalidate the continuation setup and shift focus toward a deeper pullback into prior demand and structure lows at 90.500

Fundamental Confluence (Macro + Domestic Alignment)

Fundamentals currently provide conditional support for NZD, adding confluence to the technical continuation scenario while keeping downside risks clearly defined.

1: Monetary Policy – RBNZ:

After completing an aggressive 325 bps easing cycle, the Reserve Bank of New Zealand has shifted to a neutral, data-dependent stance. While this is not an outright hawkish pivot, it strongly signals that the rate-cutting phase is likely paused for now. Markets typically interpret the end of easing as a relative hawkish shift, particularly versus currencies tied to prolonged accommodation. This reduces near-term downside pressure on NZD.

2: Global Risk & Trade Environment:

Recent developments have lowered near-term trade uncertainty. The U.S. decision to withdraw planned tariffs on several European nations, alongside the EU’s move to pause its proposed retaliatory measures, has reduced escalation risk in global trade. Historically, easing trade tensions support risk-on sentiment, encouraging carry flows into higher-beta currencies such as NZD, especially against funding currencies like JPY.

3: Positioning & Forward Risks:

CFTC data shows net speculative positioning in NZD declining for three consecutive weeks, suggesting positioning is more balanced rather than crowded. This keeps the upside constructive but not extended. Upcoming trade balance and business confidence data will be closely watched, as weak prints could undermine NZD and challenge the bullish technical structure.

Domestic (Endogenous) Economic Signals

Internal economic indicators point to a mixed but stabilizing backdrop, consistent with consolidation rather than deterioration:

Manufacturing activity and consumer confidence are improving, signaling strengthening domestic demand.

Retail sales and employment trends remain supportive, reinforcing labor-market resilience.

CPI remains elevated while PPI is easing , suggesting inflation pressures are moderating without collapsing demand.

Money supply and interest rates are declining, reflecting the lagged impact of prior easing rather than fresh accommodation.

Debt-to-GDP and budget-to-GDP ratios are improving, supporting longer-term fiscal stability

.

Services activity and building permits remain mixed, keeping policy expectations cautious rather than restrictive.

Overall, these domestic factors align with a neutral-to-constructive NZD outlook, reinforcing the case for trend continuation as long as global risk conditions remain supportive and Ris on Factor.

Technically, NZDJPY remains in a valid uptrend, with price reacting from structural support. Fundamentally, the environment supports NZD resilience with conditional upside, aligning with the buy-side bias while respecting clear invalidation levels.

Watching price action for confirmation.

Bias remains bullish while structure holds.

TheGrove | GBPUSD SELL | Day Trading AnalysisYou can expect a reaction in the direction of selling from the specified Breakout zone

GBPUSD moving higher as it tests the strong resistance area..

We expect a bearish move from the confluence zone.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity GBPUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

EURUSD: Trend Shift in Play as Buyers Defend Rising SupportHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD is trading within a broader bullish context after completing a corrective phase. Earlier, price moved higher inside a well-defined ascending channel, confirming strong buyer control with a clear sequence of higher highs and higher lows. After reaching the upper boundary of the channel, the market transitioned into a corrective bearish move, forming a descending channel that reflected temporary seller dominance rather than a full trend reversal. During this correction, price interacted multiple times with key structure levels, producing several breakouts and fake breakouts, which highlighted increased volatility and stop-hunting behavior. Eventually, EURUSD broke below the descending channel but failed to sustain downside momentum. Sellers lost control near the Support Zone around 1.1700, where price found strong demand aligned with previous structure and a rising support line. Buyers stepped in aggressively from this area, leading to a sharp bullish impulse and a confirmed breakout above the descending channel resistance. This breakout suggests a structural shift back in favor of buyers.

Currently, price is consolidating above the support zone and holding above the rising support line, indicating acceptance and strengthening bullish intent. Overhead, the market is approaching the Resistance Zone around 1.1780, which previously acted as a rejection area and remains a key level to watch.

My Scenario & Strategy

My primary scenario remains bullish as long as EURUSD holds above the 1.1700 support zone and continues to respect the rising support structure. A sustained move toward the 1.1780 resistance area is likely, with this level acting as the first target (TP1). A clean breakout and acceptance above resistance would confirm continuation and open the door for further upside.

