$BRENT technicals in convegence between Fibonacci and TrendlineBLACKBULL:BRENT has been on a downtrend since last Summer...

Now the descending trend line is about to hit the bottom of the Fibonacci Retracement Levels.

This forms a triangle that we know can break either upward or downward - place your entry points and Stop-Loss points accordingly.

While I don't provide Fundamentals analysis, the latest turns of events with USA and Venezuela make me lean towards a break on the downside for more supply of Crude Oil available to the US.

Brent

BRENT Oil → Bullish Breakout | Capital Flow Confirmed🛢️ BRENT CRUDE OIL (UKOIL) - Energy Market Capital Flow Blueprint ⚡

Swing/Day Trade | Bullish Triangular Breakout Strategy

📊 ASSET OVERVIEW

Asset Ticker: BRENT CRUDE / UKOIL (ICE Futures Europe)

Current Price Zone: $64.12 USD/BBL (As of Jan 26, 2026)

Market Status: 📈 Bullish Formation Testing Resistance

Trading Type: Swing Trade / Day Trade Setup

🎯 TECHNICAL PLAN - BULLISH BREAKDOWN

Primary Bias: BULLISH CONFIRMED ✅

Setup: Triangular Moving Average (TMA) Breakout & Retest Pattern

Structure: Clean impulsive move with shallow corrective pullback

Confirmation: No structural breakdown signals observed

Timeframe: Multiple timeframes (H1, H4, D1 alignment)

💰 ENTRY STRATEGY - "THIEF LAYERING SYSTEM" 🎯

Multi-Level Limit Order Entry (Pyramid Strategy)

The "Thief Method" = Smart accumulation on dips using multiple buy limits

Primary Entry Layers (Build Position Progressively):

🔵 Layer 1: $63.50 (20% Position Size)

🔵 Layer 2: $64.00 (25% Position Size)

🔵 Layer 3: $64.50 (30% Position Size)

🔵 Layer 4: $65.00 (25% Position Size)

💡 Pro Tip: Adjust layer density (add $63.75, $64.25, etc.) based on your account size & risk tolerance. This layering approach averages your entry cost and reduces emotional decisions!

Entry Confirmation:

✓ Price bounces from support zone $63.00-$63.50

✓ Volume surge on upside break

✓ TMA bullish crossover

✓ Break above triangular resistance

🎪 PROFIT TARGETS - ESCAPE WITH GAINS! 🚀

Primary Target: $67.50 USD/BBL

Logic: Simple Moving Average (SMA 200) acts as dynamic resistance + Overbought zone + Historical swing high

Risk/Reward: Typically 2.0-2.5:1 depending on entry

Secondary Targets (Pyramid Out):

📍 Target 1: $66.50 (Partial TP - 40% position)

📍 Target 2: $67.00 (Partial TP - 35% position)

📍 Target 3: $67.50 (Full TP - 25% position)

⚠️ IMPORTANT DISCLAIMER:

These are suggested levels. As traders, YOU have full autonomy on your profit targets. Take profits at your own discretion based on market conditions, risk management, and personal strategy. Never risk more than you can afford to lose! 💪

🛡️ STOP LOSS - PROTECTION FIRST!

Stop Loss Level: $63.00 USD/BBL

Placement: Positioned BELOW the key moving average support

Logic: Clean break below this level = trend invalidation

Position Risk: Typically 1-1.5% of account per trade (strict!)

⚠️ CRITICAL DISCLAIMER:

SL placement shown is a GUIDE ONLY. Your risk management is YOUR responsibility. Adjust SL based on your risk tolerance, position size, and account protection strategy. Never ignore your stops! 🚨

📈 RELATED PAIRS TO WATCH - CORRELATION TRADING 🔗

1️⃣ WTI CRUDE OIL / TVC:USOIL

Correlation: POSITIVE (Brent/WTI typically move together)

Current: ~$61.83/barrel

Key Level: Watch $60.00 support zone

Why Watch: WTI breaks often precede BRENT moves

Strategy Tip: Confirm BRENT signals with WTI chart alignment

2️⃣ US DOLLAR INDEX ( TVC:DXY )

Correlation: DYNAMIC (Recently shifted from inverse to positive)

Current Zone: 98.68-99.38 (Testing resistance)

Key Info: 🔄 Since 2021, rising oil prices = stronger USD (Modern relationship!)

Impact: Stronger DXY = Potential headwind for oil

Watch Level: DXY breakdown below 98.23 = Dollar weakness = Oil support

Why It Matters: Oil priced in USD - dollar strength makes oil more expensive globally

3️⃣ FX:EURUSD 💶

Correlation: INVERSE to Oil (Weaker euro = Oil strength)

Current: Monitor ECB policy signals

Trade Hint: EUR/USD breakdown often coincides with oil strength

Key Level: 1.0700 zone critical

4️⃣ FX:GBPUSD

Correlation: INVERSE (Weaker pound = Oil bullish)

Why: UK oil exports increase when GBP softens

Watch: Bank of England rate decisions

Sweet Spot: GBP/USD dips = BRENT strength likely

5️⃣ COPPER / METALS

Correlation: POSITIVE (Economic growth proxy)

