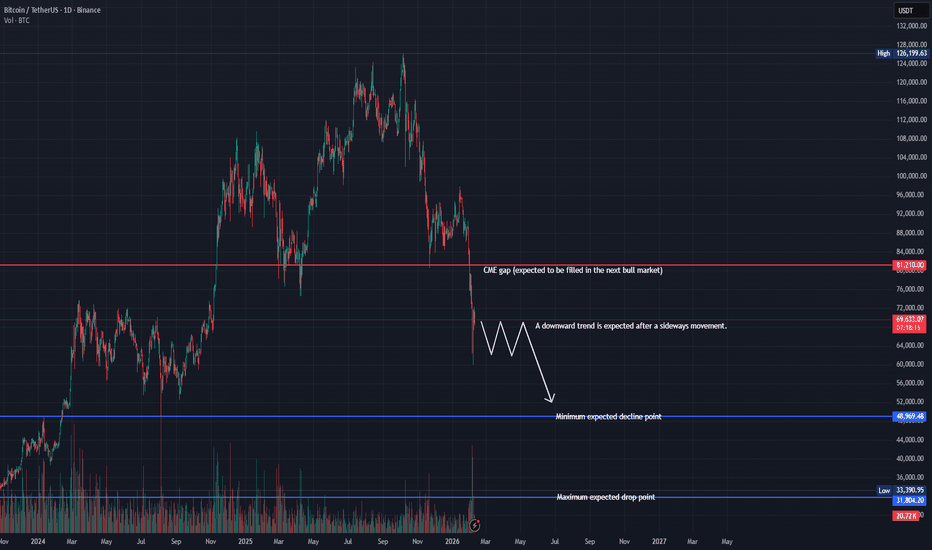

Bitcoin(BTC), has yet to reach a cyclical low.BINANCE:BTCUSDT

It’s been about four months since my post calling the end of Bitcoin’s bullish season, and here is an updated cycle-based outlook.

(CME chart during the 22-year bear market)

After forming a downside gap near the 81K level, Bitcoin saw a one-way selloff down to around 60K, followed by a technical rebound.

I believe this 81K gap is likely to be filled in the next bullish cycle, similar to the price action observed during the 2022 bear market.

From a cycle perspective, the macro bottom is expected to form around August–September 2026. Until then, Bitcoin may continue moving in a prolonged consolidation phase driven more by time correction than sharp price movements.

My projected downside target zones are:

• Primary zone: 49K–52K

• Deeper correction: below 39K

• Extreme scenario: toward the 32K region

However, if price moves up first and fills the 81K gap, this bearish cycle scenario will be invalidated.

Your follow and boost would mean a lot. 🚀

Btc!

Bitcoin’s Unfilled CME Gap: A Price MagnetBitcoin currently has a CME gap between $79,600 and $83,730, which remains unfilled.

From a historical and statistical perspective, CME gaps have a strong tendency to be filled over time, making them important reference zones for both swing traders and long-term market participants.

At the moment, price has moved significantly away from this range, which reduces the probability of a gap fill in the short term and makes any immediate retracement less likely without a clear catalyst. Strong momentum and trending conditions can delay gap fills for extended periods.

However, this does not invalidate the gap. Instead, it should be viewed as a high-probability magnet zone that may come into play during future corrections, deeper pullbacks, or broader market structure shifts.

As long as this CME gap remains open, it represents a key area of interest for liquidity, potential support/resistance reactions, and higher-timeframe mean reversion. Traders should keep this zone marked on their charts and be patient, as sooner or later the market tends to revisit and fill these inefficiencies.

Risk management and confirmation from price action are essential when approaching this area.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

