Review and plan for 13th February 2026 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

BANKNIFTY

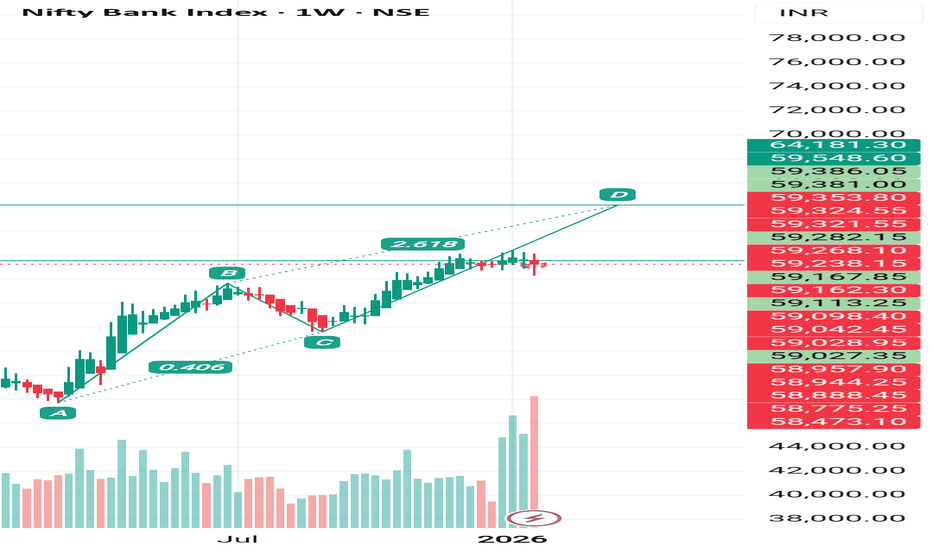

#BankNifty - 6,000 Pts Loading?Date: 12-02-2026

#BankNifty

Pivot: ₹58,824.00

Support: ₹57,494.09

Resistance: ₹60,164.33

🔼 Upside Targets:

L1 ₹61,576.16 | L2 ₹62,988.00 | L3 ₹64,549.50 | L4 ₹66,111.00

🔽 Downside Levels:

L1 ₹56,077.04 | L2 ₹54,660.00 | L3 ₹53,098.50 | L4 ₹51,537.00

#BankNifty #Tradingview

Review and plan for 12th February 2026Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 10th February 2026 Nifty future and banknifty future analysis and intraday plan.

Quarterly results-

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

#BANKNIFTY PE & CE Levels(09/02/2026)Bank Nifty is expected to open gap up, indicating a positive sentiment at the start of the session. However, despite the gap-up opening, the broader structure still suggests a range-bound to mildly bullish market, where follow-through buying will only come if key resistance levels are sustained. Traders should be patient during the first 15–20 minutes and wait for confirmation rather than chasing the opening move.

On the upside, 60050–60100 is the immediate decision zone. If Bank Nifty holds above this range, a bullish continuation is likely, and CE buying can be considered, with targets placed at 60250, 60350, and 60450+. A further strong breakout above 60550 will shift momentum decisively in favor of bulls, opening higher upside levels at 60750, 60850, and 60950+. These zones may act as profit-booking areas, so trailing stop-loss is advised.

On the downside, 60450–60400 acts as a short-term rejection zone. If the index fails to sustain above this area and shows weakness, a PE buying opportunity may emerge with downside targets at 60250, 60150, and 60050. Additionally, 59950 remains a crucial support; a breakdown below this level can accelerate selling pressure toward 59750, 59650, and 59550, making it an important level to watch for intraday risk management.

Overall, the bias remains positive but cautious. As long as Bank Nifty trades above 60000, bulls will have the upper hand, but the market is still sensitive to resistance-based reversals. A level-based strategy with partial profit booking and strict stop-loss discipline will be key for navigating today’s session effectively.

Review and plan for 9th February 2026Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Nifty 50 | Intraday Price–Time Structure Study(12 July 2023 | WD Gann Methodology)

This idea is a historical, educational study demonstrating how price structure and time alignment, as described in classical WD Gann methodology, can be analysed on an intraday chart.

