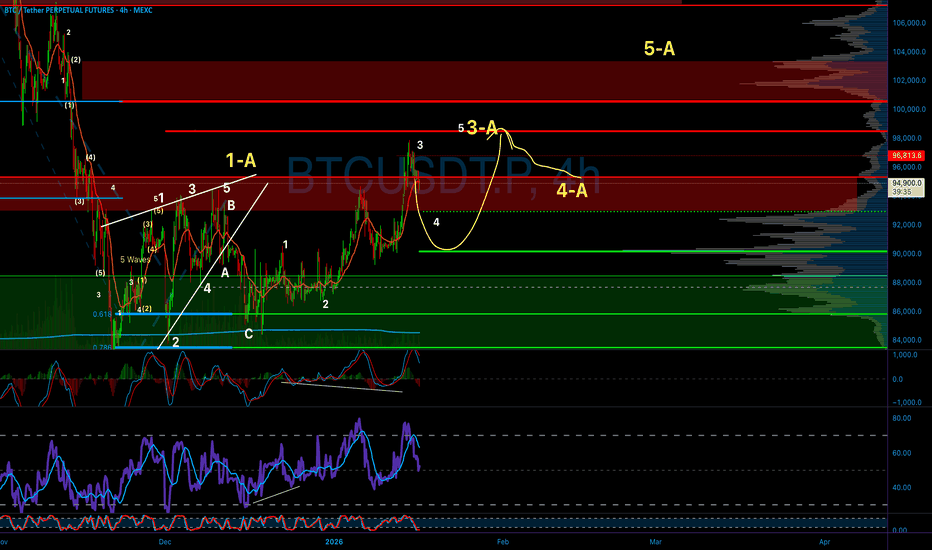

BITCOIN BEARS ARE STRONG HERE|SHORT

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 96,941.37

Target Level: 95,249.80

Stop Loss: 98,065.15

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bitcoin (Cryptocurrency)

$MONERO it was #Monero it is! One Legion - One Promise! ElliotWCRYPTOCAP:XMR is alive like never before.

Open Interest and funding rates remain healthy. Netflow is still trending outward, which strongly suggests that larger players are taking profits with the intention to re-enter at lower levels. What we are seeing right now is not weakness — it is a normal and expected corrective phase.

We are currently hunting liquidity on the long side, not breaking structure. This pullback was anticipated before the pump, as outlined in the original analysis:

Check it out! Elliot Wave 3 Prognose Monero

Elliott Wave Structure

There are two valid scenarios:

Scenario 1: Aggressive structure (1-2-1-2-1-2 at the start of Supercycle Wave 3)

In this case, Wave 4 is expected to be fast and sharp, correcting into the 0.236 – 0.5 Fibonacci zone.

We are already trading around the 0.382, which is completely healthy. Nothing abnormal here.

Scenario 2: Standard structure (1-2-3-4-5)

This would imply a longer consolidation range during Wave 4. Even in this scenario, the bias remains clearly bullish.

Regardless of how Wave 4 completes, there is no bearish signal. The fast dump is structurally normal and does not invalidate the trend.

Key Levels

Primary corrective target (Wave 4): ~ 609.91 USD

Invalidation level: 471.66 USD

Bearish scenario: Not active

After Wave 4 completes, we expect a sub-Wave 5 inside the larger Wave 3, developing over the coming days to weeks.

This cycle will not resemble previous ones. We are in Supercycle Wave 3, meaning Wave 5 should be comparable in strength to Wave 3 itself.

Targets

From the projected Wave 4 bottom around 610 USD, a +95–96% expansion is expected:

First major target: ~ 1081 USD

Psychological levels like 1000 USD are unlikely to act as strong resistance

First real resistance zone: ~ 1080 USD

From there, a gradual move toward 1200 USD

Following that, a Supercycle Wave 4 could develop and potentially extend into late 2026, before the final Wave 5 and the next macro bear cycle.

