XAUUSD 1H Market Structure & Fibonacci Range AnalysisOverview

This analysis focuses on the 1-hour timeframe (H1) of XAUUSD, highlighting a range-bound corrective phase following a strong impulsive bullish move. The market is currently consolidating within a clearly defined premium–discount range, with key Fibonacci levels acting as reaction zones.

Market Structure

Price previously formed a strong bullish impulse, reaching a major high.

This was followed by an aggressive bearish displacement, breaking market structure to the downside.

After the sell-off, price entered a consolidation range, indicating indecision and re-accumulation rather than continuation.

The current structure suggests a corrective range within a broader bullish context, not a full trend reversal.

Key Levels & Zones

Range High (Premium Zone):

Near the 0.618 Fibonacci retracement (~5,143) — a strong resistance and potential sell-side reaction area.

Equilibrium (0.5 Fibonacci):

Around 5,002, acting as a magnet level where price repeatedly reacts. This level is critical for directional bias.

Range Low (Discount Zone):

Around 4,894, where strong buying interest previously entered the market.

Major Support:

Below the range near 4,679, marking a key invalidation level for bullish scenarios.

Current Price Action

Price is trading above the range low and attempting to reclaim the equilibrium (0.5) level.

The projected price path suggests:

A possible pullback to mitigate inefficiency

Followed by a move toward the range high / daily resistance

This aligns with a mean reversion + continuation play inside the established range.

Bias & Scenario

Primary Bias: Neutral → Bullish (range continuation)

Bullish Confirmation:

Strong acceptance above the 0.5 Fibonacci level with higher lows.

Bearish Risk:

Rejection from equilibrium and breakdown below 4,894 would open the path toward deeper liquidity.

Conclusion

XAUUSD is currently in a balanced corrective phase, respecting Fibonacci equilibrium and prior structure. Until a clear breakout occurs, the market favors range-based trading, with higher probability setups forming near discount zones targeting premium liquidity.

Patience is key — wait for confirmation at equilibrium before committing to directional trades.

Beyond Technical Analysis

Why Volatility Breaks Retail Traders?Why Volatility Breaks Retail Traders

“Volatility doesn’t destroy accounts.

It exposes them.”

When markets move fast, many traders feel lost.

Setups fail.

Stops get hit quickly.

Confidence disappears.

It feels like the strategy stopped working.

But volatility didn’t break the strategy.

It revealed the weaknesses around it.

What Volatility Actually Changes

During calm markets:

• Entries feel clean

• Stops feel respected

• Moves feel predictable

During high volatility:

• Price moves faster than decisions

• Pullbacks become violent

• Stops feel too tight or too wide

• Emotions accelerate

The environment changes — and so must behavior.

Why Retail Traders Struggle

High volatility exposes hidden habits:

• Position sizes that are too large

• Stops that are too tight for fast markets

• Emotional reactions to fast losses

• The urge to “recover quickly”

• The need to stay active

In slow markets, these weaknesses stay hidden.

In fast markets, they surface immediately.

Volatility removes the margin for error.

The Speed Problem

Retail traders make decisions emotionally.

Volatility speeds up emotion.

Fear appears faster.

FOMO appears stronger.

Revenge trading happens sooner.

The faster the market moves,

the harder it becomes to stay objective.

The Real Risk of Fast Markets

It isn’t direction.

It isn’t analysis.

It’s behavior.

• Overtrading increases

• Discipline weakens

• Risk expands

• Patience disappears

And small mistakes become expensive quickly.

How Professionals Adapt

Professionals don’t fight volatility.

They adapt to it.

They:

• Reduce position size

• Trade less frequently

• Accept wider stops or stay flat

• Focus on survival first

• Wait for clarity to return

They protect capital before chasing opportunity.

Volatility doesn’t create bad traders.

It reveals unprepared ones.

📘 Shared by @ChartIsMirror

Do you trade more during volatility… or become more selective?

Comment honestly.

GOLD rush is here!!!Following my last week analysis about the last year highs supporting the price.

Now I bring a more in depth perspective a little bit more aggressive showing a quick upside move to 5500// followed by a retest at 5090 and If it supports I strongly believe at a momentum continuation too new ATH’s .

I also expect more volatility next week since gold got stuck in range this week despite the very positive weekly candle close.

