Nifty Analysis EOD – December 26, 2025 – Friday🟢 Nifty Analysis EOD – December 26, 2025 – Friday 🔴

Bears Breach 26,100: Psychological 26K Tested as Support Levels Crumble.

🗞 Nifty Summary

The Nifty started with a weak footing, opening below the PDL. Although it initially found support near 26,104 and attempted to fill the gap, a sharp rejection at the PDC pushed prices back down through the CDO, CDL, and the 26,104 level.

After a brief range-bound period near 26,070 where a symmetrical triangle formed, the subsequent breakdown dragged the index into the previous gap zone near 26,030. Following 45 minutes of high uncertainty and tight consolidation, a final leg down marked the day’s low at 26,008.60.

A late Bull Flag pattern facilitated a 50-point recovery, allowing the Nifty to close at 26,047.65, down -99.80 points (-0.38%). As predicted in our previous notes, the breakdown below 26,120 successfully triggered tests of 26,104 and 26,070.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was a masterclass in bearish control, with sellers swiftly grabbing 100 points of ground from the bulls.

The failure to sustain the initial gap-fill and the sharp rejection at the PDC set a negative tone that persisted for most of the session.

The symmetrical triangle breakdown and the subsequent uncertainty near 26,050 highlighted the lack of buyer conviction until the very end of the day.

The late recovery is a small silver lining, but the structural damage below 26,100 is evident.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,121.25

High: 26,144.20

Low: 26,008.60

Close: 26,042.30

Change: −99.80 (−0.38%)

🏗️ Structure Breakdown

Type: Bearish candle.

Range (High–Low): ≈ 136 points — moderate volatility.

Body: ≈ 79 points — reflecting clear selling pressure and bearish dominance.

Upper Wick: ≈ 23 points — weak buying attempt near the open quickly rejected.

Lower Wick: ≈ 34 points — buying interest emerged near the psychological 26,000 level.

📚 Interpretation

The market opened near 26,121 but failed to find any follow-through buying. Sellers maintained control throughout the session, pushing the price to the brink of the 26K mark. While the partial recovery from the lows shows that buyers are defending the psychological round number, the close remains significantly below the open. This structure reflects sustained short-term bearish pressure within the broader consolidation zone.

🕯 Candle Type

Bearish Candle with Lower-Wick Support Attempt — Signals selling dominance; buyers are active near lower levels but require a strong follow-up session to confirm a bottom.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 173.50

IB Range: 72.65 → Medium

Market Structure: ImBalanced

Trade Highlights:

09:32 Short Trade: Target Hit (1:1.15) (PDL Breakout)

11:07 Short Trade: Target Hit (1:1.85) (Range Breakout)

13:45 Long Trade: SL Hit (Contra Trend)

Trade Summary: The strategy capitalized on the clear bearish intent early on, hitting targets on both the PDL breakdown and the mid-morning range breakout. However, the late-afternoon attempt to catch the contra-trend recovery resulted in a stop-loss hit as the market remained volatile near the lows.

🧱 Support & Resistance Levels

Resistance Zones:

26070

26104 (Major Polarity Resistance)

26155

Support Zones:

26030

26000 (Psychological)

25985 ~ 25965 (Critical Defensive Zone)

🧠 Final Thoughts

“The 26,000 psychological zone is the next battleground.”

The upcoming session will be tricky.

While 26K acts as a psychological cushion, the structural momentum is currently with the bears. We must wait for the opening tick and the formation of the Initial Balance (IB).

I am expecting a potential test of 25,985; if we see recovery signs there, a relief rally could be in the cards.

However, any failure to reclaim 26,104 will keep the pressure firmly on the downside.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Candlestick Analysis

Short trade

📘 ZORAUSDT continues to trade in a rotational environment, with liquidity cycling between premium and discount. Precision execution at PD arrays is favoured over directional bias until a higher-timeframe break of structure occurs.

🧭 Higher-Timeframe Context

The market remains structurally corrective, not trending.

Price is oscillating between well-defined premium and discount zones, repeatedly respecting FVGs and session highs/lows. No sustained HTF BOS → rotational environment dominates.

Primary read: This is a dealer-style market, rewarding precision entries rather than directional conviction.

💧 Liquidity & Behavioural Narrative

Multiple sell-side executions at a premium have played out successfully, indicating:

Buy-side liquidity is being engineered above short-term highs.

