GBP/USD targets 1.35 after mixed UK jobs! Break or reversal?Today, we are doing a dive into GBP/USD following a mixed UK jobs report that has left traders scratching their heads. While unemployment has spiked to a 4-year high, sticky wage growth and new tariff threats from President Trump are keeping the pound bid. Is a breakout to 1.35 imminent, or is the labour market crack a warning sign?

We analyse the conflicting signals from the UK economy: unemployment rose to 5.1% in December (highest since 2021), yet wage growth held firm at 4.7%, keeping the BOE cautious on rate cuts. We overlay this with the "Greenland Tariff" threat weakening the US dollar and map out the technical path to 1.3568.

Key topics:

UK Jobs data: A breakdown of the December report—unemployment up to 5.1%, 43k job losses, yet sticky wages (4.7%) are preventing a dovish pivot from the BoE.

Trump tariff threat: How President Trump’s weekend threat to impose 10% tariffs on 8 EU nations (including the UK) over the Greenland dispute is pressuring the dollar and supporting cable.

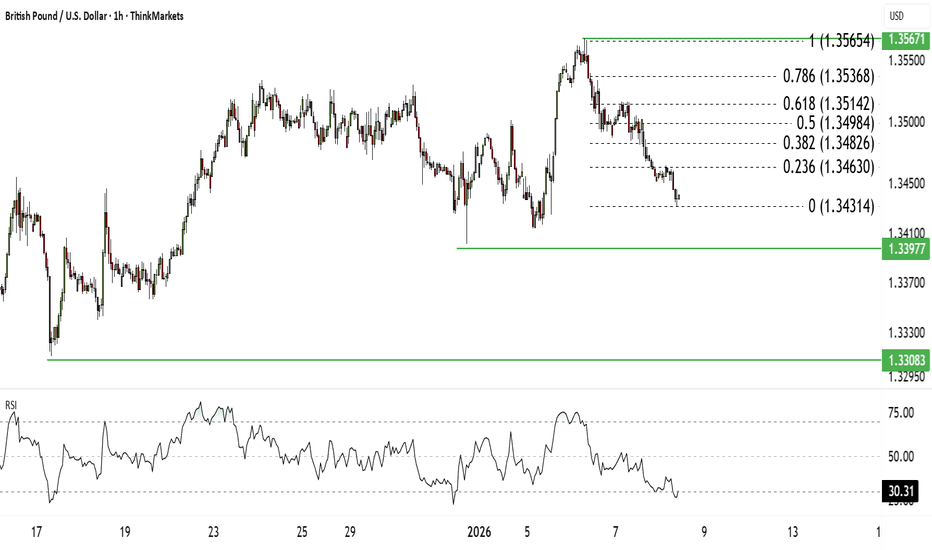

Technical setup :

Bullish flag breakout: GBP/USD has reclaimed the 1.3400 handle and is holding above the 50% Fibonacci retracement.

Golden pocket: Currently testing the 1.3481 "golden pocket." A break here targets the 1.3568 cycle high.

Extension target: The 100% Fib extension points to 1.3500 as the immediate hurdle, with 1.3539 and 1.3562 above that.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Are you speculating on a 1.35 breakout or fading the weak labour data? Let us know in the comments!

Cable

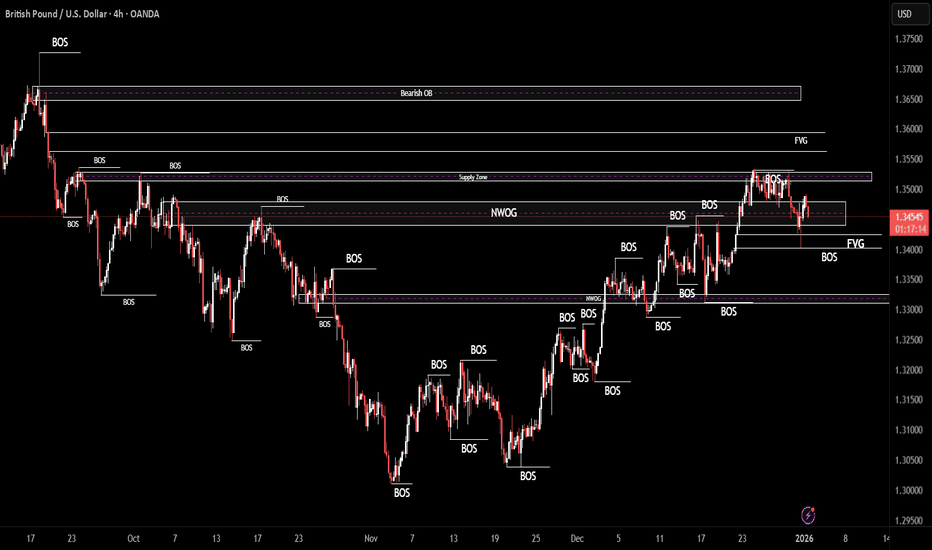

GBPUSD: Weak! Sell The Rip!Welcome back to the Weekly Forex Forecast for the week of Jan. 19-24th.

GBPUSD has closed the previous three weeks bearishly, each one below the low of the previous week. I will be looking for the bearish momentum to continue into this week.

GU has gapped open to start the week, and closed that gap immediately. Let the market head into the bearish OB and monitor the reaction to contact for signs of resistance. If there is a BOS on the LTFs, I would look for valid sells.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Cable eyes 1.34 on weak housing data.NFP to make or break bottomCable is pushing toward 1.34 with signs of a potential top forming, as clear divergence on the 4-hour RSI pushes prices lower. The big question: Will UK housing weakness and a divided Fed allow a break to 1.34 towards 1.33, or are we heading back to 1.35?

We analyse the impact of soft UK housing data, Halifax reported a 0.6% drop in December, against a backdrop of US dollar weakness and Fed uncertainty. With NFP looming tomorrow and President Trump potentially announcing a new dovish Fed Chair this month, volatility is guaranteed.

Key drivers

UK Housing softens : High mortgage rates are biting, with prices falling for the first time since June. Markets are split (47%) on an April BOE rate cut, capping Sterling's upside.

Fed & dollar : An 82% probability of a Fed pause in January is priced in, but markets still see cuts in 2026. A "U-shaped" dollar outlook favours GBPUSD upside early in the year.

NFP wildcard : Friday's jobs report could validate the Fed's "wait-and-see" stance or boost rate cut odds above 85%.

Technical levels

Bullish case : If 1.3400 holds as support (double bottom), we could bounce toward 1.3450 and eventually target 1.3500-1.3570 post-NFP.

Bearish case : A breakdown below 1.34 targets 1.3355 and the major support at 1.3300, especially if NFP comes in strong.

RSI check : The 1-hour RSI is oversold, suggesting a short-term bounce, but 4-hour divergence warns of medium-term weakness.

Are you betting on a breakout to 1.35 or fading the divergence? Share your plan in the comments and subscribe for our NFP coverage! Trade safe.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

GBP/USD | Bearish momentum continues? (READ THE CAPTION)As you can see in the hourly chart of GBPUSD, ever since it hit the low of the FVG at 1.35630, it has been in a bearish move, falling over 100 pips since Teusday morning, and is being traded at 1.34540, stuck in the NWOG.

I expect a reaction to the Consequent Encroachment (C.E.) of the wick of the orderblock that is shown in the chart, at 1.34390.

Targets for the GBPUSD are: 1.34620, 1.34680 and 1.34740.

GBP/USD | Still going higher? (READ THE CAPTION)By analysing the hourly chart of GBPUSD, it can be seen that last night, it hit the low of the NWOG at 1.34930 and them went back up to 1.35169, hitting the Low of the Supply Zone, after which it dropped to the high of NDOG at 1.35030, then retested the supply zone and then again droped in price, currently being traded at 1.35090.

For the time being, the targets are: 1.35170, 1.35240, 1.35310 and 1.35380.

Cable; Watch For A bounce From 1.3357-1.3300 area. Cable traded higher for most of December, but during the holidays we saw some reversal, which is very normal when markets slow down. At the beginning of the new year, we can expect more choppy price action, with moves in both directions, before the market potentially stabilizes and maybe even resumes higher later on. From an Elliott wave perspective, I would not be surprised to see a deeper near term retracement within the ongoing A-B-C decline. The first support comes in around 1.3357, followed by the 1.3300 area, which is an interesting zone as it marks the post Bank of England rate cut low.