Possible BTC next move. Although most of people are calling a bear market to crypto I keep my bullish sentiment. This end of the week showed a great support around 60k but knowing crypto I know there is a big chance to see a final push back to wipe all the leveraged positions and spread more fear around retail investors. The reaction at 60k is a positive sign but not strong enough to keep the momentum going in my opinion.

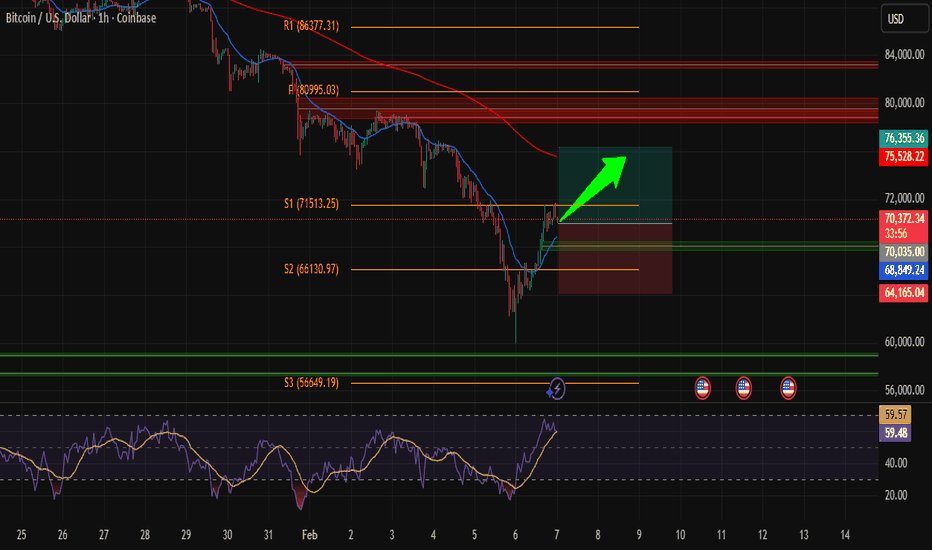

Smart Money Is Accumulating Bitcoin — Massive Move IncomingHi Traders ! BTCUSD was in a clear short-term downtrend but has now formed a strong reversal structure after bouncing from a key support zone around 64K–66K. Price is reclaiming momentum and pushing above minor resistance, signaling fresh bullish pressure.

A continuation move toward the next major resistance area is highly probable, marked as the TAKE PROFIT zone at 76,355.

📈 Long Setup

Entry: 70,035

Stop Loss: 64,165

Take Profit: 76,355

Momentum is shifting bullish — buyers are stepping back into the market. Time to go LONG on BTCUSD.

⚠️ This content is for educational purposes only, not financial advice. Trade at your own risk and manage your capital wisely.