Smart money is selling into strength. Downside moves consistently pause and react at discount/demand zones, confirming: Responsive buyers, not trend continuation sellers.

🧠 Interpretation: Liquidity is being cycled, not accumulated for a trend. Each leg is being used to rebalance the range.

🟦 TAB 15 — What Price Is Targeting

Primary draw:

Open Price Zone

Secondary draw:

Prior internal equal lows

EUR/USD: a good price level to buy on the 1-hour timeframe.1. On the Daily timeframe: EURUSD formed a peak on April 17, 2025 at 1.1900 (this was also a strong selling level around September 2021) and was pushed down sharply by sellers within one day, leaving a long wick. Currently, EURUSD is moving sideways within a parallel channel, gradually rising to retest the 1.1900 resistance zone.

2. On the 4H timeframe: EURUSD is trading above the 78 EMA and 21 EMA, indicating the bullish momentum is still intact. Price has completed a test of the 1.1800 resistance and is now undergoing a pullback.

If EURUSD breaks below the 1.1710 support, price could drop sharply to the next support at 1.1620.

Conversely, if EURUSD holds above 1.1710, price may retest the 1.1900 resistance zone.

Trading strategy (EUR/USD):

Buy: 1.1771

Target (TP): 1.1866

Stop loss (SL): 1.1695

Risk/Reward (R/R):

Potential gain: 0.0095 (≈ 95 pips)

Potential risk: 0.0076 (≈ 76 pips)

R/R = 1.24

Analysis by: Leevermore

The Language of Price | Lesson 4 – Linking Candlesticks PracticeLesson Focus: Candlestick Combinations (Practice)

In the previous lesson, we explained combining candlesticks together using a theoretical illustration.

In this lesson, the same concept is now shown in practice on a real market chart , allowing the theoretical ideas to be observed in real price behavior.

📊 WHAT ARE WE LOOKING AT?

This chart demonstrates how individual candlestick behaviors can be combined together to read market structure more clearly.

Instead of focusing on a single candle, we observe how multiple candles communicate together over time within their surrounding context.

For readers who have not seen the previous lesson , reviewing the theoretical explanation of candlestick combinations may help provide clearer understanding, as this example directly builds on it.

🧠 COMBINATIONS IN PRACTICE

On this real chart example, you can see repeated combinations of:

• Shrinking candles → slowing momentum

• Long wicks / inverse long wicks → rejection and reaction

• Inside candles → consolidation within range

• Change color candles → pressure shift

• Momentum candles → temporary dominance

When several of these behaviors appear together, they provide a stronger directional bias compared to reading only one candle in isolation.

📌 IMPORTANT CLARIFICATION

• This is market reading , not prediction

• Bias does not mean certainty

• Candlesticks reflect past price behavior

• Nothing shown here is guaranteed

This example is presented strictly for educational and analytical purposes .

Those interested in continuing this educational series may choose to follow along, as upcoming lessons will further build on these concepts and explore market structure step by step.

ETHICAL & EDUCATIONAL NOTICE

This content is presented solely for educational and analytical purposes , based on historical price data.

It does not promote or encourage any specific trading method, financial instrument, gambling, leverage, margin usage, short selling, or interest-based activity .

Readers are encouraged to align any financial activity with their own ethical, legal, and religious principles .

⚠️ DISCLAIMER

This material is strictly educational and informational .

It does not constitute financial advice, investment recommendations, or trading instructions.

The author does not provide personalized guidance.

Any decisions made based on this content are the sole responsibility of the individual.

FireHoseReel | ZEC at a Critical Range Breakout Ahead🔥 Welcome To FireHoseReel !

Let’s dive into ZCash (ZEC) analysis.

⛳️ ZEC Fundamental Overview

Zcash (ZEC) is a long-standing privacy-focused cryptocurrency, usually ranked around #16 on CoinMarketCap, enabling users to send private, non-traceable transactions with strong cryptographic privacy.

👀 ZEC 4H Overview

On the 4-hour timeframe, ZEC is trading inside a range box with resistance at $457 and support at $374. Price has reached the upper-middle area of this range, and a breakout above the range high or the midline could drive the next move toward the following resistance or support level.

📊 Volume Analysis

Zcash volume has declined over the past few days, but in the last few hours buyers have shown strength by forming a higher low. A strong volume blow-off candle has entered the market, indicating renewed buying interest.