This post is not a trade call, prediction, or recommendation.

📌 Market Context

On 12 July 2023, Nifty was trading within a short-term consolidation phase after a prior decline.

According to WD Gann principles:

Markets often react near structural price levels

These levels gain importance when price and time balance

Risk is always defined before observing market response

📈 What the Chart Illustrates

The chart highlights:

A reference price zone derived from prior structure

A downside risk boundary used for invalidation

Subsequent price response after interaction with the level

This example is shared to explain how price structure can be studied objectively, without emotional bias.

🧠 Key Learning Points

Gann analysis begins with price structure

Risk must be pre-defined, not adjusted later

Time confirms whether price is accepted or rejected

Studying completed sessions improves execution discipline

The focus here is on process, structure, and risk awareness, not outcome.

⚠ Disclaimer

This idea is shared strictly for educational and analytical purposes only.

It does not constitute financial advice, live trade calls, or investment recommendations.

Nifty 50 | Price–Time Square Structure(22 Nov 2023 | Educational Gann Study)

This idea presents a historical, educational study of how Price–Time Square geometry, as described in classical WD Gann methodology, appeared on the Nifty 50 intraday structure.

The intent of this post is market structure analysis, not prediction or trading advice.

📌 Structural Context

On 22 November 2023, Nifty was trading within a defined intraday range after a prior swing.

According to Gann principles:

Markets often respond to square relationships between price and time

When price units align proportionally with time units, measurable reaction zones may appear

These zones act as reference levels, not guarantees

📈 What the Chart Illustrates

The chart highlights:

A reference base level used for structure measurement

Two price–time proportional zones derived from square calculations

Price movement interacting with these zones during the same session

This example helps demonstrate how price symmetry and time balance can be studied objectively.

🧠 Key Takeaways

Gann analysis focuses on structure, not certainty

Price–Time Squares help define potential reaction areas

Risk control and confirmation remain essential

Studying completed sessions improves future market awareness

The emphasis is on process and discipline, not outcome.

⚠ Disclaimer

This idea is shared strictly for educational and analytical purposes.

It does not constitute financial advice, live calls, or recommendations.

BANKNIFTY Technical Analysis - Important levels📌 BANK NIFTY – Recovery Approaching Supply With Constructive CPR Undertone

BANK NIFTY has rebounded sharply from its recent swing low near the 59,600 demand zone, signalling responsive buying interest at lower levels but stopping short of confirming a full trend reversal. The index is currently trading around 60,100–60,120, where it is beginning to test an important overhead supply region. Immediate resistance is placed at 60,298.78, followed by a stronger resistance band near 60,400–60,480, which aligns with prior rejection areas and a developing supply zone within the broader descending structure. A higher resistance is visible at 60,804.13, marking the level that would need to be reclaimed for stronger bullish continuation.

On the downside, immediate support is positioned at 59,793.43, while deeper supports are seen at 59,466.32 and 59,288.08, forming a layered demand base that could absorb short-term volatility. The chart clearly highlights a primary demand zone around 59,600–59,750, whereas the supply zone is concentrated near 60,300–60,450, suggesting the index is currently travelling between value pockets rather than trending decisively.

From a CPR perspective, the structure remains narrow and positioned in a bullish zone, indicating potential for expansion once a directional trigger emerges. However, the dashboard also reflects low momentum and a wait-and-watch tone, implying that the market is stabilising after volatility rather than entering an impulsive move.

Overall, BANK NIFTY appears to be in a range recovery within a broader corrective framework. Sustaining above the 59,800–59,900 region keeps the short-term tone stable, but a decisive breakout above 60,400+ is essential to shift sentiment toward bullish continuation. Until then, rotational movement between demand and supply zones is likely.

📊 Market sentiment for financials remains balanced. Stable domestic liquidity conditions and resilient credit growth provide a supportive backdrop for banking stocks, yet rising yields and intermittent profit booking near higher levels continue to limit aggressive upside participation.

