NASDAQ Futures Long Setup: Pullback Entry After Tariff BoostMarket Outlook – April 13, 2025

Quick recap: In my last public analysis, I mentioned watching the 18,350–18,000 zone for signs of support — a level stacked with confluence (50–61.8% Fib, EMA, VWAP, pivot). Price broke down deeper than expected but responded beautifully:

✅ Tagged 18,000 almost to the tick

✅ Rejected hard at the 61.8 Fib

✅ Respected the 50 Fib on the way back up

All solid signs of strength.

Now with tariff exemptions announced today (bullish for tech/Nasdaq), I’m opening the door to more long setups this week.

Here’s What I’m Watching:

🔹 Scenario A: Pullback into the 18,575–18,500 zone (first dotted white line). If price reclaims structure or gives me something clean — EMA bounce, VWAP tag, candle pattern — I’ll look for longs.

🔹 Scenario B: If that level breaks or I miss the first shot, I’ll look for a second chance around 18,000–18,300. Same deal: not jumping in blindly, waiting for a setup to form.

To be clear — these are areas of interest, not automatic trades. I want clean structure and confirmation before entering.

Let’s see how it plays out. Will update if/when I take a position. Stay sharp. 📈

Bullishpattern

Weekly Support is around 80000.Weekly Support is around 80000.

However, 72500 - 73000 is its previous

breakout level & probably a Best Buying Rage

(if it touches) which is also a Confluence area of

Trendline Support+Important Fib. level.

Bullish Divergence on Shorter Time Frame +

Weekly Support around 80000 (if Sustained)

may push the Price up towards 87000 &

then around 95000 - 96000.

Ultimate Resistance is around 110000.

Crossing this level may open new Highs

Targeting around 136000.

On Shorter Timeframe, 85000 - 86000 is

the Immediate Resistance & Support is

around 80000.

Total 3 targeting 1.5TWelcome back dearest reader,

This is going to be a short one, all information is in the chart above.

Total 3 has been in a Massive Cup and handle formation.

Measured from the base of the cup till the top of the handle gives us a ''total 3'' price target of 1.5T$ which is 100x from here. If you were to do a different analysis and like flags more then we come to the same price target of 1.5T$ (Blue bars).

Price action is now retesting resistance from march 2024 as support. When this is done i expect blast-off mode.

~Rustle

Road to 3200Gold had a strong 4hr timeframe rejection from the 2960-2980 zone.

Also had a triple bottom in the same area.

Showing super strong signs of another bullish run.

Gold is making the strong move up to the 3140 area once 3100 is broke.

Should get a small rejection off the 3140 zone before a strong push up to a new all time high.

Next all time high goal is 3200 🚀

Short Notes:

•Run up to 3140 (Small rejection/load up zone)

•Then Load up zone 3110-3100

•Take Profit area 3200

As always, trade safe during these high volatility times and go crush it!💰

Markets bottom on fearA short term relief is due in the coming days.

I will buy QQQ at the opening of the market, for a few days.

Only the fundamentals (and Trump) will decide if it will be the bottom of a correction or the first bottom of a huge market crash.

I am using here:

- The RSI(14), weekly (below 40).

- The ROC(2), daily (below 10%).

