GBPUSD - BullishGBPUSD has had clean bullish momentum for some time now, clearly visible on the past 3 weekly candles. Last week was a correction from previous momentum and this week has stared off with continuance of movement to the upside. With NFP coming tomorrow (11.02.2026), I am expecting a further push to the upside with possible entry opportunities on the marked out support/TP areas if price respects and breaks the resistance & retests.

Please share thoughts and insight as I'm willing to learn from all of you as well

Beyond Technical Analysis

XAU/XAGIn the continuous search for a macro indicator, that can guide me through the unforeseen events I believe this ratio seems the fittest.

Here we have a glimpse of the sentiment and capital allocation across several timeframes. Also we got a parallel between other timeframes where things were pretty bad... (DotCom, 2008, 2011, 2020). The thing is, we have something legitimate we can relate.

Of course Silver and Gold supplies, despite being finite are not actually known, just merely estimated which can influence the broader market if anything changes in that terrain, however abidding to what is known it is possible to create a thesis of where the future is leading us to, if a crisys is at our doorstep or not.

For me the current chart is clear, we still have 2-3 months to wait a bottom confirmation and probably there will be a reversal, position accordingly, we shall be defensive for the time being and position accordingly eyeing on the assets which can present a low RR and scale as the chart moves

Is Copper Next to Rally After Silver and Gold?Last week, we came across news: China calls for more copper stockpiling.

Therefore, is Copper Next to Rally After Silver and Gold?

Why Is China Stockpiling Copper?

Micro Copper

Ticker: MHG

Minimum fluctuation:

0.0005 per pound = $1.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Potential 13X on GBPUSDPrice is currently trading intraday, showing a potential inverted head & shoulders formation after the structural story on the daily. On the weekly, this is still subjective, but we could potentially see a rally toward 1.4000 in the coming days or weeks.

Intraday Bias:

Price may bounce off the discount level @ 1.3650. Upon entry, the bias will be confirmed as a swing if price breaks and closes above 1.3733 on the 4H timeframe, validating the inverted Head and Shoulder pattern.

Alternative Scenario:

If bullish anticipation fails, keep an eye on 1.3452 as a potential bearish target, where another buy setup could be considered if all confirmations align.

Patience is the Way.

— Ieios

Can Moog Engineer Dominance in the New Defense Era?Moog Inc. has entered 2026 with transformative momentum, delivering record-breaking Q1 results that crushed analyst expectations by 19% with adjusted earnings per share of $2.63. Revenue surged 21% year-over-year to $1.1 billion, while the company's backlog exceeded $5 billion, providing unprecedented visibility into future revenue streams. This exceptional performance is driven by a global rearmament cycle, with management raising full-year 2026 EPS guidance to $10.20 and the stock soaring to new heights near $305.

Beyond financial metrics, Moog is strategically repositioning itself as a techno-industrial leader rather than a traditional manufacturer. The company's partnership with Niron Magnetics to develop rare-earth-free Iron Nitride actuators addresses critical supply chain vulnerabilities, as China controls approximately 90% of the global rare earth processing market. This move toward supply chain independence, combined with advanced systems integration through partnerships like the Echodyne collaboration for integrated weapon systems, demonstrates Moog's evolution from component supplier to full-spectrum defense technology provider. Every operating segment achieved record quarterly sales simultaneously, with Space and Defense leading at 31% growth.

The company is capitalizing on multiple tailwinds, including NATO's new 5% GDP defense spending targets, the U.S. Department of Defense's Acquisition Transformation Strategy, which favors high performers, and the shift toward AI-enabled defense systems. With C-130 Hercules modernization programs, hypersonic missile technology, and an aggressive patent portfolio spanning autonomous navigation and robotics, Moog is positioning itself at the intersection of mechanical precision and digital innovation. Despite tariff headwinds and inflationary pressures on fixed-price contracts, the company's 13.0% adjusted operating margin and conservative 2.0x leverage ratio provide the financial strength to sustain this technological transformation through 2026 and beyond.

