BTC/USDT 1H Chart Review🔍 Market Structure

• Price is in an ascending channel (higher lows, higher highs).

• Currently, we are in the middle of the channel, after a rejection from above.

⸻

📉 Price Action

• 90,500–90,800 → strong resistance (upper zone + previous rejections).

• The last upward impulse has been reversed, but without breaking the structure.

• Retracement candles are relatively short → no aggressive supply.

⸻

🧱 Key Levels

Resistance:

• 90,500 – local high / reactions

• 91,600 – upper band of the channel (target at breakout)

Support:

• 88,650 – key mid-support (very important decision level)

• 87,400 – lower band of the channel (must hold for bulls)

⸻

📊 RSI Stochastic

• RSI Stochastic in the oversold zone (<20)

• This is a signal for a potential bounce, but:

• candle confirmation needed (e.g., bullish engulfing / higher low)

⸻

🧠 Scenarios

🟢 Baseline Scenario (more likely)

• Defense at 88,600

• Rebound up the channel

• Test at 90,500

• On breakout → 91 600

👉 Typical buy-the-dip setup

⸻

🔴 Negative scenario

• 1H close below 88,600

• Quick move to 87,400

• Loss of 87,400 = structure changes to corrective

Btc-e

ETH — Price Slice. Capital Sector. 3162.75 BPC 6.9© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 29.01.2026

🏷 3162.75 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 6.9

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

Bitcoin Loves Bulls Right Now… Until This HappensYello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

The "V-Recovery" Logic: Why DCA Targets Move Faster Than Price

Most traders think they need a full V-recovery to get back to break-even. They don't. By the time a 15% drop hits the 5th Safety Order, your average price is already halfway down the cliff.

This visual guide shows the math of the 'Pivot Point'. You don't need the price to return to your entry; you only need a 3-5% bounce to exit the entire position in profit. Stop trading with hope, start trading with a ladder.

BTC 1W Update: Leaning bullishBitcoin continues to lean bullish from a higher-timeframe perspective, even after all the recent volatility.

What the weekly is telling us:

• Price held trend support and respected the rising structure

• BTC is consolidating above the mid-range, not below it

• Repeated acceptance around this zone shows buyers defending value

• Momentum is compressing, which often precedes expansion

The key difference now versus earlier selloffs is where price is stabilizing. Instead of rolling over, BTC is building a base while holding higher lows. That’s constructive behavior, especially within a broader range.

As long as:

• Trend support holds

• Price remains accepted above the mid-range

The bias stays upward, with the range highs back in play. This doesn’t mean straight up – chop and fakeouts are part of the process – but structurally, BTC is acting like a market preparing for continuation, not failure.

Let price do the work. Bullish lean, patient execution.

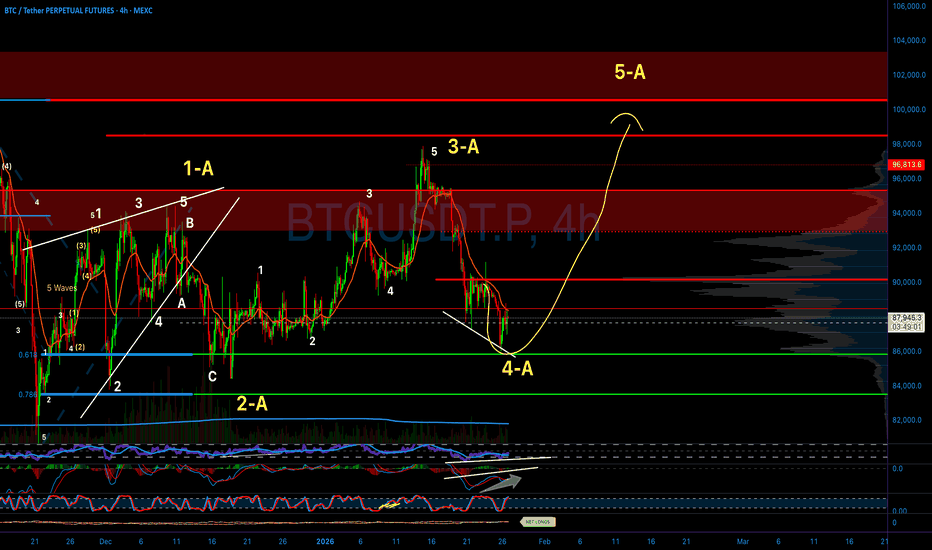

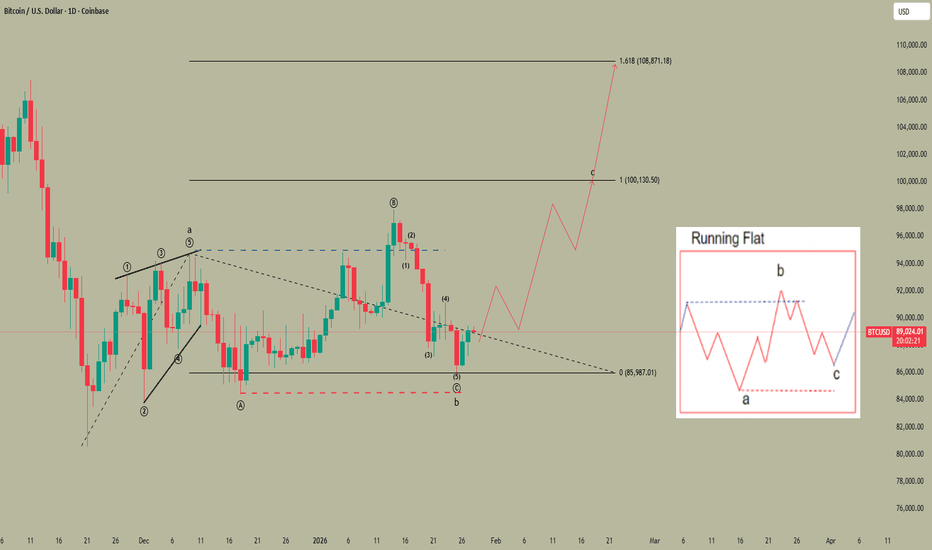

BTC: The Chart Designed to Wreck You (102k Incoming?)This current correction is extremely deceptive. I have re-labeled this chart more than 8 times, and this is arguably one of the trickiest price actions I’ve seen in my trading experience.

I am sharing this strictly for educational purposes only.

Honestly, trading a complex correction like this is reckless. I see people calling "longs" just because the correction is technically an uptrend or because of some EMA signal— Trading the direction of a correction drastically lowers your win rate compared to trading the main trend. This price action is designed to liquidate reckless and inexperienced people—you won't see it coming.

The structure might be shaping up as a Expanding Triangle to complete a W-X-Y correction.

* **W:** Zigzag

* **X:**

* **Y:** Expanding Triangle (Current)

Unlike standard triangles that contract, this structure shows increasing volatility. In these specific "Expanding" setups, the final Wave E often exhibits a blow-off top expanding significantly in price.

Potential Target:

If the "blow-off" play out, we could see a thrust toward **98,000 – 102,000**

Critical Levels & Invalidation:

- Watch **87,777**. If this level breaks, assume Wave D is extending.

* **Invalidation:** If **84,398** is broken, then this entire triangle idea is invalid.

* **C-5 Confirmation:** If the **80,604** is lost, it confirms C-5 is underway.

LINK Break & Retest SetupWe're closely watching Chainlink (LINK) as it approaches the critical $12.00 resistance zone. This level has capped price action multiple times, and a confirmed breakout with a successful retest could signal the start of a fresh bullish leg.

📈 Trade Plan

We'll be entering a long spot position on the break and retest of $12.00. Patience is key—confirmation is everything in this kind of setup.

🎯 Targets:

• TP1: $13.00 – $14.50

• TP2: $16.00 – $17.00

🔻 Stop Loss: Just below $11.35

This setup aligns with classic breakout-retest price action and will be monitored closely over the coming sessions.

BITCOIN IS ABOUT TO PENETRATE BEARS!!!!!? (hard)Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

DCA Target Drag: Why You Don't Need a Full Recovery

One of the biggest misconceptions in trading is that if you buy an asset at $100 and it drops to $80, you need it to go back to $100 to break even. In a DCA (Dollar Cost Averaging) system, every Safety Order (SO) 'drags' your Take Profit (TP) target closer to the current price.

Using the OrangePulse LITE visual framework, we can see exactly how this works. By adding volume at lower levels, your average price drops significantly. The bot automatically recalculates the new TP line based on the updated average. This means a minor 5% relief bounce can exit a trade that is currently 15% in drawdown.

Conclusion: Success in DCA isn't about picking the bottom; it's about the speed of the target adjustment. Math > Predictions.

XAUUSD (1H, chart pattern)...XAUUSD (1H, chart pattern).

bullish structure is still intact 💛📈

Here’s the clean target based on what i’ve drawn.

🎯 Targets (bullish continuation)

TP1: 5,080 – 5,090

→ Recent highs / minor resistance

TP2 (main target): 5,190 – 5,210

→ Measured move from the trendline + breakout projection

(this matches my vertical “target point” perfectly)

🧠 Why this works

Clear higher highs & higher lows

Price respecting the ascending trendline

Pullback held above support → continuation setup

Ichimoku cloud below price = bullish bias stays valid

❌ Invalidation

1H close below 5,040

Clean break and hold under the trendline

🧭 Bias

Best play: buy pullbacks

Chasing buys only makes sense after a clean break above 5,080

If i want, send:

My entry price

Scalping or swing.

BITCOIN isn't diverging from 2022 at all!Bitcoin (BTCUSD) continues to replicate the 2022 Bear Cycle almost in the exact same fashion. This is of course a concept we introduced back in October for the first time and so far it has fulfilled all conditions set in its way.

The most recent is the 1D MA100 (green trend-line) rejection, which in 2022 happened on March 02 and after another Support test, BTC rebounded for the final rejection on the 1D MA200 (orange trend-line). As mentioned before, that could be around $100k.

Assuming the 2026 Bear Cycle continues to repeat the 2022 price action, the next Support level should be around $70k, then $51-52k and finally around $45000.

So do you think it will unfold like 2022? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin at Key Support – Correction Complete or Another Drop!?Bitcoin( BINANCE:BTCUSDT ) has continued its correction in recent days due to the following key reasons:

1. U.S. Government Shutdown Risk: Political deadlock over the federal budget deadline (January 30) has triggered a "risk-off" sentiment in global markets, pushing investors away from volatile assets like Bitcoin.

2. Trade Tensions and Tariff Threats: Trump's threats of 100% tariffs on Canadian imports have strengthened the U.S. dollar ( TVC:DXY DXY), acting as a headwind for Bitcoin and contributing to broader market declines.

3. ETF Outflows and Market Fundamentals: Net outflows of about $6.1B from Bitcoin spot ETFs over the past three months, combined with on-chain realized losses for holders and leveraged position liquidations, have intensified selling pressure.

4. Geopolitical Tensions in the Middle East: Escalating conflicts, including risks around Iran and oil( FX_IDC:USDBRO ) supply disruptions, have amplified global uncertainty and risk aversion, leading to further sell-offs in cryptocurrencies as investors seek safer assets.

Let’s dive into the technical analysis of Bitcoin on the 1-hour timeframe to see how it’s performing. Stay tuned!

As I expected in the previous idea , Bitcoin followed the anticipated bullish and bearish movements, reaching its targets (Targets Done).

Currently, Bitcoin is moving near a support zone($86,420-$83,820) and has also created a new CME Gap($89,205-$88,385) with the start of this trading week.

From an Elliott Wave perspective, it appears that Bitcoin has completed its main wave 5 near the support zone($86,420-$83,820) and support line, so we can now expect a corrective wave.

Additionally, we can observe a negative Regular Divergence (RD-) between two consecutive valleys.

I expect that after a correction, Bitcoin will resume its upward movement and potentially reach the first target of $88,667. With strong bullish momentum, we could see Bitcoin move even higher in the short term.