PS: On the #XMR/#BTC chart, Monero has reached the 2.618 extension after breaking all major structures. This is a very strong signal. A clean 2.618 hit is often the ideal level for continuation, especially when followed by a fast and aggressive pullback.

With multiple BOS (Breaks of Structure) confirmed on #XMR/BTC, the probability remains high that the broader uptrend will continue to expand.

This setup is not comparable to ZEC or other so-called “privacy coins.”

CRYPTOCAP:XMR stands alone structurally, fundamentally, and historically.

Monero remains the only real privacy coin.

Trust the structure. Trust the wave.

$Monero it was - #Monero it is.

Shinyflakes we hold until the end.

BITCOIN Free Signal! Buy!

Hello,Traders!

BITCOIN Price has tapped into a well-defined horizontal demand, where sell-side liquidity has been cleared and displacement higher followed. Current consolidation suggests absorption of remaining supply, favoring continuation toward buy-side imbalance above.

--------------------

Stop Loss: 93,846$

Take Profit: 97,304$

Entry: 95,248$

Time Frame: 4H

--------------------

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BITCOIN CAN FAKE THIS OUT NOW!!!!!!!(be careful)Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Is The Price Of Silver Telling Us What The Dollar Is Going To DoTrading Fam,

I am sensing some events on the horizon, and the charts seem to confirm what I am feeling. I want to let you know what I am seeing. We’ll talk Silver, the dollar, S&P500, Bitcoin, and Ethereum in this video. Don’t shoot the messenger.

✌️Stew

BITCOIN Will Go Higher From Support! Buy!

Take a look at our analysis for BITCOIN.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 94,951.39.

Considering the today's price action, probabilities will be high to see a movement to 96,189.10.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

$ZEC 1D Update: Into the chop here ZEC update.

ZEC is firmly in the doldrums right now. Price is all over the place with no clear directional control, and the chart is telling a story of chop rather than trend.

After the sharp breakdown and the fast bounce that followed, ZEC has failed to reclaim the prior uptrend structure and is now stuck rotating in the middle of the range. Rallies are getting sold, dips are getting bought, but neither side is showing conviction. That’s classic consolidation behavior after a high-volatility move.

The $400–430 area is acting as a noisy pivot zone where price keeps flipping back and forth. This is not a level to expect clean follow-through. Above here, there’s still heavy overhead supply from the prior breakdown. Below, buyers continue to defend in anticipation of another bounce, which is why price isn’t collapsing either.

The only higher timeframe level that really matters remains $300–310. As long as that zone holds, this chop can be interpreted as digestion rather than full trend failure. But until price either decisively reclaims the mid-$400s or flushes closer to $300, ZEC is likely to remain frustrating and directionless.

This is a low-quality environment for momentum trades. Patience is key here. ZEC tends to resolve these dull, messy ranges with expansion, but right now it’s firmly in chop mode, and the chart is reflecting that clearly.

TOTAL 1W Outlook We are now two weeks into 2026. The broader crypto market structure looks like this:

- Nearly two months at the trendline support zone after ATH in early October.

- Breaking out of the downtrend after bouncing off the bullish trendline, could be the start of the next leg up for the crypto market?

- $3.68T would be the next significant level for the upside to target. Equal with the left shoulder set in December '24.

- Macro looks in support of the bulls, the FED now expanding the balance sheet introduced liquidity into the market again. It is likely that the cutting cycle continues this year towards the Mid-terms in November.

- For the bears it's a case of capitalizing on the momentum by pushing price through the trendline support. For me, that would be confirmation of a bearish HTF trend as structurally BTC would have lower highs and lower lows + a trendline break.

BTC: The "Easy Mode" is Over. Now We Fight the Boss (150/200 MA)Okay, the bounce was nice. The sentiment flipped from "It's Over" to Greed (74) in a blink of an eye. But before you go max leverage long, I need you to look at the Daily Chart.