- One other personal indicator

- My personal quant strategy

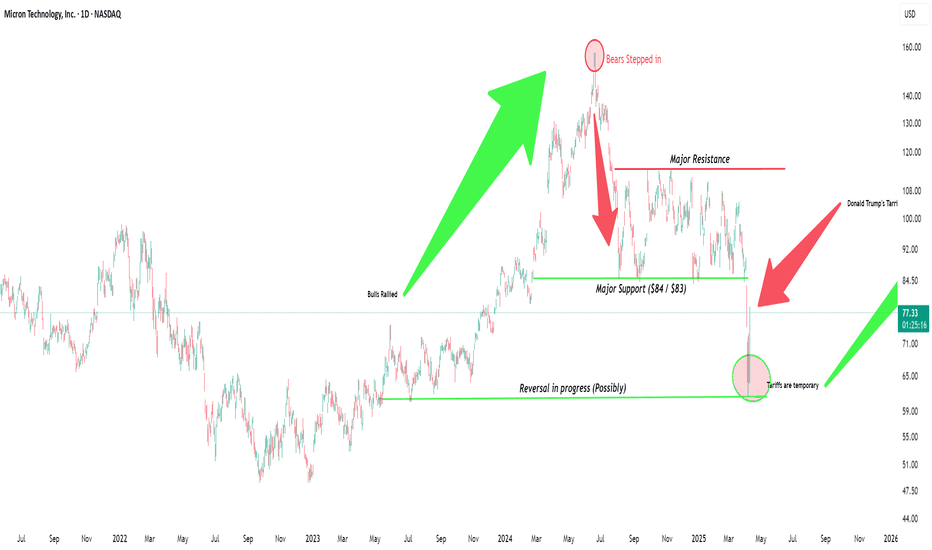

Micron's Time to Be THAT Semiconductor is coming and FastNASDAQ:MU is extremely undervalued, I produced this chart last night. Its time that the market appreciates this monster with such solid fundamentals. Micron since 2022 has been working hard to become a major producer in the United States. I believe that Trump and his government could get behind the only major memory company to be based in the United States.

-----------------------

Balance Sheet:

Cash: $8.22b

Debt: $11.54b

Equity: $48.63b

Total Liabilities: $24.42b

Total Assets: $73.05b

All Stated in $ USD

-----------------------

Valuation:

Price To Sales: 2.72

Price To Earnings: 18.30

Forward Price To Earnings: 6.84

-----------------------

WILL GOLD PUMP AGAIN IN FOMC NEWS ALERT🚨 XAUUSD Market Update! 🚨

Gold is on the move, battling key levels between 3040! Will we see a breakout soon? 🔥

Bearish Watch: If the price drops below this range, we could target 3015 and 3020. ⚠️

Bullish Opportunity: A break above 3042 could signal a buying surge, with targets set at and 3100. 🚀

💬 What’s Your Move? Join the conversation and share your thoughts! Let’s navigate this golden opportunity together and aim for new highs! 💰

#VOXELUSDT is in an uncertain zone📊 BYBIT:VOXELUSDT.P Scenario – Potential for Movement in Both Directions!

🚀 BYBIT:VOXELUSDT.P is forming a bullish Falling Wedge pattern — a breakout to the upside could provide a great risk/reward long opportunity!

At the current stage, the BYBIT:VOXELUSDT.P market is shaping a scenario where both directions — long or short — are possible, depending on the reaction to key levels.

✅ Overview

➡️ The chart shows two key formations:

🔻 Bearish Pennant – a bearish continuation pattern, which has already played out to the downside.

🔻 Falling Wedge – a potentially bullish pattern, and price is now near the lower boundary of the wedge.

➡️ A weak bounce on volume is visible, and price is approaching a key resistance zone — a potential target if the wedge breaks out upward.

➡️ If the wedge plays out, a bullish impulse is expected.

Timeframe: 1H

📈 LONG BYBIT:VOXELUSDT.P from $0.03406

🛡 Stop loss: $0.03322

🎯 TP Targets:

💎 TP 1: $0.03456

💎 TP 2: $0.03526

💎 TP 3: $0.03586

➡️ This scenario becomes viable if price breaks and consolidates above the $0.03126–$0.03200 zone, opening the path toward the POC zone at $0.03676.

➡️ Volume should increase on the breakout to confirm momentum.

📉 SHORT #VOXELUSDT from $0.03016

🛡 Stop loss: $0.03126

🎯 TP Targets:

💎 TP 1: $0.02960

💎 TP 2: $0.02900

💎 TP 3: $0.02860

➡️ This scenario activates if the price fails to rise and pulls back below $0.03000.

➡️ Volume should confirm seller pressure.

➡️ The chart shows lower highs — risk of further decline remains.

📍 The price is currently in a critical decision zone , between the short entry level and the potential breakout zone for a long.

📍 The support below is strong — it has held the price several times already. No clean breakdown has occurred yet, which increases the chances of the wedge breaking upward.

📍 Avoid rushing into a position — wait for a clear confirmation in either direction (e.g., strong impulse on volume and consolidation above/below key levels).

📢 General advice on this asset:

📢 Wait for direction confirmation — both long and short setups are valid.

📢 Stay flexible and adjust to the move.

📢 Manage your risk carefully — do not enter without a signal.

🚀 BYBIT:VOXELUSDT.P is in an uncertain zone — the signal could play out in either direction. Watch the key levels and enter only after confirmation!

