The "Siege" of Strategy (A Technical Reality Check)You want to talk about "Diamond Hands"? The chart suggests this isn't just a hold— it is a Siege.

Strategy ( NASDAQ:MSTR ) is the ultimate high-beta Bitcoin proxy. For a long time, leverage made it a hero. But right now, the technicals show that the same leverage is turning into a massive overhead weight.

Here is the data-driven reality of the current structure ( NASDAQ:MSTR Weekly Chart).

1️⃣ THE DATA: The "Vice Grip" 📉 We are witnessing a classic compression event. Price is being squeezed between two major technical levels:

The Floor (Support): Price is sitting exactly on the Yellow Baseline (Weekly SMA). This is the "Line in the Sand." As long as this moving average holds, the bullish trend is technically intact.

The Ceiling (Resistance): Look overhead. The candles are trapped below a dense cluster of Short-Term Moving Averages (Red/Purple lines). This represents "overhead supply"—investors looking to exit at break-even.

2️⃣ THE SIGNAL : Defensive Regime ⚠️ The chart has shifted from an Offensive structure (consistently making Higher Highs) to a Defensive structure (struggling to hold the lows).

The Implication: When an asset loses its short-term moving averages, the probability shifts from "Buy the Dip" to "Sell the Rally" until proven otherwise.

3️⃣ THE SETUP: Survival Mode 💀 Current price action is testing the Weekly Support, not bouncing from it yet. This is a critical juncture:

The Bear Case: If the Weekly SMA cracks, the "Air Pocket" opens up. There is very little structural support below this level, meaning price could enter rapid discovery mode to the downside.

The Bull Requirement: To invalidate this bearish pressure, price must reclaim the overhead resistance cluster. Until then, the path of least resistance remains lower.

🎯 THE VERDICT This is a "Don't Blink" situation. Technically, the floor hasn't broken yet, so the bulls are alive. But the structure is heavy. The technicals demand a successful defense of this baseline before any long-term entry can be considered safe. Watch the Yellow Line. If it breaks, the siege breaks.

⚠️ RISK MANAGEMENT MSTR is highly volatile and tied to BTC. A sudden spike in Bitcoin can invalidate technical bearishness instantly. This is NOT a recommendation to Short. It is a warning to watch the support level. Always use stop-losses.

👇 THE DISCUSSION: Do you think Saylor can hold the line here, or is the leverage unwinding? Let me know below!

🔥 Follow me for more institutional-grade analysis.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice, portfolio management, or a solicitation to buy any assets. Trading involves significant risk. Do your own due diligence.

Btc-e

What I Expect from 2026Scenarios • Markets • Levels • Positioning

First of all, I want to thank everyone for the activity under my previous post .

More than 300 likes are not just numbers to me — they show that you read, think, and ask the right questions. These are exactly the people who motivate me to keep sharing my perspective.

I don’t write for algorithms.

I write for those who want real results and understand that results come through process, discipline, and the right environment.

This text is not about fast growth or guessing the bottom.

It is about patience, structure, and working during moments of maximum pain.

In 2026, the market will be selective: opportunities will become fewer, and the cost of mistakes will be higher.

This is exactly when an advantage is built — by those who can wait and work systematically, not alone.

___________________________________________

Context and Philosophy of 2026

2026 is a year of reassessment and awareness.

A year when the market stops rewarding haste and illusions.

We are in a bearish phase, and according to my calculations, it will likely last almost until the end of the year. This is not a time for emotions or hope — it is a time for learning and preparing for the next cycle.

It’s important to accept a simple truth:

the market does not owe you opportunities every day.

No trade is also a position.

I’ve been in financial markets since 2009 and in crypto since 2016.

I’ve seen how every cycle looks different but ends the same way — disappointment and denial. That is exactly where the market pushes the majority in 2026.

___________________________________________

What Really Happened in 2025

2025 became the year of maximum institutional involvement.

ETFs, derivatives, structured products, and complex instruments fully integrated crypto into the global financial system.

And the global financial market is:

- highly competitive

- professional

- cold and calculated

This is not a place for belief — this is where capital positions, hedges, and extracts liquidity.

Crypto remains a young industry, but it is already playing by adult rules.

Many failed to understand this — and paid for it.

___________________________________________

The Main Mistake Most Will Make in 2026

Two things:

1. Believing in a quick reversal

2. Increasing risk in an attempt to “win it back”

Hope is the most expensive emotion in the market.

The market does not pay for hope — it pays for timing, structure, and execution.

Most people will leave not because the market is “bad,” but because they will break psychologically. I’ve seen it many times: different cycles, different faces — the same mistakes.

If you stay in the market, you must relearn it every cycle.

___________________________________________

Macro Environment and Market Conditions

Key factors I’m watching:

- interest rates

- regulation

- capital flow direction

- narratives that attract new liquidity

Regulation is neither an enemy nor a savior — it is reality.

Licenses, requirements, and rules are shaping a market that is becoming part of the global financial system.

2026 is a year of redistribution and accumulation, not growth.

Liquidity is fragmented. There are too many projects, too many tokens, and not enough capital for everyone. Stablecoins are growing, but still not enough to “feed” the entire market.

___________________________________________

Altcoins in 2026: My View

My position is strict and honest:

Most altcoins face collapse, cleansing, and increased regulatory pressure.

The reasons are clear:

- an excessive number of tokens

- fragmented attention

- constant unlock pressure

- funds sitting in long-term profit

- lack of sustainable economics

There will be exceptions — but they will be rare.

Paradoxically, memecoins (despite my skepticism) did one useful thing:

they forced people to learn on-chain analysis, search for inefficiencies, and track capital flows.

What remains structurally alive

RWA (tokenized real-world assets)

infrastructure

DeFi v2 as an alternative to the traditional system

At the same time, we must be honest: potential returns in altcoins are structurally declining compared to previous cycles.

___________________________________________

Bitcoin — Base Scenario for 2026 and Key Levels

My base scenario is continued pressure and bottom formation.