However, if price gets rejected from resistance, a period of consolidation or a shallow pullback toward the support zone could occur before the next attempt higher. A decisive breakdown below the 1.1700 support would weaken the bullish bias and signal a deeper corrective move. For now, structure and price action favor buyers while support continues to hold.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

Bitcoin Buyer Zone Reaction Signals Potential Move to $90,500Hello traders! Here’s my technical outlook on BTCUSD (3H) based on the current chart structure. Bitcoin previously traded within a broader bullish context, supported by a rising trendline and a well-defined Buyer Zone around the 88,300–88,600 area. After a strong impulsive move higher, price entered a consolidation range and later formed a corrective descending channel, signaling a temporary pause in bullish momentum rather than an immediate trend reversal. During this correction, multiple fake breakouts occurred near the channel boundaries, highlighting indecision and liquidity grabs on both sides of the market. Recently, BTC broke below the descending channel support and briefly dipped into the Buyer Zone, where buyers reacted and defended the level. This area aligns with a key Support Level and prior structure, making it a critical demand zone to watch. The current price action suggests a corrective pullback within the larger structure, as the move down lacks strong impulsive continuation. Above price, the market is capped by the Seller Zone and Resistance Level around 90,500, which coincides with a previous breakout area and the underside of the former range. My scenario: as long as BTC holds above the 88,300 Buyer Zone and maintains higher lows from this support, the broader bullish structure remains valid. A sustained reaction from demand could lead to a recovery move toward the 90,500 Resistance Level (TP1). Acceptance and a clean breakout above this level would signal renewed bullish strength and open the path for continuation higher. However, a decisive breakdown and acceptance below the Buyer Zone would invalidate this scenario and increase the probability of a deeper corrective move toward lower support levels. For now, price is at a key decision point, with buyers and sellers actively battling for control. Please share this idea with your friends and click Boost 🚀

EURUSD Rejection From Resistance, 1.1630 Support in FocusHello traders! Here’s my technical outlook on EURUSD (4H) based on the current chart structure. EURUSD previously traded within a well-defined bullish channel, supported by a rising trend line and a sequence of higher highs and higher lows. This structure confirmed strong buyer control after price reversed from the broader base and pushed higher with momentum. During this bullish phase, price broke above a key Seller Zone around 1.1680–1.1700, confirming bullish continuation and acceptance above former resistance. The market then extended higher before momentum started to fade near the upper boundary of the channel, where price clearly turned around, signaling exhaustion from buyers. Following the top, EURUSD transitioned into a corrective phase, breaking below the ascending structure and forming a descending channel. This shift marked a short-term change in market control, with sellers gaining strength. Price respected the descending resistance line, producing lower highs and confirming bearish pressure. Several corrective pullbacks occurred, but each rally failed below the Resistance Level near 1.1700, reinforcing this area as a strong supply zone. Fake breakouts and quick rejections from this zone further highlight active selling interest. Currently, EURUSD has broken below the descending resistance line and is trading beneath the Seller Zone, suggesting that recent upside moves are corrective rather than impulsive. Price is now moving toward the Buyer Zone / Support Level around 1.1630–1.1600, which previously acted as a key demand area and structural reaction zone. This level is marked as TP1, where buyers may attempt to slow or pause the decline. My scenario: as long as EURUSD remains below the 1.1680–1.1700 Resistance Level and continues to respect the broader bearish structure, the downside bias remains valid. I expect price to continue lower toward the 1.1630–1.1600 Support Level (TP1). A clean breakdown and acceptance below this zone would open the door for a deeper bearish continuation. However, a strong bullish reaction and acceptance back above resistance would invalidate the bearish scenario and suggest a possible return to consolidation or trend recovery. For now, market structure favors sellers while price trades below resistance. Please share this idea with your friends and click Boost 🚀

EURUSD Deep Pullback ScenarioQuick Summary

EURUSD rallied strongly throughout the last week gaining more than 250 pips without a proper correction

A pullback is highly likely to rebalance the fair value gaps and the Key levels to watch are 1.17687 and 1.17189

A bullish reaction may occur after testing the second FVG due to inducement at that level

Full Analysis

After the strong upside movement on EURUSD throughout the week price rise more than 250 pips without performing a meaningful retracement

Such impulsive moves usually leave significant imbalance in the market which often leads to a corrective phase

Because of this a downside move is highly likely in order to rebalance the fair value gaps left behind

The first area of interest sits around 1.17687 while the second fair value gap is located near 1.17189

Price may continue lower until the second FVG is tested

This area holds additional importance because there is inducement present which can attract liquidity and support a bullish reaction

If price reaches this zone and shows strength it may serve as the base for the next upside continuation

BTC Reacts at Demand After Sharp Sell-Off Relief Bounce On the H1 chart, Bitcoin remains in a clear bearish short-term structure following the impulsive sell-off from the 93,000–93,500 resistance zone. That rejection marked the start of a strong markdown phase, with price breaking multiple minor supports and staying consistently below the EMA, confirming seller control. The move down was fast and directional, characteristic of distribution resolving to the downside, not a healthy pullback.

