Btc-e

Bitcoin: The Calm Before...We're at $80,252 watching one of those classic market contradictions that separates disciplined traders from emotional ones. Weekly RSI at 18.7 is screaming "bottom," but the structure is screaming something else entirely. Here's how to think three moves ahead instead of reacting to the noise.

1. THE TECHNICAL REALITY 📉

• Price rejected violently from $84,599 with a 37.5% upper wick, sellers defended the bearish order block ($97,932-$90,066) with serious intent

• Trading in PREMIUM zone (Smart Money Concepts) where institutions typically sell, not buy

• Lower high formation confirms bearish structure is taking control despite "bullish" swing trend label

• MACD deeply bearish at -5,482, price below EMA20 ($95,230) and EMA50 ($96,374)

2. THE INDICATORS ⚖️

Bearish Signals:

• ADX at 48.1 = strong downtrend conviction (trends with this strength don't just roll over)

• MACD at -5,482 showing deep bearish momentum

• Bearish FVG between $98,888-$96,012 remains unfilled (magnet for any relief rally)

• MFI at 35.6 showing weak money flow

Bullish Signals:

• RSI at 18.7 and Stochastic at 0.5 = extreme weekly oversold readings

• Still above EMA200 at $68,515 on macro view

• Volume at average levels ($987,996) = no panic capitulation yet

The Conflict:

Extreme oversold readings create the possibility of reversal, but structure must confirm first. Right now, structure remains bearish. Strong trends don't reverse just because an indicator hits an extreme, they need structural breaks.

3. THE TRADE SETUP 🎯

🔴 Scenario A: Continuation Lower (Primary)

• Trigger: Continued rejection from $80,000-$84,000 zone, failure to reclaim $97,932

• Entry: Confirmed rejection at bearish OB with stop above $97,932

• Target 1: $74,457 (7.2% downside) - top of bullish order block, last major defense

• Target 2: $68,587 (15% downside) - high volume node from accumulation zone

• Extended Targets: $65,157 and $61,728 if $74,457 breaks on 4H close

🟢 Scenario B: Structural Reversal (Alternative)

• Trigger: $74,457 tested with volume showing accumulation signs

• Entry: Bounce confirmation from $74,457 support zone

• Stop: Below $70,000

• Invalidation: 4H close above $97,932 (reclaims bearish OB, flips structure bullish)

MY VERDICT

Risk-reward favors waiting. The meta-game here is recognizing that extreme oversold on weekly doesn't mean immediate reversal, it means reversal becomes possible IF structure confirms. Until $74,457 is tested or $97,932 is reclaimed, path of least resistance remains down. Confidence: 72% bearish.

The "US Bitcoin Reserve" is a Lie. (A Macro Deep Dive)While Retail is chasing headlines about a "Strategic Bitcoin Reserve," Smart Money is aggressively de-risking. Why? Because the "News" is a linguistic misunderstanding, and the "Macro" just turned violently bearish.

If you are buying this dip because you think the US Government is about to print trillions to buy Bitcoin, you are walking into a trap. Today, we are going to deconstruct the three pillars of this bearish thesis: The "Project Vault" Deception, The Kevin Warsh Pivot, and the Technical Reality of DXY and ETHUSD .

__________________________________________________________________________________

1. The "Project Vault" Deception (Fact Check) 🕵️♂️

The entire bullish narrative right now hangs on the rumor that the administration's "$12 Billion Project Vault" is a secret plan to accumulate Bitcoin.

This is false.

I dug into the executive details. "Project Vault" is indeed a strategic reserve, but not for Crypto. It is a stockpile for Critical Minerals ,specifically Gallium, Cobalt, and Lithium—to secure the US defense supply chain against China.

• Retail hears: "Vault" = Cold Storage for BTC.

• Reality: "Vault" = Warehouses for EV Batteries and Fighter Jet components.

• The Takeaway: The market is pricing in a massive liquidity injection for Crypto that simply does not exist. When this realization hits the masses, the repricing will be severe.

__________________________________________________________________________________

2. The Macro Villain: Kevin Warsh 🦅

While everyone watches the "Reserve" headlines, they are ignoring the single most important variable: The Federal Reserve.

The new nominee for Fed Chair, Kevin Warsh , is the ultimate Hawk.

• History: He resigned from the Fed in 2011 specifically because he opposed Quantitative Easing (QE).

• Philosophy: He believes in a "Smaller Fed," "Positive Real Rates," and a "Strong Dollar."

• The Impact: Warsh is the anti-thesis to the "Money Printer Go Brrr" narrative. His nomination is a signal that the era of easy liquidity is ending. This is a Liquidity Withdrawal Event , and risk assets like BTCUSD are the first to suffer.

__________________________________________________________________________________

3. The Technical Truth: DXY & ETH 📉

The charts are confirming the Macro view perfectly. The "Smart Money" is already positioning for a liquidity crunch.

A) The DXY (US Dollar Index) Squeeze

The Dollar is waking up.

• Price Action: DXY is compressing tight at 26.9950 , sitting exactly at the confluence of the EMA50 and EMA200 . This is a massive decision point.

• Momentum: Stochastic is overbought (95.3), BUT ADX is at 52.2 . This tells us the trend strength is real.

• The Trigger: A 4H close above 27.09 (Upper Bollinger Band) triggers a breakout. If the Dollar flies, Crypto dies. It’s that simple.

B) Ethereum (The Canary in the Coal Mine)

If the "US Reserve" story were real, insiders would be front-running it on ETHUSD . Instead, ETH is lifeless.

• Structure: We have confirmed a CHoCH Bearish . Price is trading below every major Moving Average (20, 50, 200).

• The Trap: RSI is oversold (25.1), but ADX is 53.0 . Do not mistake "Oversold" for "Reversal." High ADX + Low RSI = A strong, relentless downtrend.

• Volume: We are trading at 39% below average volume . There is ZERO institutional support at these levels. The "Smart Money" has left the building.

__________________________________________________________________________________

4. The Operational Risk (The "John Lick" Scandal) 🚨

Finally, for those who believe the US Government is competent enough to manage a trillion-dollar Bitcoin reserve, look at the news from last week. A government contractor’s son was caught draining US-seized wallets on Telegram to flex wealth.

The Reality: The US Government cannot even secure the Bitcoin it already has. The idea that they are about to execute a sophisticated sovereign accumulation strategy is a fantasy.

__________________________________________________________________________________

🎯 The Verdict & Strategy

The "Strategic Reserve" narrative marked the top. The "Kevin Warsh" reality will drive the trend.

• The Trade: I am fading this narrative entirely.

• Invalidation: A DXY breakdown below 26.41 or an ETH reclaim of 3,403 (Bearish Order Block).

• Target: As long as DXY holds above the EMA200, I am targeting a flush on BTCUSD to 70k and ETH to 2,224 .

Do not trade the Headlines. Trade the Liquidity.

Do you trust the "US Reserve" hype?

A) Yes, HODL for nation-state adoption 🇺🇸

B) No, the chart is broken 📉

Vote A or B below! 👇

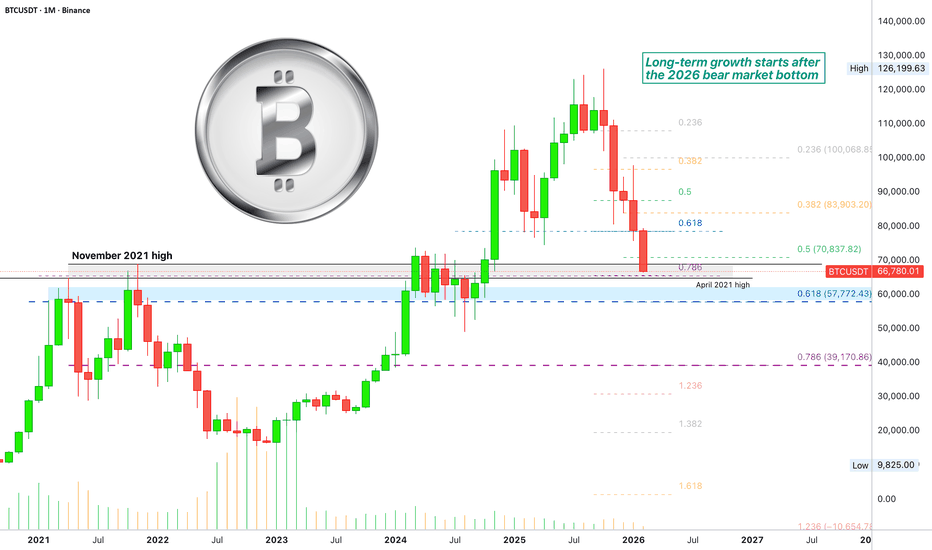

Bitcoin monthly—Hope! The 2026 bear market in its full gloryI waited before sharing this chart to see if market conditions would improve but nothing happened. While it is extremely bearish now, I haven't lost hope, things can easily turn after sustained, really strong, bearish action.

Bitcoin is now on its strongest bearish momentum in all of its history and also with five consecutive months trading in the red. This month is still early though.

Bitcoin is moving at super strong support. The strongest support ever sits at $57,772, the 0.618 Fib. retracement for the bigger, broader cycle. I would call this one an unbreakable support.

This zone has the candle closures from 2021, both April and November, as well as the entire consolidation period between March - October 2024. Months and months of consolidation and not a single month managed to close below this level.

Two things about it: If it is challenged, a reversal of some type develops here. If it breaks, a recovery can happen after some weak action below it, similar to Q3 2022. Instead of strong bearish momentum, more like consolidation at bottom prices, like we see on the smaller altcoins.

The extreme level sits at $39,172. We are using $40,000 for simplicity.

If Bitcoin continues straight down, it is possible to have an early end to the bear market. If it produces a second relief rally—the move from $80,000 to $98,000 was the main one—then it can crash again to produce a final low.

Conclusion

After five months of bearish action, it is more likely that a very strong relief will happen next. The market is bearish though. Oversold.

Thank you for reading.

Namaste.

Bitcoin Entry- When BTC was $500, it was “a Scam”.

- When BTC was $20k, it was " too dangerous".

- When BTC was $100k+. it was "too expensive".

- The problem today is simple: big hands are positioned ahead of you, with a professional strategy.

- You already have some tools for DCA entries : Fib levels, volume profiles, MA200 and key historical points of interest.

- Everything is priced in graphic, lower numbers would be very lucky.

Remember. Everyone gets BTC at the price they deserve.

Happy Tr4Ding !

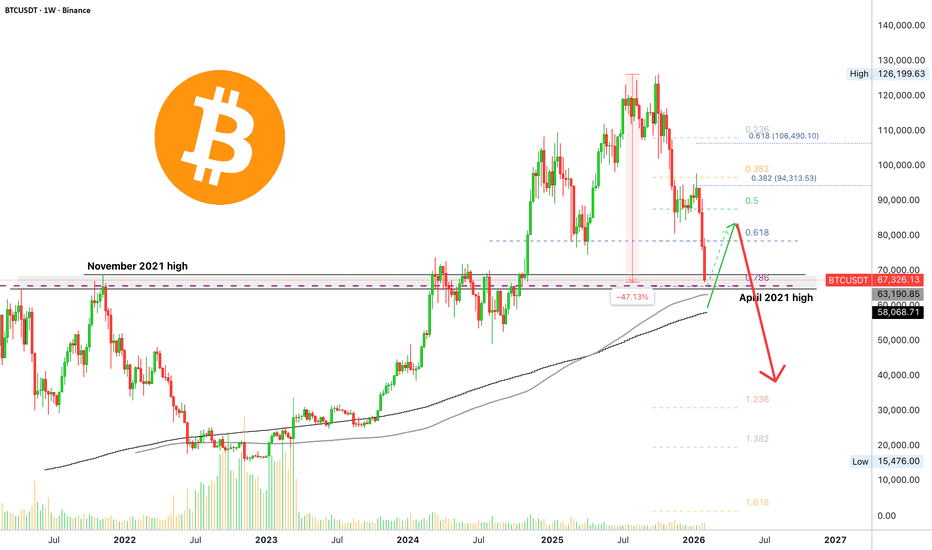

Bitcoin hits strongest long-term support —2021 ATH & 0.786 Fib.Bitcoin just hit its strongest support ever long-term, this is where the first reversal can happen.

The support level in question sits perfectly between the high from November and April 2021. It is happening right above EMA233 weekly and also the 0.786 Fib. retracement level in relation to Bitcoin's last major bullish wave—August 2024 through October 2025.

I mentioned this level yesterday at $65,000 but it is actually a range. 65K is only the 0.786 Fib. The range sits between $64,850 (can start at $63,200 if we count EMA233) to $69,000.

Bitcoin so far produced a low of $66,666, right in-between these two levels and below $70,000. A major bearish development.

The full size of the crash so far amounts to -47.13%. Time duration is 119 days. In 2018, Bitcoin produced a major low on the 5th of February. Here, anything goes.

If the current support range were to break a new support zone becomes active between $50,000 and $60,000 short-term. With $57,777 being a major level as shown here .

The bear market bottom can sit around $40,000. We still expect some sort of relief or pause before this level is reached. We still have until mid-February for wild shaky action on Bitcoin and the bigger projects. Many of the smaller projects are not duplicating what Bitcoin and Ether are doing. Those can be bought.

If we consider the $98,000 high as the end of the relief rally, and Bitcoin matches the same pattern as the 2022 bear market, then a major low can be reached around late March 2026. This is a different scenario to what we've been seeing, the one were straight down happens.

Namaste.

BTC TO 61K Keep Eyes on Bitcoin 👀👀🤑

BINANCE:BTCUSDT BTC Making a bearish flag on 1D frame

Just keep your Eyes on it

====================================

we will entry (short) After breakout the flag

Entry Level : 88k

Target 1 : 80K

Target 2 : 74k

Target 3 : 61K

SL: 98.25K

===================================

I think Bitcoin will be very bearish in 2026, and we will see prices below 60k! It looked like sci-fi a few weeks ago, but this idea of 60k Bitcoin seems to be real.

Make sure you Follow me to see the market from another angle ❤️🕊️👌

BITCOIN (BTC) — THE FALL HAS ONLY JUST BEGUN⚠️ THE GREAT BITCOIN REVERSAL — THE STORM NO ONE IS READY FOR ⚠️

For years, Bitcoin INDEX:BTCUSD climbed with the arrogance of a king convinced its throne was eternal.

But every empire falls.

And the chart…

The chart has been whispering the truth long before anyone wanted to hear it.

Today, that whisper has become a SCREAM. 📉⚡

🔥 1. The Final Wave Has Broken — and So Has the Illusion

The macro Wave 5 top is in.

Perfect confluence.

Perfect exhaustion.

Perfect euphoria.

The same pattern that ended EVERY Bitcoin mega-cycle… just printed again.

This wasn’t a top.

It was THE top.

The moment the bull cycle let out its final breath. 💀📈

🩸 2. Smart Money Has Already Left the Building

While retail celebrated “new highs,” Smart Money carved out:

• Stop hunts

• Liquidity grabs

• Breaker blocks

• Distribution ranges

• A devastating SOW

• And the cleanest market structure break BTC has shown since 2018

Institutions aren’t buying dips.

They are offloading the mountain .

The crowd doesn’t see it — yet.

⚡ 3. A Market Structure Collapse Echoing 2014, 2018 and 2021

Each cycle’s death began the same way:

A gentle pullback…

A sudden rejection…

Then a violent swing failure ,

followed by the HTF structure snapping in half.

That exact sequence is happening right now .

This is not a correction.

This is a cycle reset .

🎯 4. Fibonacci Retracements Don’t Lie — They Warn

Every true macro Wave 2 in history has returned to:

🔻 0.786

🔻 0.886

🔻 1.0 – 1.618 extensions

Where do they converge this time?

👇

🔮 $6,000 – $1,250

The forgotten land of 2017 mania…

A level BTC has avoided for 8 years.

But the cycle demands balance.

And balance always returns.

🌪️ 5. Price Action Has Flipped From Confidence to Panic

The candles have changed character:

• Weak closes

• Long tall wicks of rejection

• Failed rallies

• Imbalances breaking lower

• Bull traps everywhere

• A violent displacement to the downside

This isn’t cooling off.

This is unwinding.

📉 6. Market Cycle Psychology Has Entered Its Darkest Phase

We just exited Euphoria.

We are in Complacency.

Next comes:

😨 Anxiety

😱 Fear

💀 Capitulation

🔥 Anger

🌑 Depression

Only after that does a new accumulation begin.

And that’s why Wave 2 is infamous.

It destroys what Wave 1 built.

🚨 THE VERDICT: THE DOWNFALL IS IN MOTION — AND WE ARE EARLY

From $126K to $90K was not the crash.

It was merely the first spark in a forest full of dry leaves.

Wave A has barely begun.

Wave B will deceive.

Wave C will devastate.

The endgame target remains:

🎯 $1,250 – $6,000

The cycle reset.

The cleanse.

The opportunity of the decade — but only after the fire burns everything above it.

🔥 This is not fear. This is structure, math, psychology, liquidity, and time itself.

And all of them point in the same direction. Down, Down And Down

🔥 Follow this idea to stay ahead of the next macro move.

📈 We’ll update the chart as the structure unfolds — Wave A, Wave B trap, and the full Wave C capitulation zone.

💬 Drop your thoughts below — agree or disagree, the chart will decide.

🚀 Turn on notifications so you don’t miss the next critical breakdown.

⚠️ DISCLAIMER: This analysis is for educational and informational purposes only.

Not financial advice. Always manage risk and make decisions based on your own research and personal strategy.

#Bitcoin #BTC #Crypto #CryptoAnalysis #TradingView #BTCUSD #BearMarket #ElliottWave #SmartMoney #PriceAction #MarketCycle #Fibonacci #TechnicalAnalysis #CryptoCrash #CryptoWarning

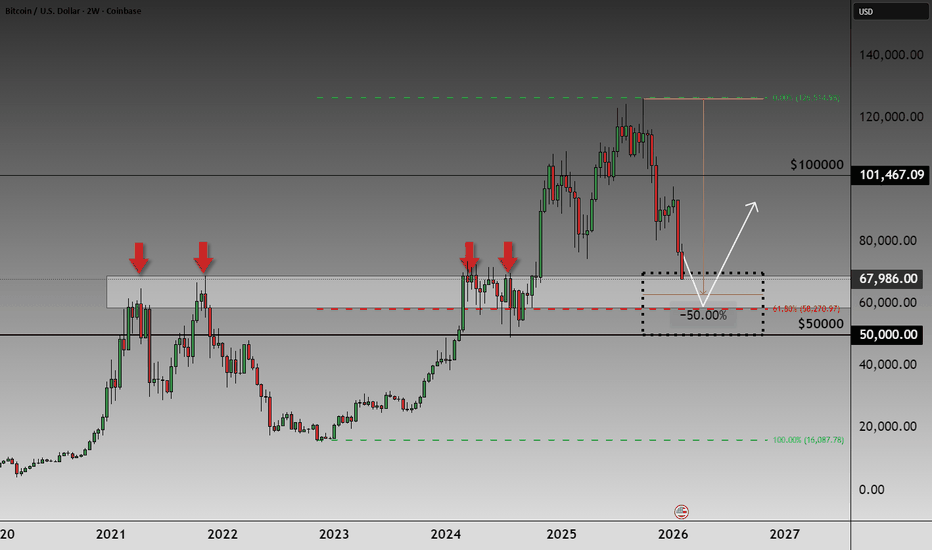

BITCOIN: The $50K–$70K Decision ZoneRemember this post 👇

Eight months ago, Bitcoin was trading just above the 100k area.

At the time, price action looked strong on the surface, but beneath it, there was unfinished business.

A "clear" inefficiency below the price.

A one-way move that hadn’t been properly filled.

Markets rarely like that.

They don’t rush, but they tend to revisit areas where participation was thin and emotions were one-sided.

Not because of narratives.

Because of the structure.

Today, the price is finally here.

Not via the road most people expected, including me, but exactly where technical logic said it could end up.

🔍 Why this Bitcoin zone matters to me

Price has arrived in a long-watched high-confluence area between $50,000–$70,000 - a zone built on multiple independent technical criteria:

1. Multiple prior yearly highs

Former resistance clustered in this range, now being revisited from above - acting as a potential support zone.

2. -50% drawdown from the all-time high

A level where excess optimism tends to reset and risk/reward begins to normalize. In crypto, this zone often becomes a meaningful liquidity "provider."

3. Psychological round number: $50,000

A level that matters not because it is magical, but because humans react to it... as seen clearly during 2024.

4. Weekly 200 moving average

A long-term trend reference widely respected by institutions and systematic players.

5. Fibonacci Golden Ratio (61.8%)

Currently measured from the last major upside move, from the end of 2022 to the 2025 all-time high, aligns perfectly with this zone.

----------------

This is not a buy-now signal.

Not a prediction.

Not a bottom call.

It’s a “pay attention” zone.

For me, this is where charts say:

Slow down. Reduce noise. Let structure take the lead.

It’s also the type of zone where I’m confident that my preparation makes sense.

The criteria I’ve waited for, and seen work repeatedly, are finally aligned.

Areas like this tend to do a few important things:

- They attract liquidity.

- They flush out panic.

- And they often mark the moment where control starts shifting from emotional sellers to participants who have a plan — and are ready to execute it.

If this area holds, it matters.

If it fails, that information matters just as much.

Either way, this is a range where I’m active, selective, and responsive... not impulsive, but not on the sidelines either.

Good luck,

Vaido

ONDO – Swing Trade Setup from Key Support ZoneONDO has now pulled back into a major support area between $0.25 and $0.29, a level that previously held as a strong demand zone. This presents a solid opportunity to ladder into a long swing trade, anticipating a potential move back toward higher resistance levels.

📈 Trade Plan:

Entry Zone: $0.25 – $0.29 (ladder entries)

Take Profit Targets:

TP1: $0.35 – $0.45

TP2: $0.55 – $0.68

Stop Loss: Just below $0.24

We're watching for confirmation from price action and volume at this zone. If momentum builds, ONDO could push back toward those higher resistance levels. A gradual scale-in approach helps manage risk while positioning for potential upside.

LINK – Retracement into Key Support | Long Spot SetupChainlink has retraced into a major support zone, offering a potential opportunity for a long spot position. This area ($8.50–$9.50) has held well in the past and could act as a base for the next leg up, especially if broader market sentiment improves.

🛠 Strategy Setup:

Entry (Ladder In): $8.50 – $9.50

Take Profit Targets:

TP1: $11.00 – $12.00

TP2: $13.00 – $14.00

Stop Loss: Below $8.00 (to manage downside risk)

The idea here is to accumulate gradually (laddering) within the support zone, not all at once. This helps manage timing risk and smooths out entry price. If bulls return, we could see a push toward key resistance clusters around $11–$14.

$BTC – Looking for the Panic Flush Before the LongCRYPTOCAP:BTC – All Key Supports Broken | Watching for a Seller Capitulation Wick

Bitcoin has officially broken all major support levels, and the $70K zone is the last big psychological area before things can get ugly fast. That said — this is exactly the kind of tape I wait for.

🔹 What I’m Seeing:

Supports have failed across multiple timeframes.

Liquidations are accelerating — forced selling, not orderly distribution.

Sentiment is awful across crypto — fear, frustration, and disbelief everywhere.

That’s not when you short.

That’s when you prepare.

🔹 What I’m Waiting For (Very Important):

I want a true flush day — heavy selling pressure, big red candle.

Ideally we get long downside wicks showing seller exhaustion.

That kind of candle often marks the end of forced selling.

🔹 Key Levels:

$70K: Psychological pivot, already cracked.

Low $60Ks: This would be roughly a 50% retracement, a very normal reset after a cycle run.

If we get there with panic + wick = that’s when I start paying attention.

🔹 My Game Plan:

I have not touched CRYPTOCAP:BTC in months — intentionally.

I’m now stalking it again, but I will not catch a falling knife.

I want to see capitulation first, then a remount before I step in long.

🔹 Why This Matters:

Big bottoms don’t form quietly — they form with emotion.

Extreme liquidations + horrible sentiment are prerequisites, not problems.

When everyone gives up, risk/reward finally flips.

Patience here matters more than prediction.

Let the sellers exhaust themselves — then we strike.

CIFR triangle in wave B has completed, per previousNASDAQ:CIFR has completed the triangle in wave B of 4 with thrust down in wave C, characteristic behaviour of wave Cs.

Triangle are patterns found before a terminal move suggesting we are nearing a bottom at the daily 200EMA, 0.236 Fibonacci retracement.

Safe trading

IREN Ready for lower $27.50Interestingly the same pattern as CRYPTOCAP:BTC which has been a leading indictor for some stock price action for some time, with stocks lagging.

Price appears to have completed wave B up, with yesterdays -17% drop.

Wave C of 4 is underway with an initial target of the 0.382 Fibonacci retracement, right at the S2 pivot and High Volume Node $27.50. The 1:1 of wave A to B.

Safe trading

TradeCityPro | Bitcoin Daily Analysis #260Welcome to TradeCity Pro!

Let’s move on to Bitcoin analysis. The market is in a very sharp downtrend, and we can take advantage of this move to look for short opportunities.

1-Hour Timeframe

As you can see on the 1-hour chart, Bitcoin’s trend is clearly bearish, and yesterday, with the break of 72,996, the next bearish leg officially started.

The RSI oscillator is hovering near the oversold zone and has already found support around the 30 level multiple times. A move of RSI into oversold territory is a strong momentum trigger for short positions.

If you already have an open position, an RSI move into oversold could push your trade into strong profit. However, if you haven’t taken profits yet, I strongly recommend doing so—this bearish wave has already extended quite a lot, and the market could enter a corrective phase at any time.

At the moment, we don’t have a new trigger for opening additional short positions. We need to wait for the market to build more structure before the next short trigger forms.

For long positions, it’s still far too early to consider them. The market is currently bearish, and conditions are not suitable for longs.

If this bearish leg continues, the next support level to watch is 67,735, where Bitcoin could potentially show a reaction.

BTC triple major supportSET:BTS has arrived at the weekly 200EMA, S1 weekly pivot and major High Volume Node on weekly RSI oversold. Weekly bearish divergence has now played out. Price could go lower but this s High probability major bottom area. Wave 4 is likely to finish around the .382 Fibopnacci retracement form the 2022 bottom to 125k.

This has only ever happened 3 times with a 500%+ rally afterwards.

Sentiment is the worst it ever been for the longest at extreme fear, 11.

Safe trading

Bitcoin Daily Accumulation: Short‑Term Buy Bias Backed by Macro Bitcoin has sharply corrected from its 2025 highs and is now pulling back on the daily chart, but several fundamental drivers still favour a short‑term bullish bias.

Strong net inflows into spot Bitcoin ETFs at the start of 2026 signal renewed institutional demand and a reversal of the ETF outflows seen late last year, easing structural selling pressure.

With the Fed shifting to a more neutral stance on rates and Bitcoin trading in a fearful sentiment zone after the drop below the 75,000 area, the post‑halving environment of slower new supply continues to support dip‑buying interest.

I’m looking at BTC as a daily‑timeframe buy while price holds key support and ETF flows remain positive, targeting a grind back toward major resistance and psychological levels, with invalidation on a decisive daily close below the latest swing low and a clear deterioration in ETF inflows.

Full Reset before Full SendWhy March 2025 Could See New Highs

What's Happening Right Now?

Everyone is freaking out right now, but this is actually creating one of the best buying opportunities we've seen. Bitcoin is trading around $95,600 after dropping about 24% from its peak of $126,000 in October.

The Fear & Greed Index is at 10 (Extreme Fear) – and you know what they say? Be greedy when others are fearful. But, also, be patient and set limits.

The thing is, most people don't understand the economics behind Bitcoin or how liquidity actually works in crypto markets. We're playing a completely different game than stocks here.

The Real Cost to Mine Bitcoin (And Why It Matters)

Here's where it gets interesting. The big mining operations are producing Bitcoin for around $26,000-$28,000 per coin, while less efficient miners saw costs spike to $114,842 in October 2025... That's a massive range, and it tells you everything about where the floor is.

After the April 2024 halving, it now takes 854,400 kilowatt-hours to mine just one Bitcoin – that's about 81 years of electricity for an average home, just for one coin. That's a fun fact.

No smart miner is going to sell at a loss when they're paying that much for electricity and equipment (GPUs, etc). They'll just hold and wait. This creates natural supply constraints.

The Liquidity Trap

Right now, the market is in what I call a liquidity trap. As Bitcoin crashed from $126K down to where we are now, all the leveraged traders got wiped out. We saw $870 million in Bitcoin ETF outflows in a single day – that's both panic selling and intelligent, planned shorting, not fundamental weakness.