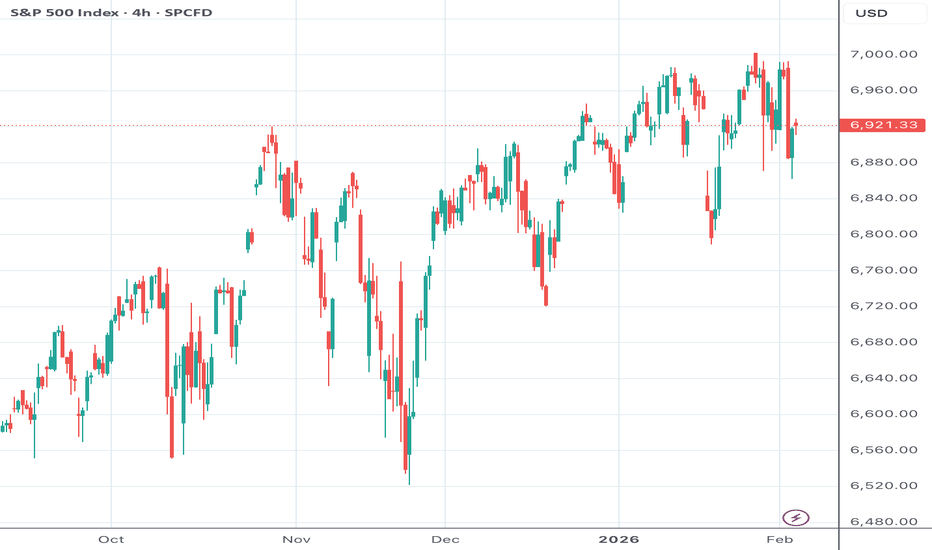

Why I'm Selling the S&P 500: It’s Not Economics, It’s Leverage.The S&P 500 is facing a mechanical "forced liquidation" event triggered by the historic 30% collapse in silver, which is compelling funds to sell liquid equities to meet margin calls. This selling pressure, compounded by uncertainty surrounding the Warsh Fed nomination, has shattered key support at 6,940. Fade intraday rallies as the market reprices this sudden liquidity drain, with a target break below 6,900.

SPX closes lower on February 4 compared to February 3CBOE:SPX

VIX has jumped from the mid‑teens toward 18, signalling rising demand for downside protection and a more cautious risk tone. At the same time, gold has surged above recent levels, reinforcing a classic hedging pattern rather than a clean risk‑on environment. The dollar is slightly firmer, adding a small headwind for equities, while today’s earnings slate is busy but lacks a single mega‑cap catalyst to drive a strong upside follow‑through. Taken together, the backdrop favors a choppy session with rallies facing selling pressure and a mildly negative bias into the close versus February 3.

SPX closes higher on February 5 compared to February 4!TVC:SPX

Yesterday’s S&P 500 drop was driven mainly by mega‑cap tech and AI names, not by a broad macro shock. Today the economic data are second‑tier rather than game‑changing, Fed messaging is a continuation of existing inflation concerns instead of a hawkish surprise, and oil is pulling back as U.S.–Iran talks reduce geopolitical and inflation risk. At the same time, safe‑haven assets like gold and silver are correcting from recent spikes, signaling less acute fear, while index futures and cross‑asset moves point to a more balanced—if choppy—risk environment. Historically the index closes green slightly more often than red, and after a modest down day with no new systemic stress, I see a slightly better‑than‑even chance that today’s close ends up above yesterday’s level.

What do you think—does the S&P 500 finish today above yesterday’s close, or does the selling pressure continue?

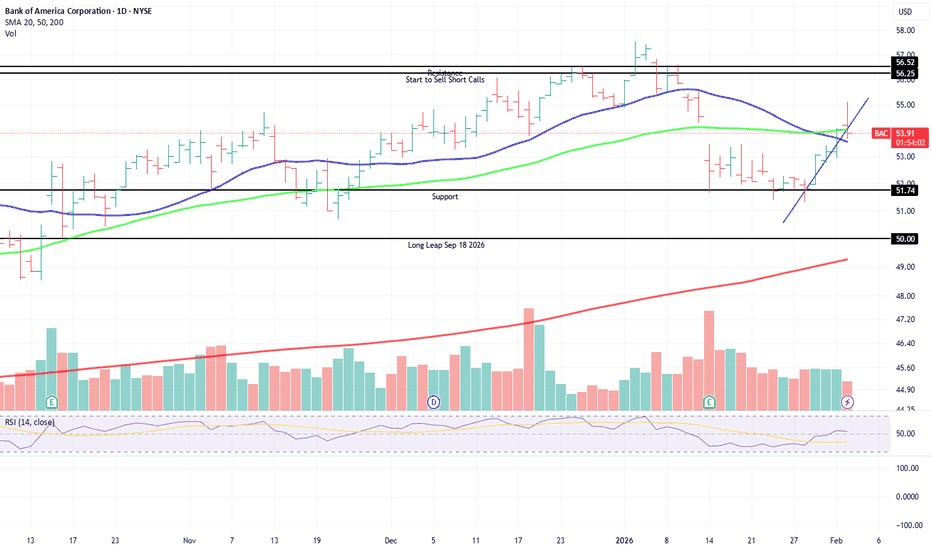

BAC: Buying Time, Not Noise — Long LEAP After Structural ReclaimBank of America has reclaimed key moving averages after a controlled pullback, and price is now holding above former resistance near the mid-$50s. Rather than chasing short-term momentum or trying to time every candle, this idea focuses on structure + time.

I initiated a long-dated LEAP (Sep 2026 $50 call) to express a bullish thesis while keeping risk defined and capital efficient. The goal here is not to trade intraday volatility but to participate in a broader trend as price stabilizes above rising support.