✍️ ZEC Trading Scenarios

🟢 Long Scenario:

ZEC is currently pressing against the mentioned resistance. A breakout above this level, supported by increasing buying volume and RSI crossing above the 70 momentum threshold into overbought territory, could confirm the breakout and open the path toward the next resistance.

🔴 Short Scenario:

A breakdown below the box midline at $374, accompanied by visible selling pressure and RSI dropping below the 33 momentum zone, could trigger a move down toward the next support level.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

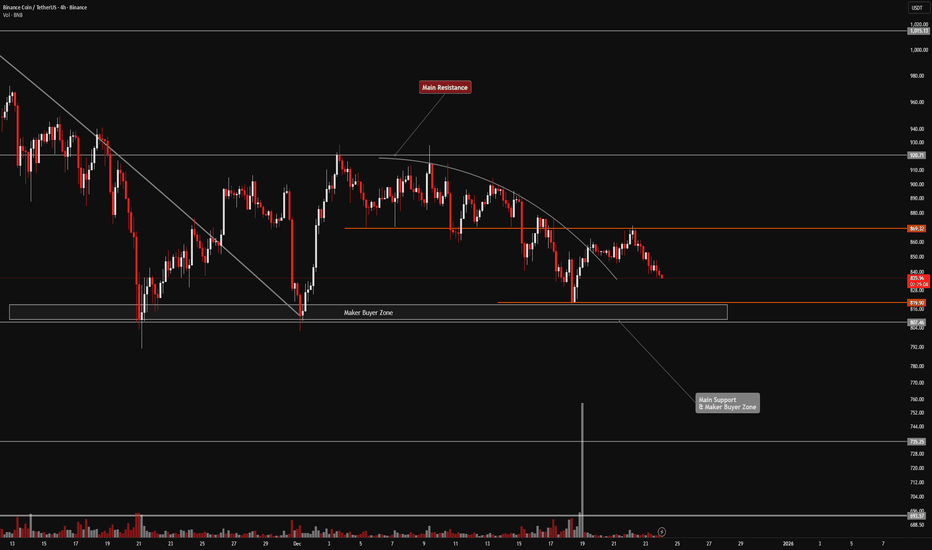

FireHoseReel | BNB Daily Analysis #27🔥 Welcome To FireHoseReel !

Let’s dive into Binance Coin (BNB) analysis.

👀 BNB 1H Overview

After its recent declines, BNB is currently ranging on the 1-hour timeframe between the $850 resistance and the $835 support. A breakout from either side could lead to a move toward the next key resistance or support level.

📊 Volume Analysis

On the 1-hour timeframe, BNB volume looks unclear to me. Volume has dropped significantly and doesn’t provide a strong or reliable signal at the moment, making it difficult to interpret what is happening from a volume perspective.

✍️ BNB Trading Scenarios

🟢 Long Scenario:

A breakout above $850 accompanied by increasing buying volume could trigger a move toward $870, making it a valid long setup.

🔴 Short Scenario:

A breakdown below the $835 support with visible selling volume could push price toward its next maker buyer zone, where we can then reassess market behavior.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

FireHoseReel | USDT.D Compression Signals a Big Market Reaction🔥 Welcome To FireHoseReel !

Let’s dive into USDT.D analysis.

👀 USDT.D 4H Overview

USDT Dominance is trading inside a large 4H range (box) with a very strong monthly resistance at 6.605%, a key 4H and daily support at 5.859%, and a newly formed midline at 6.210%. A breakout or breakdown of any of these levels could drive a major move across the crypto market.

✍️ USDT.D Trading Scenarios

🟢 Long Scenario:

An initial long setup can be considered on a break below the 6.210% midline, allowing for a small-risk entry. If downside momentum continues and the 5.859% support is lost, a second long position can be opened, with the option to add to earlier positions if conditions allow.

🔴 Short Scenario:

A breakout above the 6.605% range high could activate short triggers across crypto assets, leading to broader market downside. A confirmed break of this level may result in a deep correction across the crypto market.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

FireHoseReel | WLD at a Major Decision Zone Range Break Incoming🔥 Welcome To FireHoseReel !

Let’s dive into Worldcoin (WLD) analysis.

⛳️ WLD Fundamental Overview

Worldcoin (WLD) is a digital identity and crypto project using biometric proof of personhood. Ranked #52 on CoinMarketCap, it has ~2.58B circulating supply, ~$1.24B market cap, and steady daily volume.