We are walking straight into the biggest test of 2026.

1. The "Great Wall" Overhead 🧱

Look at the Red Line (150 MA) and the Orange Line (200 MA) sloping down above the price.

The Reality Check: In a true bull run, these lines are support (below us). Right now, they are resistance (above us).

The Boss Fight:

We are currently squeezing right underneath them. This is the "Prove It" zone. To confirm a real reversal, we have to smash through this confluence of institutional supply.

2. The Squeeze is On 🤏

Support : The short-term MAs (Blue/Green/Purple) have crossed up and are pushing price higher.

Resistance : The long-term MAs (Red/Orange) are pushing down.

Result : Price is getting compressed. Usually, when this happens, the subsequent move is violent.

3.Don't get complacent just because the screen is green.

Until we get a Daily Candle Close above that Orange 200 MA, we are technically still in a "Relief Rally" inside a correction. A rejection here could send us back to retest the lows. A breakout sends us to ATH.

Do you think we slice through the 200 MA like butter, or do we get rejected? Place your bets below. 👇

BTCUSD t the time of writing, Bitcoin has successfully broken out of its previous sideways structure and is currently filling an existing gap. Price is expected to continue its upward move toward the $99,884 area to fully close the gap, which acts as Take Profit 1.

Take Profit 2 is located in the $111,610 – $113,000 range. After reaching these levels, price is expected to form a new base and enter another consolidation phase (sideways).

DYOR

BITCOIN Ultimate Rainbow Cycle AnalysisBitcoin (BTCUSD) is headed towards a 1D MA200 rejection, which as mentioned is what historically kickstarts Phase 2 of the Bear Cycle.

This excellent indicator that illustrates not only the Halving events but also the most optimal Sell and Buy levels based on the Fibonacci Time extension levels shows that the next point of interest is the 4.618 Fibonacci Time extension on the final week of September 2026, where the Cycle is expected to bottom.

With the next Halving estimated in April 2028, we will still be far from the start of the Profit Taking Zone (green vertical layers), which historically starts taking place around 38 weeks (266 days) after the Halving, but the 4.618 Time Fib its technically ideal for long-term buying again. Based on this model the price should be at least at $60000 by that time.

We also see that the price didn't even reach the orange Rainbow Wave on this Bull Cycle, confirming the Law of Diminishing Returns. But the timing of the Fibonacci Time extensions, as we first did more than 7 years ago, worked again to perfection. And this is why on this market (and as a matter of fact on most of them), it is more important to plan buying and selling based on time rather than absolute prices.

So are you expecting this Bear Cycle to have ended by October 2026 and will it reach at least $60000? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Coinranger| BTCUSDT. Is growing still actual?🔥News

🔹No important news today. Potentially, Trump could start doing something in Iran. And, as we remember, in such cases, crypto can go down very fast.

🔥BTC

🔹However, yesterday it broke through 96,700 and even went a little higher:

1️⃣ Today's levels above: 98,900, and that's a bit too much. There are a couple of lower timeframe levels: 97,860 and 98,300. But today, both Trump and the pending US crypto laws are against crypto growing.

2️⃣ Levels below, a bit updated: 94,770, 93,460, 92,450

The downside move remains the priority. Glassnode data isn't talking about an influx of new capital, but about a short squeeze. This is a dangerous and fragile situation for such powerful growth.

$BTC.D - Crypto cycle is not over yetPeople are confused right now. Some scream bear market while others scream bull market.

I am one of those people who think the bullrun is not over yet.

And this very chart right here is why I have conviction in my analysis: CRYPTOCAP:BTC.D

It has been in a sell program ever since creating its swing high up there. It created two consecutive monthly bearish FVGs (SIBIs). While it wicked into the upper one, the candle bodies stayed within the lower one, which is exactly what you want to see when you are bearish.

It left open a significant bullish FVG while it was repricing higher in March 2023. My personal view is that it will revisit this FVG.