Price has now reached and reacted from a key support zone around 87,800–88,300, where downside momentum has visibly slowed. The strong rejection wick from this area suggests sell-side exhaustion, making a technical relief bounce reasonable. Current consolidation just above support indicates short-term balance after the impulse, rather than immediate continuation lower.

From a structural perspective, any upside at this stage should be treated as corrective. The first logical upside target sits near 90,200–90,500, followed by 91,200–91,300, where prior structure and the descending EMA align. The major resistance remains the 93,000–93,500 zone, and as long as price trades below it, the broader bearish bias remains unchanged.

Only a sustained reclaim above 91,300 would suggest a deeper corrective phase. A full bullish shift would require acceptance back above 93,000, which currently appears unlikely without a clear change in momentum.

In summary, Bitcoin is bouncing from strong demand after a completed markdown, making a short-term recovery plausible. However, until key resistance levels are reclaimed, this remains a relief rally within a bearish trend, favoring cautious longs and a continued sell-the-rally mindset for trend traders.

ETH Pauses at Key Support After Breakdown —Relief Bounce or TrapETH (1H) is still trading within a clear bearish structure, with price holding below the former accumulation range and remaining capped by the declining EMA. The sharp sell-off from the upper range confirms that distribution has already played out, and the market is now in the markdown → stabilization phase. Currently, price is reacting inside a well-defined support range around 2,900–2,930, where selling pressure has slowed and short-term bids are absorbing supply. This explains the sideways-to-slight-bounce behavior, but it should be read as technical stabilization, not a trend reversal.

As long as ETH stays below 3,180–3,230 (previous range low / resistance flip zone), any upside move is best classified as a corrective pullback. The projected bullish path on the chart only becomes valid if price can reclaim and hold above that zone with acceptance; otherwise, rallies into the 3,000–3,080 area are likely to face rejection from EMA and prior structure. Failure to hold the current support range would reopen downside risk toward 2,850 and lower, completing another bearish leg. In short, support is active but fragile the market is pausing, not flipping. Directional confirmation must come from either a clean reclaim of former structure above, or a decisive breakdown below the current support base.

Liquidity Compression Before FLY ? Key Support Holds the LineOn the H1 chart, ETHUSD is currently trading inside a well-defined liquidity range, following a sharp impulsive sell-off that transitioned the market into a controlled accumulation phase. After the aggressive downside move, price began compressing between clear upper and lower boundaries, signaling liquidity absorption rather than continuation selling. This behavior suggests that large players are building positions, not chasing price lower.

Structurally, the support zone around 2,920–2,950 is the most important area on the chart. Price has already reacted multiple times from this level, confirming it as a defended demand zone. Each reaction from support has been followed by higher internal lows, indicating selling pressure is weakening. Although ETH is still trading below the EMA, momentum loss on the downside and range compression often precede expansion, not continuation.

From a price-action standpoint, as long as ETH holds above the support zone, the current structure favors a range breakout to the upside, targeting the upper liquidity band around 3,100 → 3,215. A clean break and acceptance above the accumulation range would confirm bullish intent and open the door for a broader recovery move. However, if support fails decisively, price risks being pulled into a deeper liquidity sweep below the range.

Invalidation:

A strong breakdown and acceptance below 2,900 would invalidate the accumulation thesis and confirm bearish continuation.

ETH is not trending yet it’s coiling. This is a classic liquidity-building environment, where patience pays. Watch the support closely: hold = expansion higher, lose = continuation lower.

Bounce From Demand, Trend Still Bearish Until Proven OtherwiseOn the H4 timeframe, Bitcoin has completed a clear distribution-to-markdown transition. After failing to hold the prior range high around 95–96k, price compressed, broke structure, and accelerated lower confirming trend exhaustion and supply control. The impulsive sell-off that followed was not corrective in nature; it was a clean markdown leg, taking out multiple intraday supports and pushing price directly into a higher-timeframe demand zone around 87–88k.