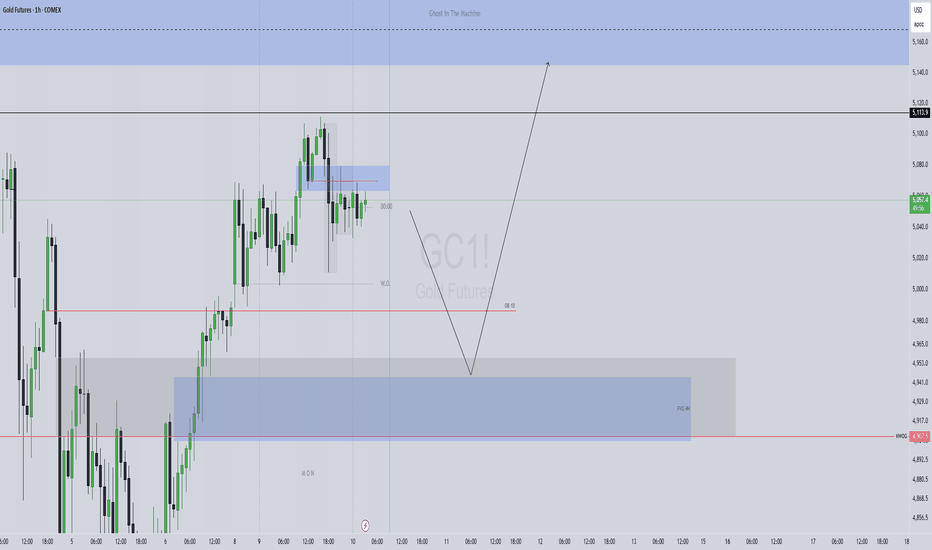

The daily close is aboveHi, I’m Maicol, an Italian trader.

I study Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small thing for you, but important for my work.

Please read the description to understand the trading plan.

Don’t focus only on the chart. Thanks.

Live today at 14:00 CET (Rome time).

🌞 GOOD MORNING EVERYONE 🌞

Yesterday’s daily close is above a key area.

The daily shift zone.

Price is also holding above 5000.

With this structure, I expect a bullish continuation, in line with yesterday’s idea.

Until 14:00, I stay on the sidelines.

After that, I’ll reassess based on the news.

If the long starts losing strength and signals are not clear, I will wait.

In the worst-case scenario, if a short move develops, I won’t chase it.

I’ll wait for more discounted levels to look for a long.

Key area to monitor very closely:

daily imbalance 5100 – 5120.

We’ll be live at 14:00.

See you later, and have a good Tuesday.

🔍 Reminder 🔍

I avoid trading during the Asian and London sessions.

I focus on the 14:30 news and the New York open at 15:30.

🔔 Turn on notifications so you don’t miss anything.

📬 If you have any questions, message me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, we’ll be live at 14:00 to follow the market in real time.

In the meantime, have a good day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

BITCOIN - Weekly & long timeBitcoin Update :

Despite penetrating a strong support zone, the price failed to consolidate below this level. As a result, we anticipate a short-term price rise toward the marked zone around $83,800.

However:

Since the monthly trend is bearish and the price has closed below the key support level, our long-term outlook remains downward.

More detailed explanations and technical markers are provided on the chart.

GOLD H4 | Double Top Reject OR Breakout to 5500 Rally

Gold (XAUUSD) on H4 timeframe is currently trading at a critical decision zone.

Price has formed a clear Double Top structure exactly at the 0.5 Fibonacci retracement level, which is a high-probability reversal area.

🔴 Bearish Scenario (Primary Plan):

Double Top rejection from resistance

Expecting sell pressure from current levels

🎯 Target 1: Support 1 at 4779

🎯 Target 2: If Support 1 breaks, continuation towards Support 2 at 4504

This aligns with market structure shift + fib confluence, suggesting sellers are active.