Capitulation will affect:

- traders

- investors

- miners

- funds

- large corporations

The market will be cleansed of large holders.

This process is always painful — and always necessary.

Key ranges

- base: 48,000 – 74,000

- extreme zones: 38,000 – 46,000

My operating logic

- the first meaningful accumulation zone is around 64k

- limit orders are placed lower

- buying only during moments of panic

- no rush, no emotions

There is an old saying:

“ We enter the market when there is blood in the streets .”

This is not drama — this is how asymmetric advantage is built.

Short squeezes are possible, but they will be short-lived.

Markets do not trend higher on disappointment.

In my view, the final deep phase of this cycle and the shift toward early bullish conditions align closer to September 2026.

___________________________________________

Other Markets and Diversification

One of the biggest mistakes crypto traders make is thinking the world ends with crypto.

Blockchain is infrastructure — not the entire market.

That’s why in 2026 I diversify across:

- gold

- oil

- indices

- stocks

- and only very selectively crypto assets

Other markets are:

- more liquid

- more structured

- often cleaner in execution

S&P 500

So far there are no clear reversal signals, but after new highs I expect correction or stagnation. The reasons are obvious: the AI bubble, debt pressure, and liquidity concentration.

Gold

A historical safe haven. The trend remains intact.

My long-term target is $6,000 ± $1,000.

DXY

Weakening is possible, but the dollar is likely to maintain dominance due to digitization and global settlement demand.

Oil

One of my key instruments. Expensive oil is not beneficial for the US, and I see no strong reasons for sustainably high prices in the short term.

___________________________________________

Narratives Beyond Crypto

The world is reaching the limits of energy supply.

Energy is becoming a strategic advantage.

Those who produce electricity efficiently will be in a strong position.

Alternative energy sources and the entire energy chain will play a key role.

AI is not just hype.

AI will drive breakthroughs in medicine, energy, data analysis, and financial markets.

Global instability is no longer a forecast — it is a condition.

We are moving toward a reset of global processes and agreements.

___________________________________________

My Trading Approach in 2026

- more cash

- short-biased trading when structure allows

- only selective entries

- waiting for panic

- minimized risk

If there is no setup - there is no trade.

That is discipline.

And one more thing: if you are tired - rest.

The market will not disappear.

Your capital and your mindset are your main assets.

___________________________________________

Personal Commitment and Community

In 2026, I will relaunch the Academy and deeply integrate AI tools.

For members of my community, the Academy will be free under specific conditions.

Discipline is not motivation.

Discipline is the ability to follow a plan regardless of emotions.

Growth is slow alone. It is faster in the right environment.

I am building a strong trading community where:

- thinking evolves

- on-chain capital flows are analyzed

- portfolios with limit orders are structured

- experience is shared, not illusions

Some of these portfolios have already started activating, and one position is around +15%. This is not luck — this is systematic work.

___________________________________________

One Honest Question

Ask yourself honestly:

Are you here to prove something to the market — or to achieve a sustainable result?

Because results only come through self-study, discipline, and a repeatable process.

___________________________________________

Final Thoughts

Markets reward preparation, not urgency.

Give the market time. Give the system time.

If you are still here in 2026 — you are already ahead of most.

The main task is simple: stay in the game.

Build positions when it hurts.

Grow when it is quiet.

Best regards EXCAVO

MACD at the zero lineHoliday volume has effectively stalled progress in Bitcoin’s anticipated advance. With MACD resting at the zero line, momentum is ready to coil, rather than exhausted, and technical conditions remain conducive to a renewed bid from traders closing out their year. In this environment, it would not take much participation for buyers to reassert control, as reflected in the chart below.

ETH — Price Slice. Capital Sector. 2488.80 BPC 18© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 30.12.2025

🏷 2488.80 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 18

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2271.53 BPC 31© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 30.12.2025

🏷 2271.53 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 31

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2503.16 BPC 15© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 30.12.2025

🏷 2503.16 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 15

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

Bitcoin Setups: Smart Entry for Buy and Sell Positions (3H)Bitcoin Market Analysis: How Market Makers Banks and Governments Manipulate Price and Capture Liquidity

Market makers large financial institutions and even government entities often influence Bitcoin’s price movements to serve their own trading strategies. Their goal is to manipulate the market in a way that allows them to fill their own orders efficiently and enter positions at more favorable prices. Understanding this behavior is crucial for retail traders who want to avoid being caught on the wrong side of these movements.

As we have observed Bitcoin has been consolidating for over a month moving sideways within a specific range. During this period it repeatedly hits buyers’ and sellers’ stop orders creating temporary spikes or drops before continuing its range bound movement. These price actions are often small and controlled but they are deliberate. The key question we need to ask is why is this happening The answer lies in thinking like market makers rather than retail traders.

In this low volatility phase the main focus should be on identifying where liquidity resides. Market makers target areas where stop orders are clustered these are points where they can collect liquidity to fuel their next large move. On lower timeframes we’ve identified a critical stop zone between 90,154 and 91,600 dollars. This range represents a high probability area to look for sell short setups as market makers often attempt to trigger these stops to gather liquidity.

Why is it unlikely for price to break significantly above this zone at this moment On higher timeframes the long stops have not yet been triggered meaning sufficient liquidity has not been collected. Banks and institutional players are still filling their orders. Until this accumulation process is complete strong bullish moves are less likely.

Entering positions should always be strategic and aligned with proper risk to reward management. On our chart we’ve marked a setup that respects this principle. It is positioned where sellers’ stops are likely to be triggered allowing us to enter in alignment with market makers and institutional flows. This approach increases the probability of a successful trade while minimizing unnecessary risk.

Equally important is integrating trader psychology into your analysis. Technical analysis alone is rarely enough. The majority of trading success approximately 70 to 80 percent comes from understanding market psychology not just price patterns. Recognizing how other traders are likely to react to stops liquidity pools and market maker movements is essential to staying ahead in the market.