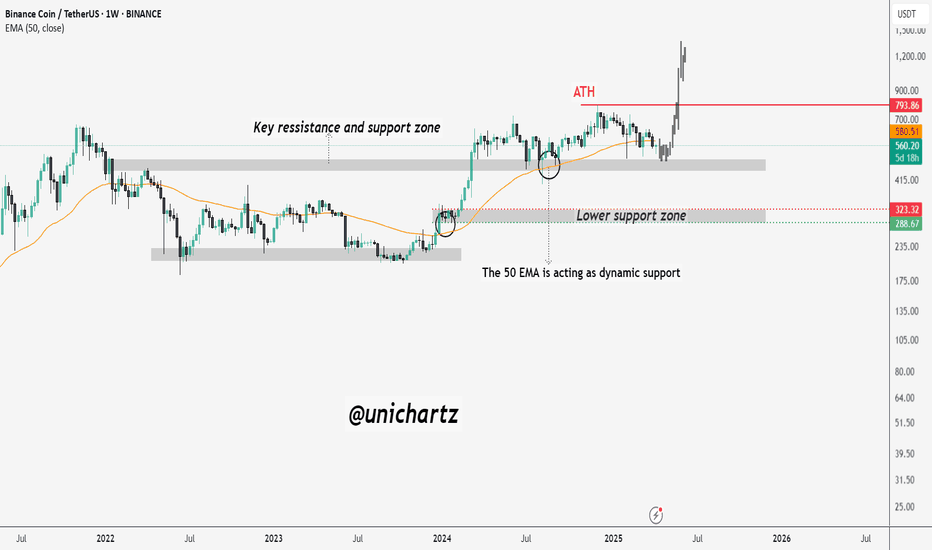

BNB Bulls Must Defend This LevelBNB is currently trading near a key support and resistance zone, a historically significant area that has acted as both supply and demand over the past few years. After reaching its all-time high (ATH) near $793, price has been gradually correcting, and is now approaching a critical point.

The 50-week EMA (Exponential Moving Average) is acting as dynamic support, and so far has played a strong role in providing bounce zones during corrections. This EMA is currently being tested once again, and price action around it will be crucial.

Just below this lies a major horizontal support zone around $415–$430, which previously served as a breakout base in 2023. If this area holds, BNB could see a rebound attempt.

We have 3 reasons to here

1. There is a megaphone pattern almost finished (A).

2. A broadening wedge is forming at a high level (B).

3. Another broadening wedge is nearing completion (C).

So, what I think is that Trump will announce something interesting to end the commercial conflict with everyone.

We will see a market recovery period and a new high.

Right now it looks bad, but it's not too bad.

WILL GOLD MARK NEW ATH TRUMP TERRIF ALERT!🚨 GOLD UPDATE (XAU/USD)🚨

Gold is showing a strong bullish trend, and it’s expected to continue for the next month. 🌟 If you see any dips, buy in again and again! We could see gold touch 3200 soon, especially with the ongoing China & Trump tensions. The US economy remains strong, and fundamentally, gold is primed to soar even higher! 📈💥

After Trump's tariffs, gold may dip and sweep more liquidity before bouncing back stronger. ⚡ As China and Trump battle, US strength keeps pushing gold to new heights. 📊

Key Buying Zones 🔑:

- 3030 – 3035: Last zone for reversal 🔄

- 3000: Strong support zone 🚀

Targets 🎯:

- 3100 💰

- 3200 💎

- After 1 month: 3300 💥

⚠️ Always follow risk management⚠️

BTC/USD Weekly Analysis – Cup and Handle Breakout Toward Target🔍 Overview

The chart displays a classic Cup and Handle pattern on the weekly timeframe, a well-established bullish continuation formation often found in long-term uptrends. This pattern, combined with major technical confluences such as trendline support and strong horizontal levels, provides a high-conviction long setup with defined risk and reward.

☕ 1. The Cup Formation

Timeframe: Mid-2021 to early 2024

Shape: Rounded bottom, a hallmark of slow accumulation.

After reaching an all-time high in late 2021, BTC entered a bear market, dropping sharply and eventually bottoming out between $15,000–$20,000.

A gradual recovery followed, forming a wide and symmetrical base—indicating accumulation by institutional and long-term holders.