🟢 Bullish Scenario (Invalidation Plan):

If price breaks and sustains above the Double Top resistance

❌ Sell idea will be invalidated

We will shift bias to BUY

🚀 Next upside target will be the 5500 resistance zone

📌 Trade Like a Pro:

No prediction, only reaction

Follow structure, not emotions

Let the market confirm the direction

👇

If this analysis adds value:

👍 Hit LIKE to support quality analysis

💬 Drop your bias in comments (SELL or BUY?)

⭐ FOLLOW for more high-probability, structure-based setups

Trade smart. Protect capital. Consistency beats excitement. 💼📊

High-Risk XAUUSD Setup | 15M | Key Levels

XAUUSD 15-minute chart showing a pullback near resistance.

Key levels to watch:

· Resistance: 4,963.911

· Support: 4,936.608

⚠️ Labeled as high risk – tight stops and careful position sizing advised.

Chart date: 10 Feb 2026

#XAUUSD #Gold #Forex #TradingView #DayTrading #HighRisk #SwingTrading #Finance

Disclaimer: Not financial advice. Trade with caution.

Fundamental Note: BTCUSD (Bitcoin) 09 Feb 2026Bitcoin is hovering around the $70K–$72K area after a violent washout and rebound, but risk appetite remains fragile and headline-driven.

The down-move was dominated by forced deleveraging, and futures markets saw the largest long-liquidation spike of this drawdown.

On-chain structure has deteriorated: BTC broke below the True Market Mean, which it now frames near ~$80.2K as overhead resistance, while Realized Price sits around ~$55.8K as the deeper “re-engagement” zone.

Cost-basis maps show early dip-buying in the $70K–$80K band, with a dense $66.9K–$70.6K cluster emerging as a high-conviction area that may absorb near-term sell pressure.

Stress is still high: it shows the 7D SMA of realized losses above ~$1.26B/day (with recent extremes above ~$2.4B), while spot volumes remain structurally weak—typical of a “demand vacuum” regime.

Derivatives internals remain defensive: funding and futures OI have cooled and options positioning is still paying for downside (short-dated IV near ~70%, steep skew, and a negative 1-week volatility risk premium around -5).

Macro catalysts are immediate: the delayed US January jobs report is scheduled for Wed, Feb 11, and January CPI for Fri, Feb 13—either can swing USD/yields and decide whether BTC can reclaim $73K/$80K or retest the lower demand bands.

🟢 Bullish factors:

1. Dense on-chain demand cluster at $66.9K–$70.6K may act as a “shock absorber” if selling returns.

2. Leverage is being flushed (OI/funding cooling), which can reduce reflexive liquidation pressure on rebounds.

3. If jobs/CPI come in softer, USD and real-yields can ease, supporting a relief rally in risk assets.

🔴 Bearish factors:

1. “Demand vacuum” conditions: structurally weak spot volumes and ongoing distribution tone.

2. Loss realization remains elevated (realized losses > ~$1.26B/day on 7D SMA), suggesting forced exits are still happening.

3. Options still price heavy downside risk (high short-dated IV, steep skew).

4. Major overhead resistance sits above: ~$73K “contested” area and the True Market Mean near ~$80.2K.

🎯 Expected targets: Near-term range/bearish bias while below 73,000–75,000. Support is 70,000–69,000, then 66,900–70,600; a breakdown opens 60,000 and potentially 56,000–55,000 (Realized Price zone). If BTC reclaims 73,000 and then breaks above 80,000–80,500, upside can extend toward 85,000–88,000 next.

USD/CNY 2026: Tech Dominance and Fiscal Shifts Drive YuanThe USD/CNY pair is entering a transformative era in 2026. The Chinese Yuan recently hit three-year highs against the US Dollar. This shift reflects bigger structural changes in global economics and technology. Investors now witness a move beyond simple interest rate differentials.