Since we didn't have REAL euphoria yet (that type of euphoria where your barber tells you to buy crypto coins) coupled with other crypto charts, I expect the crypto market to have its final leg up this year.

My analysis will be invalidated once CRYPTOCAP:BTC.D manages to trade above its 2025 high.

Not financial advice. See this post as entertainment purpose. :)

Building a Bitcoin MONSTER Trade | Here's My Trade Plan We’re continuing our BTC Bitcoin Monster Trade 🚀📈, building on existing positions and getting ready for Bitcoin’s next potential move 🔍💰.

In this video, we break down the Monster Trade strategy, exploring its benefits and how it could be a life-changing opportunity when you catch a higher time frame trend reversal with an extended target 🧠⚡.

We cover price action, market structure, and the multiple trade strategy, plus risk management techniques and the rules of engagement for opening your next position 🛡️📊.

Not financial advice.

Bitcoin’s Structure Is Speaking — Are You Listening?Hello Traders,

If you zoom out and look at Bitcoin calmly, one thing becomes very clear, price is not breaking down, it is building structure. The current movement may look slow on the surface, but underneath, the market is still behaving in a controlled and bullish manner.

Big Picture:– Structure Matters More Than Noise

Bitcoin is currently trading inside a Rising Structure / Bullish Range.

This structure is defined by higher lows and a gradually rising price channel, which tells us that buyers are still in control despite short-term pullbacks.

The upper trendline is acting as dynamic resistance, where temporary profit booking appears.

The lower trendline continues to act as strong support, showing consistent demand on dips.

As long as this structure remains intact, the broader bias stays bullish.

High-Probability Accumulation Zone

This 90.2k – 89.5k zone marked on the chart is not random.

This area was previous resistance , which has now flipped into support.

Price is consolidating above this zone , not breaking below it, a strong sign of acceptance.

Sellers are failing to push price lower , indicating absorption of supply.

This is why this region qualifies as a high-probability accumulation zone, not a chasing zone.

Upside Targets – If Structure Holds

If Bitcoin continues to respect the demand zone and the rising structure, these levels come into play naturally:

Target 1 → 91,825

Target 2 → 93,790

Target 3 → 96,027

These are not predictions :— they are logical reaction levels based on structure and range expansion.

Risk Side:– Structure Invalidation

Every bullish structure has a clear line in the sand.

A clean breakdown below 87,600 would invalidate the current bullish structure.

If that happens, the market would need time to rebuild acceptance before any sustainable upside continuation.

Strong trends don’t start from excitement :—they usually start from patience.

Conclusion :- At the moment, Bitcoin is:

Holding above key demand

Respecting its rising structure

Consolidating instead of breaking down

The next major move will depend not on speed, but on how price reacts around this zone.

If this analysis helped you see the chart more clearly, share your view in the comments,

I’m always open to discussing structure with serious traders.

Analysis By @TraderRahulPal | More analysis & educational content on my profile.

Bitcoin Is Pausing Before the Next Expansion — Bullish StructureOn the BTCUSD 45-minute timeframe, the market continues to respect a strong bullish structure, clearly defined by consecutive impulsive expansions followed by controlled consolidations. Each highlighted box on the chart represents a re-accumulation phase, where price pauses, absorbs liquidity, and builds energy before the next leg higher. This stair-step behavior is a classic sign of a healthy uptrend, not distribution.

From a structural perspective, Bitcoin is holding higher lows above previous breakout bases, with price remaining comfortably above the rising moving average, confirming that buyers are still in control of the broader flow. The recent pullback into the 95,600–95,800 demand zone shows declining bearish momentum and shallow retracements — a typical corrective move rather than a trend reversal. Sellers have failed to push price back into prior ranges, reinforcing bullish dominance.

