#GBPUSD TradeNow that we had our potential reversal move (short term) . We should continue to the bullish trend and continue to take out old highs. If the pullback remains above the 0.5 Fibonacci level this will let me know that the trend still strong to the buyside. If it falls below the 0.5 simply means the trend is getting weaker. The Fibonacci 0.8 Level is a very strong area; it will be though to break that zone unless is caused by a red folder news tomorrow. So, my bias for this pair is bullish, but price perhaps fall to the 0.8 Fib level if the 0.5 - 0.7 levels isn't strong enough. Theres also and order block between the 0.8-1 Fibonacci level making the 0.9 Fibonacci level the sweet spot. A quick sell in order to buy by the market maker, so price will eventually target this area but for now, i see that we are targeting new highs we need more conformation, and this usually happens when we get closer to the Open Session of London . I will put the Risk to reward tool just for educational purpose and opportunity i will put one for current price and one more conservative position which is a pending buy limit around 1.34450.

AND

MNQ (15m) POI Map — Why These Levels Matter and how to use themMNQ (15m) POI Map — Why These Levels Matter (and how I’m using them)

I don’t like “winging it” once the market starts moving fast. So before the session (or during quieter pre-market hours), I mark **Points of Interest (POIs)** that I expect price to **react from**—either as support/resistance, liquidity targets, or “decision zones” where bias can flip.

These POIs are not magic lines. They’re **locations where order flow has already proven itself**, and where I want to be *ready* instead of *surprised*.

---

## How I chose these POIs (my filter)

Each POI on this chart was mapped using 3 things:

1. **Structure (15m swings / pivots)**

Where price previously *broke structure* or *rejected hard*.

2. **Liquidity (obvious targets)**

Equal highs/lows, clean swing points, and “everyone sees it” areas where stops sit.

3. **Reaction history (clean reactions)**

Levels that have already caused a noticeable bounce, stall, or reversal = worth respecting again.

---

## The Levels (Bull POIs)

### **BULL POI #1 — 25,810.50**

This is my **first decision level** in the current zone. It’s the closest “line in the sand” where:

* Holding above it keeps bullish continuation alive

* Losing it opens the door for a rotation back into the lower POIs

**How I use it:**

If we tag this area and **hold/accept above** (strong bodies, wicks getting bought, reclaim after a sweep), I’m looking for longs targeting the next POI up.

---

### **BULL POI #2 — 25,874.25**

This one is a **higher pivot / reaction zone**—the type of level where price often:

* pauses to consolidate

* rejects for a pullback

* or breaks through and turns into support

**How I use it:**

If price is trending up, this is a logical **first major target** and a spot to either scale profit or look for a clean break-and-retest to continue.

---

### **BULL POI #3 — 25,927.00**

This is a **liquidity + swing area**. It’s the kind of level that’s attractive for:

* stop runs above prior highs

* profit-taking

* reversal setups if momentum stalls

**How I use it:**

I treat this as a “reaction expected” level. If we arrive with weak momentum, I’m cautious chasing longs into it.

---

### **BULL POI #4 — 25,949.25**

This is my **upper extreme POI**—usually a bigger “decision area” where:

* late longs get trapped if momentum dies

* reversals can form (especially after a sweep)

* or we get continuation if the tape is strong

**How I use it:**

I’m more likely to **take profit into this** than initiate fresh longs unless the market is clearly in expansion.

---

## The Levels (Bear POIs)

### **BEAR POI #1 — ~25,754 zone (25,754.25 on my map)**

This is my **bearish trigger / pivot**. If price loses Bull POI #1 and continues lower, this becomes the next major “prove it” level.

**How I use it:**

If we break down into this area and **reject** (heavy wicks, failed reclaim), I’ll look for continuation shorts toward the next bear POIs.

---

### **BEAR POI #2 — 25,649.75**

This is a deeper **demand/reaction pocket**—a level I expect price to *respect* or at least *pause* at.