In summary successful trading in Bitcoin requires a combination of technical awareness liquidity analysis and psychological insight. Always think like the market makers anticipate where liquidity is concentrated and enter trades with calculated risk to reward setups. By doing so you can align yourself with the larger players instead of constantly reacting to their manipulations.

If the price does not reach the red zone and our sell position is not triggered, and then it reaches the green zone without hitting our sell zone, we will no longer enter the sell position. In this case, we will look for a buy/long in the green zone

We have two entry points for the position, allowing you to enter the sell position using DCA. There are also two targets; after hitting the first target, take some profit and move your stop to break even.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

How to interpret charts and trade...

Hello, fellow traders!

If you "Follow" me, you'll always get the latest information quickly.

Have a great day.

-------------------------------------

The Trend Check (TC) indicator is a comprehensive evaluation of the PVT, OBV, and StochRSI indicators.

Therefore, a breakout above the zero level indicates strong buying pressure and a high probability of a price increase.

The StochRSI indicator is a coincident indicator that can be used as a trading signal by quickly detecting overbought and oversold levels in a stock price.

The OBV indicator is a volume indicator that measures buying and selling pressure by adding the trading volume on days when the price is rising and subtracting the trading volume on days when the price is falling. It was developed based on the assumption that trading volume precedes the price.

The PVT indicator is a technical analysis tool that analyzes buying and selling pressure and trends in the market by reflecting both stock price movements and trading volume. It combines accumulated trading volume with price volatility to sensitively reflect market supply and demand and trends.

By comprehensively evaluating these indicators, it can be used to determine trading timing.

However, since the trend may fluctuate depending on whether the StochRSI indicator is in the overbought or oversold zone, the StochRSI indicator has been displayed accordingly.

If the StochRSI indicator enters the overbought zone, upside is likely to be constrained, and if it enters the oversold zone, downside is likely to be constrained.

Therefore, it is recommended to check the StochRSI indicator's fluctuations along with the TC indicator.

If the On-Bottom Volume (OBV) indicator is between the Low Line and High Line, the price is likely to move sideways.

Furthermore, if it rises above the High Line, it is likely to be bullish, and if it falls below the Low Line, it is likely to be bearish.

To confirm this, the On-Bottom Volume (OBV) indicator has been added separately.

In summary, if the TC indicator shows an upward trend or remains above 0, the price is likely to rise.

However, the movements of the StochRSI and OBV indicators are checked to determine whether the upward trend can be maintained or whether a downtrend will occur.

Therefore, for the price to continue its upward trend,

1. the TC indicator must show an upward trend above 0,

2. the StochRSI indicator must show an upward trend without entering an overbought zone, and

3. the OBV indicator must remain above its High Line or show an upward trend.

For the price to continue its downward trend, this is the opposite of the above conditions for a sustained upward trend.

If the StochRSI or OBV indicators show a different trend than the TC indicator, the price is likely to move sideways, so be mindful of this when trading.

-

Since most indicators are based on 1D charts, it's important to first check the movements of the 1D chart.

Next, it's best to trade by reflecting the movements of the 1D chart with the movements of the timeframe chart you're trading.

In other words, if the 1D chart shows an upward trend, you should trade based on the expectation that the price will rise on the timeframe chart you're trading.

Therefore, when prices are falling, it's best to trade with a smaller investment amount and a shorter investment period to react quickly (with a short stop-loss point). When prices are rising, it's best to trade with a larger investment amount and a longer investment period (with a more generous stop-loss point).

-

Auxiliary indicators should be considered as supplementary indicators, as their name suggests, in interpreting charts.

The key is to identify support and resistance points or ranges for the price and the movements of the M-Signal indicator on the 1M, 1W, and 1D charts.

To determine the overall chart movement, check the movements of the M-Signal indicator on the 1M, 1W, and 1D charts.

For the price to continue its upward trend, it must remain above the M-Signal indicator on the 1M chart.

If it fails to do so, a downward trend is highly likely, so you should consider a strategy to counter a bearish market.

If the price is below the M-Signal indicator on the 1M chart, it is recommended to shorten the investment period.

Consequently, it is also recommended to set a shorter stop-loss point.

For this purpose, the HA-MS indicator includes indicators designed to indicate support and resistance points.

The most representative indicators are the HA-Low and HA-High indicators.

The HA-Low and HA-High indicators are designed for trading using the Heikin-Ashi chart.

The HA-Low indicator indicates the low range, so if it encounters support, it's a buy signal.

The HA-High indicator indicates the high range, so if it encounters resistance, it's a sell signal.

To make this more clear, the DOM(60) and DOM(-60) indicators have been added.

The DOM(-60) indicator, like the HA-Low indicator, indicates the low range.

The DOM(60) indicator, like the HA-High indicator, indicates the high range.

Therefore, if support is found within the established DOM(-60) ~ HA-Low or HA-Low ~ DOM(-60) range, it's a buy signal.

If resistance is found within the established HA-High ~ DOM(60) or DOM(60) ~ HA-High range, it's a sell signal.

-

When assessing support at these points or intervals, adding the interpretation of the auxiliary indicators mentioned above will be a significant aid in determining support.

In other words, if price movements indicate support, but the auxiliary indicators do not support it, the price is likely to decline.

-

If you trade based on indicator movements, you may suddenly find yourself trading against them.

This happens because you prejudge the indicators' movements based on your own thinking and then trade accordingly.

To prevent this problem, it's important to ensure that all auxiliary indicators are moving in the same direction.

Also, while you can buy to some extent in spot trading, you should never initiate a trade based on price movements when trading short positions in futures.

This is because price volatility is higher when prices are falling.

Therefore, when starting a short position, it's best to initiate the trade at support and resistance levels.

-

We begin trading based on indicator movements or chart analysis, but we lose something.

That's our trading strategy.

When actually trading, we must first determine:

1. How long will the trading period be?

2. How much capital will we invest?

3. How will we conduct the trade?

If we simply analyze the indicator movements and charts without deciding on these factors, we are likely to trade in a state of constant anxiety.

This is because maintaining a stable mental state is more important than profit when trading.