At this location, the market is doing what it typically does after a sharp displacement: pause and react. The current bounce should be read as a technical reaction from demand, driven by short-covering and liquidity absorption not a trend reversal. Structurally, BTC remains in a lower-high / lower-low sequence, and any upside from here is best treated as a retracement into resistance, with key levels stacked around 91.9k → 93.3k → 95k (prior breakdown levels and supply).

As long as price fails to reclaim and hold above the 93–95k resistance band, the broader bias stays bearish, and the rally scenario remains corrective. A clean acceptance back above that zone would be required to invalidate the bearish structure. Until then, this is a sell-the-rally environment, with demand acting as a temporary floor not a foundation for continuation higher.

Bitcoin Is Coiling — Break the Box or Stay TrappedOn the H1 timeframe, Bitcoin is currently compressing inside a well-defined accumulation box after a sharp bearish impulse. The prior sell-off was impulsive and decisive, with price remaining below the EMA 98, confirming that the higher-timeframe bias is still bearish to neutral, not bullish yet. Inside the box, price action is overlapping, choppy, and rotational classic accumulation behavior where liquidity is being built rather than direction being confirmed. Multiple internal highs and lows are being absorbed, suggesting both buyers and sellers are active, but no side has taken control.

The key technical level is the upper boundary of the accumulation box near ~90,500. This level also aligns with:

- Prior breakdown structure

- Dynamic resistance from the EMA 98

- A clear liquidity pool above equal highs

👉 Bullish scenario:

A clean H1 close above the box and above EMA 98, followed by acceptance, would confirm a breakout. In that case, price has room to expand toward the ~93,200–93,300 target zone, where the next major resistance and liquidity sit.

👉 Bearish / neutral scenario:

Failure to break and hold above the box keeps BTC range-bound, with continued fake breakouts and stop hunts inside the range. Any rejection from the upper boundary would favor another rotation back toward the lower edge of the accumulation.

This is not a buy-the-middle environment. Directional trades only make sense after confirmation. Until a breakout occurs, BTC remains in accumulation, not trend.

ETHEREUM H4 — Decision Point Inside Premium DemandOn the ETH 4H chart, price has completed a full Cup & Handle expansion and topped at the pivot high before transitioning into a sharp corrective leg. The selloff was impulsive, not corrective, confirming that the move is a higher-timeframe pullback, not random volatility. ETH is now trading directly inside a premium demand zone, which is a critical decision area for the next multi-session move.

Structurally, this zone is important because it is the origin of the prior expansion leg. If demand holds and price forms a base here (compression, higher lows, failed breakdowns), ETH can re-accumulate and rotate higher toward Target 1 → Target 2 → Target 3, with the first key reclaim being the handle-low region and then the mid-range resistance. That scenario would signal absorption of sell pressure and continuation of the broader bullish structure.

However, if price fails to hold this demand zone and we see a clean breakdown with acceptance below it, the bearish scenario activates. That would confirm a distribution-to-expansion failure, opening the door for a deeper markdown toward lower liquidity levels, as projected by the red path.

ETH is at a make-or-break level. This is not the place to chase . it’s the place to wait for confirmation. Hold demand → bullish continuation. Lose demand → deeper correction. Let price show its hand before committing.

BTCUSDT Short: Lower Highs, Supply Rejection & Demand in FocusHello traders! Here’s a clear technical breakdown of BTCUSDT (2H) based on the current chart structure. Bitcoin previously traded within a broader bullish recovery phase, supported by a rising trend line that guided price higher from the lows. During this advance, BTC formed a consolidation range, reflecting accumulation before continuation. This range eventually broke to the upside, confirming buyer control and pushing price toward a major Supply Zone around 91,400. At this level, price reacted sharply, forming a clear pivot high and signaling strong seller presence. Following the rejection, BTC entered a corrective phase, trading within a short-term range near the highs before breaking down. After the breakdown, price lost the ascending demand line and confirmed a structural shift to the downside. Subsequent pullbacks failed to reclaim the broken structure, and former support acted as resistance, reinforcing bearish pressure. The move lower accelerated, bringing price back toward the broader Demand Zone near 88,600–88,700, which aligns with the long-term rising trend line and a key historical reaction area.

Currently, BTCUSDT is trading near this demand zone after a strong bearish impulse. This area is critical, as buyers may attempt to slow the decline or form a short-term base. However, until price shows a clear bullish reaction and regains broken structure, the downside risk remains.