Key points behind the trade:

The higher-low structure is intact on the daily chart

Price back above the 20/50 DMA with trend support underneath

Former resistance is now being tested as acceptance, not rejection

LEAP chosen to reduce theta pressure and avoid short-term noise

At this stage, I’m not selling short calls against the position. The trend is still young, and the priority is letting Delta work before considering income strategies like a PMCC. Short calls may come later if the price becomes extended or volatility expands.

This is a patience trade, not a prediction. As long as the structure holds, the plan is to let time and trend do the heavy lifting.

Risk is defined. Management is rule-based. No intraday micromanagement.

FACT CHECK: The "$8k MicroStrategy Liquidation" is a Lie.Stop panic-selling your Bitcoin because of a rumor.

Everywhere on the timeline, I see the same copy-paste FUD: "If Bitcoin hits $8,000, Saylor gets liquidated and BTC goes to zero."

I just finished a forensic audit of Strategy Inc.'s Q4 2025 filings.

Here is the Institutional Reality vs. The Retail Myth.

__________________________________________________________________________________

1. THE MYTH: "Saylor has a Liquidation Price at $8k." 🧟♂️

THE TRUTH: This number is Rhetorical, not Contractual .

* Origin: This figure came from a "Stress Test" comment by the CEO, illustrating where Assets would equal Liabilities. It is NOT a loan trigger.

* The Structure: MSTR retired their secured loans (Silvergate) years ago. Their current debt is Unsecured Convertible Notes (due 2027-2032).

* The Key Difference: Unsecured notes have NO Liquidation Trigger . They cannot be margin called based on price price.

2. THE SAFETY NET ($2.25 Billion Firewall) 🛡️

Even if Bitcoin goes to $20k, MSTR does not have to sell a single Satoshi.

* Cash Reserve: They hold $2.25 Billion USD in cash.

* Runway: This covers all interest payments through mid-2028 .

* Conclusion: They can survive a multi-year Crypto Winter without forced selling.

__________________________________________________________________________________

3. THE REAL "PAIN POINT" (It's not $8k) ⚠️

The real risk is not Liquidation; it is Stagnation .

* MSTR Avg Cost: $76,052

* Current Price: ~$70,000

* Status: UNDERWATER.

The risk isn't that they *sell*; it's that they can't *buy* anymore. The "Infinite Money Glitch" (issuing stock to buy BTC) breaks when the stock trades below NAV. This removes the biggest buyer from the market.

4. THE ODDS OF $8K? (<1%) 📉

We analyzed the Dec 2026 Derivatives Market .

* Smart Money Positioning: Massive "Put Wall" (Hedging) at $50,000 .

* The Void: There is near-zero open interest below $30k.

* Implied Probability: The market prices a drop to $10k at <1% .

__________________________________________________________________________________

🎯 THE VERDICT

The "$8k Liquidation" is a ghost story from 2022.

* Risk of Liquidation: 0% (Structure is Unsecured).

* Risk of Stagnation: High (Until we reclaim $76k).

* Major Support: The 200-Month Moving Average is at $58,000 . That is the real floor.

Don't trade the FUD. Trade the Structure.

Which side are you on?

