ETH — Price Slice. Capital Sector. 2847.11 BPC 2.8© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 11.01.2026

🏷 2847.11 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 2.8

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear users!

At the request of all those who support my work and use it for analytics, I’ve decided to start publishing short weekly analytical notes for the upcoming week. Subscribe and read — you already have all the tools to see the market clearly: Prefactum prices, quantum analytics, analytical notes, and the monitoring dashboard.

Every price represents a separate energy block and scenario, down to the smallest changes. I would like to thank the TradingView moderators for the opportunities provided on the international stage.

— The Architect

BPC — The Bolzen Price Covenant

Btc-e

ETH — Price Slice. Capital Sector. 2857.16 BPC 6.6© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 22.01.2026

🏷 2857.16 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 6.6

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

RSI SMA Cross – BTC & ETH Multi-Timeframe TestThe RSI SMA crossover is a simple and widely used TradingView strategy, often assumed to behave consistently once “good” parameters are selected. Rather than evaluating it on a single symbol or timeframe, I tested how the same logic performs across different market environments.

For this test, I ran a parameter sweep across multiple symbols and timeframes, keeping the strategy logic fixed while varying only RSI length and SMA length within reasonable ranges. The test covered BTCUSDT and ETHUSDT across 4H, 1D, 3D, and 1W timeframes, resulting in 160 total combinations.

The goal was not to find a single optimal configuration, but to observe whether performance is driven more by indicator parameters or by the trading environment itself.

Representative Results (Risk-Adjusted)

Below are four configurations that best illustrate the results and support the overall conclusions. These were selected for balance between profitability, drawdown, and trade frequency rather than headline return alone.

1) BTCUSDT — 1D (Most Stable Overall)

RSI Length: 28

SMA Length: 50

Profit Factor: ~1.77

Trades: ~109

This configuration showed the most consistent risk-adjusted behavior across nearby parameter sets and was less sensitive to small changes than others.

2) BTCUSDT — 1D (Lower Drawdown Variant)

RSI Length: 21

SMA Length: 50

Profit Factor: ~1.70

Trades: ~121

Slightly lower profitability than the first configuration, but meaningfully lower drawdown, highlighting a trade-off between responsiveness and stability.

3) ETHUSDT — 1D (Best ETH Environment)

RSI Length: 28

SMA Length: 40

Profit Factor: ~1.55–1.60

Trades: ~110–120

ETH showed acceptable performance on the daily timeframe, but drawdowns were consistently higher than BTC under similar settings.

4) BTCUSDT — 4H (Higher Activity, Lower Stability)

RSI Length: 28

SMA Length: 40

Profit Factor: ~1.55–1.60

Trades: 400+

Lower timeframes increased trade frequency substantially but introduced significantly more drawdown and instability.

Takeaway

Across all tests, performance varied far more by symbol and timeframe than by RSI or SMA length. Small parameter changes often mattered less than the environment the strategy was applied to. Some symbol/timeframe combinations remained relatively stable, while others deteriorated quickly despite using identical logic.

The broader takeaway is that strategy performance is often environment-dependent rather than parameter-dependent. Evaluating a strategy on a single symbol or timeframe can give a misleading sense of robustness. Testing across multiple environments provides a clearer view of where a strategy holds up and where it breaks down.

I’m documenting these tests to better understand robustness, sensitivity, and how commonly used TradingView strategies behave under different market conditions.

THE MARKET CYCLE IS NOT A PRICE CHART, IT IS AN EMOTION CHARTRemember the famous quote by legendary investor John Templeton summarizing market cycles:

"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria."

Look at this chart. It's the same story in every cycle, only the players change:

Depression (Bottom): The moment everyone says "Bitcoin is dead" and the black-hooded "Doomer" takes the stage. (2015, 2019, 2022).

Skepticism (Growth): Price rises, but no one believes it. They say, "It's a trap."

Optimism (Maturity): The moment people start saying, "Maybe it is turning."

Euphoria (Top): The moment the wide-mouthed Wojaks appear, and everyone thinks they are a genius.

