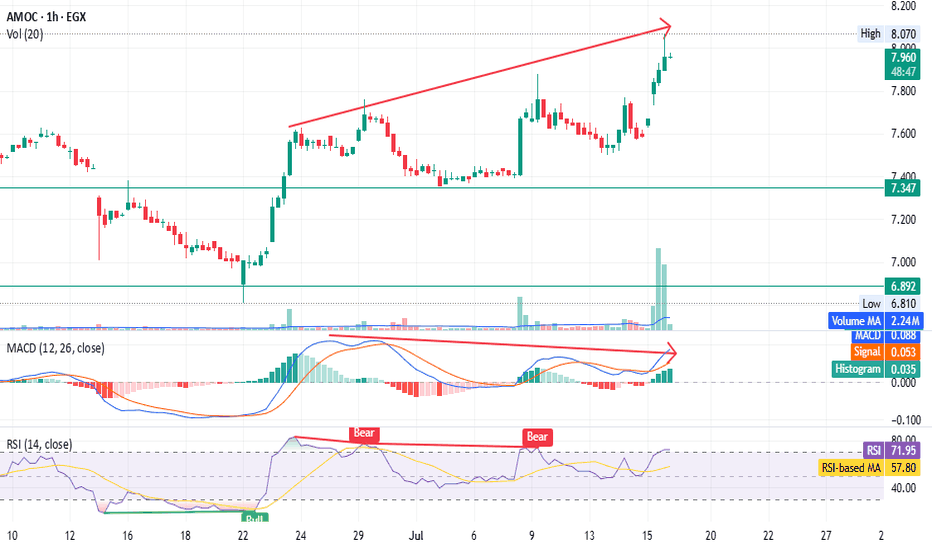

AMOC - Beware of the bear trap - only for shareholders EGX:AMOC timeframe: 1 hour

Prices continue to rise, forming a higher top than the previous one,

but MACD shows a negative divergence.

RSI indicates bearish dominance despite the price increase.

High volume with a gap, unsupported by other indicators, suggests possible distribution.

Stop loss (profit-saving) at 7.62.

This is not financial advice, just our analysis based on chart data. Consult your account manager before investing.

Thanks and good luck!

Breadth Indicators

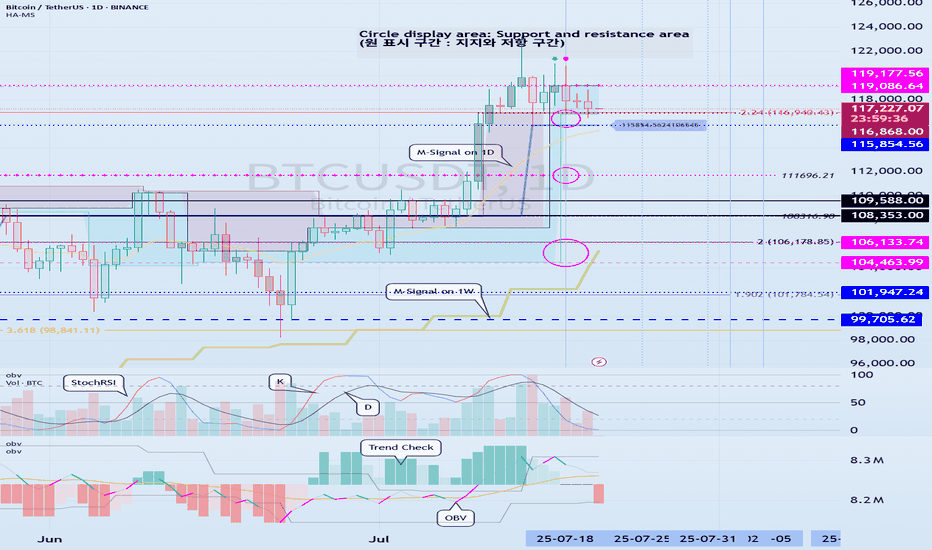

Important Volatility Period: August 2nd - 5th

Hello, fellow traders!

Follow us for quick updates.

Have a great day!

-------------------------------------

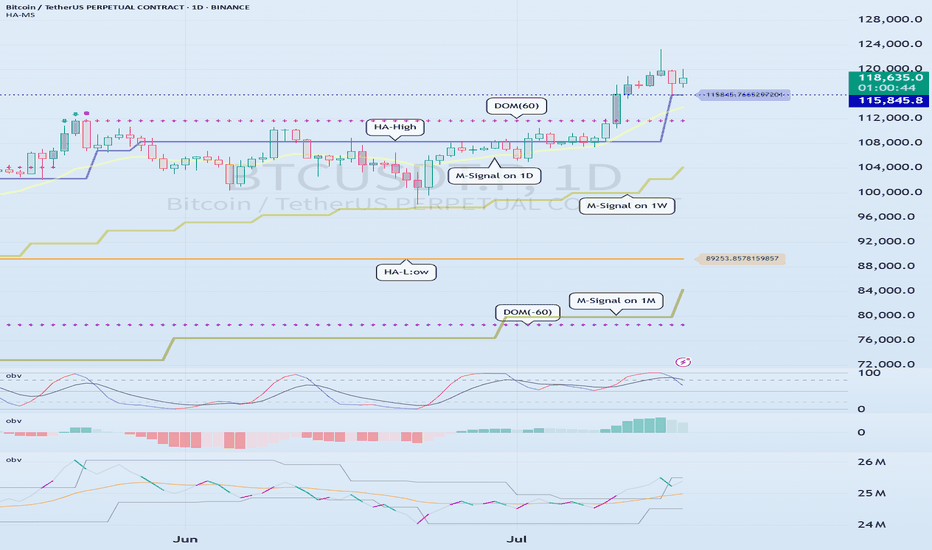

(BTCUSDT 1M Chart)

Let's take a moment to check the trend before the new month begins.

There have been two major declines so far, and a third major decline is expected next year.

For the reason, please refer to the "3-Year Bull Market, 1-Year Bear Market Pattern" section below.

-

My target point for 2025 is around the Fibonacci ratio of 2.618 (133889.92).

However, if the price surges further, it could touch the Fibonacci range of 3 (151018.77) to 3.14 (157296.36).

If it rises above 133K, it's expected that prices will never fall below 43823.59 again.

Since the HA-Low indicator hasn't yet been created on the 1M chart, we need to monitor whether it appears when a downtrend begins.

Based on the current trend, the HA-Low indicator is expected to form around 73499.86.

More details will likely be available once the movement begins.

-

The basic trading strategy involves buying in the DOM(-60) ~ HA-Low range and selling in the HA-High ~ DOM(60) range.

However, if the price rises above the HA-High ~ DOM(60) range, a step-up trend is likely, while if the price falls below the DOM(-60) ~ HA-Low range, a step-down trend is likely.

Therefore, the basic trading strategy should be a segmented trading approach.

The further away from the HA-High indicator, the more likely it is that the DOM(60) indicator will act as a strong resistance when it forms.

Therefore, if the current price and the HA-High indicator are trading far apart, and the DOM(60) indicator forms, it is expected to face significant resistance.

-

Looking at the current trend formation, the high trend line is drawn correctly, but the low trend line is not.