Here's what most people are missing: if Bitcoin drops to around $75K, it's going to unlock massive amounts of liquidity – I'm talking hundreds of millions, possibly billions of dollars that's currently locked up in long positions (Futures).

When those long get liquidated, the shorts will likely reverse their positions, that money floods back into the market and creates a supply shock. Basic economics: limited supply + sudden demand increase = price explosion.

Price Targets & When to Buy

I think we'll see $89K very soon – possibly this week between Monday and Wednesday (November 17-19, 2025). But here's my recommended strategy instead of trying to catch the exact bottom:

First Buy: $89K

Put in about 30% of what you're planning to invest. This is still a good entry even though it's not the absolute bottom.

Second Buy: $80K

Another 35% here. This is where things get really interesting from a risk/reward perspective.

Third Buy: $75K

The final 35%. This is the sweet spot where all that trapped liquidity gets released. Remember, demand increases as the price drops, and miners won't sell below cost. That's your supply shock waiting to happen.

What About MicroStrategy?

MSTR has crashed about 40% and is now trading at only 1.06 times its Bitcoin holdings, down from 2.7 times. The stock is around $200-$237 now, way down from its November 2024 high of $543.

My prediction: MSTR will probably hit the $140-$150 range, maybe even drop to $100-$120 (which is where it found strong support from March to September 2024). If we do see those lower prices, I'm going all-in on

MSTX

shares, not

MSTR

– the 2x leverage structure is better.

The Macro Picture

Fed rate cut expectations dropped from 90% to about 40%, which is why everything's selling off. But this is temporary sentiment, not permanent damage. The infrastructure is still being built, institutions are still coming in, and the fundamentals haven't changed.

Bottom Line

Be patient. Wait for the dips. Bitcoin will likely hit $89K this week, and from there we could see further drops to $80K and $75K. Each level is a buying opportunity. By March 2025, I expect we'll be making new all-time highs.

The key is understanding that crypto operates on different rules than stocks. Liquidity and supply dynamics matter more than anything else right now.

Good luck,

Terrapins

Could $BTC Slip Below 60k?I’m flat for now and mainly watching the CRYPTOCAP:USDT dominance chart.

If USDT.D continues to grind higher and retests the 8.2–8.5% zone, that usually lines up with risk-off flows sticking around. In that case, it wouldn’t be surprising to see CRYPTOCAP:BTC drift lower and test the 64k-57k area before any meaningful stabilization.

For now, this still looks like a patience game — letting dominance show its hand before committing again.

Are we due for a relief bounce on Bitcoin soon?After the ~22% drop I mentioned earlier, could Bitcoin see a relief bounce this weekend toward the 78,000 range? Indicators are already showing bullish divergence.

The question is whether this would be a dead-cat bounce before another leg down or a potential double bottom. A clean break above 78,000 could also open the door for further upside.

Bitcoin BTC Hits Major Support: Why I Am Not Selling YetIs the Bitcoin sell-off going to grind to a halt? Or are we just catching our breath before the next leg down? In this session, we break down the aggressive price action that has pushed BTC into a high-confluence support zone and why patience is your most profitable tool right now. 📉

As we approach the weekly close, the market structure remains bearish, but entering a short at these lows carries significant expansion risk. I am walking you through my technical bias, explaining why I’m avoiding "chasing the move" and instead waiting for a high-probability pullback into the 61.8% Fibonacci retracement level.

What we cover in today’s analysis:

Market Structure: Identifying the recent impulse leg and key support levels.

Fibonacci Confluence: Why the 61.8 zone is the "Golden Mean" for this short setup.

Risk Management: Why the end-of-week liquidity makes new entries dangerous.

Execution Strategy: The specific price action confirmations I need to see before clicking sell. 📊

Whether you are a swing trader or a scalper, understanding this higher-timeframe context is vital for protecting your capital. Stay disciplined and wait for the setup to come to you. 🔥

RISK DISCLAIMER: Trading foreign exchange, cryptocurrencies, and indices on margin carries a high level of risk and may not be suitable for all investors. The content in this video is for educational purposes only and does not constitute financial advice. Past performance is not indicative of future results.