👀 WLD 4H Overview

After recent sell-offs, WLD is trading below a descending curve trendline. Price is currently ranging between the $0.5587 resistance and $0.4728 support. A breakout from this structure could offer a solid trading opportunity.

📊 Volume Analysis

Worldcoin is experiencing strong selling pressure, with sell-side momentum and fear outweighing buying interest. Sellers are currently driving price toward the lower boundary of the range.

✍️ WLD Trading Scenarios

🟢 Long Scenario:

There are two resistance-based long setups to choose from. The first is our pre-breakout trigger at the orange trendline around $0.5247, which requires increasing buying volume to activate a long. The second and stronger long trigger is the monthly resistance at $0.5587.

🔴 Short Scenario:

The short setup is straightforward. A breakdown below the daily support at $0.4728, confirmed by rising sell volume, could provide a valid short entry.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

FireHoseReel | WIF at Decision Point Will 0.317 Hold or Collapse🔥 Welcome To FireHoseReel !

Let’s dive into Dogwifhat (WIF) analysis.

⛳️ WIF Fundamental Overview

Dogwifhat (WIF) is a Solana-based meme coin focused on community-driven trading and speculation. Ranked #121 on CoinMarketCap, it has ~998.8M supply and strong daily volume fueled by hype.

👀 WIF 4H Overview

WIF is currently experiencing a strong bearish trend on higher timeframes. On the 4H timeframe, price is moving inside a large range (box) and is now attempting to break down below the lower boundary of that range.

📊 Volume Analysis

During upward pullbacks, trading volume tends to decrease, while selling volume expands during bearish continuation. If the box support breaks, an increase in sell volume is expected to confirm the breakdown.

✍️ WIF Trading Scenarios

🟢 Long Scenario:

A breakout above the descending curve trendline, followed by a reaction toward the $0.361 resistance, accompanied by a strong surge in buying volume, could initiate a bullish leg relative to the recent decline.

🔴 Short Scenario:

A breakdown below the box structure and loss of the $0.317 support, confirmed by increasing sell volume, could provide a solid short opportunity.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

FireHoseReel | BNB Daily Analysis #26🔥 Welcome To FireHoseReel !

Let’s dive into Binance Coin (BNB) analysis.

👀 BNB 4H Overview

BNB has reached the vicinity of its key resistance but was rejected after forming a lower high compared to the previous peak. Price is now rotating downward and moving toward the lower boundary of the range (box).

📊 Volume Analysis

As price approached the $876.76 resistance, buying volume weakened and failed to support a breakout. This lack of demand caused a rejection from the level, allowing sellers to take control of price action.

✍️ BNB Trading Scenarios

🟢 Long Scenario:

Our risky pre-breakout trigger has shifted slightly lower and is now located above the newly formed lower high at $869.32. A breakout above this level, accompanied by rising buying volume, would activate our long trigger.

🔴 Short Scenario:

A breakdown of the maker buyer zone, ranging from $819.90 to $807.46, is expected to occur with a strong impulsive (whale) candle. If this level is broken, we will wait for a pullback to enter short positions.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

USD/JPY(20251224)Today's AnalysisMarket News:

The US economy expanded at a rate of 4.3% in the third quarter, the fastest growth in two years, but the US consumer confidence index declined for the fifth consecutive month.

ADP Weekly Employment Report: In the four weeks ending December 6, 2025, private sector employers added an average of 11,500 jobs per week.

Trump: Those who disagree with him will never become Fed Chair. Next Fed candidate Hassett: Predicts monthly job growth may return to 100,000+, and the Fed is far behind the times on interest rate cuts.

Technical Analysis:

Today's Buy/Sell Threshold:

156.30

Support and Resistance Levels:

157.71

157.18

156.84

155.76

155.42

154.90

Trading Strategy:

If it breaks above 156.30, consider buying, with a first target price of 156.84.

If it breaks below 155.76, consider selling, with a first target price of 155.42.

NZDUSD SHORT Market structure bearish on HTFs DH

Entry at Daily AOi

Weekly Rejection At AOi

Daily Rejection at AOi

Potential Head And Shoulder forming on the Daily

Previous Structure point Daily

Around Psychological Level 0.58000

Touching EMA H4

H4 Candlestick rejection

Rejection from Previous structure

Potential Head And Shoulder forming on the H4

TP: WHO KNOWS!