Looking forward, as long as BTC holds above the current consolidation base, the primary scenario favors continuation to the upside, with price likely rotating higher toward the next psychological zone near 99,000–100,000. Any short-term dips into demand should be viewed as buy-the-dip opportunities within trend, not weakness. Only a decisive breakdown below the current demand structure would invalidate this bullish roadmap and force a deeper correction. Until then, Bitcoin remains in expansion mode, with consolidation acting as fuel for the next breakout.

Breakout Continuation or Bull Trap Before a Deeper Pullback?Hello traders! Here’s a clear technical breakdown of BTCUSD (1H) based on the current chart structure. Bitcoin has just delivered a strong impulsive bullish expansion, breaking above multiple prior resistance levels with momentum and displacement. This move clearly shifted short-term market control back to buyers. However, after reaching the upper range, price has started to stall and compress, indicating a pause in momentum rather than immediate continuation. The current price action shows overlapping candles and reduced follow-through after the impulse, which is typical behavior when the market transitions from expansion into distribution or corrective consolidation at premium levels.

SUPPLY & DEMAND – KEY ZONES

Major Supply / Premium Zone:

The 97,800–98,000 area stands out as a strong supply zone, where previous reactions occurred and selling pressure is expected to increase. This zone represents overhead liquidity and is the main barrier for further upside.

Key Structural Support (Flip Zone):

The 95,800–96,000 region is a critical support area, acting as a structure flip from the recent breakout. This level is currently being tested and will determine whether the bullish impulse can be sustained.

Lower Demand & Liquidity Targets:

- If price fails to hold above the flip zone, downside liquidity sits around:

- 94,800 – prior consolidation base

- 92,400 – major demand zone and trend support area

These levels define the corrective path if sellers regain control.

🎯 CURRENT MARKET POSITION

Currently, BTC is trading between premium supply and the nearest structural support, placing price in a high-risk decision zone. Momentum has slowed, and buyers are no longer showing the same urgency seen during the breakout, suggesting that profit-taking is active.

This is no longer an impulse environment it is a reaction and confirmation zone.

My scenario:

As long as Bitcoin fails to break and hold above the 97,800–98,000 supply zone, the probability favors a corrective rotation lower. A rejection from supply followed by a loss of the 95,800–96,000 support would confirm short-term distribution and open the door for a pullback toward 94,800, and potentially deeper into the 92,400 demand zone. However, if price can reclaim and accept above the supply zone with strong bullish momentum, that would invalidate the pullback scenario and signal trend continuation toward new highs.

⚠️ RISK NOTE

Premium zones often produce sharp reversals and false breakouts. Let price confirm acceptance or rejection at supply, avoid chasing extended moves, and always manage your risk.

Bitcoin at a Major Elliott Wave Turning PointPrice action on the H1 timeframe shows a clean and well-structured Elliott Wave impulse, suggesting the bullish cycle has likely reached maturity. Bitcoin has completed a 5-wave impulsive structure (1–2–3–4–5), with Wave (3) showing strong expansion and Wave (5) printing a momentum peak followed by immediate rejection a classic sign of trend exhaustion.

Following the completion of Wave (5), the market has started to transition into a corrective phase, forming an ABC correction structure:

- Wave (A): Initial sharp pullback from the top → confirms sellers entering after the impulse.

- Wave (B): Corrective rebound with weaker momentum, failing to make a new high → typical bull trap behavior.

- Wave (C): Projected continuation lower, usually equal to or extended from Wave (A), targeting deeper liquidity zones.

🔹 Key Elliott Wave Insights

The impulsive leg from Wave (2) → Wave (5) remains intact and textbook.

Divergence between price and momentum near Wave (5) reinforces cycle completion.

Current structure favors distribution → correction, not immediate continuation higher.

🔹 Market Bias

🔴 Primary Bias:

Short-term bearish correction within a larger bullish cycle.

📌 As long as price remains below the Wave (5) high, rallies are likely corrective (Wave B) rather than trend continuation.

🟢 Bullish scenario only returns after a completed ABC correction and clear impulsive reclaim of structure.