Logic: Rising copper = Industrial demand = Oil demand up

Watch: Copper above $4.00 = Oil tailwind; Below = Headwind

Macro Signal: Copper strength validates risk-on environment

6️⃣ GOLD ( OANDA:XAUUSD ) 🏆

Correlation: MIXED (Risk sentiment dependent)

Inverse Risk Indicator: Gold spike = Flight to safety = Oil weakness

Current: Monitor inflation expectations

Edge: Gold spike above $2,100 = Caution for oil shorts

📰 FUNDAMENTAL & ECONOMIC FACTORS - WHAT'S MOVING THE MARKET 🌍

🔴 BEARISH PRESSURES (Short-term headwinds)

1. Global Oil Oversupply⚖️

IEA Projection: 3.8 million bpd surplus forecast for 2026

EIA Outlook: Brent average declining to $56/barrel in 2026 (vs $66+ current)

Driver: OPEC+ restraint + US production records + Guyana scaling + Canadian output

Impact: ⬇️ Price ceiling pressure - Don't expect explosive rallies

2. Abundant Global Inventories 📦

Status: Chinese onshore inventories at RECORD HIGHS

US Data: Crude oil storage volumes climbing above recent lows

Signal: Market well-supplied = Limited upside surprise

3. OPEC+ Production Pause ⏸️

Decision: 8 OPEC+ members pausing output increases Jan-Mar 2026 (Seasonality reasons)

Members: Saudi Arabia, Russia, UAE, Kazakhstan, Kuwait, Iraq, Algeria, Oman

Next Review: February 1, 2026 - KEY DATE TO WATCH

Context: 1.65 million bpd voluntary cuts could be restored gradually

Implication: No fresh production cuts coming - Supply likely to grow

4. Weak Demand Growth 📉

Global Demand Growth: ~1.2% annually (MODEST)

Context: Not enough to absorb supply growth

Risk: Structural oversupply becomes normalized

🟢 BULLISH CATALYSTS (Support factors)

1. Geopolitical Risk Premium ⚠️

Status: ACTIVE - Iran tensions elevated

Trump Position: Armada deployed toward Iran region

Risk Event: Potential military escalation = Supply disruption fear

Oil Response: Every Iran threat = $0.50-$2.00 premium added

Probability: Remains tail-risk but keeps bids elevated

2. Middle East Supply Disruptions 🔥

Kazakhstan Issue: Tengiz oilfield production still hasn't fully resumed

Impact: Estimated production shortfall present

Status: Repairs ongoing - Completion timeline critical

3. Softer US Dollar Support 💵

Current DXY: Trending down from recent highs (Positive for oil)

US-Europe Tensions: Strains weighing on dollar

Ukraine Uncertainty: Unresolved peace talks = Safe-haven weakness

Implication: Weak dollar = Oil cheaper for foreign buyers = Demand lift

4. China Strategic Reserves Demand 🇨🇳

Estimated Rate: Nearly 1.0 million bpd being added to strategic stockpiles

Duration: Continuing through 2026 (potential support)

Impact: Artificial demand creation = Price floor supporter

Note: Rate decreases ~33% in 2027 - Watch this transition

5. Strong Global Oil Demand Momentum 📊

2025 Achievement: Record oil consumption globally

2026 Projection: OPEC expects +1.4 million bpd growth

OPEC Confidence: Cartel maintaining bullish demand outlook despite IEA skepticism

Key Driver: AI infrastructure energy needs, aviation recovery, industrial activity

📅 CRITICAL DATES & ECONOMIC CALENDAR - WHAT TO MONITOR 🗓️

IMMEDIATE (Next 2 Weeks)

Jan 28-29: US CPI Release - MAJOR (Impacts Fed expectations & dollar)

If hot: USD strength = Oil headwind

If cool: USD weakness = Oil support

Feb 1, 2026: OPEC+ Monthly Meeting - WATCH CLOSELY

Production decision review

Any hints at Q2/Q3 production changes?

Cartel messaging critical

February 2026

Feb 7: US Jobs Report (NFP)

Economic health indicator - impacts oil demand expectations

Feb 14: OPEC Monthly Oil Market Report Release

Updated 2026 demand/supply forecasts

Sentiment gauge

Q1 2026 Focus

ECB Policy: European Central Bank meetings - EUR weakness = Oil strength

Fed Stance: Rate hold expectations - Dollar direction crucial

China Data: Manufacturing PMI, economic activity signals

⚡ TRADE EXECUTION CHECKLIST

BEFORE ENTRY ✅

Confirm TMA breakout on H4/D1 chart

Check volume surge on breakout candle

Verify no negative divergences on MACD

Monitor DXY position (avoid entry if DXY spiking higher)

Check geopolitical news - Any Iran/Middle East developments?

Confirm all 4 layers placed at limits

POSITION MANAGEMENT 🎯

Set 50% TP at $67.00 (secure profits early!)

Move SL to breakeven after 1.5R profit

Pyramid out of position gradually

Trail stops on partial profits

NO holding through FOMC/OPEC meetings without hedges

EXIT SIGNALS 🚨

❌ Break below $63.00 = Stop loss hit (exit 100%)

❌ Close below 200-SMA = Trend invalidation

❌ Major DXY rally begins = Risk/reward deteriorates

❌ Negative gap opens (overnight) = Reassess position

🎓 STRATEGY SUMMARY

Best Case Scenario:

Break above $65.50 → Run to $67.50 TP = 2.5:1 Risk/Reward ✅

Worst Case Scenario:

Rejection at $65.00 → Fall to SL $63.00 = 1:1.5 Risk Loss ✅ (Managed)

Breakeven Trade:

Bounce to $64.50 then reversal = Tighten SL, exit flat

⚠️ FINAL RISK DISCLAIMER

Oil trading involves substantial risk:

Volatility: Brent can swing $1-3/barrel intraday on news

Geopolitical Risk: Unexpected escalations can gap prices overnight

Liquidity Events: Thin volume periods can cause slippage

Leverage Risk: If using leverage, losses amplify quickly

Margin Calls: Futures trading can wipe accounts quickly

YOU are responsible for:

✓ Your position sizing (risk max 1-2% per trade)

✓ Your stops (ALWAYS set them)

✓ Your profits targets (take them!)

✓ Your research (verify all signals yourself)

✓ Your broker selection (regulated, reputable)

Trade with discipline. Trade with a plan. Trade what you can afford to lose. 💪

🚀 ENGAGEMENT BOOST TIPS FOR TRADERS

Share this idea if:

✅ You believe in the bullish breakout thesis

✅ You're tracking geopolitical oil risks

✅ You're using this for swing trade confirmation

✅ You found the layering strategy useful

✅ You're monitoring OPEC+ next move (Feb 1)

Questions? Comments? Drop them below - Let's discuss the setup! 💬

Good luck, fellow traders! May your entries be timely and your stops be tight! 🎯

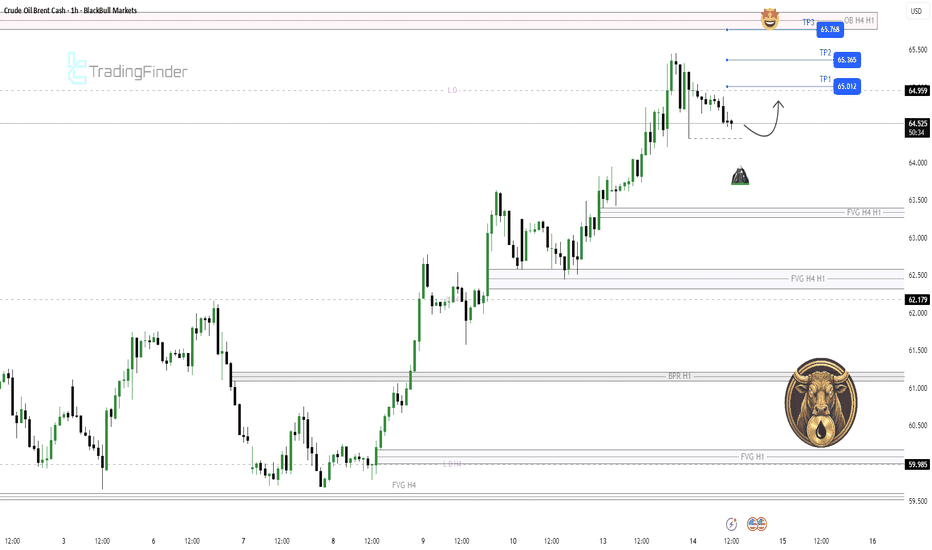

Brent Oil M30 HTF Discount Reaction and Bullish Continuation📝 Description

BLACKBULL:BRENT crude oil has completed a corrective pullback after a strong impulsive rally and is now stabilizing above a key short-term demand zone. Price has reacted cleanly from the SSL and lower boundary of the recent range, suggesting buyers are defending this area and preparing for another leg higher toward premium liquidity.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the recent swing low and SSL

Preferred Setup:

• Entry: 65.015

• Stop Loss: Below 64.730

• TP1: 65.25

• TP2: 65.45

• TP3: 65.73

________________________________________

🎯 ICT & SMC Notes

• Sell-side liquidity sweep followed by bullish displacement

• Reaction from intraday support and SSL confirms demand

• No bearish break of structure after the pullback

• Upside targets aligned with prior highs and premium liquidity

________________________________________

🧩 Summary

As long as BLACKBULL:BRENT holds above the 64.75–64.90 support zone, the bullish continuation scenario remains favored. The current pullback appears corrective, with expectations of a rotation higher toward recent highs and upper liquidity pools.

________________________________________

🌍 Fundamental Notes / Sentiment

Oil sentiment remains constructive amid steady demand expectations and the absence of strong bearish catalysts. Short-term pullbacks into defended demand zones are likely to be viewed as buying opportunities rather than trend reversals.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

UKOIL/BRENT Chart Shows That OIL Can RallyI am using UKOIL/BRENT chart because there is a direct correlation between this and any other USOIL/WTI chart.

What we have are:

1. It has been falling in a wedge pattern and is coiling. Hence a breakout sooner or later is expected.

2. It has reached an FCO zone which is acting as a good support. The price has started to form a possible double bottom this week.

3. We have Trend Line support which price has not been able to break though.

This presents a very good medium to longer bullish opportunity on OIL and associated sectors

Lets wait and watch and always this is not and advice but just an observation. Risk management is extremely important as always.

Follow for more. Please support this analysis by liking, commenting, and sharing with friends, colleagues, traders, and trading communities. Thanks👍🙂

Brent Oil — H4 | Bullish Continuation ScenarioBrent Oil — H4 | Bullish Continuation Scenario

Price is holding above key support after a corrective pullback, with structure favoring continuation to the upside.

🧩 Technical Overview

• On the higher timeframe, the market is forming a potential 5th wave, indicating the final impulsive phase of the current bullish cycle.

• On H4, the correction is developing as an ABC structure, formed after a breakout above the descending channel boundary.

• The pullback remains corrective, with price holding above structural support.

📈 Bullish Scenario

• Key support zone: 63.9–63.1

• Invalidation / Stop-loss: below 63.15

(below the corrective low and failed structure scenario)

• Upside targets:

– 65.44 — first resistance / reaction level

– 67.47 — continuation target

– 69.00 — higher resistance

– 72.00 — extended bullish objective

A sustained move above 65.4 would confirm continuation of the impulsive leg.

⚙️ Market Context

• Higher timeframe supports a 5th wave expansion.

• Breakout above the channel followed by ABC correction fits a classic trend-continuation setup.

• Structure remains bullish while price stays above the support zone.

🧭 Summary

Brent maintains a bullish bias above 63.1–63.9.

The combination of a 5th wave on the higher timeframe and an ABC correction after channel breakout supports continuation toward 65.4 → 67.5 → 69.0, with further extension possible if momentum accelerates.

UKOIL Bearish Opportunity — Is This the Pullback to Sell?🛢️ BRENT CRUDE (UKOIL) - BEARISH SWING TRADE SETUP 📉

📊 CURRENT MARKET DATA (Live as of Nov 21, 2025)

Brent Crude: $64.07/barrel (+0.88% from previous day)

WTI Crude: $57.77/barrel (-2.09% from previous day)

Market Status: Bearish momentum with descending channel pattern confirmed

🎯 TRADE SETUP - BEARISH CONFIRMATION

📍 ENTRY STRATEGY: Layered Limit Orders (Thief Method)

Layer 1: 63.00

Layer 2: 62.50

Layer 3: 62.00

(Scale entries based on your risk tolerance - add more layers if desired)

🛑 STOP LOSS: 64.00

⚠️ Risk Disclaimer: Adjust SL according to YOUR strategy and risk management. This is reference only - manage YOUR capital YOUR way.

🎯 PRIMARY TARGET: 60.50

Strong support zone identified

Oversold conditions anticipated

Trap zone detected - secure profits accordingly

💡 Exit Strategy Note: Not financial advice. Take profits when YOUR targets align with YOUR risk/reward ratio.

📈 TECHNICAL CONFLUENCE

✅ Volume-weighted moving average pullback confirmed

✅ Retest of resistance completed

✅ Descending channel pattern active

✅ Bearish momentum building

🔗 CORRELATED ASSETS TO MONITOR

1. WTI CRUDE (USOIL) 💵

Current: $57.77/barrel

Correlation: Direct (85%+ correlation with Brent)

Watch for breakdown below $57.00 support

2. USD/CAD

Inverse Correlation with oil prices

CAD weakens when oil falls

Monitor for USD strength continuation

3. ENERGY SECTOR ETFs 📊

XLE (Energy Select Sector SPDR)

XOP (Oil & Gas Exploration ETF)

Follow for confirmation of sector weakness

4. NATURAL GAS (NATGAS) ⚡

Parallel Energy Market

Similar bearish patterns observed

Confirms broader energy sector weakness

5. RUSSIAN RUBLE (USD/RUB)

Oil-dependent currency

Weakens with falling oil prices

Geopolitical risk indicator

🌍 KEY MARKET FACTORS

⚠️ Supply Pressure

Increased global production capacity

OPEC+ policy uncertainties

📉 Demand Concerns

Global economic slowdown fears

Industrial activity softening

💵 Dollar Strength

Stronger USD = Lower oil prices

Monitor Federal Reserve policy

⚡ RISK MANAGEMENT REMINDER

🚨 Ladies & Gentlemen (Thief OG's) - This is NOT financial advice:

✓ Position size according to YOUR account

✓ Never risk more than you can afford to lose

✓ Adjust stops based on YOUR strategy

✓ Take profits at YOUR comfort levels

✓ Market can remain irrational longer than you can stay liquid

Your Capital = Your Responsibility = Your Profits/Losses

🎯 Trade Smart | Stay Disciplined | Manage Risk 🎯

USDCAD: breakout setup targeting 1.4150🛠 Technical Analysis: On the H4 chart, USDCAD remains in a recovery phase after reclaiming the key SMA cluster, with price holding above the 50/100/200 SMAs. The pair is consolidating just below the 1.39000 – 1.40000 supply area, suggesting buyers are building pressure for a continuation move. A confirmed push above the local pivot (around 1.3925) would likely open the way toward the next resistance at 1.39876. If the breakout fails, the scenario shifts toward a pullback back into the 1.38600 support area.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Buy on a confirmed breakout and H4 close above 1.39249

🎯 Take Profit: 1.39876, medium-term target near 1.41500

🔴 Stop Loss: 1.38621

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Brent Oil M30 HTF Breakdown and Bearish Continuation Setup📝 Description

Brent Oil experienced a sharp impulsive sell from the HTF supply area, shifting momentum decisively bearish. The current price action is a corrective pullback into a lower-timeframe FVG, with no signs of structural recovery.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price remains below the M30 FVG and prior breakdown level

Preferred Setup:

• Entry: 63.38

• Stop Loss: Above 63.73

• TP1: 63.01

• TP2: 62.67

• TP3: 62.38 (HTF liquidity / FVG draw)

________________________________________

🎯 ICT & SMC Notes

• Strong impulsive sell confirms bearish order flow

• Current move classified as corrective retracement

• No bullish CHOCH or demand reaction confirmed

________________________________________

🧩 Summary

As long as price fails to reclaim the M30 FVG, the structure favors continuation toward lower liquidity targets.

________________________________________

🌍 Fundamental Notes / Sentiment

With easing geopolitical tensions, the risk premium priced into oil is likely to unwind. In the absence of supply disruption fears, Brent faces downside pressure, keeping lower prices favored as the market rebalances.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Risk premium on Oil unwinding?A Reuters report yesterday suggested a US attack on Iran was imminent, pushing oil to its highest level since October.

“Iranian Patriots, KEEP PROTESTING, TAKE OVER YOUR INSTITUTIONS!!! HELP IS ON ITS WAY,” Trump posted on Truth Social.

Today, that risk premium is fading as no military action has materialised. WTI is down, erasing two of the last four days of rallies.

The outlook can shift to the upside again quickly if tensions escalate, but traders should weigh the geopolitical risk against the reality of an oversupplied oil market.

BRENT H1 HTF Pullback and Bullish Continuation Setup📝 Description

Crude Oil is trading within a strong bullish structure after a clean impulsive move. The current price action represents a shallow corrective pullback, with no signs of structural breakdown so far.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the H1 pullback

Preferred Setup:

• Entry: 64.5

• Stop Loss: Below 64.4

• TP1: 65

• TP2: 65.35

• TP3: 65.75 (HTF OB)

________________________________________

🎯 ICT & SMC Notes

• Bullish continuation after impulse leg

• Pullback aligned with H1–H4 FVG demand

• No bearish BOS or displacement against trend

________________________________________

🧩 Summary

As long as price respects the current FVG support, the expectation remains bullish continuation toward higher-timeframe liquidity levels.

________________________________________

🌍 Fundamental Notes / Sentiment

With the potential for increased geopolitical tensions, risk premium may reprice into the market. Any escalation affecting supply routes or producers could support upside in Brent, keeping prices biased higher despite broader macro headwinds.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Fundamental Note: GOLD 12 Jan 2026Gold is printing the first major record high of 2026 as markets rush into safe havens on a sharp spike in geopolitical risk and US policy uncertainty. Protests in Iran are a key catalyst today: traders are pricing higher tail-risk around regional escalation and potential energy supply disruptions (Strait of Hormuz risk), which typically lifts gold’s risk-premium. The Venezuela situation remains in the background after last week’s US action, adding to “geopolitics bid” conditions even as expectations of Venezuela export normalization can cap oil’s upside. On the macro side, fresh concerns about Fed independence (and political pressure around the Fed) weakened the USD and reinforced demand for non-yielding hedges. The construction backdrop is mixed-but-cooling (UK construction recession signals, soft housing activity), which supports the idea of slower growth/inflation ahead — a setup that can keep real yields contained and indirectly favor gold. In metals, “supply vs demand” is diverging: mined gold supply is strong (WGC notes 2025 mine output tracking a record), but physical availability can still feel tight regionally — China’s premiums recently widened while India’s retail demand softened at elevated prices.

Bottom line: today’s price action is being driven more by risk-premium and USD dynamics than by jewelry demand, with volatility likely to stay elevated while headlines remain hot.

🟢 Bullish factors:

1. Safe-haven demand on Iran unrest / escalation risk.

2. Venezuela geopolitics keeps risk-premium supported even if oil stays range-bound.

3. Fed-independence concerns + softer USD boost non-yielding hedges.

4. Regional physical tightness signals (China premiums) despite high global prices.

🔴 Bearish factors:

1. If geopolitics cools quickly, the “risk-premium” can unwind fast.

2. Record-high prices strain retail demand (notably India), increasing pullback risk.

3. Any rebound in US real yields / USD would pressure gold from these highs.

🎯 Expected targets: Bullish bias while above 4,550–4,520, with upside toward 4,650–4,750 if risk headlines persist. A volatility-driven pullback could retest 4,500–4,450; a deeper risk-off-to-risk-on flip would expose 4,350–4,300 as the next support zone.

Weekly outlook: XAUUSD, #SP500, #BRENT | 16 January 2026XAUUSD: BUY 4570.00, SL 4540.00, TP 4660.00

Gold starts the week near $4,570 per ounce, holding close to record highs amid stronger demand for safe-haven assets. Support comes from rising geopolitical tensions and a softer US dollar as investors reassess the stability of US monetary policy.

Over the coming days, the main driver will be US inflation data and the Fed’s messaging: if price growth remains moderate, expectations of rate cuts should keep gold in demand. A sharp jump in government bond yields could cap gains, but ongoing buying by central banks continues to provide a fundamental cushion.

Trading recommendation: BUY 4570.00, SL 4540.00, TP 4660.00

#SP500: BUY 6970, SL 6940, TP 7060

The S&P 500 begins the week near 6,966 after setting fresh record highs. Sentiment is supported by expectations of resilient corporate earnings, but the market has become more sensitive to Fed-related headlines and potential political and legal risks in the US.

Key focal points this week are US inflation data and the start of the earnings season for major banks and technology companies. Softer inflation and strong results may sustain demand for equities, while higher inflation and a new wave of uncertainty could increase caution and temporarily cool risk appetite.

Trading recommendation: BUY 6970, SL 6940, TP 7060

#BRENT: SELL 63.40, SL 64.00, TP 61.60

Brent starts the week around $63.39 per barrel: geopolitical risks in the Middle East add a premium, but the market is not yet pricing in serious supply disruptions. At the same time, attention is growing around a potential recovery of Venezuelan exports.

Over the week ahead, pressure comes from expectations of excess supply in 2026 and cautious demand estimates. Support could appear if there are signs of production cuts or new restrictions on supply from major producers, but without such news the balance of factors still favors a modest decline in Brent.

Trading recommendation: SELL 63.40, SL 64.00, TP 61.60

WTI M15 Bullish Continuation After H1 FVG Hold📝 Description

WTI crude remains in a strong short-term bullish structure on M15 after an impulsive expansion. Price has pulled back in a controlled manner and is holding above the H1 FVG / BPR zone, suggesting this move is a healthy retracement, not distribution. The higher lows indicate continuation potential rather than exhaustion.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish

Preferred Setup:

• Entry (Buy): 58.03

• Stop Loss: Below 57.8

• TP1: 58.36

• TP2: 58.60

• TP3: 58.75

Acceptance below the H1 FVG invalidates the bullish continuation idea.

________________________________________

🎯 ICT & SMC Notes

• Clean impulsive leg followed by corrective pullback

• Price respecting H1 FVG + BPR as demand

• No bearish CHOCH on LTF

________________________________________

🧩 Summary

WTI is consolidating above a key HTF demand zone after a strong markup. As long as price holds above the H1 FVG, the market favors continuation toward upside liquidity rather than deeper retracement.

________________________________________

🌍 Fundamental Notes / Sentiment

Oil sentiment remains supported by steady demand expectations and ongoing geopolitical sensitivity. With no immediate bearish catalyst and technical structure aligned, price action favors trend continuation, especially according to geopolitical situation in in Iran and Venezuela.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Can geopolitics rescue oil from five-year lows?At some point this year there could be a strong opportunity to buy crude oil, as prices near USD 55 per barrel are potentially unsustainable.

WTI crude oil futures rose more than 3.5% on Thursday to trade above USD 57.9 per barrel, rebounding from a two-day slide. The move, however, was not enough to recover the losses earlier in the week, and prices remain close to the five-year low set in December.

Uncertainty around Venezuelan exports resurfaced after Washington announced plans to maintain indefinite control over the country’s crude sales.

Meanwhile, in Iran, protests have been reported in Tehran and other cities as inflation rises and the currency weakens, adding another layer of geopolitical risk for oil. Unlike Venezuela, Iran continues to export roughly 2 million barrels per day and produces between 3.2 and 3.5 million barrels per day, contributing a meaningful volume of global supply.

Oil Risk-Premium Phase, Geopolitical-Driven Upside Move📝 Description

Crude Oil on H4 is trading inside a bearish HTF structure, but recent price action shows a corrective recovery driven by rising geopolitical risk. The current move looks reactionary, not impulsive, with price responding to risk-premium flows rather than a confirmed structural shift. Market remains sensitive around key HTF PD Arrays.

________________________________________

📈 Analysis (Scenario-Based | Non-Signal)

Primary Scenario (Risk-Premium Driven):

• Rising US–Venezuela tensions are adding a clear risk premium to oil prices

• Initial upside moves are headline-driven spikes fueled by hedging and speculation

• Price is reacting to expectations, not confirmed supply disruptions

Short-Term Market Behavior:

• Short-term bias remains bullish with elevated volatility

• Pullbacks are likely liquidity-driven corrections, not reversals

• These moves help reset positioning before continuation

Structural Context:

• No confirmed HTF CHOCH + BOS so far

• Structure remains corrective within the broader range

________________________________________

🎯 ICT & SMC Notes

• Upside moves classified as risk-premium reactions, not structural breakouts

• Corrections viewed as liquidity accumulation phases

• HTF PD Arrays remain dominant reference points

________________________________________

🧩 Summary

Oil is trading in a risk-premium environment driven by US–Venezuela tensions. Short-term bias remains bullish, with upside spikes fueled by hedging and speculation. Pullbacks are likely liquidity resets, not trend reversals, keeping the structure tilted higher despite volatility.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

OIL, 4 years in the making. a forceful break awaits. STRONG BUY!OIL is not for the faint hearted -- the constant abrupt shifting of prices made it almost untradeable.

Geopolitics, Economics, Dollar metrics -- and all fundamentally driven factors seem to have evaded any effect on OIL this past 4 years. Constantly headed south this past 4 years since January 2022.

Now, based on recent metrics that spans, 96 months.. we are seeing some major shift in structure hinting of an impending strong breakout. This ascending bend has only materialized after 2 years (referencing our diagram) -- with expanding upside pressure on its 4-year trend.

I Expect some expanding vertical momentum from here at 57 bargain area aiming for a 30-40% increase in price.

Factoring the geopolitics issues thats been arising lately -- the directional context of OIL finally waking up from its slumber is becoming clearer by the day.

Ideal seeding zone at the current price range. 57ish.

Target: 80.0

Long term. 100

Weekly outlook: XAUUSD, #SP500, #BRENT | 09 January 2026XAUUSD: BUY 4415.50, SL 4380.00, TP 4522.00

Gold starts the week near 4415.50 per ounce: thin trading at the beginning of the year has amplified reactions to news from Venezuela and broader geopolitical tension, lifting demand for safe-haven assets. Support also comes from expectations of lower US interest rates in 2026 and continued buying by central banks.

For the week of January 5–9, the focus is on US data on business activity and the labor market, with the key event being Friday’s jobs report. Weaker figures could strengthen interest in gold, while strong numbers may boost the dollar and cool the market temporarily.

Trading recommendation: BUY 4415.50, SL 4380.00, TP 4522.00

#SP500: BUY 6858, SL 6778, TP 7098

The #SP500 is holding around 6858 at the start of the first full week of 2026: investors are weighing geopolitics and oil, but the main guide remains expectations for US interest rates. After a strong finish to 2025, the market enters the week with a cautious tone.

The week of January 5–9 is packed with US statistics, with Friday’s employment report as the highlight. Moderate data would support equities through hopes of lower borrowing costs, while a surprise rise in inflation expectations and yields could increase pressure on the stock market.

Trading recommendation: BUY 6858, SL 6778, TP 7098

#BRENT: SELL 60.43, SL 62.10, TP 55.40

#BRENT is trading near 60.43 per barrel: news around Venezuela has added sharp swings, but the market sees no major supply disruptions for now. OPEC+ is keeping current output settings, and talk of potential supply growth ahead is capping prices.

For the week of January 5–9, the spotlight is on demand signals via US statistics and updates from China, as well as the regular US inventory figures. If demand stays soft and the dollar strengthens, oil risks sliding; however, tighter sanctions or logistical disruptions could quickly restore support.

Trading recommendation: SELL 60.43, SL 62.10, TP 55.40

The Venezuelan EffectIn this video I going to exhibit the effect of the the profound economic crisis in Venezuela and its broader global implications. WTI, BRENT, BA, EXXON, LOCHKEADMARTIN

Overview of the Crisis

The video details Venezuela's transition from being the wealthiest nation in South America to a country grappling with extreme hyperinflation and economic collapse . It highlights how the nation's heavy reliance on oil exports—accounting for nearly 95% of its export earnings—made it uniquely vulnerable to fluctuations in global oil prices .

Key Economic Factors

The Resource Curse: The video explains how "Dutch Disease" occurred, where the focus on oil led to the neglect of other sectors like agriculture and manufacturing .

Hyperinflation: It discusses the catastrophic devaluation of the Bolívar, which led to a scenario where basic necessities became unaffordable for the average citizen .

Government Policy: The narrative touches upon the impact of price controls, nationalization of industries, and the role of political instability in exacerbating the financial downturn .

The Human and Global Impact

Mass Migration: A significant portion of the video is dedicated to the massive exodus of Venezuelans seeking better opportunities in neighboring countries, creating a regional humanitarian challenge .

Geopolitical Shifts: It explores how Venezuela’s situation has influenced regional politics and energy markets worldwide .

The video concludes by analyzing the current state of the Venezuelan economy and whether recent shifts in policy or international relations offer a path toward stabilization .

Venezuela’s Risk PremiumU.S. airstrikes on Venezuelan military-related sites in/around Caracas (Fuerte Tiuna, La Carlota) triggered a Maduro state of emergency. No confirmed hits to core oil infrastructure (PDVSA upstream, refineries, José/Amuay) so far.

Venezuela remains a marginal, heavily sanctioned barrel ( ~0.6–0.7 mb/d exports pre-event ), so physical disruption risk is largely contained absent verified terminal/port outages.

WTI settled Fri Jan 2 near $57/bbl amid a multi-month downtrend. Expect a near-term geopolitical premium/vol bid that can lift prompt into the mid–high $60s on tail-hedging, positioning, and technical resistance/“measured move” dynamics.

But fundamentals should cap duration:

•IEA flags ~3.8 mb/d surplus into Q1 ’26; non-OPEC+ growth (US/Guyana/Brazil) offsets risk.

•Jan 4 OPEC+ JMMC likely reiterates the production hold; compliance noise ≠ catalyst.

•Physical/curve reads loose: elevated hub stocks + contango -> ample prompt supply/storage incentive.

spike then mean-revert, premium fades sub-$60 over the next few sessions. Watch regime-shift risks (confirmed infra damage, retaliation/transit risk, OPEC+ surprise). Invalidation: sustained >$70 = structural breakout.

Weekly Outlook: XAUUSD, #SP500, #BRENT | 02 January 2026XAUUSD: BUY 4475.00, SL 4465.00, TP 4550.00

Gold starts the week near $4,470 per ounce: demand is supported by expectations of further Fed rate cuts in 2026 and ongoing geopolitical uncertainty. Investors are also watching the minutes of the Fed’s December meeting and fresh U.S. data.

If the minutes confirm the regulator’s readiness to ease policy as inflation slows, interest in safe-haven assets may strengthen. A key risk for prices is a sharp rise in government bond yields and a stronger dollar on upbeat data.

Trading recommendation: BUY 4475.00, SL 4465.00, TP 4550.00

#SP500: BUY 6930, SL 6910, TP 7080

The S&P 500 ends the year near record levels around 6,930 points, while the new week is expected to be quiet due to the holidays. The focus is on the minutes of the Fed’s December meeting and a set of U.S. housing and business-activity indicators.

A positive driver for the market is expectations of cheaper borrowing and solid corporate earnings forecasts for 2026. A restraining factor is the risk that the minutes signal Fed caution and trigger a reassessment of rate expectations.

Trading recommendation: BUY 6930, SL 6910, TP 7080

#BRENT: BUY 61.00, SL 60.70, TP 63.70

Brent crude is holding near $61 per barrel: the market is reacting to news around talks on Ukraine and tensions in the Middle East, which increase the risk of supply disruptions. Prices are also supported by a seasonal pickup in demand at year-end.

At the same time, concerns about oversupply in 2026 remain, limiting the upside. This week, attention will be on U.S. oil inventory data and statements from major producers about production plans.

Trading recommendation: BUY 61.00, SL 60.70, TP 63.70

Weekly Outlook: XAUUSD, #SP500, #BRENT | 26 December 2025XAUUSD: BUY 4397.16, SL 4387.16, TP 4427.16

Gold starts the week near record highs: as of December 22, XAUUSD is hovering around 4397.16. Support comes from expectations of lower U.S. interest rates in 2026 and safe-haven demand amid geopolitical uncertainty and a softer U.S. dollar.

This week, interest in gold may strengthen if U.S. data on growth and inflation come in softer, and if headlines point to continued central-bank buying. On the other hand, year-end profit-taking and thin holiday liquidity may limit the upside.

Trading recommendation: BUY 4397.16, SL 4387.16, TP 4427.16

#SP500: BUY 6835, SL 6815, TP 6895

#SP500 enters the week near 6835 points as investors reassess the Fed’s 2026 rate path and aim for a calm year-end finish. Sentiment is also supported by renewed demand for large-cap stocks, which carry the biggest weight in the index.

With a shortened week, market reactions to U.S. releases can be sharper—especially GDP updates, corporate orders, and consumer confidence. Strong figures would support revenue expectations, while softer data could reinforce bets on policy easing, which often also supports equities.

Trading recommendation: BUY 6835, SL 6815, TP 6895

#BRENT: SELL 60.93, SL 61.43, TP 59.43

#BRENT starts the week around 60.93 per barrel. In the short term, supply-risk headlines may provide support, but the market is still focused on the possibility of oversupply in 2026 and rising output from producers outside coordinated agreements.

Pressure may increase if new assessments confirm softer demand and elevated inventories. At the same time, any fresh geopolitical developments can trigger sharp but brief spikes, so the key driver remains the broader supply-demand balance.

Trading recommendation: SELL 60.93, SL 61.43, TP 59.43

Energy market cools down: oil and gas under pressureOver the past three months, global prices for oil (#BRENT/#WTI) and gas (#GAS) have declined noticeably. Benchmark oil grades Brent and WTI have lost around 11–12%, ending the year near multi-month lows. U.S. natural gas has also entered a correction after a strong rally at the start of the winter season.

Factors Behind the Decline:

#BRENT — U.S. production is at record levels, supplies from Brazil and other countries are rising, and some African oil remains unsold for extended periods. As a result, Brent struggles to stay above $60 , with any price rebound quickly sold off.

#WTI — Economic and fuel demand forecasts have weakened, while crude oil and fuel inventories continue to grow, making WTI more vulnerable to selling on pullbacks.

#GAS — In autumn, gas prices surged on colder weather forecasts and record exports, but later forecasts turned milder, production stayed high, and inventories remained sufficient — leading to a price correction.

Brent and WTI are ending the year amid a clear supply surplus: record U.S. output and rising supplies from other regions prevent prices from holding above recent levels, while OPEC+ has not yet moved toward aggressive production cuts. This suggests that the risk of a gradual further decline in oil prices may persist into early next year.

The gas market follows the same logic: high production, well-filled storage facilities, and a relatively mild winter create room for prices to move lower after the recent rally. Altogether, this makes #BRENT, #WTI, and #GAS vulnerable to a continuation of the correction unless there is an unexpected surge in demand or a sharp supply disruption.

FreshForex analysts note that in the coming months, the price trajectory of oil (#Brent/#WTI) and natural gas (#GAS) will largely depend on whether the supply surplus persists, how the global economy develops, and whether expectations of a mild winter are confirmed. In such an environment, investors and traders are advised to maintain strict risk management and closely monitor news from the commodity markets.