My scenario: as long as BTCUSDT stays below the 91,400 supply zone and fails to reclaim the broken demand line, the bearish bias remains valid. I expect price to test and potentially react from the 88,700 demand area (TP1). A clean break and acceptance below this zone would open the door for a deeper correction. Conversely, a strong bullish reaction from demand followed by a reclaim of key resistance would weaken the bearish outlook and suggest a potential recovery. Manage your risk!

EURUSD Long: Buyers Step In After Bearish Structure FailsHello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current chart structure. EURUSD previously experienced a corrective bearish phase, trading inside a descending channel after forming a rounding top near the highs. However, this bearish structure has recently weakened. Price broke above the descending channel, signaling a loss of seller control and the beginning of a potential structural shift. After the breakout, EURUSD formed a pivot low and reacted strongly from the Demand Zone around 1.1690, which aligns with previous structure and acts as a key support area. This demand zone is now being defended by buyers, and the latest bullish impulse suggests that the breakout from the descending channel is valid rather than a fake move.

Currently, price is consolidating above demand and below the Supply Zone near 1.1760, indicating short-term compression after the breakout. This consolidation looks constructive, as price is holding above former resistance turned support and is not showing strong bearish rejection.

My scenario: as long as EURUSD holds above the 1.1690 Demand Zone and continues to print higher lows, the bullish bias remains valid. I expect buyers to maintain control and attempt a continuation toward the 1.1760 Supply Zone (TP1). A clean breakout and acceptance above 1.1760 would confirm bullish continuation and open the door for a move toward higher resistance levels. Manage your risk!

XAUUSD: Holds $4,770 Support With Upside Potential Toward $4,890Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold is trading within a well-defined bullish structure, supported by a clear ascending channel that reflects sustained buyer control. Earlier in the move, price respected the lower boundary of the channel and formed a sequence of higher highs and higher lows, confirming strong bullish momentum. During the advance, XAUUSD entered a consolidation range, signaling a temporary pause and accumulation before continuation. This range eventually resolved to the upside, reinforcing the prevailing bullish trend. After the breakout, price experienced a brief corrective move, including a fake breakout to the downside, which was quickly absorbed by buyers. This false break further validated underlying demand and led to a strong impulsive move higher back into the channel. Most recently, Gold broke above a key intraday resistance and successfully retested the former resistance as support near the 4,770 Support Zone, confirming acceptance above this level.

Currently, XAUUSD is trading above support and pushing toward the upper boundary of the ascending channel. Price is approaching a major Resistance Zone around 4,880–4,890, which aligns with the channel high and represents a critical reaction area where profit-taking or short-term selling pressure may appear.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the 4,770 support zone and continues to respect the ascending channel structure. A sustained move and acceptance above the 4,890 resistance would confirm continuation toward higher levels within the channel.

However, rejection from the resistance zone could lead to a short-term consolidation or a corrective pullback toward the 4,770 support area before the next attempt higher. A clear breakdown and acceptance below support would weaken the bullish bias and signal a deeper correction. For now, market structure and momentum favor buyers while price remains supported above key levels.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD Ascending Channel Holds, Upside Toward $4,950Hello traders! Here’s my technical outlook on XAUUSD (1H) based on the current chart structure. Gold is trading within a well-defined bullish structure, supported by a rising price channel formed after a clear shift in market control from sellers to buyers. Earlier on the chart, price respected the ascending support line, creating higher lows and confirming sustained buying pressure. This gradual advance led to a consolidation phase, where price formed a clear range, reflecting temporary balance before continuation. Following the range, XAUUSD broke out to the upside, confirming trend continuation. This breakout was supported by a clean impulse move and acceptance above the former range high. After the breakout, price successfully retested the Buyer Zone around 4,820, which aligns with the prior resistance turned support and the lower boundary of the bullish channel. This area is acting as a strong demand zone, where buyers are actively defending the structure. Currently, price is moving higher within the ascending channel and approaching a key Resistance Level and Seller Zone near 4,950. This zone represents a major upside objective and a potential area for profit-taking or seller reaction. The bullish momentum remains intact as long as price holds above the Buyer Zone and respects the rising support line. My scenario: as long as XAUUSD stays above the 4,820 Buyer Zone, the bullish structure remains valid. Continued strength could drive price toward the 4,950 resistance level (TP1). A clean breakout and acceptance above this seller zone would open the door for further upside continuation. However, a decisive rejection from resistance could lead to a corrective pullback toward the Buyer Zone. A breakdown below support would weaken the bullish bias and signal a deeper correction. For now, the market structure favors buyers while price remains supported within the ascending channel. Please share this idea with your friends and click Boost 🚀