Entry 90%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

Nifty Analysis EOD – December 23, 2025 – Tuesday🟢 Nifty Analysis EOD – December 23, 2025 – Tuesday 🔴

The 26235 Ceiling: Nifty Pauses After Early Volatility.

🗞 Nifty Summary

The Nifty opened with a 44-point Gap Up above the PDH, but the optimism was short-lived as the first minute candle immediately filled the gap.

The index slipped 87 points from the high to mark the day low at 26,119.05. A sharp 77-point recovery ensued, bringing the index back to the 26200 level, where it spent the majority of the session oscillating in a narrow 35-point range (26165 ~ 26200).

Around 2 PM, an attempt to break out was met with heavy rejection at the 26220 ~ 26235 resistance zone.

Nifty eventually closed virtually flat at 26,177.15 (+0.02%), signaling a period of digestion after the recent rally.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The session was characterized by a quiet, range-bound environment post the initial volatility. Most of the action took place within the Initial Balance (IB), indicating a lack of directional conviction among institutional players during this weekly expiry.

The failure to sustain above the 26220 zone for the second time is a technical warning that supply is building at these elevated levels.

However, the successful defense of the 26119 low suggests that bulls are not ready to retreat just yet.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,205.20

High: 26,233.55

Low: 26,119.05

Close: 26,177.15

Change: +4.75 (+0.02%)

🏗️ Structure Breakdown

Type: Small-body indecision candle (Spinning Top).

Range (High–Low): ≈ 115 points — moderate intraday movement.

Body: ≈ 28 points — minimal real body, reflecting a lack of directional conviction.

Upper Wick: ≈ 28 points — selling pressure confirmed near the 26233 high.

Lower Wick: ≈ 58 points — significant buying response defending the 26119 level.

📚 Interpretation

The Spinning-Top formation at these heights typically indicates exhaustion or consolidation. While the buyers defended the lower levels aggressively (evident in the longer lower wick), the rejection at the top suggests that the bulls are struggling to maintain the momentum required for a breakout. This is a classic “wait-and-watch” candle.

🕯 Candle Type

Spinning-Top / Indecision Candle near Highs — Signals a tug-of-war; the next session will determine if this is base-building for a move to 26320 or the start of a reversal.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 184.86

IB Range: 87.50 → Medium

Market Structure: Balanced

Trade Highlights:

11:10 Long Trade: SL Hit (Trendline Breakout)

Trade Summary: The market’s refusal to trend today made breakout attempts difficult. The 11:10 long attempt on a trendline break was caught in the range-bound chop, resulting in a stop-loss hit as the price reverted to the mean (26180).

🧱 Support & Resistance Levels

Resistance Zones:

6220 ~ 26235 (Key Supply)

26277

26320 (Major Target)

Support Zones:

26155 (Immediate Pivot)

26104 (Major Support)

26070 ~ 26045

26030

🧠 Final Thoughts

“The 26220 zone is the gatekeeper.”

The market is at a crossroads. For the bulls to regain control, we need a gap-up above 26235 followed by a sustained hold of the 26180 level; this would open the path toward 26320. Conversely, if the index opens below the current range and faces rejection again, we are likely to see a test of the deeper support levels at 26104 and 26070.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

US 100 Index – Can the Year End Rally Continue?News released yesterday that Alphabet were going to buy data center partner Intersect in a deal worth around $5 billion to give it more power generation, alongside the on-going battle between Netflix and Paramount for Warner Bros has thrown the spotlight back on US stock indices, especially now that Larry Ellison, Chairman of Oracle and the world’s 5th richest man is now heavily involved in the deal.

Turning focus to the US 100 index, traders may now be wondering if it can turn its current 3 day winning streak into a longer string of daily gains, even pushing itself back up to challenge its record high set on October 30th at 26277, or whether the rally could run out of steam around current levels (25445, 0630 GMT).

With the Christmas Day holiday less than 48 hours away, today’s volatility driver could be the release of two pieces of US economic data. First up at 1330 GMT is the latest Q3 GDP growth update. Although it’s a second estimate, this could provide further insight into the current health of the US economy and shed some light on whether the market’s expectation of 2 further 25bps interest rate cuts from the Federal Reserve in 2026 is spot on, overblown or understated.

Then, next up is the US consumer confidence reading at 1500 GMT. This number has been under pressure in recent months with households worried about their financial situation and job security. Traders may be looking to see if the number has rebounded at all, which if it has, could be good news for spending and corporate profits over the important festive period.

Technical Update: Santa Rally Only Extends Sideways Range

If the latest 3.7% rally in the US 100 index from its December 17th low at 24644 can even be described as a “Santa rally,” it hasn’t so far at least brought too much in the way of Christmas cheer. As the chart below shows, price action is still trapped between the October 30th high at 26277 and the November 21st low at 23834, suggesting the index remains caught within a broad more balanced range at best.

As we move into the Christmas–New Year trading period, traders may be looking to identify key support and resistance levels to monitor in case a confirmed breakout triggers a more sustained move in the direction of the price break.

Potential Resistance Levels:

Following the latest price strength, the December 10th high at 25844 could now mark the first resistance level. While not a guarantee of further gains, closing breaks above 25844 may now be needed to open the way for additional price strength.

As the chart above shows, if the 25844 resistance were to give way on a closing basis the focus could then shift to the high from October 30th which stands at 26277. A break above that level could then open the way for scope for further upside.

Potential Support Levels:

Of course, the resistance levels highlighted above currently remain intact, and while they do price weakness can still emerge. If that happens, traders could be monitoring how the 25094 level is defended on a closing basis. This level represents half of the latest rally and could be the first support focus.

Closing breaks below 25094 could signal further price weakness, possibly leading to a test of 24644, which is the December 17th low. Closes below 24,644 could then warn of a deeper decline toward 23834.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Those who are bullish are right, new highs are not the top.#XAUUSD OANDA:XAUUSD TVC:GOLD

Fueled by escalating geopolitical tensions over the weekend, market risk aversion intensified, driving gold prices higher and easily breaking previous highs to new records. This aligns with our consistent bullish outlook, but we avoid blindly chasing the rally.

Short-term support levels to watch are 4385-4375. If gold prices pull back to this level for the first time during the European session, we can consider taking a small long position in gold.

However, be aware of the current overbought market, suggesting a technical need for a correction. If this correction extends further, it could be substantial. At this point, we need to pay attention to the important support level of 4355-4345. This is where the daily MA5 is located, and it is also the point where the moving averages and the middle Bollinger Band converge in multiple timeframes such as the hourly and 4-hour charts, which provides strong support. Therefore, if gold prices fall further to this level during the day, we can still consider going long on gold.

In short, the most prudent trading approach is to avoid chasing rallies and wait for a pullback before going long

GOOGL low resistance liquidity run to ATHI think this GOOGL 24 hour chart has a great set up to take us back to All-time high.

We got the formation of a bullish fair value gap today.

We have relative highs sitting at 321.31.

Most definitely a low resistance run on liquidity at 332.98.

There was a gap on the weekly timeframe that got filled, and we got a bounce out of it two weeks in a row, and this would be the third week of a bounce .

The only thing that could disrupt this move up, is that there is a bearish weekly Fair value gap that needs to get broken through.

We clear that and it could be smooth sailing.

BTC bull market is not over, how should we plan for the future?#BTCUSD BINANCE:BTCUSDT BITSTAMP:BTCUSD BITSTAMP:BTCUSD

The BTC market did not experience much volatility over the weekend, and today it only rose to near the 90500 resistance level before falling back again. Judging from the hourly and 4H charts, BTC still has room for a pullback and adjustment, and may need to consolidate again before breaking through the upper resistance. Short-term support is at 87800-87000. If it falls back to this level, we can consider taking a small long position in BTC. The key support level remains at 85500-85000. As long as this range holds, the bullish trend for BTC remains intact

The Sun May Be Setting On EJ's Break of HighsOANDA:EURJPY has made an impressive Bullish Rally after breaking out of the Resistance that was holding price down around 183 - 183.1, but currently seems to be showing a great deal of exhaustion with a strong Bearish Reversal pattern forming, the Evening Doji Star!

The Evening Doji Star consists of 3 candlesticks:

1) Large Bullish Candle

2) Doji Candle

3) Large Bearish Candle

If Bears are able to Close this candle strong down at the Lows of the large Bullish Candle that started the pattern, this will be great Confirmation of the pattern and we can expect that price will continue to push down!

The next level of structure expected to be visited will be the Previous Resistance at the 183 - 183.1 level.