Candlestick Analysis

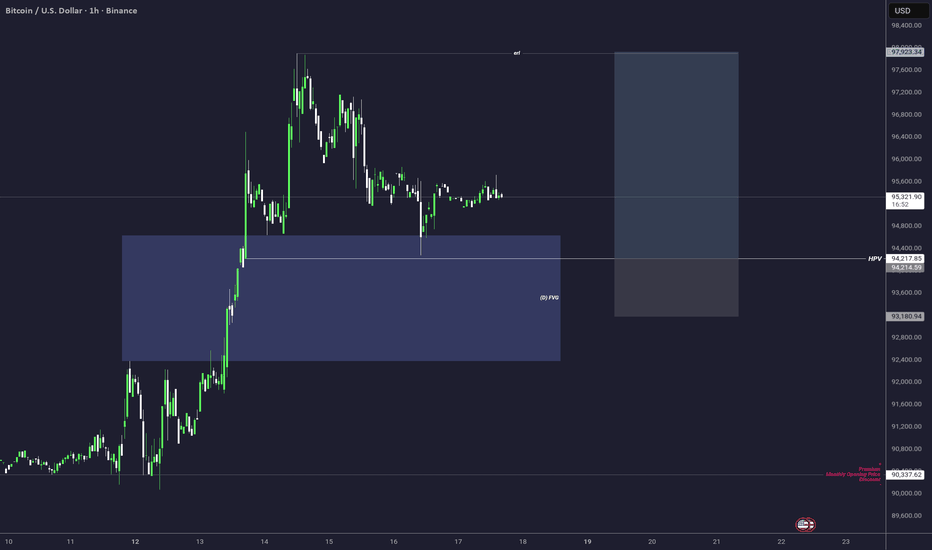

Short trade

30min TF overview

Trade Journal Entry — Sell-Side Execution

Pair: BTCUSDT

Date: Sun 17th Jan 2026

Time: 9:30 AM

Session: NY Session AM

Execution TF: 5-Minute (refined from HTF bias)

Trade Type

Sell-Side (Short)

Execution Levels

Entry: 95,159.6

Take Profit: 94,077.3 (−1.13%)

Stop Loss: 95,300.5 (+0.14%)

Risk–Reward: 7.68R

🧠 Sentiment & Market Narrative (NY Session AM)

Market sentiment during the NY Session AM was bearishly skewed, with price action reflecting distribution rather than accumulation.

Despite earlier session attempts to stabilise, BTC failed to reclaim premium pricing. The market engineered liquidity above recent intraday highs, encouraging late buy-side participation before swiftly rejecting those levels. This behaviour is characteristic of smart-money sell-side positioning, where upside is used as liquidity fuel rather than continuation.

The rejection from the premium coincided with a shift in order flow, marked by bearish displacement and a break in the lower-timeframe structure. This confirmed that bullish momentum was exhaustive, not expansive.

From a session perspective:

The London session built the liquidity framework (range highs and inducement)

New York AM acted as the execution engine, converting buy-side liquidity into downside expansion

Broader sentiment favoured risk-off positioning, with market participants fading strength rather than bidding pullbacks. This aligns with a distributional environment, where price is magnetised toward sell-side liquidity resting below the range rather than continuing higher.

Overall, sentiment strongly supported a sell-side continuation model, validating short exposure with tight risk and asymmetric reward.

MOC/USDT: Short at Major Supply (Rejection Play)On the BINANCE:MOCAUSDT.P 4H chart, price has rallied back into a major supply zone (red), which previously acted as a strong distribution area. This is the area where I expect sellers to step in again. I’m looking to short the rejection from this zone rather than chase the move higher.

Entry is planned on clear bearish confirmation inside the supply (rejection wick, bearish engulfing, or a lower-high / structure shift). Invalidation is a clean acceptance above the supply zone (sustained closes above the red area). If rejection holds, the downside target is a mean reversion back toward the prior range / lower liquidity area.

Trade Plan:

Direction: SELL / Short

Entry: Rejection confirmation inside the red supply zone

Stop: Above the supply zone highs

Target: Drop back into the range (toward lower support / liquidity)

Xauusd bullish after consolidationOn daily time frame as we can see we are clearly on a bullish momentum an consolidating

Between resistance level 4620 and support 4580

On 4hour time frame consolidation breaks to the downside and aggressive backing up leaving a rejection wick and sweeping all liquidities below,

Confirmation 1H we will wait for more on confirmation that price will go up.