**How I use it:**

This is a common “bounce zone.” If shorts are in profit, I’m scaling here. If we sweep it and reclaim, I’m watching for reversal setups.

---

### **BEAR POI #3 — 25,622.25**

This is the **lower extreme / liquidity pool** level—where panic moves can exhaust and snap back.

**How I use it:**

I’m not trying to short *into* this level late. This is where I expect **either**:

* a final flush and reversal attempt

**or**

* a strong breakdown continuation (if the day is truly risk-off)

---

## The whole point of mapping POIs

These levels give me a simple plan:

* **Hold above Bull POI #1 → bullish bias stays active**

* **Lose Bull POI #1 → expect rotation to Bear POI #1**

* **Each POI is either a target, a reaction zone, or a bias flip zone**

I’m not predicting. I’m preparing.

---

## Execution Rules (what I wait for at a POI)

At any POI, I want confirmation like:

* **Sweep + reclaim** (liquidity grab then strong close back through)

* **Break + retest** (clean structure change)

* **Rejection candles** (wicks + follow-through away from the level)

* **Acceptance** (multiple closes above/below = level flips)

Then I manage risk using a simple concept:

**Invalidation goes just beyond the POI. Targets are the next POI.**

---

### If you’re using my tool stack:

These POIs pair well with:

* **ORB direction/bias**

* **VWAP/EMA context**

* **Reversal confirmations** (only when the POI + context agree)

---

**Not financial advice. Futures are high risk—size accordingly and protect your downside.**

If you want, I can turn this into a cleaner “TradingView publish-ready” format with a tighter intro + bullet layout, and add your usual TRADESWITHB call-to-action at the end.

ETH/USD - BUILDING MOMENTUM FOR NEXT BULLISH LEGOn the 15-minute ETH/USD chart, we can clearly observe that price action has shifted into a bullish structure after forming a strong impulse move from the lower demand zone. The market respected the higher timeframe liquidity area around 4,140 – 4,150, where buyers stepped in aggressively, creating a solid base for the upward push. From there, a clean series of higher highs and higher lows started to establish, indicating strong bullish momentum in play.

Currently, ETH is respecting the ascending trendline that has been guiding the price upward. Each retest of this trendline has been met with bullish rejections, confirming that buyers remain in control. The price is now consolidating just above the minor supply-turned-demand zone near 4,170, which shows that the previous resistance has flipped into support — a positive sign for continuation.

If the price manages to sustain above this intraday support and trendline, we can expect a potential continuation toward the upside target. Any minor pullback into the demand zone would likely attract buyers again, keeping the bullish structure intact. As long as price stays above the 4,160 zone and does not break below the trendline with strong bearish candles, the bias remains bullish.

Overall, the structure suggests that ETH is preparing for another leg higher, with the projected target in sight. Traders should monitor the price behavior around the support and trendline for confirmation before entering, as clean candle closures above these levels will add confidence to the bullish scenario.

Gold setup indicates a fall ahead – Stay alert, traders!This is the 15-minute chart of GOLD1!

Gold is moving in a well-defined parallel channel and currently respecting the LOP resistance zone at 109750–109850.

The channel’s lower boundary near 108650 may act as short-term support.

If Gold breaks down below this support, the projected downside target is near 107750.

In case of range-bound movement, the ideal sell zone remains at the LOP (109750–109850).

If this resistance level sustains, Gold may fall and test the lower targets.

Additionally, a Head & Shoulders pattern has formed within the channel, with its downside target aligning with the channel projection.

Thank you.

GBPUSD at make or break level ahead of a split BOEThe BOE faces a pivotal moment as it prepares to announce its latest interest rate decision.

With MPC members split between hawkish concerns about stubborn inflation and dovish worries over a weakening job market, expectations are swirling about the path forward.

Will the BOE signal a pause after this cut, or will inflation surprises force a more cautious, hawkish stance going into the end of the year?