This is because the StochRSI indicator failed to enter the oversold zone.

Therefore, the low trend line is marked with a dotted line, not a solid line.

Therefore, what we should pay attention to is the high trend line.

We need to see if the uptrend can continue along the high trend line.

-

(1D chart)

If we use the trend lines drawn on the 1M, 1W, and 1D charts to predict periods of volatility, the periods around August 5th and August 13th are significant periods of volatility.

By breaking this down further, the volatility periods are around July 31st, August 2nd-5th, and August 13th.

Therefore, trading strategies should be developed based on the assumption that the volatility period extends from July 30th to August 14th.

The current price is moving sideways in the 115,854.56-119,177.56 range.

This range, the HA-High ~ DOM (60), is a crucial area to consider for support.

This will determine whether the price will continue its upward trend by rising above 119,177.56, or whether it will turn downward by falling below 115,854.56.

If the price falls below 115854.56, it is expected to meet the M-Signal indicator on the 1W chart and reestablish the trend.

The HA-High indicator on the 1W chart is forming at 99705.62, and the DOM (60) indicator on the 1W chart is forming at 119086.64.

Therefore, when the price declines, it is important to check where the HA-High indicator on the 1W chart forms and determine whether there is support near that point.

-

The On-Board Value (OBV) indicator within the Low Line ~ High Line channel is showing a downward trend.

If the OBV falls below the Low Line, the price is expected to plummet.

Therefore, it is necessary to closely monitor the movements of the OBV indicator.

The Trend Check indicator is a comprehensive evaluation of the StochRSI, PVT-MACD Oscillator, and On-Board Value (OBV) indicator.

The TC (Trend Check) indicator interprets a rise from the 0 point as a buying trend, while a decline indicates a selling trend.

In other words, a rise from the 0 point is likely to indicate an uptrend, while a decline is likely to indicate a downtrend.

Currently, the TC (Trend Check) indicator is below the 0 point, suggesting a high probability of a downtrend.

However, if the TC (Trend Check) indicator touches a high or low, the trend may reverse.

In other words, touching a high increases the likelihood of a reversal from an uptrend to a downtrend, while touching a low increases the likelihood of a reversal from a downtrend to an uptrend.

When such movements occur, it's important to consider the support and resistance levels formed around the price level to determine a response.

In other words, consider the support and resistance levels formed at the current price level.

As a significant period of volatility approaches, prepare to transition from box trading to trend trading.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------

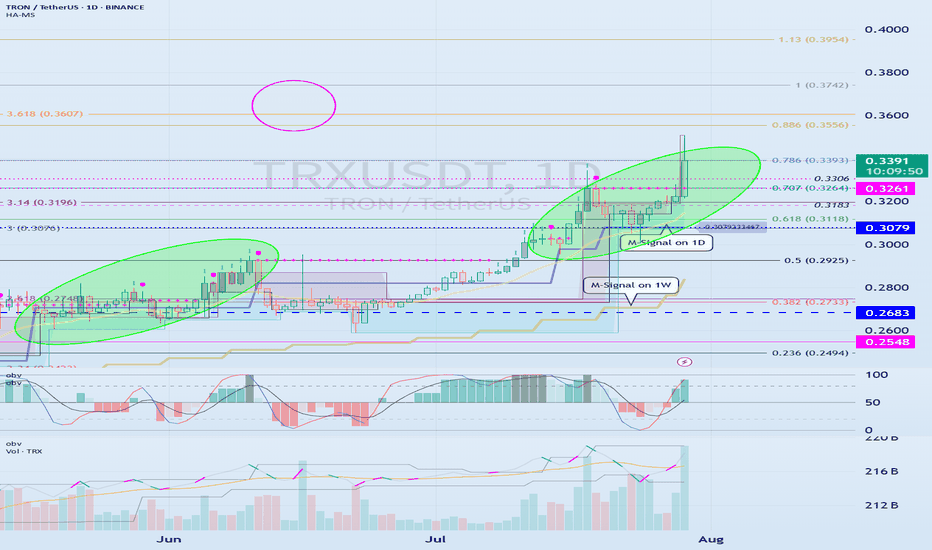

Check if the second step-up trend can be maintained

Hello, traders.

If you "Follow" us, you'll always get the latest information quickly.

Have a great day.

-------------------------------------

(TRXUSDT 1M Chart)

We need to see if the price can sustain itself by rising above the left Fibonacci level 3.618 (0.3607) and the right Fibonacci level 1 (0.3742).

When the next monthly candlestick is formed, we need to check the movements of the supporting indicators.

-

(1W Chart)

The DOM (60) indicator on the 1W chart is showing signs of forming a new trend.

Accordingly, we need to examine whether a rise above the left Fibonacci level of 3.618 (0.3607) will trigger a new wave.

The left Fibonacci level was created during the first rising wave.

Therefore, if the price rises above the left Fibonacci level of 3.618 (0.3607), a new wave is expected to form.

Since the HA-High indicator on the 1W chart is formed at 0.2683, if the price declines, support near 0.2683 will be crucial.

-

(1D chart)

If the price maintains above the 0.3079-0.3261 range, further upside is expected.

For the price to rise above the left Fibonacci ratio of 3.618 (0.3607) and the right Fibonacci ratio of 1 (0.3742), the OBV indicator of the Low Line ~ High Line channel must rise above the High Line and remain above it.

However, since the StochRSI indicator has entered an overbought zone, the upward movement may be limited.

Therefore, we need to consider how to reset the indicator.

-

The price is continuing a stepwise upward trend, rising above the HA-HIgh indicator.

It is currently in its second stepwise upward movement.

Therefore, the key is whether the price can sustain above the HA-High indicator.

Whether a third stepwise upward movement occurs will depend on whether the price can sustain itself around or above the 0.3079-0.3261 level.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------

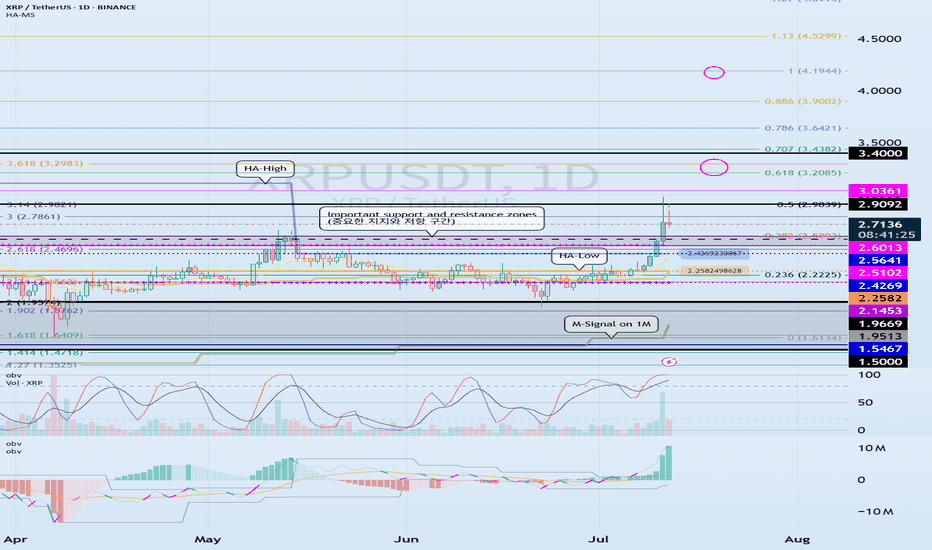

XRP Eyes $4? Analyst Says ‘Most Profitable Phase’ May Have BegunAs the broader crypto market shows signs of recovery, XRP is once again capturing investor attention—this time with bold forecasts of a surge toward $4.00, driven by technical momentum, market sentiment, and expanding real-world utility.

According to crypto analyst Darren Chu, CFA, founder of Tradable Patterns, XRP may be entering its “most profitable phase” since its 2021 rally. The token has posted a 20% gain over the last three weeks, breaking key resistance levels and displaying stronger correlation with broader altcoin inflows.

“XRP has the ideal confluence of legal clarity, technical breakout, and network traction,” Chu explained in a recent research note. “The conditions now resemble the early stages of major cyclical surges we’ve seen in past bull runs.”

Legal and Regulatory Tailwinds

Since Ripple Labs’ partial legal victory against the U.S. SEC in 2023—where a federal judge ruled that XRP is not a security when traded on exchanges—the asset has regained credibility among institutional players. Multiple crypto funds and ETFs have added exposure, and on-chain wallet growth has accelerated.

This legal clarity has paved the way for Ripple to resume aggressive expansion of its payment corridors, especially in Latin America and Asia-Pacific.

Real-World Utility as a Demand Catalyst

Unlike many Layer 1 tokens with purely speculative value, XRP benefits from real-world utility as a bridge asset for global payments. RippleNet, the enterprise-grade payment network built on XRP, now boasts over 300 financial institutions using or piloting XRP-based settlement infrastructure.

In July, Ripple announced its latest partnership with Banco Bradesco, one of Brazil’s largest banks, to streamline USD/BRL remittances—a deal expected to drive significant volume on-chain.

Analysts note that real-world utility may now be priced into XRP’s valuation at a discount, creating room for catch-up as adoption increases.

Technical Analysis Points Toward Breakout

From a technical standpoint, XRP has breached its multi-month descending channel, with daily trading volume rising 35% over the past two weeks. Analysts are watching the $0.92–$1.00 range as a short-term hurdle. If broken, momentum could accelerate quickly toward $1.50, and potentially as high as $3.80–$4.20, according to Fibonacci-based projections.

“The breakout setup is textbook,” says Chu. “We’re seeing volume confirmation, RSI divergence, and a broader macro narrative—all aligning.”

Risk and Reward: A Balanced View

Of course, XRP is not without risks. Pending SEC appeals, macro volatility, and delays in Ripple’s expansion plans could temper the pace of gains. Still, many investors are betting that the risk-reward profile is increasingly asymmetric in XRP’s favor.

In the eyes of analysts and asset managers alike, XRP is now more than a litigation story—it’s a comeback story.

For those seeking exposure to a large-cap crypto with strong fundamentals, legal clarity, and real-world traction, the message from the market is clear: XRP’s most profitable phase may have just begun.

Metaplanet Doubles Down on Bitcoin Despite Weak SharesJapanese investment firm Metaplanet continues to draw attention with its pro-Bitcoin stance, announcing a fresh acquisition of BTC worth $93 million. The move comes despite ongoing pressure on the company's stock, underscoring its long-term commitment to digital assets.

Publicly listed on the Tokyo Stock Exchange, Metaplanet began accumulating Bitcoin in early 2024, taking inspiration from U.S.-based MicroStrategy. Since then, the company has steadily increased its holdings, viewing the cryptocurrency as a hedge against inflation and currency devaluation — particularly in light of the weakening yen.

With this latest purchase, Metaplanet’s total Bitcoin holdings now exceed 5,000 BTC, making it one of Asia’s largest corporate holders of the asset. Company executives emphasize that their approach is not driven by short-term speculation, but rather by a strategic vision to transform the balance sheet and align with the future of finance.

Still, the stock market has not fully embraced the strategy. Since the company’s initial crypto investments, Metaplanet shares have experienced significant volatility and an overall downward trend. Some investors remain wary of overexposure to a single volatile asset, fearing it could deter traditional capital and increase overall risk.

Speaking to local media, CEO Tetsuya Nagata reiterated that the firm’s Bitcoin commitment is deliberate and resilient. “We’re not chasing short-term price movements,” he said. “We see corrections as opportunities to strengthen our position and prepare for long-term transformation.”

Analysts are divided. Some view Metaplanet’s approach as a sign of growing institutional appetite for crypto in Asia, while others call for a more diversified portfolio to mitigate risk. There is growing speculation that Metaplanet’s bold move could set a precedent for other Japanese and regional companies seeking similar exposure.

Against the backdrop of global economic uncertainty and financial digitization, Bitcoin is evolving from a speculative asset into a core component of strategic asset allocation. Metaplanet is a clear example of this shift — one that is navigating short-term market challenges in pursuit of a long-term digital vision.

Time will tell whether the strategy pays off. But for now, Metaplanet is carving out a bold new role in Japan’s corporate landscape, as a pioneer of institutional Bitcoin adoption in Asia.

Crypto Might Protect You from a Global Debt Crisis | OpinionAs sovereign debt levels surge and central banks struggle with inflationary aftershocks, investors worldwide are seeking new forms of financial protection. While gold and U.S. Treasuries have historically served as safe-haven assets, the current global debt structure presents unprecedented risks. In this context, cryptocurrencies — particularly decentralized, deflationary assets — may offer a unique hedge against systemic instability.

A Mounting Crisis

According to the IMF, global debt reached $315 trillion in Q2 2025, led by the U.S., China, and EU member states. Rising interest rates have pushed sovereign debt servicing costs to record highs. At the same time, inflation remains sticky, and fiscal deficits continue to expand — creating a scenario where traditional instruments may no longer preserve purchasing power.

Credit downgrades of major economies — including a recent warning from Moody’s on the UK and France — further highlight the fragility of fiat-based systems.

Why Crypto Provides an Alternative

Fixed Supply:

Bitcoin’s 21 million cap remains untouched. In an era of unlimited fiat printing, scarcity is a value proposition in itself.

Decentralization:

Cryptocurrencies operate outside centralized banking systems. In case of capital controls or currency devaluation, digital assets remain globally transferable and resistant to censorship.

Accessibility and Liquidity:

From stablecoins to DeFi protocols, crypto provides 24/7 access to financial tools — often with greater transparency than traditional banks.

Not Without Risk

Crypto remains volatile and vulnerable to regulatory shifts. The recent ETF delays by the SEC and tax crackdowns in G20 countries underscore the uncertain terrain. However, compared to the looming debt traps of fiat economies, some volatility may be an acceptable tradeoff for autonomy and deflationary exposure.

Growing Institutional Interest

Firms like Fidelity, BlackRock, and BBDelta have significantly increased their crypto allocations, particularly in ETH and BTC. Even central banks are researching CBDCs and holding digital reserves as a contingency plan.