Change in state of delivery / forming new bullish FVG to support our analysis

GLM/USDT: Liquidity Sweep Long (SL Below Invalidation)On the OKX:GLMUSDT.P 15-minute chart, price has been trending down and then printed a clear liquidity sweep at the marked $$ level. That sweep took out the prior swing low and immediately reclaimed, which often signals trapped sellers and a potential short-term reversal.

My plan is to enter long at the $$ level (liquidity level) once price shows it can hold above that reclaimed level. The trade is invalid if price breaks the lower low — my stop is placed below the marked Invalidation line (below the lowest swing / lower low). Upside target is the next liquidity pool / mean reversion toward the larger grey target zone.

Trade Plan (as shown):

Entry: At $$ (liquidity sweep level) after reclaim / hold

Stop-loss: Below the lower low (the Invalidation line)

Target: Reversion upward toward the grey objective zone (first resistance area, then extension)

What I Expect Next:

Ideally, GLM holds above $$, forms a higher low, and pushes into the upper range. If we lose $$ and break below the invalidation low, the setup is invalid and I’m out.

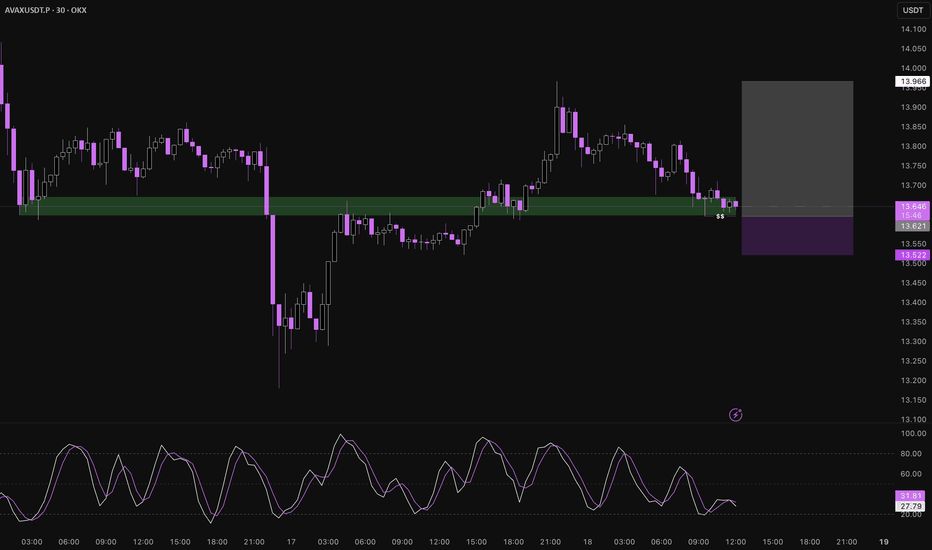

AVAX/USDT: Demand Sweep Long (Stoch Cross Trigger)On the OKX:AVAXUSDT.P 30-minute chart, price has pulled back into a well-defined demand zone (green) and just swept the prior swing low (SS), which often acts as a liquidity grab before a reversal. Structure is still bearish short-term (descending trendline), so I’m treating this as a reactive long from support rather than a trend-following entry.

My entry trigger is the Stochastic (5,3,3) crossing back up (bullish cross) while price holds inside/above the demand zone. This gives me confirmation that momentum is rotating upward after the sweep. If the trigger prints, I’m looking for a bounce back into the range with the first objective at the nearby supply/inefficiency area above, and a larger target toward the upper grey target zone if momentum expands.

Trade Plan (as shown):

Entry: After Stoch bullish cross + price holds the demand zone

Invalidation / Stop: Below the swept low / below the demand zone

Targets: First reaction back to the prior breakdown area, then extension toward the upper target zone

What I Expect Next:

I want to see price stabilize above the demand zone and Stoch cross upward. If that confirmation appears, I’ll take the long. If price loses the demand zone and closes below the swept low, the setup is invalid and I’ll stand aside.

How to Sit through Drawdown on GBPUSD (Part 2)Most traders don’t fail because they lack strategy.

They fail because they never slow down long enough to master one market.

In this video, I’m starting the only series I’m running in 2026: Mastering GBPUSD.

This is not about indicators or hype. It’s about rebuilding consistency by focusing on one pair, learning its rhythm, managing drawdown, and developing the discipline most traders avoid.

We cover

• Why mastering GBPUSD starts with a decision, not a strategy

• How to build trust in a market before increasing position size

• How to sit through normal drawdown without sabotaging your plan

• Practical ways to observe price, mark levels, and reduce overtrading

• Why alerts and walking away matter more than staring at charts

If you’ve traded before, had success, lost momentum, and you’re looking to get back into rhythm, this video is for you.

This series is about focus, patience, and self-mastery through one market.

Watch. Apply. Repeat.

Comment “GBPUSD only” if you’re committing to this journey, and subscribe so you don’t miss the next deep dive in the series.

FARTCOINUSDT Neckline Decision Zone Adam & Eve vs Cup & HandleFARTCOINUSDT is currently exhibiting a bearish structure, forming an inverse Adam & Eve setup, which also aligns with a potential inverse Cup & Handle formation. The highlighted supply zone remains the critical decision area. A rejection from this zone, followed by a breakdown below the neckline, would confirm bearish continuation and expose price to a deeper decline toward the projected target around $0.01472. Conversely, a clean break and acceptance above the supply zone would invalidate the bearish bias and shift momentum toward the bullish targets already outlined.

The primary approach is to wait for clear confirmation before committing to any directional bias.

#GBPAUD Long FridayIf I was to re-analyze the short on GBPAUD trade chart again on Friday. It was definitely a reversal, and the more candles got revealed it is clear that it was going to be bullish London and NY session, that's why I like for these sessions to open because in my opinion you can easily get liquidated. Around 11PM it started a bullish trend creating higher highs and higher lows creating a channel and even broke out a 4-hour zone and had gain momentum. OANDA:GBPAUD

GBPCAD: Move Down Ahead 🇬🇧🇨🇦

GBPCAD will likely turn bearish next week,

as the market is closed, retesting a significant

daily resistance cluster.

Expect a down movement at least to 1.855 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Solana Stablecoin Market Reaches a Historic $15 Billion MilestonThe Solana stablecoin market has reached an all time high of $15 billion, marking one of the fastest expansions among major blockchain networks. This represents nearly 200 percent growth year over year, highlighting strong confidence in Solana’s infrastructure and ecosystem maturity. Developers, traders, and payment platforms continue migrating activity to Solana because of its speed and cost efficiency. This milestone signals a clear shift from experimental usage toward real financial activity happening onchain.

This growth reflects practical adoption rather than speculative hype. Stablecoins on Solana now support everyday financial operations across decentralized finance, payments, and applications. Users rely on these digital dollars for trading, lending, and settlements without exposure to volatility. As stablecoins become essential financial tools, Solana positions itself as a preferred settlement layer for blockchain based transactions.

The rapid rise of the Solana stablecoin market also highlights changing user behavior across crypto markets. Participants now prioritize efficiency, low fees, and instant finality over legacy congestion issues. Solana delivers consistent performance during periods of high activity, strengthening its role as a reliable network for stable value transfers.

Key Drivers Behind the Solana Stablecoin Market Expansion

Several core factors continue pushing the Solana stablecoin market higher. Low transaction fees remain a major advantage, allowing users to move large volumes without cost pressure. This efficiency encourages frequent usage across decentralized exchanges, lending platforms, and payment applications. Solana’s high throughput ensures transactions settle quickly, even during peak demand periods.

Scalability also plays a critical role in this expansion. SOL supports thousands of transactions per second without sacrificing performance or decentralization. Stablecoin transfers remain fast and predictable, which appeals to institutional users and fintech platforms. This reliability fosters trust and encourages long term capital deployment on the network.

Growing institutional participation further supports this momentum. Asset managers and payment firms increasingly prefer transparent, onchain settlement infrastructure. SOL provides real time data, fast execution, and low operational friction. These factors collectively strengthen confidence in the Solana stablecoin market.

How Stablecoins Are Powering Solana DeFi Growth

Stablecoins serve as the foundation of SOL DeFi growth across lending, trading, and yield strategies. DeFi protocols rely on stable assets to manage risk and maintain liquidity during volatile market conditions. Solana enables fast liquidations and real time price updates, ensuring platforms operate smoothly under stress.

SOL DeFi growth benefits from efficient capital movement between protocols. Users can shift funds across platforms within seconds, increasing overall liquidity utilization. Stablecoins also support innovative products such as automated yield vaults and decentralized credit markets. These offerings attract sophisticated participants seeking reliable returns.

As more developers launch financial applications on Solana, stablecoin demand continues rising. Each new protocol increases usage across multiple touchpoints. This expanding ecosystem reinforces Solana DeFi growth and deepens the network’s economic activity.