A stable mental state during a trade increases the likelihood of a successful trade.

This is because it allows us to respond more effectively.

Therefore, establishing a basic trading strategy that suits your investment style is paramount.

By considering the investment period for the stock or coin you're considering, you can determine your investment amount accordingly and choose a detailed trading method.

Therefore,

1. Investment Period

2. Investment Size

3. Trading Method

When conducting a trade, consider the three factors above.

When investing for a medium- to long-term or longer, it's important to carefully manage your purchases to lower your purchase price.

If your average purchase price is high, it can be psychologically burdensome to trade with a medium- to long-term investment horizon.

Therefore, in this case, you should trade for shorter periods of time, generating cash profits while lowering your average purchase price.

Lowering your average purchase price isn't easy in the stock market.

This is because trading is done on a weekly basis.

However, the coin market allows for decimal trading, so you can lower your average purchase price by increasing the number of coins corresponding to your profit.

For coins corresponding to profit, you trade by purchase price. When profits are generated for each purchase price, you sell the amount equivalent to the purchase price (including transaction fees) for each purchase price, thereby retaining the remaining coins.

Since the purchase price of these remaining coins is 0, as the number of these coins increases, the average purchase price will decrease.

-

Investment size is crucial, as it determines how you allocate your total investment capital to conduct your trading.

If your investment is misallocated, even with high returns, actual profits may be small, and even with low loss rates, actual losses may be large.

Furthermore, the most important aspect of investment size is always maintaining a reserve fund.

The amount of reserve fund you should keep will vary depending on your individual investment style.

I recommend approximately 20% of your total investment capital.

This reserve fund is used for emergencies. If you start trading with this reserve fund, you must sell it quickly to secure the reserve fund.

Failure to do so can lead to extreme anxiety and the inadvertent execution of unintended trades.

Depending on your investment size, you should consider how many stocks (coins) you will trade at a time.

Investing in too many stocks (coins) can lead to a small purchase amount or simultaneous trading, which can hinder your ability to execute your trades effectively.

Therefore, you should always consider the number of stocks (coins) you can manage simultaneously.

Typically, the number of stocks (coins) you can manage simultaneously is 1-3.

Long-term investments, even if managed concurrently, often require time to respond, so they don't need to be included in the number of concurrent investments.

However, it's recommended to include mid-term and shorter investments in your concurrent management count.

-

Once you've chosen a stock (coin) based on your investment horizon and investment size, you can then proceed to detailed trading based on chart analysis and indicator movements.

Therefore, it's best to keep chart analysis as short as possible.

This is because prolonged chart analysis increases the likelihood of your subjective opinions incorporating them into your analysis, which can result in inaccurate chart analysis.

Furthermore, prior to chart analysis, if you first review non-chart-related issues (such as company news, politics, or the economy) and then analyze the chart based on those, you may end up basing your analysis on your own subjective opinions. Therefore, it's important to be mindful of this.

It's important to remember that over-information can actually be detrimental to your trading.

-

When developing a detailed trading strategy, I outlined the basic trading strategy of buying in the DOM(-60) ~ HA-Low range and selling in the HA-High ~ DOM(60) range.

By adhering to this principle, even if you don't achieve significant returns, I believe you'll be able to ensure consistent profits.

Looking at the basic trading strategy broadly, it follows a trading pattern within a box range.

However, the length of that box range is unknown.

To achieve significant profits, it is necessary to break beyond the box range.

Therefore, if the price rises within the HA-High ~ DOM(60) range, a stepwise upward trend is likely, transitioning into a trend trade.

Conversely, if the price falls within the DOM(-60) ~ HA-Low range, a stepwise downward trend is likely, transitioning into a trend trade.

However, it's important to note that a stepwise upward trend ends in a decline, while a stepwise downward trend ends in a rise.

In other words, while a stepwise upward trend is likely to lead to a significant upward trend, it also means a significant downward trend.

Therefore, when entering a trade during a stepwise upward trend, it's important to respond quickly to minimize losses.

Failure to do so could result in a significant decline, resulting in losses that are difficult to recover from.

Conversely, a continuous step-down trend is more likely to lead to a significant decline, but it also carries the potential for a significant rise.

Therefore, we must consider how to implement tranche purchases during a step-down trend to lower the average purchase price or secure more stocks (coins).

Therefore, we should execute more trades during a step-down trend.

However, in the stock market, tranche purchases during an actual downtrend can lead to a loss of purchases, so caution is advised.

In the coin market, transactions are processed in decimals, reducing the burden of trading.

This means that trades can be organized by purchase price and executed at each purchase price.

Therefore, in a step-down trend, it's important to execute trades at each purchase price to retain a profit-making number of coins (tokens). This can lower the average purchase price or increase the number of coins (tokens).

There are two ways to retain a profit-making number of coins (tokens): buying and then selling, or selling and then selling.

Any method is fine, but if possible, it's best to trade using a buy-then-sell method.

This is because a cascading downtrend ends in an uptrend.

Therefore, in a cascading downtrend, you should trade less aggressively and execute more trades.

Downtrends are more likely to exhibit volatility than uptrends, so buying and then selling may actually feel easier.

However, you should avoid being greedy.

The root cause of all losses stems from greed.

-

If you can consistently generate profits, regardless of the trading method, then that's the best trading method.

We invest a lot of time and money in finding this, and remain in the investment market.

Charts ultimately represent the movement of money.

Therefore, charts should always be the top priority.

The main problem with the stock market is that issues outside of the charts dominate the market.

This problem prevents investors from seeing the movement of money, and they are constantly being misled by things outside of the charts.

As the coin market is being incorporated into the stock market, I believe that many people are dragging the main problems of the stock market into the coin market, leading to a rise in new losses.

The biggest difference between the stock and coin markets is that coins are relatively unusable in real life.

Therefore, I don't think analyzing them like the stock market is appropriate.

In the stock market, too, capital movements are often reflected in charts, so it's best not to check news outside of the charts first.

Such news can be toxic to individual investors who lack the ability to gather and analyze information.