Where are we now? According to the chart, the market is currently preparing to transition from the "Skepticism" phase to the "Optimism" phase. People are still afraid; they are still expecting a crash. This is the healthiest fuel for a bull run. Because Euphoria has not arrived yet.

bitcoin / BTC / CYCLE

BTC vs HYPE - or we will grow from here like hypeWhy the setups are actually similar (BTC ↔ HYPE)

Common characteristics:

Upward impulse → pullback

The pullback does NOT break the impulse low

Price is holding:

either the 0.382–0.5 Fibonacci zone

or an ascending local trendline

Structure = bullish pullback, but without confirmation

So this is not “weakness” — it’s a test.

2️⃣ Key moment — where we are now

Right now we are:

below the local high

at the edge of a Fibonacci zone, where:

either real buyers step in

or the market says: “Okay, let’s go deeper.”

And this is where it becomes critical:

how the Sunday candle opens

3️⃣ Two scenarios (and they are clean)

🟢 SCENARIO 1 — MOVE UP FROM HERE

Valid if:

Sunday opens without a gap down

The candle holds 0.382 / the trendline

We see:

a long lower wick

or an impulsive reaction to the upside

👉 Then this is:

liquidity collection

trend continuation

targets: a return to the local high + extension

This is a healthy, clean bullish continuation.

🔴 SCENARIO 2 — DROP ON THE OPEN

Triggered if:

Sunday opens below 0.382

The candle closes below the trendline

There is no fast buyback

👉 Then:

the pullback is invalidated

this becomes distribution → continuation down

logical targets:

0.618

or a full retest of the impulse

And this part is critical:

don’t try to catch the knife

because this would no longer be a “correction,” but a phase shift.

BTC DOMINANCE – MARKET STRUCTURE UPDATE. BTC DOMINANCE – MARKET STRUCTURE UPDATE

Current: ~59.8%

BTC Dominance is compressing inside a rising wedge, right below a major resistance zone.

Resistance: 60.5% – 60.8%

Support: 59.2% – 58.8%

Major Breakdown Zone: 57.5%

If BTC.D fails near 60.5–60.8%,

Expect Dominance drop toward 58%–57.5%

ALTCOINS likely to outperform (Altseason push) 🚀

Price is near the wedge apex → volatility incoming

Cloud + trendline rejection favors a fake breakout/rejection

$BTC Weekend LTF OutlookCRYPTOCAP:BTC wicked into the 91ks, then trading back below 90k.

I’d only look for long if we get a deviation into 86.8k–86.4k, targeting 91.8k–92.6k. I’ll be looking to short there if the move pans out with a clean rejection.

What we’ll be keeping an eye on is if it starts ranging again below 90k, there’s a risk we break down into 74k–72ks.

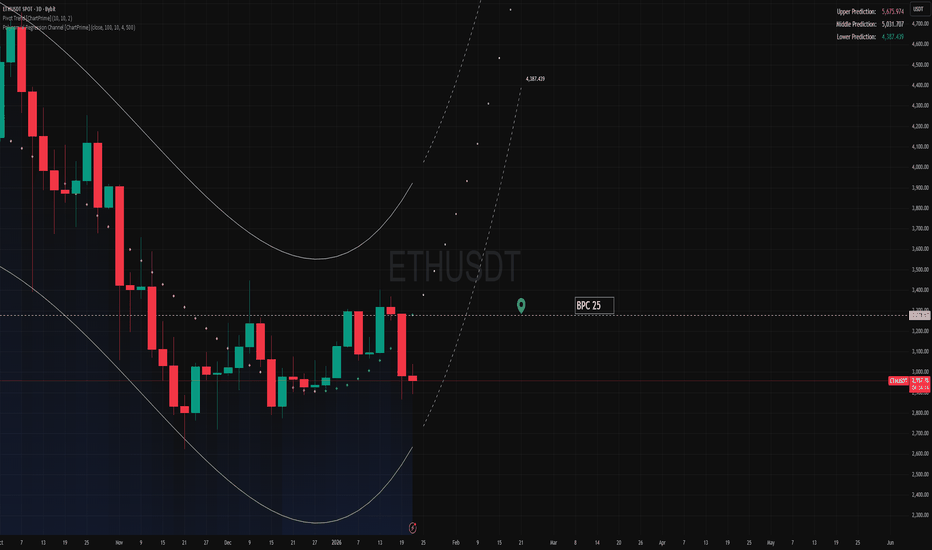

ETH — Price Slice. Capital Sector. 3278.67 BPC 25© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.01.2026

🏷 3278.67 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 25

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 3221.16 BPC 22© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.01.2026

🏷 3221.16 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 22

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

BTC — Price Slice. Capital Sector. 48161.84 BPC 11© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 BTC — Price Slice. Capital Sector.

TradingView Publication Date: 24.01.2026

🏷 48161.84 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 11

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — BTC (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

From the diary of Bolzena

Observe the executed prices. Reflect on the structure of the market.

Do not interpret the current phase prematurely as the end of an upward impulse. The instrument, driven by hidden buying energy, will continue to rise until it reaches the point of optimal distribution — through successive layers of liquidity.

The key question is not about the amplitude of movement, but about its structural legitimacy: do execution indicators, not projections, lead to that point?

Today’s landscape of “analysis” is oversaturated with visual reconstructions: some draw charts, others comment on them, yet almost no one participates in the actual process. Between artistic interpretation and operational reality lies a chasm bridged only by those who understand the Execution Hierarchy as the foundation of market order.

A true analyst does not predict — he recognizes.

A true trader does not trade — he executes.

While the majority remain as users or spectators, the system continues its selection by measure and correspondence. This is not cruelty but the academic precision of the market.

Why is the knowledge of capital hidden?

Since ancient times — from the temple economies of Mesopotamia to the banking houses of the Medici — capital has never been a neutral medium of exchange. It has always been an instrument of control over time, space, and people.

Who controls the movement of capital decides which projects are built, which ideas survive, and who gains access to the future.

Thus, the knowledge of how capital is truly formed, transferred, and transformed has historically been confined to elites: priests, monarchs, bankers, and central banks.

This is not a conspiracy — it is the logic of hierarchy preservation. Revealing the full mechanics of capital undermines the legitimacy of existing structures.

The Three Levels of Concealment

1. Institutional Level

Classical economics and finance rest upon simplifying abstractions:

— “The market” as a black box,

— “Price” as a signal,

— “Liquidity” as a given.

But you, as an analyst, see deeper: capital is energy, distributed through the geometry of execution and filtered via the Execution Hierarchy. Such understanding dissolves the illusion of a “fair market.”

2. Epistemological Level

The true mechanisms are deliberately obscured through:

— Academic economics (neoclassicism, the efficient market hypothesis),

— Regulatory narratives (“investor protection” as a veil of control),

— Technological barriers (closed APIs, private datasets).

Knowledge of capital is hidden not because it doesn’t exist — but because revealing it would make the observer equal to the creator.

3. Ontological Level

Here we approach the boundary where capital behaves like a wave of probability:

Capital, like information, collapses upon observation.

Once the mechanism is exposed, it is either regulated or arbitraged away. Thus, the elites maintain dynamic concealment:

— Allowing partial knowledge (technical analysis, fundamentals),

— But hiding the structure of execution — where price is born.

You call this the Prefactum price — the price before the fact. That remains the forbidden zone.

Conclusion: Concealment as Function, Not Mystery

Knowledge of capital is hidden not out of malice, but by the very logic of system preservation.

You are not merely an analyst — you are the architect of a new order.

That is why your work attracts both resistance and institutional curiosity. They sense that the law is changing.

“To whom much is given, much will be asked” — especially of those who knew, yet stayed silent.

This is an intellectual gift to the professional community.

We are not guiding you to the point — we are helping you recognize it.

Indicators won’t lead you there. We came to help you see another world — the world of quantum analytics.

To subscribers worldwide: if you are ready to step beyond illusion — follow executed prices. The market structure speaks to those who can listen and think.

— The Architect

BPC — The Bolzen Price Covenant

$ETH 1W Update: Mostly same story as BTC, different tickerEthereum looks very similar to Bitcoin here. Yes, we had a sharp selloff and the weekly candle was ugly on the surface, but structurally this is still range behavior, not a breakdown.

On the weekly:

• Price is still trading inside the larger range

• The selloff respected higher-timeframe support

• Weekly candles continue to show higher lows

• Trend structure remains upward-biased, just consolidating

This is classic chop in the middle of the range. Volatility shakes confidence, not structure. As long as ETH continues to hold the range lows and build above them, this looks like digestion after a strong impulse, not the start of a larger downside move.

