Gold |XAUUSD . 30M -- Liquidity Reaction Trade1. Price swept previous liquidity near NY High and showed rejection from supply zone.

2. Market created a strong bearish displacement after liquidity grab.

3. structure shift (CHoCH) confirmed bearish bias on lower timeframe.

4. London and Tokyo session highs acting as resistance confluence.

5. Expecting downside move targeting NY low liquidity area.

Trade Zone (Sell Area)

• Near NY High / Supply Zone

• Around 5070 – 5085

• Area where liquidity was swept and bearish rejection appeared

Beyond Technical Analysis

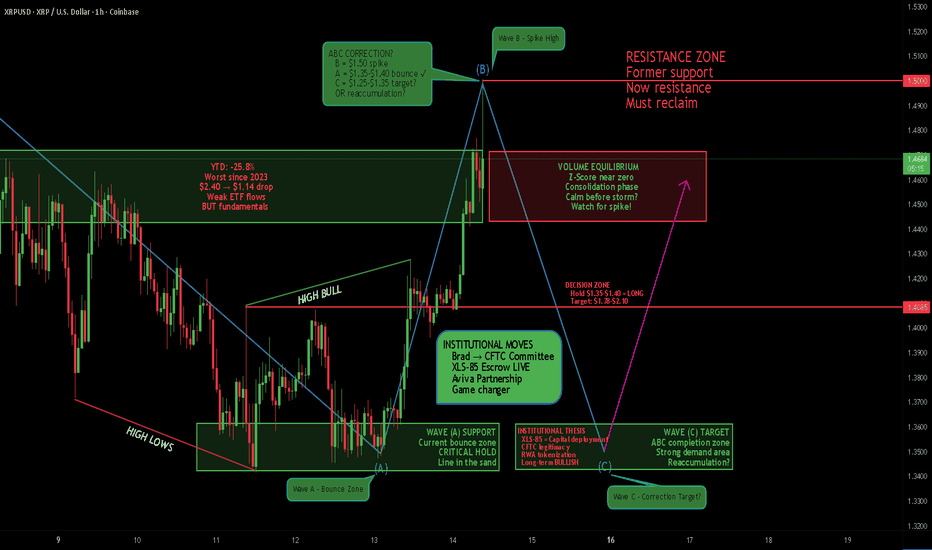

XRP - ABC Correction or Reaccumulation? $1.40 Support Holds

What's good, crypto fam! 🚀

XRP is at a critical juncture right now. Let me break down what's happening on the 1-hour chart and why the next move could be MASSIVE.

The Setup

XRPUSD is trading at $1.4609 after bouncing from the green support zone around $1.35-$1.40. We're seeing a potential ABC correction pattern playing out - price spiked to $1.50 (B), dropped to support (A), and now we're waiting to see if (C) wave takes us lower or if this is just reaccumulation before the next leg up.

The big question: Is this a healthy pullback before ATH push, or are we heading to $1.25?

Why This Setup Matters

Bounced cleanly from green support zone (A) - buyers defending

Volume equilibrium (Z-Score near zero) = calm before the storm

MASSIVE institutional news - Brad Garlinghouse on CFTC committee

XLS-85 Token Escrow live on mainnet - game changer for institutions

Aviva partnership for tokenizing real-world assets

BUT - XRP down 25.8% YTD, worst performance since 2023

The News is MIXED (Critical Context)

Bullish catalysts:

Brad Garlinghouse appointed to CFTC Innovation Advisory Committee - HUGE

XLS-85 Token Escrow launched on XRPL mainnet (Feb 12) - institutional DeFi ready

Aviva Investors partnership - tokenizing RWAs on XRPL

Ripple expanding presence in UK and Europe

Coinbase, Robinhood CEOs also on CFTC committee - crypto legitimacy

Token escrow = stablecoins, RWAs, institutional settlement on XRPL

0.2 XRP reserve per escrowed asset = supply lock-up potential

Bearish/Risk factors:

XRP down 25.8% YTD - worst return since 2023

Price fell from $2.40 yearly high to $1.14 low

Declining channel on chart - bearish structure

Futures Open Interest dropped from $10.94B to $2.26B - weak confidence

Zero ETF inflows on Thursday - institutional demand cooling

Volume Z-Score near zero = consolidation, not momentum

Analysts warning of potential drop to $1.15-$1.25

Key Levels I'm Watching

Resistance:

$1.50 - Recent high / Wave (B) top

$1.54 - Friday's high (key breakout level)

$1.78 - Major resistance zone

$2.10 - Psychological level / next cycle target

$2.40 - 2026 yearly high

Support:

$1.40 - Current support / green zone (A) - CRITICAL

$1.35 - Lower green zone boundary (must hold)

$1.25-$1.35 - Wave (C) target / green support zone

$1.15 - Analyst target / danger zone

$1.12 - Friday's low / major support

My Game Plan

Bullish scenario: If XRP holds the $1.35-$1.40 green zone and breaks above $1.50 with volume, we could see a rapid move to $1.54, then $1.78. The institutional news is MASSIVE - Brad on CFTC committee + XLS-85 live = legitimacy + utility. If institutions start deploying capital on XRPL (as analysts suggest), XRP could rocket. Target: $2.10+ retest.

Bearish scenario: If we lose $1.35 support, the ABC correction completes with Wave (C) dropping to $1.25-$1.30 green zone. Break below $1.25 = danger zone, target $1.15-$1.12. The YTD performance is brutal (-25.8%), and weak ETF flows + declining OI suggest institutions are waiting. Volume equilibrium = no momentum yet.

Most likely scenario: I think we consolidate between $1.35-$1.50 for a bit longer while the market digests the institutional news. The XLS-85 upgrade is HUGE but takes time to show impact. Watch for volume spike - that's your signal. If we hold $1.40 = accumulation. If we break $1.35 = Wave (C) to $1.25.

The Bottom Line

I'm cautiously BULLISH on fundamentals but NEUTRAL on technicals. The institutional developments are incredible - CFTC committee, XLS-85 escrow, Aviva partnership. This is the kind of news that changes trajectories long-term.

BUT the chart is weak. Declining channel, poor YTD performance, weak volume. The market needs TIME to absorb the news and for institutions to actually deploy capital.

My bias: If $1.35-$1.40 holds = long to $1.78-$2.10. If $1.35 breaks = wait for $1.25 retest.

The $1.35-$1.40 green zone is the line in the sand. Watch it like a hawk.

What do you think? Reaccumulation before ATH push or ABC correction to $1.25? Drop your take! 👇

If this helped, smash that 🚀 Boost button!

Not financial advice. DYOR.

Range or Trend? The 30-Second Checklist Before Every TradeMost losing trades aren’t “bad signals” — they’re good setups taken in the wrong market mode.

A trend setup inside a range gets chopped up.

A mean-reversion setup inside a trend gets steamrolled.

So before you look for an entry, do this 30-second check:

Trend vs Range (quick read)

TREND

• Directional structure (HH/HL or LL/LH)

• Pullbacks pause, then continuation

• Breakouts tend to hold

RANGE

• Rotates between support & resistance

• Overlapping swings / choppy middle

• Breakouts often fail

The pre-trade sequence

1. MODE — Trend or range? (If unsure: treat as range until structure proves trend.)

2. LOCATION — At a real level (edge / HTF zone) or in the middle of nowhere?

3. INVALIDATION — Where is the idea objectively wrong? (your “I’m wrong” point)

4. RISK — Does stop distance fit your position size and the market’s typical swing?

5. TRIGGER — Only now: use your entry signal (pullback / retest / confirmation)

If you want, comment “MODE” and I’ll post a chart example next showing the same signal in a trend vs in a range.

Building Better Inputs: The Foundation of AI Trading Success

The Best Algorithm in the World Can't Fix Bad Inputs

Here's a secret that separates amateur AI traders from professionals:

The model architecture matters far less than the features you feed it.