🔎 Probabilistic Tilt Based on Levels & Environment:

Bullish Scenario: A sustained move above 60,300–60,450 could trigger momentum toward 60,800, signalling strengthening institutional participation.

Neutral / Choppy Scenario: Holding between 59,600–60,400 would indicate consolidation as the index digests recent recovery.

Bearish Scenario: Failure to hold 59,793 may drag the index back toward 59,450–59,300, especially if broader market sentiment weakens.

⚠️ Disclaimer:

This content is shared purely for educational and informational purposes to enhance market understanding. It should not be construed as investment, trading, or financial advice. Market conditions can change rapidly, and past price behaviour does not guarantee future outcomes. Please consult a SEBI-registered financial advisor before making any investment or trading decisions, and ensure appropriate risk management at all times.

WEEKLY MARKET OUTLOOK – STRUCTURE OVER EXCITEMENTNIFTY 50

Nifty closed the week at 25,693, a strong 868-point recovery from the previous week. The index made a high of 26,241 and a low of 24,679. This sharp upmove was largely driven by positive sentiment around the Indo–US tariff deal announcement, which triggered a classic relief rally.

However, regular readers know my style –

👉 I’m never a fan of V-shaped recoveries.

This week’s bounce looks impressive on the surface, but structurally it still doesn’t inspire full confidence. Sustainable trends are built on proper bases, not straight-line rebounds.

MY PREFERRED APPROACH

Rather than chasing this rally, I would be more comfortable initiating fresh longs if:

Nifty comes down to test 25,000 or 24,600,

Holds those levels firmly,

And starts forming a bullish W-pattern

That kind of setup offers far better risk–reward than buying after a sharp vertical move.

LEVELS TO WATCH NEXT WEEK

I expect Nifty to remain in a range of 26,000 – 25,200.

Above 26,000:

Upside momentum can continue, but 26,200 will be a tough resistance to cross.

Below 25,200:

The bounce loses steam and lower levels may be revisited.

For now, patience remains more important than aggression.

BANK NIFTY – THE OG VOLATILITY KING

Bank Nifty lived up to its reputation once again with wild swings.

From a weekly low of 57,829,

It surged to a high of 61,764,

And finally closed at 60,120, just above the key psychological level of 60,000.

What Next?

If Bank Nifty manages two consecutive daily closes above 60,200, the index can push higher towards:

60,600 → 60,900 (important Fib level) → 61,300

In case of retracement, 58,900 becomes the most critical level to monitor.

Until 60,200 is clearly conquered, moves should be approached cautiously.

S&P 500 – RESILIENT STRUCTURE

The S&P 500 closed at 6,932, almost unchanged from last week despite testing lows near 6,780. This clearly indicates that demand remains strong at lower levels.

Consecutive daily close above 6,970

can open doors towards:

7,026 (important level) → 7,122 (important Fib level)

For investors in the US market, a trailing stop-loss near 6,500 is a sensible level to protect profits.

FINAL THOUGHT

This remains a market where structure matters more than headlines.

Instead of getting carried away by fast moves, focus on levels, confirmations, and disciplined entries.

📢 IMPORTANT UPDATE

After sharing my weekly market views free of cost for nearly two years, I plan to launch a more structured and detailed Premium Weekly Edition soon – with deeper analysis, clearer market framework, and enhanced insights.

Free updates will continue as usual.

More details to follow in the coming weeks.

#BankNifty - 3000+ Points Coming?Date: 30-11-2025

BankNifty Current Price: ₹ 59,752.70

Pivot Point: ₹ 59,324.50 Support: ₹ 58,489.09 Resistance: ₹ 60,165.33

Upside Levels:

L1: ₹ 60,827.92 L2: ₹ 61,490.50 L3: ₹ 62,302.75 L4: ₹ 63,115.00

Downside Levels:

L1: ₹ 57,823.79 L2: ₹ 57,158.50 L3: ₹ 56,346.25 L4: ₹ 55,534.00

#Sensex #Markets #Stocks #IndiaMarkets #Trading #Nifty #SensexUpdate #MarketOutlook #in_tradingview

Review and plan for 6th February 2026Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Nifty Bank Index – Technical View: Bearish / Corrective Risk EmeThe Nifty Bank Index appears to be in the final stages of a five-wave advance, suggesting potential exhaustion at higher levels. The latest session has formed an Open–High candle, indicating strong supply pressure and the development of a near-term resistance zone around current prices.