This phase represents a shift in market sentiment, from bearish to neutral, and eventually bullish, as buyers stepped in around key demand zones.

🔧 2. The Handle Formation

Timeframe: Early 2024 to late 2024

After reclaiming its previous high resistance area near $69,000–$75,000, BTC formed a short-term consolidation or pullback, creating the "handle" portion of the pattern.

The handle appeared as a descending channel, a healthy correction that typically precedes a breakout in this pattern.

This correction also aligned with a trendline retest, offering dynamic support and further strengthening the pattern's reliability.

💥 3. Breakout Confirmation

The breakout from the handle occurred above the descending resistance of the handle pattern.

Weekly candles showed strong bullish momentum, backed by rising volume and rejection from lower trendline levels.

BTC is now trading near $83,000, just above the trendline, confirming both pattern validation and support holding.

🎯 4. Target & Projection

The measured move of the Cup and Handle pattern is calculated by measuring the depth of the cup and projecting that from the breakout point.

Cup Depth: Approximately $60,000

Breakout Point: ~$75,000–$80,000

Target Price: ~$123,000–$125,000

This target aligns with historical Fibonacci extensions and psychological round-number resistance.

🔐 5. Key Levels

Support Zone: $20,000–$30,000 (multi-year accumulation base)

Trendline Support: Drawn from 2022 lows, holding well through handle correction

Resistance Zone: $100,000 psychological barrier

Stop Loss: Placed just below trendline and swing low at $76,340 to protect against downside volatility

🧠 Why This Setup is Strong

Multi-year Base Formation (2.5+ years of consolidation)

Pattern Reliability: Cup and Handle is a well-tested bullish continuation pattern

Confluence of Support: Both horizontal and dynamic trendline support levels

Momentum Structure: BTC has resumed higher highs and higher lows

Volume: Breakout occurred with a noticeable spike in volume, a key validation point

🏁 Conclusion

Bitcoin is displaying strong bullish potential through a large-scale Cup and Handle pattern. This technical setup is supported by:

Long-term accumulation

Structural breakout

Strong support levels

A clear roadmap toward $120K+ targets

As long as BTC maintains above the trendline and doesn't invalidate the handle's structure, the bulls remain firmly in control.

#LAYERUSDT setup remains active 📉 LONG MEXC:LAYERUSDT.P from $1.5722

🛡 Stop loss: $1.5440

🕒 Timeframe: 1H

✅ Market Overview:

➡️ The coin is showing "its own game" — price action is independent of #BTC and #ETH, reacting to internal volume dynamics.

➡️ Ascending triangle breakout with a confirmed close above the key $1.5440 zone.

➡️ Empty space ahead — no major resistance levels until $1.6060–$1.6210.

➡️ Accumulation is forming between $1.5440–$1.5700 — a breakout may follow.

➡️ Important: candles must close above $1.5440 to confirm the long scenario.

🎯 TP Targets:

💎 TP1: $1.5880

💎 TP2: $1.6060

💎 TP3: $1.6210 (full measured move from triangle pattern)

📢 Recommendations:

If volume MEXC:LAYERUSDT.P increases during a breakout above $1.5722 — expect a rapid move.

If price pulls back — the $1.5254 area could offer a second entry opportunity.

The coin looks strong but slightly overbought — partial take profit at TP1 is advised.

📢 A strong breakout above $1.5700 may lead to a sharp move due to lack of resistance.

📢 Avoid 1H candle close below $1.5440 — scenario invalidation.

📢 If the move occurs on weak volume — watch for a potential reversal near TP1.

🚀 MEXC:LAYERUSDT.P setup remains active — holding the key level could lead to a move toward TP2–TP3!