Conclusion

While crypto isn’t a panacea, it represents a credible hedge in a world where fiat debt continues to spiral. For risk-aware investors, a balanced portfolio in 2025 likely includes a thoughtful allocation to digital assets — not for speculation, but for protection.

The debt crisis is not a distant threat. It’s unfolding now — and cryptocurrency may be one of the few tools with the potential to navigate what comes next.

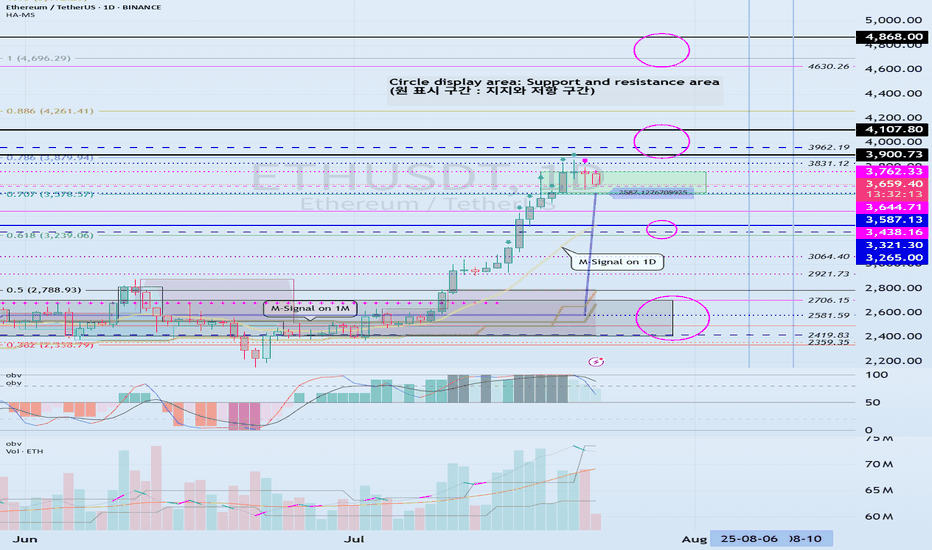

Check if HA-High indicator is forming at 3587.13

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

HA-High indicator is showing that it is about to form at 3587.13.

Accordingly, if the HA-High indicator is newly created, the support in the 3587.13-3762.33 section is an important issue.

If it falls below 3587.13, it is likely to touch the M-Signal indicator on the 1D chart.

Therefore, we should check whether it touches the area around 3265.0-3321.30 and rises.

-

This can be seen as a time to test whether it will continue the first step-up trend while rising in the important section of 2419.83-2706.15.

ETH's volatility period is around August 6-10, but we should check what kind of movement it shows after passing the volatility period of BTC.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Aave proposal tolaunch centralized lending on Kraken’s Ink movesAave’s community overwhelmingly approved a proposal to license a centralized version of its lending protocol for deployment on Kraken’s Ink blockchain.

A proposal for the decentralized finance (DeFi) lending protocol Aave to launch a centralized version of its service on the crypto exchange Kraken’s Ink blockchain has received widespread approval among the community.

An Aave request for comment (ARFC) for the deployment of a whitelabel version of Aave v3 for the Ink Foundation, the organization behind the Ink blockchain, was approved with 99.8% of the votes cast in favor.

An ARFC acts as a preliminary offchain vote before proceeding with a full decentralized autonomous organization (DAO) vote. The next phase involves drafting an Aave improvement proposal (AIP) that will be voted onchain.

The ARFC states that “by granting a license to deploy a centralized version of the Aave (AAVE) codebase, Aave can expand its technology adoption while creating new revenue streams.”

Aave had not responded to a request for comment by publication time.

Kraken unveiled its Ink blockchain in late 2024, following an October announcement. The chain aims to serve as a compliant layer-2 platform for tokenized assets and institutional DeFi.

Aave eyes institutional lending market

The proposal states that the partnership could be “an opportunity for Aave to expand its influence in the institutional lending space,” creating additional revenue streams for the protocol.

The Aave DAO would receive a share “greater than or equal to the equivalent of a Reserve Factor of 5% based on borrow volume in all pools.” The Ink Foundation also committed funds to the development of the new protocol

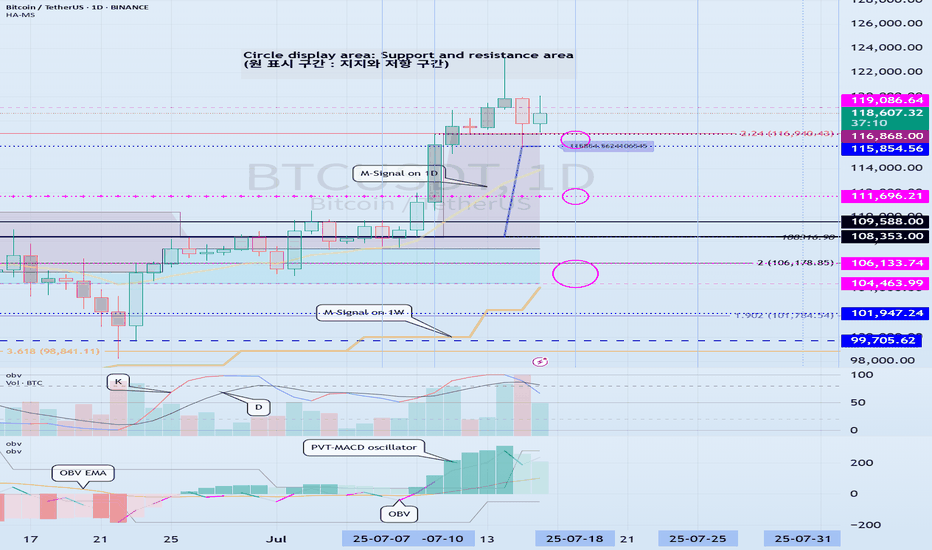

Support around 115854.56-116868.0 is the key

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

The DOM(60) indicator of the 1W chart is generated at the 119177.56 point, and the DOM(60) indicator of the 1D chart is generated at the 119086.64 point, and then shows a downward trend.

However, since the HA-High indicator is formed at the 115854.56 point, it is difficult to say that it has yet turned into a downward trend.

Accordingly, it is necessary to check whether it is supported in the HA-High ~ DOM(60) section.

The next volatility period is expected to occur around July 25 (July 24-26).

However, the important volatility period is expected to be around August 2-5 (maximum August 1-6), so we need to look at what kind of movement it shows as it passes through the volatility period that will occur in the future.

-

Since the StochRSI indicator has entered the oversold zone, there is a possibility that the decline will be restricted.

Therefore, the key is whether there is support around 115854.56-116868.0.

This is because if it falls below the HA-High indicator, there is a possibility that a downtrend will begin.

Also, since the M-Signal indicator on the 1D chart is rising around 115854.56, it can be seen as an important zone.

--------------------------------------------------

An indicator called Trend Check has been added to the OBV indicator.

This indicator is an indicator that comprehensively evaluates the StochRSI, PVT-MACD oscillator, and OBV indicators and expresses them in a column.

Accordingly, if the TC indicator rises from the 0 point, it can be interpreted that the buying force is dominant, and if it falls, the selling force is dominant.

Therefore, if it rises above 0, it is likely to show an upward trend, and if it falls below 0, it is likely to show a downward trend.

Also, if the TC indicator touches the highest point (6) or lowest point (-6), there is a high possibility that the trend will reverse, so you should think about a response plan for this.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

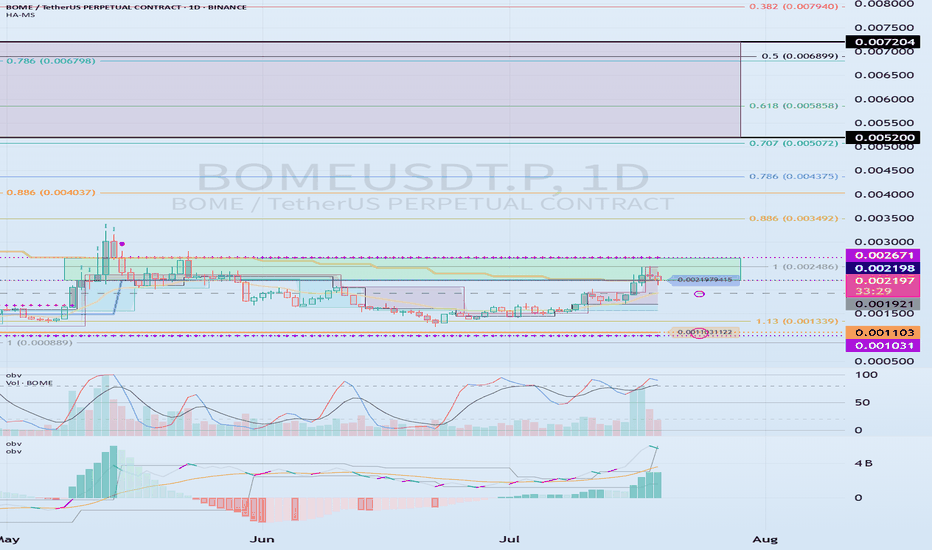

0.002198-0.002671 The key is whether it can break above

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(BOMEUSDT.P 1D chart)

BOME is a BOOK OF MEME, which is a meme coin and belongs to the Solana Ecosystem.

If the price breaks through the 0.002198-0.002671 section upward and maintains, it is expected to rise to around 0.005200-0.007204.

As a condition for this,

- The K of the StochRSI indicator should show an upward trend with K > D below the overbought section.

- The PVT-MACD oscillator indicator should show an upward trend. (If possible, it should be above the 0 point.)

- The OBV indicator of the Low Line ~ High Line channel should show an upward trend. (If possible, it should be above the High Line. It should maintain a state where at least OBV > OBV EMA.)

When the above conditions are met, if the 0.002198-0.002671 section breaks through upward, it is expected to continue the upward trend.

If not and it falls, you should check if it is supported near 0.001921.

This is because I think that the upward trend can continue if it receives support near the 0.001921 point, which is the volume profile section.

Therefore, if it falls below 0.001921, you should stop trading and watch the situation.

You can trade with a SHORT position in futures trading, but since it falls below the volume profile section, you should be aware of the volatility.

Therefore, if you insist on trading, a short and quick response is required.

-

(15m chart)

The trading method is simple.

Buy near DOM(-60) ~ HA-Low, and sell near HA-High ~ DOM(60).

However, if it falls from DOM(-60) ~ HA-Low, it is likely to show a stepwise downtrend, and if it rises from HA-High ~ DOM(60), it is likely to show a stepwise uptrend.

Therefore, you should maximize your profits by taking a split transaction format.

Other indicators can be used as points where you can conduct split transactions depending on the situation.

That is, sell about 25% at the support and resistance points drawn on the 1M, 1W, and 1D charts, and sell about 10% at the support and resistance points on the 15m chart to maximize your profits.

While conducting transactions in this manner, you may wonder if you can actually drag the transaction to around 0.005200-0.007204, but it is possible.

It is good to hold to make a big profit, but since the current price range is in the support and resistance range, I think it is an unstable range to just hold.

-

Thank you for reading to the end. Wishing you a successful trade.

--------------------------------------------------

Check support at 115854.56-119086.64

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

On the 1W chart, the DOM(60) indicator was created at the 119086.64 point.

Accordingly, the key is whether it can be supported near 119086.64.

The meaning of the DOM(60) indicator is to show the end of the high point.

In other words, if it rises above HA-High ~ DOM(60), it means that there is a high possibility of a stepwise upward trend.

On the other hand, if it fails to rise above DOM(60), it is likely to turn into a downtrend.

The basic chart for chart analysis is the 1D chart.

Therefore, if possible, check the trend of the 1D chart first.

The DOM(60) indicator of the 1D chart is currently formed at the 111696.21 point.

And, the HA-High indicator was created at the 115854.56 point.

Therefore, since it cannot be said that the DOM(60) indicator of the 1D chart has been created yet, if the price is maintained near the HA-High indicator, it seems likely to rise until the DOM(60) indicator is created.

We need to look at whether the DOM(60) indicator will be created while moving sideways at the current price position or if the DOM(60) indicator will be created when the price rises.

If the price falls and falls below 111696.21, and the HA-High indicator is generated, the HA-High ~ DOM(60) section is formed, so whether there is support in that section is the key.

-

Since the DOM(60) indicator on the 1W chart was generated, if it fails to rise above the DOM(60) indicator, it is highly likely that the HA-High indicator will be newly generated as it eventually falls.

Therefore, you should also look at where the HA-High indicator on the 1W chart is generated when the price falls.

-

The next volatility period is around July 18 (July 17-19).

Therefore, you should look at which direction it deviates from the 115854.56-119086.64 section after this volatility period.

Since the K of the StochRSI indicator fell from the overbought section and changed to a state where K < D, it seems likely that the rise will be limited.

However, since the PVT-MACD oscillator indicator is above 0 and the OBV indicator is OBV > OBV EMA, it is expected that the support around 115845.56 will be important.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

Need a trading strategy to avoid FOMO

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

1D chart is the standard chart for all time frame charts.

In other words, if you trade according to the trend of the 1D chart, you can make profits while minimizing losses.

This can also be seen from the fact that most indicators are created based on the 1D chart.

In that sense, the M-Signal indicators of the 1M, 1W, and 1D charts are suitable indicators for confirming trends.

If the price is maintained above the M-Signal indicator of the 1M chart, it is highly likely that the upward trend will continue in the medium to long term, so it is recommended to take note of this advantage especially when trading spot.

The M-Signal indicator on the 1W, 1D chart shows the medium-term and short-term trends.

The M-Signal indicator uses the MACD indicator formula, but it can be seen as a price moving average.

You can trade with just the price moving average, but it is difficult to select support and resistance points, and it is not very useful in actual trading because it cannot cope with volatility.

However, it is a useful indicator when analyzing charts or checking general trends.

Therefore, what we can know with the M-Signal indicator (price moving average) is the interrelationship between the M-Signal indicators.

You can predict the trend by checking how far apart and close the M-Signal indicators are, and then checking the direction.

-

If you have confirmed the trend with the M-Signal indicator, you need support and resistance points for actual trading.

Support and resistance points should be drawn on the 1M, 1W, and 1D charts.

The order of the roles of support and resistance points is 1M > 1W > 1D charts.

However, the strength of the role of support and resistance points can be seen depending on how long the horizontal line is.

Usually, in order to perform the role of support and resistance points, at least 3 candles or more form a horizontal line.

Therefore, caution is required when trading when the number of candles is less than 3.

The indicators created considering this point are the HA-Low and HA-High indicators.

The HA-Low and HA-High indicators are indicators created for trading on the Heikin-Ashi chart and indicate when the Heikin-Ashi candle turns upward or downward.

Therefore, the creation of the HA-Low indicator means that there is a high possibility of an upward turn.

In other words, if it is supported by the HA-Low indicator, it is a time to buy.

However, if it falls from the HA-Low indicator, there is a possibility of a stepwise decline, so you should also consider a countermeasure for this.

The fact that the HA-High indicator was created means that there is a high possibility of a downward turn.

In other words, if there is resistance from the HA-High indicator, it is a time to sell.

However, if it rises from the HA-High indicator, there is a possibility of a stepwise upward turn, so you should also consider a countermeasure for this.

This is where a dilemma arises.

What I mean is that the fact that the HA-High indicator was created means that there is a high possibility of a downward turn, so you know that there is a high possibility of a downward turn, but if it receives support and rises, you think that you can make a large profit through a stepwise upward turn, so you fall into a dilemma.

This is caused by greed that arises from falling into FOMO due to price volatility.

The actual purchase time should have been when it showed support near the HA-Low indicator, but when it showed a downward turn, it ended up suffering a large loss due to the psychology of wanting to buy, which became the trigger for leaving the investment.

Therefore, if you failed to buy at the purchase time, you should also know how to wait until the purchase time comes.

-

It seems that you can trade depending on whether the HA-Low and HA-High indicators are supported, but the task of checking whether it is supported is quite difficult and tiring.

Therefore, to complement the shortcomings of the HA-Low and HA-High indicators, the DOM(60) and DOM(-60) indicators were added.

The DOM(-60) indicator indicates the end of the low point.

Therefore, if it shows support in the DOM(-60) ~ HA-Low section, it is the purchase time.

If it falls below the DOM(-60) indicator, it means that a stepwise downtrend is likely to begin.

The DOM(60) indicator indicates the end of the high point.

Therefore, if it is supported and rises in the HA-High ~ DOM(60) section, it means that a stepwise uptrend is likely to begin.

If it is resisted and falls in the HA-High ~ DOM(60) section, it is likely that a downtrend will begin.

With this, the basic trading strategy is complete.

This is the basic trading strategy of buying when it rises in the DOM(-60) ~ HA-Low section and selling when it falls in the HA-High ~ DOM(60) section.

For this, the trading method must adopt a split trading method.

Although not necessarily, if it falls in the DOM(-60) ~ HA-Low section, it will show a sharp decline, and if it rises in the HA-High ~ DOM(60) section, it will show a sharp rise.

Due to this volatility, psychological turmoil causes people to start trading based on the price, which increases their distrust in the investment market and eventually leads them to leave the investment market.

-

When looking at the movement of the 1D chart, it can be seen that it is not possible to proceed with trading at the moment because it is already showing a stepwise upward trend.

However, since there is a SHORT position in futures trading, trading is possible at any time.

In any case, it is difficult to select a time to buy because the 1D chart shows a stepwise upward trend.

However, looking at the time frame chart below the 1D chart can help you select a time to buy.

The basic trading strategy is always the same.

Buy when it rises in the DOM(-60) ~ HA-Low section and sell when it falls in the HA-High ~ DOM(60) section.

Currently, since the 1D chart is continuing a stepwise upward trend, the main position is to eventually proceed with a long position.

Therefore, if possible, you should focus on finding the right time to buy.

However, if it falls below the HA-High indicator of the 1D chart, the possibility of a downtrend increases, so at that time, you should focus on finding the right time to sell.

In other words, since the HA-High indicator of the current 1D chart is generated at the 115845.8 point, you should think of different response methods depending on whether the price is above or below the 115845.8 point.

Therefore, when trading futures, increase the investment ratio when trading with the main position (a position that matches the trend of the 1D chart), and decrease the investment ratio when trading with the secondary position (a position that is different from the trend of the 1D chart) and respond quickly and quickly.

When trading in the spot market, you have no choice but to trade in the direction of the 1D chart trend, so you should buy and then sell in installments whenever it shows signs of turning downward to secure profits.

In other words, buy near the HA-Low indicator on the 30m chart, and if the price rises and the HA-High indicator is created, sell in installments near that area.

-

You should determine your trading strategy, trading method, and profit realization method by considering these interrelationships, and then trade mechanically accordingly.

If you trade only with fragmentary movements, you will likely end up suffering losses.

This is because you do not cut your losses.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Check support above 2.5102-2.6013

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(XRPUSDT 1D chart)

It has broken through the important support and resistance zone.

Accordingly, the key is whether the price can be maintained above 2.5102-2.6013 and rise.

If the price is maintained above 2.5102-2.6013, it is possible that a stepwise rise will occur.

At this time,

1st: Right Fibonacci ratio 0.618(3.2085) ~ Left Fibonacci ratio 3.618(3.2983)

2nd: Right Fibonacci ratio 1(4.1944)

You need to check for support near the 1st and 2nd above.

The strong support area is 1.5-1.9669.

----------------------

The left Fibonacci ratio was drawn in the initial rising wave, and the right Fibonacci ratio was drawn in the recent rising wave.

Therefore, if the price rises above 3.618(3.2983) of the Fibonacci ratio drawn in the initial rising wave and maintains it, there is a high possibility of creating a new wave.

Since the Fibonacci ratio is a tool for analyzing the chart, it is not good to use this point as a support and resistance point.

Therefore, we need to check whether the DOM(60) indicator or the HA-High indicator is newly created and create a response strategy depending on whether there is support.

Currently, the DOM(60) indicator is formed at the 2.5102 point, and the HA-High indicator is formed at the 2.4269 point.

The basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, if it receives support in the HA-High ~ DOM(60) section and rises, it is likely to show a stepwise upward trend, and if it receives resistance in the DOM(-60) ~ HA-Low section and falls, it is likely to show a stepwise downward trend.

Therefore, trading begins by checking whether there is support in the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Here is a description of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

The key is whether it can be supported and rise near 300.17

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(MCD 1D chart)

Before following the basic trading strategy, the first thing to check is whether the current price is above or below the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, there is a possibility that it will turn into a medium- to long-term downtrend.

Therefore, if possible, it is recommended to trade stocks whose prices are above the M-Signal indicator on the 1M chart.

If the price is below the M-Signal indicator on the 1M chart, you should respond quickly and briefly using the short-term trading (day trading) method.

-

The support and resistance zones can be seen as the 287.46-290.14 zone and the 307.41-314.89 zone.

The 287.46-290.14 zone is the DOM(-60) ~ HA-Low zone, and the 307.41-314.89 zone is the HA-High ~ DOM(60) zone.

These two zones are likely to form a trend depending on how they break through, so they can be seen as support and resistance zones.

-

The 300.17-316.56 zone is the HA-High ~ DOM(60) zone on the 1W chart.

Therefore, we need to check whether it can receive support and rise in the 300.17-316.56 zone.

Therefore, if it falls near the 307.41-314.89 range, you should check for support near 300.17.

-

If it rises above the HA-High ~ DOM(60) range, it is likely to show a step-up trend, and if it falls in the DOM(-60) ~ HA-Low range, it is likely to show a step-down trend.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

Can we break above the 0.8063-0.8836 range?

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ADAEUSDT 1D chart)

ADA is forming a long-term rising channel and is showing an upward trend as it breaks above the mid-term high downtrend line.

We need to see if it can rise above 0.8836 and maintain the price to rise above the previous mid-term low trend line.

-

The DOM(60) indicator is showing signs of being newly created.

Accordingly, we need to see where the DOM(60) indicator is formed.

Since the HA-High indicator is formed at 0.8063, in order to continue the upward trend, it must rise at least above 0.8063 to maintain the price.

Accordingly, the key is whether the price can be maintained above 0.6328.

-

It is possible to show a mid- to long-term upward trend only if it breaks through the HA-High ~ DOM(60) section of the 1W chart upward.

Therefore, the 0.8836-1.1936 section is likely to be the resistance section.

-

Based on the current price position, the support section is the 0.5824-0.6328 section.

However, since the positions of the HA-Low indicator and the DOM(-60) indicator are switched, if it shows a downward trend, there is a possibility that a new HA-Low indicator will be created.

If a new HA-Low indicator is created, it is important to determine whether there is support near it.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

Resistance zone: 3265.0-3321.30

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

It is showing an upward breakout of the important zone of 2419.83-2706.15.

We need to see if the price can be maintained by rising above the Fibonacci ratio of 0.5 (2788.93).

If so, it is expected to rise to the resistance zone of 3265.0-3321.30.

The important zone of 2419.83-2706.15 is the support and resistance zone that can lead to a full-fledged uptrend.

Therefore, if it falls below this zone, we should stop trading and watch the situation.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Check if there is an upward breakout of 0.21409-0.22958

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(DOGEUSDT 1D chart)

HA-High and HA-Low indicators are converging.

Accordingly, if it breaks through the 0.21409-0.22958 section, it is expected to surge.

However, since the DOM(60) indicator is formed at the 0.46635 point, we need to look at how the DOM(60) indicator is newly created.

It seems possible that the DOM(60) indicator will be newly created while shaking up and down in the 0.21409-0.31600 section, which is the HA-High indicator ~ DOM(60) indicator section of the 1M chart.

If the DOM(60) indicator is newly created, we need to check whether it is supported in the HA-High ~ DOM(60) section.

If it rises above the HA-High ~ DOM(60) section, it is likely to show a stepwise upward trend.

-

To summarize the above, it is as follows. - Buy range: 0.16343-0.22958

- Resistance range: 0.31600-0.37778

If the price breaks through the resistance range upward and maintains, there is a high possibility that the upward trend will continue in the medium to long term.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

CoinMarketCap chart and correlation with BTC

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(USDT.D 1D chart)

USDT dominance is showing a downward trend along the medium- to long-term downtrend line.

The decline in USDT dominance can be interpreted as an upward trend in the coin market.

Therefore, if it remains below 4.91 or continues to decline, the coin market is likely to enter a bull market.

The coin market is expected to show a major bull market until 2025.

At this time, the USDT dominance is expected to fall to around 3.42 and then rise, causing the coin market to enter a bear market.

Therefore, a major bear market is expected in 2026.

-----------------------------------------------

(BTCUSDT 1M chart)

You might think that it would be good if it continued to rise in a bull market, but in reality, that is not the case.

The reason is that if the price continues to rise, you have to buy more money.

Therefore, it will show a pattern of falling when appropriate and rising again when appropriate.

As I mentioned earlier, 2025 is a major bull market, so it will eventually show a rising pattern.

So, when should we buy and when should we sell?

It would be nice if we could know this a little bit faster, but we can never know.

Currently, BTC is renewing its ATH, so it is even more difficult to predict the movement.

Therefore, we can only predict it through predictable chart analysis techniques.

Among them, the method I use is to predict and respond to the high point using the HA-Low, HA-High indicators and the DOM (DMI + OBV + MOMENTUM) indicator using the Heikin-Ashi chart.

The DOM indicator indicates the end of the high and low points, and the HA-Low and HA-High indicators are used to establish a basic trading strategy.

The sky blue (#00bcd4) arrow is generated, indicating that the DOM (60) indicator is likely to be generated soon.

In other words, it means that the end of the high point is becoming more likely.

When the DOM(60) indicator is created, there is a high possibility of resistance, so the price is likely to fall.

Therefore, you should think about a countermeasure for the decline.

However, as I mentioned earlier, since 2025 is expected to show a major uptrend, it is recommended to sell in installments at an appropriate level to preserve profits.

The reason is that we cannot know how far it will fall.

The start of a full-scale decline is likely to begin when it falls below the HA-High indicator.

Therefore, if it falls after the DOM(60) indicator is created, we should observe whether a new HA-High indicator is created.

If a new HA-High indicator is created, the key point is whether there is support in the vicinity.

If a new HA-High indicator is not created, it is likely to fall to the current HA-High indicator location of 73499.86.

-

A trend line has been formed between highs, but a trend line between lows has not yet been formed.

Therefore, it is difficult to predict how far it will fall once the decline begins.

In the 2025 bull market, BTC is expected to rise to around the Fibonacci ratio of 2.618 (133889.92).

Therefore, we should also consider countermeasures for this.

------------------------------------------------

(BTC.D 1M chart)

When will the altcoin bull market start?

I think the timing is when BTC dominance falls below 55.01 and is maintained or continues to decline.

I think the rising BTC dominance means that the funds flowing into the coin market are concentrated toward BTC.

Therefore, we should consider that a market for trading BTC has been formed.

If BTC dominance fails to fall below the 55.01-62.47 range, BTC dominance is expected to rise to around 73.63-77.07.

At this time, it is highly likely that it will encounter strong resistance and begin to decline.

Since it has not fallen below the mid- to long-term trend line, it seems likely that it will continue to rise.

In order to eventually turn into a downtrend, BTC dominance must fall below 60.

If not, I think it will be difficult to expect an uptrend in altcoins.

----------------------------------------------------------------------

(BTCUSDT 1D chart)

This period of volatility is expected to continue until July 11.

Therefore, the key issue is whether there is support near 111696.21.

If there is support at the 111696.21 point, it is expected to rise to the right Fibonacci ratio 2.24 (116940.43).

If not, we need to check whether there is support near 108316.90.

As I mentioned in the previous idea, three conditions must be met to break through the 111696.21 point upward.

- The StochRSI indicator is showing an upward trend with K>D,

- The PVT-MACD oscillator is showing an upward trend (if possible, above the 0 point),

- The OBV indicator of the Low Line ~ High Line channel is maintained above the High Line,

If the above conditions are met, I said that there is a high possibility of a stepwise upward trend from the 111696.21 point.

-

The next volatility period is expected to occur around July 18 (July 17-19).

Therefore, we need to see if it can be maintained above 111696.21 until the next volatility period.

If it fails, we need to check if it is supported above the M-Signal indicator on the 1D chart, near 108316.90.

If not, it is likely to fall to the M-Signal indicator on the 1W chart or near 99705.62.

-

The basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, if the HA-High indicator rises, there is a possibility of a stepwise uptrend, and if the HA-Low indicator falls, there is a possibility of a stepwise downtrend.

The end of the stepwise uptrend is a downtrend, and the end of the stepwise downtrend is an uptrend.

That is, we can see that the support around the HA-High ~ DOM(60) section and the DOM(-60) ~ HA-Low section will be important turning points for the future trend.

----------------------------------------------------

On the USDT dominance chart, it seems likely that August 3rd will be the volatility period.

Looking at the BTC chart, it seems likely that August 2nd to 5th (August 1st to 6th) will be the pre-movement for the volatility period of August 1st to 6th.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

Important Volatility Period: Around August 21

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(TSLA 1D chart)

The medium-term trend is maintaining an uptrend.

However, if the price falls below the M-Signal indicator on the 1M chart and maintains, there is a possibility of a downtrend, so caution is required.

The support zone is

1st: 222.15-235.59

2nd: 172.16

Around the 1st and 2nd above.

The 268.07-311.48 zone is an important support and resistance zone.

If the price is maintained above this zone, there is a high possibility that a full-scale upward trend will continue.

However, since a resistance zone is formed in the 347.21-382.40 zone, we need to look at how this zone is broken upward.

-

When it falls to the 172.16-234.59 zone, we need to find a time to buy.

If not, we need to buy when it shows support in the 268.07-311.48 zone.

It would be better to buy at a lower price, but since the investment period will inevitably be longer, I think it is better to buy when an upward trend is detected.

-

The important volatility period is around August 21st, but before that, we need to check the movement around July 25th.

If it falls below 268.07 after August 21st, it could lead to further decline.

If it rises above 311.48 and maintains the price during the movement around July 25th, it could lead to further increase and it seems likely to create a trend after the volatility period around August 21st.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

What is the key that makes you start trading?

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

HA-Low, HA-High indicators are indicators created for trading on Heikin-Ashi charts.

Therefore, they are determined by Heikin-Ashi's Open, Close, and RSI values.

If the RSI indicator value is above 70 when the candle starts to rise and then falls on the Heikin-Ashi chart, the HA-High indicator is generated.

If the RSI indicator value is below 30 when the candle starts to rise and then falls on the Heikin-Ashi chart, the HA-Low indicator is generated.

Therefore, rather than judging the rise and fall with your eyes, you can judge the rise and fall transitions with more specific criteria.

If you look at a regular chart, you can see that there are many rise and fall transition points, unlike the Heikin-Ashi chart.

The Heikin-Ashi chart has the effect of reducing fakes.

Therefore, it has a higher reliability than judging with a regular chart.

The biggest disadvantage of the Heikin-Ashi chart is that it is difficult to know the exact values of the Open and Close values.

Therefore, the HA-Low, HA-High indicators are used to accurately and quickly identify the Open and Close values by indicating the rising and falling transition points of the Heikin-Ashi chart on a general chart.

-

The Heikin-Ashi chart uses the median.

Therefore, the HA-Low indicator corresponds to the median when it leaves the low range, and the HA-High indicator corresponds to the median when it leaves the high range.

If the HA-Low indicator is generated and then receives support, there is a high possibility that an upward trend will begin, and if the HA-High indicator is generated and then receives resistance, there is a high possibility that a downward trend will begin.

Therefore, the HA-Low, HA-High indicators are used in basic trading strategies.

However, since the HA-Low and HA-High indicators are intermediate values, if the HA-Low indicator resists and falls, there is a possibility of a stepwise decline, and if the HA-High indicator supports and rises, there is a possibility of a stepwise rise.

Therefore, to compensate for this, the DOM (60) and DOM (-60) indicators were used.

The DOM indicator is an indicator that comprehensively evaluates the DMI + OBV + MOMENTUM indicators.

When these indicators are above 60 or below -60, the DOM (60) and DOM (-60) indicators are created.

In other words, the DOM (60) indicator corresponds to the overbought range and indicates the end of the high point.

The DOM (-60) indicator corresponds to the oversold range and indicates the end of the low point.

Therefore, when the HA-Low indicator resists and falls, the actual stepwise decline is likely to start when it falls below DOM (-60).

On the other hand, when the HA-High indicator is supported and rises, the actual step-up trend is likely to start by rising above DOM (60).

This compensates for the shortcomings of the HA-Low and HA-High indicators.

-

There is no way to be 100% sure in all transactions.

Therefore, if the motivation to start a transaction is clear, it is only worth challenging the transaction.

Finding that motivation and deciding how to start a transaction that suits your investment style is the trading strategy and the core of trading.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

Volatility period likely to continue until July 11th

Hello, traders.

Please "Follow" to get the latest information quickly.

Have a nice day today.

-------------------------------------

This volatility period is expected to last until July 11th.

The first volatility period, July 1-7, 3 days passed, and the second volatility period began on July 6.

It is important to explain it in words, but I think it would be better if you could intuitively understand the flow by looking at the chart.

For that reason, I divided the chart into a chart with a trend line drawn and a chart with indicators.

Since the trend line is used as a tool to calculate the volatility period, it is not necessary to show it after the volatility period is displayed.

What we need to look at is the support and resistance points drawn on the 1M, 1W, and 1D charts after the calculated volatility period, or the support in the indicator to find the trading point.

-

It seems that support is being checked around 108316.90, which is the HA-High indicator point of the 1D chart.

Therefore, we need to see if it can rise after receiving support near 108316.90 during this volatility period.

If not, it will eventually show a downward trend.

As a basic trading strategy, we use buying near the HA-Low indicator and selling near the HA-High indicator.

Therefore, considering the current price position, it can be said that it is a section where we should sell to make a profit.

However, since the HA-Low and HA-High indicators are intermediate values, if it falls from the HA-Low indicator, it is possible to show a stepwise downward trend, and if it rises from the HA-High indicator, it is possible to show a stepwise upward trend.

Therefore, we need to respond with a split transaction.

Conditions for continuing the uptrend include:

1. When OBV is above the High Line and shows an upward trend,

2. When PVT-MACD oscillator is above the High Line,

3. When StochRSI is above K > D, showing an upward trend,

If the above conditions are met, there is a high possibility that the uptrend will continue.

-

If it falls below the M-Signal indicator on the 1D chart, it is highly likely that it will select the trend again when it meets the M-Signal indicator on the 1W chart.

At this time, whether there is support near 99705.62 is important.

If it rises, you should check whether it is supported near 111696.21.

If it is not supported, it means that it has not broken through the high point section, so you should prepare for a decline.

The high point boundary section is the 108316.90-111696.21 section.

Therefore, if the price is maintained within this section, there is a possibility that it will continue to attempt to break through upward.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

I don't think this will be left in the past...Well well well, Walgreen's is definitely going to try and redo there entire business model in order to save it.

There are some weird and unbalanced volume levels left behind that I think we will see again this year.

Target is $12 and depending on this earnings, I don't know when it will hit. Shares only.