Beyond Technical Analysis

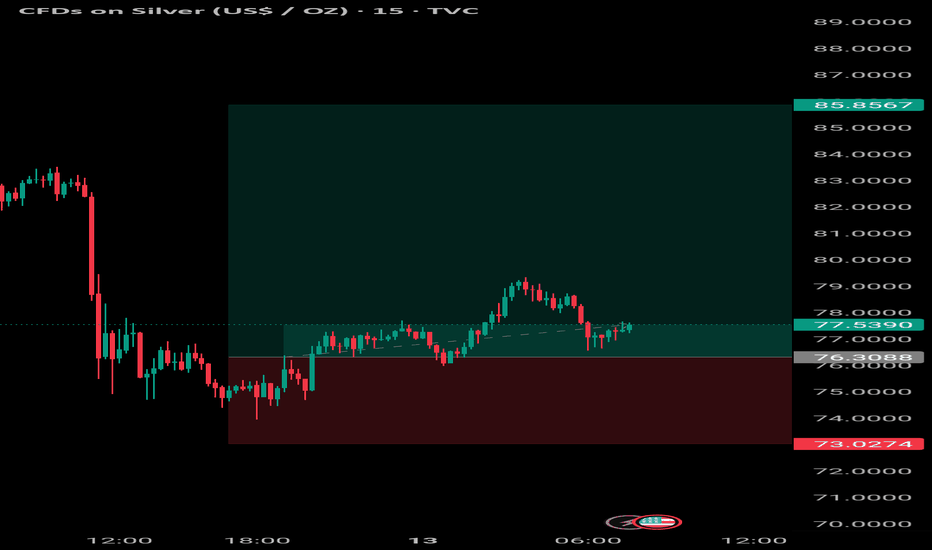

XAG/USD TRADE SETUP LONG 13TH FEB Entry Zone: Around 77.50 – 78.00

Stop Loss (SL): 73.00

Trailing Stop Loss (TSL): Activate after TP1 is hit; trail below higher lows to lock in profit.

Take Profits:

TP1: 81.00 USD

TP2: 83.22 USD

Setup Rationale:

Price is showing short-term bullish structure with higher lows forming on the 15m timeframe. Momentum is building after a pullback, suggesting continuation toward previous resistance levels. Risk-to-reward is favorable, with strong upside potential toward 81 and extended move toward 83.22 if bullish momentum continues.

Management Plan:

A sneak peak in commodities, ahead of Core Inflation dataTwo Major economic events on line.

1. Core Inflation Rate YoY

2. Inflation Rate MoM

_Core Inflation Rate YoY_ measures annual price increases excluding volatile food and energy, reveals underlying inflation trends.

Higher-than-expected reading pressures Fed to keep rates high, weighing on global stocks, strengthening USD, and hitting commodities like gold/oil; Indian indices (Nifty) and metals fall on FII selling.

_Inflation Rate MoM_ tracks monthly change in overall consumer prices, capturing short-term shifts.

Higher (Hot print) rate triggers risk-off: global equities dip, rupee weakens, Sensex drags (FMCG/auto sensitive);

Lower prices (softer data) boosts markets worldwide.

Ahead of the announcement, sharing the projections of important levels and possible impacts on the major commodities, specially metals.

AUDUSD: Commodity Supercycle meets RBA/Fed Divergence📍Quick Summary

The Australian Dollar is witnessing a structural regime shift, clearing the 0.7000 psychological handle on the weekly timeframe. This "rip" is the result of a "Perfect Storm": a hawkish Reserve Bank of Australia (RBA), record-breaking commodity prices, and a weakening U.S. Dollar ahead of critical Non-Farm Payrolls (NFP) data.

The Macro Environment

The fundamental backdrop for the Aussie has flipped to "Aggressive Bullish" due to three core drivers:

Monetary Policy Divergence:

The RBA surprised the market in February with a hike to 3.85%, citing sticky inflation. Meanwhile, the Federal Reserve is expected to ease toward a target range of 3.25% by year-end. This yield spread is a massive magnet for institutional carry-trade inflows.

The Commodity Super-cycle:

AUD is acting as a "Hard Asset Proxy." With Spot Gold trading above $5,050 and Copper at $5.98, the terms of trade for Australia are at multi-year highs. We are seeing a "debasement trade" out of fiat and into materials.

China Disinflation Hedge:

While China's 0.2% CPI print is a global concern, the RBA's hawkish stance is keeping the AUD stronger than its peers (CAD, EUR), as it acts as a selective play on base metal demand.

Technical key-levels:

The weekly chart shows a vertical expansion following a successful retest of the 0.6900 support zone. We have officially cleared the 200-week Moving Average, which has acted as a ceiling for the last two years.

Immediate Resistance: 0.7150, 0.7180 (NFP Targets)

Psychological Target: 0.7300 (Q3 2026 Objective)

Main Supply Target: 0.7500

Support Levels: 0.7020, 0.6980

📍The Bull Case (The "Rocket" Scenario)

The structural momentum is being driven by a rare convergence of monetary hawkishness and a multi-decade commodity rip.

Carry Trade Magnet:

The RBA is the only "G10 Hawk" left, making the AUD the primary destination for yield.

Hard Asset Proxy:

Global investors are treating the AUD as a liquid way to play the surge in Gold and Copper.

Dollar De-leveraging:

The DXY is entering a "Death Spiral" as markets frontrun a recessionary NFP.

📍The Bear Case (The "China Proxy" Trap)

To remain objective, we must identify the "Fail State":

China Demand Deficit:

If 0.2% CPI leads to an industrial collapse, the AUD's link to metals won't save it from a "China Proxy" sell-off.

Iron Ore Divergence:

If the softening in Iron Ore ($100 handle) eventually outweighs the rally in Gold/Copper, the AUD's "Resource Floor" may be thinner than expected.

Hawkish Shock:

A "Beat" in NFP (>100k) would trigger a "Bull Trap" liquidation back to 0.7000.

📍Event Risk:

Current intraday gains look like "Frontrunning" the delayed NFP print.

Bull Case: NFP < 50k confirms the recession narrative, catapulting AUDUSD toward 0.7200.

Bear Case: NFP > 100k triggers a short-squeeze in the DXY, testing 0.7000.

The Elephant Jungle 2/13/26 Page 4There is still a fresh 4H supply range sitting directly in confluence with the Macro Range Low. That matters. This is a level that has not been fully explored yet and price has a habit of revisiting unfinished business.

Is it possible we see the Bulls push into that supply range today and then give us a slow weekend grind back down? Yes it is on the table. The path upward is not complicated. There is relatively easy liquidity above that could be swept to fuel the move.

For that to happen the Bulls simply need to reclaim the high and get the train moving. Nothing dramatic. Just enough momentum to invite participation and force shorts to react.

But before jumping to conclusions let’s zoom in again. Let’s take this down to the 1H timeframe and see where the hesitation really is. When price stalls the answer is usually hidden in the lower timeframes. The Jungle always leaves clues if you know where to look.

NAS - STRATEGY WHEN MARKET OPENTeam, today we done well 5/5 trades for NAS100.

Here is a safe plan.

Plan we are setting enter LONG position at 24408-25 - AS THE MARKET open, it will be very fast volatile.

STOP LOSS at 24365

Target at 24556-24586

Target 2 at 24615-24663

If it every hit our STOP LOSS, it will likely we can catch the NICE bottom.

I will be setting LONG at 24208-24232

STOP LOSS at 24115

NOW, with this, you can HOLD for big swing

Target 1 at 24276-22312 - Take 50% partial bring stop loss to BREAK EVEN

Target 2 at 24328-24382 - Take another 30% partial

Target 3 at 24415-24536 - you can booked last one with BIG SMILE

LETS GO

GOLD CPI TODAYHi, I’m Maicol, an Italian trader.

I study Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small thing for you, but important for my work.

Please read the description to understand the trading plan.

Don’t focus only on the chart. Thanks.

Live today at 14:00 CET (Rome time).

🌞 GOOD MORNING EVERYONE 🌞

Yesterday’s daily close is not encouraging.

We had a strong rejection candle from the previous daily shift level, as shown on the chart.

Price is also positioned below the 5,000 handle, which is significant.

Personally, I’m considering shorts today.

But we have CPI, so it’s better to wait for the release and then react accordingly.

This is the current context, and I’ll explain how I plan to position myself once the data is out.

Today’s CPI is the main driver.

The market expects cooling inflation (lower YoY vs prior), but positioning is asymmetric:

Downside surprise → renewed bullish momentum.

Upside surprise → potential retracement toward structural support.

CPI will set the next directional move.

The Federal Reserve remains data-dependent.

The inflation path is key for rate expectations.

If CPI confirms further cooling:

real yields down → gold higher.

- US CPI – Scenario

--> Hot CPI

(≥0.4% MoM and/or Core ≥0.4% | YoY above 2.5%)

Disinflation stalls.

Rate cuts get pushed back.

Yields rise, USD strengthens.

-Gold → bearish pressure

-USD → bullish impulse on hawkish repricing

---> Soft CPI

(≤0.2% MoM and/or Core below expectations | YoY ≤2.4%)

Disinflation accelerates.

Markets price earlier cuts.

Yields fall, USD weakens.

-Gold → bullish pressure

-USD → weakness

See you live at 14:00.

🔍 Reminder 🔍

I avoid trading during the Asian and London sessions.

I focus on the 14:30 news and the New York open at 15:30.

🔔 Turn on notifications so you don’t miss anything.

📬 If you have any questions, message me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, we’ll be live at 14:00 to follow the market in real time.

In the meantime, have a good day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

The Elephant Jungle 2/13/26 Page 3Now let’s drop down to the 1D timeframe. This is where things start to get interesting.

Last time I talked about the idea of the Bulls allowing the Bears to retrace into the golden/silver pocket (the 681 and 786 zones) for a clean and healthy bounce. That scenario made sense structurally and a lot of traders were patiently waiting for it.

But price does not owe anyone a perfect entry.

What we are seeing now is the possibility that the Bulls are changing their mind. Instead of giving a textbook pullback they may be front running the golden pocket entirely. Or this could simply be a controlled tug on the line. The kind a fisherman uses to make the bait jiggle just enough to get the Bears to bite early.

Either way this is where discipline matters. Because if this move holds the 1D candle is already showing strength. It looks bullish. It looks intentional. Like it woke up this morning drank a cup of Folgers and chased it with a shot of wheatgrass.

And if this does turn out to be a front run the Fibonacci traders are going to be heated. But that is the lesson. The Jungle does not reward expectations. It rewards those who can adapt when price reveals its hand.

Cpi to come in Hot @2.5% bears to drive Gold @4,660 zone As we await the Cpi data currently, the Price is sitting under supply.

Momentum failed at 5,100.

Technically, this leans slightly bearish going into CPI.

But here’s the danger:

Everyone sees that 4,660 as liquidity. Everyone sees the downside magnet.

When positioning gets too obvious, CPI can squeeze the other way first.

What I’d Watch Immediately After Release

Does 4,940 hold on the first reaction?

Do we get a strong 4H reclaim above 4,980?

Or do we close below 4,920 with momentum?

Because if 4,920 breaks cleanly,

Then the path to 4,800 opens quickly. Bigger Picture TruthGold has already failed at 5,100

Already broken prior higher low, Printed lower high, That means bulls must prove themselves.

My Straight Read

If CPI comes in exactly at 0.3%?

We could get a whipsaw.Because neutral data often means, Liquidity hunt first… direction second.

If CPI is hot? 2.5% hotter

Probability favours downside toward 4,800–4,660.

If CPI is soft?

Gold needs to break and hold above 5,000 to regain control.

My take is that CPI will be hotter than expected; thus, unmitigated liquidity will be a major magnet for the precious metal @4,660.

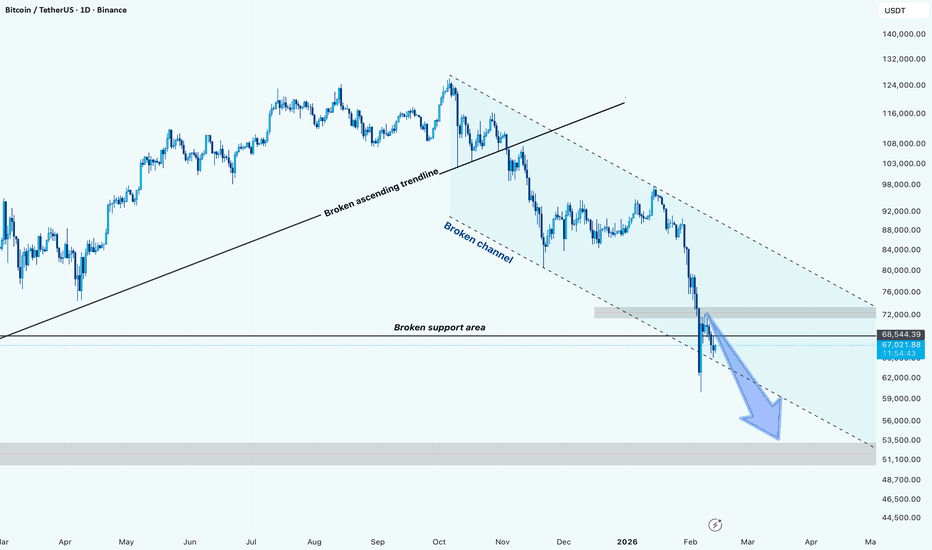

BTCUSDT: Structure Break & Bearish Channel ContinuationHi!

Bitcoin has shifted into a clear bearish market structure after breaking the long-term ascending trendline and losing the key horizontal support zone. Price is now trading inside a descending channel, confirming downside momentum.

The recent breakdown below the 68K support area turned previous support into resistance, increasing the probability of continuation toward lower liquidity zones.

Market Structure

Broken ascending macro trendline

Lost major horizontal support

Clean rejection from broken support → resistance flip

Price respecting bearish channel boundaries

Bearish Scenario (Primary Bias)

If the price continues to respect the channel resistance, further downside is likely.

Target Zones:

Target 1: 60,000 – 58,000

Target 2: 55,000 – 53,500

Important Context – Monthly Support

This setup comes with reduced statistical confidence because the price is approaching a higher timeframe (monthly) support region.

That means:

Downside continuation is possible

But sharp bounces can happen unexpectedly

Overall win rate of this bearish continuation idea could be lower than usual due to higher timeframe demand presence

The Elephant Jungle 2/13/26 Page 2Now that we zoomed in a notch the picture gets a lot clearer. The 1W Internal Demand Range is doing most of the heavy lifting right now. This is the zone that has been quietly supporting the Bulls while the noise above tries to shake confidence.

If the Bears manage to push through that 1W level and continue pressing through the remainder of the 1M Demand Range there is still work to be done. Sitting below is a fresh 1W Internal Demand Range around 49k. That level is not just decoration. It is real structure and it stands in the way of any clean or easy move down toward 30k. There is no straight shot here no matter how loud the fear gets.

And honestly it is hard to believe the Bulls would put in this much effort all week just to roll over without at least forcing a back test of the Macro Range Low. That kind of move would make sense. It would be earned. It would be part of the process. Folding here without a fight would not.

So come on Bulls. Dig a little deeper. Show the Jungle that this move has heart behind it. Show that this is more than just survival. Get on up and handle your business. The Jungle is watching.

BTC: another Drop??????Hi everyone!

After a strong rally, BTC formed a rising wedge pattern and has now broken to the downside. Price is currently sitting at a very important support zone, which could be difficult to break.

🔴For now, it’s better to stay patient and wait for a clear breakdown below the $74,400 support level, or a breakdown followed by a retest/retracement, before considering any short positions.

🎯If this support fails, the potential downside target would be around $63,500.

Gold Technical Outlook (XAUUSD)Hi!

Gold is still holding above its ascending trendline, and this structure has not been broken yet. After a sharp decline from the $5600 area, price rebounded strongly from the trendline and the key flip zone highlighted in blue.

The first supply/demand area around $4807 has now been fully engulfed, which strengthens the bullish case. A long position can be considered after a minor retracement, with an upside target near $5104.

Gold May Correct Below the 5000 Level📊 Market Overview:

Gold is under corrective pressure after breaking below the psychological 5000 USD/oz level, as the USD remains strong and US bond yields stay elevated. Market sentiment is cautious ahead of upcoming US economic data and Fed policy expectations, leading to short-term profit-taking in gold.

📉 Technical Analysis:

• Key Resistance: 5005 – 5015 / 5050 – 5060

• Nearest Support: 4920 / 4980

• EMA: Price is trading below EMA 09 → short-term bearish bias.

• Candlestick / Volume / Momentum: Selling pressure increased after the breakdown below 5000. Decreasing volume suggests a potential technical pullback before the main trend continues. RSI is moving down from overbought territory, and bearish momentum still dominates.

📌 Outlook:

Gold may decline in the short term if it fails to reclaim the 5000 level, but a technical rebound toward resistance zones is still possible before a deeper correction.

________________________________________

💡 Trading Strategy:

🔻 SELL XAU/USD at: 5057 – 5060

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 5064

🔺 BUY XAU/USD at: 4920 – 4917

🎯 TP: 40 / 80 / 200 / 300 pips

❌ SL: 4913

The Elephant Jungle 2/13/26 Page 1Well it is Friday. Not just any Friday. It is Friday the 13th.

Now the question the Jungle is quietly asking is what does that mean for the markets.

As of right now the Bulls are holding the line on the 1M Demand Range and they are attempting to work their way back into the Macro Range. It has been a long week. Bulls and Bears went head to head day after day and credit where it is due the Bulls did not fold. They absorbed pressure and stayed standing.

But today is the real test.

Does the symbolism of the day shake the Bulls confidence. Will the support be pulled from under them like a loose Jenga block. Or do the Bulls stay disciplined and prove that price does not care about superstition only structure and liquidity.

Then there is always the wildcard. Does Trump wake up and say something wild that sends the markets into a quick flush. Or does the market pump and turn the table around on the Bears.

Now that would be Bad News for the Bears but good news for those Hodling Bitty while everyone else is distracted by headlines and fear.

Instead of guessing let’s slow it down and zoom in. Let’s go to the 1W timeframe and see what is actually happening beneath the noise. Because the Jungle does not reward emotion. It rewards patience clarity and respect for the range.

USNAS100 | CPI Data in Focus After Sharp DropUSNAS100 | CPI Data in Focus After 650-Point Drop

The Nasdaq dropped around 650 points, keeping the broader structure bearish as markets now shift attention to the U.S. CPI release, a key catalyst that could drive volatility across equities.

Technical Outlook

The index remains bearish while trading below 24785.

As long as price remains below this level, downside pressure is expected toward 24370, followed by 24180 and 23940.

Macro Trigger:

• CPI above 2.5% → bearish for indices

• CPI below 2.5% → bullish recovery scenario

Key Levels

• Pivot: 24780

• Support: 24370 – 24180 – 23940

• Resistance: 24960 – 25200

POL: ready for a rebound? key levels to watch in the coming daysPOL – tired of bleeding or just loading the spring for the next move? According to market sources, fresh headlines around the Polygon 2.0 migration and new incentives for builders lit up the ecosystem today, and intraday volume picked up right away. On the chart we’re sitting right on a chunky demand zone where buyers defended price several times already.

On the 4H, RSI bounced from oversold and is pushing above its signal line, while the visible range volume profile shows a fat node a bit higher, around the first red supply block. I’m leaning long from this green zone, aiming for a squeeze into the 0.103–0.11 area as late shorts get uncomfortable. I might be wrong, but this looks more like accumulation than a safe downtrend continuation. ✅

My base plan: hold longs while price stays above the lower edge of demand around 0.088 and watch for a clean 4H close above local resistance to confirm strength. If bulls fail and we lose that 0.088 support, I step aside and let it drift toward deeper liquidity below 0.085. Until then, I treat dips into the green zone as potential reload spots, scaling out near the first red supply blocks.

Report 13/2/26Macro & Geopolitical Report

Report Summary

This report assesses the market and geopolitical implications of Iran’s crackdown expanding from street dissent into the political class, with the arrest of senior reformist figures and the further hollowing-out of President Masoud Pezeshkian’s governing coalition. The core thesis is that this is an internal-stability shock that matters externally because it narrows Tehran’s room for negotiated compromise while raising the probability of erratic escalation behavior. In markets, this does not always translate into an immediate “war premium” bid; instead it often produces a risk-distribution widening—higher volatility, faster rotations, and a persistent premium in energy hedges—especially while U.S.–Iran talks continue and U.S. force posture remains elevated.

What happened and why it matters now

Iran’s theocratic leadership has extended repression beyond protesters and civil society into the reformist movement, arresting at least seven reformist figures including the leader of the Reformist Front, amid deepening fractures triggered by the regime’s handling of mass-casualty repression. The arrests follow reformists breaking publicly with the state narrative around killings, and Iranian hardline institutions framing these insiders as part of a subversive ring aligned with foreign enemies—language that signals the regime is treating “internal dissent” as a national security threat rather than a political problem.