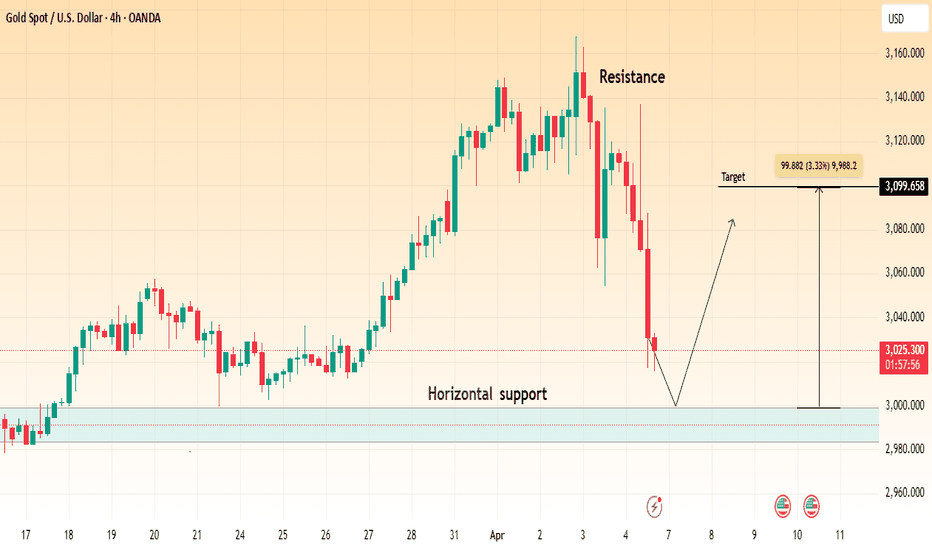

"Gold Approaching Key Support – Will Bulls Take Control?"🔹 Market Structure:

Gold is currently in a corrective phase after a strong bullish run, facing a pullback from recent highs around $3,160. The price has now approached a key horizontal support zone near $2,980 - $3,020.

🔹 Key Levels:

✅ Resistance: ~$3,160 (previous high)

✅ Horizontal Support: ~$2,980 - $3,020 (marked in blue)

✅ Target Level: ~$3,099 (potential bounce area)

🔹 Potential Scenarios:

1️⃣ Bullish Reversal: If the price finds support in the marked zone and forms bullish confirmation (e.g., hammer candle, bullish engulfing), we could see a retest of $3,099 and potentially higher levels.

2️⃣ Breakdown Scenario: If support fails, gold may see further downside towards $2,950 or lower.

🔹 Trading Plan:

📈 Buy Setup: Look for bullish confirmation near support (~$3,020) with a target of $3,099 - $3,120.

📉 Sell Setup: If support breaks, short positions could target $2,950 - $2,920.

🔸 Bias: Bullish above support, bearish below it.

🔸 Risk Management: Use a stop-loss below support (~$2,980) to manage risk.

Would you like me to refine this further or add any indicators like RSI, Moving Averages, etc.? 🚀

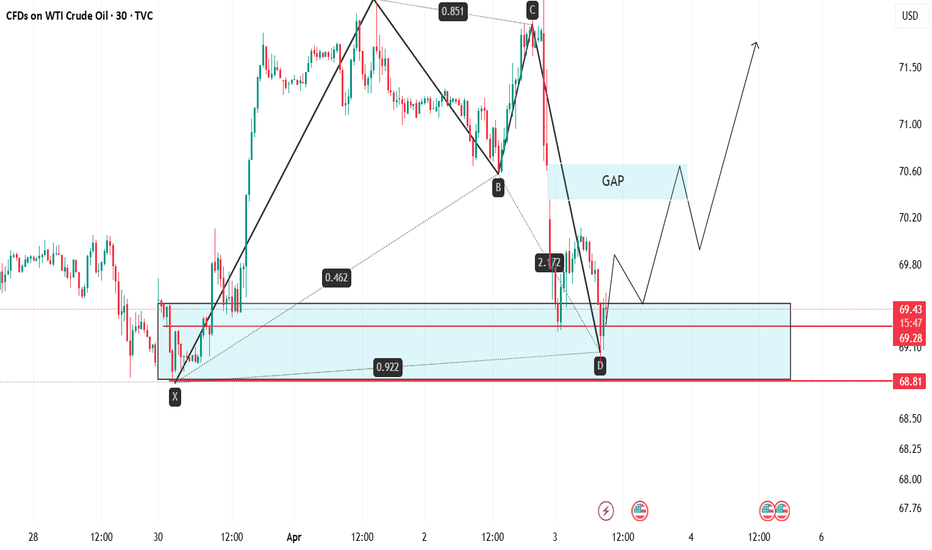

USOIL: Key Levels and Bullish Prospects Amid Trade War ConcernsGood morning Traders,

Trust you are doing great.

Kindly go through my analysis of USOIL.