GH

GBP/USD | Going back up? (READ THE CAPTION)As you can see in the 4h chart of GBPUSD, it went through the NWOG only to be stopped in the supply zone, consolidating there for a while and finally a drop in price. Cable dropped all the way to 1.34016, hitting the low of the FVG and then bouncing back up, going through the NWOG once again but it dropped again and it is now being traded in the NWOG zone at 1.34560.

If GBPUSD continues to fall, I expect a reaction to the high of the FVG.

For the time being, the upwards targets for the GBPUSD are: 1.34690, 1.34910 and 1.35130.

GBP/USD | Retesting, retesting, retesting! (READ THE CAPTION)In the 4H of GBPUSD, we can see that it was rejected by Supply Zone, but after hitting the NWOG (New Week Opening Gap), it is currently being traded at 1.34850. I expect it to retest the Supply Zone, should it go through, it can go up to the low of the FVG at 1.35633, then we shall wait and see how it reacts to the level.

Next targets for GBPUSD: 1.3489, 1.3512, 1.3534 and 1.3557

*First target has already been reached*

GBPUSD wave 2 pullback? Buy the dip or sell the Rachel rally?Sterling surged over 1% last week on UK budget relief, the so-called "Rachel Rally", but profit-taking kicked in at resistance. With both the BOE and Fed now 90% expected to cut in December, the dollar is under more pressure, making Cable pullbacks attractive buying opportunities.

Key drivers:

"Rachel Rally" profit-taking after Sterling's best week since August led to double top at 1.3275 resistance.

BOE December rate cut priced at 90%, creating short-term headwinds.

Fed December cut odds surged to ~90% after ISM Manufacturing fell to 48.2, the ninth straight month of contraction, keeping dollar weak.

Both central banks are cutting, but USD is under more pressure right now, supporting GBPUSD on pullbacks.

Wave structure : Five-wave leg complete from 1.30 low, now in Wave 2 correction. Key support zone between 38.2% and 61.8% Fibonacci (around 1.3150–1.3130). If this holds, buying the dip for Wave 3 of Wave 3 (or Wave 3 of C) targeting 1.3275, then 1.3315 and higher.

Alternative : Losing 1.31 increases risk of continuation lower toward previous low and potentially 1.2847.

Looking to buy the GBPUSD dip? Share your Wave 2 entries in the comments and follow for more macro-plus-technicals trade ideas.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

GBPUSD: Wait For Confirmations For Sell Setups!Welcome back to the Weekly Forex Forecast for the week of Nov. 17-21st.

The GBPUSD is pulled back last week, moving higher. But it is still fundamentally weaker than the USDollar, and may be ending the corrective pullback early this week.

Wait patiently for the confirmation for sells to form up. The Daily barish FVG is a good place to look for sell setups on the 1H TF.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GBPUSD Could Grow 12-13% In Symmetric MoveCable in a large two-leg consolidation

The first big move in 2022–2023 travelled 27%

It formed two smaller legs joined by a brief corrective pause (orange circle)

Then the market entered a wide corrective phase (yellow trendlines)

lasting through 2023–2025

After that, the second large move has been unfolding

The first leg was softer and the mid correction (orange circle) deeper

but the structure remains alike

Last week’s candle printed a Hammer — clear reversal

suggesting the end of consolidation and start of the final leg up

Target for this leg equals the length of the first large move

→ $1.4870

That’s roughly +13% from the current $1.3160

There is another closer target based on symmetry of smaller legs within current large move

I marked it with green price measurement arrows, it hits below larger target of 1.4718

That’s almost +12% from the current $1.3160

GBP/USD | Pound Under Pressure – Bearish Reaction Expected!By analyzing the GBP/USD chart on the 1-hour timeframe, we can see that the price is currently trading around 1.3120. The supply zones ahead are 1.3130–1.3143 and 1.3148–1.3163 , where we may expect a bearish reaction once price reaches these levels.

For this scenario to be confirmed, we need a 1-hour candle close below 1.3130. The downside targets are 1.3107, 1.3095, and 1.3084.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

GBPUSD: Bearish! Sell The Pullback To The Daily -FVG!Welcome back to the Weekly Forex Forecast for the week of Nov. 3 - 7th.

The GBPUSD is weak and just swept sell side LQ at relative equal lows. I expect a retracement higher from there... to the Daily -FVG. There, I will look for the formation of a -BOS, and short this market.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly Outlook for GBP/USD (20–24 October 2025)Overview

GBP/USD enters the week of 20–24 October 2025 trading around the mid-1.34 level, having rebounded from recent lows near 1.33. The pound’s modest recovery has been underpinned by a softer U.S. dollar (amid expectations of Federal Reserve rate cuts) even as the UK faces domestic economic headwinds. This week brings a packed calendar of market-moving events: critically, the UK’s inflation report and consumer data, a delayed U.S. CPI release, and flash PMI surveys across major economies. Meanwhile, fiscal and political developments – from Britain’s looming budget to U.S.–China trade tensions – add further context. Retail FX traders should brace for potential volatility as these drivers converge on the GBP/USD pair.

Key Themes: The UK’s inflation trajectory is in focus on Wednesday, which could reshape Bank of England (BoE) expectations, while U.S. policy clarity is clouded by a recent government shutdown that delayed data releases. Both factors, alongside global risk sentiment, will determine whether GBP/USD can sustain its footing above $1.34 or if it retraces toward recent lows.

United Kingdom – Inflation in Focus Amid Domestic Pressures

UK Inflation: Critical CPI Data (Wed 22 Oct)

Britain’s Consumer Price Index (CPI) for September is due on Wednesday, 22 October, and is the marquee event for sterling. After holding at 3.8% in August – the highest inflation among major advanced economies – markets expect an uptick towards ~4.0% year-on-year. The Bank of England itself has forecast headline inflation could reach ~5.5% by Christmas before easing.

A hotter-than-expected CPI print this week “could offer GBP some relief” by bolstering bets that the BoE might need to maintain or even extend its tightening stance. In particular, traders will scrutinise the core inflation and services CPI components for any signs of sticky price pressures.

Conversely, a softer CPI reading – especially if accompanied by a drop in core or services inflation – would “deepen downside” for the pound. A weak print would reinforce the view that UK inflation is finally on a clear downtrend, cementing dovish BoE expectations and potentially undercutting GBP.

Several factors are influencing the UK’s inflation outlook.

Energy costs are a major wildcard: oil prices have actually fallen to multi-month lows (Brent crude ~$61, the weakest since May) on oversupply concerns. Cheaper oil and petrol should help temper near-term inflation for the UK, which is a net energy importer. Additionally, the British government is actively considering measures to reduce household energy bills – notably a plan to scrap the 5% VAT on domestic fuel in the upcoming budget.

The Chancellor, Rachel Reeves, has confirmed she is examining a cut of VAT on gas and electricity to 0%, aiming to ease cost-of-living pressures. Such a move, if enacted, could modestly dampen CPI (by directly lowering utility bills), but it comes at a fiscal cost of about £2.2 billion per year in lost revenue. This illustrates the policy dilemma: providing inflation relief versus safeguarding public finances. Markets will be alert this week to any official hints on this VAT cut, as it might alter the medium-term inflation path (a VAT removal would likely knock a few tenths of a percent off headline CPI in the short run) and thus influence BoE policy calculus.

Consumer Spending & Retail Data (Fri 24 Oct)

Beyond inflation, the pulse of the UK consumer is another focal point. Retail Sales for September are scheduled for Friday, 24 October (7:00am UK time). Recent signals suggest a mixed picture. On one hand, official retail volumes have shown pockets of resilience – August sales rose 0.5% MoM, outperforming expectations. On the other, surveys indicate underlying weakness: the Confederation of British Industry (CBI) reported retail activity has declined year-on-year for “a 12th straight month” in September. The CBI survey balance was -29 in Sept (from -32 in Aug), and retailers foresee another drop in October (expectations balance plunging to -36) amid weak consumer demand. Retailers note that “lacklustre economic conditions” and even US import tariffs (part of renewed trade tensions) are hurting sales. Moreover, consumer confidence has wavered heading into the autumn – households are grappling with higher borrowing costs and uncertainties about fiscal policy.