From an Elliott Wave standpoint, the completion of the fifth wave raises the probability of a corrective or impulsive decline unfolding from the recent highs. With momentum showing signs of fatigue, downside risk is now increasing.

On the downside, immediate support is seen near 57,700, followed by 54,700. A deeper corrective phase could extend towards 53,050, which aligns with prior swing structures and broader price projections.

The bearish view stands negated on a sustained move above 61,765, which would invalidate the current wave count and reopen upside potential.

Review and plan for 4th February 2026 Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 3rd February 2026Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 30th January 2026Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 29th January 2026Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Plan for 27th Tuesday 2026 Nifty future and banknifty future analysis and intraday plan.

Ultracemco.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

NIFTY | BANK NIFTY – Breakdown, Range Play & Key Levels AheadNifty closed at 25,048, down nearly 650 points from the previous week. The index made a high of 25,653 and a low of 24,919, and in the process breached my earlier range of 26,150–25,200, confirming continuation of weakness.

The only silver lining this week is that Nifty managed to close above the psychological 25,000 mark, which now acts as an important decision zone going forward.

Key Levels to Track Next Week

if Nifty sustains above 25,000

A technical pullback cannot be ruled out towards:

25,200

25,300

25,500

❌ Day close below 25,000

Downside may open towards:

24,850

24,600

24,550

👉 Expected Trading Range:

25,500 – 24,500

With Republic Day holiday on Monday, the week is truncated, and hence chances of range-bound trade remain high. In such conditions, large players generally focus on option premium decay from both sides rather than strong directional bets.

Medium-Term Support Zones

23,900

23,500

These are important demand areas, from where a meaningful relief rally can emerge if tested. Till then, the approach remains disciplined — set alerts, wait for confirmation, and deploy capital only in fundamentally strong stocks.

BANK NIFTY – HEAVYWEIGHT PRESSURE CONTINUES

Bank Nifty closed at 58,473, down nearly 1,600 points for the week. The index made a high of 60,107 and a low of 58,278.

As discussed earlier, weakness in HDFC Bank continued this week, with the heavyweight correcting nearly 3%, dragging the broader banking index lower.

Downside Levels:

Below 58,278 → 57,700 / 57,200

Upside Scenario:

If Bank Nifty manages to trade above 59,000, a pullback towards 59,700 is possible.

One Chart to Keep on the Radar (Observation Only)

While indices remain volatile, HNGSNGBEES is showing relative strength. The ETF has delivered a weekly timeframe breakout, which makes it worth tracking as a banking sector strength gauge.

If the breakout sustains, the structure highlights the following reference zones:

579 → 615 → 633 → 660 (important level)

This is not a recommendation, but a technical observation to monitor price behavior during this corrective phase.

Market Structure Insight

As per my calculations, on Tuesday:

Either the market may open gap-up, OR

Even in case of a gap-down opening, an attempt to move higher early in the session is possible

Reason: Put option premiums are currently very lucrative, and such imbalances are often adjusted by big players intraday.

Bonus Trading Tip

If Nifty sustains above 25,400 for at least one hour, chances of short covering increase

Until then, sell on rise remains the preferred strategy

MUltibagger in making

After a downfall of 58% from it's high, Jindal Saw formed a base at around 153. After a sequential gains in Q3 results stock surges and gives a breakout at 176.

Jindal Saw is a manufacturing company focused on pipes mainly used for water, oil and gas, sewarage with a market cap of 11365 cr.

Financials are all good for the company,

PE : 10

ROE : 15%

Positive cashflow

Stock declines to a level of 177 after a breakout and now is the best time to buy this stock for a huge upside.

Review and plan for 22nd January 2026Nifty future and banknifty future analysis and intraday plan.

stocks with quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Plan for 21st January 2026 Nifty future and banknifty future analysis and intraday plan.

stocks and commodities too.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT