SDR | Golden Zone Reload — Bulls Aren’t Done Yet!After reacting beautifully to our prior call near $3.59, SDR has continued to deliver strong bullish structure.

Price has now retraced from recent highs, forming a clean re-entry opportunity within the golden zone, perfectly overlapping a daily/weekly fair value gap (FVG).

This confluence area could act as a high-probability demand zone, where price may form a higher low before targeting the next liquidity levels.

If the zone holds, the next major objectives remain $7.90 and $11.35, aligning with the broader bullish market structure.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR).

ASX

Bearish potential detected for A2MEntry conditions:

(i) lower share price for ASX:A2M along with swing of DMI indicator towards bearishness and RSI downwards, and

(ii) observing market reaction around the 4hr support/resistance levels previously established, depending on risk tolerance (i.e.: $8.25 from 23rd January or $8.14 from 20th January).

Depending on risk tolerance, the stop loss for the trade would be:

(i) above all congestion and declining yearly VWAP (currently $8.79), or

(ii) above the previous support level established on 18th December (open of $8.92).

Potential outside week and bullish potential for GLNEntry conditions:

(i) higher share price for ASX:GLN above the level of the potential outside week noted on 23rd January (i.e.: above the level of $0.47).

Stop loss for the trade would be:

(i) below the low of the outside week on 19th January (i.e.: below $0.33), should the trade activate.

Bearish potential detected for AGLEntry conditions:

(i) lower share price for ASX:AGL along with swing of DMI indicator towards bearishness and RSI downwards, and

(ii) observing market reaction around the share price of $9.00 (open of 28th November).

Depending on risk tolerance, the stop loss for the trade would be:

(i) above the declining 200 day MA (currently $9.55), or

(ii) above the recent swing high of $9.63 from 3rd December.

Potential outside week and bullish potential for PYCEntry conditions:

(i) higher share price for ASX:PYC above the level of the potential outside week noted on 16th January (i.e.: above the level of $1.755).

Stop loss for the trade would be:

(i) below the low of the outside week on 15th January (i.e.: below $1.595), should the trade activate.

Potential outside week and bullish potential for MYREntry conditions:

(i) higher share price for ASX:MYR above the level of the potential outside week noted on 19th December (i.e.: above the level of $0.475).

Stop loss for the trade would be:

(i) below the low of the outside week on 18th December (i.e.: below $0.44), should the trade activate.

Potential outside week and bullish potential for HMCEntry conditions:

(i) higher share price for ASX:HMC above the level of the potential outside week noted on 9th January (i.e.: above the level of $4.14).

Stop loss for the trade would be:

(i) below the low of the outside week on 6th January (i.e.: below $3.73), should the trade activate.

Bullish potential detected for WAMEntry conditions:

(i) higher share price for ASX:WAM along with swing up of indicators such as DMI/RSI, and

(ii) observing market reaction around the $1.795 resistance area.

Depending on risk tolerance, the stop loss for the trade would be:

(i) below the rising 30 day MA (currently $1.775), or

(ii) below the recent swing low of $1.755 of 11th December, or

(iii) below the rectangle low of $1.74 of 19th November.

Potential outside week and bullish potential for MQGEntry conditions:

(i) higher share price for ASX:MQG above the level of the potential outside week noted on 9th January (i.e.: above the level of $210.69).

Stop loss for the trade would be:

(i) below the low of the outside week on 5th January (i.e.: below $201.97), should the trade activate.

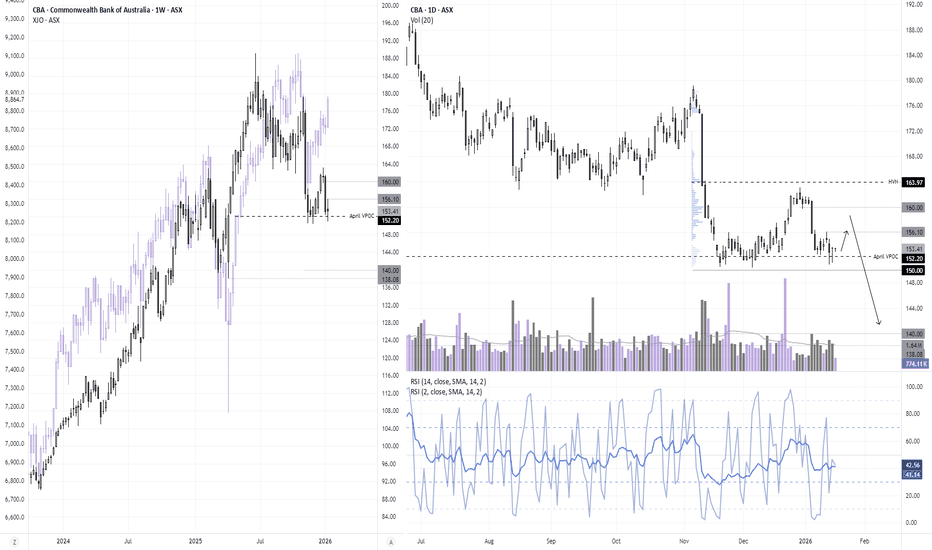

CBA To Bounce from Support?With the risk of Reserve Bank of Australia (RBA) hikes rising, the ASX financials sector could face further pressure ahead. I therefore retain my bias that CBA will eventually break below 150. For now, however, it continues to hold above this level while the broader ASX enjoys a materials-led bounce. The longer support holds, the greater the chance CBA attempts to close the gap with the ASX over the near term — provided the index itself does not roll over.