Conclusion

The $15 billion supply milestone confirms Solana’s transition into a mature financial network. Stablecoins anchor liquidity during market fluctuations and support consistent application usage. Builders now focus on creating real world solutions rather than speculative experiments.

Network effects continue strengthening as stablecoin adoption increases. More users attract more developers, which drives further capital inflows. This cycle accelerates ecosystem expansion and innovation. The Solana stablecoin market benefits from this compounding growth.

SOL also positions itself well for regulatory compliant adoption. Transparent onchain data and regulated stablecoin issuers appeal to policymakers and institutions. This alignment supports Solana’s role in bridging traditional finance and decentralized systems.

Short trade

Sell-Side Trade — YGGUSDT.P (15m)

Pair: YGGUSDT

Bias: Sell-side

Date: Fri 16th Jan 2026

Session: London Session AM

Time: 10:15 am (UK)

Entry TF: 15-minute

🎯 Execution Levels

Entry: 0.07067

Take Profit: 0.06853 (3.02%)

Stop Loss: 0.07093 (0.36%)

Risk–Reward: RR 8.23

Sentiment & Session Context

Price expanded into premium during the London session before failing to hold above prior highs. Rejection from internal FVGs and a clean break in short-term structure confirmed distribution. London AM provided the sell-side displacement, with price targeting inefficiencies and sell-side liquidity resting below.

Bias Going Forward

Valid while: Price remains below the London highs / premium PD array

Invalidation: Acceptance back above 0.07093 with displacement

Expectation: Continued mean reversion into sell-side liquidity

Short trade

Sell-Side Trade — BTCUSDT (15m)

Pair: BTCUSDT

Bias: Sell-side

Date: Fri 16th Jan 2026

Session: London Session AM

Time: 5:00 am (UK)

Entry TF: 15-minute

Execution Levels

Entry: 95,525.7

Take Profit: 94,140.5 (1.45%)

Stop Loss: 95,623.3 (0.10%)

Risk–Reward: RR 14.19

Session-Based Narrative

🌏 Tokyo Session

Price formed a tight consolidation beneath resistance.

Liquidity was engineered but not expanded.

Typical range-building and inducement behaviour.

➡️ Sentiment: Neutral → Bearish setup

🇬🇧 London Session

London attempted continuation but failed to reclaim premium.

Multiple reactions at FVGs and prior highs without displacement.

Structure showed weak bullish follow-through.

➡️ Sentiment: Distribution

🇺🇸 New York Session

NY delivered sell-side displacement, breaking internal structure.

Buy-side liquidity above was left untapped → confirmation of failed continuation.

Price began targeting sell-side liquidity and inefficiencies below.

➡️ Sentiment: Bearish continuation

Trade Thesis Summary

Following a completed bullish expansion, BTCUSDT entered a distribution phase marked by failure to hold premium pricing and repeated rejection from higher-timeframe supply. London and New York sessions confirmed bearish intent through internal structure breaks and sell-side displacement. With buy-side liquidity exhausted and inefficiencies resting below, price is expected to continue lower toward sell-side targets.

GBPAUD: Bullish Move From Support 🇬🇧🇦🇺

There is a high probability that GBPAUD will pullback

from the underlined support.

Goal - 2.0004

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Long trade

5min TF overview and entry

Pair YGG

Buyside trade

LND Session AM

Thu 15th Jan 26

4.15 am

Entry 0.07274

Profit level 0.07274 (5.52%)

Stop level 0.06878 (25.4%)

RR 25.4

Neutral → Bearish corrective within a broader bullish impulse

The price is transitioning from expansion into distribution, with sell-side pressure emerging after the buy-side objective was achieved.

🧠 Structural & Liquidity Read

Price delivered a strong bullish expansion from the sell-side drawdown low, efficiently rebalancing multiple FVGs. The rally fulfilled a buy-side objective, reaching into premium pricing relative to the prior dealing range.

Following the expansion, the price failed to hold above the London/NY highs, signalling buy-side liquidity exhaustion. The rejection from highs shows distribution behaviour, not continuation.

Narrative Summary

Price completed a bullish expansion phase, efficiently delivering into buy-side liquidity resting above prior session highs. Subsequent failure to hold premium pricing, combined with NY session rejection and volume acceptance below the high-volume node, signals distribution rather than continuation. Current sentiment favours a bearish corrective phase or consolidation until sell-side liquidity is sufficiently rebalanced.