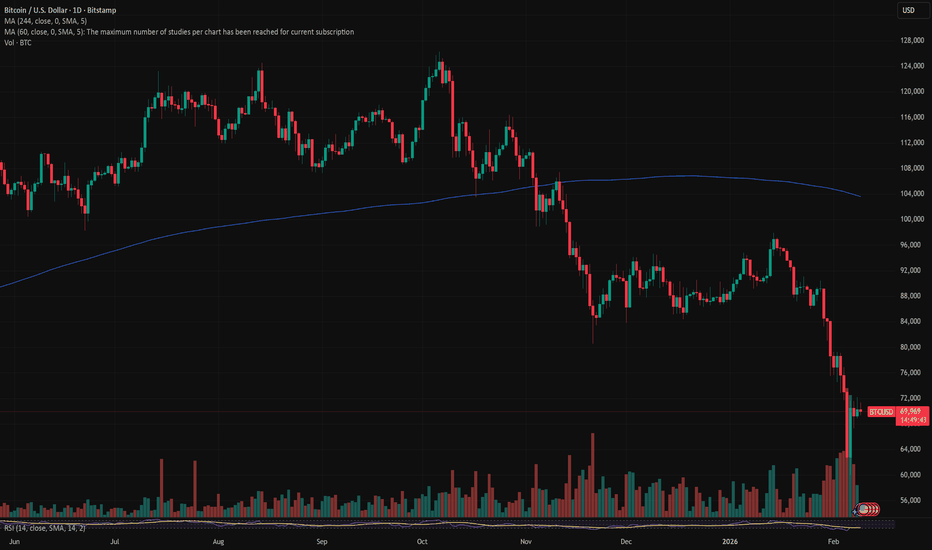

BTC/USDT — Exhausted Sell-Off: Consolidation or Slow Grind Lower✔️ The week closed with a red candle and a long lower wick, but it does not qualify as a reversal pattern.

🟢 RSI is extremely oversold on higher timeframes.

🟢 Buyer reaction is visible at the support block.

Price spent ~250 days in the 55–70k range — it’s reasonable to expect at least a pause or consolidation here.

🟢 US employment is weakening — a potential signal for rate cuts ahead.

🟠 The structure resembles May 2022, as if only half of the downside move has played out.

This scenario is now widely discussed on social media, which reduces the odds of a direct repeat.

🟠 Extreme fear, with the index dropping to 5.

🔴 The market is highly exhausted, but hasn’t reached full apathy yet.

🔴 Both institutional and retail investors continue selling crypto ETFs.

🔴 Negative cumulative delta: –$1.62B.

🔴 The risk of entering a prolonged bear cycle is increasing.

🧠 The sell-off unfolded faster than expected, but the rebound failed to produce a reversal.

Base case: slow grind lower for 1–3 weeks, with a reversal near the lows — possibly with a sweep, possibly without.

The key is that a reversal eventually forms.

Toncoin: bounce or breakdown? key levels to watch this weekToncoin. Tired of watching it bleed or ready to trade the bounce? After the hype around its ecosystem partnerships and the recent shakeout across majors, Toncoin is still stuck in a heavy downtrend and every pop is getting sold into, according to market chatter. Volatility is back, which means opportunity if you’re precise with levels.

On the 4H chart price is pressing under a chunky supply area around 1.38-1.40 with repeated rejections there and point of control slightly below. RSI made a lower high while price retested that zone - classic bearish divergence. With that and the dominant downtrend, I lean short bias, expecting sellers to defend 1.40 unless some fresh catalyst brings real spot demand.

My base plan: as long as 1.40 holds as resistance, I expect a slide toward 1.32, then 1.26-1.22 where the next demand cluster sits ✅. If buyers suddenly push and we get a clean 4H close above 1.40 with volume, that invalidates the short idea and opens the door to 1.47 then 1.55 ⚠️. I might be wrong, but for now I’m hunting shorts near 1.38-1.40 with tight risk above the range high.

Unlocking Altseason: Chart Signals You Can't IgnoreAltseason without myths: what actually shows up on charts before alts go crazy

Everyone loves to say “altseason is coming” the same way kids say “summer is coming” in March. Feels good, zero responsibility.

But altseason isn’t magic. It’s just money rotating. And that rotation leaves fingerprints on the charts way before your favorite microcap does +500%.

Let me walk you through the main conditions I usually want to see before I start taking alt setups seriously – not memes, not hopium, just price.

1. King Bitcoin does his move first

Healthy altseasons rarely start from flat Bitcoin.

Typical pattern:

- First, a strong impulsive move up on BTC

- After that move, BTC stops trending and starts chopping in a range

- Volatility cools down, candles get smaller, volume drops

TL;DR: Big boys rode BTC, locked in chunky profits, and now their fresh capital is looking for higher beta plays. That’s when alts start feeling “lighter”.

If BTC is nuking or making fresh parabolic highs every day, alts usually just get dragged around like bags on a train.

2. BTC dominance stops climbing and starts bleeding

Open BTC.D (Bitcoin dominance) and zoom out.

Before most big alt runs, I usually see:

- A clear uptrend in dominance while BTC is running

- Then a topping structure: double top, lower high, or a fake breakout above the previous high

- And then – the key part – a confirmed breakdown with lower lows

That’s literally money leaving BTC relative to alts.

No need to overcomplicate:

Rising dominance – market respects Bitcoin.

Falling dominance – market starts gambling on the side quests.

3. ETH vs BTC wakes up

ETHBTC is my canary in the coal mine.

If ETH can’t even beat BTC, why should I expect your random GameFi coin to do it?

Before many altseasons I’ve watched:

- ETHBTC prints a base or higher low

- Breaks local resistance

- Starts grinding up, even if slowly

ETH often leads the rotation. When this pair wakes up, liquidity is starting to accept “more risk”.

4. Total alt market cap breaks structure

Open TOTAL2 or TOTAL3 – that’s your x-ray of altcoins as a whole.

What I like to see:

- A clear downtrend turning into a sideways accumulation range

- Higher lows forming under a big horizontal resistance

- Breakout of that resistance with expanding volume

That’s not your random lucky pump – that’s the whole sector getting repriced.

5. Volume rotation: BTC quiet, alts noisy

Check the volume bars:

- BTC: volume fades while it ranges

- Major alts: volume spikes on green days, pullbacks on lower volume

That’s exactly what “rotation” looks like. Money doesn’t appear from nowhere – it walks from chart to chart.

Maybe I’m wrong, but I think “altseason” is mostly a marketing word influencers use when they ran out of Bitcoin content. On charts it’s just a sequence:

BTC pumps → BTC chills → dominance tops → ETHBTC turns → alt market cap breaks out → volume rotates.

Last nuance: don’t try to guess the exact start like it’s New Year’s midnight. Focus on conditions, not dates. When several of these signals line up, I start hunting alt setups. When they disappear, I stop dreaming about 50x and go back to trading what the market actually gives.

In the end, altseason is just greed with a chart pattern. Learn to spot the pattern – and the greed will find you on its own.

Lighter (LGT) Swing Trade Setup – Approaching Key SupportLighter (LIT) is currently pulling back and heading toward a critical support zone between $1.50 and $1.54. This area has historically acted as a demand region, and price action is now slowing — signaling a potential bounce setup. If support holds, this could be a solid swing opportunity.

🟢 Trade Plan

Entry Zone: $1.50 – $1.54

Take Profit Targets:

• TP1: $1.68

• TP2: $1.80

Stop Loss: $1.50 (hard stop — close below invalidates setup)

ASTER Rejected at Resistance — Support Retest LikelyASTER has just faced a rejection at a key resistance level, signaling a potential move back down toward support. This pullback could offer a solid opportunity for bulls to re-enter if price stabilizes. The current structure remains valid as long as price doesn’t break below the invalidation zone.

🔔 Trade Setup

Entry Zone: $0.56 – $0.57

Take Profit Targets:

• TP1: $0.64

• TP2: $0.70

• TP3: $0.80

Stop Loss: $0.48

Risk management is key. Wait for confirmation.

TradeCityPro | Bitcoin Daily Analysis #263👋 Welcome to TradeCity Pro!

Let’s move on to Bitcoin analysis. Today, the market may continue its bearish move.

⌛️ 1-Hour Timeframe

On this timeframe, after getting rejected from the 71,616 high, Bitcoin is moving down toward its support at 67,735.

🔍 At the moment, price has reacted around 68,732, and it could now enter a ranging phase. In that case, we can look to open a short position on a break of 68,732.

📊 Otherwise, we can wait and look for a short entry on the break of 67,735.

✨ For long positions, our trigger remains the break of 71,616. If buying volume starts to increase, we can enter a long position once this level is broken.

⚡️ A break above 71,616 would give us the first bullish signal, and after that, forming higher highs and higher lows above this area would confirm a trend reversal to the upside.

✔️ However, if the short trigger at 67,735 gets activated, price could move toward 62,824. A break below 62,824 would then signal the start of the next bearish leg.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC — Range Deviation Play & Bear Flag TargetBitcoin continues to trade inside a clearly defined sideways range. Recently, the price made a deviation above the range high — a classic false breakout — and quickly returned back inside the channel, confirming the upper boundary as strong resistance.

Now, on the daily timeframe , the market is forming a bear flag , which typically acts as a continuation pattern to the downside. If this structure breaks lower, it opens the way toward the $68–67K zone , which aligns perfectly with the lower boundary of the range.

A move into this area would likely create a deviation below the range low, mirroring the earlier deviation at the top. Such symmetrical deviations often signal liquidity grabs before a potential mid-term reversal.

Key Points:

Range structure remains intact

Upper deviation confirmed — failed breakout

Daily bear flag suggests continuation lower

Target: $68–67K (potential lower deviation zone)

This scenario remains valid as long as BTC stays below the mid-range and the bear flag structure holds.

IREN Still lower to complete wave 4NASDAQ:IREN printed another daily bearish divergence in a downtrend, signalling continued momentum to the downside. Price met the 200EMA and caught a bid Friday closing its candle only +5%, a far cry from the competitors last week, considering its volatility, showing weakness.

The narrative and buzz of the bull run is still being sold into as investors are still greedy.

Wave C of 4 has a termina target f the major High Volume Node support and 0.382 Fibonacci retracement, the highest probability area for wave 4 to end, $27.

Daily RSI has room to fall. The daily pivot is lost.

Safe trading

BITCOIN always leads stocks when Bear Cycles happen. This time??Bitcoin (BTCUSD) completed a more than -50% drop last week from its October 2025 All Time High (ATH) while stocks stayed close to their ATH. This chart shows that while BTC is obviously on a Bear Cycle, the S&P500 (SPX) illustrated by the blue trend-line, is still on Bull Cycle territory.

So why this huge divergence between BTC and stocks. Well looking at it historically, this is not uncommon. During the 2022 Bear Cycle, Bitcoin had to crash by more than -40% before the stock market started its own correction, while in 2018 Bitcoin again crashed by more than -50% before the SPX started a Bear Cycle.

This is very logical from a long-term investing standpoint as investors seek first to liquidate the massive profits on riskier assets like Bitcoin, add some remaining capital on stocks and then when the stock market shows signs of a long-term correction, withdraw their funds from there as well. This is usually when the USD takes off as they convert stocks to dollars and choose to weather out the storm primarily in cash (others might choose precious metals).

In any event, this analysis shows that since Bitcoin is already down by more than -50% from its historic High, we might be seeing a Bear Cycle starting on the S&P500 as well.

Do you agree with that? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

CIFR Triangle path played out nicely..NASDAQ:CIFR triangle in wave B played out, following my path closely, touching the daily 200EMA and major High Volume Node support line, at the 0.236 Fibonacci retracement. This is a highly probable place for wave 4 to end.

Triangle are a penultimate pattern, so that thrust lower last week should mark the end of the downtrend.

There is no divergence in the daily RSi and has a little room left to hit oversold but can do so on a bullish divergence without a new low.

Price closed Fridays candle at the highs +16% showing consumer confidence to hold over the weekend news cycle.

Safe trading

COIN, Elliot wave degree changed, Wave 2 complete?NASDAQ:COIN has a larger sell off then expected completely falling out of its rising wedge. This suggests that the top was a wave 1, completing 5 wave ups diminishing with wave V, with a poke above all time high, IPO launch.

The Elliot wave count is textbook. Wave C of 2 looks to have complete 5 waves down, just below the weekly 200EMA at the major High Volume Node support, 0.382 Fibonacci retracement. While the trend remains down and below the weekly pivot I think Friday was a capitulation event and we move up from here. Theres always a sweep of the lows possible first.

Friday closed at the daily candle high, showing investor confidence to hold over the weekend news and BTC price cycle.

Weekly RSI is tapping oversold, with slight hidden bullish divergence.