🔹 Summary

Bitcoin is no longer in an impulsive rally phase. From an Elliott Wave perspective, the market is shifting from expansion to correction, and traders should expect lower prices before the next major bullish cycle resumes.

⚠️ Chasing longs at this stage carries elevated risk.

BTC/USDT (4H) – Chart UpdateBTC/USDT (4H) – Chart Update

Trend: Bullish structure intact

Price Action: Higher highs & higher lows continue

Ichimoku: Price holding above the cloud → strength remains

Bitcoin has successfully reclaimed the key demand zone (~94K) and is respecting the rising trendline. This pullback looks healthy, not a trend reversal.

As long as BTC holds above 93.5K–94K, upside momentum stays active

A clean push above 96K can open the path toward the 100K–102K liquidity zone (marked area)

Loss of the 94K support may lead to a deeper retest near 90K before continuation.

Structure favors continuation to the upside. Patience and proper risk management are key.

Why BTC Won't Crash to $50k (The 138.2% Rule)I want to share my full-view analysis of BTC today. Usually, I try to simplify my charts or translate them into standard Elliott Wave terms, but I feel like we might be at a 'moment of truth' here, so I’m going to stick to pure NeoWave and Ichimoku for this one, This idea tries to connect most of my previous ideas

It’s likely going to be a long read, and honestly, if you aren't interested in wave theory, this might not be for you. But for those who want to see what the deeper structure could be suggesting, let’s take a look.

The Big Picture: Supercycles

First, let's zoom all the way out. Based on the structure, it looks like Bitcoin has likely completed two major "Supercycles."

• Supercycle 1: Started way back in Nov 2011 and topped out around April 12, 2021.

• Supercycle 2: This was the corrective phase that followed which ended in November 2022

From my perspective, Supercycle 2 was a bit tricky. It actually failed the Time Similarity rule (it was too fast, lasting less than 1/3 of the time of the first wave). However, it passed on Price Similarity comfortably. The retracement was around 78%, which is well above the minimum needed. Because the price ratio is strong, I view this wave as acceptable despite the short duration.

The confirmation is seen November 2022. That’s when we broke the 2-4 trendline, which officially signaled that the Supercycle 1 correction (an Expanded Flat) was finished.

So, what does this mean for today? It suggests the rally we've seen since late 2022 is likely the start of Supercycle 3—specifically, we are looking at internal waves 1 and 2 of this new giant cycle.

Before we jump into the current setup, we need to quickly look at the popular Elliott Wave count that most people are following. I want to briefly explain why I think it might be flawed. We'll keep this part fast and short, just to clear the way for the actual analysis.

Let’s briefly test the common scenario most people are charting right now. The common view marks the move from Nov 2022 to Mar 2024 as a massive Extended Wave 1, followed later by Wave 3.

But when we look closer, the market physics tell a different story.

• Wave 1: Climbed roughly $58k, but it took a long 69 candles to do it.

• Wave 3: Climbed around $56k, but did it in just 25 candles.

Do you see the contradiction? Wave 3 covered almost the same ground but was nearly 3x more powerful in terms of speed and intensity. If Wave 1 was truly the "extended" leader, it shouldn't be outperformed so drastically by Wave 3.

The "Litmus Test" for a wave to be considered extended, it typically needs to dwarf the others—usually by at least 161.8%. Here, Wave 1 and Wave 3 are essentially the same size. When your motive waves are equal like this, it strongly suggests we aren't looking at a standard impulse pattern. The math simply doesn't support it.

Does that massive "Wave 1" actually subdivide into a clean 5-wave impulse? I checked the daily chart, and it fails the Degree Test.

• Wave 2: Lasted 23 candles.

• Wave 4: Lasted 153 candles.

Wave 4 took nearly 7x longer to correct the same amount of price. You cannot connect two waves with such a massive time imbalance and call them partners. The "impulse" theory simply breaks down when you zoom in.