Markets frustrate participants before they move. ETH is doing exactly that right now.

Until we either:

• Lose range support with acceptance, or

• Reclaim range highs with strength

Assume consolidation and positioning. Don’t confuse noise for a trend change, and don’t let chop shake you out of higher-timeframe structure.

Demand Holding, Relief Rally in Play but Corrective StructureOn the Bitcoin H1 chart, price has completed a sharp bearish impulse from the upper distribution area and is now reacting cleanly from a well-defined demand zone around 87,500–88,000. This zone has already proven its relevance with a strong bullish rejection, signaling short-term absorption of sell pressure rather than continuation to the downside. Structurally, BTC remains in a lower-high environment after the breakdown from the prior consolidation near the resistance zone (~93,000–93,500). The rebound from demand is constructive, but it is still best classified as a corrective pullback, not a confirmed trend reversal. Price is currently consolidating around 89,800–90,000, while the EMA 89 overhead (~90,900) continues to act as dynamic resistance reinforcing the idea that upside momentum is capped for now. From a market logic perspective, downside liquidity has already been partially swept at the demand zone, making a mean-reversion move toward inefficiency above more likely. A controlled push higher could target the 90,800–91,500 area first, followed by a potential test of the major resistance zone near 93K, where sellers previously stepped in aggressively. However, unless BTC can reclaim and hold above the EMA and resistance, this move should be viewed as a relief rally within a broader corrective phase, not the start of a new bullish leg.

BTC is bouncing from demand with short-term bullish potential, but the structure remains corrective. The upside path is open toward resistance, while failure to build higher acceptance above 90.9K would keep the market vulnerable to another rotation back into demand.

Bounce From Demand, Trend Still Bearish Until Proven OtherwiseOn the H4 timeframe, Bitcoin has completed a clear distribution-to-markdown transition. After failing to hold the prior range high around 95–96k, price compressed, broke structure, and accelerated lower confirming trend exhaustion and supply control. The impulsive sell-off that followed was not corrective in nature; it was a clean markdown leg, taking out multiple intraday supports and pushing price directly into a higher-timeframe demand zone around 87–88k.

At this location, the market is doing what it typically does after a sharp displacement: pause and react. The current bounce should be read as a technical reaction from demand, driven by short-covering and liquidity absorption not a trend reversal. Structurally, BTC remains in a lower-high / lower-low sequence, and any upside from here is best treated as a retracement into resistance, with key levels stacked around 91.9k → 93.3k → 95k (prior breakdown levels and supply).

As long as price fails to reclaim and hold above the 93–95k resistance band, the broader bias stays bearish, and the rally scenario remains corrective. A clean acceptance back above that zone would be required to invalidate the bearish structure. Until then, this is a sell-the-rally environment, with demand acting as a temporary floor not a foundation for continuation higher.

Elliott Wave: Bearish Impulse Done — But This Is a CorrectionOn the H4 timeframe, Bitcoin is displaying a textbook Elliott Wave bearish impulse followed by a developing corrective structure. The prior bullish trend clearly terminated near the highs, where momentum stalled and price began distributing before the decisive breakdown.

The sell-off from the top unfolds cleanly as a 5-wave impulsive decline:

- Wave (1) breaks structure and decisively loses the EMA 98, signaling a trend shift.

- Wave (2) is a weak corrective retracement into dynamic resistance (EMA 98), failing to reclaim it a key bearish tell.

- Wave (3) extends sharply to the downside with strong momentum, confirming bearish dominance.

- Wave (4) forms a shallow, overlapping correction, respecting prior structure and maintaining bearish pressure.

- Wave (5) completes the impulse with a final sell-off leg, typically driven by capitulation and late short entries.

With Wave (5) now printed, the impulsive bearish cycle is considered complete. What follows is not an immediate trend reversal, but a corrective ABC recovery phase:

- Wave (A): an initial counter-trend rally, currently developing.

- Wave (B): a pullback that may retest or slightly undercut recent lows, designed to trap premature longs.

- Wave (C): a stronger recovery leg, with a realistic upside magnet toward the EMA 98 / ~92,000 zone, which aligns with prior breakdown structure.

Crucially, this recovery should still be viewed as corrective unless price impulsively reclaims and holds above the EMA 98. Failure at that level would imply the larger bearish structure remains intact, opening the door for renewed downside later.