A) Believing the FUD (Target $8k) 🐻

B) Buying the Value (Target $58k) 🐂

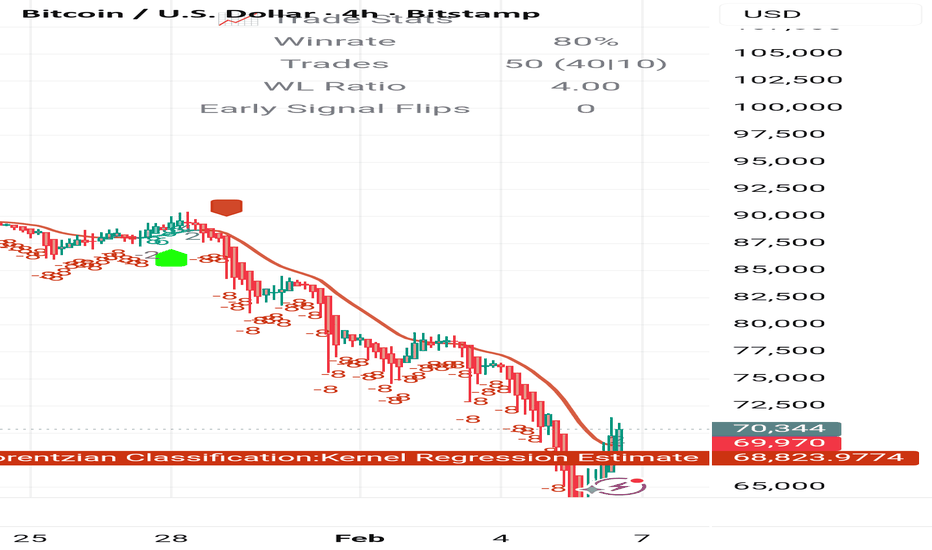

Bitcoin’s V-Bounce Raises Red Flags! Short Squeeze or Real BottoBTC Today: Short Squeeze or Real Bottom? Why This Move Might Be a Trap

Today’s Bitcoin move has sparked optimism across the market. After dipping into the ~60k region, BTC aggressively squeezed higher, reclaiming key levels around 68k–71k in a short amount of time. Many are already calling this “the bottom.”

But if you zoom out and study Bitcoin’s historical behavior, this move looks far more like a short squeeze than a confirmed cycle low.

Why Today’s Move Looks Like a Short Squeeze

The rally came after:

A sharp sell-off into a well-known high-liquidity demand zone (~58k–60k)

Extremely bearish sentiment

Heavy short positioning after multiple breakdowns

This is the perfect environment for a squeeze:

Shorts pile in late

Price hits a major level

Market snaps higher as shorts cover and late longs FOMO

Short squeezes are fast, emotional, and convincing — exactly like what we saw today.

The Historical Problem: BTC Rarely Bottoms With a V-Shaped Recovery

Here’s the key issue:

Bitcoin almost never forms a macro bottom with a clean V-shaped recovery.

Across prior cycles:

Bottoms are formed through chop, retests, and boredom

Price usually revisits the lows at least once

Structure builds slowly, not explosively

The only major exception was the COVID crash, which was driven by:

Emergency global stimulus

Forced liquidations across all markets

Extreme external intervention

Outside of that event, V-shaped BTC bottoms are not the norm.

Why This Move May Be Creating False Hope

Markets often rally just enough to:

Convince traders the worst is over

Pull sidelined money back in

Force shorts to exit

This creates hope, which is a powerful tool.

But hope-driven rallies inside broader corrective structures often lead to:

Lower highs

Failed breakouts

A return to sweep remaining liquidity

And right now, there is still significant liquidity resting below 60k.

Why the “Real Move” Often Happens on the Weekend

Another pattern worth noting:

Bitcoin frequently makes decisive moves during low-liquidity periods

Weekends are notorious for:

Stop hunts

Fake breakouts

Sharp reversals when participation is low

If the market truly wants to reset positioning, a weekend move that:

Reverses lower

Sweeps liquidity below 60k

Forces maximum pain

…would be completely in line with historical behavior.

Key Levels to Watch

Resistance: 71k–72k (squeeze extension zone)

Support: 68k, then 66.8k

Liquidity magnet: sub-60k

As long as BTC remains below major weekly resistance, today’s move should be treated with caution.

Final Thoughts

This rally does not need to fail immediately to still be a trap.

Short squeezes can extend, consolidate, and then reverse.

Until Bitcoin:

Holds higher lows on higher timeframes

Reclaims and sustains key weekly levels

Stops reacting violently to liquidity

…it’s premature to declare the bottom is in.

Hope rallies feel good. Real bottoms feel boring.

Stay patient. The market may still have unfinished business below.

BTC actually Bullish IMOI get everyone is bearish on BTC and for all the right reasons. It lost support after support. But if you check supply profit/loss we are in a stage where honestly I really DONT SEE how whales and institutions will not fill their bags at this low prices similar to december 2018. Its common sense IMO. For me, this looks very bullish.

Dow: Fourth Attempt at the CeilingThree times since late 2024, the Dow has run head-first into the same resistance zone around 45,092 — each time pulling back, but each time finding higher lows and quicker recoveries.