Sticking to My Previous Analysis

I’m not trying to reinvent the wheel here. This is the exact same count I proposed in my previous analysis, and I haven't seen anything yet that changes my mind.

While the popular view has its merits, I’m sticking with this count simply because it passes the strict internal structure tests without having to force the rules.

• Wave 1: Nov 21, 2022 → Apr 10, 2023

• Wave 2: Apr 10, 2023 → Sep 11, 2023

• Wave 3: Sep 11, 2023 → Mar 11, 2024

• Wave 4: Mar 11, 2024 → Sep 02, 2024

• Wave 5: Sep 02, 2024 → Jan 20, 2025

• Major Correction: Jan 20, 2025 → Ongoing (Flat correction)

Unlike the other scenario, this count passes the Internal Structure Test. The waves are balanced, and the subdivisions are clean.

Why Jan 20, 2025 Was the Top ,The confirmation here is the 2-4 Trendline. We broke this line decisively around March 2025, once that line breaks, it confirms the entire 5-wave pattern is finished. This proves the subsequent rally to $126k wasn't a new impulse—it was just a corrective B-Wave in a flat pattern, also I reviewed the rally to 126k on 1D chart, from my view it’s a corrective pattern and not an impulse.

Ichimoku Evidence If you doubt the wave theory, look at the Ichimoku Base Line (Kijun-sen) on the weekly chart. It tells the real story of that rally to $126k.

From April to October 2025, the Base Line went completely flat.

• The Stat: It remained horizontal for 22 out of 27 weeks (81% of the time).

• The Reason: The calculation was "anchored" to the A-wave low ($74,434).

What This Means: In Ichimoku, a flat Kijun means the market is stuck in a range or equilibrium. Even though the price was rallying up to $126k, the math showed that the median equilibrium wasn't rising—it was pinned to the lows.

My view, that’s Flat behavior (specially B-wave). In a real trend, the equilibrium lifts with the price. Here, the price went up, but the structure stayed flat.

Combined with the fact that the upward speed (Velocity) was much slower than the drop in Wave A, this a major red flag, this was a corrective rally, not a new bull run.

This is where we have to look at the physics of the move.

• The Drop (Wave A): Fast, sharp, and velocity higher.

• The Rally (Wave B): Slower, grinding, and taking more time with a slower velocity.

Why This is a Major Red Flag In market theory, the "real" trend is usually the direction with the most speed. Impulse waves (the true trend) tend to move fast because everyone is rushing to the same side. Corrections (the counter-trend) tend to be slower and choppier because they are fighting the dominant flow.

While it is not a "god-given rule" that B-waves must be slower, when you see a rally that is significantly more lethargic than the drop that preceded it, it is a massive warning sign. It tells you that despite the green candles, the sellers are still stronger than the buyers. The "true" direction is likely still down.

The Million Dollar Question: How Deep?

Everyone seems worried that we are going to crash back down to $50k or $55k. But if we stick to the rules, I don't think that's happening.

I admitted before that was possible. But I need to make a correction.

What changed my mind? TIME. This drop moved too fast. Deep crashes usually drag out with a heavy feeling. This felt rushed. That intuition forced me to re-check.

The "138.2%" Rule The difference between a crash and a shallow bottom is the strength of the rally (Wave B).

• If Wave B is massive (> 138.2% of A), the pattern upgrades to an "Irregular Failure flat"

The Result: Our rally smashed that limit. This means the market is technically too strong to break the old lows. So, the $74,434 floor should hold. I am dropping the $50k target for now. Instead, I’m looking for a shallow bottom right here between $79k – $76.2k.

The Psychology of the pattern:

"Irregular Failure flat" sounds like a bad thing, but in reality, it is a sign of extreme strength.

Think of it like a Black Friday sale for a wildly popular product. You are standing in line waiting for the price to drop 50% so you can buy in cheap. But the demand is so crazy that people start buying the moment the price drops just 5%.

The crowd is so "hungry" that they don't let the price hit the clearance rack. They step in early.

That is exactly what a "Running Flat in elliott terms" is. It’s not just a chart pattern; it’s a map of impatience. It tells us the buyers are so aggressive that they aren't willing to wait for the deep discount everyone else is expecting.

A Final Word of Caution

However, let’s be real: These are not God's rules.

Markets are living things. Patterns break and structures shift all the time. If a major black swan event happens tomorrow—like a global conflict—and we smash through that $74k floor, the analysis changes. The whole rally from 2022 might turn into a complex correction (like a W-X-Y), and that is okay.

As traders, we don't predict the future with 100% certainty; we manage risk based on the structure we have right now. And right now, the structure says the bottom is close.

Summary & The Game Plan

So, to wrap this all up, here is what we are watching:

• The Target: We are waiting for C-5 for a bottom between $79k – $76.2k (Also there is a scenerio that C-5 might get truncated)

• The Invalidations: The absolute floor is $74,434 (Wave A low). If we break that or even wick near it, this specific "irregular failure flat" theory is dead, and we are likely dealing with a much larger, messier structure.

Where are we now?

We are currently forming a Running Triangle (Wave C-4). This typically signals the end is near—just one last leg down to go.

It looks like it's going to finish soon, unless it develops into something darker.

What Comes Next? The signal I am waiting for is a break of the 2-4 trendline (That’s when C-4 is confirmed finshed).

That might be the finish line. Once we smash through that line, it might confirm downtrend is over, But remember the break must be impulsive. It needs to be fast, strong, and convincing.

I will update you guys as soon as that breakout happens. If it doesn't... well, pretend you never saw this and just forget I exist.

A Note on Volatility (The BBWP Warning)

I also want to address the massive Weekly BBWP contractions I’ve flagged in most of my previous ideas.

I am sticking with the Supercycle theory. To me, this BBWP contractions is simply the "calm before the storm" right before Supercycle 3 kicks off. I fully agree with this outlook. it's coiling up for the next major move.

Also Technically, extreme contractions can signal a dangerous, higher-degree triangle or diagonal. That is the "darker" possibility, but I don't want to overcomplicate things today—that is a story for another time and I am not even considering it at the moment.

BTC Roadmap 2026-2027 ~ $320KHello BTC Watchers.

A quick update on BTC outlook for 2026 and a possible target for the next 2 years.

Incase you missed the explanation on the logarithmic chart, I mapped out the date-ranges, as well as how far the price fell logarithmically after each top. You'll see the word "lines" on the chart. This simply indicates the amount of diagonal trendlines it has fallen. By using this pattern-dedicated approach, a commonality is found which may be useful in speculating a future price. Because if not for past history, how else would we speculate on the future?

It's interesting to note that the past 3 ATH's (all time high's) are each lower than the previous if you compare it not to price but to the "lines". Even the fifth high (the one coming next) will be on a lower click-line than the previous, and that estimate is already over 300k. This is a really helpful way to speculate a future high because usually, on a regular-view chart, the zone above the ATH is uncharted territory. You could use a Fibonacci trend-based extension, but this is limited to the cycle that you're using for input points. Logarithmic chart + indicators factor in the entire history of the price.

This would mean the new peak could be in 2026 around USD 300k.

It's important to note that this ay not be a straight line up. As you'll see, although the price has been increasing exponentially, there have been periods of hard pullbacks or corrections. These are great times to enter the market, NOT when the price is close to the peak of the curve (in green).

So currently, it's likely we're seeing the beginning of a slow bearish cycle / correction or dip in the road before starting another impulse wave up towards a new ATH.

In the short term, it may seem like we're bullish due to the flag patterns showing up everywhere. But in reality, this is more likely a corrective bounce up before another minus 20% - 30% drop:

Moreso, before we consider a MEANINGFUL reversal we must first see a daily candle close ABOVE the 200d MA< which is the upper grey: