The Elephant Jungle 2/13/26 Page 1Well it is Friday. Not just any Friday. It is Friday the 13th.

Now the question the Jungle is quietly asking is what does that mean for the markets.

As of right now the Bulls are holding the line on the 1M Demand Range and they are attempting to work their way back into the Macro Range. It has been a long week. Bulls and Bears went head to head day after day and credit where it is due the Bulls did not fold. They absorbed pressure and stayed standing.

But today is the real test.

Does the symbolism of the day shake the Bulls confidence. Will the support be pulled from under them like a loose Jenga block. Or do the Bulls stay disciplined and prove that price does not care about superstition only structure and liquidity.

Then there is always the wildcard. Does Trump wake up and say something wild that sends the markets into a quick flush. Or does the market pump and turn the table around on the Bears.

Now that would be Bad News for the Bears but good news for those Hodling Bitty while everyone else is distracted by headlines and fear.

Instead of guessing let’s slow it down and zoom in. Let’s go to the 1W timeframe and see what is actually happening beneath the noise. Because the Jungle does not reward emotion. It rewards patience clarity and respect for the range.

Beyond Technical Analysis

POL: ready for a rebound? key levels to watch in the coming daysPOL – tired of bleeding or just loading the spring for the next move? According to market sources, fresh headlines around the Polygon 2.0 migration and new incentives for builders lit up the ecosystem today, and intraday volume picked up right away. On the chart we’re sitting right on a chunky demand zone where buyers defended price several times already.

On the 4H, RSI bounced from oversold and is pushing above its signal line, while the visible range volume profile shows a fat node a bit higher, around the first red supply block. I’m leaning long from this green zone, aiming for a squeeze into the 0.103–0.11 area as late shorts get uncomfortable. I might be wrong, but this looks more like accumulation than a safe downtrend continuation. ✅

My base plan: hold longs while price stays above the lower edge of demand around 0.088 and watch for a clean 4H close above local resistance to confirm strength. If bulls fail and we lose that 0.088 support, I step aside and let it drift toward deeper liquidity below 0.085. Until then, I treat dips into the green zone as potential reload spots, scaling out near the first red supply blocks.

XAUUSD - H1 - SHORT1. As expected, the H4 resistance prevented further upside; no sell signal was issued due to uncertainty.

2. Price didn't reach the first support level and rebounded.

3. If an upward move is to occur, it will likely start from the lower zone.

4. On the H1 timeframe, the lowest-risk levels for both buy and sell entries have been identified.

BTC Weekly Conclusion:For BTC price, it starts to decrease near 61 388 points, but one more retest there can push the price downside near 50k, above the 71 818 points price can increase near 89 000 points, but it can delay next week.

From fundamentals, new Fed chair expectations are manipulating the market now, crypto regulations are in the process now, they are not releasing the expected dates for accepting the law (Clarity Act), but CFTC increases the commission members with the crypto-experienced people, which makes the future more clear, this week inflation rate delay and it causes fear in the market.

S&P 500 Cools While VIX Awakens: What's the Market Pricing In?By Ion Jauregui – Analyst at ActivTrades

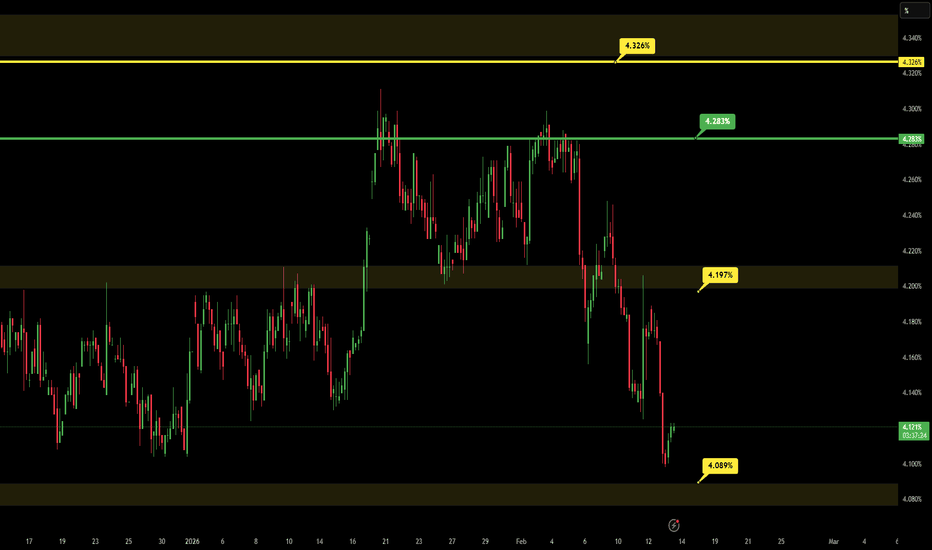

The U.S. market is entering a phase of heightened sensitivity and reduced complacency. The S&P 500 S&P 500, the primary benchmark for global equities, has shifted into a consolidation phase after months of sustained gains. At the same time, the VIX CBOE Volatility Index — commonly referred to as the “fear index” — is rebounding from historically low levels, reflecting an increase in institutional hedging activity.

This is not, at least for now, a panic-driven environment. Rather, it is a technical adjustment as the market recalibrates expectations around interest rates, economic growth, and corporate earnings.

Technical Analysis – S&P 500 (AT Ticker: USA500)

Institutional-Led Corrective Phase

From a structural standpoint, the primary trend remains bullish as long as the index holds above the 6,768.23 support level, a former consolidation area. The volume Point of Control (POC) is located near 6,647 points, acting as a key medium-term structural support.

The upper boundary of the current movement stands at 7,019.43 points, marking the recent high within this consolidation-distribution phase.

The latest session closed around 6,917.81 points, extending a four-day corrective sequence amid heightened sensitivity surrounding Non-Farm Payroll (NFP) expectations. The 6,932.30 level, previously used as an intraday reference, failed to break decisively, reinforcing short-term selling pressure. Pre-market activity continues to show bearish momentum.

Technical Indicators

RSI (14) near 43%, trending lower toward oversold territory, though not yet at extreme levels.

MACD in negative territory, confirming loss of bullish momentum.

Bearish crossover with price breaking below both the 50-day and 100-day moving averages in recent sessions, signaling an active technical correction.

Price is currently trading around the 38.2% Fibonacci retracement of the latest bullish impulse. If this level fails to hold, the next technical target lies at the 50% retracement, aligned with the upward impulse initiated on Wednesday, January 28. A further extension would likely test the previously mentioned POC zone.

At this stage, the move remains consistent with a healthy technical correction. The critical factor is the preservation of structural support levels. A confirmed breakdown could open the door to prolonged consolidation or even deterioration of the long-term trend.

The internal ActivTrades US Market Pulse indicator currently signals a Risk-Off environment, consistent with rising corrective volume — suggesting partial institutional redistribution following the recent bullish leg.

In recent weeks, the index has traded within an approximate range of 6,496.89 to 7,019.43 points, reflecting increasing intraday volatility and tactical uncertainty.

The Role of the VIX

The VIX has broken its short-term descending trendline and is beginning to form a sequence of higher highs. Historically, sustained upward movements in this volatility benchmark have preceded corrections of 3% to 7% in the S&P 500.

As long as the rise remains gradual, it represents risk normalization following a period of excessive complacency. Only an abrupt spike toward stress levels would suggest systemic risk escalation.

Why Is the Market Behaving This Way?

The market is simultaneously pricing in:

Uncertainty surrounding the Federal Reserve’s policy trajectory.

Sector rotation toward defensive assets.

Elevated valuations after heavy concentration in mega-cap technology stocks.

Narrowing market breadth.

There is no confirmed change of cycle at this stage, but rather a transition into a less accommodative environment. Complacency has given way to prudence, and the S&P 500–VIX relationship will remain the most reliable barometer to assess whether the correction exhausts itself or evolves into a deeper structural adjustment.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

XAUT Weekly Conclusion:XAUT has the up trend, and now the price can decrease till 4554 points from here, but above 5064 points price can increase till 5277 points, which will increase the chance of ATH.

Because of Geopolitics, interest on the Metals are losing, because the main conflicts in the world are in the peace negotiation phase. But interest rate expectations are manipulated on the market now.

The channel or trend line confluence observation for BitcoinWas just dabbling with a trend line and then I explored if it had confluence with future price action. Surprisingly it did. It not recommended as a strategy but its just another chart element that can be a supporting confluence level for future trades for bitcoin. Just putting it out there.

If you have free time, and open minded, this approach might fit into your trading strategy.

Cheers,

S.SAri

BITCOIN - H4 - UPDAT - LONG1. On the monthly timeframe, we previously noted that the trend is bearish.

2. On the weekly and daily timeframes, there are still no signs of a price decline.

3. Therefore, we continue to expect upside movement toward the identified levels.

4. However, the optimal entry level has been updated and marked on the chart.

S&P 500 Weekly Conclusion:From S&P, the price increased expected 7000 points and came down near 6765 point, price can start the increase from the 6765 points till 6898 point, but the USA economic rates should be released; this week inflation rate is delayed, and it causes uncertainty in the market, which makes the investors fear.

USOIL Weekly Conclusion:From the USOIL price, it has a delayed in 63.87 points, and now the price decision depends on Iran and USA negotiation, on the peace negotiation stage, the price can come down till 58.44 points, and under this point, 55.96 level is the target.

Above the 63.87 point price can increase more, but probably a war will start in Iran after this.

Understanding Short Squeeze Dynamics - Educational FrameworkUnderstanding Short Squeeze Dynamics - Educational Framework

If you're finding value in these educational posts, hit that follow button.

What Creates Explosive Price Moves?

Certain stocks experience rapid percentage moves within short timeframes. One recurring pattern involves mechanical buying pressure related to borrowed shares.

When a significant percentage of shares have been borrowed and sold, mechanical pressure builds. Every borrowed share represents a future buy order. When price reverses upward, those holding short positions face increasing pressure to close by buying back shares, creating cascading buying demand.

The key is identifying where conditions exist, waiting for technical confirmation, and entering with defined risk parameters.

The Three-Filter Analysis Framework

Filter 1: Borrowed Share Threshold (20%+)

This measures what percentage of shares have been borrowed and sold. We focus on stocks where 20%+ of available shares are borrowed.

Why this threshold? Below 20%, pressure typically isn't sufficient. Above 20%, meaningful mechanical buying pressure exists when triggered.

High borrowed shares alone don't create movement. This filter simply identifies where potential exists.

Filter 2: Price Quality Filter ($10+)

We only analyze stocks trading above $10 per share. Non-negotiable.

Why this matters:

→ Better liquidity and tighter spreads

→ More reliable execution quality

→ Deeper order books

→ Institutional participation

→ Lower manipulation risk

Sub-$10 stocks often have poor liquidity, wide spreads, and unreliable execution that destroys otherwise solid analysis.

Filter 3: Technical Trigger (Daily Chart)

The first two filters identify potential. This filter identifies timing.

What we look for:

→ Price closing above key moving averages

→ Clean breaks above descending trendlines

→ Volume increase (50%+ above average)

→ No major overhead resistance immediately above

When a heavily borrowed stock breaks key technical levels, it signals potential thesis invalidation, potentially triggering position adjustments.

Structure Analysis Examples

Example Setup A: 23% Move Over 7 Days

Pre-conditions:

→ Borrowed shares: 24%+ (above threshold)

→ Price: Above $20 (quality filter met)

→ Technical: First daily close above 50-day MA on volume

Risk structure:

→ Entry zone: $22.60

→ Stop level: $20.17 (below breakout candle)

→ Risk per share: $2.43

→ Target zone: $27.50

→ Potential reward: $4.90 per share

→ Risk/reward ratio: Approximately 2:1

Result: Moved to $27.84 over 7 days

Example Setup B: 14% Move Over 2 Weeks

Pre-conditions:

→ Borrowed shares: 25%+ (high threshold)

→ Price: $40.50 (quality filter met)

→ Technical: Breaking trendline and reclaiming 20-day MA

Risk structure:

→ Entry zone: $40.50

→ Stop level: $37.68

→ Risk per share: $2.82

→ Target zone: $45.74

→ Potential reward: $5.24 per share

→ Risk/reward ratio: Approximately 1.9:1

Result: Reached target in 10 days

The pattern: Both had 20%+ borrowed shares, price above $10, clear technical trigger, defined stop placement, and realistic 2:1+ risk/reward ratios.

The Weekly Analysis Process (15 Minutes)

Step 1: Initial Screening (5 minutes)

Screen for:

→ Short interest above 20%

→ Price above $10

→ Average volume above 500K

This generates 50-100 potential candidates.

Step 2: Chart Review (10 minutes)

Look for:

→ Price approaching key moving averages from below

→ Descending trendlines being tested

→ Basing patterns forming after downtrends

Disqualify:

→ Already extended 20%+ from lows (too late)

→ Major overhead resistance immediately above

→ Choppy structure with no clear pattern

→ Volume completely dried up

Narrow to 5-10 clean setups approaching triggers.

Step 3: Set Alerts

Create alerts for:

→ Price closing above key moving average

→ Volume spikes 50%+ above average

→ Breaks above resistance or trendlines

Let technical confirmation come to you.

Step 4: Evaluate Confirmed Setups

When alert triggers, verify:

→ Daily close above the level (not just a wick)

→ Volume elevated 30-50%+ above average

→ Clear stop loss level below breakout

→ Minimum 2:1 risk/reward ratio

If all four criteria align, setup is valid for evaluation.

Risk Management Framework

Position Sizing: The 1% Rule

Never risk more than 1-1.5% of account capital on any single setup.

Example calculation:

→ Account size: $50,000

→ Risk per trade: 1% = $500 maximum loss

→ Entry price: $40

→ Stop price: $38 (risk of $2 per share)

→ Position size: $500 ÷ $2 = 250 shares

If stopped out, loss is exactly $500 (1% of account).

Why 1% matters: With 1% risk, ten consecutive losses = 10% drawdown. With 10% risk per trade, two losses = 20% drawdown, which psychologically destroys most traders.

Stop Loss Placement

Two methods:

→ Method 1: Below the breakout candle low

→ Method 2: Below previous daily low (more breathing room)

Typical stop distance: 3-7% from entry

The rule: Honor stops without exception. If triggered, exit immediately.

Profit Management

Primary target: 2R (twice your risk)

If you risked $2 per share, first target is $4 profit per share.

At 2R target:

→ Take 50% of position off the table

→ Lock in meaningful gain

→ Keep 50% for potential extended move

Trail the remainder: Use 20-day MA or trailing stop for remaining 50%. If price closes back below entry trigger level, exit completely.

The math:

→ Entry: $40 (risking $2 to $38 stop)

→ First target: $44 (2R gain)

→ Sell 50%, lock $2/share profit on half

→ Trail remaining 50% toward $46-$48

→ Even if remainder stops at breakeven, you captured 1R total

Common Analysis Mistakes

Mistake 1: Analyzing After the Move

Seeing a stock up 18% and then checking data is too late for optimal entry.

Fix: Screen before moves. Identify candidates, then wait for technical triggers.

Mistake 2: Ignoring the Quality Filter

Lower-priced stocks with high borrowed shares look compelling until slippage and spreads destroy edge.

Fix: Only analyze stocks above $10. Always.

Mistake 3: No Defined Invalidation

Entering without predetermined stop level leads to emotional decision-making and larger losses.

Fix: Define stop before entry. If triggered, exit without debate.

Mistake 4: Over-Concentration

Risking excessive capital on single setups because they "look perfect" magnifies losses when wrong.

Fix: Maintain 1-1.5% risk per trade regardless of conviction level.

Mistake 5: Not Taking Partial Profits at 2R

Holding entire position hoping for extended targets often results in giving back gains.

Fix: Take 50% off at 2R target every time. Trail the rest.

The Statistical Reality

Even with solid analysis:

→ 30-40% of setups will fail or break even (normal expectation)

→ 60-70% should work if selective with entries

The edge comes from:

→ Keeping losses small (1% maximum)

→ Capturing meaningful wins (2-3R average)

→ Taking partial profits (locking gains)

→ Maintaining discipline (no revenge trading)

Example over 10 trades:

→ 4 losers at -1R = -4R total

→ 6 winners at +2.5R average = +15R total

→ Net result: +11R

If R = $500 (1% of $50K account):

→ +11R = +$5,500 on 10 trades

→ 11% account gain with 40% loss rate

This demonstrates asymmetric risk/reward with controlled position sizing.

Framework Summary

Three filters:

→ Borrowed shares above 20%

→ Price above $10

→ Technical trigger on daily chart

Weekly process:

→ Screen candidates (5 min)

→ Review chart structures (10 min)

→ Set alerts for triggers

→ Enter only on confirmed setups

Risk management:

→ Risk 1-1.5% maximum per trade

→ Stop below breakout structure

→ Take 50% profit at 2R

→ Trail remaining 50%

Realistic expectations:

→ 60-70% win rate when selective

→ 2-3R average on winners

→ Multiple setups appear monthly

→ Consistency over home runs

Key Takeaways

This pattern repeats across different sectors throughout the year. The framework provides a systematic approach to identifying these structures before they develop.

The three-filter system isolates stocks with mechanical pressure (borrowed shares), quality execution (price above $10), and technical catalysts (chart triggers).

Proper risk management ensures losses stay small while winners contribute meaningfully to account growth. The 1% rule combined with 2R profit targets creates favorable asymmetry over sufficient sample size.

Opportunities appear multiple times monthly. Most traders never learn to identify them systematically before momentum develops.

Now you understand the analytical framework to spot these structures in their early stages.

Educational content only. Analysis of borrowed share dynamics and technical patterns is for educational purposes. All trading involves substantial risk. This framework does not guarantee results. Heavily shorted stocks can be volatile and unpredictable. Always use proper position sizing and risk management. Never risk more than you can afford to lose. Past examples do not guarantee future outcomes.

Gold is still trading within its uptrend channel.Even though gold is still holding within its bullish channel, yesterday’s EQL sweep gives me the idea that, after a clear CISD on lower timeframes, we could see a move toward the bottom of the channel.

This doesn’t mean gold is about to reverse completely, but there’s a strong probability of price targeting the lower boundary and sweeping liquidity there.

We have many swing lows resting below current price, which means plenty of liquidity. If gold intends to continue higher in the short term, it may first need to clear out those positions.

In these market conditions, it’s important to trade with caution and only take A+ setups. With key fundamentals such as USD weakness and rising geopolitical tensions between the US and Iran, volatility can increase quickly. Either scenario could lead to a bullish gap and a potential move back toward the $5,500 area.

Economic Calendar:

London Session:

GBP (GDP)

Pre-New York:

USD (Unemployment Claims)

Good morning, and wishing you all a great trading day.

Extreme Bullish Alignment Meets Dual Volume Squeeze, Explosion NAORISUSDT — Extreme Bullish Alignment Meets Dual Volume Squeeze, Explosion Loading

NAORISUSDT is showing one of the most one-sided multi-timeframe readings you will find in crypto right now. The main overlay reads Bull 89% vs Bear 11% — an extreme bullish lean with a 78.72% conviction spread. The detailed factor breakdown confirms it at 81.1% vs 18.9% with a "Deep BULL" classification and 62.3% spread. This is not a marginal signal. This is near-unanimous bullish agreement across almost every timeframe and factor.

The numbers are staggering in their consistency. Candle bias reads 13 bullish vs 1 bearish across 14 timeframes. Close-vs-leading-line analysis shows 12 bullish vs 1 bearish — price is above its key reference line on nearly every timeframe from 3-minute to monthly. Ichimoku crossovers read 7 bullish vs 3 bearish. EMA trend is 4 bullish vs 0 bearish — not a single timeframe is showing bearish trend structure. Five candle patterns are active, all bullish — four validated three-candle continuation patterns and one star reversal. Zero bearish patterns detected anywhere.

The recovery metrics are parabolic. Price has retraced just -2.9% from recent highs while the bounce from recent lows reads 49.2%. That is a recovery ratio of 16.9x classified as "Parabolic" — the highest tier. The detailed panel confirms it at 15.5x. This means the upside momentum is roughly sixteen times stronger than the remaining pullback. Price is not just recovering — it is running. The 25.20% gain on the current candle with 243.83M volume confirms aggressive buying.

But the most significant signal on this chart may be the dual volume squeeze.

Both spot and futures volume are in imminent squeeze territory simultaneously. Spot volume has been compressed for 25 consecutive bars. Futures volume has been compressed for 26 bars. The price squeeze on the main chart has been building for 47 bars. The squeeze divergence reads "Both Compressed" — spot and futures are coiling together, which means when this fires, the explosion will be backed by both real and derivative participation. This is the highest-conviction squeeze setup — not one-sided speculation, but coordinated compression across the entire market structure.

Spot squeeze momentum is already showing contraction with an upward bias at 125.8% bandwidth. Price squeeze momentum reads bearish but turning upward. When squeeze momentum flips bullish while all multi-timeframe factors are already aligned bullish, the resolution tends to be violent to the upside.

Volume conditions are calm — all Z-scores sit near zero. Spot at -0.28, futures at -0.17, combined at -0.18 — all classified as "Steady." This is the quiet before the storm. Volume is flat because it is being compressed. The moment the squeeze fires, volume will spike. Momentum reads -0.03, essentially flat but classified as "Falling" — the last breath of compression before release.

The futures-to-spot ratio is 18.16x — classified as "High" but not extreme. Spot volume of 23.57M coins ($628K) vs futures volume of 428.05M coins ($11.41M) shows futures participation is elevated but not at manipulation levels. This is leveraged interest, not ghost market territory. Enough spot activity exists to give the move legitimacy.

Supply and demand structure shows 1 demand zone vs 5 supply zones. This is actually bullish context — it means price has been breaking through overhead supply on the way up and those broken zones are now behind it. Only one demand zone remains below as support, which means if this reverses, the drop could be sharp. But the multi-timeframe alignment suggests that is not the immediate probability.

No whale activity detected. No liquidation events. The move is organic and building — not being driven by a single large actor or a cascade event.

One risk factor to note: the spot pair was not found on this exchange, which means premium analysis is unavailable. Without premium and funding data, one layer of confirmation is missing. The directional and volume data are strong enough to read the setup, but the absence of premium intelligence means potential manipulation through funding rates cannot be assessed.

What to watch for the explosive move: The 47-bar price squeeze fires with bullish momentum. Both spot and futures volume squeezes fire simultaneously — the "Both Fired" divergence status. Multi-timeframe bull readings hold above 80%. If all three trigger together, this could produce one of those vertical moves that redefines the chart.

What could go wrong: A squeeze can fire in either direction. If price squeeze momentum shifts firmly bearish and the multi-timeframe reading drops below 65%, the squeeze fires downward and catches leveraged longs off guard. With only one demand zone below, the downside could be fast. Low-cap tokens with 18x futures-to-spot ratios can gap violently on deleveraging events.

Bottom line: NAORISUSDT has near-perfect multi-timeframe bullish alignment, parabolic recovery momentum, and a dual volume squeeze that has been building for 25+ bars on both spot and futures. This is a loaded spring. The direction of the squeeze resolution will determine whether this becomes a breakout or a trap — but with 89% of signals pointing up and a 16.9x recovery ratio, the probability favors the upside. Waiting for the squeeze to fire for confirmation before full commitment.

Direction: Long

Tags: NAORISUSDT, bullish, squeeze, breakout, volumeanalysis, multitimeframe Opus 4.6ExtendedClaude is AI and can make mistakes. Please double-check res

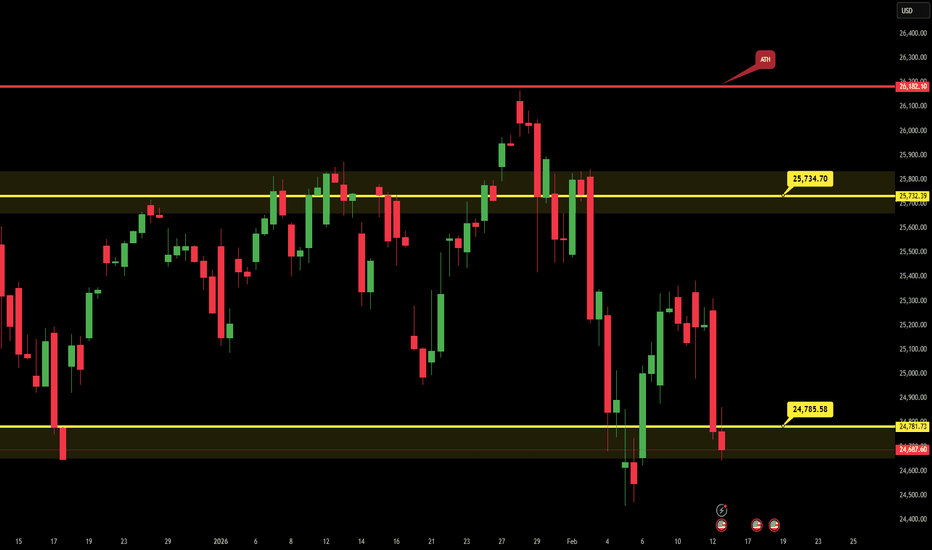

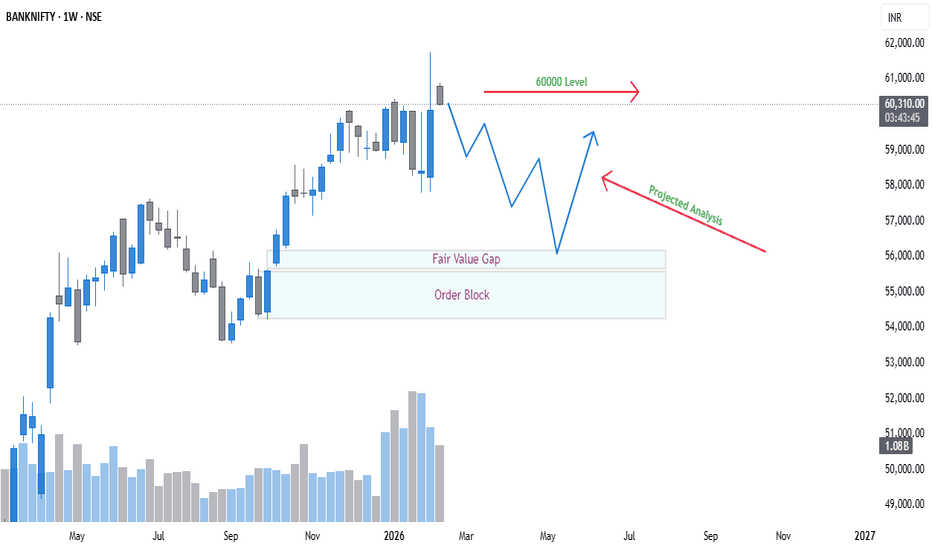

Bank Nifty Projected Move - Analysis as per Market StructureBank Nifty is currently trading around 60,740 (as of Feb 13, 2026 close vicinity), near the key psychological 60,000 support amid mild bearish cues. Here's an enhanced market structure analysis incorporating your view.

Key Levels & Order Block

Bullish Order Block: ~58,500–59,000 (21-DEMA support; strong demand zone from recent lows). Expect pullback here if downside accelerates.

Psychological Pivot: 60,000—clean break below signals deeper correction to 59,000/58,500.

Resistance: 61,000 (R1), 61,500–61,764 (52W high).

Macro Drivers

INR Weakness: USD/INR at ~90.57 (up ~1% WoW), pressuring banking NPAs/FX margins—rupee depreciation often weighs on Bank Nifty (correlation -0.7).

Sector Heatmap: HDFC/ICICI heavyweights mixed; PSU banks dragging (PNB -1.6%).

Projected Move

Bearish Bias Short-Term: 1–2% downside (~1,200 pts) to order block at 59,500. Implied volatility (India VIX ~15) supports 600–800 pt daily swings.

Bears Dominate Multi-Timeframe, But a Squeeze is LoadingXAUTUSDT 12H — Bears Dominate Multi-Timeframe, But a Squeeze is Loading

Tokenized gold is under bearish pressure across nearly every analytical factor. Multi-timeframe scoring across 14 timeframes shows Bull 34.4% vs Bear 65.6% — a strong bearish lean with a 31.3% conviction spread and 54% signal clarity. More than half of all 119 directional signals are active, and they overwhelmingly favor the downside.

The factor breakdown paints a consistent picture. Trend analysis shows just 2 bullish vs 4 bearish. Candle bias is heavily skewed at 4 bullish vs 10 bearish — sellers are closing candles lower across the majority of timeframes. Ichimoku TK crossovers read 5 bullish vs 7 bearish. But the most telling factor is the close-vs-leading-line analysis at 3 bullish vs 11 bearish — price is sitting below its key reference line on 11 out of 14 timeframes. That is broad-based weakness.

Engulfing patterns confirm bearish dominance at 1 bullish vs 6 bearish — six timeframes are showing bearish engulfing candles simultaneously. Three evening star reversals are active with zero morning stars. The candle pattern total reads 1 bullish vs 3 bearish. The structure agrees: 6 demand zones are active vs only 1 supply zone, which means price has been chewing through support levels on the way down and supply has mostly been broken above.

The retrace reads -3.1%, placing price in the "Prime" zone — the theoretical sweet spot for mean-reversion entries. The bounce from recent lows shows 7.5% with a 2.4x recovery ratio classified as "Recovery." Price has bounced more than twice the remaining retrace depth. This is where it gets interesting — the bearish multi-timeframe signals say lower, but the recovery ratio says buyers are stepping in with some force.

A price squeeze is building — 3 bars of Bollinger Band compression inside Keltner Channels. It is early stage, but momentum within the squeeze is bullish with 7.61% bandwidth. If this squeeze fires upward while multi-timeframe bearish signals dominate, it creates a dangerous short squeeze scenario. If it fires downward in alignment with the bearish bias, it confirms the next leg lower with force.

Futures premium is essentially zero at -0.03%, neutral with a Z-score of 0. Annualized yield reads -33% APY which carries a mild bullish implication — shorts are marginally paying longs. Standard deviation is 0.034%, classified as normal on both short and long lookbacks. Mean Z-score at 0.94 is within normal range. The premium market is calm — no extreme positioning, no crowded trade, no manipulation signal. This is a clean directional market being driven by structure, not speculation.

The tension in this chart is between the bearish multi-timeframe consensus and the building squeeze with bullish momentum. When these two forces collide, the resolution tends to be violent. Either the squeeze confirms the bearish trend with a momentum shift downward, or it produces a counter-trend rip that traps late shorts before resuming lower.

What to watch for bearish continuation: The squeeze fires with bearish momentum, multi-timeframe bear readings push above 70%, and the recovery ratio drops below 1.0x. That would confirm demand exhaustion and the next leg down.

What to watch for a counter-trend bounce: The squeeze fires bullish with spot volume confirmation, and the close-vs-leading-line factor starts flipping from 3/11 toward 7/7 or better. Without that multi-timeframe shift, any bounce is likely a short squeeze rather than a trend reversal.

Bottom line: Bears control the multi-timeframe picture decisively, but a volatility squeeze is loading and its direction will determine the next major move. The prime retrace zone and 2.4x recovery ratio suggest this is not a free short — there is buying pressure present. Wait for the squeeze to resolve before committing. Direction will become obvious within the next few sessions.

Direction: Neutral (bearish bias, but squeeze resolution pending)

Tags: XAUTUSDT, gold, bearish, squeeze, volatility, multitimeframe, supplyanddemand

Tokenized Gold Recovering, 3.1x Bounce Ratio Signals BreakoutXAUTUSDT 12H — Tokenized Gold Recovering, 3.1x Bounce Ratio Signals Breakout

Tokenized gold is showing strength. The 12-hour chart on XAUTUSDT reads Bull 69% vs Bear 31% — a strong bullish lean with a 37% conviction spread. This is not a marginal signal. More than two-thirds of all multi-timeframe readings are pointing up.

Price dropped from the $5,700 region down to the $4,700 zone in a sharp sell-off — you can see the cluster of distribution arrows marking the decline. But the story has shifted. Price has since recovered back above $4,960, printing a series of higher lows and reclaiming territory that was lost during the dump.

The bounce metrics tell the real story. The retrace from recent highs reads -2.6%, but the bounce recovery from recent lows is 8%. That gives a recovery ratio of 3.1x with a "Breakout" classification. This means the upside recovery is three times stronger than the remaining pullback — price is not just recovering, it is gaining ground with momentum. A 3.1x recovery ratio is one of the stronger readings you will see. It indicates buyers are absorbing supply and pushing higher with conviction.

Futures are essentially flat to spot — 4,966.8 vs 4,965.6. A negligible discount that tells us there is no speculative excess driving this move. When price rises without leveraged futures leading the charge, it tends to be more sustainable. This is spot-driven strength, not derivatives-fueled hype.

The demand zone sits far below at $4,300, which means there is significant structural support underneath. The point-of-interest level from the previous high around $5,700 represents the next major target overhead. That is roughly 15% above current price — a meaningful move if bullish momentum continues.

Signal clarity at 48% means about half of all signals are directional. While not extreme, the ones that are directional are heavily skewed bullish at a 69/31 ratio. The market has made its decision on direction even if not every timeframe has fully confirmed yet.

What to watch for continuation: A clean break above $5,100 with multi-timeframe bull readings holding above 65% and rising volume would confirm the next leg toward $5,400-5,700. The higher lows pattern needs to hold — any break below $4,800 with bull readings dropping below 55% would weaken the thesis.

What could go wrong: Gold-pegged tokens can gap sharply on macro news. Geopolitical shifts, central bank decisions, or USD strength could override the technical picture quickly. The -2.6% retrace is shallow, which means there has not been a deep pullback to build a strong base. A sudden reversal could find limited nearby support until the $4,300 demand zone.

Bottom line: XAUTUSDT is in recovery mode with strong bullish multi-timeframe alignment, a convincing 3.1x bounce ratio, and no speculative excess in futures. The path of least resistance is higher. Watching for $5,100 breakout confirmation or $4,800 support failure.

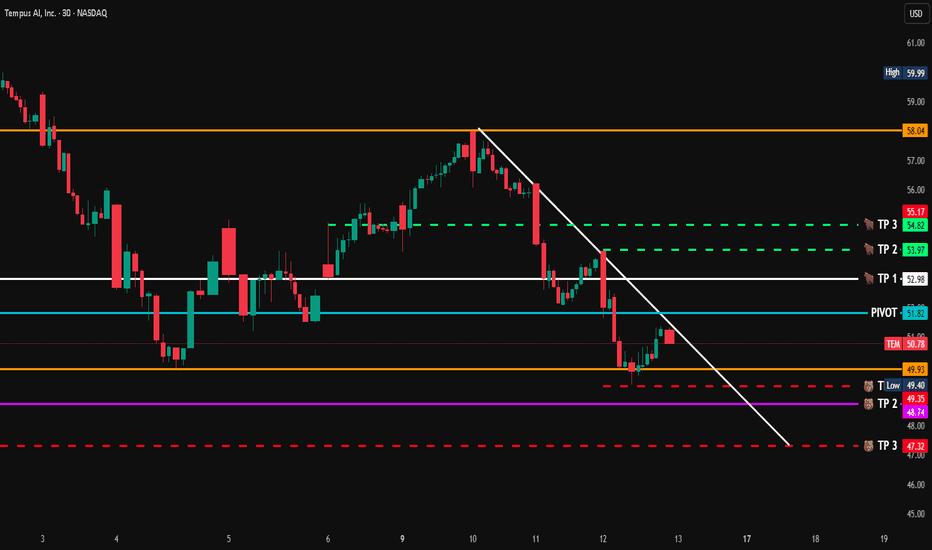

TEM – IF / THEN / ELSE Breakdown (Bias: PUTS)Here’s the clean game plan based on the levels shown in the chart so we’re prepared either way.

🔻 Current Structure

Clear downtrend (lower highs + trendline resistance)

Price trading below Pivot (51.82)

Failed push into the 52.98 (TP1 area / prior support now resistance)

Weak bounce off 49.93 (intraday low zone)

Momentum favors continuation lower unless bulls reclaim structure.

🔴 IF → PUT Scenario (Primary Bias)

✅ IF:

Price rejects 51.82 (Pivot)

OR fails again near 52.98 (prior breakdown level)

OR breaks below 49.93 (Low) with continuation volume

🎯 THEN:

Entry: On breakdown or rejection candle confirmation

Targets:

TP1: 49.35

TP2: 48.74

TP3: 47.32

Stop: Above rejection candle high OR above 52.98 if entering breakdown

Structure says continuation toward 47s if 49.93 fails cleanly.

🟢 ELSE → CALL Scenario (Alternative Plan)

We stay disciplined. No emotional bias.

✅ IF:

Price reclaims 51.82 Pivot with strength

AND holds above it on retest

OR breaks and holds above 52.98

🎯 THEN:

Entry: Reclaim + hold confirmation

Targets:

53.97

54.82

55.17

Stop: Back below Pivot

A strong reclaim shifts momentum short-term bullish toward mid-54s.

🧠 What I’m Watching

Does 49.93 crack with conviction?

Is bounce volume weak (bear flag forming)?

Does price respect the descending trendline again?

Bottom Line:

As long as price stays below 51.82, sellers control the structure.

Break of 49.93 likely opens room to 48.74 → 47.32.

Plan the trade. Trade the plan. No guessing.