Safe trading

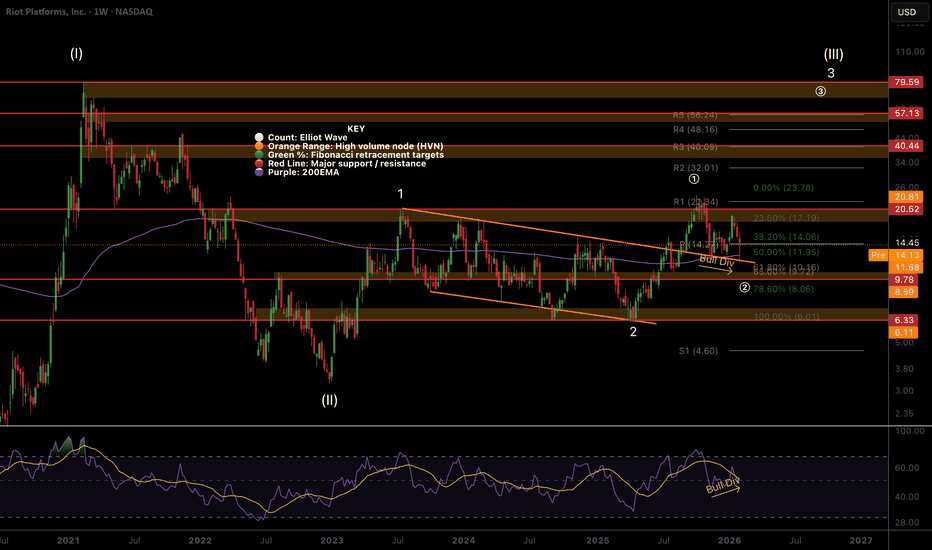

RIOT entering Wave (3) of 3 of III?This will be crazy if so...NASDAQ:RIOT has been trying to go on a tear for months, but keeps getting knocked back by broader economic and BTC uncertainty.

Price is testing the weekly 200EMA and previous range trend-line with RSI printing bullish divergence at the EQ, a bullish sign. Price recovered the weekly pivot, leaving a long lower, bottoming wick. All of this is just above the golden pocket Fibonacci retracement.

It closed Friday at the high of a 20% candle. Closing at the high on a Friday is a significant move as it shows investors are confident in holding over the weekend news cycle and Bitcoin price action.

Elliot Wave (3) of 3 of III will be crazy fast and bullish, hitting my $80 target at the very least.

Safe trading

CLSK Still in a triangle, nothing change on the weekly/macroNASDAQ:CLSK remains firmly in the macro triangle boundaries and has not penetrated wave E on last weeks dumping price action.

In fact, wave (2) is still alive and now printing weekly bullish divergence!

Fib depths for the triangle remain deep 0.786+ which is a characteristic of triangle.

Price left a long lower wick and Friday closed at the high of a 22% bullish engulfing daily candle. Closing at the high on a Friday is a significant move as it shows investors are confident in holding over the weekend news cycle and Bitcoin price action.

The goal is still to break wave D to end the triangle and thrust us in our final move to take profits around $40. This will be highly likely one we get back above the weekly pivot and 200EMA ~£14.

Safe trading

MSTR has likely found a bottomNASDAQ:MSTR has a huge bullish engulfing candle on Friday, 26% closing at the high. CLosing at the high on a Friday is a significant move as it shows investors are confident in holding over the weekend news cycle and Bitcoin price action.

Saylor continues buying weekly including today, now lowering his cost average as he below. He still has 2 years worth of USD to survive a pro-longed bear market and STRC continues to give him more capital.

Wave 4 hit the 0.5 Fibonacci retracement where it can not go beyond, per the rules. Any lower would invalidate the Elliot wave count and it would become wave 2. Which means wave 3, the most powerful is still to come....

Weekly RSI printed a huge bullish divergence at a major High Volume Node resistance in oversold, with a long lower wick being left. You cant get better bottoming signals than all of these confluences.

MSTR may be a good proxy for judging BTC bottoms moving forward, following institutional flows.

All of this said, the trend is down, the weekly 200EMA and pivot are lost. Don't fade the trend, wait for the reversal signal in price action. Overcoming these 2 areas is the first challenge to cement a new bullish trend in place.

Safe trading

Bitcoin - Is Bitcoin's Downtrend Over?!Bitcoin is below the EMA50 and EMA200 on the four-hour timeframe and is in its medium-term descending channel. Bitcoin's upward correction towards the specified supply zones will provide us with its next selling opportunities.

If the decline continues towards the demand zone, we can buy Bitcoin with appropriate risk-reward. It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and compliance with capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand limit.

Market sentiment across the cryptocurrency space has fallen to its lowest level since the collapse of FTX, a period when Bitcoin’s sharp decline triggered widespread forced deleveraging and heavy selling pressure throughout the market.

The Crypto Fear & Greed Index dropped to 9 on Friday, placing it firmly in the “extreme fear” zone—levels historically observed only during periods of severe market confidence breakdown.

By the end of the trading week, spot Bitcoin ETFs recorded another negative performance, similar to the previous two weeks. However, despite the deeper market decline, total outflows reached $689 million, noticeably lower than the $1.49 billion and $1.33 billion outflows seen in the two prior weeks.

Bitcoin’s sharp سقوط to around $60,000—roughly a 30% drop within a single week—has fueled widespread speculation among traders and analysts. Many believe the decline was not driven solely by general risk-off sentiment but was likely connected to the forced liquidation of a large non-crypto entity.

According to these scenarios, the recent heavy selling may have originated from a **major institution—possibly based in Asia—**that was compelled to exit positions rapidly due to financial pressure. Social media discussions have ranged from multi-billion-dollar Bitcoin sales by a government or exchange to chain reactions across leveraged trades, carry trades, and options positions tied to BlackRock’s spot Bitcoin ETF (IBIT).

This سقوط marked Bitcoin’s worst single-day performance since the 2022 FTX collapse. “Flood,” a well-known crypto trader, described the selling as “violent, forced, and indiscriminate,” noting that pressure of this magnitude has rarely been seen in recent years.

At the same time, the steep price decline has reignited concerns about Bitcoin’s long-term security. Some industry participants argue that falling prices and reduced liquidity may be the only forces capable of pushing the market toward serious efforts to harden Bitcoin against quantum-computing threats, particularly as sentiment reaches post-FTX lows.

Arthur Hayes, co-founder of BitMEX, attributed the sudden drop in Bitcoin’s price to bank hedging activity linked to BlackRock’s spot ETF (IBIT). He noted that institutions such as Morgan Stanley have issued structured productstied to the ETF’s performance.

Hayes explained that these instruments effectively represent bank bets on Bitcoin’s price, and when BTC moves rapidly, banks must buy or sell immediately to manage risk—behavior that can amplify volatility and produce sharp price swings.

He emphasized that he will closely monitor these ETF-linked financial products going forward, as they may provide signals of Bitcoin’s next major market moves.

Meanwhile, Strategy reported significantly higher losses in its fourth-quarter earnings, with unrealized digital-asset losses reaching $17.4 billion and a net loss of $12.4 billion.

As of February 1, 2026, the company holds 713,502 BTC, acquired at a total cost of $54.26 billion and an average price of $76,052 per Bitcoin.

During 2025, Strategy raised $25.3 billion in funding while building a $2.25 billion cash reserve, which the company states is sufficient to cover approximately 2.5 years of dividend payments and interest expenses.

The Anatomy of a Bottom. Why the $60k Breakdown Isn't the EndGreetings, everyone.

Today, we are going to perform a deep dive into the most critical process in any market: the formation of a bottom. I want to share with you not just patterns, but the very psychology and mechanics of a reversal, a subject I have been studying and honing since 2019. For my trading style, where the goal is to find an entry with minimal stop-loss and maximum profit potential, understanding formation of the bottom and top.

Part 1: The Physics of the Market. Why Instant Reversals Don't Happen.

The first and most important rule that needs to be carved in granite is this: in an established market, especially for a multi-trillion dollar asset like Bitcoin, there is no such thing as a quick recovery after a prolonged decline.

The market is not a rubber ball. It is a massive mechanism that obeys the laws of inertia. Every phase—accumulation, growth, distribution—requires time. Big capital needs a wide price range and months to accumulate or distribute a position without creating anomalous movements. Liquidity in the crypto market is fragmented; it's spread across dozens of exchanges, and moving large funds onto a CEX is a risk in itself. All of this slows the process down.

Therefore, the market always moves according to the same pattern: Impulse -> Correction (Sideways) -> Impulse . We cannot skip the phase of a long, grueling sideways correction. And we are entering exactly such a phase right now.

Part 2: The $60k Breakdown. A Cold-Blooded Hunt and the "First Leg" of the Bottom.

Let's break down the recent drop. They will tell you fairy tales about an erroneous transfer on Bithumb. Let's leave those fairy tales to the storytellers who look for simple explanations.

In reality, what happened was a cold-blooded, calculated hunt for liquidity. The $64-66k zone was an obvious magnet.

The market always moves from one liquidity pool to another, and this was the largest one. Exchanges and the biggest manipulators earn from liquidations. Without any news, without any apparent reason, they came to the exact point where the maximum pain for long positions was concentrated, and they took their money. You saw the tears on Twitter. This is normal. This is market mechanics.

I stopped asking "why did this happen?" long ago. You can invent any explanation in hindsight. The fact is, someone was pushing buttons. I will not mince words: with this move, we have established the " first leg " of our future bottom. We have marked the first critical point from which the entire future formation will be built.

Part 3: The Architecture of a Bottom. What It Actually Looks Like.

A bottom is a complex structure. Here is the most common scenario I have observed over the years:

The "First Leg" Forms: A sharp drop occurs ( like the one we just had ), establishing the first significant low.

The Deceptive Recovery: A slow bounce begins. It gives the market false hope for a V-shaped recovery.

The Return and "Support" Illusion: The price slowly drifts back down to the level of the first low. This level starts to look like rock-solid support. Everyone sees it, everyone buys from it.

The Final Act: The Liquidation Sweep. Below this obvious support line, liquidity accumulates for weeks—the stop-losses of the buyers. When enough has gathered, a sharp, final move down occurs. It breaks the "support," collects all the stops, and only after this final capitulation does the true reversal begin.

We saw variations of this in 2024, in the

73k−49k range, where a series of lower lows transitioned into a long, grueling sideways market.

And we saw it in the great bear market of 2021-2022—a series of deadly downward impulses, interrupted by corrections that systematically killed off any hope.

In this post, I didn't say anything about the accumulation and distribution of Wyckoff.

But the last time I posted about it, I was told I didn't understand anything about it—okay.

Part 4: My Plan and a Warning to the "Gods of the Market".

I want to speak directly to those whose limit order was luckily filled at $60,000. If you think you've caught lightning in a bottle and become a god of this market, I want to warn you: the market brutally punishes such overconfident people.

One successful trade is not a system. We are in a global bear market, which is exacerbated by external factors. US indices and gold are at all-time highs. The geopolitical cards of Taiwan and the Middle East have not yet been fully played. The market dislikes instability, and in such times, capital flees from the highest-risk assets. And cryptocurrency is asset number one on that list.

My personal timing has not changed: I believe the complete formation of the bottom and my position accumulation phase will conclude by September 2026.

Since 2022, I have, and I don't say this lightly, identified the key tops and bottoms of this market with 90% accuracy

proof in the links:

This isn't magic. It's an approach based on an understanding of timing and market cycles. I have dropped hints about this system in my posts since 2017, but the full, structured methodology is something I share only in my Academy.

Welcome.

Best Regards, Your EXCAVO.

Bitcoin: Brutal correction; risk-off mode still onThe word used to describe the crypto market correction among analysts and practitioners is - brutal. Indeed it looks so on charts, Another massive selloff of the crypto market wiped out in one moment more than 30% in the value of BTC. Altcoins had even higher correction. The risk-off mode is still active on all markets, and there is nothing that anyone can do about it, except to wait for its end. There is one saying among brokers, metaphorically noting that when markets are” bleeding”, it is time to buy. The crypto market is currently in the phase of “bleeding” which might indicate that the correction might soon be over.

BTC reached its lowest weekly level at $60K on Thursday and triggered a bit stronger buyers at this level. Friday was a day of relief, with strong gains, when BTC retested the $70K level. At the $71K buying orders were exhausted, while Saturday trading brought silence modestly below the $70K. The RSI reached the level of 16, which is historically the lowest level of RSI on BTC price, showing the depth of the oversold market side. The indicator is closing the week at the level of 31, which is still the oversold market side. Moving averages of 50 and 200 days are moving as two parallel lines with a downtrend, without indication that the cross might come soon.

At this moment charts are “screaming” - precaution. Friday's move to the upside, means that only a selected number of investors are back into BTC, mostly traders. The difference will be made when large institutional clients start buying. This would be the moment when we will see BTC on substantially higher levels. At this moment, the level of $75K could be the first level of stronger resistance for the week ahead, and a potential for a short term reversal. That reversal could easily get BTC back toward the $60K. In short, for the week ahead it is still not time for celebration. A serious precaution is required at this moment. Keep in mind that the vast majority of large investors are still in the risk-off mode.