The most important macro implication is that the crackdown further erodes any moderating mechanism inside the Islamic Republic. The reporting describes Pezeshkian as increasingly isolated, with his power “gutted” and his presidency reduced to something ceremonial—an “ornate, visible and hollow” stage set. In parallel, the same coverage highlights the role of internet access as a battleground (Starlink versus VPNs, geolocation risk, and U.S. internal debates about funding), which matters because sustained protests and information warfare keep domestic instability “alive” even if external diplomacy proceeds.

Market reaction and positioning signal

The market tape around this newsflow is consistent with de-grossing rather than pure geopolitical hedging. The S&P 500 closed 6832.76 (-1.57%), while market pages also show high-level commodity and metals pricing that included Engelhard industrial gold at 5077 and other bullion proxies—useful as a sentiment read on precious metals in that session. The key inference is that when internal Iran risk rises but crude does not immediately spike, investors often reduce risk and raise cash rather than chase headline hedges—especially when uncertainty is about political trajectory and retaliation logic, not a confirmed kinetic event.

The positioning signal to watch is whether crude’s front end and gold regain a consistent bid in the days after a weak equity session. If equity weakness persists without a rebound in energy hedges, it suggests macro tightening/positioning stress is dominating. If equity weakness is paired with a firmer crude curve and stronger gold, it suggests the market is shifting toward pricing disruption probability, not just uncertainty.

Macro transmission mechanism

The dominant transmission channel is energy-tail risk into inflation-policy constraints. Iran escalation risk matters because it can propagate through the Strait of Hormuz, where oil flows are systemically important. The U.S. EIA estimates that in 2024 oil flows through Hormuz averaged ~20 million barrels/day, roughly ~20% of global petroleum liquids consumption, with flows remaining relatively flat into early 2025. That chokepoint reality means the market can reprice inflation expectations quickly on even partial disruption risk (insurance premia, slower transit, harassment), tightening financial conditions and pressuring equity multiples.

A second channel is negotiation leverage and miscalculation risk. U.S.–Iran talks in Oman are ongoing amid deep agenda disputes (Washington pushing wider topics; Tehran insisting nuclear scope), and the existence of talks does not remove tail risk—it often increases two-way volatility because each headline can swing probabilities. The internal crackdown raises the risk that Iranian decision-making becomes more securitized, which historically reduces flexibility and increases the chance of “externalization” dynamics (provocations, proxy activations, maritime incidents) to consolidate control.

Political and fiscal implications

Internally, the crackdown signals that Tehran prioritizes regime cohesion over political legitimacy, widening the gap between society and state. That tends to increase the probability of repeated protest cycles and, critically, reduces the credibility of any negotiated “reset” because a regime relying on coercion is less able to sell concessions domestically.

Externally, Israel is explicitly emphasizing that any Iran deal must address nuclear, missiles, and proxies, which increases the difficulty of a clean diplomatic outcome and raises the odds of friction even if Washington pursues a narrower agreement. The U.S. political constraint remains inflation optics: if Middle East risk lifts crude materially, it becomes a domestic political issue and complicates policy flexibility. That creates an incentive for Washington to maintain coercive leverage while searching for a framework that caps energy tail risk—yet that same leverage can increase miscalculation probability.

Strategic forecast: base case and pivot points

The base case for the next 4–8 weeks is contained tension with intermittent volatility spikes. Iran continues repression at home while maintaining a negotiating track abroad; Israel signals red lines; and the U.S. maintains a posture that keeps military options credible. Under this regime, markets should expect range trading in crude with an embedded geopolitical floor, episodic equity drawdowns on headline risk, and a persistent bid for hedges when volatility compresses too far.

The upside scenario is a credible interim framework that reduces near-term escalation probability (even if incomplete). In that case, crude risk premium compresses first, equities stabilize, and gold can lag tactically as fear hedges are unwound. The downside scenario is a cascade: internal instability interacts with external confrontation (shipping incident, proxy escalation, misinterpreted signaling), which forces markets to rapidly reprice disruption probability. In that downside path, the Hormuz chokepoint math becomes decisive for crude and inflation expectations.

Asset impact section

XAUUSD (Gold)

Gold’s role here is “regime hedge.” Iran’s internal crackdown is not a one-day gold catalyst unless it increases the probability of external escalation or policy constraint. The more credible the disruption channel (Hormuz risk) and the more constrained central banks appear by inflation tails, the more durable gold’s bid becomes. If the market remains in a cash-raising phase, gold can be sold tactically as liquidity before it reasserts, which is consistent with episodes where risk comes from uncertainty and positioning rather than immediate physical disruption.