Note: Bitcoin, like other dollar-denominated assets, is influenced by various factors, including political statements and news. Therefore, it’s crucial to manage risk carefully and stay prepared for any scenario. Make sure to keep an eye on updates.

I’d love to hear your thoughts on Bitcoin. Do you think the downward trend will persist, and how far do you expect it to drop?

First Target: $88,667

Second Target: $89,401

Third Target: $90,231

Stop Loss(SL): $85,527(Worst)

Cumulative Long Liquidation Leverage: $86,450-$85,600

Cumulative Short Liquidation Leverage: $88,890-$88,400

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

BTC recovery - above 90kBTC Daily (D1) – Short Analysis

Bitcoin is in a corrective phase after being rejected from the 95,000–96,000 resistance zone.

Price is trading below the daily EMAs (34/89/200) → EMAs now act as resistance.

Market structure shows a lower high, keeping the short-term bias bearish to neutral.

Key Levels

Support: 88,500 – 89,000

→ Breakdown may lead to 86,000 – 85,500

Resistance: 91,300 – 92,000

→ Stronger resistance at 93,800 – 95,300

Bias

Below 92K: bearish / consolidation

Daily close above 93.8K: bullish recovery toward 96K+

Conclusion: BTC is at a decision zone. The next daily breakout will define the next major move.

Coinranger|BTCUSDT. Potential reversal to 90930🔹Fed rates at 22:00 UTC+ 3, FOMC press conference at 22:30 UTC+ 3. We can fly on this news.

🔹US earnings season is in full swing.

🔥BTC

🔹Still holding towards 89840:

1️⃣ The main upper level has been clarified at 89840. Above that are 90930 and 92930, but these are just worth keeping in mind for now. This is a complete set of upside waves.

2️⃣ Below, the important 88,500 level is actual and 85,000 and 84,700 lower are still relevant.

Until the rate issue, bitcoin may be trading in a micro-flat of 89,840 - 88,500. There's a chance afterward of a move higher to 90,930.

---------------

Share your thoughts in the comments!

Bitcoin versus Gold 3DAY Chart almost at support!Bitcoin/Gold on 3DAY timeframe is approaching key support at the 1.272 fib extension level, which is also a bullish butterfly harmonic target. Very likely we see some kind of bounce at least in the short term, with potential for a massive reversal to new highs for BTC against Gold coming if the harmonic pattern plays out.

Bitcoin Isn’t Trending — It’s CompressingBITSTAMP:BTCUSD is not in a clean trend right now. Instead, price is rotating inside a tight range, signaling compression rather than weakness after the recent liquidity sweep. Price is currently trapped inside a sideways structure between 89,700 and 90,250, with the EMA cluster flattening. This loss of slope confirms that momentum has paused, and the market has transitioned from expansion into range acceptance.

🧠 Market Structure & Liquidity

The breakdown below support earlier was not a trend continuation it was a liquidity grab. Once sell-side liquidity was cleared, price quickly reclaimed the prior support zone, trapping late shorts.

Since that reclaim:

- Higher lows are forming from the 87,800–88,400 demand zone

- Pullbacks are shallow and overlapping

- Buyers are defending aggressively, but not chasing price higher yet

This behavior is typical of institutional accumulation, not distribution.

🟩 Key Levels to Watch

Demand / Support: 87,800 – 88,400

Range Mid / Pivot: 88,800 – 89,000

Range High / Resistance: 89,700 – 90,250

📈 Primary Scenarios

Bullish Continuation (Preferred):

Price holds above demand and the rising short-term trendline

A clean H1 close above 89,700

Targets:

Target 1: 90,250

Target 2: 91,000

Extension toward higher liquidity zones if momentum expands

Bearish Invalidation:

H1 close below 87,800

Demand fails → structure breaks

Downside targets:

86,500 – 85,800 (next liquidity pool)

🌍 Macro Context

Market volatility remains compressed as traders wait for macro catalysts (Fed guidance, inflation data, ETF flows)

No strong macro impulse favors immediate expansion

This environment supports range-building and positioning, not impulsive breakouts

✅Conclusion

Bitcoin is not bearish it is coiling.