Now we’re at attempt #4. The prior pullbacks have been smaller, and breadth is improving — only 5 out of 30 Dow components are negative since December 24, 2024.

Yes, there are plenty of unknowns — macro headwinds, earnings gaps, global geopolitical and tariff risks — but the chart says one thing loud and clear: the bulls are still in control.

A clean breakout here could open the door to new highs. Until proven otherwise, momentum belongs to the buyers.

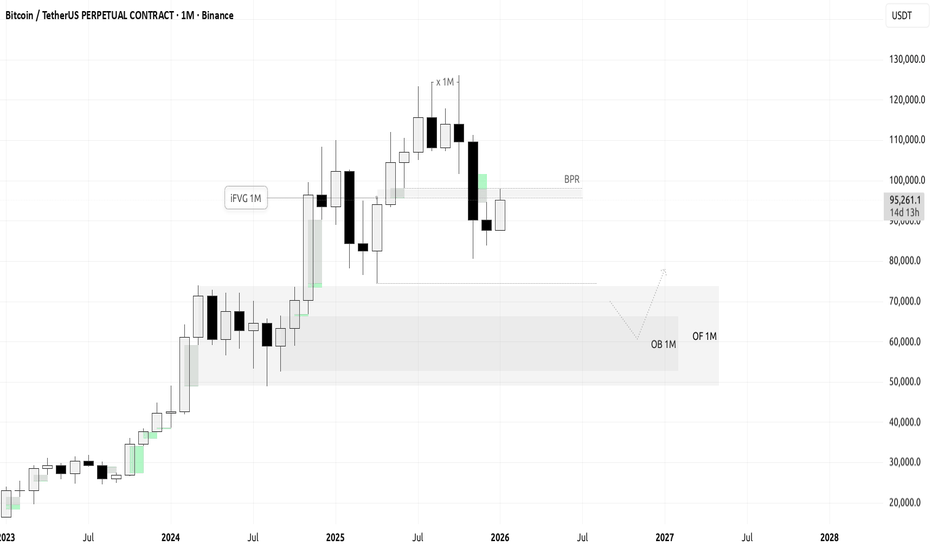

BTC — Global Outlook | MTF 1M → 1W → 1DBTC — Top Pick | Higher-Timeframe Short Context

Counter-trend correction within a bearish MTF structure

🔎 Overview

BTC is trading within a higher-timeframe bearish structure .

Liquidity sweeps, imbalance inversions, and divergences on 1M and 1W suggest the market is transitioning from expansion into a corrective phase , with priority toward discount pricing .

The current upside move on 1D is treated as a counter-trend correction , not a trend reversal.

📌 Higher-Timeframe Context (1M → 1W)

Monthly (1M):

Monthly liquidity swept

Bearish divergence confirmed

Bullish Monthly Imbalance inverted → Bearish Monthly Imbalance formed

Overlap creates a BPR resistance zone , from which price is currently reacting

Monthly downside focus:

OF: 48,900 – 73,900

OB (refined): 52,500 – 66,500

Weekly (1W):

Weekly liquidity swept to the upside

First bullish weekly imbalance inverted

Bearish weekly imbalance confirmed (body close below liquidity)

Price currently reacting from Weekly OF

This supports a corrective market structure aligned with the monthly bias.

📈 Execution Context (1D)

Daily liquidity swept at ATH

Price retraced into Daily Order Flow and is reacting

Local bullish structure supported by spot buying volume

Despite the short-term bullish structure, the move is considered corrective within the higher-timeframe bearish framework.

Expected correction completion zone:

OF 1D: 98,900 – 107,500

4H refinement: 100,700 – 104,000

Within this area, the focus shifts to short-continuation setups targeting higher-timeframe objectives.

❗ Invalidation

Acceptance above 101,500 invalidates:

Weekly and Monthly bearish imbalances

The higher-timeframe short thesis

🧭 Thesis Summary

Higher timeframes remain bearish

Current upside move is a counter-trend correction

Priority is short continuation after correction completion

Bias remains valid below 101,500

💬 Your Thoughts?

If this perspective resonates with you, feel free to share your thoughts in the comments .

Like the idea if you find the analysis useful — it helps the idea reach more traders and supports future updates.

Not financial advice. Educational market structure analysis.