-

Thank you for reading.

I wish you successful trading.

--------------------------------------------------

LTCUSDT - Retest of the liquidity zone on a downtrendBINANCE:LTCUSDT.P is forming a local rally after breaking through resistance at 78.0. The market is bearish, but within the bullish run, the altcoin may test liquidity at 79.4 - 81.0.

Bitcoin looks weak, a rebound from resistance is forming, and Friday's daily bar indicates strong bearish dominance. A fall in the flagship currency could trigger a fall in LTC after a local rally...

LTC looks slightly stronger than the market. The target of such a rally may be hidden behind 79.4 - 81.0. In the current situation: global downtrend, low market liquidity, I see this as a manipulative hunt for liquidity before a decline.

Resistance levels: 79.4, 81.0

Support levels: 78.0, 77.0, 75.4

A retest of this resistance cluster could end in liquidity capture and a false breakout. Consolidation below 79.4 could trigger a reversal and a decline.

Best regards, R. Linda!

TradeCityPro | Bitcoin Daily Analysis #251👋 Welcome to TradeCity Pro!

Let’s move on to Bitcoin analysis. Bitcoin is still ranging, and the longer this ranging continues, the higher the probability of a move starting.

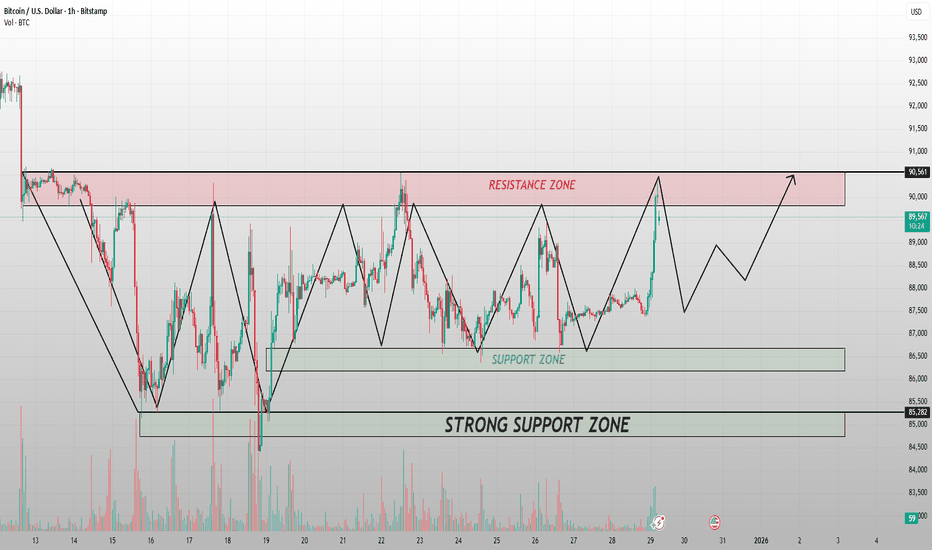

⏳ 1-hour timeframe

Yesterday, Bitcoin was supported from the support zone that had formed between 86,855 and 87,355, and currently, with increasing volume, it is moving upward.

✔️ Yesterday, with the break of 87,345, we could open a risky short position on Bitcoin, but the price was supported from 86,855 and started an upward move.

✨ Currently, the price is still inside the same range box between 86,855 and 90,221, with the difference that volume has increased with the start of the new week.

🔔 Bitcoin’s triggers have not changed yet, and we can still open a short position with the break of 86,855 and a long position with the break of 90,221.

🧩 For now, whatever trigger the market gives, I open short-term positions with it and take profits quickly.

🎯 If, along with the break of triggers, volume also increases, the probability of the move continuing increases, and we can open long-term positions as well by breaking the next triggers.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Silver Already Showed The Playbook – Bitcoin Might Be Next!When you compare OANDA:XAGUSD and COINBASE:BTCUSD side by side, the similarity in structure is hard to ignore. Silver spent time consolidating, respected its higher lows, absorbed supply, and then expanded aggressively once the structure was confirmed. Bitcoin now appears to be in a very similar phase.

At the moment, Bitcoin is trading around $88,000. The previous all-time high sits near $126,000. The most recent major November low was formed around $80,700.

Importantly, price has not violated the $74,000 macro support, which remains a key level. This alone keeps the higher-timeframe structure intact and bullish.

What we are seeing right now is not panic or distribution. Pullbacks are corrective, momentum remains controlled, and price continues to hold above key demand zones. This behavior suggests compression and energy build-up, not exhaustion.

Silver already executed this sequence cleanly. Bitcoin has not broken down yet, and structurally, it is still behaving like an asset preparing for continuation rather than reversal.

There is, however, a macro risk that cannot be ignored. Rising geopolitical tensions, especially the risk of escalation between Iran and Israel with potential U.S. involvement, could change market dynamics very quickly. Events like these can override any technical structure.

That said, this analysis is based strictly on current price action and confirmed data, not on hypothetical scenarios. As long as price respects structure, the technical bias remains valid.

From a long-term perspective, if Bitcoin continues to respect its macro supports and resumes expansion, the broader upside zone I am watching lies between $200,000 and $280,000.

This is not a buy or sell signal. This is a structural comparison and a technical roadmap.

The market often looks uncertain right before the next major leg begins.

The real question is simple:

Does Bitcoin follow Silver’s playbook, or does macro risk step in first?

Let me know your view below.

UNI/USDT – Bullish Momentum Builds But Resistance Looms at $6.26Uniswap (UNI) has surged nearly 35% from its December 18th low, igniting stop-loss runs above prior swing highs and establishing clear upside momentum.

The rally left behind a bullish daily gap between $6.06 and $5.38, which now serves as a key support zone.

🗳️ This price action coincides with the start of a new governance vote, adding fundamental interest. However, $6.26 – where sellers last pushed back on Dec 20th – remains the critical resistance bulls must flip for continuation.

🔼 Bullish Targets (if $6.26 breaks):

$6.57 – Prior distribution zone (week of Nov 10).