CBA remains above support despite Wednesday’s high-volume bearish candle, and a bullish pin bar has since formed. Bulls could look to fade dips within Thursday’s range for a minor counter-trend move towards the 156.10 high. A break above this level would open the door to a move towards 160.

Beyond that, I will continue to look for evidence of a swing high, in anticipation of an eventual break below 150.

Matt Simpson, Market Analyst at City Index

ASX200 to find support at market price?AU200AUD - 24H expiry

There is no clear indication that the upward move is coming to an end.

Offers ample risk/reward to buy at the market.

The lack of interest is a concern for bears.

Our short term bias remains positive.

20 1hour EMA is at 8848.

We look to Buy at 8851 (stop at 8811)

Our profit targets will be 8971 and 8991

Resistance: 8869 / 8900 / 8950

Support: 8830 / 8777 / 8740

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

ASE Technology (ASX) — Advanced Packaging Tailwind from AI & HPCCompany Overview

ASE Technology NYSE:ASX is a global leader in semiconductor packaging & testing, leveraged to rising chip complexity and outsourcing across AI, HPC, automotive, and communications.

Key Catalysts

Revenue Momentum: Nov ’25 sales +15.5% YoY (~$1.9B) on accelerating demand for AI-related assembly and advanced test.

LEAP Platform: LEAP advanced packaging is a growing mix & margin driver as heterogeneous integration (chiplets, 2.5D/3D) becomes essential for next-gen AI silicon.

Scale Advantage: Broad customer base + leading OSAT scale support capacity, yield, and time-to-market advantages versus smaller peers.

Auto/Comms Upside: Content-per-vehicle and RF/optical upgrades add durable, non-AI legs to growth.

Investment Outlook

Bullish above: $13.50–$14.00

Target: $20.00–$21.00 — supported by AI/HPC packaging demand, LEAP margin expansion, and continued test outsourcing.

#ASX #Semiconductors #AdvancedPackaging #AI #HPC #Chiplets

ASX and Consumer Stock Rebounce Could Help Coles (COL:ASX)For some time, I have been waiting for Coles to show signs of bullish life. The recent rebound in the ASX 200 and consumer sectors may now be providing a strong enough signal for bulls to reassess its potential.

Matt Simpson, Market Analyst at City Index.

Bullish potential detected for KLREntry conditions:

(i) higher share price for ASX:KLR along with swing up of indicators such as DMI/RSI, and

(ii) observing market reaction around the $0.19 resistance area from 21st November.

Depending on risk tolerance, the stop loss for the trade would be:

(i) below the potentially rising 30 day MA (currently $0.161), or

(ii) below the recent swing low of $0.15 of 29th December, or

(iii) below the ultimate swing low of $0.125 of 15th December.

ASX Bulls Eye 8800ASX futures were higher for a third consecutive session by Thursday’s US close. The daily RSI is curling higher from the 50 level, signalling positive momentum without nearing overbought territory and confirming the near-term bullish structure.

Support has also been found above the monthly pivot point, along with the 20-day and 50-day EMAs. Volumes remain subdued, though this is likely a seasonal effect.

The bias is for a move towards 8,800 — near the December high, monthly R1 pivot and November VPOC — while prices hold above the recent daily swing low.

Matt Simpson, Market Analyst at City Index.

Its all a load of hot air anywaysLooking on the daily chart we can spot what looks like a set up for an upcoming Golden Cross. Looks like price is moving to the upside and has been staying steady above the 50ema for some time. Looking for a good entry level using the 2 hour chart over the next few days. You would be a fool to believe this is financial advise, because this is far from it.

Light the fires...maybeIts starting to look what could be described as a bullish set up. Will keep a keen eye to see if price bounces of the 50ema and continues within the upward channel. Will look for a good entry price on the 2 hour charts if conditions are met on the daily. Not financial advise, so its not.

Does it have any energy left?BTL sending out mixed signals on the daily chart. Looks like a bullish channel but its starting to look like a possible death cross within the next 2 weeks. Expecting a bounce back to the 50ema, then it could be time to flip the coin and enter the market. Time will tell, but not financial advise, so its not.

Potential outside week and bearish potential for CWYEntry conditions:

(i) lower share price for ASX:CWY below the level of the potential outside week noted on 19th December (i.e.: below the level of $2.55), and

(ii) observing the market reaction around prior support of $2.50.

Stop loss for the trade would be:

(i) above the high of the outside week on 17th December (i.e.: above $2.69), should the trade activate.

Potential key reversal bottom detected for WINAwait signals for entry such as DMI/ADX and/or RSI swing to the bullish direction.

Stop loss for the trade involving ASX:WIN (and indication that this trade is an absolute 'no-go') is any trade below the low of the signal day of 18th December (i.e.: any trade below $0.029).