Traders are watching for clues in the updated forecasts, as even a minor shift could spark major volatility in GBP/USD.

If the BOE sounds hawkish—maybe they raise their inflation forecasts, or the vote split shows strong resistance to further cuts, or they signal a pause in easing—then GBPUSD might have found a bottom for now.

On the flip side, if the BOE puts more emphasis on economic risks, reduces its GDP outlook, or if the vote split shows a strong push for even bigger cuts, then the pound could come under pressure.

On the charts, Cable is clinging to 1.3375, with a potential developing head and shoulders pattern threatening a deeper move lower if the neckline breaks.

Will the upcoming BOE decision be the make-or-break catalyst for the pound?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Yes the chicken man - PPC Short?PPC is at the bottom of a monthly box and at VAL of the daily and weekly anchored volume profile. It could catch a bid here and retest $45.60s(VPOC).

If the retest ends in a rejection of that area, and a daily close below the previous low around $41.95 then I expect short continuation and validation of the H&S.

I would especially like this trade after a retest and rejection of box bottom around $43.41 - $43.30.

My targets would be 40.11, 38.98, 37.27,35.96 then 33.72.

XAU/USD Intraday Plan | Support & Resistance to WatchGold tested the $3,674 resistance yesterday before pulling back to the $3,620 area, where the 50MA provided dynamic support. Price is now trending around $3,646, attempting to recover from the pullback.

For bulls to regain control, we need a clean break above $3,658, which would open the path toward $3,674, followed by $3,690, and an extension to $3,706.

However, a rejection at $3,658 resistance could trigger a deeper pullback into lower support levels.

📌Key Levels to Watch:

Resistance:

$3,658

$3,674

$3,690

$3,706

Support:

$3,644

$3,630

$3,617

$3,594

$3,564

📌 Fundamental Focus – Sept 10

The fireworks start today with U.S. inflation data. Core PPI and PPI figures will be released this afternoon, kicking off a packed midweek that continues with CPI tomorrow and ends with Consumer Sentiment & Inflation Expectations on Friday.

⚠️ Expect volatility to pick up from today onward, with sharp moves likely around each release.

Risky NZDUSD Trade RecapThis setup wasn’t the cleanest, but sometimes calculated risk pays off.

📉 Setup:

Price was in a clear downtrend, making this buy counter-trend.

Demand zone around 0.5818 offered a possible bounce.

Break of the descending trendline gave early confirmation.

✅ Entry: 0.58189

❌ SL: 0.57964

🎯 TP: 0.59420 – 0.59490 supply zone

📊 Outcome:

Despite the risk of fading the trend, price respected demand, broke structure, and ran straight into my supply target at 0.5940+ for full profits.

⚠️ Not every trade will be textbook perfect — but with proper risk management, even the risky ones can pay off.

#NZDUSD #ForexTrader #RiskManagement #RiskyTrade #PriceAction #SmartMoneyConcepts #ForexJourney #MarketStructure

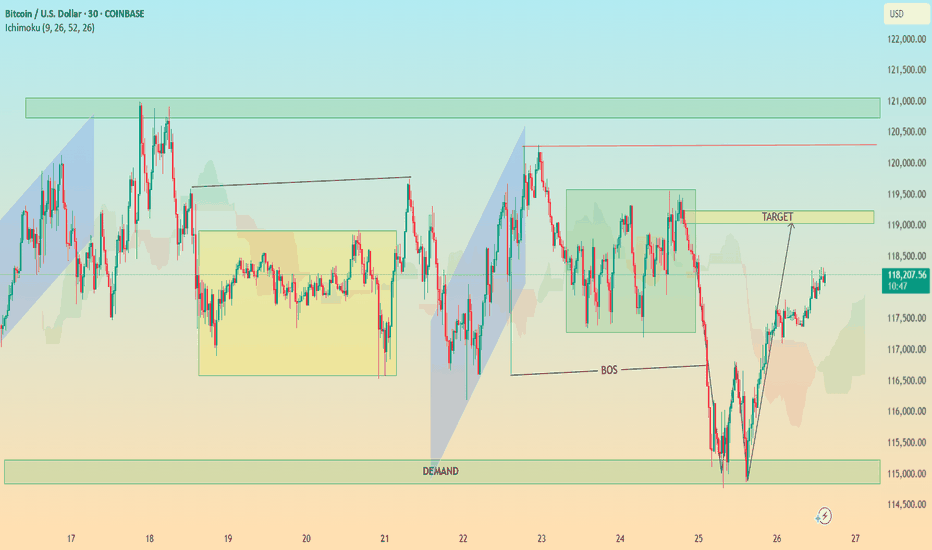

BTC In-Depth Technical Analysis: BTC/USD (30-Min Chart)🔍 In-Depth Technical Analysis: BTC/USD (30-Min Chart)

🟩 1. Demand Zone Reaction

Location: ~$114,500 – $115,500

Significance:

Price sharply reversed after a strong move into this demand zone.

This zone coincides with a liquidity grab below previous lows — textbook Smart Money trap.

Volume (if checked) would likely spike here, indicating institutional interest.

✅ Interpretation: Institutional demand stepped in, absorbing sell orders and triggering a reversal.

📉 2. Break of Structure (BOS)

Zone: Around July 24–25

Price broke below a key higher low, signaling temporary bearish structure.

However, this was quickly reclaimed after demand zone reaction — suggesting a fakeout BOS or a liquidity sweep.

✅ Interpretation: BOS caused shorts to enter, but reversal suggests a bear trap and continuation higher. The BOS served to fuel a more aggressive bullish rally.

🎯 3. Target Zone

Marked Target: ~$118,900–$119,200

Why This Area?

It aligns with a previous consolidation zone / supply before the sharp drop.

Also overlaps with Ichimoku cloud resistance and previous highs — strong confluence.

✅ Interpretation: Price is likely to face resistance here. If broken with strong momentum, bullish continuation to the next supply zone (~$121K) is possible.

⛓️ 4. Market Structure Analysis

Higher Lows Forming after demand reaction.

Price is forming a bullish market structure with an ascending wave pattern.

A break and retest of the $119K zone could lead to a mid-term rally.

Failure to break could result in:

A pullback to the $117,000 area

Or a deeper retest of the demand zone

✅ Trading Plan Options:

Bullish Bias: Buy pullbacks above $117,000 with $119,000 as target

Bearish Bias: Wait for strong rejection at $119,000 to short back to $115K

☁️ 5. Ichimoku Cloud Insight

Price has moved above the cloud, suggesting momentum shift to the upside.

The cloud is twisting bullish, supporting short-term bullish trend.

However, flat Kumo tops around $119K = likely rejection zone.

✅ Interpretation: Ichimoku confirms bullish potential, but price must close above the cloud + $119K zone to sustain trend.

📌 Key Takeaways for Publishing

Chart Idea Title:

“BTC/USD Demand Zone Reversal | Break of Structure & $119K Target in Sight”

Summary Description:

Bitcoin has reclaimed bullish momentum after a sweep into the $115K demand zone. A break of structure triggered shorts, but demand absorption led to a sharp reversal. Now, price is approaching the key $119K supply zone — a critical level that could determine if this is a short-term rally or the beginning of a new trend. Watch for either a clean breakout or a rejection for a possible retest of $117K or lower. Confluence from Ichimoku, BOS, and market structure support the analysis.

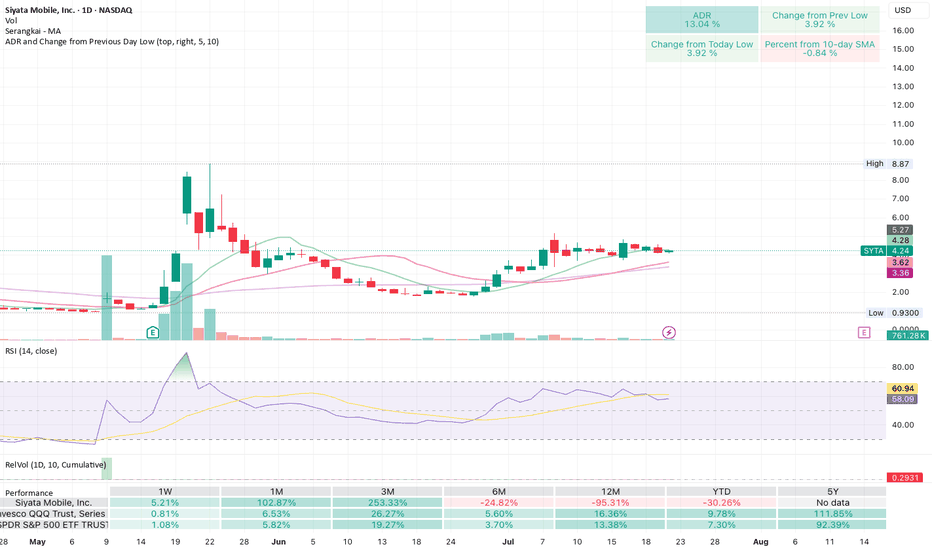

Getting ready to blow! Cup and handle after positive surprisesSiyata makes 2-way telecoms for things like first responders, miltary, construction crews.

Had big earnings and revenue surprises a few weeks ago, and now looks to be forming a cup and handle. Low volume yesterday shows a squeeze pattern like it's getting ready to go.

GBPUSD Week 30 Swing Zone/LevelsPEPPERSTONE:GBPUSD is expected to trend upward from the 1.34032 level towards the resistance zone. Whether it breaks through or reverses downward will ultimately depend on market players.

This projection is based on a forward-looking metric analysis, which explains why the zones are not derived from historical price action on the left side of the chart, as is common in traditional technical analysis. However, the daily candles from previous weeks still contribute meaningfully to this outlook.

Taking profit on GE Aerospace stock to buy in lower after summerIt's clear NYSE:GE has hit overbought, it's the perfect time to take profits now. Less stress managing stocks over the summer too lol...

$196 is the 0.618 level I'm aiming to re-enter, there's also decent support near that level $190 to $200

Platinum's Quiet Ascent: What Drives Its New Value?Platinum, often operating in the shadow of gold, has recently experienced a significant surge in value, reaching multi-year highs and capturing considerable investor attention. This resurgence is not arbitrary; it stems from a complex interplay of industrial demand, tightening supply, evolving geopolitical dynamics, and a notable shift in investment sentiment. Understanding these underlying forces becomes crucial for investors seeking to decipher the trajectory of this vital industrial precious metal.

A primary catalyst for platinum's price rally is its strong industrial utility, particularly within the automotive sector, where it remains indispensable for catalytic converters. While the rise of battery electric vehicles presents a long-term shift, the robust growth in hybrid vehicle production continues to sustain demand. Critically, the market faces persistent physical deficits, with supply consistently falling short of demand for the past two years, a trend projected to continue into 2025. Mine output struggles due to disruptions in key producing regions, such as South Africa and Zimbabwe, and secondary supply from recycling has proven insufficient to bridge the growing gap.

Geopolitics and strategic investment further amplify platinum's upward trajectory. China has emerged as a pivotal market, with a sharp rebound in demand as consumers increasingly favor platinum for both jewelry and investment amidst record gold prices. This strategic pivot by the world's largest consumer market is reshaping global platinum price discovery, supported by China's initiatives to develop new trading ecosystems and futures contracts. Concurrently, renewed investor confidence is evident in growing inflows into platinum Exchange-Traded Funds (ETFs) and robust physical buying, with anticipated lower borrowing costs also enhancing its appeal.