Feature engineering - the art of transforming raw data into meaningful inputs — is where the real edge lives.

---

What Is Feature Engineering?

Definition:

Feature engineering is the process of creating input variables (features) from raw data that help machine learning models make better predictions.

In Trading:

Transforming raw price, volume, and other data into signals that capture market behavior.

The Core Principle:

Raw data (OHLCV) contains information, but it's often hidden. Features extract and highlight that information.

---

Why Feature Engineering Matters

1. Models Learn from Features, Not Raw Data

A model seeing learns little

A model seeing learns patterns

Features encode the relationships that matter

2. Domain Knowledge Becomes Computable

"Price is extended" → Z-score feature

"Volume is unusual" → Volume ratio feature

"Trend is strong" → ADX feature

3. Reduces Noise, Amplifies Signal

Raw prices contain noise

Well-designed features filter noise

Model focuses on what matters

4. Enables Simpler Models

Good features + simple model often beats

Bad features + complex model

Interpretability improves

---

Categories of Trading Features

Category 1: Price-Based Features

Returns:

Simple returns: (Close - Previous Close) / Previous Close

Log returns: ln(Close / Previous Close)

Multi-period returns: 5-day, 20-day, 60-day

Price Relationships:

Distance from high/low

Distance from moving average

Price relative to range (where in today's range)

Candle Features:

Body size: |Close - Open|

Upper wick: High - max(Open, Close)

Lower wick: min(Open, Close) - Low

Body to range ratio

---

Category 2: Trend Features

Moving Average Features:

Price above/below MA (binary)

Distance from MA (continuous)

MA slope (trend direction)

MA crossover signals

Trend Strength:

ADX value

Consecutive higher highs/lower lows

Linear regression slope

R-squared of price trend

Trend Duration:

Bars since trend started

Bars since last MA cross

Time in current regime

---

Category 3: Momentum Features

Oscillators:

RSI value

RSI zone (oversold/neutral/overbought)

Stochastic %K and %D

CCI value

Rate of Change:

ROC over various periods

Momentum acceleration/deceleration

Momentum divergence from price

Relative Momentum:

Performance vs benchmark

Sector relative strength

Percentile rank of momentum

---

Category 4: Volatility Features

Range-Based:

ATR (Average True Range)

ATR ratio (current ATR / historical ATR)

Range expansion/contraction

Standard Deviation:

Rolling standard deviation

Bollinger Band width

Z-score of price

Volatility Regime:

High/low volatility classification

Volatility percentile

Volatility trend (increasing/decreasing)

---

Category 5: Volume Features

Volume Ratios:

Volume / Average volume

Volume trend (increasing/decreasing)

Relative volume by time of day

Price-Volume Relationships:

Up volume vs down volume

Volume on up days vs down days

OBV (On-Balance Volume)

Volume-price trend

Volume Patterns:

Volume spike detection

Volume climax signals

Accumulation/distribution

---

Category 6: Time Features

Calendar Features:

Day of week

Month of year

Quarter

Days until/since events (earnings, FOMC)

Session Features:

Time of day

Session (Asian, European, US)

Minutes since open/until close

Cyclical Encoding:

Sin/cos transformation for cyclical features

Preserves cyclical relationships

Day of week: sin(2π × day/7), cos(2π × day/7)

---

Category 7: Cross-Asset Features

Correlation Features:

Rolling correlation with benchmark

Correlation regime changes

Beta to market

Relative Features:

Spread between assets

Ratio between assets

Relative performance

Market Context:

VIX level and change

Sector performance

Market breadth

---

Feature Engineering Best Practices

Practice 1: Normalize Features

Raw values vary wildly across assets and time.

Methods:

Z-score: (value - mean) / std

Min-max scaling: (value - min) / (max - min)

Percentile ranking

Why: Models work better with normalized inputs.

---

Practice 2: Handle Look-Ahead Bias

Features must only use data available at prediction time.

Common Mistakes:

Using future data in calculations

Normalizing with full dataset statistics

Including target information in features

Solution: Always use rolling/expanding windows.

---

Practice 3: Create Interaction Features

Combine features to capture relationships.

Examples:

RSI × Trend direction

Volume ratio × Price change

Volatility × Momentum

Why: Captures conditional relationships.

---

Practice 4: Lag Features Appropriately

Include historical values of features.

Examples:

RSI 1 bar ago, 5 bars ago, 20 bars ago

Return over last 1, 5, 20, 60 periods

Volatility change over time

Why: Captures temporal patterns.

---

Practice 5: Test Feature Importance

Not all features help. Some hurt.

Methods:

Correlation with target

Feature importance from tree models

Ablation studies (remove and test)

Why: Reduces overfitting, improves interpretability.

---

AI-Powered Feature Engineering

1. Automated Feature Generation

AI can generate thousands of feature combinations:

Mathematical transformations

Interaction terms

Lagged versions

2. Feature Selection

AI identifies which features actually help:

Removes redundant features

Identifies most predictive features

Optimizes feature set for model

3. Dynamic Feature Weighting

AI adjusts feature importance over time:

Some features work better in certain regimes

Adaptive weighting based on recent performance

Regime-specific feature sets

4. Deep Learning Feature Extraction

Neural networks can learn features automatically:

Convolutional layers for pattern detection

Recurrent layers for sequence patterns

Attention mechanisms for importance weighting

---

Feature Engineering Mistakes

Too Many Features - More features ≠ better model. Overfitting risk increases. Curse of dimensionality. Start simple, add complexity only if needed.

Highly Correlated Features - Multiple features measuring the same thing. Redundancy without benefit. Check correlation matrix, remove duplicates.

Unstable Features - Features that change dramatically with small data changes. Unreliable in live trading. Test stability across time periods.

Ignoring Domain Knowledge - Letting AI generate features without trading logic. May find spurious patterns. Combine AI generation with human curation.

Not Testing Out-of-Sample - Features that work in-sample may fail out-of-sample. Always validate on unseen data.

---

Building Your Feature Library

Step 1: Start with Fundamentals

Returns (multiple timeframes)

Volatility (ATR, std dev)

Trend (MA relationships)

Momentum (RSI, ROC)

Volume (ratios, trends)

Step 2: Add Domain-Specific Features

What do you look for when trading?

Encode your analysis into features

Test if they add predictive value

Step 3: Create Derived Features

Combinations of base features

Regime indicators

Cross-asset relationships

Step 4: Continuously Refine

Monitor feature performance

Remove degraded features

Add new features as markets evolve

---

Key Takeaways

Feature engineering transforms raw data into meaningful model inputs

Good features often matter more than model complexity

Categories include price, trend, momentum, volatility, volume, time, and cross-asset

Always normalize, avoid look-ahead bias, and test out-of-sample

AI can automate feature generation and selection, but domain knowledge guides the process

---

Your Turn

What features do you find most predictive in your trading?

Have you experimented with creating custom features?