$6.73 – Bearish daily gap (Nov 20).

$7.18 – Major resistance (week of Nov 17), where bears previously regained control.

🔽 Bearish Scenarios (if support fails):

$5.20 – December 17 open; key line of defense.

Below that: $4.86 (Dec 18 swing low) becomes vulnerable.

These levels also align with the mid-point of last week’s long wick, adding further confluence.

📊 Momentum favors bulls for now, but watch how UNI reacts at $6.26—it's the gate to further upside or potential rejection.

ETH 1W Update: Chopping, but looking good for Q1 2026 ETH Update: Ethereum is continuing to work through a higher timeframe consolidation after the strong move into the upper range earlier this year. The rejection from the ~$4.7k resistance zone was sharp, but importantly, price has since stabilized and is now holding above the key ~$2.7k–$3k support region. That area has acted as a major pivot multiple times in the past, and holding it keeps the broader structure constructive.

From a market structure perspective, this still looks like a reset within a larger range rather than a full trend failure. The selloff from the highs has transitioned into sideways-to-overlapping price action, which is typical during digestion phases on the weekly. ETH is effectively building a base between higher timeframe support and prior resistance, allowing momentum and positioning to cool off.

The ~$3.4k level remains an important inflection zone. Acceptance back above it would be an early signal that ETH is ready to rotate higher again and challenge the upper range. Until then, some chop and volatility should be expected as the market works through this consolidation. The projected path suggests a period of basing followed by a renewed push higher once participation and liquidity return.

Zooming out, the bigger picture remains intact. ETH continues to hold above major cycle support, and as long as that remains the case, the odds favor continuation rather than a deeper corrective phase. This looks less like distribution and more like consolidation ahead of the next leg.

For now, patience is key. As long as ETH holds this support zone and avoids a decisive breakdown, the structure supports higher prices over time, with the upper range near ~$4.7k remaining the key target once momentum rebuilds.

BTC 1W Update: Boring is Good, Enjoy the Holidays BTC Update: We’re firmly in the boring part of the market right now, and that’s reflected clearly in the price action. Bitcoin is holding up well, but momentum has slowed and volatility has compressed as we move deeper into the holiday period. This is typically when participation dries up, traders step away, and larger institutions go quiet until the new year.

Structurally, nothing here looks concerning. BTC remains above major higher timeframe support, and despite the pullback from the highs, price is consolidating rather than breaking down. The recent downside move has transitioned into sideways chop, which suggests the market is digesting prior gains instead of rolling over impulsively.

This kind of environment often leads to frustration because nothing seems to happen, but it’s a normal phase in broader uptrends. With liquidity thinning into year end, I wouldn’t be surprised to see some short-term volatility or whipsaw moves, especially as we head into early January when participants return and positioning resets.

A brief flush or shakeout is still possible, particularly if the market looks to test lower liquidity pockets before resuming higher. That said, as long as BTC continues to hold these levels and avoid a decisive breakdown, the bigger picture remains intact. Overall, things are holding up well, and this looks more like consolidation within a healthy structure rather than the start of a deeper correction.

For now, patience is key. This is the quiet part of the cycle, but these periods often precede the next meaningful move once volume and participation return in the new year.

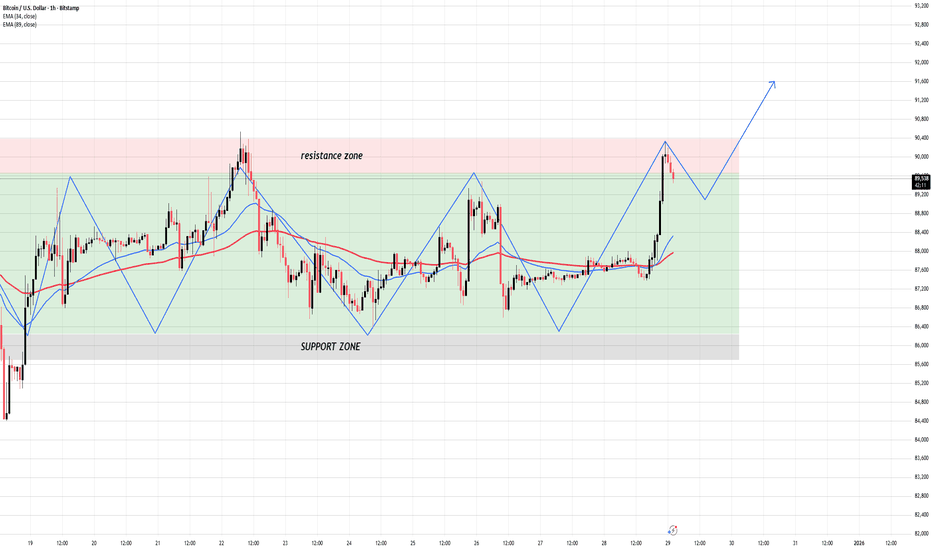

What the Market Is Actually Doing Right NowBitcoin continues to trade inside a clearly defined horizontal range, and the latest 1H price action reinforces that this market is still in distribution–accumulation rotation rather than trend continuation.

Price is currently reacting just below the $90,000–$90,500 resistance zone, an area that has repeatedly capped upside attempts over the past sessions. Every impulsive move into this zone has been met with immediate rejection, indicating that sell-side liquidity remains heavy and that larger players are using this level to offload positions rather than chase breakout momentum. Importantly, these rejections are occurring without follow-through volume, confirming the absence of strong bullish commitment.

On the downside , Bitcoin continues to respect the $86,500–$86,000 support zone , with a deeper strong support area around $85,200–$85,500 . Each rotation lower into these zones has attracted responsive buying, but notably buyers are not pushing price to new highs, only back toward range highs. This behavior confirms a mean-reversion environment , where price oscillates between liquidity pools instead of forming a directional trend.

Structurally, Bitcoin is printing lower highs within the range, while lows remain defended. This creates internal compression and signals that the market is waiting for a catalyst. Until either side of the range breaks decisively, both bullish and bearish narratives remain incomplete. A clean hourly and daily close above $90,500 would invalidate the range and open the path toward higher continuation targets. Conversely, a break and acceptance below $85,200 would expose downside expansion toward lower demand zones.

From a macro perspective, this consolidation aligns with the broader market context. Risk assets are currently lacking fresh drivers as Federal Reserve rate-cut expectations remain uncertain , and liquidity conditions are stable but not accelerating. Without a strong shift in macro liquidity or a surge in institutional inflows, Bitcoin is behaving exactly as expected rotating, absorbing orders, and building a larger move.

In summary, Bitcoin remains neutral and range-bound , not weak, but not ready for sustained upside yet. Traders should respect the range, remain patient, and avoid chasing moves in the middle. The real opportunity will come only after a confirmed breakout , not before.

Bitcoin Is Coiling — The Next Move Won’t Be QuietBITCOIN (BTC/USD) – 4H MARKET ANALYSIS

Market Structure Overview

- Bitcoin is currently trapped in a well-defined range on the H4 timeframe.

- Price is oscillating between a major resistance zone around 90,000–90,500 and a strong support zone around 86,500–87,000.

- Repeated rejections at resistance and consistent reactions from support confirm a classic consolidation / distribution range.

Key Technical Observations

- Each push into the resistance zone is met with strong selling pressure, indicating supply dominance at higher levels.

- Sellers, however, are failing to break decisively below support, suggesting buyers are still absorbing liquidity.

- The repeated zig-zag structure inside the range shows liquidity being built, not trend continuation yet.

- Volume remains relatively muted compared to impulsive legs → typical behavior before a -volatility expansion.

Scenarios to Watch

Bullish Breakout Scenario

A clean breakout and acceptance above 90,500 could trigger a strong upside expansion, opening the path toward 92,000–94,000.

This would confirm accumulation and invalidate the current range.

Bearish Breakdown Scenario

A decisive break below 86,500 would shift the structure into a deeper corrective phase.

In that case, downside momentum could accelerate quickly as range support fails.

Trading Bias & Strategy

Neutral bias while inside the range.

Best strategy: trade reactions at the edges of the range, not the middle.

For swing positioning, patience is key — wait for a confirmed breakout with volume before committing size.

Conclusion

Bitcoin is not trending it is preparing.

The longer the range holds, the stronger the eventual breakout.

Stay disciplined, protect capital, and let the market reveal direction before acting.

Bitcoin Rejects the Ceiling — Liquidity Is Pulling Price BTCUSD (1H) — Market Outlook

Bitcoin is currently rejected from a major resistance zone near 90,000, confirming that sellers remain active at premium prices.

Key Market Structure

The recent impulsive move up failed to hold above resistance, signaling a lack of breakout strength.

Price is still trading inside a broader range, not a confirmed trend.

This rejection suggests bullish momentum is weakening short term.

Probable Scenario

The higher-probability path is a pullback toward the support zone around 86,500–87,000.

This move would allow the market to rebalance liquidity and test real demand.

Only strong buyer reaction at support would justify renewed upside attempts.

Invalidation

A clean H1 close above the resistance zone with follow-through would invalidate the pullback scenario.

Macro Context

Strong USD and elevated bond yields continue to cap risk assets.

With no immediate bullish macro catalyst, Bitcoin rallies into resistance are likely to be sold.

Bottom Line:

Bitcoin remains range-bound. Until resistance is clearly broken and accepted, expect downside probing before any sustainable upside continuation.

Bitcoin Trapped in the Holiday Range — Breakout Comes BITCOIN (BTC/USD) – 1H MARKET ANALYSIS

Market Context

Bitcoin is currently trading in a well-defined range, trapped between a strong support zone around 85,000 USD and a major resistance zone near 90,000 USD. The current structure reflects consolidation and accumulation, not distribution.

1. Price Structure

Price continues to form higher lows near the support area, indicating that buyers are still actively defending this zone.

Each approach toward 89,500 – 90,000 is met with strong selling pressure, confirming this area as a valid resistance zone.

The EMA 34 and EMA 89 are flattening and overlapping, a typical sign of a sideways market.

➡️ No confirmed breakout = no new trend yet.

2. Market Behavior

The price is moving in a controlled zigzag pattern inside the range, which is characteristic of:

Liquidity accumulation

Market makers controlling both sides of the range

Sharp intraday spikes without follow-through suggest liquidity sweeps, not trend continuation.

3. Key Scenarios (Outlook)

Scenario 1 – Range Continuation (High Probability)

Price continues oscillating between 85,000 – 90,000.

Best approach:

Buy near support

Sell near resistance

Avoid chasing price in the middle of the range

Scenario 2 – Bullish Breakout (Confirmation Required)

Trigger conditions:

Strong H1/H4 candle close above 90,000

Clear increase in volume

If confirmed:

Range is broken

Next upside targets: 92,000 – 95,000

Scenario 3 – Bearish Breakdown (Lower Probability)

Only valid if price breaks below 85,000 with strong momentum.

In that case:

Deeper correction may follow

Next key demand zone: 82,000 – 83,000

4. Summary

Market state: Sideways / Accumulation

Primary trend: Pausing, not reversing

Optimal strategy: Trade the range or wait for confirmation

Risk note: Avoid entries in the middle of the range poor risk-to-reward

👉 The market rewards patience and discipline, not impatience.

Breakout Ahead or Another Trap Inside the $85K–$90K Range?Bitcoin is currently trading inside a well-defined consolidation range between $85,000 and $90,000, and the latest price action confirms that this zone remains highly respected by both buyers and sellers. On the 1H timeframe, price was aggressively pushed into the upper boundary near $89,500–$90,000, but the immediate rejection shows that sell-side liquidity and profit-taking are still concentrated at this resistance zone. This behavior is typical of a mature range market, where impulsive moves toward the extremes are often faded unless strong follow-through volume appears.

From a technical structure perspective, Bitcoin has failed to establish a clean series of higher highs above resistance. Instead, the market continues to print range highs with weak continuation, while the EMA 34 and EMA 89 remain relatively flat, reinforcing the sideways environment. The lack of trend expansion indicates that momentum is being absorbed rather than extended. As long as price remains below the $90,000 supply zone, upside attempts should be treated as range tests, not trend breakouts.

On the downside, the $86,000–$85,500 support zone remains the key level to monitor. This area has repeatedly attracted buyers and represents the lower liquidity pool of the range. The projected move on the chart suggests that, after rejection from resistance, price may rotate lower toward this support zone to rebalance liquidity. A reaction from this area would likely result in another mean-reversion move back toward mid-range or resistance, keeping the market rotational rather than directional.

From a macro standpoint, Bitcoin is currently lacking a strong catalyst to break out decisively. U.S. macro data remains mixed, with Federal Reserve rate-cut expectations still uncertain, keeping risk assets in a cautious state. Liquidity conditions are stable but not expanding aggressively, which aligns with Bitcoin’s current consolidation rather than trend acceleration. Without a clear shift in monetary policy expectations or ETF inflow momentum, the market is more likely to continue respecting this range.

In conclusion, Bitcoin remains neutral and range-bound, not bearish but also not yet bullish. Traders should remain disciplined, focusing on selling near resistance and buying near support until a confirmed breakout occurs. A daily close above $90,000 with strong volume would invalidate the range and open the door toward higher targets. Until then, patience is key, the market is building structure, not direction.

Bitcoin Is Compressing — The Bigger the RangeBTC/USD (4H) — Market Analysis

Market State

Bitcoin remains range-bound between $85,000 and $90,000, showing classic high-liquidity consolidation after a strong prior move. Price is not trending it is building energy.

Key Zones

Resistance Zone: $89,500 – $90,500

→ Repeated rejections confirm strong supply and profit-taking.

Support Zone: $85,500 – $86,500

→ Buyers consistently defend this area.

Mid-Range Magnet: ~$87,500

→ Price frequently rotates back here, signaling balance.

Structure Insight

EMAs are flattening and overlapping → clear sideways regime.

Wicks on both sides show liquidity sweeps, not directional commitment.

This is range trading, not accumulation completion yet.

Probable Scenarios

Primary (Higher Probability):

Continued range rotation between support and resistance.

Bullish Breakout:

A clean 4H close above $90,500 opens upside toward $92,000+.

Bearish Breakdown:

Loss of $85,500 exposes downside toward $83,000–82,000.

Macro Context

Market is waiting for a catalyst (rates, USD move, ETF flows).

Until macro momentum returns, BTC favors patience over aggression.

Bottom Line

Bitcoin is not weak it’s coiling.

The longer price stays trapped, the more violent the eventual breakout.

Until then, discipline beats prediction.

Bitcoin Isn’t Breaking Out — This Range Is Most Trader Get TrapBTC/USD – 1H Market Analysis

Bitcoin is still trading inside a well-defined range, not a trending market. Price continues to oscillate between the support zone around 86,000–86,500 and the resistance zone near 89,800–90,500, confirming that the market is in consolidation rather than expansion. Despite recent impulsive candles, structure remains intact and controlled.

From a technical perspective, EMA 34 and EMA 89 are compressing and overlapping, signaling equilibrium. This behavior typically appears before a larger move, but until price decisively exits the range, directional bias remains neutral-to-range-based. Every push into resistance has been met with selling pressure, while dips into support continue to attract buyers — classic range rotation.

Key Scenarios Ahead:

Primary scenario: Price pulls back toward the mid-range or support zone, absorbs liquidity, and attempts another rotation higher.

Bullish continuation: A clean hourly close above 90,500 with follow-through volume opens the path toward 91,800–92,500.

I nvalidation: Loss of 86,000 would shift structure bearish and negate the current range thesis.

Bottom line:

This is not a breakout market yet it’s a patience market. Traders who chase candles will get chopped; traders who respect structure will be positioned when volatility finally expands.

Most Traders Think This Is a Breakout — It’s Actually a LiquiditBITCOIN (BTCUSD) – 1H MARKET STRUCTURE ANALYSIS

1. Current Market Context – Sideways Is Not Weakness

Bitcoin is currently trading inside a clearly defined sideways (range-bound) structure.

This type of market often confuses traders because:

- Price moves frequently

- No clean trend is visible

- Fake breakouts appear on lower timeframes

However, sideways movement is not randomness it is order accumulation and distribution.

2. Key Price Zones on the Chart

🔴 Resistance Zone (Upper Range)

Price has been rejected multiple times from this area

Sellers consistently defend this level

Breakout attempts fail without structure confirmation

🟢 Support Zone (Lower Range)

Price repeatedly finds buyers in this area

Long wicks and strong reactions confirm demand

Smart money absorbs sell pressure here

3. Sideway Zone = Liquidity Zone

The highlighted sideway zone is where:

- Retail traders overtrade

- Emotions dominate

- Stop-losses are clustered on both sides

Professionals use this phase to:

- Accumulate positions quietly

- Create false breakouts

- Prepare for a high-momentum expansion later

This is why most losses occur inside ranges.

4. Price Behavior Inside the Range

Notice the repeated pattern:

- Push up → rejection

- Drop down → strong reaction

- Higher volatility near range edges

- Compression near the middle

This behavior confirms:

- No trend confirmation yet

- Market is waiting for liquidity completion

5. Breakout Logic – Not Guessing, Only Confirmation

A valid breakout requires:

- A clean close outside the range

- Structure continuation, not a single candle

- Acceptance above resistance or below support

Until then:

- Every move inside the range is noise

- Every early entry is risk exposure

6. Professional Trading Mindset

In a sideways market:

- Patience is a strategy

- Waiting is a position

- Capital preservation > prediction

Conclusion – Read the Market, Don’t Fight It

This chart is a textbook example of range accumulation.

Until price proves otherwise:

Respect the range

Trade only confirmed reactions

Ignore emotional breakouts

The market always shows its intention only disciplined traders are calm enough to see it.