Macroeconomic Divergence and Fiscal Policy

The People’s Bank of China (PBOC) maintains a firm stance on the Yuan's value. Robust policy backing currently supports a stronger Yuan. Meanwhile, the US faces cooling growth and shifting Federal Reserve priorities.

Differing fiscal strategies drive this currency decoupling. China’s targeted stimulus focuses on high-tech manufacturing rather than broad consumption. This precision attracts long-term institutional capital. Consequently, the USD/CNY reference rate continues to trend lower.

Technological Sovereignty and Patent Leadership

Technology now serves as the primary engine for currency valuation. China leads the world in 6G and renewable energy patent filings. These innovations create a structural trade advantage for the Yuan.

Institutional investors track patent quality to gauge future economic strength. China’s focus on "Little Giant" enterprises fosters a specialized high-tech ecosystem. This dominance in critical supply chains reduces reliance on dollar-denominated imports.

Geostrategy and Global Trade Blocs

Geopolitical alignments are reshaping currency demand across Asia. The expansion of regional trade agreements bolsters Yuan usage in cross-border settlements. These geostrategy shifts decrease the Dollar’s historical dominance in Eastern markets.

Stable political leadership provides a predictable environment for investors. This stability contrasts with the political polarization often seen in Western markets. Traders increasingly price this "stability premium" into the Yuan's exchange rate.

Cyber Security and Financial Infrastructure

Cyber resilience determines modern market confidence. China has implemented rigorous data security laws to protect its financial core. This robust infrastructure ensures the integrity of the digital Yuan and offshore trading.

A secure digital environment attracts risk-averse global funds. Enhanced cyber defenses mitigate the impact of external financial shocks. This technological moat strengthens the Yuan’s status as a reliable reserve currency.

Management Innovation and Business Models

Chinese firms are redefining global management through "Digital Agility." They integrate AI to streamline decision-making and reduce operational waste. This efficiency boosts corporate margins and supports domestic currency value.

Business models in China now emphasize "Dual Circulation." This strategy balances domestic consumption with high-end exports. Stronger corporate leadership ensures China remains competitive despite global inflationary pressures.

Industry Trends: The Green Revolution

The automotive industry highlights China's industrial ascent. Breakthroughs in battery science have secured China’s lead in the EV market. These high-value exports generate consistent demand for the Yuan.

Western competitors struggle to match China’s scale and speed of innovation. This industrial gap influences long-term capital flows. As the world goes green, the Yuan becomes the currency of the energy transition.

Strategic Outlook for 2026

The USD/CNY pair represents a clash of two economic philosophies. China’s focus on science and manufacturing creates a formidable currency floor. Investors should expect continued Yuan strength as tech leadership matures.

The era of Dollar exceptionalism faces a sophisticated challenger. Monitoring patent trends and fiscal policy remains essential for traders. The Yuan is no longer just a currency; it is a high-tech asset.

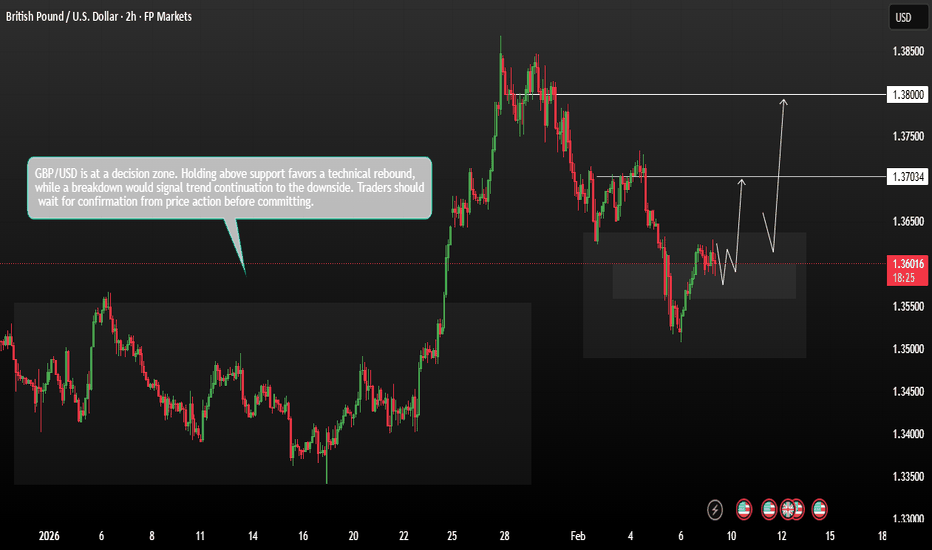

GBPUSD Price is consolidating inside the demand zonGBP/USD is currently trading around 1.3605, showing signs of stabilization after a corrective decline from recent highs. Price has reacted positively from a demand/support zone near 1.3520–1.3560, where buyers stepped in and defended the downside.

The broader structure still favors a bullish bias, as the pair previously formed a strong impulsive move upward, followed by a healthy pullback rather than a full trend reversal. The recent bounce suggests that buyers are attempting to regain control.

On the upside, immediate resistance is seen near 1.3700–1.3730, which aligns with prior consolidation and supply pressure. A confirmed break above this level could open the door for a further rally toward 1.3800, a key psychological and technical resistance area.

Tecnically as long as price holds above the 1.3520 support zone, the bullish recovery scenario remains valid. A clear breakdown below this area would weaken the outlook and could expose the pair to deeper losses toward 1.3450.

You may find more details in the chart,

Trade wisely best of luck buddies.

Ps; Support with like and comments for better analysis Thanks for Supporting.

NIFTY 50 | Natural Time Cycle Observation (Jan–Mar 2023) WD GannThis post presents a historical market study focusing on time-cycle behavior in NIFTY, using concepts derived from WD Gann’s Natural Time Cycle and Vibration framework.

⚠️ This is not a trading signal or forecast.

Shared strictly for educational and analytical purposes.

📌 Study Context

During mid-January 2023, NIFTY entered a period where time symmetry and vibration balance became more relevant than short-term price movement.

Instead of forecasting direction, this study focuses on:

Time windows

Structural reference levels

Volatility expansion zones

📊 What the Chart Illustrates

A clearly defined reference low

A broader time window extending into late March

How markets often resolve trends near time-cycle completion

Price reaction occurring after time alignment, not before

🧠 Key Educational Observations

Time plays a leading role; price responds later

Natural cycles often define when movement expands, not how

Gann analysis emphasizes market structure, not prediction

Studying completed cycles improves contextual market understanding

⚠️ Disclaimer

This content is for educational purposes only and does not constitute financial advice or a trading recommendation.

NIFTY 50 | Time & Price Interaction Study (26 Nov 2022)This idea presents a historical study of how time-based pressure zones can interact with important price levels, using concepts derived from WD Gann methodology.

⚠️ This is not a trading signal or forecast.

It is shared purely for educational and structural study purposes.

📌 Study Background

In late November 2022, NIFTY was trading near an important reference low formed around 26 November.

This study observes how markets often respond when time alignment and price structure intersect

.

📊 What the Chart Shows

A clearly defined reference price zone

Subsequent increase in volatility once price closed below that zone

Expansion in directional movement after time–price imbalance

How pressure zones often act as decision points, not guarantees

🧠 Key Learning Takeaways

Time-based levels often define risk zones, not direction

Price behavior changes when pressure builds near reference dates

WD Gann analysis focuses on structure and balance

Studying past cycles helps traders understand market behavior, not predict outcomes

⚠️ Disclaimer

This content is for educational and research purposes only.

It does not constitute financial advice or market recommendations.

XAUUSD BUY 10 FEB 2026GOLD Buy Setup – Channel Support Rejection + Trend Continuation

Price is trading within a rising channel, maintaining a clear bullish market structure with higher highs and higher lows. After rejecting the upper resistance (yellow supply zone), gold pulled back in a controlled descending channel, forming a corrective move rather than a reversal.

Price has now tapped into strong confluence support:

• Lower ascending trendline

• Blue demand zone

• Channel support

• Previous structure low

This area shows buyer strength with bullish rejection and momentum shift, signaling the correction is likely complete.

I’m entering long from this support zone expecting a continuation of the overall uptrend.

Targets:

TP1: Mid-channel resistance

TP2: Previous high

TP3: 5,135 supply zone

Stop Loss: Below demand zone / channel break

Bias remains bullish as long as price holds above support and maintains higher lows.

Oracle’s Cloud Ascent: Powering the Global AI RevolutionOracle has shed its legacy reputation. It now stands as a central pillar of the artificial intelligence era. Recent stock surges reflect a profound transformation in the company’s core identity. This evolution positions Oracle as a formidable challenger to established cloud giants.

The AI Infrastructure Pivot

Oracle Cloud Infrastructure (OCI) currently drives the company’s aggressive growth. A landmark partnership with OpenAI validates Oracle’s high-performance computing capabilities. OpenAI utilizes OCI’s massive GPU clusters to train next-generation models. This collaboration signals a shift in the industry hierarchy.

OCI offers a unique architectural advantage. It uses Remote Direct Memory Access (RDMA) networking. This technology allows GPUs to communicate with extreme efficiency. Consequently, Oracle provides faster training speeds than many competitors. Enterprises now view OCI as the premier destination for AI workloads.

Sovereign Clouds and Geostrategy

Geopolitics now dictates the future of data management. Nations increasingly demand data residency within their own borders. Oracle’s "Sovereign Cloud" strategy directly addresses these national security concerns. The company builds localized data centers for specific government entities.

This geostrategy provides Oracle with a significant competitive moat. It captures high-value contracts that require strict regulatory compliance. Oracle enables digital sovereignty for the European Union and beyond. By aligning technology with policy, Oracle secures long-term global revenue streams.

RDMA: The Science of Speed

Oracle’s success stems from deep scientific innovation in networking. Patent analysis reveals a strong focus on high-speed data interconnects. These patents protect the firm’s ability to scale AI clusters seamlessly. High-tech hardware and software integration remains a core competency.

The company’s engineering focus reduces the "tail latency" common in cloud environments. This precision attracts research institutions and high-tech startups. Oracle’s science-first approach ensures that OCI handles the most demanding computational tasks. The market rewards this technical superiority with higher valuations.

Autonomous Security and Resilience

Cybersecurity threats grow more sophisticated every year. Oracle counters these risks with its Autonomous Database technology. This system utilizes machine learning to patch vulnerabilities without human intervention. Automated defense reduces the risk of data breaches significantly.

The "Zero Trust" architecture embedded in OCI protects sensitive enterprise information. Oracle’s business model emphasizes security as a fundamental feature. This commitment to hardware-level protection builds deep trust with financial institutions. Resilience has become a primary selling point for the Oracle brand.

Management Continuity and Vision

Larry Ellison remains the primary visionary for the company. His focus on integrated vertical stacks pays massive dividends today. Safra Catz provides the operational discipline to execute this complex vision. This leadership duo maintains a rare balance of innovation and fiscal responsibility.

Oracle’s management fosters a culture of engineering excellence. They avoid the bureaucratic hurdles that slow down larger competitors. This agility allowed Oracle to pivot rapidly toward generative AI. Assertive leadership continues to steer the firm through volatile market conditions.

The Macroeconomic Verdict

Macroeconomic trends favor Oracle’s current business model. High interest rates force companies to seek efficient, cost-effective cloud solutions. Oracle’s aggressive pricing and superior performance offer a compelling value proposition. Subscription-based revenue provides stability during economic shifts.

Wall Street analysts remain bullish on Oracle’s capital expenditure strategy. The firm invests billions to expand global data center capacity. These investments convert directly into high-margin cloud services. Oracle’s financial health reflects a perfect alignment of technology and market timing.