If Friday’s official data confirm a significant slowdown in September retail spending, it would underscore the drag on the UK economy from the cost-of-living squeeze. However, any surprise uptick (as happened in August) could imply British consumers are coping slightly better than feared, which might lend the pound support. Context: UK shoppers face cross-currents – falling inflation in some areas (e.g. food inflation has eased from double digits, though still ~5%reuters.com) versus rising outgoings like energy bills (the winter price cap increased) and high mortgage rates. This week’s data will help “connect the dots” on whether the UK’s economic momentum is holding up or rolling over as we approach Q4.

Labour Market & Wages – Cooling, but Watch for Policy Impact

While no major jobs data is due this week, the UK labour market backdrop looms over the BoE’s decision-making. Last week’s ONS report showed the unemployment rate has crept up to 4.8% (in the June–August period), the highest since 2021. Crucially, wage growth is slowing: regular pay rose 4.7% YoY, the slowest since 2022.

This cooling of pay pressures is a welcome sign for the BoE’s inflation fight. As one analyst noted, the combination of easing wage growth and a rising jobless rate gives the data a “dovish tint” for the BoE. Indeed, markets have slightly pulled forward their expectations of the first BoE rate cut into early 2026 (though no cut is expected in 2025). If inflation numbers this week undershoot or if any BoE speakers emphasise the labour market’s softening, rate-cut speculation could grow, potentially weighing on GBP.

Conversely, a CPI upside surprise might re-focus attention on still-elevated wage levels (4.7% pay growth is above the BoE’s inflation target) and keep rate cuts on the backburner. Traders should note that BoE Governor Andrew Bailey recently flagged concerns about financial stability – citing some corporate failures as possible “canaries in the coal mine” for broader risks – but he did not suggest this was altering the immediate monetary policy stance.

Overall, the BoE appears in “wait and see” mode: inflation data will be key in either reinforcing that peak rates have passed or, if unexpectedly high, reviving talk of one last hike.

Fiscal Policy and Politics – Budget Looming, Borrowing High

The UK’s fiscal picture has taken on greater significance for FX markets as government borrowing swells. Data out on Tuesday showed Britain’s public sector net borrowing from April–September reached £99.8 billion, 13% higher than a year prior and the second-highest on record for that period (only topped by the 2020 pandemic year). In September alone, the government borrowed £20.2 billion, a five-year high for that month. This overshoot in borrowing (about £7.2bn above official forecasts so far this year) keeps the pressure on Chancellor Rachel Reeves ahead of the 26 November Autumn Budget.

She has already signalled that tax rises and spending cuts are on the table to plug the gap and meet fiscal rules. Indeed, Reeves aims to balance day-to-day spending by decade’s end, but with her “fiscal headroom all but exhausted” due to weaker growth and higher interest costs, tough choices lie ahead.

From a currency perspective, tighter fiscal policy (higher taxes, restrained spending) could dampen UK growth prospects, which is typically a negative for sterling.

As ING economists cautioned, “tighter fiscal and looser monetary policy should ultimately be a bit bearish for sterling”. However, a credible budget that reins in borrowing might also appease bond markets and prevent any flare-up in UK risk premium. Investors vividly remember the gilt turmoil of 2022, so there is focus on Reeves avoiding any loss of market confidence.

For now, the pound has taken the borrowing news in stride – sterling was “little changed” after the latest debt figures – suggesting that as long as fiscal slippage remains modest, it is not a primary driver for GBP/USD. Still, traders will monitor any weekend headlines or leaks on budget measures (such as the mooted energy VAT cut or other tax changes) as we inch closer to November.

Surprise announcements could cause intraday shocks to the pound, especially if they imply significantly more borrowing or, conversely, austerity that could hit growth.

United States – Data Vacuum and Fed Policy Uncertainty

U.S. Economic Data: CPI and the Shutdown Effect

Over in the U.S., the economic calendar has been disrupted by the federal government shutdown that began on 1 October and lasted most of the first three weeks of this month. This led to a “data vacuum” where key releases like the September jobs report were postponed, leaving Fed officials and markets “flying blind” to some extent. Fortunately, one crucial indicator – the September Consumer Price Index – will be published this week on Friday, 24 October. (The U.S. administration ensured the CPI release goes ahead, partly because it’s needed to calculate Social Security COLA adjustments.)

Consensus expectations see U.S. headline CPI at around +3.1% YoY for September, which would be an uptick from August and above the Fed’s 2% goal. Any upside surprise (e.g. an even higher inflation number or stronger core CPI) could give the dollar a fillip – it would “keep alive policymakers’ concerns about the wisdom of cutting rates any further” at upcoming Fed meetings. In contrast, a cooler-than-expected CPI (say, below 3%) might reinforce the dovish case and deepen the market’s conviction in Fed rate cuts, weighing on the dollar. Notably, the Fed’s preferred inflation gauge, core PCE, has been running a bit lower (2.7% YoY as of August) but was on an upward drift into year-end. This CPI print is thus seen as pivotal for shaping the late-2025 inflation trend.

Besides CPI, the U.S. will see flash PMI surveys on Friday (covering manufacturing and services), which will provide a timely check on business activity in October across major economies (US, Eurozone, UK).

The U.S. PMIs have been hovering around the breakeven 50 mark in recent months – any significant weakness could amplify recession worries, while resilience might bolster the soft-landing narrative. Additionally, weekly jobless claims (Thursday) will be watched for any creep higher now that certain industries (and possibly government contractors hit by the shutdown) faced stress. However, overall, this week’s U.S. data flow is relatively light, and the absence of some regular reports (e.g. housing starts, trade data, which may have been delayed by the funding lapse) means the focus is squarely on CPI and broader themes rather than a barrage of numbers.

Federal Reserve Outlook: Cuts on the Horizon?

The Federal Reserve meets the following week (Oct 28–29), and despite limited fresh data, expectations are firmly tilted toward a rate cut. Financial markets are pricing in a 25 bp cut at that meeting (to a 3.75–4.00% Fed funds range) with near certainty. Fed officials themselves appear divided: some, like Kansas City Fed President Schmid, argue the current 4%+ rate is “the right place to be” to keep pressure on inflation while others – notably new Fed Governor Stephen Miran – contend that rates are far too high given inflation’s downtrend. The wildcard is the missing data: “The big question mark right now is the labour market, and we cannot know that until we see the report,” noted one economist, referring to the delayed September payrolls.

The Fed is essentially going into the meeting with an incomplete picture, which raises the bar for aggressive policy moves. Yet, with job growth clearly slowing (only ~29k per month on average June–Aug, a dramatic comedown from the post-pandemic boom) and the fiscal drag from the shutdown, doves have a strong argument that some easing is prudent. Indeed, futures now price not just October’s cut but another in December, and Fed speakers like St. Louis Fed’s Musalem have voiced support for more easing if employment risks grow.

For the dollar, a confirmed Fed rate cut (especially if coupled with dovish guidance) is typically a negative driver. This expectation has been part of why the USD Index (DXY) slipped under 99.

However, the effect on GBP/USD will also depend on relative outlooks – if the BoE is perceived as even more dovish (with UK rate cuts looming sooner, or a bigger growth worry), the pound could still weaken on a relative basis.

At present, Fed easing bets have taken some wind out of the dollar’s sails, aiding cable’s bounce. But any hawkish surprise from the Fed (e.g. if they signal no more cuts due to inflation worries) could swiftly reverse that. Keep an eye on Fed Chair Powell’s remarks – although they’ll come after this week, speculation around them may already start mid-week if CPI surprises.

Also notable: the U.S. government is still operating only on stopgap funding, and political paralysis in Washington (House leadership issues, etc.) has not fully resolved. This has macro implications – the recent 19-day shutdown is estimated to shave ~0.3 percentage points off Q4 GDP – and contributes to an overhang of uncertainty that intermittently hits the dollar.

Trade Tensions and Other U.S. News

An emerging theme that could influence global sentiment (and by extension, safe-haven USD demand) is the renewal of U.S.–China trade tensions. In recent days, the world’s two largest economies have imposed tit-for-tat restrictions, including new port usage fees on each other’s shipping, effectively rekindling a trade war.

This escalation has raised concerns about global supply chains and growth – the WTO warned a full decoupling could cut world output by 7% over time. For now, markets are warily watching diplomatic developments: there are talks scheduled (U.S. Treasury officials meeting Chinese counterparts) that could either ease or worsen the standoff.

The tone from U.S. President Trump (back in office as of January 2025) has oscillated between hardline – e.g. pressuring allies like India to stop buying Russian oil – and occasional optimism, such as him softening rhetoric by expressing hope for Chinese purchases of U.S. goods.

Any further headlines on trade this week may sway risk appetite: an easing of tensions could boost equities and risk-sensitive currencies (potentially helping GBP), whereas a sharp escalation could drive a flight-to-quality benefiting the dollar (and possibly hurting sterling).

In addition, U.S. corporate news has injected some jitters – the recent bankruptcies of two U.S. companies (First Brands and Tricolor) led to loan losses at certain banks, rattling stock prices.

While these are idiosyncratic events, the BoE’s Bailey and others are asking if they hint at broader credit stress. If U.S. financial sector concerns deepen, that too might spur safe-haven USD flows at the expense of currencies like GBP. So far, these seem contained, but it’s a space to watch.

Global Risk Environment and External Influences

Europe and PMIs

This Friday’s round of flash PMI surveys will not only cover the US and UK, but also the Eurozone, offering a near-real-time health check of major economies in October. Europe’s data could indirectly affect GBP if it moves the euro (EUR/USD), given GBP often trades in tandem with the euro against the dollar. Recent trends show the Eurozone had somewhat better momentum in early autumn while the UK was stagnating – September PMI for UK services slipped to ~50, and manufacturing was deep in contraction at 46.2. Should the Eurozone PMIs surprise positively while the UK’s disappoint, GBP could face a double whammy (as EUR/GBP strength might emerge). Conversely, if Europe’s economy also looks sluggish, it might limit GBP’s downside. The global backdrop as indicated by PMIs is expected to be one of subdued manufacturing and moderating services activity, reflecting the lagged impact of rate hikes worldwide.

Geopolitical Tensions

Geopolitics remain a simmering factor. The war in Ukraine and recent conflict in the Middle East (Israel-Hamas) continue to pose event risk. A major flare-up or expansion of conflict could spark risk-off moves – typically benefitting the U.S. dollar and other safe havens (and possibly weakening GBP, given the pound’s status as a risk-sensitive currency). Additionally, any shock OPEC+ action or supply disruption due to geopolitical events could whipsaw oil prices, which, while currently low, are one headline away from a spike. For now, absent new shocks, oil’s trajectory has been downward on oversupply: Brent’s forward curve even shifted into contango (a sign of glut) for the first time in a long while. Cheaper oil is a small positive for the UK’s inflation outlook and trade balance.

Market Sentiment and Equities

Global equity markets’ performance this week could also influence GBP/USD via the risk sentiment channel. If stocks rally on, say, hopes of Fed easing and cooling inflation, the dollar could weaken modestly as investors seek higher yields outside the U.S., which might support GBP. Indeed, the pound has held up relatively well against the dollar compared to some other currencies, partly thanks to periodic “risk-on” flows into UK assets when global markets rally.

On the other hand, any sharp equity sell-off – whether triggered by earnings misses, credit concerns, or geopolitics – might revive demand for the safe-haven dollar, pressuring GBP/USD lower. It’s worth noting that U.S. Treasury yields (especially long-term) have been a driver lately; a pullback in yields (as markets bet on Fed cuts) hurt the dollar, but yields remain historically high. Should yields rebound this week (for example, if CPI is hot), the dollar may catch a bid and weigh on the pair. Keep an eye on the U.S. 10-year yield around the 5% threshold as a barometer.

GBP/USD Technical Outlook

From a technical perspective, GBP/USD is in a consolidation phase, trading within roughly a 1.32–1.36 range in recent weeks. The pair’s 50-day and 200-day moving averages are converging near the current price, reflecting the lack of a strong trend and an indecisive momentum backdrop. Support is evident around $1.33 – cable bounced off about $1.3250 last week, which was a multi-month low.

Below that, the 1.3200 area and August’s trough near 1.3150 are potential downside targets if bearish momentum resurfaces. On the topside, initial resistance comes in at 1.3450, and a break above there would be a bullish sign, possibly opening a move toward 1.3515–1.3520 (a congestion zone from September).

Beyond 1.3520, the next hurdle would be around 1.3600. Technical indicators are mixed: the RSI is near 50, and other oscillators are neutral, showing neither overbought nor oversold conditions. This suggests GBP/USD could await a catalyst (such as the CPI releases) to break out of its current equilibrium. Traders may thus see range-bound trading persist in the early part of the week, with volatility likely picking up mid-week onward. Notably, option implied volatilities have edged higher ahead of the UK CPI event, indicating the market is positioning for larger moves. In summary, 1.3380–1.3400 (roughly the 50-day EMA region) is a pivot area to watch; sustained trade below it could tilt bias lower, whereas holding above keeps the recent rebound intact.

(Chartists’ take: As of now, the pound’s failure last week to vault the mid-1.34s suggests lingering selling interest on rallies. But equally, dip-buyers emerged around 1.33. This tug-of-war may continue unless a data surprise tips the scales.)

Summary and Trading Considerations

In the week ahead, GBP/USD will be driven by a balance of domestic UK catalysts and U.S. developments, within a broader global mood of cautious optimism tempered by risk flare-ups. The pound’s bullish case would be bolstered if UK inflation surprises to the upside or other data (e.g. retail sales, PMIs) show unexpected resilience – that scenario could delay BoE easing and push GBP/USD higher, especially if U.S. CPI comes in tame (denting the dollar).

In such a case, a test of the mid-1.35s could be on the table. Conversely, the bearish case for GBP/USD is that UK data disappoint (soft inflation, weak retail activity) and the Fed remains on track to ease – meaning the pound’s own fundamentals deteriorate while the dollar might find safe-haven or yield support. Add in any risk-off events (e.g. worsening trade war or geopolitical shock), and cable could retest recent lows around 1.33 or lower. At present, the bias among many strategists is mildly bearish on GBP as domestic fundamentals (high inflation and soft growth) limit upside.

As one analysis noted, “bearish bias persists — GBP continues to struggle under domestic pressures”.

However, the dollar’s trajectory is equally crucial: if the Fed’s data-dependent stance turns more cautious with incoming numbers, the USD’s recent strength could wane, offering GBP/USD some relief.

Connecting the Dots: It’s important for traders to contextualise each piece of news. For example, a hot UK CPI might spike GBP higher on Wednesday morning – but if later that day U.S. trade or political news triggers a risk-off, the dollar could rebound and erase those gains. Similarly, a benign U.S. CPI on Friday could send GBP/USD upward, but one must consider that by then markets will also be positioning for the Fed meeting outcome the week after.

Risk management is key in such a headline-driven environment. Many will be watching volatility around the London session (for UK releases) and the New York session (for U.S. releases) for intraday opportunities.

In conclusion, GBP/USD traders should monitor:

(1) the UK CPI and retail figures for clues on the BoE’s next steps,

(2) the U.S. CPI and any Fed speak for confirmation of the anticipated rate cut,

(3) fiscal headlines from the UK (as budget plans firm up) and political developments in the US (post-shutdown manoeuvrings), and

(4) the general risk tone influenced by global events like trade and geopolitical issues.

All these elements are “contextually connected” – for instance, stronger UK data coupled with a dovish Fed could produce a synergy lifting GBP/USD, whereas weak UK data in a risk-off, dollar-favouring climate could see the pair test new lows. By keeping an eye on all these moving parts, one can better navigate the week’s challenges.

Sources: Key insights and data points have been drawn from Reuters, UK's ONS, and other reputable outlets to ensure an up-to-date and analysis. For instance, Reuters reports provided details on the UK’s inflation outlook and fiscal situation, the cooling of Britain’s labour market, and the Fed’s predicament amid the U.S. data blackout. Developments in energy and trade (e.g. oil prices hitting 5-month lows, U.S.–China tariffs) were also referenced from Reuters coverage.

These sources underpin the analysis, ensuring that each “dot” – from macroeconomic releases to political news – grounded in factual reporting as we connect them to map out the likely trajectory of GBP/USD this week.