USOIL is currently experiencing market imbalance due to the nature of its opening range, following a gap-down decline last night in response to trade war concerns that have fueled recession fears. The price dropped from its weekly high of 72.22 to a key support zone at 69.00, which is near the week's low. As we anticipate the release of the ISM Services PMI at 3 PM GMT+1, I expect the demand zone to hold, driving the price higher—initially to fill the gap and subsequently toward the 71.35 region. Furthermore, this outlook is strengthened by the formation of a bullish Bat pattern on the M30 chart.

The key levels I will be monitoring for potential price action include the previous week's high at 70.10, the five-week high at 70.62, and the 71.35 region. These areas represent significant resistance levels that could be tested as price moves upward. A break below 68.80 will invalidate this outlook.

Cheers and Happy trading.

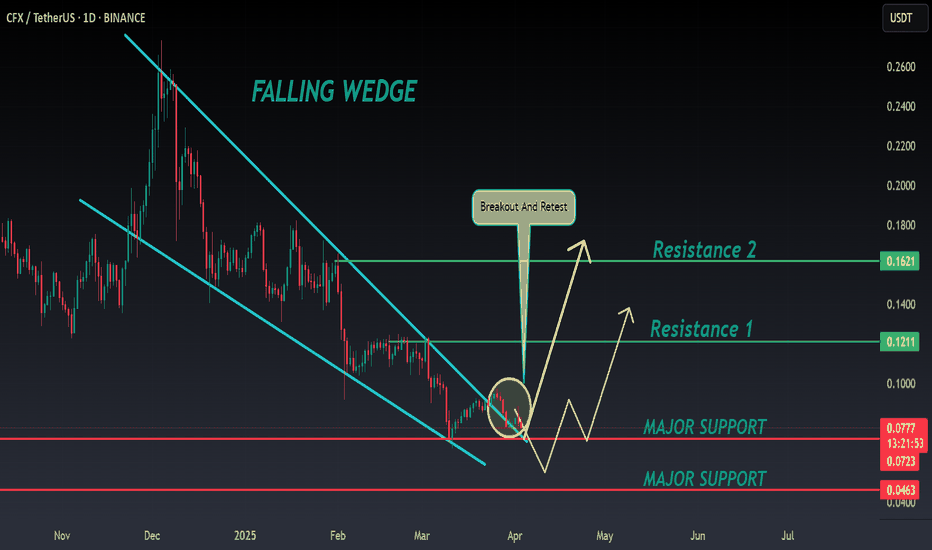

CFX ANALYSIS📊 #CFX Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retests from the major resistance zone🧐

Pattern signals potential bullish movement incoming after a successful retest

👀Current Price: $0.0775

🚀 Target Price: $0.1210

⚡️What to do ?

👀Keep an eye on #CFX price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#CFX #Cryptocurrency #TechnicalAnalysis #DYOR

Bullish on All Time Frames.Bullish on All Time Frames.

Monthly Closing above 211 - 212 would

be very positive for OGDC.

Retested the Previous Breakout Level

around 194 - 195.

Hidden Bullish Divergence on Daily Tf.

227 - 228 is the Weekly Resistance that

seems to break this time.

If this level is Sustained, we may witness

250+ initially.

EUR/GBP: Inverse Head & Shoulders Breakout Towards TargetChart Overview

Asset: Euro / British Pound (EUR/GBP)

Timeframe: 1-hour (1H)

Date and Time: Published on April 2, 2025, at 19:21 UTC

Publisher: GoldMasterTraders on TradingView

Current Price (at the time of the chart):

Open: 0.83668

High: 0.83670

Low: 0.83260

Close: 0.83635

Change: -0.00035 (-0.04%)

Price on the Right Axis: The price scale ranges from approximately 0.83100 to 0.84447, with the current price around 0.83642 (ask) and 0.83635 (bid).

Chart Elements and Technical Analysis

1. Candlestick Price Action

The chart displays a 1-hour candlestick representation of EUR/GBP, showing price movements from mid-March to early April 2025.

Trend Context:

Prior to the formation of the pattern, the price experienced a downtrend, declining from around 0.84200 (March 12) to a low of 0.83260 (March 25). This indicates a bearish trend leading into the pattern formation.

Following this decline, the price began to consolidate, forming the Inverse Head and Shoulders pattern, which suggests a potential reversal from bearish to bullish.

Recent Price Action:

On April 2, the price appears to have broken out above the neckline of the Inverse Head and Shoulders pattern, closing above the resistance level with a bullish candle. The current price of 0.83642 is above the breakout level, supporting the bullish thesis.

2. Chart Pattern: Inverse Head and Shoulders

Pattern Identification:

The chart highlights an Inverse Head and Shoulders pattern, a bullish reversal pattern that typically forms after a downtrend. It consists of three troughs:

Left Shoulder: A low around 0.83400 (March 20), followed by a bounce.

Head: A deeper low at 0.83260 (March 25), marking the lowest point of the pattern.

Right Shoulder: A higher low around 0.83400 (March 30), indicating diminishing selling pressure.

The neckline is drawn by connecting the highs between the shoulders (around 0.83600–0.83700), sloping slightly downward in this case.

Pattern Dynamics:

The Inverse Head and Shoulders pattern signals a shift from bearish to bullish sentiment. The left shoulder and head represent selling pressure, while the higher right shoulder indicates buyers stepping in at a higher level, showing increased demand.

The breakout occurs when the price closes above the neckline, confirming the reversal. In this chart, the breakout is confirmed around April 2, with the price closing above the neckline at approximately 0.83600–0.83700.

Breakout Confirmation:

The price broke above the neckline on April 2, with a strong bullish candle closing at 0.83635. The current price of 0.83642 is holding above the breakout level, which is a positive sign for bulls.

The breakout level aligns with the resistance zone, making the move significant as it also clears this key barrier.

3. Key Support and Resistance Levels

Support Level:

A horizontal support zone is marked around 0.83425 (approximately 0.8340–0.8345).

This level corresponds to the lows of the left and right shoulders, where buyers stepped in to defend the price. It also aligns with the lower boundary of the pattern, reinforcing its importance.

Resistance Level:

A resistance zone is marked around 0.83700 (approximately 0.8365–0.8375).

This level corresponds to the neckline of the Inverse Head and Shoulders pattern and a previous high from March 19. It acted as a barrier during the pattern formation but has now been broken, turning it into potential support on a retest.

Target Level:

The target for the breakout is projected at 0.84447.

This target is calculated using the standard method for Head and Shoulders patterns: measuring the height of the pattern (from the head at 0.83260 to the neckline at 0.83700, which is 0.00440) and projecting that distance upward from the breakout point (0.83700 + 0.00440 = 0.84140). The target of 0.84447 is slightly higher, possibly adjusted for the next significant resistance.

The chart indicates a potential move of 0.00627 (0.75%), which aligns with the distance from the breakout level (0.83700) to the target (0.84447).

4. Stop Loss and Risk Management

Stop Loss:

The stop loss is suggested below the support level at 0.83425.

Placing the stop loss below this level ensures that if the breakout fails and the price falls back below the neckline and the right shoulder, the trade is exited with a controlled loss.

The distance from the breakout level (0.83700) to the stop loss (0.83425) is 0.00275, representing the risk on the trade.

Risk-Reward Ratio:

The chart indicates a potential move of 0.00627 (0.75%) to the target.

The risk is 0.00275 (from 0.83700 to 0.83425), and the reward is 0.00627 (from 0.83700 to 0.84447), giving a risk-reward ratio of approximately 2.28:1 (0.00627 / 0.00275). This is a favorable ratio for a trading setup.

5. Additional Annotations

Pattern Components:

The chart labels the Left Shoulder, Head, and Right Shoulder, clearly identifying the structure of the Inverse Head and Shoulders pattern.

A blue arrow labeled “Inverse Head & Shoulder pattern” points to the formation, making it easy to recognize.

Arrows and Labels:

A green arrow labeled “Support Level” points to the 0.83425 zone, indicating where buyers have defended the price.

A red arrow labeled “Resistance Level” points to the 0.83700 zone, highlighting the neckline and the breakout area.

A blue arrow labeled “Target” points to 0.84447, showing the projected price objective.

A blue arrow labeled “Stop Loss” points to 0.83425, indicating the risk management level.

Price Labels on the Right Axis:

The right axis shows key price levels, with the current ask price at 0.83642 (red) and bid price at 0.83635 (black), reflecting the live market spread.

Trading Setup Breakdown

Based on the chart, here’s the detailed trading setup:

Entry:

Position: Long (buy) EUR/GBP.