S&P 500

The S&P is primarily sensitive to whether Middle East risk tightens financial conditions through energy and rates. Without a crude spike, the index impact is more about risk premium and breadth: investors reduce exposure to cyclicals and high beta, rotate into quality and defensives, and price more downside convexity. The next key tell is whether equities stabilize on diplomacy headlines or remain fragile because the market interprets internal Iranian instability as reducing the probability of a durable diplomatic outcome.

Dow Jones

The Dow can show relative resilience if markets rotate toward cash-flow durability and industrial/defense exposures during geopolitical tension. However, if crude risk premium rises meaningfully, the Dow’s cyclical sensitivity can become a headwind through margin pressure and tighter conditions. Its relative performance therefore depends on whether the shock remains political/volatility-based or becomes an energy/inflation shock.

USDJPY

USDJPY will be two-factor: risk sentiment versus rate differentials. A geopolitical risk-off impulse often strengthens JPY via deleveraging and carry unwind, pushing USDJPY lower. But if the market’s dominant interpretation is “higher inflation tails → higher U.S. yields,” USDJPY can reverse higher quickly. The more the episode looks like an oil-inflation shock, the more whipsaw risk increases.

DXY

DXY tends to firm in acute stress because USD liquidity is the default hedge, especially if Europe is perceived as energy-vulnerable. If diplomacy becomes credible and volatility compresses, DXY can soften as risk appetite broadens. The durability of any USD bid will be determined by whether the market is pricing a short episode or a persistent rise in geopolitical and policy uncertainty.

Crude Oil

Crude is the fulcrum. Iran’s internal repression matters insofar as it changes the probability of external escalation and the credibility of de-escalation. The Strait of Hormuz remains the systemic constraint—~20 million b/d in 2024 per EIA—so even partial disruption probability can reprice the front end quickly. If crude stays contained despite worsening internal Iranian instability, it implies the market is leaning toward diplomacy and/or is relying on offsetting supply expectations; that can change abruptly if an operational marker appears.

Closing synthesis

Iran’s crackdown moving into the political class is a structural negative for internal moderation and therefore a structural positive for uncertainty premia. The market should treat this as a tail-risk amplifier rather than a linear “war now” signal: it increases the chance of miscalculation and reduces the probability that diplomacy produces a durable reset without further confrontation. The most important real-time indicators remain the front end of crude (risk premium), gold’s behavior versus real yields, and whether equity weakness is accompanied by classic hedges or by broad de-grossing into cash.

BTCUSDT 4H setup - Outlines a BULLISH continuation strategyThe idea anticipates a liquidity grab within the $0.618$ to $0.786$ Fibonacci discount zone ($62,500 – $64,600) to clear out early long positions before a trend reversal. Following this sweep, the plan projects an impulsive move upward, reclaiming the psychological $70,000$ level and targeting the $-0.382$ extension at approximately $76,936. The strategy utilizes tiered take-profits, seeking "full" target realization once the local high is cleared.

XAUUSD - H1 - SHORT1. As expected, the H4 resistance prevented further upside; no sell signal was issued due to uncertainty.

2. Price didn't reach the first support level and rebounded.

3. If an upward move is to occur, it will likely start from the lower zone.

4. On the H1 timeframe, the lowest-risk levels for both buy and sell entries have been identified.

Gold continues to fall - CPI newsRelated Information:!!! ( XAU / USD )

Here is a more financial-market–oriented paraphrase:

Meanwhile, the stronger-than-expected US Nonfarm Payrolls (NFP) report released on Wednesday prompted investors to dial back expectations for a Federal Reserve rate cut as early as March. As a result, the US Dollar Index (DXY), which measures the greenback against a basket of major currencies, has stabilized above a two-week low—contributing to the overnight pullback in gold prices.

That said, market participants continue to price in the likelihood of two additional Fed rate cuts in 2026. Moreover, softer-than-anticipated US Jobless Claims data released on Thursday has limited the upside in the US Dollar, preventing a more pronounced recovery.

personal opinion:!!!

Gold prices are consolidating below 4985, awaiting CPI news which is under selling pressure at the end of the week, and CPI and DXY data are recovering.

Important price zone to consider : !!!

Resistance zone point: 4985, 5040 zone

Support zone point : 4944 , 4890 zone

Follow us for the most accurate gold price trends.