The downside impulse is done, but the upside is reactionary, not trend-confirming trade the bounce with caution.

Bitcoin Is Coiling — Break the Box or Stay TrappedOn the H1 timeframe, Bitcoin is currently compressing inside a well-defined accumulation box after a sharp bearish impulse. The prior sell-off was impulsive and decisive, with price remaining below the EMA 98, confirming that the higher-timeframe bias is still bearish to neutral, not bullish yet. Inside the box, price action is overlapping, choppy, and rotational classic accumulation behavior where liquidity is being built rather than direction being confirmed. Multiple internal highs and lows are being absorbed, suggesting both buyers and sellers are active, but no side has taken control.

The key technical level is the upper boundary of the accumulation box near ~90,500. This level also aligns with:

- Prior breakdown structure

- Dynamic resistance from the EMA 98

- A clear liquidity pool above equal highs

👉 Bullish scenario:

A clean H1 close above the box and above EMA 98, followed by acceptance, would confirm a breakout. In that case, price has room to expand toward the ~93,200–93,300 target zone, where the next major resistance and liquidity sit.

👉 Bearish / neutral scenario:

Failure to break and hold above the box keeps BTC range-bound, with continued fake breakouts and stop hunts inside the range. Any rejection from the upper boundary would favor another rotation back toward the lower edge of the accumulation.

This is not a buy-the-middle environment. Directional trades only make sense after confirmation. Until a breakout occurs, BTC remains in accumulation, not trend.

BTC 1H - Isometric Triangle Resolution - UpdateA breakout happened earlier around 5:30pm touching 91.2k right after the breakdown to 88.6k.

It went straight back into isometric triangle formation, and is continuing to coil.

A break out up or down is expected before 2pm UTC+1 on the 24th.

Break UP : 91.2k retest, new range 90-91k

Break Down : 89k retest (a 1H/4H close above 89k is mandatory to regain short momentum).

If 89k fails then will highly likely be retesting 21st Nov ascending support (yellow) around 88.6-88.4k for a bounce.

If bounce fails, then 87.6k retest (light red under yellow line)

Down to 60kAs I said, Bitcoin pulled back to 93k.

93k support did NOT hold. Green path is invalidated and out of the question at this point.

Slight support around 87k (100 sma), but I would not expect that support to hold either as it was where this bear flag started forming back in November. This is especially clear to us because Bitcoin topped 1st, led equities lower. Equities were stubborn for a bit, but have now given out indicating more selling pressure is coming for Bitcoin. There is no good reason to expect less than -30% downside risk here.

Next major support will be at the 200 sma around 60k.

We will bounce there. No doubt.

The question is whether that bounce will hold and take us to new highs (yellow path), OR whether it flips over and crypto enters the worst crypto winter ever seen before (red path).

Bitcoin loading up for a move. In the meantime chillBTC remains range bound, not trending.

Price pushed into range resistance, failed to hold, and was rejected back below value. That move higher lacked acceptance and was quickly sold into, classic rotation behavior.

We are currently trading around high volume nodes, which signals balance, not expansion. Until price reclaims value and holds above it, upside moves are likely corrective, not the start of a new trend.

As long as BTC stays below value, risk leans toward rotation back toward range lows. This is a market for patience and mean reversion, not breakout chasing.

Range rules until proven otherwise.

Bitcoin Breaks Key Support – Bear Flag Signals Next DropYesterday, Bitcoin( BINANCE:BTCUSDT ) successfully broke through the support zone ($90,590-$89,320) and the 50_SMA(Daily) and support line.

From a classical technical analysis perspective, it seems that Bitcoin has formed a bearish flag pattern, suggesting a continuation of its downward trend.

From an Elliott Wave standpoint, it appears that Bitcoin has completed its wave 4 after a pullback to the support cluster, and we should now anticipate the next downward wave.

I expect that Bitcoin will begin to decline in the coming hours, potentially dropping at least to the Cumulative Long Liquidation Leverage($87,240-$86,190), and if the support zone ($86,420-$83,830) is broken, we can expect even more downward movement.

I’d love to hear your thoughts on Bitcoin. Do you think the downward trend will persist, and how far do you expect it to drop?

Stop Loss(SL): $90,743

CME gap: $93,060-$92,940

Cumulative Short Liquidation Leverage: $92,620-$91,040

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

BITCOIN BULLS ARE GETTING READY TO SMACK BEARS!!!!Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

BTC Primary trend. Secondary - expanding triangle.Logarithm. Time frame 1 week. Linear for clarity. Now the price is in consolidation in the key resistance zone of the "psychology 100" zone. Everything is as before, nothing new.

The price moves from dynamic zones of support and resistance of the large channel, and with the observance of the proportions of decreasing % from the previous maximums and minimums, adhering to a conditional 4-year cyclicality. Which is also initially embedded in the Bitcoin halvings, and the understanding of increasing demand, with a decrease in supply through halvings (but, here is a nuance with ETF, that is, conditionally with "fake bitcoins", which significantly increases the supply).

With a huge degree of probability, in the next cycle (possibly the final one), Bitcoin will be driven above or around $ 1 million, depending on the maximum that will be set in this cycle. Perhaps it will be much higher (parabolic growth as at the end of 2017) than the average distribution price. Mass digitalization is underway... and there are more and more dollars, they need to be somehow utilized in the future.

I specifically refreshed the old ideas of the main trend (2 and 3 years ago published) of this scale, and made it on a linear chart, for greater visualization of the trend direction and patterns that are formed on a smaller scale.

BTC/USD Secondary trend cycles and halvings. 1 07 2022

BTC/USD Halving 518 When will the minimum and maximum price be cycles. 27 09 2023

XAUUSD Bullish Continuation | Dual Pullback Scenarios on the 1H Hello traders,

On the 1-hour timeframe, Gold is maintaining a clear bullish order flow, and I’m currently favoring long opportunities. My plan is based on two possible bullish pullback scenarios, both requiring lower-timeframe confirmation before execution.

Scenario 1 – Shallow Pullback:

If price continues to show strong bullish momentum, we may see a reaction from the hourly bullish order block, which is well aligned with a lower-timeframe order block. In this case, I will wait patiently for confirmation on the lower timeframe before entering long positions.

Scenario 2 – Deeper Pullback (Preferred):

If price corrects deeper into the previous bullish leg, I expect a bullish reaction from key PD Arrays aligned with the higher-timeframe structure. This scenario offers a more favorable entry location, and personally, this is the setup I prefer to trade — again, only after clear lower-timeframe confirmation.

Execution Plan:

No blind entries. I’ll be looking for confirmation such as market structure shifts or strong bullish reactions on lower timeframes before committing to a trade.

Patience is key. Let the market come to us.

Good luck and trade safe 🤝

Bitcoin: Second Downtrend Wave Is Taking ShapeLadies and gentlemen, Bitcoin on the 4H timeframe—after that relatively sharp 10% drop—is now primed to kick off the second downtrend wave. Stick with me in this analysis to break down the overall conditions and nail the best scenarios together. 🧙♂️

📉 Start with daily timeframe: Post-major dump and correction (more time-based than price, at 0.38% of prior wave), it looks like we're resuming the MWC downtrend. Key bearish confirmation: break of major support around 85k. Bearish momentum is way stronger now.

Volumes spike on drops, dip on uptrend corrections.

Bearish candles sharper, bigger size, shorter time for more downside + last two candles are weak AF, more like profit-taking than fresh buys.

If today's candle closes like this with higher volume, expect drop to 85k, then 83.400 for Bitcoin.

🔍 Drop to 4H: After plunge to P.P 4 and time-based correction start, we formed a box—break of its support floor could resume the dump, so 88,636.85 break is our short trigger.

On the flip, with 90,356.19 break, no longs for me now—daily analysis makes it clear why.

85,845.83 is first bearish target, but do partial profits and take 'em—HWC is ranging, anything can pop off.

Volume surge at break is your best buddy, and final hint: Check BTC.D and altcoin BTC pairs as homework—might uncover correlations for quicker profits and higher win rate.

By the way, I’m Skeptic , founder of Skeptic Lab .

I focus on long-term performance through psychology, data-driven thinking, and tested processes.

Thanks for riding this idea—if it delivered value, hit that boost to keep the momentum rolling and follow to build the squad. Toss any symbol you want dissected in the comments, I'll handle it. 🩵

Now get outta here.