Entry Point: The setup suggests entering after the price breaks out above the neckline of the Inverse Head and Shoulders pattern, which occurred around April 2, 2025, at approximately 0.83700.

Confirmation: The breakout is confirmed by a strong bullish candle closing above the neckline, with the current price at 0.83642, slightly below the high of 0.83670 but still above the breakout level. Traders might wait for a retest of the neckline (now acting as support) for a safer entry, though this isn’t explicitly suggested in the chart.

Stop Loss:

Level: Place the stop loss below the support level at 0.83425.

Rationale: This placement protects against a false breakout. If the price falls back below the neckline and breaches the right shoulder, the bullish thesis is invalidated, and the trade should be exited.

Risk: The distance from the entry (0.83700) to the stop loss (0.83425) is 0.00275, or approximately 0.33% of the entry price.

Take Profit/Target:

Level: The target is set at 0.84447.

Rationale: This target is derived from the height of the pattern projected upward from the breakout point. It also aligns with a logical extension toward the next significant resistance.

Reward: The distance from the entry (0.83700) to the target (0.84447) is 0.00627, or approximately 0.75% of the entry price.

Risk-Reward Ratio:

The risk-reward ratio is approximately 2.28:1, which is attractive for a trading setup. For every unit of risk (0.00275), the potential reward is over 2 units (0.00627).

Trade Management:

Trailing Stop: Once the price approaches the target at 0.84447, traders might consider trailing the stop loss to lock in profits, especially if the price shows signs of stalling.

Partial Profit Taking: Some traders might take partial profits at a minor resistance level (e.g., 0.84000) and let the remaining position run toward the target.

Broader Market Context

Trend Analysis:

The broader trend before the pattern was bearish, as evidenced by the decline from 0.84200 to 0.83260. The Inverse Head and Shoulders pattern suggests a potential reversal to the upside, with the breakout confirming this shift.

The price action after the breakout will be critical. A strong move toward 0.84000 with high volume would confirm the bullish momentum.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of an Inverse Head and Shoulders breakout includes:

Volume: An increase in volume on the breakout candle, indicating strong buying interest.

Momentum: A bullish signal from indicators like RSI (e.g., moving above 50) or MACD (e.g., a bullish crossover).

Traders should check these indicators to validate the breakout’s strength.

Market Factors:

EUR/GBP is influenced by factors like Eurozone and UK economic data, interest rate differentials, and Brexit-related developments. On April 2, 2025, traders should consider:

Economic Data: Key releases like UK GDP, Eurozone inflation, or central bank statements around this time could impact the pair.

Geopolitical Events: Any developments related to UK-EU relations or global risk sentiment could drive volatility in EUR/GBP.

Potential Risks and Considerations

False Breakout:

If the price fails to hold above the neckline (0.83700) and falls back below the right shoulder, the setup is invalidated. The stop loss at 0.83425 mitigates this risk.

Resistance at 0.84000:

The price may encounter resistance around 0.84000, a psychological level and a previous high. Traders should watch for bearish price action (e.g., a shooting star or bearish engulfing candle) near this level.

Market Volatility:

EUR/GBP can be volatile on a 1-hour timeframe, especially around economic data releases. Unexpected news could lead to sharp price swings, potentially triggering the stop loss prematurely.

Timeframe Limitations:

This is a short-term setup on a 1-hour chart, so the target might be reached within hours to a couple of days. However, intraday noise could lead to choppy price action, requiring active trade management.

Conclusion

The TradingView chart by GoldMasterTraders presents a well-structured bullish trading setup for EUR/GBP based on an Inverse Head and Shoulders pattern. The price has broken out above the neckline on April 2, 2025, signaling a potential move toward the target of 0.84447. Key levels include support at 0.83425 (where the stop loss is placed) and the neckline resistance at 0.83700, which the price must hold above to maintain the bullish thesis. The setup offers a favorable risk-reward ratio of 2.28:1, making it an attractive trade for short-term traders.

However, traders should confirm the breakout with additional indicators (e.g., volume, RSI) and monitor broader market conditions, as this chart is a snapshot from April 2, 2025, and market dynamics may have evolved since then. If you’d like to search for more recent data on EUR/GBP or check the outcome of this setup, I can assist with that!