WILL GBPUSD CORRECTION ENDS WITH SIMPLE WXY OR WXYXZ?Cable is undergoing a weekly having successfully break above the 1.34342 resistance now turned support level to extend its impulse trend. Will the pair's trend continue after a simple wxy correction, or a more complex wxyxz or even breakdown?

N.B!

- GBPUSD price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#gbpusd

#cable

GBP/USD What’s changed in the last 24–48h

What’s changed in the last 24–48h

IMF & BoE warnings: The IMF’s October Global Financial Stability Report flags stretched equity valuations—especially the AI-led tech cohort—and rising odds of a disorderly correction.

The BoE has voiced a similar risk: if optimism about AI fades, markets could lurch lower. That mix has supported the USD via risk-off flows.

UK data softens: Fresh ONS labour data show unemployment up to 4.8% (3m to August) and wage growth cooling—nudging markets to price earlier BoE easing at the margin and weighing on GBP.

Price action: Into today, GBP/USD has remained heavy, trading around the low-1.33s and briefly probing the 1.33–1.325 support area cited by several desks. Sellers faded bounces below ~1.336/1.340 resistance.

Counterweight from the Fed: A softer USD blip followed coverage of Powell hinting at scope to cut and slow QT, but it hasn’t flipped the broader risk tone yet.

How the IMF “AI bubble” angle feeds through to GBP/USD

Risk sentiment channel: AI-froth concerns raise correction risk in U.S. megacap tech. When equities wobble, USD tends to catch a haven bid, pushing GBP/USD lower—that’s what we’re seeing.

Rates/term-premium channel: The IMF also highlights fiscal and bond-market vulnerabilities. Any jump in U.S. yields on risk stress can be USD-supportive unless the Fed leans clearly dovish.

Relative growth narrative: The IMF’s WEO/GFSR portray the U.S. as still relatively resilient (AI investment) while the UK grows ~1.3% and faces stickier inflation—tilting differentials toward the USD unless UK data surprise.

Levels & Bias (tactical)

Resistance: 1.336–1.340 (break/close above would ease pressure); then 1.348.

Support: 1.330/1.325 first; loss of 1.325 risks a run toward the low-1.32s.

Bias: Still mildly bearish while below ~1.340 given risk-off impulse + soft UK labour prints. A durable USD dip would need clearer Fed easing signals or stronger UK data.

Near-term catalysts to watch (this week)

UK August GDP/production (Thu 16 Oct): A miss likely reinforces GBP selling; an upside surprise could spark a squeeze toward 1.34–1.348.

U.S. data/Fed speak: Any firm dovish steer could cap the dollar and stabilise cable; renewed equity stress on AI-bubble headlines would do the opposite.

Bottom line

Including the IMF’s AI-bubble warnings, the story so far is risk-off supportive of the USD, UK data are not helping sterling, and GBP/USD remains under pressure while sub-1.340.

For hedging: favour sell-the-rally flow below 1.340 with eyes on 1.330/1.325 support; flip more neutral only on a daily close above 1.340 or if UK data positively surprise.

GBP/USD Outlook for 13–17 October 2025

Technical Analysis

GBP/USD 1-hour chart as of 13 Oct 2025. The pair has been trending lower in early October, making lower highs and testing support near the mid-1.32s.

On the 1-hour and 4-hour charts, GBP/USD exhibits a clear short-term downtrend. After peaking around 1.3730 in September, the pair pulled back sharply to a multi-month low of 1.3263 by early October.

This drop has pushed price below key moving averages across timeframes – for instance, on the daily chart it fell under the 50-day EMA, a bearish technical signal

On H4 and H1, shorter period MAs are similarly sloping downward, acting as dynamic resistance. The trend structure shows a series of lower highs and lower lows. In the 1-hour chart (above), the latest bounce to the 1.3370–1.3380 area was rejected, confirming that prior support as a newfound resistance zone. The market’s inability to break the descending trendline (visible on intraday charts) has kept the momentum bearish.

Price patterns suggest the pair is consolidating after the recent sell-off, possibly forming a triangle or descending channel on the 4-hour chart. In fact, by the end of last week the pound was “forming a ‘Triangle’ pattern near 1.3442”.

This pattern reflects indecision – a compression that could precede a breakout. A bearish triangle interpretation aligns with the downtrend: a break below the triangle’s lower boundary (around 1.3080–1.3100) would signal a fresh leg down, whereas breaking above 1.3440–1.3480 would invalidate the pattern and hint at recovery.

Until one of these edges gives way, the pair may gyrate within this contracting range. Notably, volume spiked during the early October sell-off (as seen by large volume bars on the chart), indicating heavy selling interest when GBP/USD broke under mid-1.33. This suggests strong resistance on bounces – rallies have been on lighter volume, while declines saw higher participation, consistent with a market biased to the downside.

Support and resistance zones are well-defined. Immediate support lies at 1.3260 (the recent swing low) – the area where buyers defended prices last week. Below that, analysts highlight 1.3185 as an “ultimate support” target for this pullback.

This level is significant as it marks the next major floor (around the June/July lows) and a potential take-profit zone for short positions. If 1.3185 were to fail, it could trigger a steeper drop; the next supports would be around 1.3125–1.3130 (an earlier structural low) and the 1.3080 region (the base of the triangle pattern).

On the upside, 1.3370–1.3400 has turned into the first key resistance. This zone, which roughly corresponds to the broken support from late September and the 23.6% Fibonacci retracement of the Sep–Oct slide, now caps intraday rebounds. It also aligns with the Ichimoku kijun and Senkou Span B (~1.3390–1.3430) on H4 charts, reinforcing its importance as a pivot area

A sustained break above 1.3400 would neutralize the immediate bearish bias. Above, 1.3485 is the next focal level – technical forecasts indicate this as a likely corrective rally target if the pound strengthens..

Indeed, one weekly outlook suggests an attempt to test 1.3485 before sellers reassert control.

Beyond 1.3485, additional resistance lies around 1.3535–1.3550 (prior congestion zone) and then 1.3680–1.3730 (the September high). However, such levels may only come into play on a significant sentiment shift. For now, traders will be watching 1.3370 and 1.3260 as inflection points – a breakout or breakdown beyond these could set the tone for short-term direction.

In summary, the technical picture skews bearish going into the week. Trend indicators and moving averages point downward, and the pound’s failure to hold support indicates sellers remain in control. Key levels identified for short-term trading include: 1.3370 (near-term resistance/pivot), 1.3420 (strong resistance, near the 50-day MA and trendline confluence), 1.3260 (minor support), and 1.3185 (major support).

Scalpers may look to sell rallies near resistance and buy dips at support, but should do so cautiously given the potential for a volatile breakout from the consolidative pattern. The volume profile suggests any breakout should be watched for volume confirmation – e.g. a high-volume push above 1.3400 could signal a real reversal, whereas a low-volume pop might fade quickly. Likewise, a spike in volume on a drop through 1.3260 would confirm fresh selling pressure. These technical cues, combined with the broader context, will guide intraday and swing positioning as we move through the week.

Macroeconomic Fundamentals

Central Bank Policy Outlook (BoE vs Fed): The policy stances of the Bank of England and U.S. Federal Reserve are central to GBP/USD’s medium-term direction. The Bank of England (BoE) has shifted to a more dovish footing in late 2025, as the UK economy shows signs of cooling. In August, the BoE cut its benchmark rate by 25 bps to 4.0%, the first cut since 2023

This decision was contentious – inflation was still ~3.8% (nearly double the 2% target) at that time, and nearly half of the BoE’s MPC members opposed the cut on inflation concerns.

However, a couple of policymakers continued to vote for further cuts at the latest meeting, citing weakening growth.

The BoE’s dilemma is clear: inflation remains above target, but economic momentum is fading. The bank’s current guidance leans toward staying on hold in the very near term, yet markets are beginning to price in the possibility of additional rate cuts in coming months if the downturn deepens. In short, the BoE’s policy outlook has turned cautious – rate cuts are on the table if data continue to deteriorate, though the bank is treading carefully given inflation’s persistence.

The U.S. Federal Reserve likewise appears to have ended its rate-hiking cycle and is eyeing potential rate reductions ahead. U.S. inflation has moderated closer to the Fed’s target (headline CPI was last about 2.9% YoY in August), and the Fed adopted a pause in hikes since late 2024. Now, amid signs of slowing economic activity, the futures market is assigning ~75% probability that the Fed will cut rates twice more by end-2025.

Fed officials have maintained a cautious tone, balancing lingering inflation risks against emerging growth and employment risks. Notably, Fed Chair Jerome Powell has warned of “dual risk” – that inflation could tick up again even as unemployment rises – which justifies a data-dependent approach.

But if incoming data (once fully available) confirm cooling price pressures and softer growth, the bias will tilt toward monetary easing. In sum, both central banks are shifting from tightening to easing bias, but timing differs: the BoE has already made a cut (with some hesitation), whereas the Fed has paused but not cut yet. This relative stance will influence yield differentials – any hint of the Fed cutting sooner or more aggressively than the BoE tends to weaken the USD against GBP (and vice versa).

Economic Indicators (Inflation, Growth, Employment): Recent data underscore the divergence in economic conditions. Inflation: UK price growth, while down from its 2022 peaks, is still elevated at 3.8% as of the last reading (August).

In the U.S., inflation is lower (~3.1% core, 2.9% headline in Aug), much closer to the Fed’s 2% goal. Thus, real interest rates in the UK are more negative, which erodes consumer purchasing power and complicates BoE policy (they must support growth without letting inflation stay too high). Growth: The UK economy appears to be flatlining. July GDP was 0.0% (no growth), and forecasts for Q3 are modest. The upcoming UK monthly GDP for August (due 16 Oct) is a crucial data point – if it shows another month of stagnation or contraction, it will reinforce the narrative of a slowing UK economy. (Recent forecasts suggest 2025 UK GDP around 1.2–1.3% for the full year, aided by a better first half,, but momentum in H2 is weak.).

The U.S. by contrast had a solid first half of 2025 and is still growing, though potentially at a slowing pace due to higher rates and external headwinds. With a U.S. government shutdown (more on that below) delaying data, markets have less visibility on current U.S. growth – but industrial output and other proxies will be watched for clues. Employment: The UK labor market is visibly cooling. The unemployment rate has climbed to 4.7%, its highest in nearly four years, as of the three months to July. Joblessness has risen steadily from ~4.2% a year ago to 4.7% now, indicating slack is building. Wage growth has also come off the boil (regular pay ex-bonus grew 4.8% in that period, slowing from 5% prior).

These trends point to less pressure from the labor side – something the BoE will take into account if unemployment continues to tick up. In the U.S., the labor market (last known unemployment ~3.8%) has softened only mildly from ultra-tight conditions, and weekly jobless claims – when reported – have been relatively low (though this week’s claims release is in doubt due to the shutdown)..

Overall, macro fundamentals favor the dollar slightly: the U.S. has lower inflation and a stronger growth profile, whereas the UK faces higher inflation and stagnation. However, the flip side is that the Fed has more room to cut rates (since inflation is near target), while the BoE is constrained by still-high inflation. This tug-of-war in fundamentals is a key part of the GBP/USD equation.

KEY EVENTS THIS WEEK (13–17 Oct 2025):

A number of scheduled releases and events in the coming week could be catalysts for GBP/USD volatility:

• UK Employment Report (Tue 14 Oct): The August labor market report from the ONS will be “scrutinised for signs of continued employment weakness”. Markets expect the unemployment rate to remain at 4.7%, but attention will also be on job gains/losses and wage figures. Given recent PMI surveys showed ongoing job cuts , any downside surprise (e.g. a rise in unemployment above 4.7% or poor employment change) could weaken GBP by bolstering expectations of BoE rate cuts.

Conversely, an unexpectedly robust labor report (e.g. stable unemployment with strong wage growth) might lend support to sterling by suggesting the economy isn’t deteriorating as fast as feared.

• China Trade & Inflation Data (Mon 13 and Wed 15 Oct): While not UK/US data, these will set the global risk tone. China’s September trade figures (exports/imports) out on Monday will be scoured for the impact of U.S. tariffs.

Weak Chinese export numbers could heighten global growth fears – a negative for risk-sensitive currencies like GBP – whereas resilient data might improve sentiment. Similarly, China’s inflation (CPI) on Wednesday could influence commodities and risk appetite globally.

• Eurozone Industrial Production (Wed 15 Oct): Another external factor, but relevant as a gauge of European economic health. A weaker eurozone output number could indirectly pressure GBP (since it often trades in tandem with EUR when broad USD moves occur), and it might reinforce the narrative of global slowdown. Strong output, on the other hand, could slightly ease recession fears in Europe.

• UK Monthly GDP & Output (Thu 16 Oct): The UK GDP monthly estimate for August is due Thursday. Alongside, we expect industrial and manufacturing production figures for August (these are often released in the same report). This is one of the “week’s most significant releases for sterling traders”.

The prior data showed zero GDP growth in July, so the question is whether August stayed flat, expanded modestly (perhaps a rebound of ~0.2%?), or contracted. Given “ongoing steep job losses” and other headwinds,, analysts worry the data could disappoint. A weak GDP or production reading would likely hit the pound, as it “could strengthen expectations for BoE rate cuts, weighing on sterling”.

On the flip side, if the GDP/production numbers surprise to the upside (indicating the UK avoided a summer contraction), the pound may get a relief bounce as markets reassess the urgency of BoE easing. This data also comes just ahead of the UK government’s November Budget, potentially influencing fiscal considerations.

• U.S. Data (All Week, subject to shutdown): The U.S. is in a unique situation with an ongoing federal government shutdown (now in its third year, per scenario) that is preventing the release of many official economic reports.

Typically, this week would have seen September CPI (which was expected ~0.3% MoM) and retail sales, but those reports may not occur on schedule.

The absence of U.S. data creates an “information vacuum” – ironically, this uncertainty has been supporting the dollar in recent sessions (as traders shy away from risk and default to USD)

However, a few U.S. releases are still slated: Fed’s Industrial Production (Fri 17 Oct) should be published since the Fed compiles it, and it will be closely watched as a proxy for economic health. Forecasts had penciled in a +0.2–0.3% MoM rise after a slight fall previously. A weak industrial output number could undermine the dollar by upping Fed rate cut bets, while a stronger number might have the opposite effect. Additionally, weekly jobless claims (Thu) and retail sales (Wed) are at risk of delay due to the shutdown – if they are indeed not released, markets will lack those usual signals. Finally, the University of Michigan Consumer Sentiment Index (Fri 17 Oct) is due; under normal conditions this is a second-tier report, but “given the current irrationality of the market, even a neutral reading may fuel further dollar strength” in these unusual times.

Overall, the U.S. macro picture this week is murky – traders must “look to alternative data sources and international releases to gauge the health of the global economy”, which means UK data, China data, and any Fed speakers will take on added significance in guiding USD direction.

• Federal Reserve and BoE Speakers: Both central banks have officials speaking at various forums (not explicitly listed in sources, but typically likely). Notably, any Fed official comments will be parsed for hints on how the shutdown/data gap is affecting policy plans.

If Fed speakers strike a dovish tone (emphasizing downside risks or readiness to cut if needed), that could weaken the USD. If they sound hawkish (concerned about inflation despite lack of data), the dollar might firm up. For the BoE, any commentary about the impact of recent data (or hints ahead of the November meeting) could jolt GBP – e.g. if a BoE MPC member suggests that weak data could justify a cut soon, sterling would likely slip.

IN SUMMARY, macroeconomic fundamentals present a mixed picture: the UK’s slowing growth and still-elevated inflation put the BoE in a tough spot, slightly skewing policy dovish, while the U.S. has steadier growth with cooling inflation, allowing the Fed room to ease – ordinarily a dollar-negative mix. However, the immediate focus is on this week’s data and events: UK jobs and GDP numbers will directly impact sterling, and the broader risk environment (influenced by the U.S. fiscal standoff and trade tensions) will drive the dollar side of the equation. Weak UK data coupled with ongoing U.S. risks would likely bolster the bearish case for GBP/USD, whereas any positive surprises from the UK or de-escalation of U.S. risks could spur a short-term rebound in the pound.

Market Sentiment and Positioning

Risk Sentiment:

The overall market mood as we enter the week is one of cautious risk aversion, which has so far benefited the safe-haven U.S. dollar. A confluence of geopolitical and macro risks has rattled investors. Chief among them is the prolonged U.S. government shutdown (an unprecedented scenario where the shutdown has dragged on, creating significant uncertainty.

This has led to worries about U.S. fiscal stability and has deprived markets of key economic data, increasing volatility.

Another major overhang is the escalation in U.S.–China trade tensions: the U.S. administration (under President Trump) has threatened new 130% tariffs on Chinese goods by November, to which China may retaliate. Fears of a “renewed trade war” have dampened global growth sentiment.

In Europe, political uncertainty (such as the French political crisis mentioned in analyses) has also contributed to a risk-off tone.

This swirl of uncertainties has driven investors toward the safety of the U.S. dollar, pushing the Dollar Index (DXY) to a multi-week high around the 99 level (its strongest in about two months.

It’s telling that despite expectations of U.S. rate cuts, the dollar has risen – “paradoxically… strengthening despite the lack of major data releases,” as traders flock to USD whenever a new risk emerges.

Another barometer, the VIX volatility index, has been elevated in recent weeks; it remains near the high-teens (around 18–20),, reflecting heightened investor nervousness. Elevated VIX typically correlates with a stronger USD and weaker risk-sensitive currencies like GBP, as traders reduce exposure to perceived risk.

For the pound, general market sentiment has been bearish, independent of UK-specific factors. One forex analyst noted that the pound “continues falling and the dollar continues to rise” largely due to global factors, observing that the market at times “doesn’t seem to care about fundamentals or substance – it simply needs an excuse to buy dollars”.

This underscores how sentiment-driven the recent moves have been. In fact, GBP’s decline has been partly sympathetic to the euro’s slide; with the euro hit by European growth and political worries, the pound (often correlated) is “being pulled down alongside the euro, regardless of whether there’s a U.K.-specific rationale”.

Such herd behavior implies that until the global backdrop calms, sterling may have trouble finding its footing even if UK data aren’t terrible.

However, sentiment can turn on a dime. If we see any resolution or improvement in these risk factors – for example, hints of a U.S. fiscal deal to end the shutdown, or a dial-back of tariff threats – then the safe-haven bid for dollars could quickly unwind, boosting GBP/USD. Additionally, equity market performance will be influential: a continued sell-off in global stocks would likely keep USD bid (since USD often gains when investors liquidate risky assets), whereas a stock rebound would signal risk appetite returning, which could help the pound recover some ground. Traders should therefore monitor headlines on the U.S. budget negotiations, trade talks, and even other geopolitical flashpoints throughout the week for shifts in risk sentiment.

COT and Positioning: The latest Commitments of Traders (COT) data (as of late September) indicates that large speculative traders are not extremely positioned on GBP – their long vs short positions are nearly balanced.

Unlike some past episodes where speculators were heavily short the pound, currently the net position of non-commercials is around neutral. In fact, in the most recent COT report, speculators added about 4,600 net long contracts on GBP (via adding longs and closing shorts).

This suggests that institutional players had turned modestly bullish on the pound’s prospects going into October. Notably, this shift occurred as GBP/USD was rising earlier in 2025 (the pound had “risen sharply in 2025” largely due to one driver – U.S. policy under Trump – that weakened the dollar).

Now, with the dollar’s rebound, those net longs might be underwater, but the key takeaway is that positioning is not maxed out in either direction. There isn’t a massive short overhang on GBP that would fuel a short squeeze, nor an extreme long position that would exacerbate a sell-off. This balanced positioning could mean the pair is freer to move on fresh fundamental impulses rather than positional unwinding. It also implies that if a strong trend does develop (up or down), there is room for traders to build positions in that direction.

On the USD side, positioning has been shifting against the dollar in the bigger picture. Market commentary notes that the “dollar’s net positioning continues to deteriorate” in relative terms

– many traders have been positioning for a weaker dollar over the medium term, anticipating Fed rate cuts and an end to USD’s yield advantage.

This undercurrent could become important if the immediate risk-off mood eases: with so many expecting a dollar downtrend to resume, the turn in sentiment could see a wave of USD selling (and hence GBP buying). But in the very short term, as we’ve seen, those expectations are taking a back seat to fear-driven moves.

Market Internals and Other Indicators:

The US Dollar Index breaking above its 100-day MA last week shows short-term momentum is with the dollar. Yet analysts caution that this might not herald a long-term trend reversal – it “remains uncertain amid emerging expectations for further U.S. rate cuts”.

In other words, the dollar’s recent strength could be a counter-trend rally in an otherwise bearish 2025 trajectory. If we zoom out, 2025 as a whole had seen a significant dollar decline (the DXY hit a 3-year low in June before rebounding).

The pound’s broader trend this year was up until this recent pullback. Many investment houses (e.g. Cambridge Currencies analysis) still forecast the USD to weaken again by late 2025 unless major global risk events persist Investor sentiment gauges like the S&P 500 VIX (near 19) and safe-haven flows into assets like U.S. Treasuries will be watched closely.

If the VIX spikes above 20, it’s a sign of rising fear – typically bearish for GBP/USD. Conversely, if VIX subsides and equity markets stabilize or rally, risk appetite is improving, likely helping GBP.

Also of note is the performance of commodities and emerging market currencies (sensitive to China news); a stabilization there could indicate that the market is absorbing the tariff risk better than feared.

IN SUMMARY, market sentiment and positioning heading into the week favor the U.S. dollar, but the situation is fluid. The pound is weighed down by a general risk-off environment and lacks a bullish narrative of its own right now. Large traders are not aggressively shorting it (positions are roughly balanced), which means any shift in sentiment (good news or data) could allow for a rebound as dollars are unwound.

Conversely, without a positive catalyst, sentiment-driven dollar demand could continue to pressure GBP/USD. It’s a market that “doesn’t care why it’s buying dollars” at the moment – any trigger is fueling USD strength – so sterling bulls will need a clear spark (such as upbeat UK data or easing of U.S. risks) to turn the tide.

Until then, caution is warranted, as the environment has been described as “chaotic and unpredictable… not the most favorable for traders”

Integrated Forecast and Scenarios (13–17 Oct 2025)

Bringing together the technical, macro, and sentiment factors, our outlook for GBP/USD over the coming week leans cautiously bearish, with room for brief recoveries. The directional bias is bearish on a multi-day swing basis, while intraday trading may see two-way volatility (neutral-to-slightly bearish intraday bias). In practical terms, this suggests we expect the pound to remain under pressure overall, but with choppy ups and downs in the day-to-day sessions.

Below we outline likely scenarios and key technical targets under different outcomes, along with important caveats:

Baseline Scenario – Bearish Bias:

The most likely scenario is that GBP/USD sees further downside drift, consistent with its prevailing downtrend. Weak UK data and persistent risk-off sentiment could be the catalysts. For instance, if Tuesday’s UK jobs report shows rising unemployment or soft wage growth, and Thursday’s GDP figures confirm stagnation, markets would increasingly price in BoE rate cuts, weighing on the pound

Simultaneously, if the U.S. shutdown standoff and tariff threats remain unresolved, the safe-haven demand for USD should persist. Under this baseline, GBP/USD would probably test the 1.3260 support early in the week and could break below it. A daily close under 1.3260 would likely invite momentum sellers. The next downside target is around 1.3185, which analysts have identified as a strong support level (and take-profit area for shorts).

Indeed, one strategy recommends short positions with 1.3185 as the goal. Should 1.3185 be reached (possibly on a significant news trigger), we would expect some profit-taking and a bounce attempt from the bulls. If the bearish forces are overwhelming, a decisive breach below 1.3185 would be very bearish – it could open the door toward 1.3080–1.3100 (the lower boundary of the triangle pattern on higher timeframes).

Note that a drop to those levels would likely confirm a breakdown from the consolidation pattern, potentially accelerating losses. However, a fall that deep in one week may require an outsized shock or extremely poor UK outcomes. Our baseline sees 1.3185 holding (at least initially), with GBP/USD perhaps closing the week in the mid-1.32s after probing lower. The bias would remain bearish unless we get a clear upside breakout signal.