In essence, platinum's current rally reflects a powerful combination of tightening supply and resilient industrial demand, underscored by strategic shifts in major consumer markets and renewed investor interest. As above-ground stocks gradually deplete and the market anticipates continued deficits, platinum is poised for a sustained period of relevance, offering compelling prospects for those who recognize its multifaceted value proposition.

Nifty Might Range-Bound until it doesn't break 24950 levelToday 21/05/2025 around 11 O clock Nifty Tested 24950 the push was not above average volume driven that's why market was going to pullback although something absence of sellers comparatively had seen on 13 may u can see on chart but still it required to break 24950 level with good volume for being upward journey, until we expect market may range between 24500-25000.

strong Resistance- 24950-25000

Strong Support -24500

XAUUSD Gold Bearish Setup for upcoming week.XAUUSD Sell Setup – Short from Resistance at 3350

Gold (XAUUSD) has approached a key resistance level around 3350, where previous price action suggests potential for bearish reversal. With the current momentum showing signs of exhaustion, we’re looking for a short opportunity from this zone.

Trade Idea:

Sell Entry: 3350 (resistance level)

Target 1: 3310 – Minor support / first reaction zone

Target 2: 3290 – Key support area

Target 3: 3250 – Major support & potential full TP zone

Stop Loss: Above recent swing high (suggested: 3360–3370)

Analysis:

Price has formed a potential double top / rejection wicks near 3350, signaling possible downside. A break below 3310 will likely accelerate bearish momentum.

Risk Management:

Use proper lot sizing and move SL to breakeven after TP1 for a safe ride to lower targets.

Who knows ?SUZB3 is in an uptrend channel on the monthly chart, specifically at the lower edge of this channel, in a region that would indicate a buy, however, at this position on the 2-hour chart it presents a head and shoulders pattern at the end of a downtrend line. Meanwhile, the RSI shows divergence indicating a reversal to an uptrend.

Bitcoin Breakdown Head & Shoulders Pattern Death Cross in Play?This daily BTC/USD chart is showing a potential Head & Shoulders pattern, which is a classic bearish reversal structure. But that’s not all Bitcoin is also at risk of forming a Death Cross, signaling deeper downside potential. Here’s what stands out:

🛑 Key Bearish Signals:

🔻 Head & Shoulders Formation: The pattern consists of a peak (head) with two lower peaks (shoulders) on either side, indicating a loss of bullish momentum.

🔻 Neckline Breakdown: BTC is testing the neckline support around $76,000—a break below this level could trigger further downside.

🔻 Death Cross Forming: The 50 SMA (yellow) is sloping downward, getting dangerously close to crossing below the 200 SMA (blue)—a well-known bearish signal that could accelerate selling pressure.

📉 Bearish Targets if Breakdown Confirmed:

If BTC breaks below $76,000, the measured move projection suggests a possible drop toward $50,000-$52,000, aligning with previous structure support.

🚀 Bullish Case – Can BTC Recover?

For bulls to regain control, Bitcoin must reclaim $88,000+, invalidate the breakdown, and push above key moving averages. Otherwise, downside pressure remains strong.

⚠️ Final Thought: Death Cross + Head & Shoulders = Bearish Storm?

A Death Cross happening alongside a Head & Shoulders breakdown is a dangerous combination for bulls:

- A Death Cross occurs when the 50-day moving average crosses below the 200-day moving average, signaling a long-term trend shift to the downside.

- Historically, BTC has seen major sell-offs after this formation, especially when combined with bearish structures like we see now.

- If BTC loses $76,000, the next stop could be $50,000-$52,000—but if bulls defend this level and reclaim FWB:88K +, they can avoid disaster.

Verdict : Bitcoin is at a make-or-break moment—either bulls step in now, or we could see a steep drop ahead. Will you short, or do you think this is a bear trap? Let’s discuss! 🧐🔥