The real move begins after the range resolves, not inside it.

Trade the breakout, not the noise.

$BTC – Midweek OutlookCRYPTOCAP:BTC is currently trading around 89.2k, filling the CME gap near 89.3k.

From the weekend outlook, our longs were filled on the deviation into 86k. LTF structure remains intact, with price continuing to print higher lows. As long as 88.5k holds, a push into 90.6k is still on the table. If momentum sustains, upside extension toward 91.8k–92.6k remains the primary target zone.

Expect high volatility today coming into FOMC, with potential for sharp wicks and fakeouts around key levels.

BTCUSD: Building Energy Between Demand and ResistanceBitcoin is currently compressing after a sharp sell off, holding firmly above a well-defined demand zone, while price continues to form higher lows into a descending EMA. This structure signals absorption and accumulation, not panic selling. Sellers are failing to push price back into demand, while buyers are stepping in earlier on each dip a classic sign of pressure building before expansion.

Technically, this is a range-recovery structure: liquidity has already been taken below, and the market is now rotating to decide whether it can reclaim the EMA and attack the higher-timeframe resistance zone. From a macro perspective, Bitcoin remains supported by expectations of looser financial conditions ahead and persistent institutional interest on dips. Until demand is lost with acceptance, the higher-probability path remains upward continuation toward resistance, not a trend reversal.

ETHUSD: Grinding Higher to Hunt Liquidity Above Three ThousandEthereum just printed a classic post-liquidation recovery, and the structure tells a very clear story: after the sharp sell-off into the major support zone around 2,780–2,800, price rebounded aggressively and transitioned into a tight ascending channel, printing higher lows with controlled pullbacks. this is not impulsive euphoria, it’s acceptance and absorption. Notice how every dip holds above the rising trendline while price coils under the key resistance zone near 2,980–3,000, right where the EMA 89 is flattening that’s a textbook compression before expansion. From a trader’s logic perspective, this is a liquidity-building phase: shorts are getting uncomfortable below resistance, while late longs are forced to chase strength. Macro adds fuel here — stable risk sentiment, ETH ETF inflow expectations, and relative strength vs BTC keep downside limited as long as the broader market doesn’t flip risk-off. The play is simple and disciplined: as long as ETH holds above the rising structure, a breakout and acceptance above 3,000 opens the door toward the next upside leg, while failure and a clean loss of the channel would signal a deeper mean reversion back toward the lower demand. Until proven otherwise, this is controlled bullish continuation not distribution.

BTCUSD H1 — Support Held, Structure Is RebuildingBitcoin has cleanly defended the 87,200–87,500 support zone after a sharp sell-off, printing a sequence of higher lows that signals short-term structural repair. Price is now grinding higher along a rising trendline, but remains below the declining EMA 98, meaning this move is still corrective until proven otherwise. The key near-term test sits at 88,800–89,000 — a local lower-high resistance and dynamic EMA confluence. A confirmed reclaim and hold above this level would open the path toward 89,700 → 91,000, aligning with prior liquidity and range highs. However, failure to hold the rising trendline or a breakdown back below 87,200 would invalidate the bullish recovery and expose downside toward the 86,000 liquidity pocket.

⚠️ This is not a breakout yet. BTC is deciding whether this bounce becomes continuation or just a relief rally.

BTCUSDT (Weekly) – Long-term Chart Update. BTCUSDT (Weekly) – Long-term Chart Update.

BTC is still inside a rising channel (higher highs & higher lows intact).

Price is holding the lower trendline support of the channel — a key bullish area.

The weekly MA (~87.5k) is acting as dynamic support.

Current price: ~88.7k

This is a make-or-break support region.

As long as weekly closes stay above the lower channel + MA, the bullish structure remains valid.

Consolidation above 85k–90k.

100k psychological-

120k–125k (channel mid/upper area)

Extended cycle target 140k–150k+ (as projected)

Weekly close below ~85k.

Break of channel support → deeper correction toward 75k–70k.

short-term consolidation

Buy the dip mindset while structure holds.