Bullish/Relief Scenario – Short-Term Rebound:

While not the central expectation, there is a plausible scenario where GBP/USD bounces higher this week. This could happen if the news flow flips sentiment – for example, suppose UK data come in better than expected (steady unemployment, and a positive surprise in GDP or manufacturing output). That would alleviate some concerns about the UK economy and reduce immediate BoE easing bets, helping GBP. Additionally, if U.S. political leaders make progress toward ending the shutdown or if the rhetoric on tariffs cools, risk sentiment would improve, likely weakening the USD safe-haven bid.

Technically, any rally would first face the 1.3370–1.3400 resistance zone. A move above 1.3400 (especially a daily close above) would “invalidate the bearish outlook” in the short term, signaling that a larger rebound is underway. In that case, short-covering could quickly carry the pair to the next resistance at 1.3480–1.3485. Analysts cite 1.3485 as a probable target for a bullish correction – this level is near the upper trendline of the recent triangle and also roughly the 38.2% Fib retracement of the Sep–Oct drop. We would expect sellers to defend 1.3485 aggressively on first test. If, however, 1.3485 is conquered (in an extreme risk-on or USD-negative scenario), the door opens to 1.3530+ (the next supply zone, where the 50-day MA and prior highs converge).

A “strong rally and breakout of the 1.3865 area” is considered highly unlikely this week, but if it occurred, it would “cancel out the GBP/USD decline… signaling continued growth above 1.4205” in a much broader bull scenario.

To be clear, that is beyond any reasonable 1-week forecast – mentioned here only as the ultimate bullish invalidation level (i.e. the point beyond which the entire bearish trend of 2025 would be reversed). In summary, in a relief scenario we see GBP/USD potentially climbing into the mid-1.34s; our upside bias for the week would turn neutral/bullish only on a firm break of 1.3400, with 1.3485 as a best-case objective before renewed range trading.

Range/Volatile Neutral Scenario:

Given the conflicting forces, it’s also possible the pair will whipsaw within a rough range (say 1.33–1.34) without a clear trend, as traders await bigger catalysts. This could happen if data and news come in mixed – e.g. UK employment is slightly weak (pushing GBP down) but GDP is slightly above forecast (pushing it up), while on the U.S. side the lack of data continues to cloud direction. In such a case, neither bulls nor bears gain full control, and the market could see choppy range trading. Intraday volatility might be high (with 30-50 pip swings on headlines), but the week’s end could see GBP/USD not far from where it started (around mid-1.33s). Important levels for range-bound action would be the same support/resistance noted (1.3260 floor, 1.3400 ceiling). Traders might then focus on short-term scalping: buying near support and selling near resistance, albeit with tight stops given headline risk.

Caveats and Risks:

This forecast carries several caveats given the unusual market conditions.

Firstly, event risk is exceptionally high – unexpected political breakthroughs or breakdowns (for instance, a sudden resolution of the U.S. funding impasse, or conversely an abrupt escalation like China retaliating on trade) can spur outsized moves that override technical levels. Traders should be prepared for potentially elevated volatility in this “information vacuum” environment, including possible wider spreads and whipsaw price action. As one market insight noted, “market conditions remain chaotic and unpredictable… I mean... This is not the most favorable environment for traders. Caution is advised. ” . Use of stop-loss orders and disciplined position sizing is crucial.

Secondly, the reliability of technical patterns may be lower when fundamental news shocks hit – a level like 1.3185 could break temporarily on a spike only for the price to revert, for example.

Therefore, one should not rely solely on static levels; confirmation signals (such as sustaining a break for some hours, or high volume on the breakout) add confidence before acting.

Thirdly, keep an eye on correlated markets: if equity indices or commodities make big moves, FX often reacts. A rally in stock markets (signaling risk-on) could boost GBP/USD beyond what the UK-specific factors would suggest, whereas a stock sell-off could sink it further. Lastly, the scenario of continued missing U.S. data means Fed communication becomes critical – any ad hoc comments or guidance changes from the Fed in light of missing CPI/retail data would be market-moving.

IN CONCLUSION, our integrated analysis suggests a mildly bearish trajectory for GBP/USD this week , with an expectation that the pair gravitates lower unless counteracted by positive news. The intraday bias is for volatile, range-bound trading (many small swings with no strong trend, until a catalyst arrives), whereas the swing bias (over the 5-day horizon) leans bearish – we anticipate the week’s developments are more likely to favor USD strength/GBP weakness than the opposite. Key technical price targets are 1.3185 on the downside and 1.3485 on the upside, with interim levels (1.3260 and 1.3370) guiding the near-term moves.

We foresee two main scenarios: either a continuation lower towards the low-1.32s if data and sentiment disappoint (our base case), or a bounce to mid-1.34s if the pound gets a fundamental or sentimental reprieve. Traders should be ready for both, mapping out their tactics (stop-loss placements, take-profit levels) around the breakout/breakdown zones identified.

Above all, remain nimble – this week demands close attention to news flashes and an adaptive approach.

As the saying goes, “ trade what you see, not what you expect ,” especially in an environment where a single headline can tip the balance.

By blending the technical signals with macro and sentiment context, one can navigate the likely scenarios, but also be prepared to quickly adjust if the market narrative shifts unexpectedly.

Ultimately, caution and careful analysis of incoming information will be the key to successfully trading GBP/USD in the week ahead.

Sources:

• Technical analysis of GBP/USD price action and key levels

• Macroeconomic background on BoE/Fed policy and UK/US economic data

• Market sentiment drivers and positioning insights

Scenario forecasts for GBP/USD October 13–17, 2025

GBP/USD Looks Set To Extend Bounce From SupportGBP/USD looks set to extend its bounce on the daily chart, having found support at the monthly S1 pivot and 200-day EMA. The daily RSI (2) reached a heavily oversold level on Thursday ahead

of the bullish inside day at support.

A bull flag is also forming on the 4-hour chart. Given the strength of the rebound from support, the bias is for a break above the weekly pivot point and move to at least the October VPOC around 1.3440. Also note the weekly R1 pivot and monthly pivot just below 1.3500 just makes a viable target zone for bulls over the near term.

Matt Simpson, Market Analyst at City Index.

GBPUSD: Bearish From SZ! Only Sells Are Valid!GBPUSD pre-market analysis for Thursday, Oct 9th.

The GBPUSD is grinding downward, heading to the swing low.

Buys are not valid! Sellers are in control.

Trade accordingly.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GBPUSD📈 GBP/USD | Daily Price Action, Liquidity & Execution Plan

Price has already delivered into and rebalanced the Daily IFVG, completing that inefficiency. With that objective met, my focus is now on the next Daily FVG (D2), where price is currently reacting.

Liquidity Narrative

• ✅ Daily IFVG already rebalanced → inefficiency corrected.

• 🔜 Price expected to trade through FVG D2, rebalancing it and turning it into an IFVG.

• 💧 Next draw on liquidity: Buy-Side Liquidity (BSL) above recent highs.

• 🎯 Higher-timeframe liquidity target → blue Daily IFVG, sitting in premium territory with confluence of resting liquidity.

Execution Plan

• Looking for LTF confirmation entries (M15/H1) inside the Daily FVG (D2).

• Ideal setup: liquidity sweep of intraday highs (BSL) → displacement into the FVG zone → refined entry.

• Partial profits at BSL; main target at blue Daily IFVG.

Risk Management

• Invalidation if price breaks below the prior swing low that created the displacement into FVG D2.

• Risk kept tight, only engaging if confirmation aligns with narrative.

• No setup, no trade — patience until price delivers.

📌 Bias: Bullish order flow, with price seeking liquidity above until higher IFVG is satisfied.

GBPUSD: Bearish! Look For Sell Setups!Bearish over the last two weeks. Expecting more of the same this week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GBPUSD: Cable slides under 1.35 handle after triple blow!Cable faces a crucial test at 1.3500 following yesterday's triple blow from disappointing UK PMI data, hawkish comments from Powell, and concerning UK public sector borrowing figures ahead of November's Budget.

In this ThinkMarkets analysis, we break down the key technical levels as GBPUSD loses the round 1.3500 support but remains within its upward channel.

Key focus areas :

Immediate Risk : Break below channel support targeting 1.3372 double bottom

Critical Level : 1.3335 - invalidation of inverse head & shoulders pattern

Fibonacci Support : 61.8% retracement cluster around 1.3340

Trading Strategies : Three approaches for the potential breakdown

Key Levels to Watch :