Share your feature engineering insights below 👇

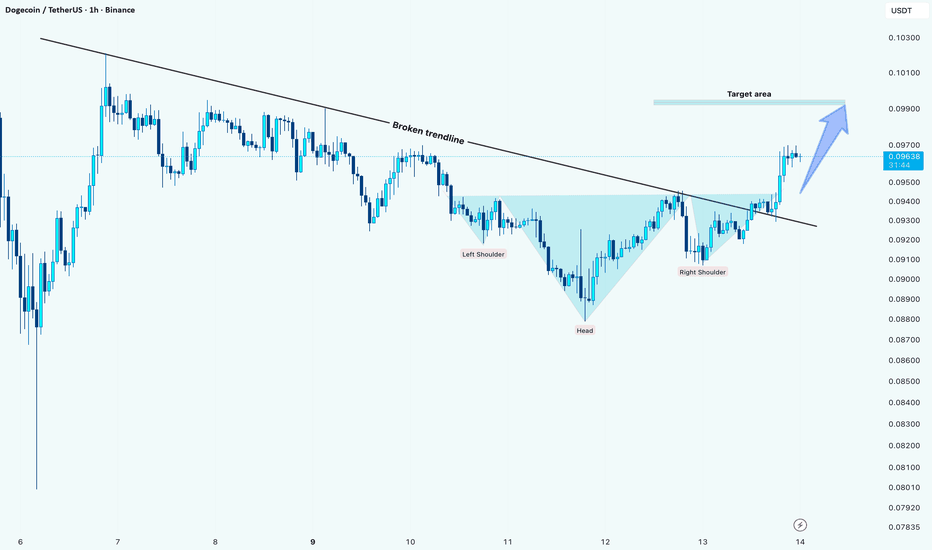

Doge: Trendline Break + Inverse H&SHI!

Market Context

Price has shifted structure after breaking the descending trendline while forming a clean inverse Head & Shoulders pattern. Momentum is gradually turning bullish as buyers step in above the neckline area.

Structure & Key Signals

Descending trendline -> Broken

Inverse Head & Shoulders -> Confirmed breakout

Higher lows forming -> Strength building

Scenario Outlook

As long as price holds above the broken trendline/neckline zone, continuation to the upside becomes the higher-probability scenario.

Target Zone 🎯

Primary target: 0.099 – 0.100

Invalidation

A move back below the neckline and trendline would weaken the bullish setup and shift price back into range conditions.

Chilling similarities in the 2021 cycle - compared to 2024What's up folks.

Not here to give any price or level predictions - as that's already included in some of my other Outlooks.

Just wanted to bring this to your attention.

Similarities in behavior are impressive and I believe - with the current stance on rates etc. - that'll be spending quite a long time in the 50-70k range.

Enjoy your Weekend.

XAUUSD: FVG Resistance Hold Targeting the $4,700 Discount FloorThe recent attempt to reclaim the $5,100 psychological handle has met significant institutional selling pressure. The price is currently reacting to the bottom of the Fair Value Gap (FVG) and a bearish Order Block located between $5,100 and $5,130. This zone is acting as a solid ceiling, as the market lacks the volume to fill the entire imbalance.

Technical Evidence for the Short:

FVG Resistance: The $5,120 – $5,140 area represents the 61.8% Fibonacci retracement level, which is currently holding as major resistance.

Exhaustion Signals: Short-term indicators show "exhaustion of bullish strength" after gold reached its weekly high, suggesting a technical reversal is imminent.

Liquidity Magnet: Below the current price, there is a large pocket of downside liquidity and a secondary Discount Zone near the 200 EMA at $4,799.

Fundamental Pressure: Stronger-than-expected US labor data has bolstered the US Dollar Index, keeping gold under pressure and preventing a sustained breakout above $5,100

Neutral / Invalidation Dashboard

Bearish Bias: High conviction as long as gold fails to consolidate above the $5,140 mark.

Neutral Zone: $5,000 – $5,060 (Consolidation range).

Invalidation: A decisive break and close above $5,140 would negate the short setup and potentially trigger a move toward $5,312.

Final Thought: The "fill and drop" play is in full effect. After tapping the $5,120 Order Block, gold is showing clear signs of topping out. Expect a move back toward the $4,700 – $4,800 discount zone where long-term institutional support is likely to be re-tested.

Interesting evolution from the previous XRP snapshotsInteresting evolution from the previous XRP snapshots. Here's what shifted:

**Key changes since last capture:**

- **Bias downgraded:** Strong BULL (32.14%) → **Flat BEAR (11.11%)** — massive shift, signals are now deadlocked 33:35

- **Candle structure collapsed:** 12:2 → **7:7** — from decisive bullish to perfectly split

- **Momentum flipped:** Bull ↓ → **Bull ↑** — paradoxically, momentum is now rising as bias weakened

- **Squeeze fired AGAIN** — second consecutive dual fire, but volume still hasn't shown up (all Z-scores Low)

- **Ghost Market persists** — F/S ratio normalized to 4.68x (healthy), but overall volume is a desert

**The narrative angle** is the "fired squeeze into a vacuum" — the volatility mechanism has triggered twice now without attracting participation. This is an unusual and educational pattern that TradingView readers rarely see articulated. The primary scenario is range-bound chop (40%) because the conflicting signals + absent volume = indecision.

The breakout holding at 5.7x with only -0.9% retrace keeps the bull case alive, but without volume, it's a castle built on sand. House Rules compliant, zero indicator references.

SPACE/USDT: 41% Parabolic Bounce With Shorts Getting LiquidatedSPACE/USDT: 41% Parabolic Bounce With Shorts Getting Liquidated — But Futures Speculation Is Driving the Bus

Overview

SPACEUSDT is in full parabolic mode. A 41.3% bounce at 17.1x magnitude, a Deep BULL bias at 62.96% with an 81:19 directional split, 13:1 candlestick dominance, a price squeeze that just fired, and shorts actively getting liquidated. On the surface, this looks like an unstoppable freight train. But underneath the price action, the volume structure reveals a critical vulnerability: futures speculation is running at 10.49x spot activity, the futures Z-score is at 2.62σ (Very High) while spot is a flat -0.41σ, and the premium is volatile and unstable. This is a leveraged momentum event with real liquidation fuel — powerful but fragile.

Price Structure

Spot trades at 0.008762 with futures at 0.008744 — a -0.22% backwardation with a Z-score of -1.6. This is a meaningful premium reading. The negative Z-score at -1.6σ means futures are trading below spot by a statistically significant margin, which in a parabolic rally typically indicates heavy short positioning being squeezed — consistent with the active shorts liquidation detected on the chart.

The premium standard deviation is at 0.11%, classified as Volatile on both short and long lookbacks. This is important context: the basis between spot and futures is not just wide but unstable, swinging rapidly. Volatile premium during a parabolic move signals aggressive repositioning in the derivatives market.

The mean Z sits at 0.02σ — essentially at its historical norm. Despite the -1.6 Z-score on the premium itself, the mean reversion metric hasn't drifted far. This suggests the backwardation is a temporary dislocation driven by the liquidation event rather than a structural shift.

Yield reads -238% APY at -1.6σ — an extreme reading that screams bullish from a funding perspective. At this yield level, the cost of holding a short position is enormous, which creates additional upward pressure as shorts are forced to cover.

The bounce at 41.3% with 17.1x magnitude is classified as Parabolic. The retrace is -2.4%, which is remarkably shallow for a move of this size. Price is sitting in a demand zone. The combination of a parabolic bounce, shallow retrace, and active liquidation creates a self-reinforcing feedback loop — rising price forces shorts to cover, which pushes price higher, which forces more shorts to cover.

Multi-Timeframe Directional Bias

The bias reads Deep BULL (62.96%) — the strongest classification — with an 81% bull : 19% bear split. Total signal count: 47 bull : 17 bear out of 122 evaluated. The spread is 46.9%, classified as Strong. Clarity at 48% reflects the volatile nature of the move rather than signal disagreement.

Close vs Tenkan: 11:3 — decisively bullish. Price is closing above the Tenkan-sen on the vast majority of timeframes.

The component breakdown is overwhelmingly one-sided:

EMA alignment: 5:3 bullish. The trend structure has turned. Moving averages are now favoring buyers on the majority of timeframes — a lagging confirmation that the parabolic move has begun to reshape the broader trend.

Ichimoku TK crosses: 10:3 bullish. Near-total dominance. The cloud structure across timeframes is firmly in bull territory.

Candlestick patterns: 13:1 bullish. This is an extreme reading. On 13 out of 14 timeframes producing signals, the candle structure favors bulls. One bearish signal exists in isolation.

Pattern detail: 4 bullish 3-soldier patterns, 0 bearish. 1 bullish engulfing, 0 bearish. Pattern total: 4:0. Four separate timeframes are printing 3-soldier patterns — the most aggressive bullish continuation pattern. This is not a single-timeframe anomaly; it's a synchronized bullish cascade across the timeframe spectrum.

The price squeeze has FIRED with bandwidth at 35.56% — this is an already-expanded reading, confirming the squeeze resolved into the parabolic move. Momentum reads Bull ↑ (bullish and rising). The squeeze fire, parabolic expansion, and rising momentum are all aligned.

Zero bearish reversal patterns. Zero stars, zero harami. The bear case has no candlestick structure to lean on.

Volume Intelligence — The Structural Vulnerability

This is where the picture gets more complex.

Spot Z-score: -0.41 (Steady — slightly below average, unremarkable)

Futures Z-score: 2.62 (Very High — extreme, nearly 3 standard deviations above mean)

Combined Z-score: 0.57 (Active — pulled up entirely by futures)

Futures-to-Spot ratio: 10.49x — classified as High.

The market is classified as Futures Speculative. The dollar volumes tell the story: spot is running at $14.98M while futures sits at $157.06M. The futures market is generating over 10x the dollar volume of spot.

This isn't in the manipulation territory we sometimes see (100x+), but 10.49x with a High classification means the price move is predominantly driven by derivatives speculation rather than spot accumulation. The parabolic bounce is being fueled by leverage, not real buying of the underlying asset.

Bull:Bear volume Z-scores read 1.21 : -0.59. This is the one positive note in the volume structure — bullish volume is running above average (1.21σ) while bearish volume is suppressed (-0.59σ). The bulls that are participating are doing so with conviction, even if most of that conviction lives in the futures market.

Volume momentum is at -0.05 and falling — barely negative, but the declining trajectory suggests the speculative fervor may be peaking rather than building. Volume direction is Neutral despite the parabolic price move.

The liquidation map shows active Shorts Liquidation. This is the fuel source for the rally. As price pushes higher, short positions hit their liquidation levels, triggering forced buying that accelerates the move. The -238% APY yield and -1.6 Z-score premium confirm that shorts are under extreme pressure.

No volume squeeze on either spot or futures — the expansion is already underway. Squeeze momentum is expanding at 158.6% on the downside (contracting from previous squeeze levels), which is normal during a breakout phase.

No whale activity detected. The ceiling sits at 15.78σ — ample room for further volume expansion.

Supply/Demand Context

There are 7 supply zones overhead versus 3 demand zones below. The current price sits in a demand zone. The 7:3 ratio means resistance exists above, but the parabolic momentum and active liquidations have the potential to punch through supply zones rapidly — liquidation cascades don't respect technical resistance the way organic selling does.

The Core Analysis

This setup has a clear narrative: a legitimately powerful directional move (Deep BULL, 81:19, 13:1 candles, 4 three-soldiers, squeeze fired, shorts liquidating) that is structurally dependent on leveraged speculation (10.49x F/S ratio, futures at 2.62σ vs spot at -0.41σ, Futures Speculative classification).

The bullish case is supported by everything visible on the chart — bias, patterns, momentum, price squeeze, premium yield, liquidation pressure. It's one of the strongest multi-timeframe directional readings possible.

The risk is entirely structural. When a 41% parabolic move is backed by 10.49x futures-to-spot leverage rather than spot accumulation, the sustainability question isn't about direction — it's about what happens when the liquidation fuel runs out. Once the shorts have been cleared, the buying pressure from forced covering evaporates, and the market needs real spot demand to sustain the elevated price level. With spot Z at -0.41 (below average), that demand isn't evident yet.

Volatile premium (0.11% StdDev on both lookbacks) adds another layer of risk — the basis is swinging rapidly, which means the derivatives market is in a state of flux. Volatile premium during a parabolic move often precedes a premium normalization event, which can coincide with price retracement.

Scenarios

Scenario 1 — Liquidation Cascade Continues, Price Extends (~40% probability):

The shorts liquidation event hasn't fully cleared. More short positions hit their stops at higher price levels, creating a cascading effect that drives price through supply zones. The -238% APY yield makes holding shorts prohibitively expensive, forcing remaining bears to capitulate. Spot volume eventually follows (Z climbing from -0.41 toward 0.5+), validating the move. The 4 three-soldier patterns across timeframes prove correct as continuation signals. The parabolic structure extends before eventually exhausting.

Key confirmation: Spot Z climbing above 0 (real buyers entering), the F/S ratio compressing below 8x (spot catching up), and premium StdDev declining from Volatile toward Normal (basis stabilizing).

Scenario 2 — Liquidation Fuel Exhausts, Sharp Retracement (~35% probability):

The shorts get fully liquidated — the fuel runs out. With spot volume running below average (-0.41σ) and the entire move backed by 10.49x futures leverage, there are insufficient real buyers to hold the elevated price. Premium volatility (0.11%) triggers a normalization event. The 41% parabolic bounce retraces 30-50% of its range in a rapid correction as the leveraged structure unwinds. Futures Z collapses from 2.62σ as speculative positions close. The 3 demand zones below provide stepping stones for the correction, but the violence of a leverage unwind can blow through multiple zones.

Key warning: Futures Z declining while spot Z stays flat or falls — this is the leverage exiting. Volume momentum (-0.05, already falling) accelerating to the downside. Premium Z-score (-1.6) snapping back toward 0 rapidly.

Scenario 3 — Transition From Speculative to Structural (~25% probability):

The best-case outcome for bulls. The parabolic phase ends with a controlled consolidation rather than a sharp reversal. Spot volume gradually enters (Z climbing from -0.41 toward Average), the F/S ratio normalizes from 10.49x toward a healthier 4-6x range, and premium StdDev settles from Volatile to Normal. Price gives back 10-15% of the move but holds above key demand, establishing a new structural base. The Deep BULL bias (81:19) and 13:1 candle structure provide the foundation for a more sustainable continuation at a later stage.

Key indicator: F/S ratio declining gradually (not collapsing) while price retraces modestly. Premium StdDev moving from Volatile to Normal over multiple sessions. Spot Z climbing even as futures Z declines — a handoff from speculation to accumulation.

What to Watch

Primary trigger: The shorts liquidation status. When the "Shorts Liq" signal clears, the forced buying pressure disappears. What price does immediately after liquidations clear is the single most telling signal. If it holds — Scenario 1 or 3. If it drops — Scenario 2.

Spot participation: The Spot Z at -0.41 is the structural weak link. A parabolic move needs real buyers to sustain. Watch for Spot Z to cross above 0 — that's the signal that spot demand is validating the futures-driven move.

Premium stability: The volatile StdDev (0.11% on both lookbacks) needs to settle. Declining premium volatility alongside stable price = the market is finding equilibrium. Increasing premium volatility = more instability ahead.

F/S Ratio trajectory: 10.49x is High but not Manipulation level. If it compresses toward 6x with price holding, the structure is improving. If it climbs above 15x, the speculative excess is worsening.

Volume momentum: Currently -0.05 and falling. This needs to stabilize or turn positive for the move to sustain. A deepening decline in volume momentum during a parabolic move = the participation peak has passed.

Risk Note

A 41% parabolic bounce driven by 10.49x futures leverage, active shorts liquidation, -238% APY yield, volatile premium, and below-average spot participation creates a high-reward but structurally fragile setup. The directional signals are among the strongest possible (Deep BULL, 81:19, 13:1 candles, 4 three-soldiers), but the volume microstructure reveals that this move is built on derivatives speculation and forced liquidation rather than organic spot demand. Parabolic moves end — the question is whether they transition or collapse. Position sizing should account for the leveraged fragility, and risk management is critical during active liquidation events. Educational analysis only — not financial advice.

TAGS

SPACE SPACEUSDT Volume Analysis Squeeze Technical Analysis Supply and Demand Multi-Timeframe Analysis Crypto Futures Liquidation

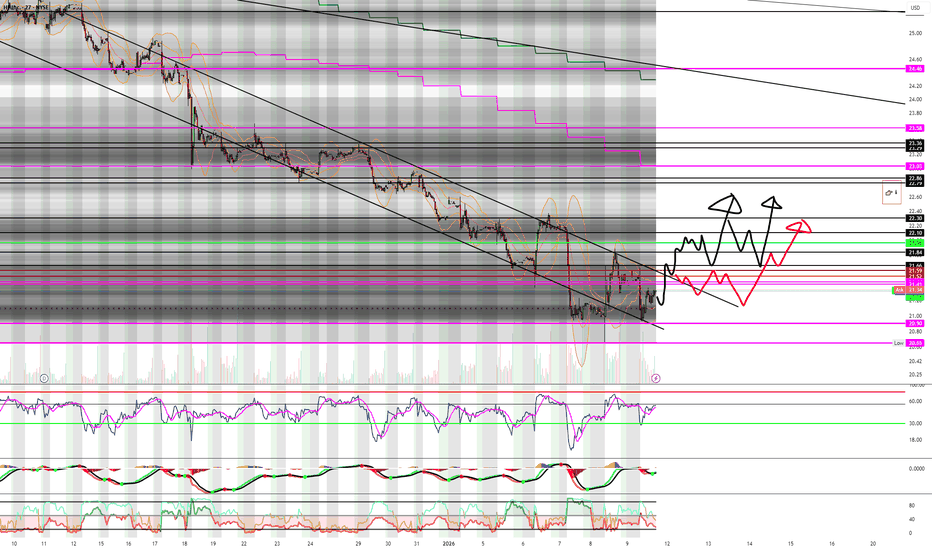

Bottoming. HP is next up ngl...My biggest edge on this one that backs my short term outlook is the fact that the POC on the volume profile inficator and also largest area of volume (Thats what a POC is) is located at this bottom that we hit within the last few trading days.

Targets next week are $21.5 and $22.

Other indicator is the amount of GEX imbalances for options chain next week.

IV wants $22 - $22.5 for 01/16/2026 Exp.

MSTR: 15x Parabolic Bounce With Candlestick DominanceMSTR: 15x Parabolic Bounce With Candlestick Dominance — But EMA Deadlock and Quiet Volume Say Wait

Overview

BATS:MSTR at 134.24 is riding a 15.1x parabolic bounce of 11.3% with a Strong BULL bias at 40.74% and a 70:30 directional split. Candlestick patterns are overwhelmingly bullish (12:2) with two three-soldier patterns and a 3:0 pattern total. The chart looks decisively bullish — until you notice that the EMA structure is perfectly split at 5:5, volume is Quiet at -0.75 Z with decelerating momentum, and there's no squeeze energy to catalyze the next leg. This is a strong directional move that hasn't convinced the trend indicators yet, running on fading participation. The question is whether the candle-led momentum can pull the lagging trend structure along, or whether the EMA deadlock and volume drain will stall the advance.

Price Structure

MSTR trades at 134.24 with a parabolic bounce measuring 11.3% at 15.1x magnitude. The retrace is a minuscule -0.7% — buyers are defending the move with almost zero concession to sellers. The status reads Extreme Breakout, and price sits in a demand zone.

The supply/demand landscape is unusually balanced for a stock in a parabolic move: 2 demand zones below and 9 supply zones above. The heavy supply overhead (9 zones) is a significant obstacle — each zone represents prior selling interest that will need to be absorbed for continuation.

The shallow retrace (-0.7%) against an 11.3% bounce creates a strong structural floor. Sellers have had every opportunity to push back and haven't been able to generate more than 0.7% of retracement. This level of buyer conviction in the retrace metric is notable, regardless of what the volume is doing behind it.

Multi-Timeframe Directional Bias

The bias reads Moderate BULL (40.74%) with a 70% bull : 30% bear split across multiple timeframes. Total signal count: 40 bull : 25 bear out of 123 evaluated. The spread is 23.1%, classified as Moderate. Clarity sits at 48%.

Close vs Tenkan: 10:4 bullish — a solid reading. Price is closing above the Tenkan-sen on the strong majority of timeframes.

Here's where the internal dynamics get interesting:

EMA alignment: 5:5. Dead even. Despite a 70:30 overall bias, the moving average structure is perfectly split. The trend — as defined by EMA positioning — has not committed to the bullish move. This is the single most important bearish data point in the entire setup. A 15x parabolic bounce that hasn't turned the EMA structure is a move that the trend doesn't yet believe in.

Ichimoku TK crosses: 8:5 bullish. A moderate bullish lean. The cloud structure favors buyers, but with 5 bearish crosses, there's meaningful resistance from the Ichimoku framework on higher timeframes.

Candlestick patterns: 12:2 bullish. This is the powerhouse of the bullish case. Twelve bullish patterns versus only two bearish across all timeframes. The detail is even more telling:

Three-Soldiers: 2:0 — two separate timeframes printing the most aggressive bullish continuation pattern.

Stars: 1:0 — a bullish reversal star with no bearish counterpart.

Engulfing: 0:0 — no engulfing patterns on either side.

Pattern total: 3:0 — all resolved patterns are bullish.

Harami: 0:0.

The candlestick structure is saying one thing loudly: the price action itself, bar by bar, is bullish across the vast majority of timeframes. Buyers are producing decisive candle patterns while sellers are not.

Momentum: Bull ↓ (bullish but declining). This is a cautionary signal within a parabolic move. Rising price with declining momentum is a classic divergence pattern. Bollinger bandwidth at 13.98% is moderately elevated — the parabolic expansion has widened the bands but not to extreme levels.

No squeeze is active. The squeeze has already resolved into the parabolic move, and there's no new compression building.

The EMA vs Candlestick Divergence

This deserves dedicated attention because it's the defining analytical feature of this chart.

The candlestick score (12:2) and the EMA score (5:5) are telling fundamentally different stories:

Candles say: The price action is overwhelmingly bullish. Buyers are producing continuation patterns (three-soldiers), reversal patterns (stars), and dominating the pattern landscape 12:2 with a 3:0 pattern total. Every resolved pattern is bullish. This is the language of a market where buyers control the session-level price action across nearly every timeframe.

EMAs say: The trend hasn't turned. Despite an 11.3% parabolic bounce, the moving average structure is exactly 50/50. The move hasn't lasted long enough or gone far enough to flip the EMA alignment. The broader trend, as measured by moving average positioning, remains contested.

This specific divergence — strong candles with flat EMAs — has two interpretations:

Interpretation 1 (Bullish): The candles are leading. Candle patterns react to price action in real-time, while EMAs are lagging calculations that require time to catch up. In a fresh parabolic move, it's normal for candles to lead and EMAs to follow. If the move sustains, the EMA alignment will shift from 5:5 to 6:4, then 7:3, confirming what the candles already showed.

Interpretation 2 (Bearish): The candles are noise. The parabolic move is producing bullish candle patterns by definition — price going up creates bullish candles. The EMAs, being less reactive and more structural, are the better judge of whether this move has true trend-changing power. A 5:5 EMA reading after a 15x parabolic bounce is a warning that the broader trend doesn't believe this move is sustainable.

Which interpretation is correct will be determined in the next 5-10 bars.

Volume Intelligence

Volume Z-score: -0.75 (Quiet). Only 856 shares on $114.91K dollar volume. Volume momentum is decelerating at -1.41 — a steep decline in participation.

Bull:Bear volume Z-scores: -0.46 : -0.47 — perfectly balanced suppression. Neither buyers nor sellers are showing up with any conviction. The volume direction is Neutral with a Direct relationship.

The VolZ across timeframes reads -0.75 on the short lookback and 0.66 on the longer lookback. This divergence is meaningful: longer-term volume is actually above average (0.66σ), but short-term volume has contracted sharply (-0.75σ). The move is happening on declining short-term participation even as the longer-term volume base remains healthy.

No volume squeeze is active. Squeeze momentum on volume is contracting at 614.9% — an extreme contraction rate, meaning volume compression is accelerating rapidly. This is unusual: price has gone parabolic while volume compression is intensifying. Normally, parabolic price moves are accompanied by volume expansion, not contraction.

No whale activity. Liquidation map clear.

The volume-price divergence is the second critical feature of this chart. A 15x parabolic bounce on Quiet volume with decelerating momentum (-1.41) and accelerating volume compression (614.9%) is a move that lacks participatory confirmation. Either volume catches up (validating the move) or it doesn't (leaving the move vulnerable to reversal on the first real selling pressure).

Scenarios

Scenario 1 — Candles Lead, EMAs Follow, Volume Catches Up (~30% probability):

The candlestick dominance (12:2) proves to be the leading signal. The EMA structure gradually shifts from 5:5 toward 6:4 and then 7:3 as the parabolic move persists. Volume Z climbs from -0.75 toward 0+ as the breakout attracts attention and participation. The 2 three-soldier patterns confirm as continuation signals, and new bullish patterns form on higher timeframes. Price begins working through the 9 supply zones overhead. The C>T ratio (10:4) holds or improves. Momentum (currently Bull ↓) stabilizes and flips back to Bull ↑.

Key confirmation: Volume Z crossing above -0.3 on continuation bars. At least one EMA signal flipping from bear to bull (moving to 6:4). Momentum shifting from Bull ↓ to Bull ↑. Bandwidth expanding above 16% on bullish continuation.

Scenario 2 — EMA Deadlock Wins, Momentum Fades (~40% probability, primary):

The 5:5 EMA reading proves to be the correct signal. The parabolic bounce was a powerful but unsustainable burst within a trend that hasn't truly turned. Declining momentum (Bull ↓) continues to decelerate. Quiet volume (-0.75 Z) and the -1.41 momentum decline mean there's no fuel for continuation. Price stalls against the first supply zone overhead, the 12:2 candle score gradually deteriorates as higher timeframe bearish patterns form, and the bounce fades. The retrace deepens from -0.7% toward -3% to -5% as the move mean-reverts.

Key confirmation: EMA remaining at 5:5 or worsening to 4:6 over the next 5-10 bars. Volume Z staying below -0.5. Candle score declining from 12:2 toward 10:4 or lower. Momentum completing the transition from Bull ↓ to Neutral or Bear.

Scenario 3 — Consolidation at Elevated Levels (~30% probability):

The strong candle structure (12:2) prevents a reversal, but the EMA deadlock (5:5) and quiet volume prevent continuation. Price enters a range between the current demand zone and the first supply zone above. Bandwidth contracts from 13.98% toward 10% as the parabolic energy dissipates into sideways movement. This scenario is the market waiting for a catalyst — an earnings release, a Bitcoin move (given MSTR's Bitcoin treasury correlation), or a macro event. The EMAs slowly catch up during the consolidation, either confirming or denying the move with time rather than price.

Key indicator: Price holding above the demand zone while bandwidth contracts. Volume remaining Quiet but not deteriorating further. Candle score holding above 10:4.

What to Watch

EMA trajectory. The 5:5 reading is the fulcrum. Any movement — even a single signal flip — is directionally informative. Track this across sessions: 6:4 = candle thesis gaining, 4:6 = trend reasserting bearishly.

Volume on the next impulse bar. Whether the next significant directional candle comes with volume (Z above -0.3) or without it determines the structural integrity of the move. The -1.41 volume momentum deceleration needs to stabilize.

Momentum direction. Currently Bull ↓. The next transition — either back to Bull ↑ (confirming continuation) or to Neutral/Bear (confirming fade) — is the momentum verdict on the parabolic move's sustainability.

Bitcoin correlation. MSTR's price action is structurally tied to Bitcoin given the company's treasury strategy. A parabolic bounce in MSTR without a corresponding move in Bitcoin suggests the MSTR-specific component is driving (potentially a squeeze of stock-specific shorts), while a bounce with Bitcoin confirmation adds fundamental support.

Supply zone density. Nine supply zones overhead is the heaviest resistance reading of any setup I've analyzed recently. Each zone represents a price level where prior selling occurred. The parabolic bounce needs continuous buying pressure to absorb this supply — and that requires the volume that currently isn't present.

Risk Note

A 15x parabolic bounce at 70:30 bias with 12:2 candle dominance creates a compelling bullish surface — but the 5:5 EMA deadlock, Quiet volume (-0.75 Z), decelerating volume momentum (-1.41), declining price momentum (Bull ↓), and 9 supply zones overhead create meaningful structural risk. The divergence between candle patterns (strongly bullish) and trend indicators (neutral) means the setup is in transition — the outcome depends on which signal is leading. MSTR carries additional factor risk from its Bitcoin treasury exposure, adding a layer of fundamental correlation that can override technical structure in either direction. Position sizing should reflect the unresolved EMA/candle conflict and the thin volume backing the current move. Educational analysis only — not financial advice.

TAGS

MSTR MicroStrategy Strategy Technical Analysis Supply and Demand Multi-Timeframe Analysis Volume Analysis Stocks Bitcoin

Discipline Beats Talent (And It's Not Even Close)Discipline Beats Talent (And It's Not Even Close)

Another educational breakdown for the crew.

If you're getting value from these, hit that follow button. Let's get into it.

The Uncomfortable Truth

You don't need to be the smartest person in the room to succeed in trading.

You don't need elite pattern recognition. You don't need to predict every move. You don't need a finance degree.

What you need is simpler: a plan and the discipline to follow it.

An average trader with a system they execute consistently will outperform a brilliant trader who wings it. Every single time. Over months. Over years.

Let me show you why.

Why Systems Beat Talent

Reason 1: Systems Remove Emotion

The talented trader without a system:

Spots a perfect setup. Enters with conviction. Price moves against them. "This is just noise, hold on." Down 5%. "Should I cut it? What if it bounces?" Down 8%. Exits in frustration. Next day, stock rips in their original direction.

They were right. But emotion made the exit decision. Emotion lost money.

The average trader with a plan:

Same setup. Same entry. Price moves against them. System says: "If price closes below X, exit." Price closes below X. Exit at 3% loss. No debate. No emotion.

They move on to the next setup. Three setups work that week. Net positive for the month.

The difference isn't skill. It's having rules and following them.

Reason 2: Systems Survive Drawdowns

Every trader hits losing streaks. Always. It's part of trading.

The talented trader without a system during drawdowns:

→ Questions everything they know

→ Changes their approach mid-streak

→ Takes bigger risks trying to recover quickly

→ Abandons good setups because confidence is shaken

→ Spirals into revenge trading

The average trader with a system during drawdowns:

→ Checks if they followed their rules (usually they did)

→ Reviews data showing similar streaks recovered before

→ Continues taking valid setups at proper size

→ Trusts the process because math supports it

→ Stays disciplined until probability swings back

The system is a psychological anchor. When emotions scream "change everything," the system says "this is normal, keep executing."

That anchor separates surviving drawdowns from blowing up during them.

Reason 3: Systems Create Repeatability

Talented traders often succeed through feel and intuition. The problem? Feel isn't transferable to tomorrow.

What worked in this market condition might not work in the next. When you operate on instinct, you can't identify what's actually working versus randomness.

The average trader with a system tracks:

→ Every entry and exit

→ Win rate over 50+ trades

→ Average risk/reward achieved

→ Which conditions favor their approach

→ Which conditions don't

After 100 trades, they know exactly what their edge is. Expected return per trade. Maximum drawdown threshold.

The talented trader has no data. Just wins and losses with no pattern. During losing streaks, they don't know if something's broken or if this is normal variance.

Without data, you can't improve. Without repeatability, you can't scale.

Real Comparison

Trader A: Experienced, No System

→ 8 years experience

→ Strong technical skills

→ Enters based on "feel"

→ No predetermined stops or targets

→ Position sizing varies by conviction

Results over 3 years: +19% total, high volatility, significant stress

Trader B: Average Skills, Strict System

→ 2 years experience

→ Adequate technical knowledge

→ Mechanical entry rules

→ Predetermined stops and targets

→ Fixed 1% risk per trade

Results over 3 years: +35% total, low volatility, minimal stress

Trader B outperformed with less experience because they had a repeatable process they executed consistently.

What Makes a Complete System?

A complete trading system includes:

Entry Rules: Specific technical conditions that must be met. No "it looks good" entries.

Exit Rules: Predetermined stop loss and profit target before entry. No mid-trade adjustments.

Position Sizing: Fixed percentage risk per trade (1-1.5%). Calculated before entry based on stop distance.

Risk Management: Maximum concurrent positions. Maximum portfolio risk. Rules for drawdowns.

Documentation: Every entry, exit, and reason recorded. Reviewed monthly for improvements.

Without all five, you don't have a system. You have guidelines that get violated when emotions run high.

The Discipline Problem

Creating a system is easy. Following it is hard.

Following it when you're down 5% on a position that "just needs one more day" is hard.

Following it when you're up 1.5R and tempted to hold for 3R (but your system says take partials at 2R) is hard.

Following it when your last three trades lost and you want to skip the next valid setup is hard.

How to build discipline:

Start small: Trade smallest positions while learning the system. Focus on execution, not profits.

Track everything: Write it down. Accountability matters.

Accept losses as data: Stopped trades aren't failures. They're the system working. Losses are the cost of business.

Celebrate process over outcomes: Did you follow your rules? That's a win regardless of result.

Review weekly: Look at execution, not P&L.

Over time, following the system becomes automatic. That's when results compound.

Why Talent Fails Without Systems

Talent gets you started. Discipline keeps you alive.

Brilliant traders blow up not because they can't read markets, but because they can't manage themselves.

They hit a winning streak and start risking 5% per trade instead of 1%. "I'm seeing clearly right now."

Three losses later, they're down 15%. Now they're trading emotionally, trying to recover. Edge disappears.

The average trader with a system never faces this. The system doesn't let them deviate. Win or lose, rules stay the same.

Boring consistency beats exciting volatility every time.

The Bottom Line

You don't need to be exceptional to succeed.

You need to be consistent.

An average trader executing a mediocre system flawlessly will outperform a great trader executing brilliantly sometimes and emotionally other times.

The math is simple:

→ Consistent execution + adequate edge = compounding gains

→ Inconsistent execution + great edge = random results

Build your system. Write down your rules. Follow them without exception.

That's the game.

Your talent doesn't matter if you can't control your behavior. Your system won't work if you don't follow it.

But an average trader with a plan they execute consistently?

That trader wins. Every time. Over years.

Be that trader.

Educational content only. Trading involves risk. Having a system does not guarantee profits. Discipline improves execution but cannot ensure positive outcomes. All traders must determine appropriate strategies based on their own risk tolerance and capital.

ARB: is the bounce finally here? key levels to watch todayARB. Tired of watching this thing bleed and asking if the bounce is finally real? After a brutal selloff, headlines around layer‑2 activity and renewed interest in scaling stories are slowly coming back, and the market stopped panic‑dumping this one. Today we see ARB stabilizing while the rest of the market cools off a bit, which is often how quiet reversals start.

On the 4H chart price is building a base above 0.11 after that waterfall move. RSI has ripped from oversold to above 60, and the volume profile shows a fat node near 0.115 where buyers keep defending. As long as we hold 0.112, I lean to the upside, with a squeeze into the first red supply zone around 0.128‑0.13 on the table.

✅ My base plan: I’m interested in dips to 0.113‑0.115 for a short‑term long toward 0.128‑0.135, maybe 0.14 if momentum really bites. If we get 4H closes back under 0.11, I step aside and expect another leg toward 0.10‑0.095. I might be wrong, but this looks more like late capitulation than the start of a fresh downtrend, so I’m trading the bounce, not marrying the coin.

Play your DICE TWICE on BTC BUYthis my favorite crypto over years , the market sentiment and FOMO over BITCOIN has been collecting millioncs under one major Crypto, but the last EPstein files , has validated the inneficiency of this market and it(s overstimulating by BOHO effect. BUT the Algorithmic design that it's price is following is solide and technical.

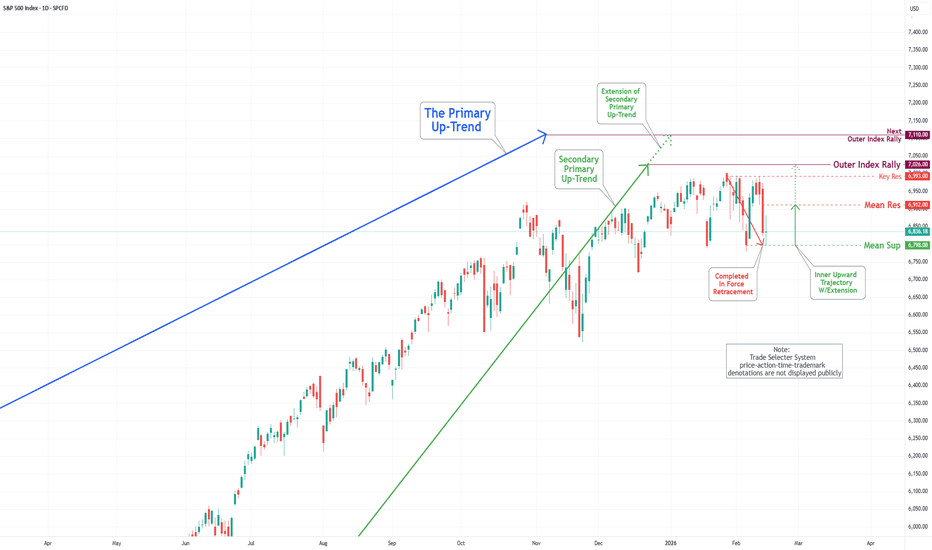

S&P 500 Daily Chart Analysis For Week of Feb 13, 2026Technical Analysis and Outlook:

The S&P500 Index exhibited an extraordinary rise and a sharp decline during the trading session this week, reflecting one of the most vigorous moves in recent trading activity. On the upside, it has met our target at Key Resistance 6,993 and has crashed sharply to Mean Support 6,798.

It is anticipated that the S&P500 Index will continue its upward trajectory toward the Mean Resistance at 6,912, with the ultimate goal of reaching our awaited outcome of an Outer Index Rally at 7,026.

Nevertheless, it is imperative to acknowledge that there is a substantial likelihood of a retracement retest that will lead to revisiting the Mean Support at 6,798 before the Index regains its bullish momentum.

EUR/USD Daily Chart Analysis For Week of Feb 13, 2026Technical Analysis and Outlook:

In the current trading session, the Euro has experienced a significant upward move, surpassing our Mean Resistance levels at 1.183 and 1.187.

It is anticipated that, following this development, the Euro has established an active Inner Trading Zone represented by Mean Support at 1.183 and Mean Resistance at 1.192.

Market participants are advised to remain vigilant for a currency downside bias, with a focus on the ultimate target of the Outer Currency Dip at 1.166.

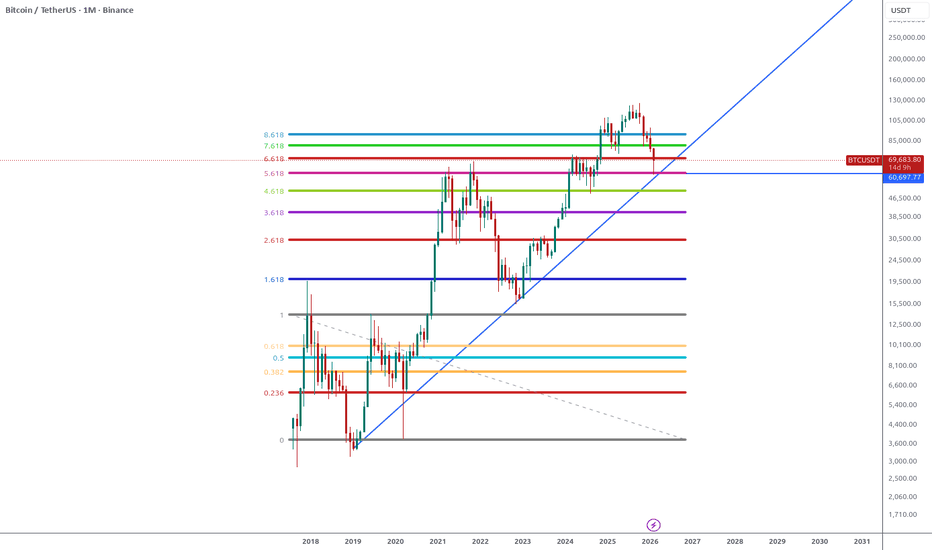

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 13, 2026Technical Analysis and Outlook:

Bitcoin has seen moderate trading activity this week. The cryptocurrency

has established an active Inner Trading Zone enveloped between Mean Support 62,800 and Mean Resistance 71,200.

Current market analysis indicates a gradual fluctuation between these two markings before a breakout in either direction. Upon the upward movement, the target price is a Mean Resistance of 78,700, while the target for downward movement is an Outer Coin Dip at 60,000.

FXHUNTER Hello, I'm FXHUNTER. Here we are analyzing the GBPUSD symbol. This symbol is bullish on the upper timeframe, but it is likely to be bearish or corrective for a while on the lower 4h timeframe. Considering that it has now encountered a valid block order, it could be a confirmation that it is bearish.

Bitcoin 10X Long with 689% profits potentialIt's been several days since Bitcoin hit bottom, six days now.

The drop that started 14-January 2026 was composed of strong bearish momentum; it was lower, followed by lower and then more lower. The longest stop was one or two days, never more than that. There was nothing weak about the drop.

Bitcoin isn't dropping anymore. The RSI oversold, the highest volume ever, etc. All those signals that I showed you multiple times are better now, stronger now—this is a great entry. The classic retrace is over, etc. There is so much supporting a bullish advance... You cannot miss this.

Ok. Bitcoin is bullish because it isn't bearish.

Bitcoin is set to rise because the altcoins are already rising.

›› The altcoins crashed first in 2025 then came Bitcoin.

›› The altcoins recover first in 2026 then comes Bitcoin.

Here you have the full trade-numbers with 10X.

___

LONG BTCUSDT

Leverage: 10X

Potential: 689%

Allocation: 3%

Entry zone: $60,000 - $67,000

Targets:

1) $69,800

2) $75,625

3) $85,300

4) $93,100

5) $100,911

6) $112,033

Stop: Close weekly below $57,000

____

Remember, it is possible that not only "the first leg down is over," but, the entire bear market. It is possible that the bear market is already over and we are set to experience long-term growth.

The bear market is over you say? Possible, I said.

Over or not over, we are going up.

Namaste.

Bitcoin —Last chance before $100,000 (Extreme buy opportunity!)While Bitcoin is no longer trading at $60,000, I am here to tell you that a strong opportunity is still present; a 2nd chance, the last chance.

Any trading below $70,000 is still a really good buy as Bitcoin is headed for a sure price between $90,000 to $100,000 first. This would be the first wave.

Not only below $70,000 but also below $75,000 and $80,000 are still good entry zones.

All support has been recovered but one, the 0.5 Fib. retracement level at $70,838. We have some interesting facts here related to Bitcoin's price.

After breaking above $70,000 in early November 2024, Bitcoin never looked back. Only recently this is happening and this happening we now know will be short-lived. Last week and this week only Bitcoin traded below $70,000 and this too soon will be history.

Within hours, Bitcoin is likely to trade back above $70,000 and then we are green long-term.

Remember, Bitcoin's supply is limited and production is cut in half every four years through the halving, a deflationary event.

With each successive halving event less Bitcoin's are created every ten minutes through mining and this puts pressure on prices to rise up.

Bitcoin is programmed to appreciate. Bitcoin's price will continue to grow.

All market conditions are now bullish. It is not too late, this is the last chance to buy Bitcoin while it trades below $70,000. This is an extreme buy opportunity. The same goes for most of the altcoins.

Thank you for reading.

Namaste.

QNT: breakout alert! key levels and targets for the upcoming dayQNT. Who else was waiting for this thing to finally wake up? Interoperability and tokenization are back in the spotlight according to market sources, and today QNT answered with a clean breakout right as headlines talked about renewed interest in institutional blockchain rails.

On the 4H chart price has ripped out of the 68-70 box and is now pushing into the green supply zone around 73-75. Volume picked up on the breakout and RSI is hovering above 70, so momentum is bullish but a bit overheated. My base case is a shallow pullback or sideways pause above 70, then a push toward the next resistance cluster near 76 and possibly 79-80.

My plan: I prefer longs on a retest of 70-71 or a tight consolidation just under 74, with 🎯 focus on 76 first, then 79-80 if the trend stays clean. ✅ As long as 70 holds on 4H closes, bulls keep the ball. ⚠️ If price dives back under 69 and closes below 68.5, I’ll treat it as a fakeout and look for 64 and lower liquidity. I might be wrong, but right now QNT finally looks ready to stretch its legs.

BTC Defends $60K — Can Bulls Take Back Control?Bitcoin is trying to get back on its feet after one of its sharpest pullbacks in months. The world’s largest cryptocurrency tumbled from around $97,946 to nearly $60,279, a painful 38% drop that shook confidence across the market. Since then, price action has started to stabilize. Bitcoin found solid support near $60,000 earlier this month and has carved out a higher low, a small but meaningful technical shift that traders often read as an early sign of strength. Momentum indicators are also flashing mild bullish divergence, suggesting that selling pressure may be losing steam even as price moves sideways.

Right now, Bitcoin is trading around the upper $60,000s, hovering near $68,000 to $69,000 after briefly testing the $70,000 area. The broader downtrend from last year’s peak above $126,000 is still intact, so the recovery remains fragile. Recent news has added to the mixed mood. Spot Bitcoin ETFs in the U.S. have continued to attract institutional inflows, although flows have been uneven week to week. At the same time, macro worries and volatility in the tech sector have kept traders cautious.

Fund managers are split. Analysts at Standard Chartered recently trimmed their 2026 outlook to $100,000 and warned that a slide toward $50,000 cannot be ruled out before a stronger rebound. On the other hand, strategists at JPMorgan and Bernstein argue that steady ETF demand and corporate accumulation, including ongoing purchases by MicroStrategy led by Michael Saylor, could push Bitcoin toward $150,000 over time.

In the near term, a decisive break above $72,000 would likely open the door for a stronger rally. Failure there could keep Bitcoin stuck between roughly $65,000 support and $72,000 resistance. The short-term tone is cautiously bullish, but bigger macro risks and the long-term trend still pose real challenges heading into 2026.